Preparing for assessments in financial management requires a clear understanding of key principles and the ability to apply them effectively in real-world scenarios. Mastery of core topics is essential for performing well and ensuring a comprehensive grasp of the material. Focusing on the most critical areas and practicing regularly will help improve performance and confidence during evaluations.

Effective study strategies play a pivotal role in achieving success. It is not just about memorizing concepts but also about developing the skills to analyze, interpret, and solve complex problems. Regular review and application of theories to practice exercises will help sharpen analytical thinking, which is crucial when addressing challenging tasks.

Key areas to focus on include understanding fundamental metrics, analyzing financial data, and applying decision-making tools. By mastering these skills, individuals can approach each test with a solid foundation, ready to tackle diverse problems with precision. The focus should be on practical knowledge that extends beyond theory, providing the tools to succeed in both academic settings and professional environments.

Business Finance Exam Questions and Answers

To excel in assessments related to financial management, it is essential to familiarize oneself with a variety of typical tasks that assess a candidate’s understanding of key principles. These tasks often require individuals to apply theoretical knowledge to practical situations, demonstrating their ability to analyze, solve, and interpret data effectively.

Common Problem Types

During evaluations, various problem formats are commonly encountered. These tasks can range from straightforward calculations to more complex case studies that require a deep understanding of the core concepts. Preparation for these challenges involves not only memorizing formulas and definitions but also practicing real-world applications of these principles.

| Problem Type | Description | Example |

|---|---|---|

| Calculation-based Tasks | Tasks that require numerical analysis, such as ratio analysis or calculating returns on investment. | Calculate the net present value of an investment with a given rate of return. |

| Conceptual Problems | Assessments that test understanding of key theories and their application in business scenarios. | Explain the impact of inflation on financial planning. |

| Case Studies | Real-life scenarios where the application of multiple principles is needed to find a solution. | Evaluate the financial viability of a merger between two companies. |

Effective Approaches for Success

To perform well, individuals must approach each problem with a systematic strategy. First, break down the task into manageable parts. Focus on understanding the core requirements before proceeding with calculations or logical steps. Practicing similar problems beforehand helps increase familiarity with the task types and ensures a smoother response during the assessment.

Key Concepts in Business Finance

Understanding the core principles that drive monetary decision-making is essential for anyone looking to succeed in this field. These concepts form the foundation for evaluating investments, assessing risk, and managing resources effectively. Mastery of these topics allows individuals to make informed choices and solve complex financial challenges.

Central to this discipline are concepts such as capital allocation, risk management, return on investment, and liquidity. These areas play a critical role in guiding decision-making, whether it involves planning for growth or ensuring stability in times of uncertainty. A firm grasp of these concepts helps translate theoretical knowledge into practical applications, essential for success in real-world scenarios.

Additionally, understanding how to interpret financial data and making sense of various metrics is key to evaluating performance. Ratios, forecasts, and trends help determine the health of a company or investment, supporting strategic decision-making. By analyzing these figures, individuals can identify areas for improvement, optimize resources, and achieve long-term objectives.

Preparing for Finance Exams Effectively

Achieving success in assessments related to monetary management requires a structured approach that combines both theoretical understanding and practical application. Effective preparation involves organizing study sessions, identifying critical topics, and practicing with real-world problems to build confidence and sharpen skills.

The first step in preparing effectively is to understand the key areas of focus. These often include a variety of essential concepts, mathematical techniques, and case studies. Organizing study material in a way that allows for focused review of each area ensures that nothing important is overlooked. Below are some strategies to enhance preparation:

- Set Clear Goals: Define what needs to be covered in each study session. Break down the material into manageable sections.

- Practice Regularly: Consistent practice with problem-solving helps reinforce concepts and improves accuracy under time pressure.

- Use a Variety of Resources: Leverage textbooks, online courses, and practice papers to gain different perspectives and insights.

- Review Past Assessments: Analyze previous tests or sample problems to identify recurring themes and question formats.

- Form Study Groups: Discussing material with peers can offer new insights and reinforce understanding of complex topics.

Another critical aspect of preparation is time management. Create a study schedule that allocates time to each topic based on its difficulty and importance. Ensure that there is enough time for revision and self-testing, which helps in consolidating knowledge. By balancing study time effectively, it is easier to maintain focus and avoid last-minute cramming.

