Understanding personal finance is a crucial step toward making informed decisions in life. Whether you’re a student looking to grasp the fundamentals of managing money or preparing for future financial responsibilities, a strong foundation in financial education can set you up for success. This section will help you navigate essential concepts and prepare for evaluations on the subject.

Through learning about budgeting, saving, and making wise financial choices, individuals gain the knowledge necessary to manage their resources effectively. By understanding key principles, such as interest, investments, and budgeting techniques, you will be better equipped to take charge of your financial future. This guide provides valuable tips and insights that will allow you to excel in your studies and assessments, empowering you to confidently answer related questions.

Everfi Savings Test Overview

This section provides an overview of the key aspects that students and learners should be aware of when preparing for financial assessments. The goal is to familiarize you with the types of questions, concepts, and evaluation methods typically used to assess your understanding of money management. By gaining a clear idea of what to expect, you will be able to approach the evaluation with confidence and clarity.

Key Concepts Assessed

The evaluation focuses on fundamental financial principles and decision-making processes. These concepts are essential for anyone aiming to build a strong financial future. Some of the core topics include:

- Budgeting and expense tracking

- Smart spending habits

- Managing short-term and long-term financial goals

- The concept of interest and its impact on savings

- Understanding credit and debt

How to Prepare for the Evaluation

Preparation for this kind of assessment involves both theoretical understanding and practical application of financial concepts. To excel, it’s important to:

- Review key financial terminology and concepts

- Practice solving budgeting and saving problems

- Apply real-world scenarios to test decision-making abilities

- Use online resources and study guides to reinforce learning

What is the Everfi Savings Test?

This evaluation is designed to assess your understanding of fundamental financial concepts. It tests your ability to manage money, make smart financial choices, and understand how financial tools work. The goal is to help learners develop the skills necessary for budgeting, saving, and making informed decisions about their finances.

Throughout the evaluation, you will encounter questions related to practical scenarios involving money management. These questions aim to measure your comprehension of budgeting techniques, financial goal setting, and the impact of savings and interest. By understanding the core principles, you can apply them effectively in real-world situations.

Understanding the Key Concepts in Savings

Building a solid understanding of key financial principles is essential for making informed decisions about how to manage and grow your money. Key concepts such as budgeting, investing, and the power of compound interest play a crucial role in achieving long-term financial stability. By mastering these ideas, you can better plan for both short-term needs and future goals.

One of the most important concepts is understanding how money grows over time. This includes recognizing the impact of interest rates on your funds and how small contributions can accumulate. It’s also vital to know how to set realistic financial goals and create a plan to reach them, whether it’s for an emergency fund, retirement, or a big purchase.

Importance of Financial Literacy for Students

Financial literacy is an essential skill that empowers individuals to make informed decisions about money, investments, and budgeting. For students, developing these skills early on can lead to greater financial independence and long-term success. Understanding how to manage personal finances can significantly impact both their academic journey and future career choices.

By mastering financial concepts, students are better prepared to navigate the complexities of the real world. Key benefits of financial literacy include:

- Improved budgeting and money management skills

- Ability to set realistic financial goals

- Understanding the importance of saving and investing

- Informed decision-making about loans and credit

- Preparation for life after graduation and independent living

Having a solid grasp of financial principles can also reduce the stress associated with money management, leading to better mental health and overall well-being. By prioritizing financial education, students set themselves up for success both now and in the future.

How to Prepare for the Evaluation

Preparation for a financial literacy evaluation requires a combination of understanding core concepts and practicing real-world scenarios. It’s important to familiarize yourself with the fundamental principles of managing money, budgeting, and making informed financial decisions. By doing so, you can increase your chances of performing well and demonstrate a strong grasp of essential financial skills.

Review Key Concepts

Start by reviewing the primary topics related to managing money. Focus on areas such as:

- Basic budgeting techniques and expense tracking

- Understanding how interest and savings work

- The importance of setting financial goals

- Identifying smart spending habits and avoiding common pitfalls

Practice with Real-World Scenarios

Another effective way to prepare is by practicing financial decision-making. Try to apply the concepts you’ve learned to real-world situations. This will not only help reinforce your knowledge but also improve your ability to think critically about financial choices. You can:

- Create a mock budget based on your own expenses

- Calculate potential savings growth over time

- Analyze different spending and saving strategies

By consistently reviewing key concepts and practicing financial decision-making, you’ll be well-prepared for any evaluation on personal finance topics.

