Understanding how to manage personal resources is essential for achieving long-term stability and success. Whether it’s budgeting, investing, or planning for retirement, acquiring key knowledge helps make informed choices. This section focuses on critical areas of money management that are crucial for both everyday decisions and long-term financial goals.

Developing a strong grasp of financial principles can empower individuals to take control of their money, avoid common pitfalls, and make strategic decisions. From understanding the basics of credit to the complexities of saving for the future, each component plays a pivotal role in building a secure financial foundation.

By enhancing your skills in this area, you can navigate life’s challenges more confidently and ensure a healthier financial future. These concepts are not just theoretical–they are practical tools that everyone can apply to improve their financial well-being.

Understanding Money Management Concepts

At the core of personal finance lies the ability to effectively manage resources in order to achieve specific goals. Understanding how money works in relation to daily expenses, savings, and long-term investments is crucial for building a secure financial future. It’s not just about having more income, but about making smarter choices with what you have.

Key Areas of Focus

Essential topics such as budgeting, debt management, and understanding the value of investments form the foundation of money management. Each area requires a different approach but is interconnected in helping individuals make wise financial decisions. Effective budgeting helps avoid overspending, while proper debt management ensures that borrowing doesn’t become a burden.

The Importance of Financial Planning

Having a clear plan for both the short-term and long-term is vital. Planning for major life events such as buying a home, starting a family, or retiring requires foresight and knowledge. By understanding key concepts in managing resources, you can create a roadmap to navigate life’s financial challenges with confidence.

Key Topics in Financial Education Course

When learning about managing personal resources, several key subjects provide the foundation for making informed and effective decisions. These topics cover a broad range of areas, from understanding how to manage money on a day-to-day basis to preparing for significant financial milestones. A comprehensive understanding of these concepts is essential for individuals who want to secure their financial well-being.

Core Areas of Focus

The course includes a variety of subjects designed to teach individuals how to manage their finances, reduce risks, and plan for future needs. Each topic equips learners with the knowledge they need to navigate different financial decisions confidently.

| Topic | Description |

|---|---|

| Budgeting | Understanding how to allocate money efficiently for both daily expenses and long-term goals. |

| Saving | Learning the importance of setting aside money for unexpected expenses and future plans. |

| Debt Management | Mastering how to manage loans, credit, and other forms of borrowing to avoid financial strain. |

| Investing | Gaining insights into the different types of investments and how to grow wealth over time. |

| Risk Management | Understanding how to protect financial assets through insurance and other safety nets. |

Practical Application of Knowledge

By covering a variety of essential topics, the course encourages learners to apply what they’ve learned in real-world scenarios. This ensures that individuals not only understand the theory behind personal finance but also how to take actionable steps towards improving their financial health.

Mastering Budgeting and Saving Skills

Being able to effectively manage your income and expenses is essential for financial stability. The ability to plan and track your spending ensures that you can meet your immediate needs while also saving for the future. Understanding how to balance both short-term goals and long-term aspirations is key to achieving lasting success in personal finance.

Creating a Balanced Budget

Developing a budget involves organizing income, expenses, and savings into a clear structure. By allocating a portion of income to essential categories such as housing, utilities, and groceries, while also setting aside funds for savings or investment, individuals can ensure that they live within their means. Tracking spending regularly helps identify areas where adjustments can be made to improve financial health.

Building a Sustainable Savings Habit

Saving money consistently is one of the most important skills to develop. It involves not only setting aside money regularly but also understanding the purpose of those savings, whether it’s for emergencies, future purchases, or retirement. Building an emergency fund and investing in long-term goals can provide peace of mind and prevent financial stress during unexpected situations.

