Understanding the intricacies of tax preparation is essential for success in certification processes. These evaluations are designed to test both theoretical knowledge and practical skills, ensuring that individuals are well-equipped to handle real-world scenarios effectively.

To achieve excellent results, a structured approach to studying is vital. This involves exploring core principles, familiarizing yourself with relevant regulations, and practicing with realistic scenarios. Comprehensive preparation not only builds confidence but also enhances your ability to apply knowledge accurately in diverse situations.

In this guide, we will delve into proven strategies, essential resources, and key areas of focus that can help you excel in your tax-related evaluations. Whether you’re just beginning or looking to refine your expertise, the insights provided here will serve as a valuable roadmap.

Understanding the Structure of Tax Exams

Assessments focused on tax preparation are designed to evaluate both foundational knowledge and the ability to apply it in practical scenarios. These evaluations often incorporate a combination of technical concepts, procedural steps, and analytical tasks, ensuring participants are equipped to handle real-world applications.

Key Components of the Assessment

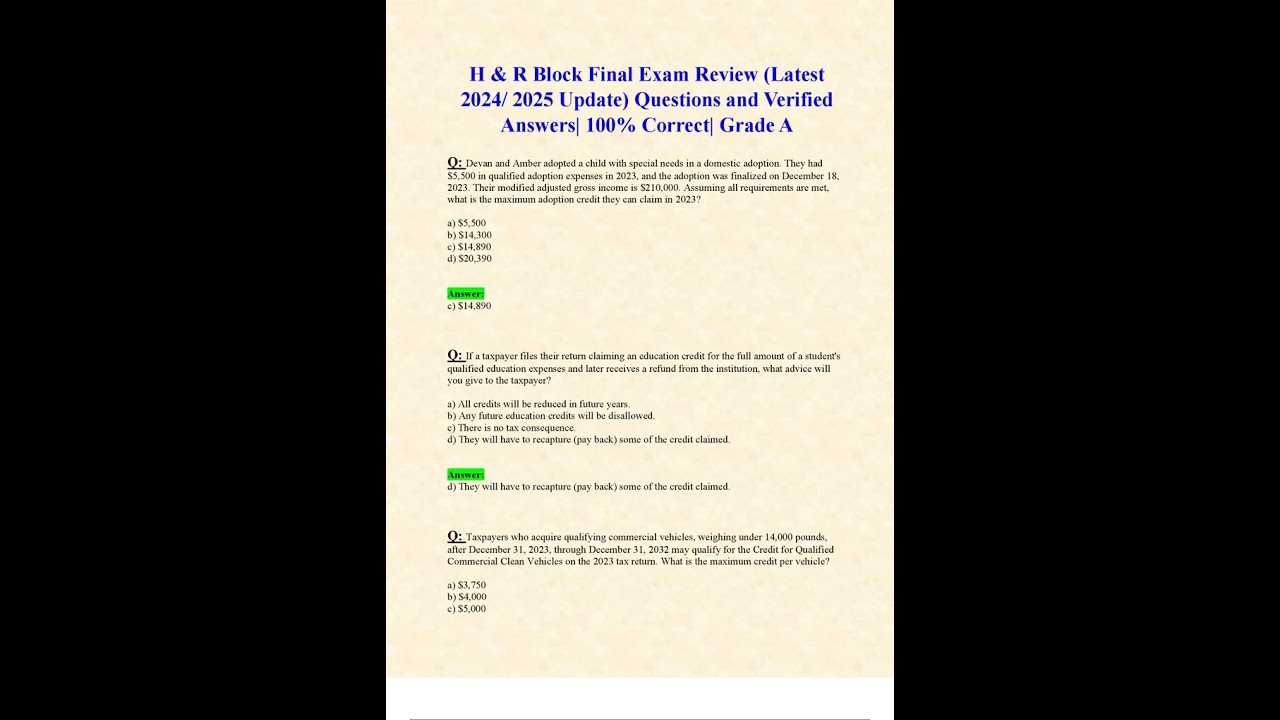

The tests typically include multiple-choice questions, scenario-based problems, and occasionally open-ended responses. Multiple-choice sections assess familiarity with regulations, while scenarios test problem-solving skills and practical application of tax laws. A clear understanding of these components can guide effective preparation.

