For anyone seeking to advance their career in financial oversight or investment strategy, thorough preparation is essential. Understanding the core principles of resource allocation, risk evaluation, and portfolio structuring is critical for success in professional assessments. These areas are often tested in various forms, assessing not only theoretical knowledge but also practical application in real-world scenarios.

By focusing on key topics such as valuation techniques, financial statement analysis, and risk management strategies, candidates can enhance their readiness. Practicing with realistic scenarios and familiarizing oneself with common problem-solving approaches will build confidence and improve the chances of a successful outcome. Preparation is about more than memorizing facts–it’s about developing a deep understanding of how these concepts apply in diverse situations.

Emphasizing practice and review, along with a clear focus on high-priority areas, can provide candidates with the edge they need to succeed. Properly approaching these evaluations can not only demonstrate competence but also showcase the ability to apply knowledge effectively in challenging contexts.

Asset Management Exam Questions and Answers

To succeed in professional assessments related to financial oversight and investment strategies, it’s important to master both theoretical concepts and practical applications. These evaluations test a candidate’s ability to analyze, interpret, and make decisions based on complex financial data. Understanding the core elements of resource allocation, risk management, and financial performance evaluation plays a critical role in achieving success in these assessments.

Key Concepts to Master

Familiarizing oneself with the fundamental principles of value assessment, market trends, and risk analysis is crucial. Scenarios often present complex data sets where candidates must choose the best course of action, relying on knowledge of financial instruments, performance metrics, and economic factors. Practicing with these types of scenarios helps candidates to think critically and apply the right techniques to various situations.

Effective Preparation Strategies

Beyond understanding theory, it’s essential to develop strategies for tackling challenging problems under time constraints. Practicing with mock tests, reviewing case studies, and understanding the reasoning behind each solution is key to building the skills needed for successful performance. Preparing in this way not only boosts confidence but also sharpens decision-making abilities in real-world situations.

Key Topics Covered in Asset Management Exams

These evaluations typically focus on a variety of critical areas that test a candidate’s understanding of financial principles, risk assessment, and the ability to make informed decisions in diverse situations. Key topics often encompass the analysis of financial instruments, portfolio construction, and the strategies used to maximize returns while mitigating risk. A comprehensive grasp of these subjects is essential for demonstrating expertise and achieving success.

Valuation Techniques

One of the central aspects of these assessments involves understanding how to accurately value different financial assets. This includes learning about discounted cash flows, market comparables, and asset-specific pricing models. Candidates must be prepared to apply these methods to real-world data and scenarios, ensuring they can assess the value of a range of investment opportunities.

Risk Evaluation and Mitigation

Another critical topic is the identification and management of potential risks. Evaluators often test candidates on their ability to assess market volatility, economic conditions, and the impact of external factors on financial performance. Understanding various risk management tools, including hedging strategies and diversification techniques, is key to demonstrating comprehensive knowledge in this area.

How to Prepare for Asset Management Tests

Preparation for these assessments requires a combination of focused study, practical application, and strategic planning. It’s essential to build a solid foundation in the core principles of financial analysis, risk evaluation, and portfolio structuring. Beyond understanding theoretical concepts, candidates must be able to apply this knowledge to real-world scenarios, demonstrating both expertise and problem-solving abilities under time constraints.

Effective preparation involves studying key topics thoroughly, practicing with mock tests, and reviewing case studies that closely mirror the types of challenges that may arise during the actual assessment. Time management is also critical–allocating sufficient time for each section of the material ensures that no topic is overlooked. Regularly testing oneself on complex scenarios helps reinforce learning and builds the confidence needed to tackle difficult problems.

Understanding the Role of Asset Managers

Professionals in this field are responsible for overseeing client portfolios, ensuring that investments align with strategic goals, and maximizing returns while minimizing risk. Their role extends beyond basic investment decisions–they analyze market trends, evaluate economic conditions, and tailor strategies to meet specific client needs. It is essential for these individuals to demonstrate both technical expertise and a deep understanding of the broader financial landscape.

Key Responsibilities

- Developing investment strategies based on client goals

- Monitoring market conditions and adjusting portfolios accordingly

- Analyzing financial performance and making recommendations

- Ensuring compliance with regulatory requirements

Skills Required for Success

- Strong analytical and problem-solving abilities

- Excellent understanding of financial markets and investment tools

- Effective communication skills for client interactions

- Attention to detail and risk mitigation capabilities

Common Challenges in Asset Management Exams

Candidates often face a variety of obstacles when preparing for assessments related to financial oversight. The complexity of the topics, the depth of knowledge required, and the need for quick decision-making under time pressure can make the process particularly challenging. Understanding how to navigate these difficulties is key to performing well in these evaluations.

