In today’s world, gaining financial knowledge is essential for making informed decisions about money management. This section aims to provide clarity on crucial principles that will help you navigate the world of personal finance, from basic terms to more advanced strategies. Whether you’re looking to learn the fundamentals or deepen your understanding, the information here will serve as a solid foundation for building your financial literacy.

By breaking down complex ideas and providing easy-to-follow explanations, we aim to equip you with the tools necessary to approach your financial journey with confidence. Whether you’re considering long-term savings or short-term opportunities, understanding these core concepts will enable you to make smarter, more strategic choices.

Investing Everfi Answers Guide

This section is designed to guide you through the process of mastering essential financial concepts and decision-making strategies. By exploring key topics, you’ll gain a deeper understanding of how to effectively manage money, evaluate opportunities, and apply strategic thinking. The goal is to equip you with the knowledge needed to succeed in the dynamic world of personal finance.

The following table outlines the core topics covered and provides a breakdown of key concepts to help you navigate through the material efficiently:

| Topic | Description |

|---|---|

| Financial Planning | Understanding the importance of setting goals and creating a roadmap for your financial future. |

| Risk Management | How to assess and balance the potential risks associated with different financial choices. |

| Asset Allocation | Strategies for distributing investments across various asset types to maximize returns and minimize risks. |

| Diversification | The principle of spreading investments to reduce the impact of a single underperforming asset. |

| Long-Term Growth | Building a portfolio with a focus on steady growth over an extended period of time. |

| Compound Interest | Understanding how reinvested earnings can accelerate growth over time. |

By reviewing and reflecting on each topic in this guide, you will be well-prepared to make sound financial decisions and build a strong foundation for future success.

Understanding the Basics of Investing

Building wealth and securing financial stability starts with understanding fundamental principles of wealth management. Whether you’re looking to grow your savings or explore new opportunities, knowing the core concepts is essential for making informed decisions. This section covers the foundational elements of managing your money wisely and effectively.

Key Principles of Financial Growth

One of the first things to grasp is the concept of generating returns. Simply put, returns are the profits made from placing money into assets that have the potential to grow. These could include stocks, bonds, real estate, or other opportunities. Understanding how each option works and the risks involved is crucial to building a robust financial portfolio.

Risk and Reward Balance

Another vital concept is balancing risk and reward. Every financial choice comes with a certain level of risk. While some opportunities may offer high returns, they may also carry a higher chance of loss. On the other hand, safer options tend to have lower returns. The key is finding a balance that aligns with your financial goals, risk tolerance, and timeline.

Key Concepts in Everfi Investing Course

Understanding core financial principles is crucial for anyone looking to manage their money and make informed decisions about future opportunities. This section highlights the key ideas and strategies that form the foundation of a successful financial education. By grasping these essential concepts, you can better navigate the complexities of wealth accumulation and financial planning.

Among the core ideas covered are the various types of assets and how they differ in terms of risk and potential return. Additionally, you’ll explore the role of budgeting and how to manage resources effectively to meet both short-term needs and long-term goals. Another important concept is the power of compound growth and how it can significantly impact your financial success over time.

By focusing on these fundamentals, you’ll be better equipped to understand the broader financial landscape and make smarter, more strategic decisions in the future.

How to Master Investment Terminology

Understanding the language of financial markets is essential for anyone looking to make informed decisions. Financial terms can often seem complex, but with the right approach, mastering them becomes much easier. This section aims to break down key terms, simplify their meanings, and provide strategies for effectively learning and retaining them.

One of the best ways to get comfortable with financial terminology is to start by focusing on the most common terms and gradually build from there. For example, terms such as “asset allocation,” “diversification,” and “risk management” are foundational, and understanding these first will give you a solid base. It’s also helpful to explore real-world examples of how these terms apply in practice, which can make their meanings clearer and more tangible.