Tips for Mastering Savings Questions

Successfully answering questions related to managing money requires a deep understanding of financial principles, as well as the ability to apply these concepts in practical scenarios. To excel, you need to focus on core topics, build your confidence with calculations, and develop strategies to approach each question thoughtfully.

Here are some effective tips for mastering questions about money management:

- Understand Key Concepts: Make sure you have a clear grasp of fundamental topics such as budgeting, interest rates, and goal-setting. Familiarity with these will help you navigate questions with ease.

- Practice Problem-Solving: Frequently practice with sample problems that involve calculating savings growth, setting budgets, or evaluating interest rates. This helps improve your speed and accuracy during assessments.

- Read Questions Carefully: Take the time to carefully read and understand each question. Pay attention to key details, such as time frames, interest rates, and specific financial goals mentioned in the scenario.

- Use Real-Life Examples: When studying, try applying the concepts to real-life situations, such as planning your personal budget or estimating how much you could save over time. This will deepen your understanding.

- Stay Organized: Keep track of important formulas, key terms, and financial strategies in an organized manner. This will make it easier to recall information when needed.

By following these tips and practicing regularly, you’ll develop the skills needed to answer money-related questions with confidence and accuracy.

Essential Skills for Financial Success

Achieving long-term financial success requires more than just basic knowledge of money management. It involves developing a range of skills that allow you to make informed decisions, plan for the future, and adapt to changes in your financial situation. Building these skills will help you stay on track with your goals and overcome financial challenges as they arise.

Building a Strong Financial Foundation

The first step in mastering money management is understanding the fundamentals. This includes:

- Budgeting: Learning how to allocate funds effectively to cover expenses while saving for future goals.

- Tracking Expenses: Keeping an accurate record of spending to avoid overspending and ensure you stay within your budget.

- Setting Financial Goals: Creating short-term and long-term targets that help guide your spending and saving habits.

Advanced Financial Strategies

Once you have a solid foundation, the next step is to learn more advanced strategies for growing wealth and minimizing financial risks. Some key areas to focus on include:

- Investing: Understanding different investment options and how to build a diversified portfolio.

- Debt Management: Knowing how to handle debt responsibly, including paying off high-interest loans and using credit wisely.

- Financial Planning: Developing long-term strategies for retirement, education, and major life events.

By mastering these essential skills, you’ll be well-equipped to achieve financial independence and make decisions that support your long-term success.

How to Approach Financial Scenarios

When faced with financial scenarios, it’s essential to approach them with a clear, methodical mindset. These situations often require you to apply your knowledge of budgeting, money management, and financial decision-making. The key to success is carefully analyzing each scenario and using logical steps to find the best solution.

Here are some strategies to effectively navigate financial scenarios:

- Read the Scenario Carefully: Take the time to understand all the details. Pay attention to figures, timeframes, and specific instructions or goals outlined in the situation.

- Identify Key Financial Concepts: Look for areas that focus on budgeting, saving, investing, or managing debt. Recognize what concepts are being tested so you can apply the appropriate strategies.

- Break Down the Problem: Divide the scenario into smaller parts. If the question involves calculations, first identify what information you need and what steps to take to solve it.

- Consider Real-Life Applications: Relate the situation to a real-world example, such as managing your own budget or planning a savings strategy. This will make it easier to visualize and tackle the problem.

- Review Your Answer: Once you’ve arrived at a solution, double-check your work. Ensure that your calculations are accurate and that your decisions align with the financial principles you’ve learned.

By taking a systematic approach and focusing on the key concepts, you’ll be better equipped to handle financial scenarios and make informed decisions with confidence.

What to Expect from Quizzes

Quizzes focused on financial literacy are designed to assess your understanding of key concepts related to managing money. These assessments often cover a variety of topics, requiring you to apply your knowledge in different ways. The questions typically test your ability to make informed financial decisions and understand core principles that will guide you in real-life situations.