Complex Scenarios and Data Interpretation

One common challenge is dealing with complex case studies that require the interpretation of large datasets. Candidates must quickly analyze and extract relevant information, which can be overwhelming if not approached strategically. The ability to identify key factors in financial reports and make informed decisions is critical in these situations.

Time Pressure and Pacing

Another challenge is managing time effectively during the assessment. With multiple sections and a wide range of topics, candidates may struggle to allocate enough time to each part. Practicing under timed conditions and developing pacing strategies can help ensure that all questions are answered thoroughly and on time.

Top Asset Management Concepts to Study

To excel in assessments related to financial strategy, it is essential to focus on understanding key principles that drive decision-making in the field. These concepts lay the foundation for evaluating investments, assessing risks, and constructing effective portfolios. A thorough grasp of these topics will not only help in passing evaluations but also in applying these techniques in real-world situations.

Valuation Methods are critical in determining the worth of various financial instruments. This includes mastering techniques like discounted cash flow analysis, price-to-earnings ratios, and net asset value calculations.

Risk Management plays a pivotal role in any financial strategy. Understanding how to identify, measure, and mitigate potential risks through diversification, hedging, and other strategies is essential for achieving long-term success.

Portfolio Optimization focuses on balancing risk and return by strategically allocating assets. This concept includes tools like the efficient frontier, modern portfolio theory, and asset correlation, which help in making informed decisions for optimal performance.

Financial Statements Analysis enables individuals to assess the financial health of investments. Being able to interpret income statements, balance sheets, and cash flow reports is key to making well-informed choices.

Behavioral Finance is also becoming increasingly important. Understanding how psychological factors influence investor decisions can help predict market trends and avoid common pitfalls.

Strategies for Answering Difficult Questions

When faced with challenging problems during a financial assessment, it’s important to approach them systematically and strategically. The key to success lies not only in knowledge but also in how you apply that knowledge under pressure. Developing a structured approach to problem-solving can significantly improve performance in high-stakes situations.

Step-by-Step Approach

- Read Carefully: Always read each problem thoroughly before attempting to solve it. Make sure you understand the context, as well as the specific requirements.

- Identify Key Information: Highlight or underline critical data that will guide your calculations or decision-making process.

- Break Down the Problem: If the issue seems complex, break it into smaller, more manageable parts. Solve each part sequentially.

- Apply Relevant Formulas: Use the appropriate formulas or models you have studied to guide your solution process. Ensure that you apply them correctly to the situation at hand.

Time Management Techniques

- Prioritize: Tackle easier problems first to build confidence, then return to the more difficult ones later when you have more time.

- Allocate Time Wisely: Keep track of time and allocate it appropriately across questions. If you’re stuck on a particular problem, move on and return to it after completing others.

- Stay Calm: Maintain composure during tricky problems. Stress can cloud judgment, so take a deep breath and focus on the next steps.

Asset Valuation Methods in Exam Questions

When tackling complex scenarios in financial assessments, understanding various techniques to determine the value of investments is essential. These methods are frequently tested, requiring candidates to apply them accurately to arrive at the most appropriate valuation. Mastery of these approaches is crucial, as each method provides unique insights into how to assess the worth of different financial instruments.

Discounted Cash Flow (DCF) Method

One of the most commonly used techniques involves calculating the present value of future cash flows. This method is based on the premise that the value of money decreases over time, and therefore, future returns need to be discounted to reflect their value in today’s terms. Candidates may be asked to use this approach to determine whether an investment is worthwhile based on projected revenues and expenses.

Comparative Market Analysis

Another widely tested method involves comparing similar assets in the market to establish a fair value. This technique leverages the pricing of similar financial instruments or companies within the same sector to gauge value. In assessments, this could involve determining how a company’s performance or market conditions compare to its peers, helping candidates identify the most realistic valuation based on external factors.

Time Management Tips for Exam Success

Effective time allocation is crucial when preparing for high-stakes assessments. Managing your time wisely during the test allows you to complete each section efficiently and avoid feeling rushed. By applying proven strategies, you can optimize your performance and ensure you address every part of the evaluation comprehensively.

Planning Your Study Time

- Create a Study Schedule: Plan your study sessions well in advance. Break down the material into manageable segments and allocate specific times for each topic.