Another effective strategy is to continuously engage with financial content, whether it’s articles, podcasts, or videos. Exposure to these terms in different contexts will reinforce your understanding and help you become more fluent in financial language.

Breaking Down Investment Types

There are many ways to grow wealth, each offering different levels of risk, potential return, and time commitment. Understanding the different options available is crucial for making smart financial choices. This section will break down the main categories of opportunities, highlighting the key characteristics of each and how they fit into a balanced financial strategy.

One of the most common types of opportunities is stocks, which represent ownership in a company. Stocks can offer high returns, but they also come with a greater degree of risk due to market fluctuations. On the other hand, bonds are a more stable option, providing steady interest income with relatively lower risk, though typically offering smaller returns. Real estate is another popular choice, offering both income potential through rentals and long-term value growth.

Each of these options has its own benefits and drawbacks, and understanding how they work is key to making informed decisions. By diversifying across different types, individuals can reduce risk while aiming for consistent growth over time.

Exploring Risk and Return in Investing

Every financial opportunity involves balancing two key elements: risk and potential return. Understanding how these two factors interact is fundamental to making sound decisions in managing your resources. This section delves into how risk affects outcomes and how to assess opportunities based on the level of return they might provide.

The Relationship Between Risk and Reward

The concept of risk and return is simple yet powerful: the higher the potential return, the greater the risk. Risk refers to the uncertainty of an outcome, whether it be a financial loss or the volatility of returns. On the other hand, return is the gain made from a decision, which can vary greatly depending on the choice. A key part of successful financial planning is understanding this relationship and determining how much risk is acceptable based on your financial goals and timeline.

Strategies for Managing Risk

One effective strategy for managing risk is diversification. By spreading resources across various types of opportunities, you can reduce the impact of a single loss. Additionally, it’s important to assess your own risk tolerance–this can vary depending on factors like age, income, and financial goals. In general, younger individuals may be willing to take on more risk in pursuit of higher returns, while those nearing retirement may prioritize stability and preservation of capital.

Strategies for Building a Strong Portfolio

Creating a well-balanced collection of assets is key to achieving long-term financial goals. A strong portfolio is built on a variety of carefully selected options that complement each other and align with your personal risk tolerance and objectives. This section outlines effective strategies for constructing a diversified and resilient collection that can weather market fluctuations while maximizing growth potential.

The foundation of a solid portfolio lies in diversification. By distributing assets across different categories such as stocks, bonds, and real estate, you reduce the impact of poor performance in any one area. This approach helps balance risk while positioning the portfolio for steady growth over time. Additionally, it is important to regularly review and adjust the portfolio based on changing market conditions, personal goals, and time horizons.

Another key strategy is to focus on both short-term and long-term objectives. A well-rounded portfolio should contain assets that meet both immediate income needs and those designed for future growth. This dual approach ensures a stable cash flow while also taking advantage of higher-risk, higher-return opportunities that may take longer to mature.

Understanding the Role of Diversification

Diversification is a key strategy for minimizing risk and maximizing returns over the long term. It involves spreading resources across different types of assets to reduce the impact of a poor performance in any single area. By balancing different asset classes, industries, or regions, you can protect your portfolio from the volatility that may affect one specific investment type or sector.

The main goal of diversification is to achieve stability. While individual assets may experience significant fluctuations, a diversified approach helps to smooth out overall performance. If one investment underperforms, others may do better, balancing out potential losses. This approach not only protects your financial interests but also enhances your ability to capture returns from various market conditions.

Incorporating a variety of assets–such as stocks, bonds, real estate, and alternative investments–creates a more resilient strategy. By carefully selecting different opportunities based on your financial goals and risk tolerance, diversification enables you to take advantage of different growth opportunities while mitigating the risks associated with market uncertainty.

Common Mistakes in Investment Decisions

When managing resources, it’s easy to make errors that can negatively impact long-term financial success. Understanding these common mistakes and learning how to avoid them can significantly improve your decision-making process. This section highlights frequent missteps that individuals often make when navigating the world of financial opportunities.