Finally, the day before the test should be dedicated to light revision and relaxation. Reviewing key points and ensuring you understand the basic concepts can provide a sense of control and reduce stress. The goal is to approach the task with confidence and clarity, ready to apply your knowledge effectively.

Types of Business Finance Questions

There are various types of problems encountered in assessments related to financial management. These problems test different aspects of a person’s understanding and ability to apply key principles in realistic scenarios. Whether the task requires numerical calculations, conceptual explanations, or decision-making analysis, each type serves to evaluate a distinct skill set that is essential for professional success.

Numerical and Calculation-based Tasks

These problems typically require performing calculations to solve financial issues. Tasks may involve determining ratios, calculating returns on investment, or computing present value and future cash flows. Mastery of mathematical formulas and the ability to apply them correctly is crucial for tackling these types of challenges. Accuracy is key, as even small errors can lead to incorrect conclusions.

Conceptual and Theoretical Problems

In addition to number-based tasks, some problems require a deeper understanding of underlying principles and theories. These questions often ask for explanations or analyses of concepts such as risk management, liquidity, or capital budgeting. It’s important to understand the theory behind the practice and be able to articulate how different variables affect decision-making. Strong comprehension of key theories is needed to answer these types of questions effectively.

Both types of problems require preparation and a clear understanding of how to approach each scenario. By practicing regularly and developing a methodical approach to problem-solving, individuals can increase their chances of performing well on these tasks.

Understanding Financial Statements for Exams

Interpreting key financial documents is a critical skill for anyone preparing for assessments in the field of monetary management. These documents provide a snapshot of a company’s financial health and performance, and understanding them is essential for analyzing data and making informed decisions. Being able to read, interpret, and extract meaningful insights from these reports is vital for success in any related assessment.

Types of Financial Statements

There are several key reports that form the backbone of financial analysis. The most commonly encountered documents are the income statement, balance sheet, and cash flow statement. Each of these plays a distinct role in offering a comprehensive view of a company’s financial status:

- Income Statement: This document provides an overview of revenues, expenses, and profits over a given period, helping to assess the company’s operational efficiency.

- Balance Sheet: This report outlines the company’s assets, liabilities, and equity, offering a snapshot of its financial position at a specific moment in time.

- Cash Flow Statement: This document tracks the inflow and outflow of cash, highlighting how well the company manages its liquidity and operational cash needs.

Key Ratios and Metrics to Understand

Once the financial documents are reviewed, it’s essential to interpret them through key ratios and metrics. These indicators help to simplify complex information, making it easier to assess a company’s performance. Key ratios such as profitability, liquidity, and leverage ratios provide a clear picture of financial health and risk levels.

In preparation for assessments, students should focus on understanding how to calculate and interpret these ratios. Familiarity with these key documents and metrics allows for better decision-making and problem-solving during evaluations.

Common Mistakes in Finance Exams

In assessments related to monetary management, there are several common pitfalls that can hinder performance. These mistakes often stem from misunderstandings of key concepts, careless errors, or inadequate time management. Identifying these common errors and knowing how to avoid them is crucial for improving results and demonstrating a clear grasp of the subject matter.

Below are some of the most frequent mistakes made during assessments in this field, along with tips on how to avoid them:

| Common Mistake | Description | How to Avoid |

|---|---|---|

| Calculation Errors | Small miscalculations, such as incorrect rounding or missing a step in a formula, can lead to inaccurate results. | Double-check all calculations and use a systematic approach for solving problems. |

| Misunderstanding the Question | Sometimes, students may misinterpret the task, leading to an irrelevant or incomplete response. | Carefully read the question and highlight key points before starting the solution. |

| Skipping Key Steps | Omitting important steps in complex calculations or analysis can lead to incorrect answers. | Work through problems step-by-step and ensure each part of the process is covered. |

| Time Mismanagement | Spending too much time on one problem can leave insufficient time for others. | Practice time management by allocating a set amount of time to each question during preparation. |

| Ignoring Units and Conversions | Overlooking the need to convert units or misinterpreting units can result in incorrect calculations. | Always check units and conversions before finalizing answers. |

By being aware of these common mistakes and taking steps to avoid them, individuals can improve their performance and ensure a more successful outcome on assessments related to monetary decision-making.