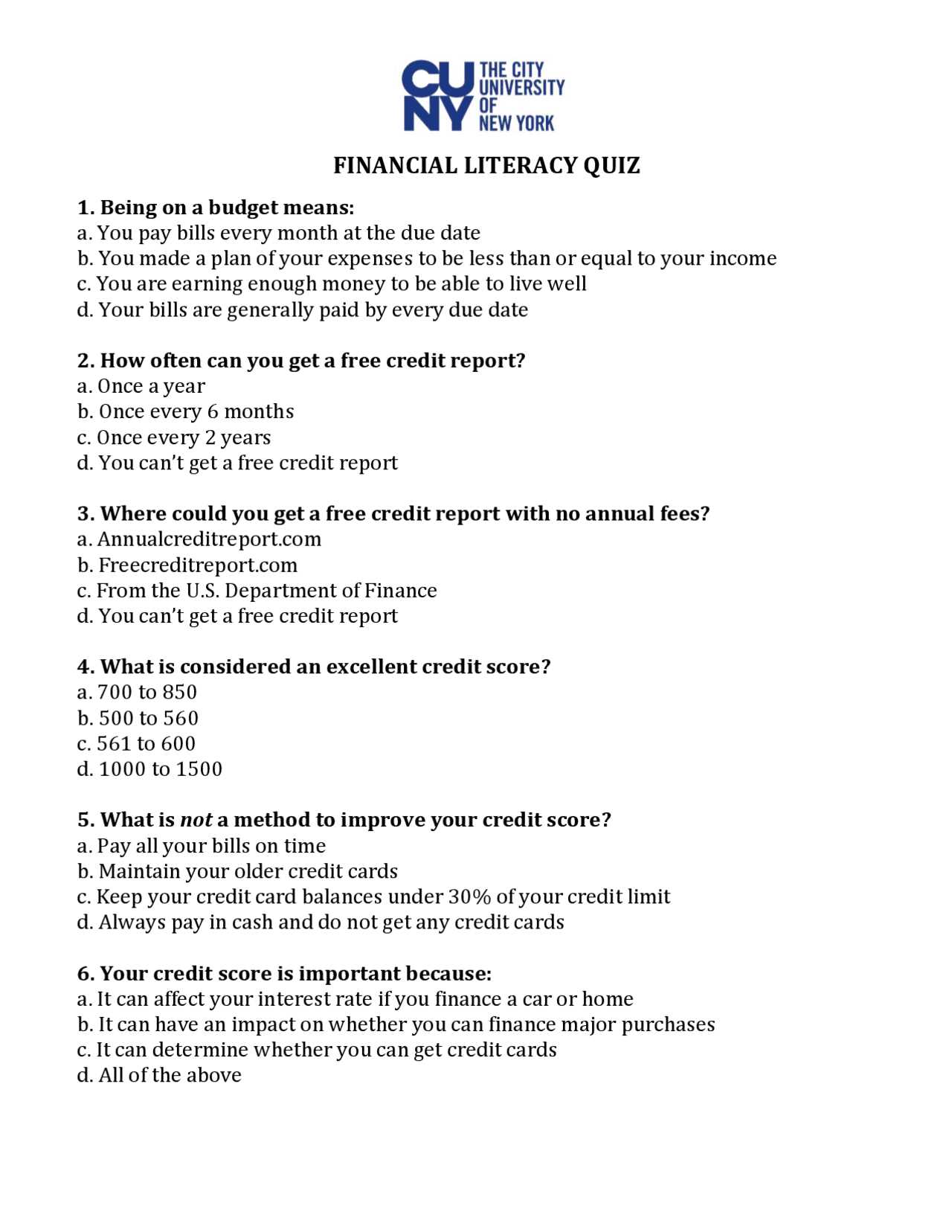

How to Build Your Credit Score

Your credit score plays a crucial role in your ability to borrow money and secure favorable interest rates. A good score can open doors to better loan terms, credit cards, and even housing opportunities. Building a strong score takes time and discipline, but understanding the key factors involved can help you make informed decisions to improve your financial standing.