- Prioritize Topics: Focus on areas where you feel least confident or that are most heavily weighted in the evaluation. Ensure you dedicate more time to complex subjects.

- Avoid Procrastination: Stick to your schedule as much as possible. Delaying study sessions can lead to unnecessary stress as the assessment date approaches.

Maximizing Efficiency During the Test

- Start with Easy Sections: Tackle simpler questions first to build confidence and save time for more challenging ones later.

- Monitor the Clock: Keep track of time throughout the test. Set milestones for when you should move on to the next section to ensure you stay on pace.

- Don’t Get Stuck: If a question proves difficult, move on and return to it later. Spending too much time on one part can eat into time for others.

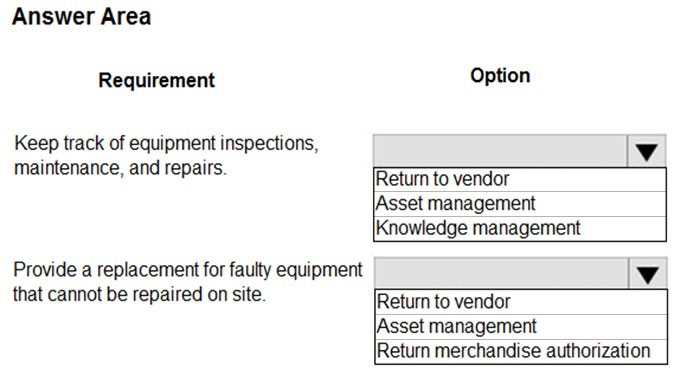

Importance of Case Studies in Exams

Case studies play a critical role in evaluations that assess practical application of theoretical knowledge. These scenarios challenge individuals to think critically, analyze complex situations, and propose effective solutions based on real-world contexts. By testing how well candidates can apply their understanding, case studies go beyond theoretical recall and provide insight into their problem-solving abilities.

Real-World Application

One of the primary benefits of case studies is their focus on practical application. Unlike traditional questions that may rely on rote memorization, these scenarios mimic actual situations professionals face in the field. Candidates must evaluate various factors, interpret data, and make decisions as they would in a real-world setting, providing a deeper understanding of the subject matter.

Enhancing Critical Thinking Skills

Working through case studies encourages individuals to think analytically and strategically. It forces them to assess multiple variables, anticipate potential outcomes, and justify their decisions with logical reasoning. This strengthens critical thinking and helps develop skills that are valuable both for assessments and future professional challenges.

How to Interpret Financial Statements in Exams

Understanding how to analyze financial documents is crucial when facing evaluations that test your ability to interpret complex financial data. These statements are often used to assess a company’s performance, financial health, and future potential. In these situations, it is essential to not only comprehend the numbers but also to draw meaningful insights that reflect the true financial position of the business.

Key Components of Financial Statements

When reviewing financial documents, focus on the three main sections: the balance sheet, income statement, and cash flow statement. Each of these offers a different perspective on the company’s financial standing.

- Balance Sheet: This provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. It helps determine the financial stability of the organization.

- Income Statement: This reflects the company’s profitability over a set period, showing revenues, costs, and profits or losses. It is key to understanding how efficiently a company is operating.

- Cash Flow Statement: This tracks the movement of cash in and out of the business, helping assess its liquidity and ability to meet short-term obligations.

Interpreting Key Ratios

Ratios derived from these financial documents provide additional context and highlight areas of strength or concern. Focus on the following:

- Profitability Ratios: These ratios, such as the gross margin or return on equity, help evaluate a company’s ability to generate profit relative to its revenue or equity.

- Liquidity Ratios: Ratios like the current ratio or quick ratio show the company’s ability to meet its short-term financial obligations.

- Solvency Ratios: These ratios assess a company’s ability to meet long-term debts, such as the debt-to-equity ratio.