Balancing Theory and Practical Knowledge

Success in such assessments requires a balanced approach, integrating theoretical study with practical exercises. This combination helps build the analytical skills needed to navigate complex financial scenarios while ensuring compliance with legal requirements. Thorough preparation in both areas is crucial for optimal performance.

Key Topics Covered in Tax Preparation Tests

Assessments in the field of tax preparation are designed to measure comprehensive knowledge of financial regulations and practices. These evaluations emphasize critical concepts that are essential for effective and compliant financial documentation.

Understanding Tax Regulations and Compliance

A significant portion of these tests focuses on understanding current tax laws and ensuring compliance with legal standards. This includes knowledge of filing requirements, allowable deductions, and applicable credits for individuals and businesses. Mastery of these areas is crucial for accurate financial reporting.

Analyzing Financial Scenarios

Participants are often required to interpret complex financial situations and apply appropriate solutions. Topics include income categorization, adjustments to gross income, and resolving discrepancies in financial records. Practical exercises in these areas help prepare for real-world applications and improve problem-solving skills.

How to Prepare for Certification Tests

Achieving success in certification assessments requires a structured and focused approach. These evaluations demand a combination of theoretical understanding and practical application, making thorough preparation essential for confident performance.

Start by reviewing the core material provided in your training program. Focus on key concepts, including legal guidelines and practical scenarios. Supplement your study with practice tests that mimic the structure and content of the actual assessment. This helps identify areas where additional effort is needed.

Time management is another critical aspect of preparation. Allocate specific periods for studying each topic and practicing different question formats. Consistent review and reinforcement of knowledge not only build confidence but also enhance your ability to recall information under test conditions.

Common Mistakes Students Make During Tests

Many students, even with thorough preparation, fall into common traps during assessments. These mistakes often stem from lack of focus, poor time management, or misinterpretation of instructions. Recognizing these issues can significantly improve test performance.

| Common Mistake | How to Avoid |

|---|---|

| Misinterpreting Questions | Carefully read each question and underline key terms to ensure full understanding before answering. |

| Skipping Review Time | Leave a few minutes at the end of the test to go over your responses and catch any mistakes. |

| Rushing Through the Test | Pace yourself throughout the test, ensuring enough time is allocated to each section. |

| Overthinking Simple Questions | Trust your knowledge and avoid second-guessing straightforward questions. |

| Not Following Instructions | Always read the instructions carefully to ensure you’re answering in the required format. |

By identifying and addressing these common mistakes, students can avoid unnecessary errors and improve their chances of success on assessments.

Effective Study Strategies for Exam Success

Achieving success in assessments is not just about understanding the material but also about applying the right study techniques. A well-structured approach can make all the difference, allowing you to retain information and perform under pressure.

Organizing Your Study Plan

Creating a clear and organized study schedule is key. Allocate time for each topic, prioritize areas of difficulty, and ensure there’s time for review. Consistent, focused sessions are far more effective than cramming at the last minute.

Active Learning Techniques

Engaging with the material actively enhances understanding and retention. Techniques like summarizing concepts in your own words, teaching others, or practicing with mock tests allow you to apply what you’ve learned and identify areas that need improvement.

By following these study strategies, students can build confidence, reduce stress, and boost their chances of success when faced with assessments.

Resources to Improve Tax Knowledge

Expanding your understanding of tax-related topics requires using a variety of reliable resources. These tools help you stay updated with the latest regulations, deepen your comprehension of tax concepts, and practice applying what you’ve learned. Here are some valuable options to consider:

- Online Courses: Platforms like Coursera and Udemy offer tax-related courses taught by experts.