Understanding the Key Factors

Several factors influence your credit score, including payment history, amount owed, length of credit history, types of credit used, and recent inquiries. Paying bills on time is one of the most important factors, as late payments can significantly damage your score. Additionally, maintaining a low balance on your credit cards and avoiding excessive debt can help keep your score in good standing.

Steps to Improve Your Credit

To build or improve your credit score, start by checking your credit report for any errors or outdated information. Paying off existing debt, avoiding new credit applications, and keeping credit card balances low are practical steps to improve your score over time. Consistency is key, as maintaining healthy financial habits will gradually reflect in a higher score.

Investing Basics for Beginners

Understanding how to grow your wealth through investments is a key component of long-term financial success. By putting your money into different types of assets, you can build a portfolio that grows over time, potentially outpacing inflation and providing you with future financial security. The world of investing can seem complex at first, but with the right knowledge and strategies, anyone can get started.

Different Types of Investments

There are various investment options available, each with its own level of risk and potential return. Stocks represent ownership in companies and offer the potential for high returns, though they also come with greater risk. Bonds, on the other hand, are a more stable investment, offering fixed interest payments over time. Mutual funds and exchange-traded funds (ETFs) allow you to invest in a diversified collection of assets, reducing risk through broad exposure.

Getting Started with Investing

When starting out, it’s important to set clear financial goals and choose investments that align with your risk tolerance and time horizon. Consider opening a brokerage account to access a variety of investment options. Many beginners begin with low-cost index funds or ETFs, which offer diversification and require less active management. Consistently contributing to your investments over time can help you take advantage of compound growth and reach your financial objectives.

Managing Debt Effectively

Successfully handling borrowed money is essential for maintaining financial stability. Whether it’s credit card debt, student loans, or mortgages, knowing how to manage your obligations can help prevent financial strain. With the right approach, debt can be paid off without sacrificing long-term financial goals.

Understanding Your Debt

The first step in managing debt is understanding exactly what you owe. Review your statements and create a list of all outstanding balances, including the interest rates, minimum payments, and due dates. This will give you a clear picture of your obligations and help you prioritize repayment strategies.

- Credit card balances

- Personal loans

- Student loans

- Mortgages

- Car loans

Strategies for Debt Repayment

There are various methods for paying off debt, each designed to help reduce the total amount owed in the most efficient way. Here are a few common strategies:

- The Snowball Method: Pay off your smallest debt first, then move on to the next. This creates momentum and motivates you to keep going.

- The Avalanche Method: Focus on paying off high-interest debt first, which will save you money on interest in the long run.

- Debt Consolidation: Combine multiple debts into one with a lower interest rate, making repayment simpler and more manageable.

By following these strategies and staying consistent with payments, you can take control of your financial situation and reduce debt over time.

Understanding Taxes and Deductions

Understanding how taxes work and the various deductions available can help you manage your income more efficiently and reduce your tax burden. Taxes are an essential part of the financial system, but knowing how they are applied and what you can legally deduct is crucial for optimizing your finances. By leveraging deductions, you can lower the amount of income that is subject to tax, which ultimately helps you keep more of your earnings.

Taxes can come in many forms, such as income tax, sales tax, and property tax, but income tax is the most common form that most individuals deal with. Alongside taxes, there are various deductions that can reduce your taxable income, such as those related to medical expenses, home mortgage interest, and charitable contributions. Understanding these deductions allows you to legally reduce your tax liability and possibly receive a larger refund.

Smart Strategies for Financial Planning

Planning ahead for future expenses and goals is one of the most important steps in building a secure and comfortable lifestyle. By setting clear financial goals, budgeting effectively, and preparing for unexpected costs, individuals can take control of their financial future. Smart planning helps ensure that resources are allocated efficiently, reducing the risk of financial stress and uncertainty.

Setting Clear Financial Goals

The first step in effective planning is identifying both short-term and long-term objectives. Whether it’s saving for a vacation, buying a home, or building retirement savings, setting specific goals allows you to create a roadmap for achieving them. Break down large goals into smaller, manageable steps, and track your progress regularly to stay motivated.