- Overlooking Diversification: Relying too heavily on one type of asset can lead to higher risk and potential losses. A lack of diversification leaves your financial plan vulnerable to market downturns in a specific sector or asset class.

- Chasing Quick Gains: Seeking short-term profits without considering long-term stability often leads to poor choices. While high returns may be tempting, they are usually accompanied by higher risk and increased volatility.

- Ignoring Risk Tolerance: Not understanding or adhering to your own level of comfort with risk can result in poor decisions. Choosing assets that don’t align with your risk profile can cause unnecessary stress and potential financial harm.

- Emotional Decision-Making: Letting emotions guide financial choices, such as panic-selling during a market dip or greed-driven buying, often leads to regret. Successful decision-making relies on rationality, not emotions.

- Timing the Market: Trying to buy at the lowest point and sell at the highest is a common pitfall. Market timing is highly speculative and often results in missed opportunities or losses.

Avoiding these mistakes requires patience, knowledge, and a disciplined approach. By making informed, calculated decisions and staying focused on long-term goals, you can significantly improve the chances of achieving financial success.

How to Analyze Investment Opportunities

Evaluating financial opportunities effectively is crucial to making informed decisions that align with your goals and risk tolerance. Proper analysis ensures that you can identify the best options, understand potential returns, and recognize associated risks. This section outlines the key steps involved in analyzing different opportunities to make smart, strategic choices.

To begin, it’s essential to assess the potential return. This involves estimating how much you could gain from the opportunity over time. Understanding the projected growth, whether it’s through income or capital appreciation, is vital. However, higher returns often come with increased risk, so it’s equally important to evaluate the level of risk involved. This includes assessing factors like market volatility, economic trends, and the stability of the asset in question.

Another critical step is to consider the time horizon of the opportunity. Short-term opportunities may offer quicker returns but might come with higher unpredictability, while long-term opportunities tend to provide more stability with slower but steady growth. Additionally, analyzing liquidity–the ease with which you can convert an asset into cash without significant loss of value–can impact your decision depending on your financial needs.

Lastly, understanding the underlying fundamentals of the asset, such as its market position, the health of the company or sector, and its growth prospects, will provide a clearer picture of its potential. By thoroughly analyzing these factors, you can make well-rounded, informed decisions that are aligned with your overall financial strategy.

The Importance of Financial Goals

Setting clear financial objectives is essential for achieving long-term stability and success. Without defined goals, it becomes difficult to stay focused, track progress, or make informed decisions about how to allocate resources. This section explores why establishing financial goals is a critical part of a well-structured financial plan.

Providing Direction and Focus

Financial goals act as a roadmap, guiding decisions and actions towards specific outcomes. By setting goals, you create a clear vision of where you want to go, whether it’s purchasing a home, saving for retirement, or building wealth. This clarity helps you stay on track and prioritize spending, ensuring that every financial choice supports your overarching objectives.

Motivation and Accountability

Having measurable financial goals also provides motivation to stay committed. It’s easier to save and make sacrifices when you know exactly what you’re working towards. Additionally, goals help hold you accountable, making it easier to assess whether you’re making progress and adjust strategies as needed.

In conclusion, clear financial goals give purpose to your actions and create a sense of direction, making it easier to navigate complex financial decisions. By identifying your priorities, you can allocate your resources more effectively and increase your chances of long-term success.

Investment Strategies for Beginners

Starting your journey toward financial growth can feel overwhelming, but with the right strategies, you can build a solid foundation for long-term success. For newcomers, understanding the fundamentals and choosing the right approach is crucial for minimizing risks and maximizing returns. This section outlines practical strategies designed to help beginners navigate the world of financial opportunities with confidence.

- Start with a Long-Term Perspective: One of the most important strategies is to focus on long-term growth. Avoid chasing short-term gains, as they often involve higher risk. By thinking long-term, you can weather market fluctuations and enjoy more stable returns over time.