Important Ratios to Know for Finance

In the world of monetary analysis, certain ratios provide valuable insights into a company’s performance, profitability, and financial health. These metrics are essential for understanding the efficiency of operations, the level of risk, and the company’s ability to meet its obligations. A strong understanding of these ratios is critical for anyone involved in assessing or managing financial information.

Profitability Ratios

Profitability ratios measure a company’s ability to generate earnings compared to its expenses over a given period. These ratios are key indicators of how effectively a company is converting sales into profits. Important ratios include:

- Net Profit Margin: This ratio indicates how much profit a company generates for every dollar of sales. A higher margin indicates better profitability.

- Return on Assets (ROA): This ratio shows how efficiently a company uses its assets to generate profit. A higher ROA suggests better asset utilization.

- Return on Equity (ROE): This ratio measures the profitability for shareholders by comparing net income to shareholder equity. It shows how well the company is using equity capital.

Liquidity Ratios

Liquidity ratios help evaluate a company’s ability to meet its short-term financial obligations. They are important for assessing whether a company can cover its immediate debts without needing to sell long-term assets. Key liquidity ratios include:

- Current Ratio: This ratio compares a company’s current assets to its current liabilities. A ratio above 1 indicates that the company has more assets than liabilities, suggesting it can cover its short-term debts.

- Quick Ratio: Also known as the acid-test ratio, this metric excludes inventory from current assets to focus on the most liquid assets. It provides a stricter measure of liquidity.

Familiarity with these ratios allows individuals to analyze financial statements effectively and make informed decisions based on a company’s financial position.

How to Solve Financial Math Problems

Solving numerical problems related to monetary management requires a methodical approach, combining an understanding of key concepts with the ability to apply relevant formulas. Whether the task involves calculating returns, determining interest, or analyzing cash flow, breaking the problem into manageable steps is essential. By following a systematic process, you can avoid common errors and arrive at the correct solution with confidence.

Here is a step-by-step guide to effectively solving these types of problems:

- Understand the Problem: Carefully read the problem to identify what is being asked. Highlight the key information and determine what data is provided versus what needs to be calculated.

- Identify the Relevant Formula: Once you understand the problem, determine which formula or method is appropriate. Common formulas include those for calculating interest, returns, or ratios.

- Organize the Data: Write down the provided values and variables. Make sure all units are consistent (e.g., dollars, percentages, time periods) before proceeding with calculations.

- Perform the Calculations: Using the identified formula, carefully carry out the calculations. Break down complex operations into smaller steps to reduce the risk of mistakes.

- Check Your Work: Review your calculations to ensure accuracy. Double-check formulas and results, especially if you are working under time constraints.

By practicing this approach regularly, you will improve both your speed and accuracy in solving complex problems. Additionally, familiarity with common types of financial math problems helps reinforce concepts and enhances problem-solving skills.

Time Management Tips for Exams

Effectively managing time during an assessment is crucial for ensuring that all tasks are completed on time and to the best of your ability. The pressure of limited time can cause stress, but with the right strategies, it’s possible to approach each problem with confidence and efficiency. By planning ahead and staying organized, you can maximize your performance and minimize errors caused by rushing.

Preparation Before the Test

Good time management starts well before the test begins. Proper preparation can help reduce anxiety and allow you to approach the task calmly. Here are some essential tips for preparation:

- Create a Study Schedule: Plan your study time in advance and break it into manageable chunks. Focus on the most important topics and allocate enough time for review.

- Practice with Timed Mock Tests: Simulate real test conditions by taking practice tests within a set time limit. This will help you become accustomed to pacing yourself.

- Organize Study Materials: Ensure that your materials are well-organized so that you can quickly reference important notes or formulas when needed.

Strategies During the Assessment

Once you are in the assessment, applying effective time management strategies is essential to completing all tasks efficiently:

- Read Instructions Carefully: Spend a few minutes at the start to review the instructions and allocate your time for each section based on its weight.

- Allocate Time per Question: Avoid spending too much time on any one question. Move on if you’re stuck and return to challenging problems later if time permits.

- Leave Time for Review: Always reserve the last few minutes of the assessment to review your answers. Check for simple mistakes or missed calculations.

By following these tips, you can improve your time management skills and feel more confident in your ability to handle the tasks efficiently and accurately.