Building a Balanced Budget

Creating a budget is essential for understanding where your money goes each month. A well-structured budget ensures that you can cover your essential expenses while setting aside money for savings and investments. Focus on balancing income and expenses, while also accounting for future needs, such as emergencies or planned large purchases. Regularly reviewing your budget and adjusting as necessary will keep your financial plan on track.

Building an Emergency Fund

Having a safety net for unexpected events is a key aspect of securing your financial well-being. An emergency fund acts as a buffer that can help you navigate unforeseen circumstances, such as medical expenses, car repairs, or sudden job loss. By saving a portion of your income regularly, you can ensure that you are prepared for emergencies without relying on credit or loans.

Building this fund requires discipline and planning. It’s important to start small and gradually increase the amount saved over time. The goal is to accumulate enough to cover essential living expenses for three to six months. Having this cushion allows you to manage life’s unpredictability with greater peace of mind.

How Much Should You Save?

The amount to save for an emergency fund can vary based on individual circumstances. However, the general recommendation is to aim for three to six months’ worth of living expenses. To determine this, calculate your essential monthly expenses and multiply by the number of months you want to cover.

| Expense Category | Monthly Amount | 3-Month Goal | 6-Month Goal |

|---|---|---|---|

| Rent/Mortgage | $1,200 | $3,600 | $7,200 |

| Utilities | $200 | $600 | $1,200 |

| Groceries | $400 | $1,200 | $2,400 |

| Insurance & Transportation | $300 | $900 | $1,800 |

| Total | $2,100 | $6,300 | $12,600 |

Once you’ve set your goal, make it a priority to build this fund gradually. Automating your savings can be an effective way to stay on track and ensure that you’re contributing consistently toward your emergency fund.

Insurance: What You Need to Know

Having the right coverage is crucial to protecting yourself, your family, and your assets from unexpected events. Insurance provides a safety net by helping to cover costs when things go wrong, whether it’s an accident, illness, or damage to property. Understanding the various types of coverage available and knowing what you need can help you make informed decisions and ensure you’re adequately protected.

Types of Insurance Coverage

There are different kinds of insurance that serve various purposes. Some are essential, while others are optional depending on your circumstances. Here’s a breakdown of the most common types of insurance coverage:

| Type of Insurance | Description | Recommended for |

|---|---|---|

| Health Insurance | Covers medical expenses, including doctor visits, hospital stays, and prescriptions. | Everyone, especially those with high medical costs or health conditions. |

| Auto Insurance | Protects you financially in the event of an accident, theft, or damage to your vehicle. | Car owners and drivers. |

| Homeowners Insurance | Helps cover the cost of repairs or replacement if your home is damaged by fire, storm, or other disasters. | Homeowners or those with a mortgage. |

| Life Insurance | Provides financial support to your dependents in the event of your death. | Individuals with dependents or outstanding debts. |

| Disability Insurance | Offers income replacement if you become unable to work due to illness or injury. | Those with jobs that could cause physical strain or injury. |

How to Choose the Right Coverage

When choosing insurance, consider your personal needs, risk factors, and budget. It’s essential to evaluate how much coverage you need and to compare different policies to find the best rates. Make sure to read the terms and conditions of each policy carefully to understand what is and isn’t covered. If necessary, consult with an insurance agent who can help tailor the best plan for your situation.

Exploring Retirement Savings Options

Planning for the future and ensuring you have sufficient resources when you’re no longer working is a critical part of long-term financial security. There are various methods available to help you save for the later stages of life, each offering unique benefits depending on your goals, time frame, and financial situation. Understanding these options can help you make informed decisions and create a strategy that aligns with your needs.

Types of Retirement Accounts

Different retirement accounts cater to various savings goals, providing tax advantages and growth opportunities. Here are some of the most commonly used options:

- 401(k) Plans – Offered by employers, these accounts allow you to save a portion of your paycheck pre-tax. Some employers may match contributions, providing additional savings. They are a great way to build long-term wealth through regular contributions.