Here’s what you can expect when taking a quiz on financial topics:

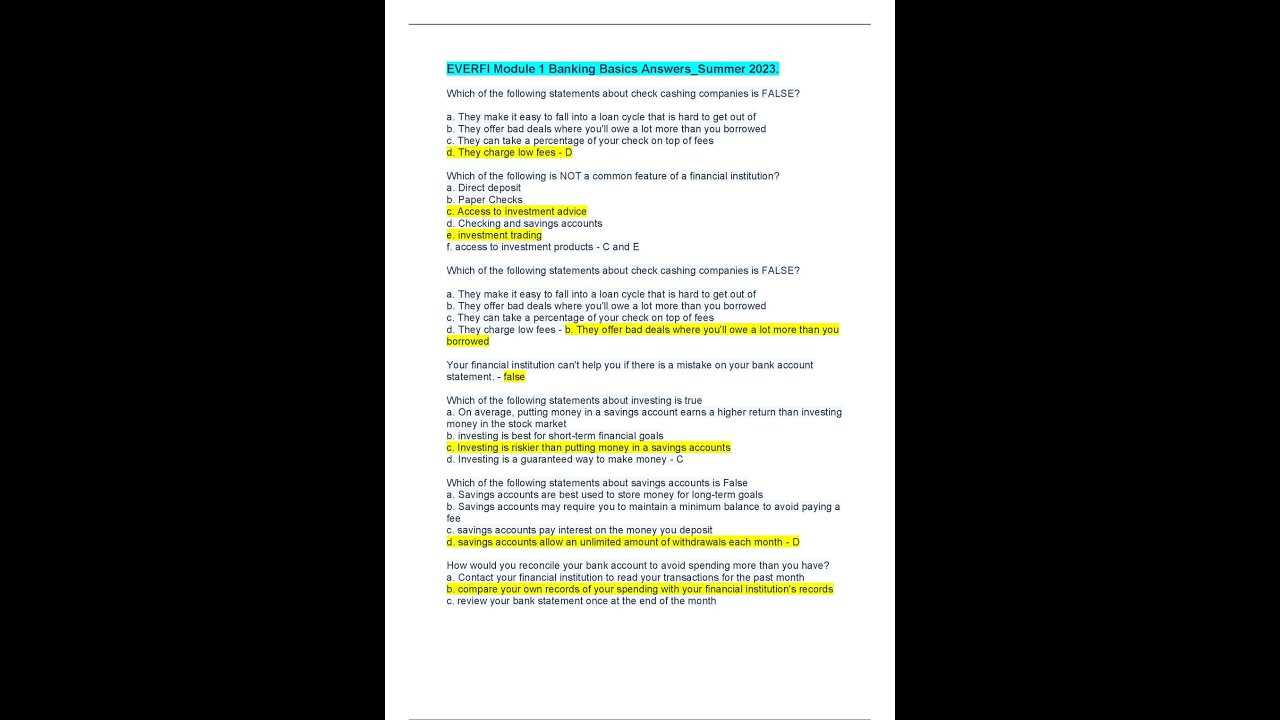

- Diverse Question Types: You may encounter multiple-choice questions, true/false statements, and scenario-based questions. Each question is designed to evaluate your grasp of different concepts, such as budgeting, saving, and managing debt.

- Practical Scenarios: Many questions will be based on real-world situations, challenging you to apply financial principles to everyday decisions. This could include things like planning a budget or deciding between saving and spending.

- Time Management: Quizzes are usually timed, so it’s important to pace yourself. Ensure you understand the key concepts before attempting the questions to avoid rushing through the assessment.

- Focus on Key Topics: Expect questions to cover important areas such as budgeting, managing expenses, understanding interest rates, setting financial goals, and the impact of credit.

By understanding what to expect, you can approach these quizzes with confidence, knowing that you’ll be tested on practical and fundamental financial knowledge.

Common Mistakes to Avoid in the Test

When it comes to assessments focused on financial literacy, making certain mistakes can hinder your ability to perform well. It’s important to stay mindful of the common errors that many students make during these evaluations. Avoiding these pitfalls will not only boost your confidence but also help you answer questions more effectively and accurately.

