In the realm of economics, the way governments influence markets and manage national resources plays a crucial role in shaping a nation’s financial health. Decisions made by state institutions can have long-term effects on everything from employment rates to inflation levels. Understanding the tools available to governments for managing these factors is essential for both citizens and businesses alike.

Government intervention in the economy often takes various forms, including taxation, public spending, and national debt management. These strategies are designed to regulate economic activity, stabilize growth, and address any economic imbalances that may arise. However, the effectiveness of such measures can vary depending on numerous factors, including political context and global trends.

Key mechanisms used by governments to influence the economy include adjusting spending, changing tax rates, and borrowing funds. These actions are intended to either stimulate the economy during downturns or slow down overheating during periods of rapid growth. Understanding how these elements work together can provide valuable insights into the current economic landscape and future trends.

Understanding Economic Management Basics

Economic management refers to the strategies and tools that governments use to control and influence the broader economy. Through various actions, governments can steer the direction of economic growth, address issues like inflation or unemployment, and ensure stability in times of economic uncertainty. The key mechanisms for achieving these goals include adjusting national budgets, managing public spending, and implementing taxation systems. These decisions have wide-reaching effects on the financial well-being of a country’s population.

Core Instruments of Economic Control

Governments rely on several core instruments to manage the economy. These include:

| Instrument | Purpose | Impact |

|---|---|---|

| Government Spending | Stimulate economic activity or manage public services | Can influence job creation and public welfare |

| Taxation | Generate revenue for public projects | Affects consumer behavior and disposable income |

| National Debt Management | Borrowing funds to cover budget gaps | Influences interest rates and overall debt sustainability |

The Role of Budget Balancing

One of the key strategies for managing a nation’s economy is balancing the national budget. A surplus indicates that the government is generating more revenue than it spends, while a deficit suggests the opposite. Both scenarios can have distinct implications for economic growth. A balanced budget typically reflects a stable economy, while persistent deficits may lead to inflation or higher national debt. Effective budget management helps maintain financial stability and can stimulate or slow down the economy as needed.

Role of Government in Economic Stability

The government plays a crucial role in maintaining the stability of a nation’s economy. By implementing various strategies and interventions, it seeks to minimize economic fluctuations and create a balanced environment for growth. Through actions such as adjusting public expenditure, regulating financial markets, and implementing tax systems, the government can influence factors like inflation, employment, and overall economic performance.

One of the primary functions of government in economic stability is to act as a regulator. By overseeing financial institutions, setting interest rates, and monitoring inflation, the government ensures that the market operates smoothly and does not spiral into crises. In times of economic downturns, the government can intervene by increasing spending or cutting taxes to stimulate demand and prevent a prolonged recession.

Another key aspect is managing the national budget. A well-managed budget helps to control the public debt and ensures that resources are allocated effectively to promote long-term growth. Balancing the budget and making strategic investments in infrastructure, education, and technology can significantly enhance a nation’s ability to withstand external shocks and remain competitive in the global economy.

Key Instruments of Economic Management

Governments have a range of tools at their disposal to guide and regulate the economy. These mechanisms help shape national wealth, manage resources, and ensure stability. By adjusting various economic factors, governments can address economic downturns, inflation, and other financial challenges, promoting long-term prosperity and growth.

Government Spending

One of the primary instruments used to influence economic activity is government spending. By increasing or decreasing expenditure on public goods, services, and infrastructure projects, the government can stimulate demand within the economy. During periods of low economic activity, higher spending can help boost employment and consumption, while reduced spending may be used to control inflation or address budget deficits.

Taxation

Taxation plays a critical role in raising revenue for the government and redistributing wealth within the economy. By adjusting tax rates, governments can influence consumer behavior, corporate investment, and savings rates. Lower taxes can encourage spending and investment, while higher taxes may be used to cool down an overheating economy or reduce government debt.

Fiscal Deficits and National Debt Explained

Understanding the concepts of government deficits and national debt is essential for grasping how a country manages its finances. When a government spends more than it earns in revenue, the result is a deficit. If this trend continues over time, it leads to an accumulation of national debt. Both deficits and debt are critical aspects of a nation’s economic health and influence the government’s ability to function effectively.

What is a Fiscal Deficit?