- Tax Research Websites: Websites such as the IRS and state tax authorities provide the most current laws and guidelines.

- Textbooks and Guides: Books on taxation and accounting provide detailed explanations and examples of tax principles.

- Webinars and Seminars: Participating in webinars and seminars allows you to learn from professionals and ask questions in real time.

- Study Groups: Joining or forming a study group with peers can promote shared learning and different perspectives on the material.

Using these resources effectively can enhance your grasp of tax regulations and practices, preparing you for any challenges that may arise during assessments or in professional work.

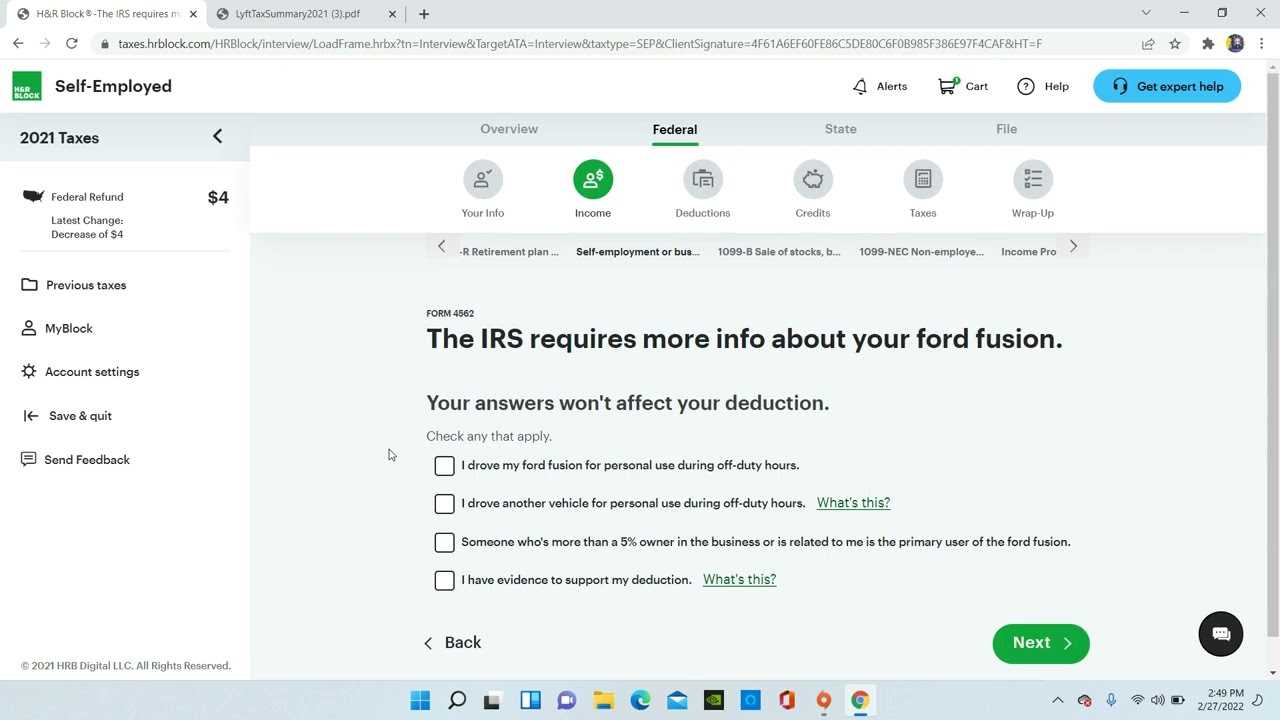

Breaking Down Complex Tax Scenarios

Handling intricate financial situations requires a methodical approach to ensure accurate results. These scenarios often involve multiple variables, such as deductions, exemptions, or different sources of income. The key to breaking them down lies in understanding each component and applying the appropriate rules step-by-step.