Here are some common mistakes to watch out for:

- Rushing Through Questions: One of the biggest mistakes is rushing through the questions without taking the time to carefully read and understand each one. It’s easy to overlook important details, especially when under time pressure.

- Misinterpreting Financial Terms: Misunderstanding key financial concepts or terms can lead to incorrect answers. Make sure you’re clear on terms like interest rates, budgeting, and compound growth before attempting questions related to them.

- Overlooking Instructions: Always read the instructions carefully before starting. Sometimes, a question may ask for more than one correct answer or require a specific approach, and skipping the instructions can cause unnecessary mistakes.

- Skipping Difficult Questions: Avoid skipping questions that seem difficult. Instead, try to break them down into smaller parts, and if necessary, return to them later once you’ve answered the easier ones.

- Not Reviewing Your Work: After completing the assessment, take a moment to review your answers. Double-check for calculation errors, misunderstandings of questions, or misinterpretation of financial principles.

By being aware of these common mistakes and taking steps to avoid them, you can significantly improve your performance and ensure that you answer questions with precision and clarity.

How Everfi Helps Build Money Skills

Learning how to manage money effectively is essential for financial success. Various educational platforms are designed to help individuals, especially students, develop crucial money management skills. These programs provide interactive lessons that teach key concepts such as budgeting, saving, and investing in ways that are easy to understand and apply.

Here are some ways that these platforms help build essential financial skills:

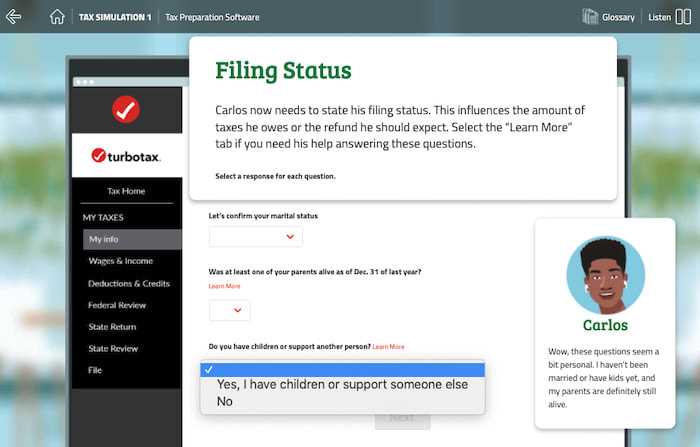

- Interactive Learning: Through engaging scenarios and simulations, learners can practice making financial decisions in a risk-free environment. This hands-on approach makes complex financial concepts more relatable and easier to grasp.

- Practical Financial Knowledge: The lessons focus on real-world applications, teaching students how to set financial goals, create budgets, and make informed decisions about spending and saving.

- Building Financial Confidence: By guiding users through various financial situations, these platforms help build confidence in managing money. The more knowledge learners gain, the more equipped they become to handle their own financial choices.

- Personalized Learning Paths: Some programs tailor lessons based on individual progress, helping students learn at their own pace and ensuring that each concept is thoroughly understood before moving on to the next.

By equipping students with the tools and knowledge they need, these educational programs foster essential financial literacy, setting the foundation for a financially secure future.

How to Use the Learning Platform

Online educational platforms provide an interactive and engaging way to learn essential financial concepts. These platforms offer a user-friendly interface that allows students to navigate through various lessons and activities at their own pace. By following a structured learning path, learners can gain valuable insights into managing money effectively.

Here’s a guide on how to make the most of the learning platform:

| Step | Action | Purpose |

|---|---|---|

| 1 | Register or log in | Access personalized learning materials and track progress |

| 2 | Explore the dashboard | Get an overview of available lessons, quizzes, and resources |

| 3 | Complete interactive lessons | Understand fundamental financial concepts through simulations and scenarios |

| 4 | Take quizzes | Test your knowledge and reinforce learning by answering questions |

| 5 | Review progress | Track your completion and identify areas for improvement |

By following these steps, you can fully engage with the platform’s offerings, ensuring a thorough understanding of the material and developing the skills necessary to manage personal finances successfully.