A fiscal deficit occurs when a government’s total spending exceeds its total revenue within a specific period, usually a year. This imbalance means that the government must borrow money to cover the gap. While some level of deficit may be acceptable, prolonged or excessive deficits can lead to challenges, such as inflation or reduced creditworthiness. The primary reasons for a deficit include:

- Increased government spending on public services, infrastructure, or social programs.

- Reduced tax revenues due to economic downturns or tax cuts.

- Unexpected financial crises requiring emergency spending.

The Impact of National Debt

National debt refers to the total amount of money that a government owes to external creditors or domestic lenders. As a result of recurring deficits, a country borrows funds, which adds to the debt. Over time, this debt can accumulate and affect the government’s fiscal flexibility. The consequences of high national debt include:

- Increased interest payments, which can divert resources from other vital areas such as education or healthcare.

- Potential reduction in investor confidence, leading to higher borrowing costs.

- Greater vulnerability to global economic shifts, as foreign creditors may demand stricter terms or higher interest rates.

Managing both deficits and national debt is essential for maintaining long-term economic stability. Governments must carefully balance spending and revenue generation to ensure that borrowing remains sustainable and does not hinder future growth prospects.

The Impact of Taxation on Growth

Taxation is one of the most powerful tools available to governments to influence economic activity. By determining the amount and type of taxes levied on individuals and businesses, governments can either encourage or discourage various economic behaviors. The level of taxes directly affects the disposable income of households, the profitability of businesses, and the overall climate for investment and innovation.

When taxes are too high, they can have a negative impact on economic growth. High tax rates may reduce consumer spending, as individuals have less disposable income. Similarly, businesses may scale back investment or increase prices to maintain their margins, which can reduce economic output. On the other hand, moderate taxes can provide the government with the necessary revenue to invest in public services and infrastructure, which, in turn, can stimulate long-term economic growth.

Governments must carefully balance tax rates to ensure they are not stifling growth while still raising the necessary funds to support public services and development. This balance is often at the heart of debates about the optimal tax system, with some advocating for lower taxes to boost spending and investment, while others argue for higher taxes to fund important social programs and address inequality.

Government Spending and Economic Stimulus

Government expenditure plays a critical role in shaping the direction of a nation’s economy, especially during times of economic downturn. When private sector activity slows down, increased public spending can provide the necessary boost to stimulate demand, create jobs, and spur growth. This approach is often referred to as an economic stimulus, where the government injects funds into the economy to counteract stagnation and promote recovery.

Public spending can take many forms, from investments in infrastructure projects like roads, bridges, and schools, to funding for healthcare, education, and social services. By directing resources to these areas, governments create jobs and provide businesses with contracts, which in turn stimulates consumer spending. This type of spending is particularly important during periods of high unemployment, as it helps reduce the negative impact of job losses and stimulates economic activity.

Economic stimulus measures are designed to increase demand for goods and services, encouraging businesses to expand and invest in production. When people have more money to spend, businesses see an increase in sales, prompting them to hire more workers and expand their operations. The cycle of increased spending, job creation, and higher production helps the economy return to a path of growth and stability.