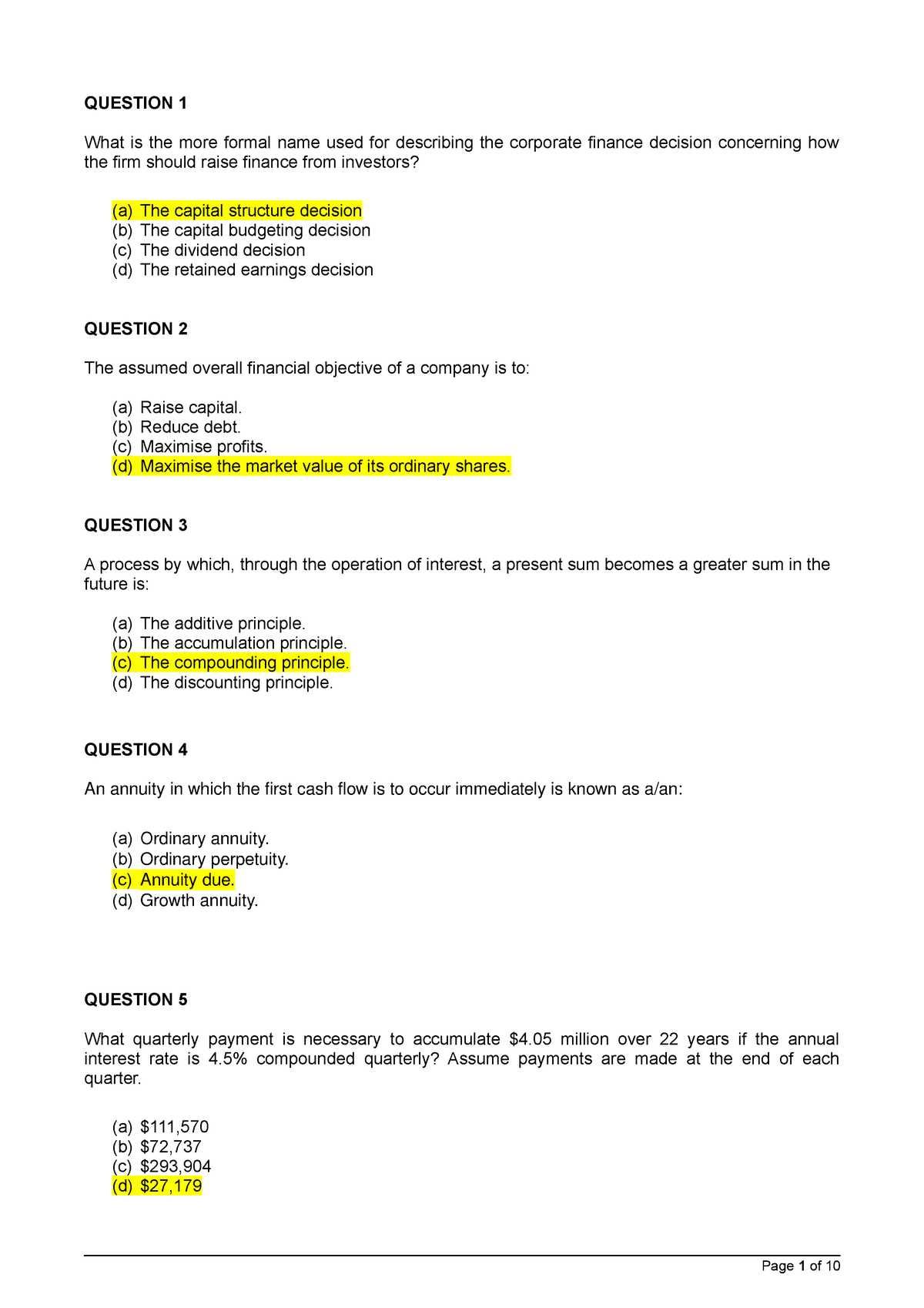

Strategies for Answering Multiple Choice Questions

When facing questions with several possible answers, the key to success lies in applying effective strategies to navigate through the options quickly and accurately. These types of tasks can often feel overwhelming, but with the right techniques, it’s possible to increase your chances of selecting the correct answer. By approaching each choice systematically and using logical reasoning, you can improve your performance and manage your time effectively.

Here are some strategies to help you answer multiple-choice tasks more efficiently:

- Read the Question Carefully: Pay close attention to what is being asked before looking at the choices. Ensure you understand the underlying concept to avoid being misled by irrelevant details.