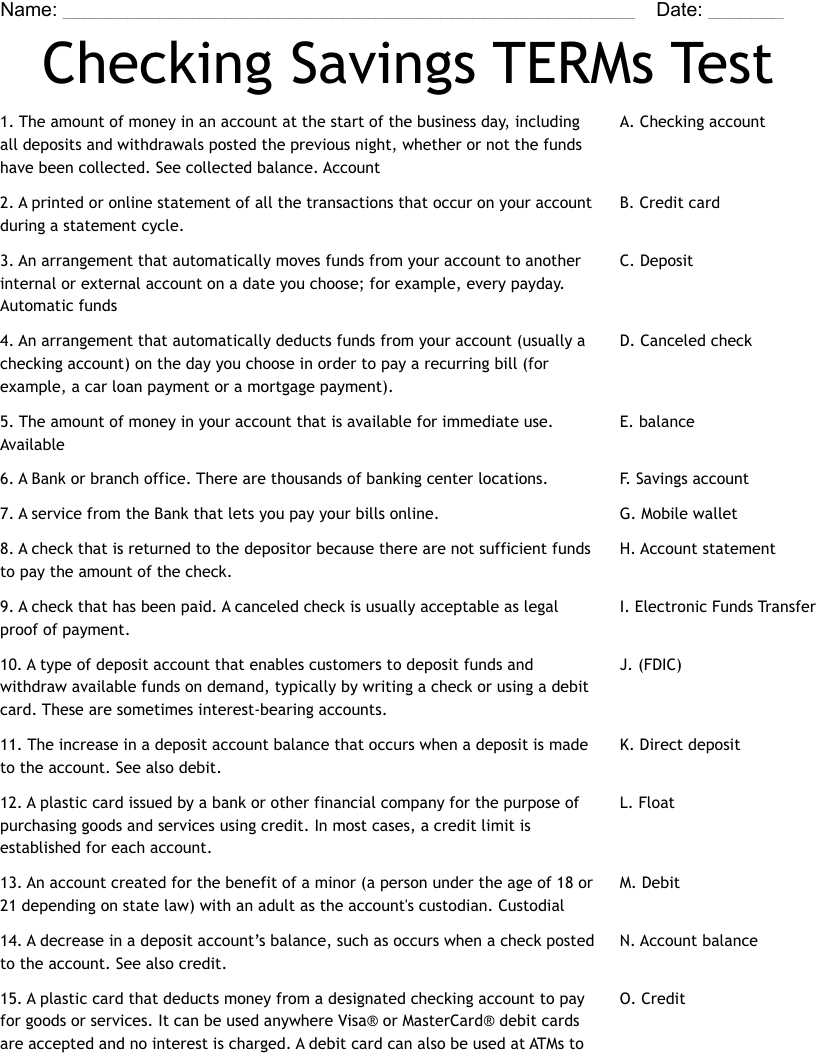

Understanding Test Formats and Question Styles

Educational assessments often use different formats and question types to evaluate understanding. Understanding the structure and style of questions can help learners prepare more effectively. Each type of question tests a specific skill or concept, allowing students to demonstrate their knowledge in various ways.

There are several common formats that are frequently used in assessments. Knowing these formats in advance allows students to anticipate what to expect and strategize for each type. Here’s a breakdown of typical question styles:

Multiple Choice Questions

These questions present several possible answers, and the student must select the correct one. They test the ability to recall and recognize the right information quickly.

True/False Questions

True/false questions assess whether the student understands a statement and can determine its accuracy. These are typically straightforward but require careful attention to detail.

| Question Type | Purpose | Example |

|---|---|---|

| Multiple Choice | Tests recognition and recall | Which of the following is the best way to save money? (A) Spend less, (B) Earn more, (C) Save a percentage of income |

| True/False | Tests understanding of factual statements | The best strategy for budgeting is tracking expenses. (True/False) |

| Fill-in-the-Blank | Tests recall and application of knowledge | One effective way to save money is by creating a __________. (Answer: budget) |

By becoming familiar with these formats, learners can build strategies to approach each question type with confidence, ensuring a better performance during assessments.