Identify the Key Elements: Start by identifying the major factors involved in the situation. For example, if you’re dealing with a case that includes both rental income and business expenses, separate these components first. Understand how each one is treated by the tax system.

Apply the Relevant Rules: Once you’ve separated the components, research the specific rules or tax brackets that apply to each. This might include calculating depreciation for rental properties or business deductions for self-employment. Use reliable tax guides or government resources to double-check the applicable laws for each aspect.

Example: Consider a scenario where a taxpayer has income from multiple streams, including employment and freelance work. In this case, the standard income tax rates apply to the salary, while the freelance income could qualify for deductions like home office expenses or business-related travel.

By systematically analyzing each aspect of a complex scenario and applying the correct tax guidelines, you can simplify even the most confusing tax situations.

Time Management Tips for Passing Tests

Effective time management is crucial when preparing for any type of evaluation. Allocating sufficient time for study and ensuring that you stay on track during the test can make a significant difference in performance. Developing strategies to manage both preparation and test-taking time will help reduce stress and maximize your efficiency.

Plan Your Study Sessions

Creating a study schedule is the first step towards mastering time management. Break down your study material into manageable segments and allocate specific time slots for each. Use the following tips to create an effective plan:

- Set Clear Goals: Define what you want to achieve in each study session. Whether it’s mastering a specific concept or reviewing a set of topics, knowing your objectives helps you stay focused.

- Prioritize Topics: Begin with the most challenging or important areas first. Tackling difficult subjects while you’re fresh will ensure better retention.

- Use a Timer: Break your study time into focused intervals with short breaks in between, such as the Pomodoro Technique, to maintain concentration and avoid burnout.

Maximize Your Test Time

When it comes to the test itself, managing your time effectively is just as important as knowing the material. Here are some strategies to consider:

- Read Instructions Carefully: Take a few minutes at the beginning to read the instructions thoroughly. This ensures you understand the requirements and avoid unnecessary mistakes.

- Allocate Time Per Section: Divide your total test time based on the number of sections or questions. Stick to your time limits for each part to prevent spending too much time on one area.

- Stay Calm and Focused: If you encounter a challenging question, don’t panic. Move on to the next one and come back to it later if needed. Managing stress is essential for maintaining a clear mind throughout the test.

By planning ahead and managing your time effectively, you increase your chances of success and reduce the pressure during both preparation and testing. The right time management techniques will help you stay organized and confident.

What to Expect in Tax Certification Assessments

Tax certification assessments are designed to evaluate an individual’s understanding of tax-related concepts and their ability to apply this knowledge in real-world scenarios. These evaluations assess various aspects of tax preparation, from fundamental principles to complex filing procedures. Understanding the structure and content of these assessments is key to performing well.

Types of Questions

In most assessments, you can expect a combination of multiple-choice questions, practical case studies, and sometimes written responses. These questions are carefully crafted to test your knowledge on:

- Tax Laws and Regulations: Understanding current tax codes and how they affect different types of taxpayers.

- Filing Procedures: Knowledge of how to prepare and file tax returns accurately.

- Calculation of Deductions and Credits: Applying formulas to determine applicable deductions and credits based on specific scenarios.

Assessment Format

The format of these evaluations can vary depending on the certifying body, but you can generally expect a timed assessment. Here are the key elements you will likely encounter:

- Multiple-Choice Questions: These test your ability to quickly recall facts and apply your knowledge to straightforward scenarios.

- Practical Case Studies: These scenarios test your ability to analyze complex tax situations and make decisions based on your knowledge.

- Time Constraints: Most assessments are time-limited, so managing your time effectively is crucial during the process.

Being well-prepared for these different question formats will ensure that you can confidently tackle the assessment and demonstrate your expertise in tax preparation.

Best Practices for Answering Tax Questions

When faced with tax-related inquiries, it is crucial to approach them with precision and clarity. The key to successfully navigating these questions lies in applying both your technical knowledge and strategic thinking. This section covers essential strategies that will help ensure your responses are well-structured and accurate.