- Eliminate Clearly Wrong Answers: Begin by ruling out options that are obviously incorrect. This increases your odds of selecting the right answer even if you’re unsure.

- Look for Keywords: Some choices may include keywords from the question. Focus on these terms as they can help you identify the correct response quickly.

- Consider the Length of Answers: Often, the longest option is the most complete or detailed. If you’re unsure, choose the one that appears more comprehensive or well-rounded.

- Don’t Overthink It: If you’re stuck on a question, trust your first instinct and avoid second-guessing. The initial choice is often the correct one.

- Manage Your Time: Allocate a set amount of time for each question. If you’re unsure, make an educated guess and move on, returning to tougher questions later if time allows.

By practicing these strategies, you can enhance your approach to multiple-choice tasks, boost your confidence, and maximize your efficiency during assessments.

Breaking Down Case Study Questions

Case study tasks often require a deeper understanding of a specific scenario and the ability to analyze and apply concepts to real-world situations. These questions typically provide detailed information, asking you to identify problems, evaluate solutions, and propose recommendations. Approaching these types of challenges systematically can help you break down the information effectively and arrive at a well-thought-out response.

To tackle case study tasks efficiently, follow these steps:

- Read the Case Thoroughly: Begin by carefully reading the entire case. Take note of key details, such as the main issues, stakeholders involved, and any relevant data or statistics.

- Identify the Core Problem: Focus on the central issue that the case is addressing. Understanding the primary challenge is crucial for crafting an appropriate response.

- Analyze the Data: Examine any figures, facts, or trends provided in the case. Identify patterns or discrepancies that may offer insights into potential solutions.

- Apply Relevant Concepts: Use the knowledge you’ve gained from your studies to assess the case. Apply theoretical frameworks, models, or principles that can help you analyze the situation.

- Formulate Your Solution: Based on your analysis, propose a well-reasoned solution or set of recommendations. Ensure your solution is realistic and supported by evidence from the case.

- Review Your Response: Once you’ve formulated your answer, review it to ensure that it is clear, concise, and addresses all aspects of the case study. Check that your solution is well-supported by evidence.

By following these steps, you can approach case study tasks with confidence, ensuring that your analysis is thorough and your response is comprehensive and well-structured.

Understanding Investment Appraisal Techniques

Evaluating potential investments involves using various methods to determine their value and the return they will generate. These techniques help individuals and organizations assess whether a particular opportunity aligns with their goals and offers a good return on the resources invested. A clear understanding of these tools can guide decision-making and improve the accuracy of assessments.

Some commonly used methods to evaluate investment opportunities include:

- Net Present Value (NPV): This method calculates the difference between the present value of cash inflows and outflows over time. A positive NPV indicates a profitable investment.

- Internal Rate of Return (IRR): IRR is the discount rate that makes the NPV of all cash flows from a particular investment equal to zero. It represents the expected annual return of the investment.

- Payback Period: This technique measures how long it will take for an investment to recover its initial cost. A shorter payback period is generally preferred, as it indicates quicker profitability.

- Profitability Index (PI): The PI ratio is the ratio of the present value of future cash flows to the initial investment. A PI greater than 1 suggests that the investment is worthwhile.

- Return on Investment (ROI): ROI is a simple way to measure the profitability of an investment by comparing the gain or loss relative to the initial amount invested.

Each of these techniques has its strengths and weaknesses. By understanding them, you can make more informed decisions about where to allocate resources and ensure that your investments meet the desired financial goals.

Financial Risk and Return Analysis

When evaluating potential opportunities, it is essential to assess both the level of risk involved and the potential return. Risk refers to the uncertainty regarding the outcome of an investment, while return is the profit or loss generated from the investment. Understanding the relationship between these two elements is critical for making informed decisions and achieving desired financial outcomes.

Assessing Risk

Risk assessment involves evaluating the likelihood that an investment will perform as expected, considering factors such as market conditions, economic variables, and company-specific issues. It can be quantified using metrics like:

- Standard Deviation: A measure of the volatility of returns, indicating how much the returns deviate from the average over a period of time.

- Beta: A measure of how an asset’s returns move relative to the overall market. A higher beta indicates higher risk but also the potential for higher returns.

- Value at Risk (VaR): A statistical technique used to estimate the potential loss in value of an asset or portfolio over a defined period for a given confidence interval.

