Preparing for a major evaluation in the field of finance can be both challenging and rewarding. As you approach the test, it’s essential to focus on the core principles that will help you demonstrate a comprehensive understanding of the subject matter. A well-rounded approach to studying involves mastering essential techniques, from recognizing key formulas to applying theoretical knowledge in practical scenarios.

Throughout this guide, we will explore different strategies and concepts crucial for achieving success. Whether you’re grappling with theoretical aspects or practical problem-solving, the goal is to equip you with the tools necessary to confidently navigate the challenges of your evaluation. Understanding the structure and content of the assessment is the first step toward efficient preparation.

By reviewing essential topics and practicing key skills, you can increase your chances of performing well and achieving your academic goals. Stay focused and approach your preparation methodically for the best results possible.

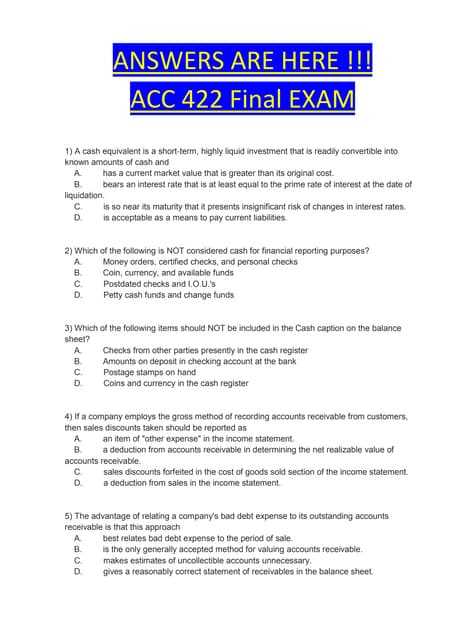

Accounting 202 Final Exam Answers

Successfully navigating a comprehensive assessment in the realm of financial management requires a deep understanding of key concepts and the ability to apply them effectively. In this section, we will delve into strategies that can enhance your preparation, focusing on techniques to master complex problems and critical thinking skills needed to excel.

Achieving a high score depends not only on memorizing formulas but also on your ability to interpret and analyze financial data. Practicing with sample problems, understanding key relationships between variables, and recognizing common patterns are essential for tackling challenging questions. By focusing on these areas, you’ll be better equipped to handle various scenarios presented during the test.

Additionally, it’s important to stay organized and prioritize the topics that carry the most weight in the evaluation. Whether it’s through reviewing past coursework or utilizing helpful resources, the goal is to ensure you’re fully prepared to demonstrate your knowledge confidently.

Understanding Key Accounting Principles

Mastering fundamental concepts is crucial when preparing for any evaluation in the field of financial management. A solid grasp of the foundational principles allows for better application in real-world scenarios and forms the backbone of more complex analysis. In this section, we will explore the key concepts that every student must understand to excel.

There are several core areas to focus on when studying for a comprehensive assessment. These concepts serve as the building blocks for more advanced topics and provide a strong framework for problem-solving. Key principles include:

- Double-Entry System: This fundamental method ensures that every financial transaction is recorded in two places, maintaining balance in financial records.

- Accrual vs. Cash Basis: Understanding the differences between recognizing revenue and expenses when they occur (accrual) versus when cash changes hands (cash basis) is essential for accurate reporting.

- Matching Principle: This principle requires that expenses be recorded in the same period as the revenues they help generate, offering a more accurate picture of financial performance.

- Revenue Recognition Principle: Knowing when and how to recognize revenue, typically when it is earned and realizable, is crucial for financial reporting.

Familiarity with these key principles will help you approach questions with a clearer perspective and apply concepts logically. Moreover, understanding these concepts will make it easier to break down complex scenarios into manageable steps, ensuring greater accuracy and efficiency in your approach.

Effective Study Tips for the Exam

Preparing for a challenging assessment requires more than just reviewing material; it involves a strategic approach to studying that maximizes retention and understanding. Adopting effective techniques can help you organize your time, prioritize key concepts, and approach difficult topics with confidence. Here are some practical strategies to enhance your preparation process.

Prioritize Key Concepts

Focusing on the most important topics will ensure that you’re well-prepared for the questions that carry the most weight. Begin by identifying the areas that are most commonly tested or have been emphasized in your coursework. These could include:

- Critical formulas and calculations

- Common financial principles and their applications

- Real-world scenarios and case studies

By concentrating on these, you’ll be able to answer more questions accurately and efficiently during the test.