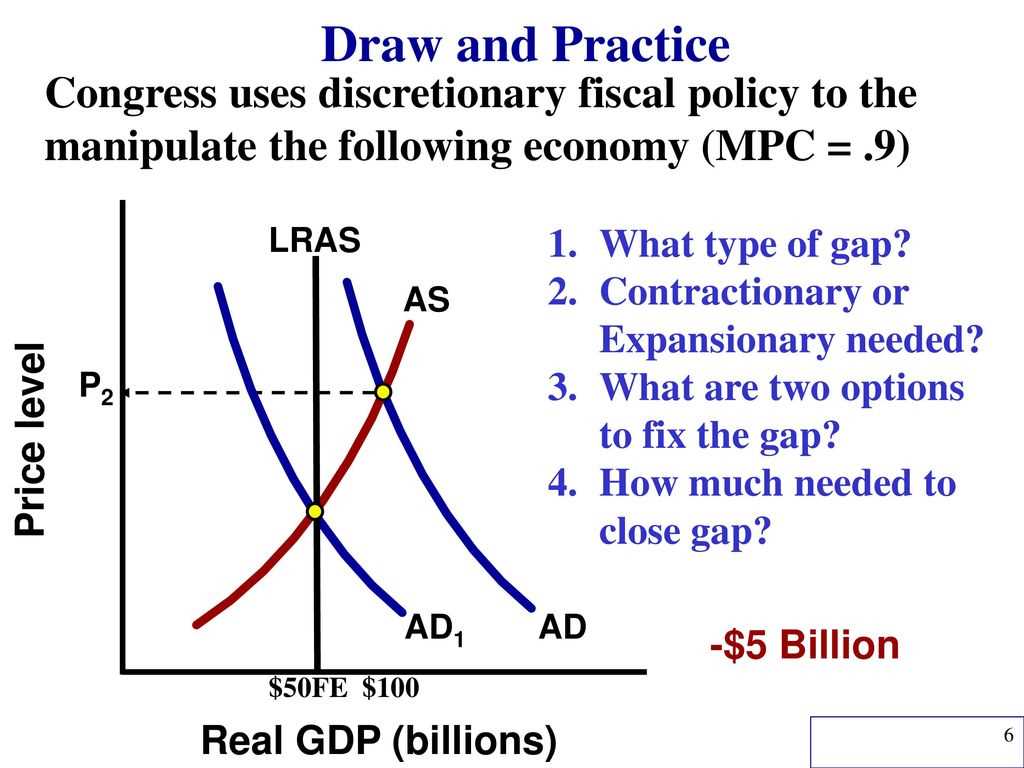

Monetary vs Fiscal Policy: Key Differences

Both government actions to manage the economy play vital roles in shaping a nation’s economic landscape. However, while both aim to achieve similar objectives–such as stabilizing inflation, reducing unemployment, and promoting growth–the tools and methods they use are distinct. Understanding these differences is crucial for grasping how a country’s economy functions and how it can respond to changing conditions.

Monetary Management

Monetary management is primarily handled by a nation’s central bank. It involves controlling the supply of money and interest rates to influence economic activity. The central bank adjusts interest rates, buys or sells government securities, and uses other tools to regulate inflation and stabilize the financial system. The key objectives of monetary management are:

- Control inflation through adjusting interest rates.

- Maintain price stability and moderate long-term interest rates.

- Ensure liquidity in the banking system to facilitate lending and investment.

Government Spending and Taxation

Government spending and taxation, on the other hand, are typically managed through the national government’s budgetary decisions. This approach directly influences national output and employment by adjusting the levels of spending or taxes. Unlike monetary management, which focuses on influencing financial conditions, fiscal actions have a more direct impact on the real economy. The primary goals of government spending and taxation include:

- Boosting or slowing economic activity by adjusting public spending.

- Raising revenue for public services and infrastructure through taxation.

- Redistributing wealth and addressing social needs.

While both approaches are used to guide the economy, their methods differ significantly. Monetary management operates through the financial system, impacting money supply and interest rates, whereas government spending and taxation involve direct intervention in the economy’s output and distribution. Both tools are complementary, but they require careful coordination to achieve overall economic stability.

The Relationship Between Fiscal Management and Inflation

The way a government manages its spending and revenue collection plays a significant role in determining the level of inflation in an economy. When public expenditures rise or revenue falls, it can lead to an increase in the overall demand for goods and services. If this demand outpaces supply, inflation can occur. Conversely, careful adjustments in spending and taxes can help keep inflation in check by controlling aggregate demand.

Demand-Pull Inflation and Government Spending

Demand-pull inflation occurs when the demand for goods and services exceeds their supply, causing prices to rise. If a government increases its spending without corresponding increases in supply or production, it can lead to higher overall demand, which might push prices upward. This situation is often seen when governments inject large amounts of money into the economy through public projects or stimulus packages.

On the other hand, if the government reduces its spending or raises taxes, it can reduce overall demand, which helps in curbing inflationary pressures. This method is often employed when the economy is overheating, and inflation is becoming a concern.

The Role of Taxation in Controlling Inflation

Taxation also has a crucial influence on inflation. Higher taxes can reduce disposable income, thereby limiting consumer spending and demand. This reduction in demand helps to prevent the economy from overheating and keeps inflation under control. However, raising taxes too much can lead to decreased economic activity, so it is essential to find a balance between stimulating the economy and preventing excessive price increases.