- Individual Retirement Accounts (IRAs) – These accounts come in two primary types: Traditional and Roth. The main difference lies in how and when taxes are applied. Traditional IRAs provide tax deductions upfront, while Roth IRAs offer tax-free withdrawals in retirement.

- Self-Employed Plans (SEP IRAs) – Ideal for self-employed individuals or small business owners, this plan allows for larger annual contributions, enabling faster growth of retirement savings.

- Health Savings Accounts (HSAs) – Though primarily for medical expenses, an HSA can also function as a secondary retirement savings tool, with tax advantages and the ability to invest for the future.

Building a Retirement Strategy

Choosing the right savings plan depends on factors such as your income level, employment status, and retirement goals. It’s essential to start early, make regular contributions, and take advantage of employer matches if available. Diversifying your retirement savings across multiple accounts can help ensure that your funds are protected against market volatility and that you benefit from different tax advantages.

As you progress through your career, review your retirement strategy periodically to ensure it continues to meet your needs and adjust for any changes in your circumstances.

Protecting Your Financial Identity

Your personal data is a valuable asset, and it’s crucial to protect it from misuse or theft. Safeguarding your identity ensures that your sensitive information–such as your banking details, social security number, and credit history–remains secure. By adopting certain strategies, you can prevent unauthorized access and reduce the risk of fraud or identity theft.

Key Steps to Safeguard Your Identity

There are several practical steps that can significantly reduce the likelihood of someone stealing your personal information:

- Use Strong Passwords: Avoid using easily guessed passwords and create complex combinations of letters, numbers, and symbols. It’s also beneficial to change your passwords regularly and avoid reusing them across multiple platforms.

- Enable Two-Factor Authentication: Adding an extra layer of security by requiring two forms of identification (e.g., password and a text message code) helps prevent unauthorized access to your accounts.

- Monitor Your Accounts: Regularly check your bank and credit card statements to detect any unusual transactions. Early detection of fraudulent activities can help prevent further damage.

- Shred Personal Documents: Shred paper documents that contain personal information, such as bank statements or tax records, before disposing of them. This prevents identity thieves from accessing your details from your trash.

Recognizing the Signs of Identity Theft

Being vigilant is key to spotting identity theft early. If you notice any of the following signs, it’s important to act immediately:

- Unexplained Transactions: Unexpected charges on your credit or debit cards may be an indication that someone has accessed your accounts.

- Credit Report Changes: If your credit report shows unfamiliar accounts or inquiries, it could be a sign that someone is using your identity to apply for credit.

- Missing Mail: Missing bank statements or tax documents might suggest that someone is redirecting your mail to commit fraud.

Taking these steps seriously can help protect your personal details and ensure that your identity remains secure in today’s digital world.

Understanding Interest Rates and Fees

When it comes to borrowing money or using financial services, understanding the costs associated with loans or credit is essential. Interest rates and fees can significantly impact the total amount you end up paying. Whether you’re taking out a loan, using a credit card, or even investing, it’s important to grasp how these costs work and how they can affect your overall financial situation.

How Interest Rates Affect Borrowing Costs

Interest is the cost of borrowing money, typically expressed as a percentage of the loan amount. The rate at which interest is charged can vary based on the type of loan, the lender, and your credit profile. Here are some key factors that influence interest rates:

- Loan Type: Different types of loans, such as personal loans, mortgages, or credit cards, come with varying interest rates. Secured loans usually have lower rates compared to unsecured loans, as they are backed by collateral.

- Credit History: Your credit score plays a significant role in determining the interest rate you are offered. A higher score typically results in a lower rate, as lenders see you as less risky.

- Economic Conditions: Interest rates can also be influenced by broader economic factors, such as inflation or central bank policies, which can cause rates to rise or fall over time.