Practice with Sample Questions

Working through sample problems or past assessments can significantly improve your problem-solving abilities. This practice helps you become familiar with the format of the questions and the best methods for tackling them. Here’s how you can make the most of this approach:

- Simulate test conditions to build time-management skills

- Review incorrect answers to understand where you went wrong

- Seek out additional problems or practice sets for comprehensive review

Through consistent practice, you’ll build both speed and accuracy, ensuring that you’re ready for anything that comes your way.

Common Mistakes to Avoid in Accounting

During any assessment in the field of financial management, it’s easy to make small errors that can have a significant impact on your performance. These mistakes often stem from misunderstandings, oversights, or misapplication of principles. Recognizing these common pitfalls can help you avoid them and improve your accuracy under pressure.

Neglecting to Double-Check Calculations

One of the most frequent errors is rushing through calculations without verifying them. Small mistakes in adding, subtracting, or multiplying can lead to incorrect results, affecting the outcome of your answers. To avoid this:

- Always review your calculations after completing each problem.

- Use estimation to check if the result is reasonable.

- Ensure you’re using the correct formula for each type of calculation.

Taking the time to double-check your work can prevent avoidable mistakes and boost your confidence.

Misunderstanding Key Concepts

Another mistake is misunderstanding or misapplying key financial concepts. For instance, confusing the recognition of revenue or expenses under different methods can lead to errors. To stay on track:

- Ensure you fully understand the distinctions between different accounting principles.

- Revisit complex concepts if you’re unsure about their application in various scenarios.

- Use study aids like summaries and flashcards to reinforce these key ideas.

By reinforcing your understanding of the foundational concepts, you can avoid confusion during more complex tasks and ensure accurate results.

How to Prepare for Your Assessment

Preparation for a major evaluation in the field of financial analysis requires a systematic approach. By organizing your study sessions, reviewing key materials, and practicing problem-solving techniques, you can significantly improve your chances of performing well. This section offers a structured guide to help you prepare effectively for the challenge ahead.

Create a Study Plan

One of the first steps in preparing for any test is creating a well-structured study plan. This helps you stay focused and organized, ensuring that all necessary topics are covered. Here’s how you can design an effective plan:

- Identify the main topics that will be covered in the test.

- Allocate specific study time for each topic, balancing difficult areas with easier ones.

- Set realistic goals for each study session to stay on track.

By breaking your study time into manageable chunks, you’ll reduce the risk of feeling overwhelmed and make your preparation more effective.

Review and Practice Regularly

Regular practice is key to mastering the material. It helps reinforce what you’ve learned and allows you to apply concepts in real-world scenarios. Here’s how to make the most of practice sessions:

- Work through sample problems to get comfortable with question formats.

- Test your understanding by explaining concepts to someone else.

- Focus on areas where you’re struggling and dedicate extra time to them.

Consistent review and practice ensure that the material is fresh in your mind and that you’re prepared to handle even the most challenging questions.