Resources to Support Your Test Prep

To excel in any evaluation, it’s essential to utilize a variety of resources that can guide you through the preparation process. These tools not only help reinforce key concepts but also improve your test-taking skills. With the right materials, you can approach your assessments with confidence and clarity.

Several online platforms and physical materials can assist you in your preparation journey. Whether you’re looking for practice questions, instructional videos, or detailed guides, these resources offer valuable support. Below are some options to consider:

| Resource Type | Purpose | Example |

|---|---|---|

| Practice Quizzes | Helps familiarize with question formats and test timing | Online quizzes that simulate real exam conditions |

| Instructional Videos | Provides visual explanations of key concepts | YouTube tutorials on financial planning and budgeting |

| Study Guides | Offers comprehensive overviews and topic breakdowns | Printable guides with summary notes on important topics |

| Interactive Apps | Engages users with real-time feedback and exercises | Financial literacy apps that offer games and challenges |

By using a combination of these resources, you can build a well-rounded understanding of the material. These tools will help reinforce your knowledge and prepare you for the questions that lie ahead.

How to Improve Financial Decision-Making

Making sound financial decisions is essential for long-term stability and growth. Whether managing personal funds, planning for future goals, or making investments, the ability to make informed choices plays a pivotal role in achieving financial success. Understanding the factors that influence financial decisions and applying structured strategies can lead to better outcomes.

There are several key approaches to improving your decision-making skills when it comes to managing money. By focusing on education, analyzing data, and practicing thoughtful planning, you can improve your ability to assess options and make wiser choices. Below are some strategies to help refine your financial decision-making process:

Key Strategies for Better Financial Decisions

| Strategy | Description | Benefit |

|---|---|---|

| Financial Literacy Education | Gain a deeper understanding of concepts like budgeting, investing, and debt management. | Increases your ability to make informed, long-term decisions. |

| Set Clear Goals | Define specific financial goals such as saving for retirement or buying a home. | Helps prioritize decisions and align them with long-term objectives. |

| Analyze Risks and Rewards | Evaluate potential risks against the benefits of each financial choice. | Prevents impulsive decisions and fosters a more balanced approach. |

| Seek Professional Advice | Consult financial advisors or mentors for expert insights and guidance. | Provides access to knowledge and strategies you might otherwise overlook. |

Tools to Enhance Decision-Making

In addition to these strategies, using digital tools and resources can support better decision-making. Budgeting apps, investment trackers, and financial calculators can help visualize data, making it easier to assess options and predict outcomes. The more information you have, the more confident and strategic your decisions will be.

By adopting these practices, you can significantly enhance your ability to make sound financial decisions that will positively impact your personal and professional life.

Final Tips for Acing the Assessment

Success in any evaluation depends on how well you prepare and approach the material. Whether it’s understanding key concepts, applying practical knowledge, or mastering the format of the questions, being prepared will significantly increase your chances of performing well. Below are some final tips to help you navigate through the assessment with confidence and precision.

Effective Preparation Strategies

- Review Key Concepts – Focus on understanding fundamental ideas and principles related to financial management. Make sure you are comfortable with terminology and basic strategies.

- Practice with Sample Questions – Engage with practice questions to familiarize yourself with the format and types of queries that may appear in the assessment.

- Stay Organized – Use notes, guides, or study sheets to keep track of important points and areas where you feel uncertain. Organizing your study materials can save time and reduce stress.

- Time Management – Practice answering questions within a set time limit. This helps you improve your efficiency during the actual assessment and prevents rushing through important details.

During the Assessment

- Read Carefully – Always read each question thoroughly before answering. Pay attention to key phrases that might impact the correct response.

- Eliminate Obvious Mistakes – If unsure about an answer, eliminate options that are clearly incorrect, which increases the chances of selecting the right one.

- Stay Calm and Focused – Remaining calm and focused helps reduce anxiety and allows you to think critically. Take a deep breath if you find yourself getting stressed.

By implementing these tips and staying diligent, you can approach the assessment with confidence and achieve success. Proper preparation, staying organized, and maintaining focus are essential to excelling in the evaluation process.