Understanding Return

Return analysis focuses on calculating the expected profit or gain from an investment. It includes both realized returns (the actual returns observed) and expected returns (the forecasted return based on historical data). Key measures include:

- Expected Return: The weighted average of possible returns, considering their probabilities of occurring.

- Return on Investment (ROI): A percentage measure of how much gain or loss an investment has generated relative to the initial cost.

- Annualized Return: The average return per year over a period, used to compare different investment opportunities over similar timeframes.

By analyzing both the risk and return of an investment, you can make more balanced decisions, ensuring that the potential rewards justify the risks involved.

Capital Budgeting Concepts to Review

When making long-term investment decisions, it’s crucial to understand how to evaluate the profitability and risks associated with various projects. Capital budgeting is the process of planning and evaluating investments in projects that require significant financial resources. By mastering key concepts in this area, you can make informed decisions about where to allocate capital for maximum returns.

Key Methods for Evaluation

Several methods are commonly used to assess the viability of an investment. These techniques provide a clear picture of the potential returns and help compare different opportunities:

- Net Present Value (NPV): A method that calculates the difference between the present value of cash inflows and outflows. A positive NPV indicates that the project is likely to be profitable.

- Internal Rate of Return (IRR): The discount rate that makes the NPV of all cash flows equal to zero. This value represents the expected rate of return on an investment.

- Payback Period: This technique measures the time it will take for an investment to recover its initial cost. The shorter the period, the more attractive the project.

- Profitability Index (PI): The ratio of the present value of future cash flows to the initial investment. A PI greater than 1 indicates a good investment.

Understanding Cash Flow Projections

Accurate cash flow projections are essential for successful capital budgeting. These projections estimate the amount of money that will be generated or spent by an investment over time. Key considerations include:

- Operating Cash Flow: The money generated from the core operations of the project or investment, excluding financing activities.

- Capital Expenditures (CapEx): The funds required to acquire or upgrade physical assets like machinery or buildings.

- Working Capital: The difference between a company’s current assets and current liabilities, representing the short-term financial health of a project.

By reviewing these concepts and applying them effectively, you can make better investment choices that align with both short-term and long-term financial goals.

Business Finance Questions on Forecasting

Predicting future outcomes is an essential skill in any financial planning process. Accurate projections help companies make informed decisions regarding resource allocation, budgeting, and strategic direction. The ability to effectively forecast trends, market conditions, and potential risks can provide a significant advantage in dynamic and competitive environments. In this section, we explore key aspects of forecasting techniques used to estimate future financial performance and how they are evaluated.

Common Approaches to Financial Forecasting

There are several methods used to predict future financial results. Each method relies on different types of data and assumptions. Below are some commonly used approaches:

- Historical Data Analysis: This method involves analyzing past performance to identify patterns or trends that can be projected into the future.

- Trend Analysis: A technique used to identify general directions in data over time, helping predict future performance based on historical trends.

- Expert Judgment: In situations where data is sparse or unreliable, predictions are often made using insights from industry experts and experienced professionals.

- Regression Models: Statistical methods used to establish relationships between different variables, allowing for predictions based on the values of independent factors.

Evaluating the Accuracy of Forecasts

Once forecasting methods are applied, it’s important to assess the accuracy of the predictions. Comparing forecasted values against actual outcomes can help identify any discrepancies and improve future forecasts. Below is an example of how forecast accuracy might be evaluated:

| Quarter | Forecasted Revenue | Actual Revenue | Difference |

|---|---|---|---|

| Q1 | $250,000 | $245,000 | $5,000 |

| Q2 | $270,000 | $275,000 | -$5,000 |

| Q3 | $290,000 | $300,000 | -$10,000 |

| Q4 | $310,000 | $315,000 | -$5,000 |

By reviewing the difference between forecasted and actual outcomes, companies can adjust their models, refine their assumptions, and improve their future projections for more reliable results.

Taxation and Its Role in Finance Exams

The concept of taxation plays a significant part in the study of financial management and decision-making. Understanding how different types of taxes impact individuals and organizations is essential for evaluating the overall economic environment. In various assessments, the role of taxes is often explored to understand how they influence profitability, investment choices, and long-term strategies. In this section, we discuss the importance of taxation as a key component in financial analysis and preparation for academic assessments.