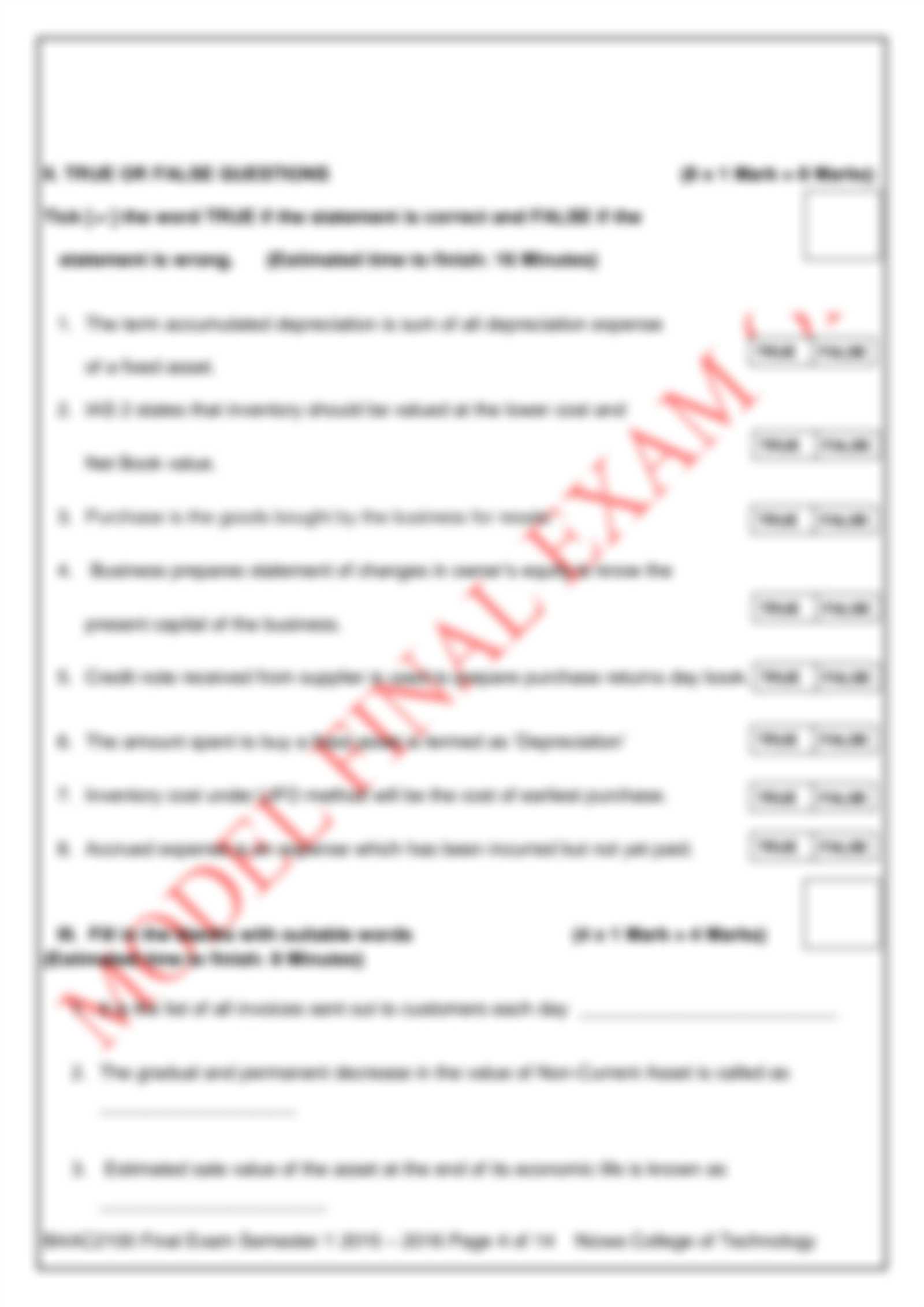

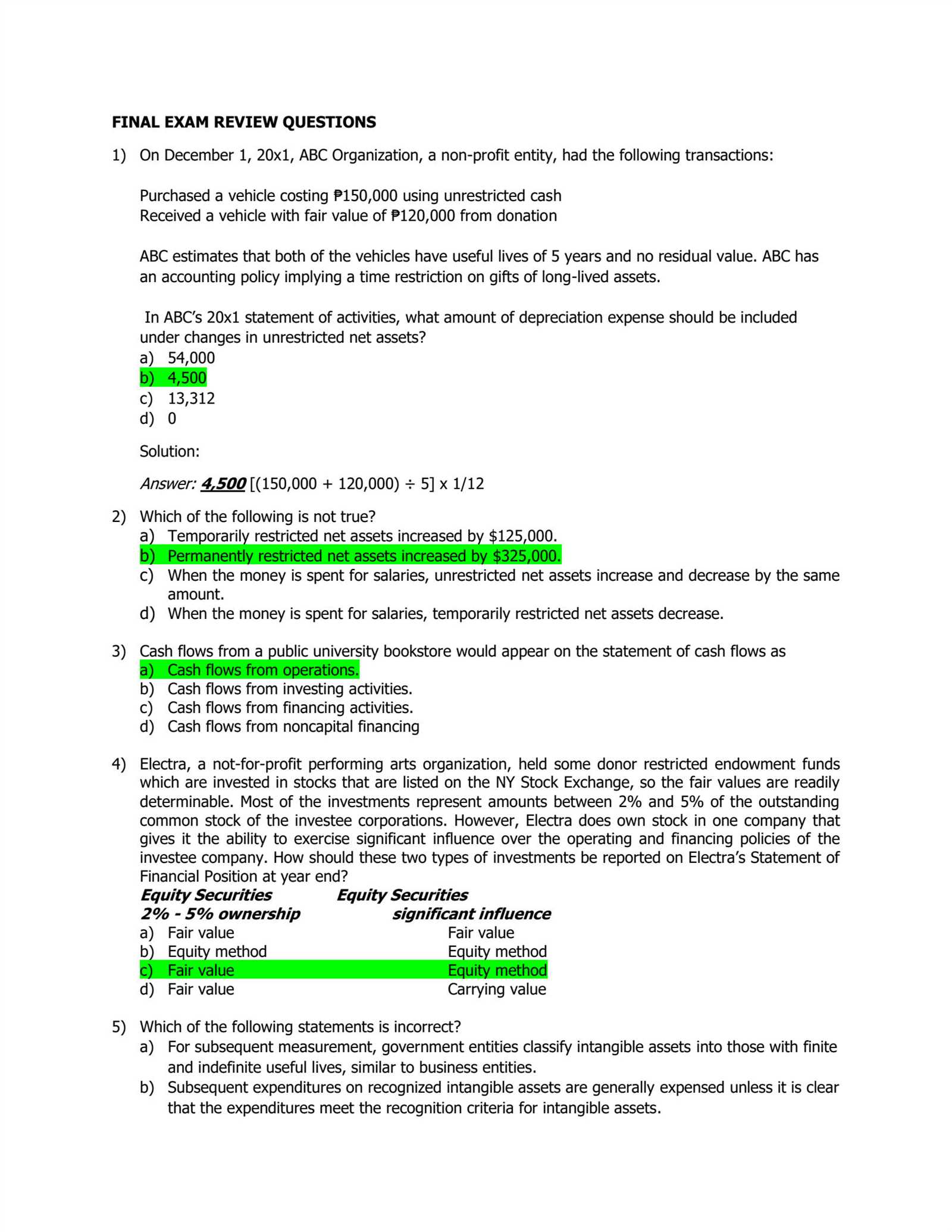

Exam Format and Question Types Explained

Understanding the structure of an assessment is crucial for effective preparation. Knowing the types of questions that are likely to appear, as well as how the test is organized, allows you to tailor your study approach and focus on the most relevant material. In this section, we will break down the typical structure of the evaluation and explain the different question formats you can expect.

The evaluation generally consists of a mix of question types, each designed to assess your understanding of key concepts and your ability to apply them. These questions can vary in complexity, and each requires a different approach to ensure accuracy and efficiency in answering.

- Multiple Choice Questions: These questions typically test your knowledge of specific facts, formulas, or concepts. They may present a scenario and ask you to choose the most appropriate response from a list of options. Practice with sample multiple choice questions to improve your speed and accuracy.

- Short Answer Questions: These questions often require a brief, concise explanation of a concept, calculation, or formula. Be prepared to write out your answers clearly and directly, focusing on the most important details.

- Problem-Solving Questions: These questions usually involve applying knowledge to solve practical problems or real-world scenarios. They may require you to perform calculations or interpret financial data. Practice solving similar problems to strengthen your problem-solving skills.

- Essay Questions: These questions evaluate your ability to discuss and analyze concepts in depth. Be ready to write well-organized responses that demonstrate your understanding and ability to explain complex ideas effectively.

Familiarity with these different question types will help you approach each section with confidence, ensuring that you can allocate your time efficiently and respond to questions in the most effective way possible.