Understanding Fees and Charges

Along with interest rates, financial products often include various fees. These fees can quickly add up and increase the total cost of borrowing or using financial services. Common types of fees to watch for include:

- Annual Fees: Many credit cards and loans come with annual fees, which are charged simply for having the account open.

- Late Payment Fees: Failing to make payments on time can result in additional charges, increasing your overall debt.

- Origination Fees: Some loans, especially mortgages or personal loans, may include an origination fee to cover administrative costs associated with processing the loan.

- ATM Fees: Withdrawing cash from an out-of-network ATM can lead to extra charges, both from your bank and the ATM owner.

By fully understanding the rates and fees associated with financial products, you can make more informed decisions and manage your costs effectively. Always read the terms and conditions of any agreement carefully to ensure that you are aware of all potential costs involved.

Smart Ways to Spend Money Wisely

Being strategic about how you use your money can significantly impact your long-term financial health. Making thoughtful decisions about your spending allows you to live within your means, save for future goals, and reduce unnecessary financial stress. In this section, we’ll explore several approaches that can help you maximize the value of your money while minimizing wasteful spending.

Prioritize Needs Over Wants

One of the most effective ways to manage your spending is by distinguishing between essential expenses and discretionary purchases. Essential expenses, such as housing, food, and utilities, should always take precedence. Once these necessary costs are covered, you can allocate any remaining funds toward savings or investments. If you have money left over, that’s when you can consider non-essential items, but it’s important to remain conscious of how much you truly need or want them.

- Focus on long-term goals: Spending on things that align with your future plans, like saving for retirement or a down payment on a house, is a wise choice.

- Evaluate discretionary spending: Items like entertainment or luxury goods can be adjusted based on your financial priorities, helping you save for larger objectives.

Embrace Smart Shopping Habits

Effective shopping habits can help you get more value from your purchases without sacrificing quality. By planning ahead, comparing prices, and avoiding impulse buys, you can make your money go further. Here are a few tips to keep in mind:

- Use coupons and discounts: Always look for deals and special offers, whether online or in stores. Many retailers offer loyalty programs or email subscriptions for exclusive discounts.

- Buy in bulk: When it makes sense, purchasing items in larger quantities can save you money in the long run, especially for non-perishable goods.

- Limit impulse purchases: If you find yourself frequently making unplanned purchases, try setting a waiting period before buying non-essential items. This will help reduce unnecessary spending.

By applying these practical strategies, you can make smarter choices about how you use your money, leading to greater financial stability and fewer regrets about your spending habits.

Why Financial Literacy is Important

Understanding the basic principles of managing money is crucial for achieving long-term stability and success in life. When individuals have the knowledge to make informed decisions about budgeting, saving, investing, and borrowing, they are better equipped to navigate the complexities of the modern economy. Without this foundation, people may struggle with debt, poor spending habits, and a lack of financial security.

Empowering Smart Money Management

Having a solid grasp of personal finance allows individuals to make conscious decisions about their money. This can lead to:

- Better budgeting: With the right knowledge, people can create realistic budgets that align with their goals and income, preventing overspending.

- Increased savings: Understanding how to save efficiently helps individuals build emergency funds and work toward future financial goals.

- Improved credit management: Knowing how to manage and maintain a good credit score can lead to better interest rates and financial opportunities.

Securing Financial Independence

Financial education is a key factor in achieving independence and financial freedom. When individuals understand how to invest wisely, plan for retirement, and reduce debt, they can pave the way for a more secure future. This knowledge also empowers them to make decisions that align with their long-term aspirations, such as buying a home, funding education, or starting a business.

- Avoiding common pitfalls: Lack of knowledge often leads to poor financial decisions, such as accumulating high-interest debt or missing out on investment opportunities.

- Building wealth: Educated individuals are more likely to make informed decisions regarding investments, which can help them build assets over time.

Ultimately, having a strong understanding of how money works is the foundation for personal success. It fosters confidence in managing resources and opens up a world of opportunities for financial growth and independence.