In summary, there is a delicate balance between government actions and inflation. By adjusting spending and tax policies, governments can influence the level of demand in the economy, helping to either mitigate or exacerbate inflationary pressures.

How Government Spending and Taxation Affect Unemployment

The decisions made by governments regarding spending and taxation have a direct impact on the employment rate within a country. When governments choose to increase their expenditures or adjust taxes, it can either create or reduce job opportunities, influencing the overall unemployment rate. These actions affect the demand for goods and services, which in turn impacts businesses’ hiring decisions and the broader labor market.

Government Spending and Job Creation

One of the most direct ways the government can reduce unemployment is by increasing public spending. When the government invests in large infrastructure projects, public services, or social programs, it can create thousands of new jobs. This is especially true during economic downturns when private sector spending may be insufficient to sustain full employment. Increased government spending helps boost demand, leading businesses to expand production and hire more workers. Some examples include:

- Building new roads, bridges, and public facilities.

- Investing in healthcare, education, and social welfare programs.

- Supporting job training and skill development initiatives.

Taxation and Its Impact on Hiring

On the other hand, changes in tax policies can either encourage or discourage businesses from hiring. Lower taxes on businesses or income allow companies to retain more profits, which can be reinvested into their operations, leading to job creation. On the flip side, higher taxes might reduce the amount of money businesses have available to expand or hire additional staff, potentially increasing unemployment. The impact of taxation is often seen in:

- Corporate tax reductions, which provide businesses with more capital for expansion and hiring.

- Personal income tax cuts, which increase disposable income and boost consumer demand, indirectly encouraging businesses to hire more workers.

- Payroll taxes, which can increase the cost of hiring and potentially reduce the number of new hires or lead to layoffs.

In summary, government spending and taxation are powerful tools that influence the unemployment rate. By strategically adjusting these levers, governments can create an environment conducive to job creation or, conversely, trigger job losses, depending on the broader economic goals they aim to achieve.

Deficit Financing: Risks and Benefits

When a government spends more than it earns through taxes and other revenues, it often turns to borrowing to cover the gap. This practice, known as deficit financing, allows the government to fund essential services and projects even when its budget is not balanced. While this approach can provide immediate relief and stimulate economic activity, it also carries long-term implications that need careful consideration.

Benefits of Deficit Financing

Deficit financing can be an essential tool for managing economic challenges and supporting growth, especially during times of recession or when investment in infrastructure and public services is necessary. Some of the key advantages include:

- Stimulating economic growth: Borrowing can inject capital into the economy, helping to boost demand for goods and services, create jobs, and promote business activity.

- Providing immediate funding: Governments can fund critical projects such as building roads, schools, or healthcare infrastructure without waiting for sufficient revenue to accumulate.

- Supporting social welfare: Deficit financing enables governments to maintain public services and social programs, especially during economic downturns when tax revenues may be lower.

Risks of Deficit Financing

While borrowing can provide short-term benefits, it also comes with significant risks that may affect the economy in the long run. These risks include:

- Rising debt levels: Continued borrowing leads to an increase in national debt, which can result in higher interest payments and reduce the government’s ability to invest in other areas.

- Inflationary pressures: If deficit financing leads to an oversupply of money in the economy, it can result in higher inflation, eroding purchasing power and destabilizing the economy.

- Loss of investor confidence: Excessive borrowing without clear plans for repayment can reduce investor confidence in the country’s financial stability, potentially leading to higher borrowing costs or reduced investment.

In summary, while deficit financing can be an effective short-term tool for managing a nation’s financial needs, it must be used judiciously to avoid long-term economic instability. Governments must strike a balance between funding immediate needs and ensuring fiscal sustainability over time.

The Role of Budget Surpluses in Growth

A budget surplus occurs when a government’s revenues exceed its expenditures. While deficits often grab the spotlight, surpluses can play a critical role in driving long-term economic stability and growth. When a government consistently runs surpluses, it creates opportunities to strengthen the economy, reduce debt, and improve public services.

Benefits of Running a Budget Surplus

Running a surplus offers several advantages for a nation’s economic health. The most significant benefits include:

- Debt Reduction: A surplus allows the government to pay down existing debt, reducing interest payments and freeing up resources for future investments.