Thoroughly Read Each Question

Before attempting to answer, take a moment to carefully review each question. Understanding the specific requirements and identifying key terms will help you avoid common pitfalls. Here are a few tips:

- Focus on Keywords: Identify terms like “deduction,” “credit,” or “income,” which will help guide your answer.

- Look for Action Words: Words such as “calculate,” “explain,” or “determine” indicate what action you need to take.

- Understand Context: Ensure you comprehend the scenario presented, as tax situations often depend on context such as filing status or income level.

Structure Your Responses Clearly

Clear, concise, and organized answers are critical for demonstrating your understanding. Following a logical flow can help ensure your points are easy to follow. Consider these practices:

- Break Down Complex Questions: If the question is complex, break it down into smaller components and address each one individually.

- Use Bullet Points or Lists: For questions involving multiple steps, lists can help ensure clarity and prevent omission of important details.

- Show Your Work: If a question requires calculations, write out your steps clearly to demonstrate your process.

By following these best practices, you can improve the accuracy and clarity of your responses, ensuring that your answers effectively communicate your knowledge of tax-related topics.

Using Practice Assessments to Build Confidence

Engaging in practice assessments is one of the most effective ways to enhance your readiness and self-assurance for any challenging evaluation. These simulations offer the opportunity to familiarize yourself with the format, identify areas of weakness, and strengthen your ability to think critically under pressure. By incorporating them into your study routine, you can gain both skill and confidence.

Simulate Real Conditions

Practice assessments allow you to recreate the experience of an actual evaluation. This helps in reducing any anxiety you might feel, as you’re already accustomed to the process. Working through timed questions or case scenarios in a controlled environment prepares you mentally for the real situation.

Identify Areas for Improvement

After completing a practice test, it’s important to analyze your results. Identify patterns in the types of questions you struggle with most. This focused review enables you to tailor your study sessions to concentrate on these areas, gradually improving your knowledge and understanding.

Build Confidence Over Time

As you continue practicing, you’ll start noticing improvement, which will naturally build your confidence. With each test, you become more adept at managing your time and handling different question types. The more you practice, the more you’ll trust in your abilities, leading to better performance during the actual assessment.

Insights into Real-World Tax Applications

Understanding the practical aspects of tax applications is essential for anyone looking to navigate the complexities of financial management. Real-world scenarios present challenges that require not only technical knowledge but also the ability to apply that knowledge to varied situations. This section explores how theoretical principles are put into practice, offering a deeper understanding of tax preparation in everyday life.

Practical Tax Scenarios

In real-world applications, tax professionals encounter a wide range of scenarios, from simple individual returns to more complex situations involving businesses or international taxes. Each scenario demands a different set of skills, such as identifying applicable deductions, calculating taxable income, and staying up-to-date with changing regulations. By gaining experience in these areas, professionals can better assist clients with minimizing their tax liabilities and ensuring compliance.

Adapting to Changing Tax Laws

Tax laws and regulations are constantly evolving, making it critical to stay informed about updates that impact clients’ financial situations. Professionals must not only know the current rules but also understand how to adapt them to unique cases. Real-world tax preparation requires a combination of continuous learning and the ability to assess how changes affect specific situations, ensuring that taxpayers benefit from available credits and deductions.