Key Areas of Taxation in Financial Assessments

Taxes can have various implications on business operations and financial planning. The following areas are often explored in assessments and exams:

- Corporate Taxation: Understanding how different tax rates affect business profits and cash flow.

- Personal Taxation: Analyzing the impact of income tax, deductions, and tax credits on individuals’ financial planning.

- Indirect Taxes: These taxes, such as sales tax or VAT, influence consumer behavior and pricing strategies.

- Capital Gains Tax: Evaluating how taxation on the sale of assets influences investment strategies and portfolio management.

- Tax Planning and Avoidance: The strategies employed by businesses and individuals to minimize tax liabilities within the legal framework.

Importance of Tax Knowledge in Financial Assessments

Understanding tax laws and their implications is crucial for accurate financial forecasting and decision-making. Below are some of the key reasons why taxation knowledge is essential:

- Investment Decisions: Taxes play a crucial role in determining the attractiveness of various investment opportunities, as different assets are subject to different tax treatments.

- Budgeting and Planning: Companies must account for tax liabilities when planning budgets and projecting future cash flows.

- Risk Management: Knowledge of taxation helps identify potential risks related to non-compliance or unforeseen tax obligations.

In academic assessments, an understanding of these concepts is necessary for correctly analyzing case studies, answering theoretical questions, and solving practical problems related to financial planning and strategy.

Practice Questions for Exam Success

To succeed in any assessment, regular practice is key. By engaging with a variety of problems and scenarios, you can refine your understanding of key concepts, improve problem-solving skills, and build confidence. This section highlights the importance of preparing with sample problems and exercises to ensure thorough comprehension and optimal performance in assessments.

Types of Practice Exercises

Different types of exercises help in mastering the subject and getting familiar with the format of the tasks. These include:

- Theoretical Problems: Focus on understanding core principles and applying them to hypothetical situations.

- Practical Scenarios: These problems require applying knowledge to real-world situations, often involving calculations and analysis.

- Case Studies: Case-based questions simulate complex business scenarios, allowing for in-depth analysis and strategic decision-making.

- Numerical Challenges: Exercises focusing on calculations, such as interest rates, cash flows, and valuation methods.

Benefits of Practicing Regularly

Engaging with sample problems consistently offers several advantages:

- Familiarity with the Format: Helps you understand the structure of the tasks, making it easier to navigate the actual assessment.

- Time Management Skills: Regular practice helps develop the ability to allocate time efficiently during the assessment.

- Confidence Building: Solving problems regularly builds self-assurance in your ability to tackle difficult tasks.

- Identifying Knowledge Gaps: Practice highlights areas that may need further review, enabling targeted improvement.

By incorporating regular practice into your study routine, you can increase your chances of success and feel more prepared to face any challenges during the assessment process.

Resources for Business Finance Exam Prep

To excel in any academic challenge, having the right resources at your disposal is essential. A wide range of materials can help you strengthen your understanding and sharpen your skills. This section will explore various types of tools and references that can support your preparation and ensure a comprehensive approach to your study sessions.

Books and Study Guides

Books and specialized study guides provide structured content and detailed explanations of complex concepts. These resources are often written by experts and can serve as a valuable reference throughout your preparation.

- Textbooks: Foundational texts that cover essential principles and theoretical frameworks in detail.

- Practice Workbooks: These often include practical problems and solutions, offering hands-on practice.

- Revision Guides: Summarized versions of core concepts, ideal for last-minute reviews.

Online Learning Platforms

Online platforms provide a variety of tools, from video lectures to interactive quizzes. These resources are often updated regularly, ensuring you have access to the latest materials and learning techniques.

- Interactive Quizzes: Platforms offering practice quizzes can help reinforce knowledge and identify weak points.

- Video Tutorials: Step-by-step guides covering complex topics in an easily digestible format.

- Webinars and Live Sessions: These can offer live interaction with experts to clarify doubts and deepen understanding.

Study Groups and Forums

Collaborating with peers can be incredibly beneficial. Engaging in discussions, sharing resources, and solving problems together can enhance comprehension and foster a sense of community.

- Study Groups: Forming or joining groups for collaborative learning allows for knowledge exchange and peer support.

- Online Forums: These provide opportunities to ask questions, share resources, and connect with others on the same academic journey.

With the right combination of textbooks, digital tools, and collaborative networks, you can efficiently prepare for any academic challenge and perform at your best.