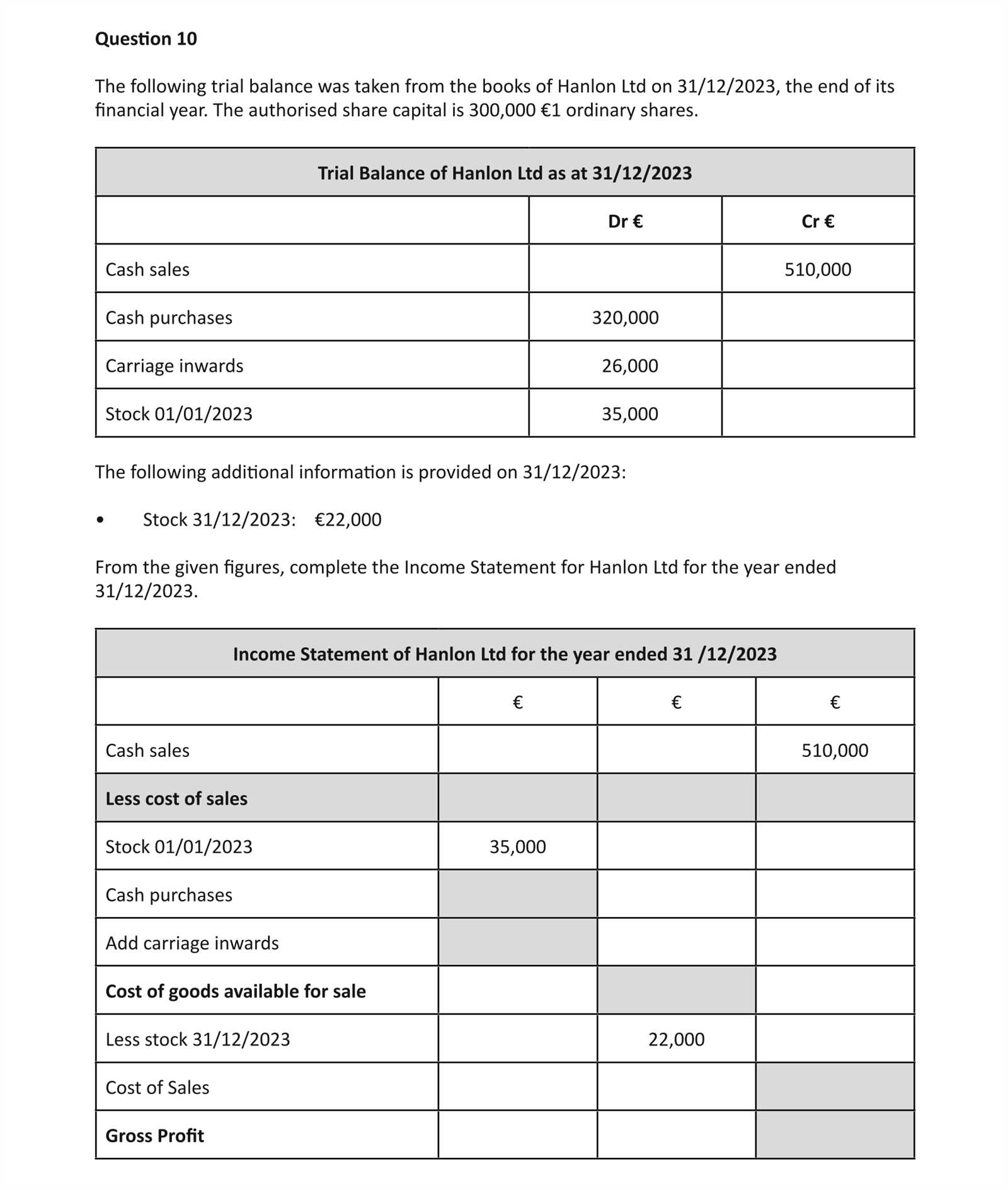

Mastering Financial Statements for the Exam

Being proficient in interpreting and analyzing financial reports is essential for any assessment in the field of financial management. Understanding how to extract meaningful insights from these documents will allow you to approach related questions with confidence and accuracy. This section will guide you through the key financial statements and how to master them for your preparation.

Key Financial Statements to Focus On

There are three primary financial statements that are often central to evaluations. Mastering these documents is crucial for answering related questions effectively:

- Income Statement: This statement provides a summary of an entity’s revenues, expenses, and profits over a specific period. Be familiar with how to analyze profitability, operating performance, and the relationship between revenue and costs.

- Balance Sheet: The balance sheet shows the financial position of a company at a given point in time, outlining assets, liabilities, and equity. Understanding how to evaluate liquidity and solvency is key to interpreting this document.

- Cash Flow Statement: This document tracks the flow of cash in and out of a business. Understanding the differences between operating, investing, and financing activities will help you assess a company’s cash position and financial health.

Strategies for Mastery

To master these financial statements, it’s important to practice both recognition and analysis. Here are some techniques to ensure a solid understanding:

- Repetition: Regularly review each statement and its components. Practice identifying key figures, ratios, and trends that are relevant to the evaluation.

- Practical Application: Work through real-life examples or case studies. This will help you develop a deeper understanding of how these statements reflect a company’s financial health.

- Review Financial Ratios: Familiarize yourself with the key financial ratios derived from these statements, such as profitability ratios, liquidity ratios, and leverage ratios, which can help in making more informed analyses.

By mastering the fundamentals of these financial statements, you will enhance your ability to respond to complex questions with precision and insight, ultimately boosting your performance.

Important Ratios to Know for Financial Analysis

Understanding and interpreting financial ratios is essential for assessing the health and performance of a business. Ratios provide a quick and effective way to analyze key financial aspects such as profitability, liquidity, and efficiency. In this section, we’ll explore the most important ratios you need to know and how they can be used to draw meaningful insights during your preparation.

Key Profitability Ratios

Profitability ratios are essential for evaluating how efficiently a business generates profits relative to its revenue, assets, or equity. These ratios give you an understanding of the company’s ability to generate profit in relation to its sales or assets.

- Gross Profit Margin: This ratio measures the percentage of revenue remaining after subtracting the cost of goods sold. A higher margin indicates a company is efficiently managing its production costs.

- Net Profit Margin: This ratio evaluates the percentage of revenue remaining after all expenses, taxes, and interest have been deducted. It reflects a company’s overall profitability.