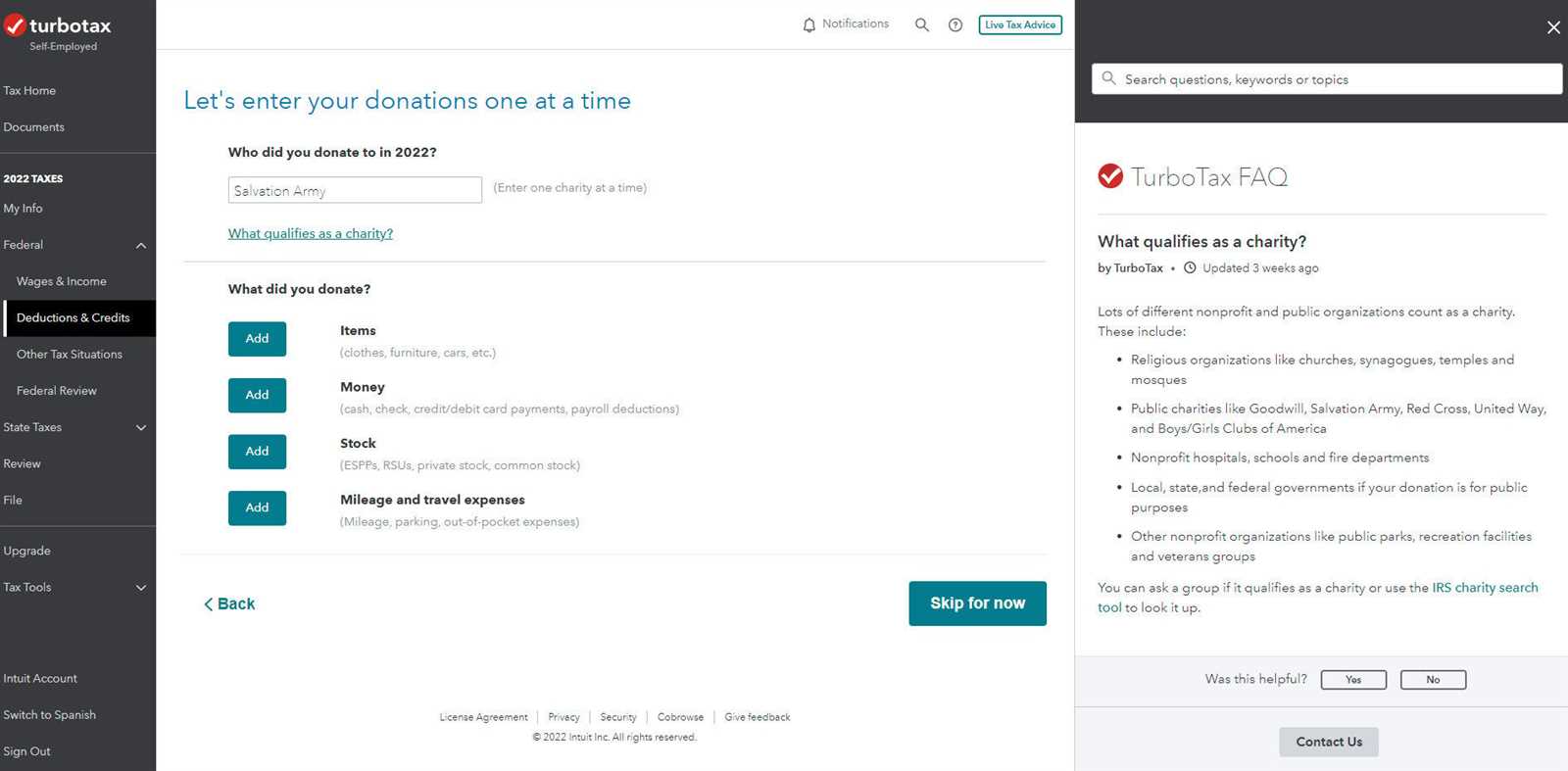

Tools and Software That Aid Preparation

In today’s fast-paced world, using the right tools and software can make all the difference when it comes to preparing for financial assessments. These resources help streamline the process, ensuring accuracy and efficiency while providing valuable support to those seeking to enhance their skills. By incorporating specialized software, individuals can simplify complex calculations, stay updated on tax laws, and practice their problem-solving skills in a structured environment.

Top Tools for Preparation

- Tax Preparation Software: These programs are designed to help users calculate taxes quickly and accurately, guiding them through every step of the process.