- Increased Financial Stability: By accumulating surpluses, a country can build financial reserves, providing a buffer in case of future economic downturns or emergencies.

- Enhanced Public Investment: Surpluses can be reinvested into public infrastructure, education, healthcare, or social programs, creating long-term benefits for society.

- Improved Investor Confidence: A government with a history of surpluses is seen as fiscally responsible, which can attract both domestic and foreign investment, boosting economic growth.

Impact of Budget Surpluses on Economic Growth

While surpluses are generally seen as a sign of fiscal health, their role in stimulating growth can be more nuanced. Here are some ways that running a surplus can contribute to sustained economic progress:

- Lower Interest Rates: By reducing the need to borrow, a government with a surplus may lead to lower interest rates, benefiting businesses and consumers alike.

- Stimulating Private Investment: A surplus allows for lower government borrowing, which can help lower the cost of credit for businesses, encouraging them to invest and expand.

- Increased Consumer Confidence: Surpluses can signal a stable economic environment, leading to greater consumer confidence, higher spending, and a boost in overall demand.

In conclusion, while the short-term effects of a budget surplus might seem minimal, its long-term benefits can provide the foundation for sustainable growth, improved public services, and a more resilient economy. Properly managed, surpluses can help ensure that a country is well-equipped to handle future challenges while fostering an environment conducive to growth and prosperity.

Fiscal Policy Responses During Recession

During periods of economic downturn, governments often take proactive measures to support recovery and mitigate the negative effects of the recession. These responses aim to stimulate demand, support employment, and stabilize the overall economy. By adjusting government spending and taxation, authorities can influence economic activity and guide the nation back toward growth.

Key Approaches to Managing Recession

Governments typically rely on several strategies to counteract the effects of a recession. These include:

- Increased Public Spending: One of the most common responses is for the government to ramp up spending on infrastructure, healthcare, and education. This helps create jobs, boosts demand, and stimulates economic activity across various sectors.

- Tax Cuts: Reducing taxes can provide businesses and individuals with more disposable income. This can increase consumer spending, encourage business investment, and boost overall demand in the economy.

- Subsidies and Support Programs: Governments may introduce direct support programs such as unemployment benefits, food assistance, or small business loans to provide a financial safety net for those most affected by the downturn.

Effectiveness of These Measures

While these responses can offer immediate relief, their long-term success depends on various factors, including the scale of the measures and the ability to implement them effectively. Some potential outcomes of such interventions are:

- Job Creation: Government spending on infrastructure and public services can lead to the creation of jobs, helping reduce unemployment and improve economic confidence.

- Increased Demand: Tax cuts and financial support can increase consumer spending, which in turn boosts demand for goods and services, helping businesses recover and expand.

- Stabilizing Financial Markets: Strategic interventions can help stabilize financial markets and prevent further economic contraction, reassuring investors and consumers alike.

In summary, government responses during a recession are crucial in helping to stabilize the economy. By adjusting spending and taxation levels, the government can stimulate demand, create jobs, and set the stage for long-term recovery. However, the effectiveness of these measures depends on how quickly they are implemented and whether they are tailored to the specific needs of the economy at that time.

Fiscal Policy in Developing Economies

In many developing nations, the management of government finances plays a crucial role in promoting economic growth and addressing issues such as poverty, inequality, and infrastructure deficits. Due to limited resources and vulnerability to external shocks, governments in these economies must carefully balance expenditure and revenue generation to drive sustainable development. Effective financial strategies are needed to improve living standards, create jobs, and build resilience against global economic fluctuations.

Challenges Faced by Developing Nations

Countries with emerging economies often face significant challenges when implementing financial strategies. These challenges include:

- Limited Financial Resources: Many developing nations struggle with insufficient government revenue due to a narrow tax base and informal economic activities, making it difficult to fund public programs.

- External Debt: High levels of external debt often constrain the ability to allocate funds for social and development projects, leading to a cycle of borrowing and repayment.

- Inflation and Currency Instability: Fluctuations in exchange rates and rising inflation can reduce the effectiveness of government measures and undermine economic stability.