- Return on Assets (ROA): ROA shows how efficiently a company uses its assets to generate profits. A higher ROA indicates better asset utilization.

- Return on Equity (ROE): ROE measures the return generated on shareholders’ equity. It indicates how well the company is using investor funds to generate profit.

Key Liquidity and Efficiency Ratios

Liquidity ratios help assess a company’s ability to meet its short-term obligations, while efficiency ratios focus on how well a company utilizes its assets and manages its operations.

- Current Ratio: This ratio measures the company’s ability to pay off its short-term liabilities with its short-term assets. A ratio above 1 is generally seen as favorable.

- Quick Ratio: Also known as the acid-test ratio, this measures a company’s ability to meet short-term obligations using its most liquid assets, excluding inventories.

- Inventory Turnover: This ratio shows how often a company sells and replaces its inventory over a period. A higher turnover rate indicates efficient inventory management.

- Receivables Turnover: This ratio measures how efficiently a company collects revenue from its credit sales. A high ratio indicates effective collection processes.

Mastering these ratios allows you to perform a comprehensive analysis of a company’s financial standing, making it easier to assess its operational efficiency and profitability under different conditions.

Time Management During Your Final Assessment

Effective time management is crucial when preparing for and taking an assessment. Properly allocating your time ensures that you can complete all sections thoroughly, minimize stress, and enhance the quality of your responses. In this section, we will cover practical strategies for managing time during your assessment, helping you make the most of the time available.

One of the key components of time management during any test is knowing how to prioritize tasks. You should first review the entire assessment and allocate time based on the complexity and length of each section. Here are some strategies to help you stay on track:

| Task/Section | Estimated Time | Tips |

|---|---|---|

| Multiple Choice Questions | 20-30 minutes | Quickly skim through and answer the easier ones first. Flag harder questions for later review. |

| Short Answer Questions | 30-40 minutes | Write concise answers but ensure you cover all key points. Don’t spend too much time on one question. |

| Problem-Solving Questions | 40-50 minutes | Work through problems step by step. Don’t get stuck on one if it’s taking too long–move on and return to it later. |

| Essay Questions | 30-40 minutes | Plan your response before starting. Be sure to allocate enough time for writing and reviewing. |

By following these guidelines and adjusting the time for each section based on your personal strengths and weaknesses, you can optimize your approach and ensure that all parts of the assessment are completed with accuracy and thoroughness. Always leave some time at the end to review your responses, as this can help catch small mistakes or refine your answers.

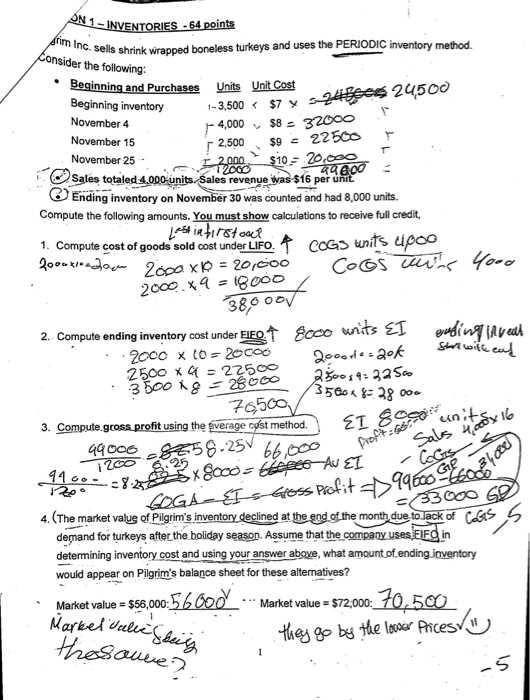

Strategies for Solving Complex Problems

Tackling complex problems requires a structured approach and the ability to break down larger tasks into manageable parts. When faced with a challenging question or situation, it’s important to stay calm, analyze the problem, and apply effective techniques to find a solution. In this section, we’ll explore several strategies that can help you approach difficult problems with confidence and clarity.

One of the most effective ways to approach a complex issue is to break it down into smaller, more digestible pieces. Here are a few strategies to help you solve complex problems efficiently:

- Understand the Problem Thoroughly: Take the time to read through the problem carefully. Highlight or note down key points and make sure you fully understand what is being asked before you begin solving it.

- Identify Known and Unknown Variables: Separate the information you know from what is missing. This will help you focus on what needs to be found and what methods or formulas can be applied.

- Work Step-by-Step: Break the problem into logical steps and address each one individually. Don’t try to solve everything at once–focus on one part at a time.