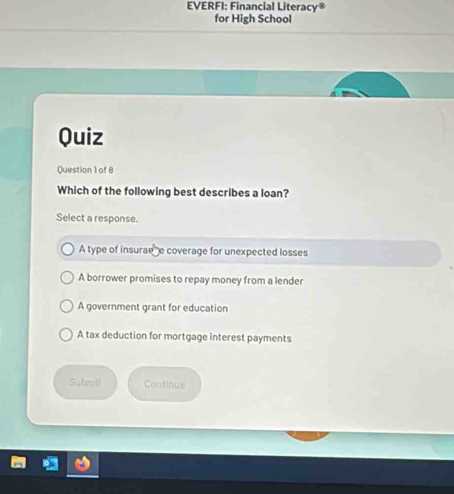

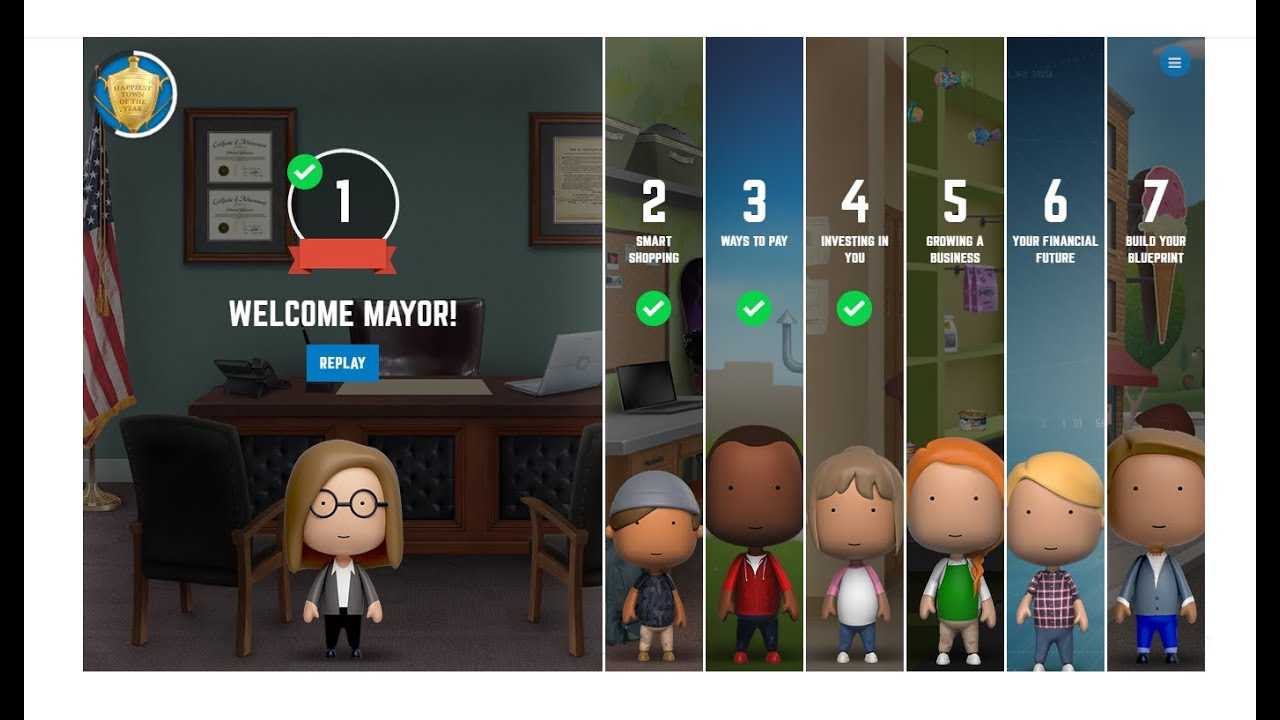

How Everfi Helps Financial Education

In today’s world, understanding how to manage money is more important than ever. Many individuals struggle with making informed choices when it comes to budgeting, saving, and investing. A platform that provides interactive learning and accessible resources can make a significant difference in equipping people with the knowledge they need to take control of their financial well-being. One such resource has become a game changer for many, helping individuals gain essential skills and knowledge.