- Prioritize Diversification: Spread your investments across different types of assets–such as stocks, bonds, and real estate–to reduce the impact of any one investment’s poor performance. Diversification helps balance risk and improves your chances of achieving consistent returns.

- Set Clear Goals: Define your financial objectives and make sure your strategy aligns with them. Whether saving for retirement, buying a home, or building an emergency fund, clear goals will help guide your decisions and keep you motivated.

- Start Small and Scale Gradually: As a beginner, it’s wise to start with manageable investments. You don’t need to commit large sums right away. Begin with small amounts and increase your investment as you gain more experience and confidence.

- Stay Consistent and Avoid Emotional Decisions: Regularly contribute to your portfolio, even in small amounts. Consistency helps you build wealth over time. Additionally, avoid emotional reactions to market fluctuations. Successful financial planning requires patience and discipline.

By adopting these strategies, beginners can begin to build a balanced and sustainable approach to financial growth. It’s important to stay informed, be patient, and make decisions based on thoughtful analysis rather than impulse or market noise.

Exploring Stocks and Bonds in Detail

Understanding the core components of the financial market, particularly stocks and bonds, is essential for making informed decisions. These two types of assets represent distinct approaches to building wealth and come with different levels of risk, potential returns, and purposes. In this section, we will delve into the specifics of stocks and bonds, examining their key features, benefits, and drawbacks.

What Are Stocks?

Stocks represent ownership in a company, allowing investors to buy a stake in a business. When you purchase shares, you become a partial owner of that company and may benefit from its success through dividends and price appreciation. However, the value of stocks can fluctuate, and there’s always the risk of losing money if the company underperforms.

- Potential for High Returns: Stocks generally offer the possibility of higher returns over the long term, particularly if the company grows and thrives.

- Dividends: Some stocks pay regular dividends, providing a consistent income stream for investors.

- Higher Risk: Stock prices can be volatile, influenced by market conditions, economic factors, and company performance. This can lead to significant fluctuations in value.

What Are Bonds?

Bonds, on the other hand, are debt securities issued by corporations or governments. When you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds tend to be more stable than stocks, but their returns are typically lower.

- Stable Income: Bonds provide regular interest payments, known as coupons, which can offer predictable income for investors.

- Lower Risk: Bonds are generally considered safer than stocks, especially government bonds. However, they are not entirely risk-free, as the issuer may default on its payments.

- Fixed Returns: While bond returns are usually more predictable than stocks, they are often lower and may not keep pace with inflation.

Both stocks and bonds have their unique advantages and disadvantages. By understanding these financial instruments in detail, investors can build a portfolio that balances risk and return based on their financial goals and risk tolerance.

Understanding the Concept of Compound Interest

Compound interest is a powerful financial concept that allows your wealth to grow exponentially over time. Unlike simple interest, which only calculates returns on the initial amount invested, compound interest generates returns on both the principal amount and any accumulated interest. This creates a “snowball effect,” where the value of your investment increases at an accelerating rate as time passes.

The key to understanding compound interest lies in recognizing its ability to accumulate value not just on your initial deposit, but also on the interest that has already been added to your balance. This principle is central to long-term wealth accumulation, whether through savings, loans, or financial investments.

How Compound Interest Works

To better understand how compound interest can grow your assets, let’s break it down into simple terms. Suppose you invest a certain amount of money, and the interest is compounded annually. Each year, you earn interest on both your initial investment and the interest from previous years. Over time, this process accelerates, making your wealth grow faster than it would under a simple interest system.

| Year | Principal | Interest Earned | Total Balance |

|---|---|---|---|

| 1 | $1,000 | $50 | $1,050 |

| 2 | $1,050 | $52.50 | $1,102.50 |

| 3 | $1,102.50 | $55.13 | $1,157.63 |

As shown in the table, after the first year, your total balance grows by $50, but in the second year, you earn interest on the new total of $1,050, which results in more interest being earned than the previous year. This compounding effect continues to build upon itself, generating greater returns as time goes on.