- Financial Calculators: These digital tools help with everything from estimating deductions to computing tax liabilities, saving time and reducing errors.

- Study Platforms: Online learning portals that provide practice scenarios, quizzes, and instructional videos, offering a hands-on approach to mastering key concepts.

- Practice Exams: Simulated tests designed to help individuals gauge their understanding and readiness by mimicking real-world assessments.

Benefits of Using Software

- Efficiency: Software solutions automate many tasks, reducing the amount of manual work and speeding up the preparation process.

- Accuracy: By following pre-programmed guidelines, tools minimize human error, ensuring the results are correct and consistent.

- Up-to-Date Information: Many programs are continuously updated with the latest tax codes, ensuring users are working with the most current data.

- Interactive Learning: Some platforms offer interactive exercises that adapt to the user’s skill level, enhancing understanding through practice.

Steps to Review Answers Effectively

Reviewing your work after completing an assessment is crucial to ensuring that all responses are accurate and well-thought-out. A systematic approach can help identify mistakes, clarify misunderstandings, and improve overall performance. Taking the time to review thoroughly can make a significant difference in the final outcome, boosting confidence and enhancing accuracy in the process.

1. Take a Break Before Reviewing

It is essential to give yourself a short break after finishing the task to refresh your mind. This allows you to approach the review process with a clear perspective, making it easier to spot errors or missed details that might have been overlooked while you were working through the questions.

2. Review Instructions and Requirements

Before diving into the answers, re-read the instructions to ensure you understood the task correctly. Confirm that each question has been addressed appropriately and that all the requirements have been met. This step is vital to avoid unnecessary mistakes due to misinterpretation.

3. Check for Consistency and Accuracy

- Verify Calculations: Double-check all figures, computations, and formulas to ensure there are no mathematical errors.

- Ensure Clarity: Make sure your answers are clear and logically presented, avoiding ambiguity.

- Cross-reference Information: Ensure that the data or concepts used are consistent throughout the responses.

4. Focus on Common Mistakes

While reviewing, pay special attention to common errors such as misreading questions, skipping steps, or writing incomplete answers. These are often areas where small adjustments can lead to significant improvements.

5. Final Review and Confidence Check

Once all answers have been reviewed, take a final look to ensure everything is in order. Trust your judgment and proceed with confidence, knowing that you have thoroughly examined your work for potential errors or omissions.

Legal and Ethical Considerations in Tax Preparation

When preparing tax-related documents and filings, professionals must be aware of both legal obligations and ethical standards that govern their actions. These guidelines ensure that the process is conducted fairly, accurately, and in compliance with applicable laws. Adherence to these principles not only protects the client but also upholds the integrity of the entire process.

Legal Responsibilities

Tax preparers are required to follow specific laws and regulations to prevent fraud, misrepresentation, and other forms of unethical behavior. Violating these legal standards can lead to penalties, fines, and even criminal charges. It is essential for tax professionals to stay informed about the latest legal changes to ensure they are always compliant.

| Legal Requirement | Description |

|---|---|

| Accurate Reporting | Tax preparers must ensure that all income, deductions, and credits are reported correctly according to tax laws. |

| Confidentiality | Client information must be kept confidential and only shared with authorized entities. |

| Record Keeping | Tax preparers are required to maintain accurate records of the tax filings and any advice given to clients. |

Ethical Standards

Beyond legal obligations, tax professionals are expected to follow a code of ethics that emphasizes fairness, integrity, and transparency. Ethical behavior helps maintain trust in the profession and ensures that clients receive honest and professional service. Some common ethical practices include:

- Full Disclosure: Informing clients about all relevant aspects of their tax situation and any potential consequences.

- Avoiding Conflicts of Interest: Ensuring that personal interests do not affect the impartiality of the services provided.

- Providing Accurate Advice: Offering tax advice that is based on facts and complies with the law, without encouraging clients to take illegal shortcuts.