Government Measures in Developing Economies

To address these challenges, governments in developing countries adopt various measures to stimulate economic activity and improve national welfare. Some of the key strategies include:

- Investment in Infrastructure: Significant investments in infrastructure projects, such as roads, schools, and healthcare facilities, can stimulate employment and create long-term benefits for economic growth.

- Social Programs: Governments may implement social safety nets like cash transfers, food assistance, and healthcare subsidies to protect vulnerable populations and promote human capital development.

- Encouraging Foreign Investment: Many developing nations offer tax incentives and create business-friendly environments to attract foreign direct investment, which can boost domestic industries and create jobs.

Impact on Growth and Stability

While these strategies are essential for growth, the impact of government financial strategies can be complex and varied. Below is a table summarizing the key effects:

| Strategy | Positive Impact | Potential Risks |

|---|---|---|

| Infrastructure Investment | Creates jobs, improves productivity, enhances living standards | High initial costs, debt accumulation |

| Social Safety Nets | Reduces poverty, improves access to education and healthcare | Unsustainable spending, dependency on aid |

| Foreign Investment Attraction | Boosts industrial capacity, generates employment | Market volatility, foreign control of resources |

In conclusion, managing public finances in developing economies requires a delicate balance between stimulating growth and maintaining long-term fiscal health. While the challenges are significant, thoughtful and strategic interventions can help improve economic outcomes, address inequality, and promote sustainable development.

Evaluating the Effectiveness of Stimulus Packages

Government stimulus measures are often implemented during periods of economic downturn to boost demand, support businesses, and reduce unemployment. These initiatives typically involve direct financial assistance, tax relief, or investment in public works, aimed at stimulating economic activity. However, the impact of such measures can vary widely depending on the scope, timing, and design of the package, as well as the specific economic conditions at the time of implementation.

To assess the success of a stimulus program, it is crucial to examine both short-term and long-term outcomes, considering factors such as GDP growth, employment levels, and consumer spending. Additionally, the effectiveness of these measures can be influenced by how quickly and efficiently funds are distributed and the extent to which the private sector responds to government interventions.

Key Indicators for Assessing Impact

The following table highlights the key indicators that are typically used to evaluate the effectiveness of stimulus packages:

| Indicator | Purpose | Impact Assessment |

|---|---|---|

| Gross Domestic Product (GDP) Growth | Measures the overall economic activity and output. | Positive GDP growth indicates the stimulus has helped revive economic activity. |

| Unemployment Rate | Tracks the level of joblessness within the economy. | A reduction in unemployment suggests the stimulus is effectively creating jobs. |

| Consumer Spending | Measures the total expenditure by households on goods and services. | Increased spending indicates that consumers are confident and willing to spend, which can drive further growth. |

| Inflation Rate | Measures the rise in the prices of goods and services over time. | Moderate inflation can suggest economic growth, while high inflation may indicate an overheating economy. |

Challenges in Measuring Effectiveness

Although the above indicators are crucial in determining the effectiveness of a stimulus program, it is important to recognize the challenges involved in measurement. Some of these challenges include:

- Delayed Impact: Stimulus packages may take time to generate noticeable effects, making it difficult to assess their immediate success.

- External Factors: Global economic conditions, such as trade relations and foreign investment, can influence outcomes and complicate the evaluation process.

- Long-Term Sustainability: While short-term recovery may be achieved, the long-term effects of stimulus measures, particularly in terms of national debt, must also be considered.

In conclusion, evaluating the effectiveness of stimulus packages requires a comprehensive approach, considering a variety of economic indicators and acknowledging the challenges in accurately measuring their full impact. Governments must carefully design and implement these measures to ensure they provide lasting benefits and support sustainable growth in the economy.

Global Economic Trends and Fiscal Policy

The global economy is shaped by numerous interconnected factors that influence how governments manage their financial systems. Trends such as technological advancement, demographic shifts, international trade dynamics, and environmental challenges all play significant roles in determining the strategies employed by governments to stabilize and grow their economies. These strategies are often reflected in the ways countries adjust their spending, taxation, and public debt management to meet both short-term and long-term goals.

As global markets evolve, governments must adapt to external factors such as economic slowdowns, changing labor markets, and rising geopolitical tensions. These changes require continuous adjustments to economic strategies to ensure that the domestic economy remains resilient and competitive on the international stage. A well-planned economic strategy that addresses these challenges can stimulate growth, reduce unemployment, and improve living standards.