By understanding and utilizing the power of compound interest, individuals can significantly increase their savings and investments, particularly when given a longer time frame. It underscores the importance of starting early and allowing your assets to grow steadily over time.

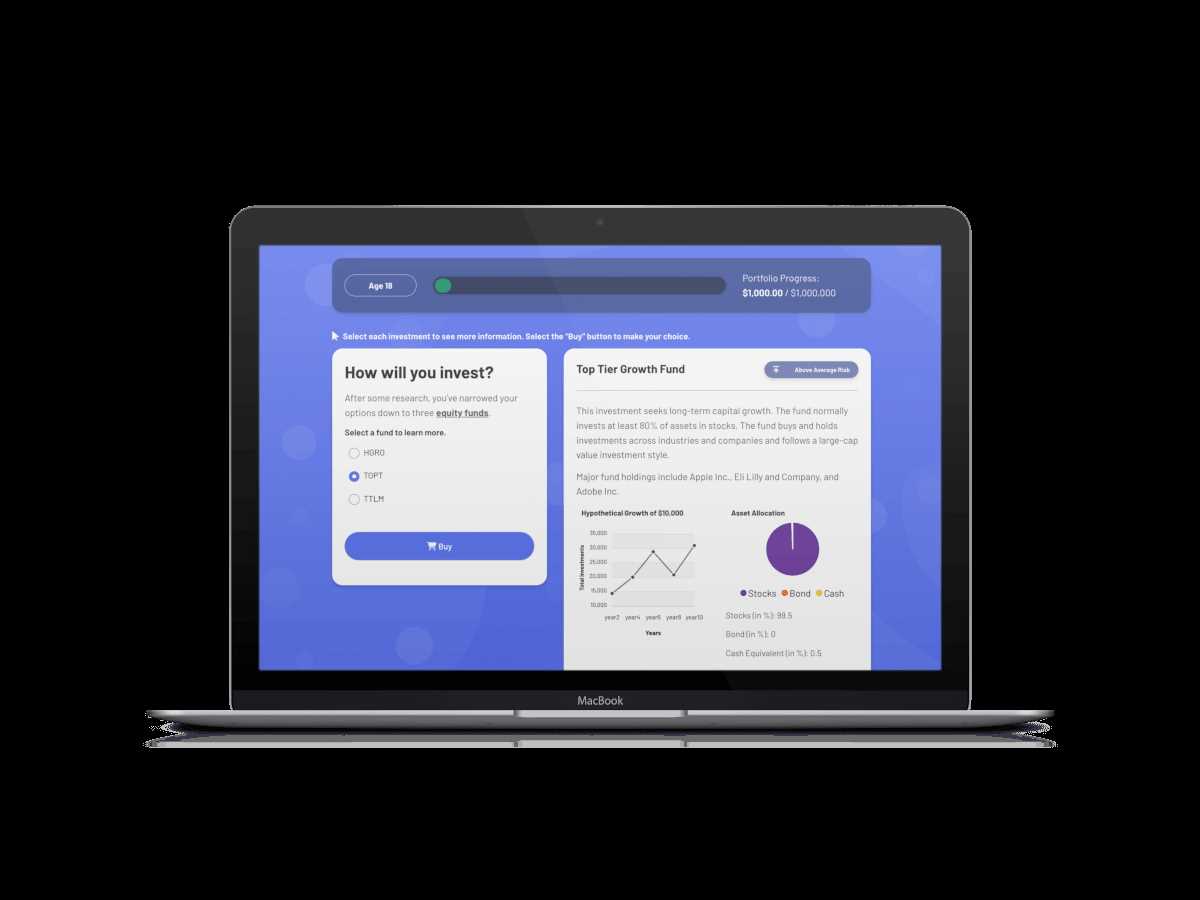

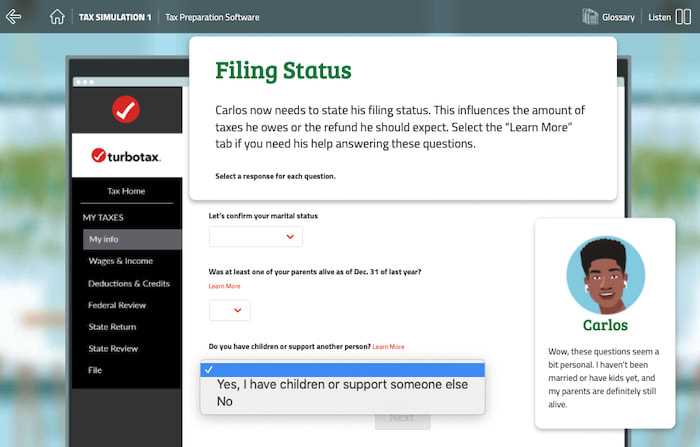

Using Everfi to Test Investment Knowledge

One effective way to assess and strengthen your understanding of financial concepts is by participating in interactive learning platforms. These platforms provide various tools that challenge your comprehension, helping you identify areas of strength and those needing improvement. By testing your knowledge in real-world scenarios, you gain a deeper grasp of the subject matter and can make more informed financial decisions.

When it comes to mastering the concepts of money management, risk, and asset allocation, interactive exercises can be invaluable. They offer practical applications of theories, turning abstract ideas into tangible knowledge. Through quizzes, simulations, and step-by-step guides, you can refine your financial literacy and build confidence in your decision-making abilities.

Benefits of Using Online Learning Platforms

Here are some key advantages of using digital platforms to test your financial knowledge:

- Engagement: Interactive learning methods keep you involved, which helps with information retention.

- Instant Feedback: Platforms offer immediate responses to your answers, allowing you to learn from mistakes quickly.

- Real-World Scenarios: You can practice applying theoretical concepts to real-life situations, improving your ability to make sound decisions.

- Self-Paced Learning: Many platforms allow you to go at your own pace, ensuring you master each concept before moving on.

How to Make the Most of Online Learning Tools

To maximize the benefit of testing your knowledge on these platforms, follow these tips:

- Be Consistent: Set aside time regularly to engage with the material to keep your skills sharp.