- Look for Patterns or Trends: Often, problems can be solved by recognizing patterns or trends in the given data. Identifying these patterns may provide clues to the solution.

- Apply Relevant Formulas or Techniques: Depending on the nature of the problem, use any applicable formulas, rules, or methods you’ve learned. Knowing the right tools for the job can simplify the process.

- Check Your Work: Once you’ve reached a solution, go back and double-check your steps. Ensure that you didn’t overlook any details or make careless errors.

By using these strategies, you can approach complex problems with a systematic and confident mindset. Breaking down large problems into smaller tasks, staying organized, and applying the right methods will greatly improve your problem-solving skills and help you succeed in any assessment.

Understanding Journal Entries and Ledgers

Mastering the process of recording and tracking financial transactions is essential for organizing financial information. Journal entries and ledgers play a crucial role in this process, helping ensure that every transaction is accurately recorded and classified. This section will explain how journal entries are made and how they are later transferred to ledgers, providing a clear understanding of the flow of financial data.

What Are Journal Entries?

Journal entries are the first step in recording financial transactions. When a financial event occurs, it must be documented in a journal, where the details of the transaction are recorded. Each journal entry typically includes the date of the transaction, the accounts involved, the amounts, and whether they are debits or credits. This system allows for a clear and structured way to track all financial movements.

Transferring to Ledgers

Once journal entries are made, they are transferred to ledgers, which are used to summarize and categorize the data. Ledgers organize transactions by account, making it easier to track the balance and movement of each individual account. Each ledger entry will reflect the total debits and credits for an account, providing a clear overview of its financial position. The process of transferring data from the journal to the ledger is known as posting.

Key Differences Between Journals and Ledgers:

- Journals: Record individual transactions in chronological order, capturing all details about each event.

- Ledgers: Group transactions by account, summarizing the impact of multiple journal entries on each account.

In practice, the combination of journal entries and ledgers allows businesses to maintain accurate and organized financial records, making it easier to prepare financial statements and ensure that all transactions are properly tracked.

Taxation Topics to Review for Accounting 202

Understanding the key taxation concepts is crucial when it comes to managing financial obligations and ensuring compliance. Taxation plays a significant role in any financial system, and reviewing essential topics will provide you with the necessary foundation for addressing tax-related questions. In this section, we will outline the main areas of taxation that are often tested and need to be well understood to succeed in related assessments.

Individual Taxation Rules

Individual taxation involves understanding how income, deductions, credits, and exemptions affect a person’s tax liability. Key areas to focus on include:

- Tax Brackets: Know the different income tax rates and how they apply based on earnings.

- Deductions and Exemptions: Review standard and itemized deductions, as well as exemptions available for individuals and dependents.

- Tax Credits: Understand the difference between tax credits and tax deductions, and how they reduce tax liability.

- Filing Status: Be familiar with the different filing statuses such as single, married, and head of household.

Business Taxation Concepts

When dealing with business taxation, it’s important to know how corporations, partnerships, and sole proprietorships are taxed differently. Key topics include:

- Corporate Tax Rates: Learn about how businesses are taxed based on their income, and any deductions or credits available to them.

- Depreciation and Amortization: Understand how businesses account for asset depreciation and amortization expenses for tax purposes.

- Self-Employment Taxes: Be aware of tax obligations for individuals who work for themselves, including both income and social security taxes.

By focusing on these taxation topics, you will be better equipped to handle tax-related problems and questions, ensuring that you have a comprehensive understanding of the subject.

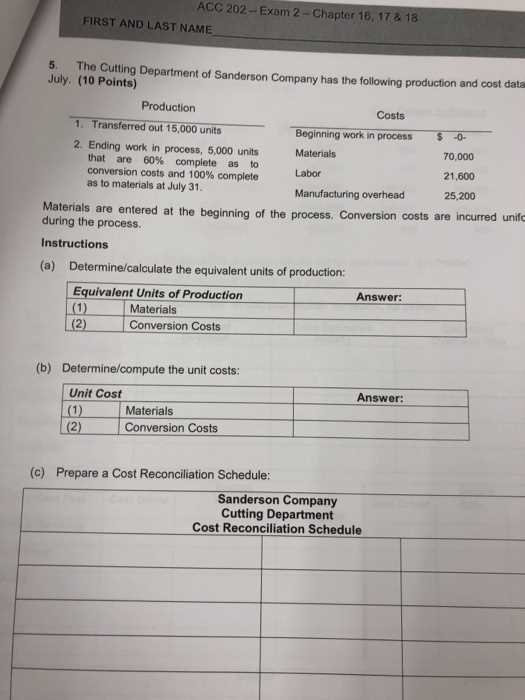

Key Concepts in Managerial Accounting

Managerial decision-making relies heavily on the ability to analyze financial information effectively. This field focuses on internal processes that assist managers in making informed decisions regarding resource allocation, cost control, and overall business strategy. Understanding the core principles of managerial accounting is essential for anyone involved in operations and financial planning within an organization.