Key Global Economic Trends Influencing Strategy

Several key trends are currently reshaping the global economic landscape and influencing governmental decisions:

- Technological Advancements: Automation, artificial intelligence, and digital transformation are driving significant changes in global industries, creating new opportunities and challenges for job markets and productivity.

- Globalization and Trade: The increasing integration of global markets affects supply chains, trade policies, and international cooperation. Countries must adjust their financial strategies to stay competitive.

- Environmental Sustainability: The global push for sustainability, renewable energy, and climate change mitigation is altering economic priorities, requiring investment in green technologies and infrastructure.

- Demographic Shifts: Aging populations in developed economies and young, growing populations in emerging markets create divergent challenges for governments in terms of labor supply, healthcare, and social security systems.

- Geopolitical Tensions: Ongoing trade wars, international conflicts, and economic sanctions have significant impacts on global trade and investments, requiring flexible and responsive economic strategies.

Adjusting Governmental Strategies to Changing Conditions

As governments respond to these trends, they must continually refine their financial management approaches. Common strategies include:

- Public Investment: Increased spending on infrastructure, education, and innovation can stimulate economic activity and create long-term growth opportunities.

- Taxation Reforms: Adjusting tax rates and structures can ensure that the government generates sufficient revenue while also encouraging investment and consumption.

- Debt Management: Effective management of public debt through strategic borrowing and repayment plans ensures that the government maintains financial stability without overburdening future generations.

In conclusion, global economic trends significantly shape the direction of governmental financial strategies. By understanding these trends and adapting to them, governments can implement strategies that promote long-term economic stability and prosperity while addressing emerging challenges.

The Future of Fiscal Policy in a Changing World

As the global landscape continues to evolve, the strategies employed by governments to manage their economic systems must adapt to a range of emerging challenges and opportunities. Technological innovations, environmental shifts, and changing demographic trends are reshaping the way nations approach economic growth, inequality, and stability. The traditional methods of balancing national budgets and managing public finances are being reevaluated in light of these transformations.

Governments are now facing a complex set of factors that require innovative and flexible financial strategies. From responding to global health crises to addressing the long-term impacts of climate change, the tools used to maintain economic equilibrium must be reimagined. As nations adjust their spending and taxation frameworks to meet the demands of a rapidly changing world, the future of economic governance will depend heavily on how effectively these adjustments can balance short-term relief with long-term sustainability.

Adapting to New Realities

The following areas are likely to shape the future of economic governance:

- Technological Transformation: The rise of automation, artificial intelligence, and digital economies will alter labor markets and productivity patterns. Governments will need to rethink taxation systems and public investment to support innovation while addressing potential job displacement.

- Environmental Sustainability: Climate change and resource depletion will increasingly influence public spending decisions. There will be a greater focus on green technologies and sustainable infrastructure, requiring shifts in both investments and regulatory frameworks.

- Globalization and Geopolitics: Trade tensions, shifting alliances, and economic nationalism are reshaping global trade. Financial strategies will need to be flexible enough to navigate a more fragmented international economic environment.

- Demographic Changes: Aging populations in developed countries and youth bulges in emerging economies will place new demands on social welfare systems, pensions, and healthcare. Managing these demographic shifts will require innovative approaches to public expenditure and taxation.

Key Areas for Future Focus

Looking ahead, the following themes will be critical in shaping future economic strategies:

- Inclusive Growth: Ensuring that the benefits of economic development are shared more equitably across all segments of society will be a priority. This may involve more progressive tax systems, targeted social investments, and enhanced public services.

- Public Debt and Sustainability: Managing national debt levels without stifling growth will continue to be a delicate balancing act. Governments will need to explore new methods of financing while ensuring long-term fiscal health.

- Digital Currencies and Financial Innovation: The rise of digital currencies and fintech will require governments to adapt their regulatory frameworks. New forms of money and investment are creating opportunities for efficiency but also new risks to financial stability.

In conclusion, the future of economic management will require governments to adopt a dynamic approach to meet the evolving demands of the global economy. By embracing innovation, sustainability, and inclusivity, nations can ensure a stable financial future even in the face of uncertainty.