- Review Incorrect Answers: Always go back and understand why an answer was wrong to deepen your understanding.

- Practice Real-Life Scenarios: Try to simulate investment decisions based on your learning, and evaluate the outcomes of different choices.

- Track Progress: Keep an eye on your improvement over time to motivate yourself and identify weak areas.

Using platforms designed for testing financial knowledge can offer a structured, engaging way to improve your expertise. Whether you’re a beginner or an experienced learner, these tools can help sharpen your skills and enhance your understanding of complex financial topics.

Tracking Your Investment Progress

To effectively grow your wealth and achieve your financial objectives, it’s crucial to monitor your progress regularly. Tracking allows you to see how your financial strategies are performing, helping you make informed decisions for the future. By assessing key metrics and understanding trends, you can adapt your approach to stay aligned with your goals.

Regular monitoring provides a clear picture of how well your assets are doing over time, whether you’re focusing on increasing returns or minimizing risk. Using a combination of digital tools and manual tracking methods ensures you stay on top of fluctuations and opportunities in the financial landscape.

Key Metrics to Track

Here are the essential indicators to keep an eye on when monitoring your financial progress:

- Returns: Track the growth or decline of your assets to understand how your portfolio is performing relative to benchmarks.

- Risk Levels: Keep an eye on the volatility of your holdings to ensure that your risk tolerance is in line with your strategy.

- Asset Allocation: Regularly review the distribution of your investments to ensure it’s diversified and balanced according to your goals.

- Fees and Expenses: Watch for any fees that may be eating into your returns, such as management fees, trading costs, or administrative charges.