Cost Behavior and Costing Methods

One of the fundamental aspects of managerial accounting is understanding how costs behave in relation to production levels and activity. Costs can generally be classified as fixed, variable, or mixed, each playing a critical role in cost analysis. Different costing methods help businesses allocate and track these costs more efficiently.

| Cost Type | Explanation |

|---|---|

| Fixed Costs | Costs that remain constant regardless of production levels, such as rent and salaries. |

| Variable Costs | Costs that change with production volume, such as raw materials and labor directly tied to production. |

| Mixed Costs | Costs that have both fixed and variable components, such as utility bills that increase with usage. |

Budgeting and Forecasting

Another critical concept in this area is the development of budgets and forecasts. Managers use these tools to plan for the future, estimate revenues and expenses, and ensure the company stays on track financially. Accurate forecasting can help businesses anticipate challenges and identify opportunities for cost savings.

Understanding the principles of budgeting, such as zero-based budgeting, flexible budgeting, and incremental budgeting, is essential for efficient financial planning. Each approach offers different insights and helps businesses manage resources effectively to align with strategic goals.

How to Tackle Multiple Choice Questions

Multiple choice questions are a common format in assessments, requiring careful analysis and strategic thinking to answer correctly. They are designed to test both your knowledge of the material and your ability to differentiate between similar options. To succeed in these types of questions, it’s essential to approach them systematically, using techniques that increase your chances of selecting the right answer.

Start by reading each question thoroughly before looking at the answer choices. This ensures that you understand what is being asked and can identify any keywords or clues that will help you eliminate incorrect options. Once you have a clear idea of the question, review all the provided answers and begin by crossing out the obviously incorrect ones. This will narrow down your choices, making it easier to focus on the remaining options.

If you’re unsure between two or more choices, look for hints within the question itself. Pay attention to words such as “always,” “never,” or “most likely,” as these can help indicate the best answer. Additionally, be cautious of answers that seem too extreme or absolute, as they are often incorrect.

Finally, manage your time effectively. If you’re stuck on a question, don’t dwell on it for too long. Move on and return to it later with a fresh perspective. This approach ensures that you can answer as many questions as possible without running out of time.

Top Resources for Review

To effectively prepare for assessments, utilizing a variety of resources is essential for reinforcing knowledge and practicing key concepts. With so many study materials available, it’s important to focus on high-quality content that will support your understanding of critical topics. Whether you’re looking for textbooks, online courses, or practice questions, the right resources can make all the difference in your preparation.

Start by reviewing official study guides and textbooks that cover the fundamental principles of the subject. These materials often provide a structured overview of important topics, as well as examples and practice problems that are essential for solidifying your understanding. Additionally, online platforms and websites dedicated to subject reviews can offer valuable insights, often providing interactive quizzes and video tutorials to enhance your learning experience.

Study groups and forums are also highly beneficial, allowing you to discuss challenging concepts with peers and gain diverse perspectives. These collaborative environments foster deeper comprehension and can help you pinpoint areas that may need more focus. Lastly, practice exams are an indispensable resource, simulating the test environment and helping you assess your readiness while building confidence.

What to Do After Completing the Exam

Once you have completed the assessment, it’s important to approach the next steps with a calm and strategic mindset. While it may be tempting to dwell on the questions you found difficult, taking a moment to relax and reflect will help you process the experience and focus on what’s next. The time following an exam can be an opportunity to evaluate your performance, manage your emotions, and prepare for future tasks.

Reflect on Your Performance

After finishing, take a moment to reflect on your performance. Consider which questions you felt confident about and which ones posed challenges. This self-assessment can help you identify areas for improvement in your study habits or understanding of certain topics. It’s also an opportunity to learn from mistakes, ensuring that future preparations are more efficient.

Review Exam Feedback

Once feedback is available, take the time to carefully review any comments or grades. Understanding where you succeeded and where you could improve is invaluable. This insight allows you to refine your study strategies and perform even better in future assessments.

| Action | Purpose |

|---|---|

| Relax and de-stress | Helps clear your mind and reduce anxiety after a challenging assessment. |

| Self-reflection | Identifies strengths and weaknesses to guide future studies. |

| Seek feedback | Improves understanding of where to focus your attention next time. |