Interactive Learning Modules

One of the most effective ways to teach complex topics is through interactive learning. This approach allows individuals to engage with material in a hands-on way, making the learning process more relatable and impactful. Some key benefits include:

- Practical application: Learners can experiment with scenarios that simulate real-life situations, helping them understand the consequences of their financial decisions.

- Engagement: Interactive content such as quizzes, challenges, and simulations keeps learners engaged and motivates them to complete courses.

- Retention: By actively participating in the learning process, individuals are more likely to retain the information and apply it to their own financial lives.

Real-World Financial Topics Covered

Understanding the basics is just the start. Comprehensive educational platforms like this provide deep dives into critical financial subjects. These include:

- Budgeting and Saving: Learners are taught how to manage their income effectively, plan for expenses, and build savings for future goals.

- Debt Management: Educational content helps individuals understand how to manage loans, credit cards, and avoid common pitfalls that lead to excessive debt.

- Investment Strategies: Information on how to start investing, the types of investments available, and the risks involved helps learners build a solid foundation.

- Retirement Planning: Courses focus on long-term planning and how to prepare financially for life after work, teaching learners the importance of early saving and smart investment choices.

These educational tools are accessible at any time, making it easier for individuals to learn at their own pace. This approach also helps to bridge the gap in financial education by offering free and easy-to-understand resources to people of all ages. By providing these opportunities for learning, individuals are empowered to make better, more informed financial decisions that can improve their long-term economic stability.

Practical Tips for Financial Success

Achieving long-term economic stability and prosperity requires more than just earning money. It involves making informed choices, managing resources wisely, and developing habits that contribute to lasting security. By incorporating a few key practices into daily life, anyone can improve their ability to manage their wealth effectively. Here are some practical tips to help guide you toward financial success.

1. Create a Budget and Stick to It

Having a budget is one of the most fundamental steps in managing your resources. It helps you track income, control spending, and ensure you are saving for future needs. Start by listing your monthly expenses and setting limits for each category. Prioritize essentials like housing, utilities, and transportation while reducing discretionary spending.

2. Build an Emergency Fund

An emergency fund is essential for protecting yourself from unexpected events such as medical emergencies, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses in a readily accessible account. Having this cushion can provide peace of mind and prevent you from going into debt when emergencies arise.

3. Pay Down Debt Strategically

Managing and reducing debt is crucial for improving financial health. Start by focusing on high-interest debt, like credit card balances, as it can accumulate quickly. Once high-interest debt is cleared, work on paying down other types of debt, such as student loans or mortgages. Consider using the debt snowball or debt avalanche method to pay off multiple debts effectively.

4. Save and Invest for the Future

Building wealth over time requires more than just saving. Consider investing in options that provide long-term growth, such as retirement accounts, stocks, or mutual funds. The earlier you start investing, the more your money will work for you. Take advantage of employer-sponsored retirement plans, especially if your employer offers a matching contribution.

5. Educate Yourself Continuously

Staying informed about money management is an ongoing process. There are always new strategies, tools, and trends to learn about. Read books, attend workshops, or consult financial professionals to deepen your knowledge. The more you know, the better equipped you’ll be to make smart decisions about your wealth.

6. Set Realistic Goals

Setting clear, achievable goals is essential for maintaining focus and motivation. Whether you’re saving for a home, paying off debt, or building your retirement fund, break your goals into smaller, manageable steps. Celebrate milestones along the way to stay encouraged and stay on track.

By adopting these habits and making small but consistent changes, you can create a strong foundation for future success. The key is to stay committed, be patient, and remain proactive in managing your resources. With time, these practices will lead to greater financial independence and stability.