Methods for Tracking Progress

To monitor your performance effectively, consider the following strategies:

- Use Portfolio Management Tools: Digital platforms and apps can help you track and analyze the performance of your holdings in real-time.

- Set Milestones: Establish clear, measurable goals that allow you to gauge your progress at various intervals.

- Regular Reviews: Schedule monthly or quarterly reviews to assess if you’re meeting your goals and if adjustments are needed.

- Compare with Benchmarks: Measure your performance against relevant indices or market benchmarks to ensure you’re on track.

By actively tracking and adjusting your approach, you can ensure that your financial efforts are optimized for long-term success. Keeping a close eye on performance not only helps you stay aligned with your objectives but also enhances your ability to make timely, strategic decisions.

How to Improve Your Financial Literacy

Improving your understanding of money management is essential for making informed financial decisions. A strong grasp of financial concepts empowers you to manage your budget, save efficiently, and make strategic decisions about your future. By gaining more knowledge about key areas such as budgeting, saving, debt management, and long-term financial planning, you can take control of your finances and work towards your goals more confidently.

Financial literacy is a lifelong journey. It involves not just learning basic principles but also staying updated on trends, tools, and strategies that can help you navigate the complex financial landscape. There are many ways to improve your financial literacy, from self-study to seeking professional advice. The more you learn, the better equipped you’ll be to handle various financial situations.

Practical Steps to Enhance Financial Knowledge

Here are some effective strategies for boosting your financial literacy:

| Action | Description |

|---|---|

| Read Financial Books and Articles | Explore books, blogs, and magazines dedicated to personal finance to deepen your knowledge and gain different perspectives. |

| Take Online Courses | Enroll in online courses that cover essential financial concepts, from budgeting to advanced investment strategies. |

| Follow Financial News | Stay up to date with current events and trends in the financial world to understand the broader economic landscape. |

| Use Financial Tools | Leverage apps and tools to track your spending, savings, and investments, which can help you apply what you’ve learned. |

| Consult Professionals | Seek advice from financial experts who can provide personalized guidance based on your unique financial situation. |

Additional Resources

In addition to the actions listed above, consider engaging with interactive tools or communities where you can discuss financial topics with others. Forums, webinars, and local workshops can be valuable spaces for learning and networking.

Improving your financial literacy isn’t just about accumulating knowledge–it’s about applying it in ways that can help you build a secure financial future. Start small, stay consistent, and use the resources available to you. Over time, you’ll gain the confidence and skills needed to manage your money effectively.

Final Tips for Success in Investing

Achieving financial success requires careful planning, patience, and discipline. Whether you’re looking to grow your wealth, secure your future, or make informed financial decisions, there are key strategies that can increase your chances of success. By understanding the fundamentals, staying informed, and avoiding common mistakes, you can build a strong financial foundation that serves you well in the long term.

These final tips provide guidance on how to approach your financial journey with clarity and confidence. They will help you navigate the complexities of personal finance and empower you to make the best choices for your future.

Stay Consistent and Patient

Financial growth is a gradual process. Avoid the temptation to make quick decisions based on short-term market fluctuations. Focus on the long-term and make informed decisions that align with your goals. Consistency is key–whether it’s regularly contributing to savings, sticking to a budget, or sticking with a well-thought-out strategy, small actions over time can yield significant results.

Maintain a Diversified Approach

Diversification is an essential principle for managing risk. Spreading your investments across different asset types, industries, or markets reduces the impact of a downturn in any one area. This strategy helps balance risk and return, providing more stability in the face of market changes. Remember that not all opportunities will perform the same way, and a diversified portfolio can offer greater resilience over time.

By taking the time to educate yourself, setting clear goals, and following these strategies, you can increase your chances of financial success. Keep a long-term perspective, make thoughtful decisions, and stay focused on your financial objectives. Success doesn’t happen overnight, but with patience and careful planning, you can achieve your financial aspirations.