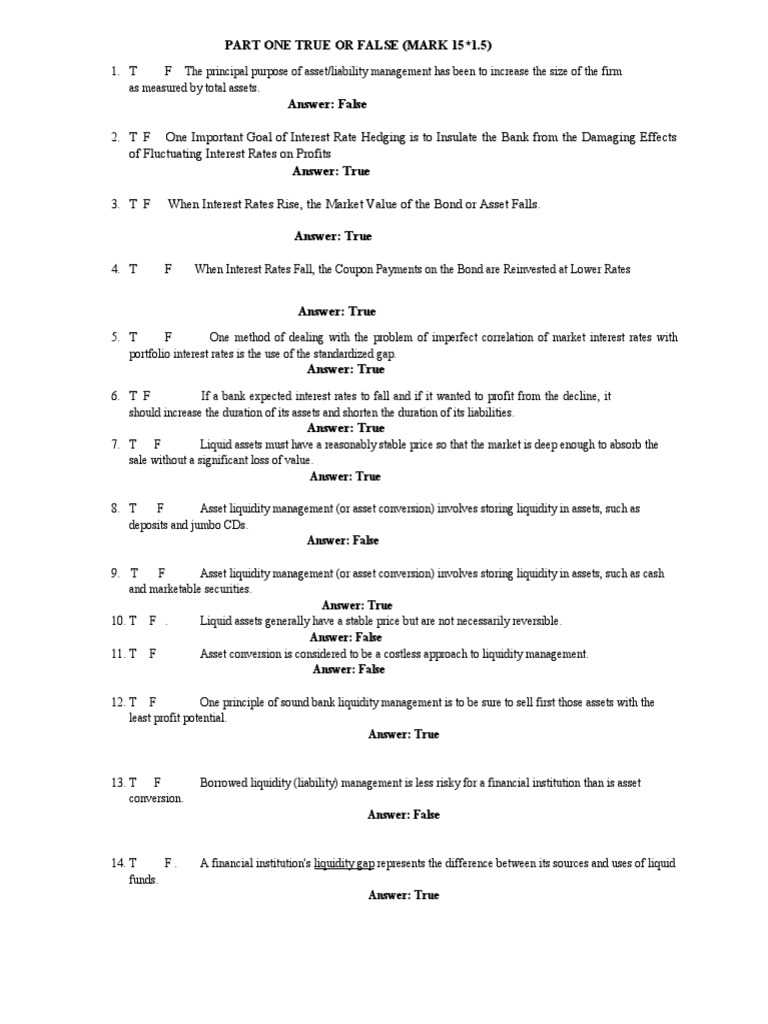

Risk Management Questions in Assessments

In evaluations that focus on financial strategies, it’s crucial to understand how to identify, assess, and mitigate risks. These types of scenarios often involve recognizing potential threats to investments or portfolios and formulating strategies to reduce their impact. The questions in this area test your ability to apply theoretical knowledge in practical, risk-related situations that could affect long-term financial stability.

Types of Risks to Address

Risk-related challenges often require a deep understanding of the various types of risks that businesses or investors may encounter. Common categories include:

- Market Risk: The possibility of an investment’s value fluctuating due to changes in market conditions such as interest rates, currency values, or commodity prices.

- Credit Risk: The risk that a borrower or counterparty may default on an obligation, leading to potential losses.

- Operational Risk: The risk arising from failures in internal processes, systems, or human error that can affect business operations.

- Liquidity Risk: The challenge of converting an asset into cash without affecting its market price.

Approaches to Mitigate Risk

When tackling these topics in assessments, it’s important to consider various approaches to minimize or avoid potential risks. Effective strategies may include:

- Diversification: Spreading investments across various assets to reduce exposure to any single risk.

- Hedging: Using financial instruments or strategies to offset potential losses in investments.

- Risk Assessment Models: Implementing quantitative tools, such as Value at Risk (VaR), to evaluate potential losses and make informed decisions.

Preparing for Asset Management Certifications

Achieving a professional certification in the field of financial strategy requires a combination of practical knowledge, theoretical understanding, and the ability to apply concepts in real-world situations. These credentials not only validate your expertise but also help advance your career by showcasing your proficiency in key areas of investment strategy, risk evaluation, and financial analysis. To succeed in these certifications, effective preparation is essential.

Start by familiarizing yourself with the structure and content of the certification program. It is important to understand the topics that are covered, the level of complexity, and the format of the assessments. A structured study plan is key to managing the vast amount of material and ensuring that you grasp the core principles.

Additionally, focus on building a solid foundation in relevant areas such as:

- Investment Strategies: Understanding different methods of allocating resources and optimizing returns.

- Risk Management Techniques: Learning how to identify, measure, and mitigate various types of risks.

- Financial Analysis: Gaining proficiency in reading and interpreting financial statements and using them to make informed decisions.

- Ethical Standards: Developing a deep awareness of the ethical considerations involved in managing finances and investments.

Incorporate both theoretical learning and practical exercises into your study routine. Practice using past materials, participate in mock tests, and engage in discussions with peers or mentors to enhance your knowledge and build confidence.

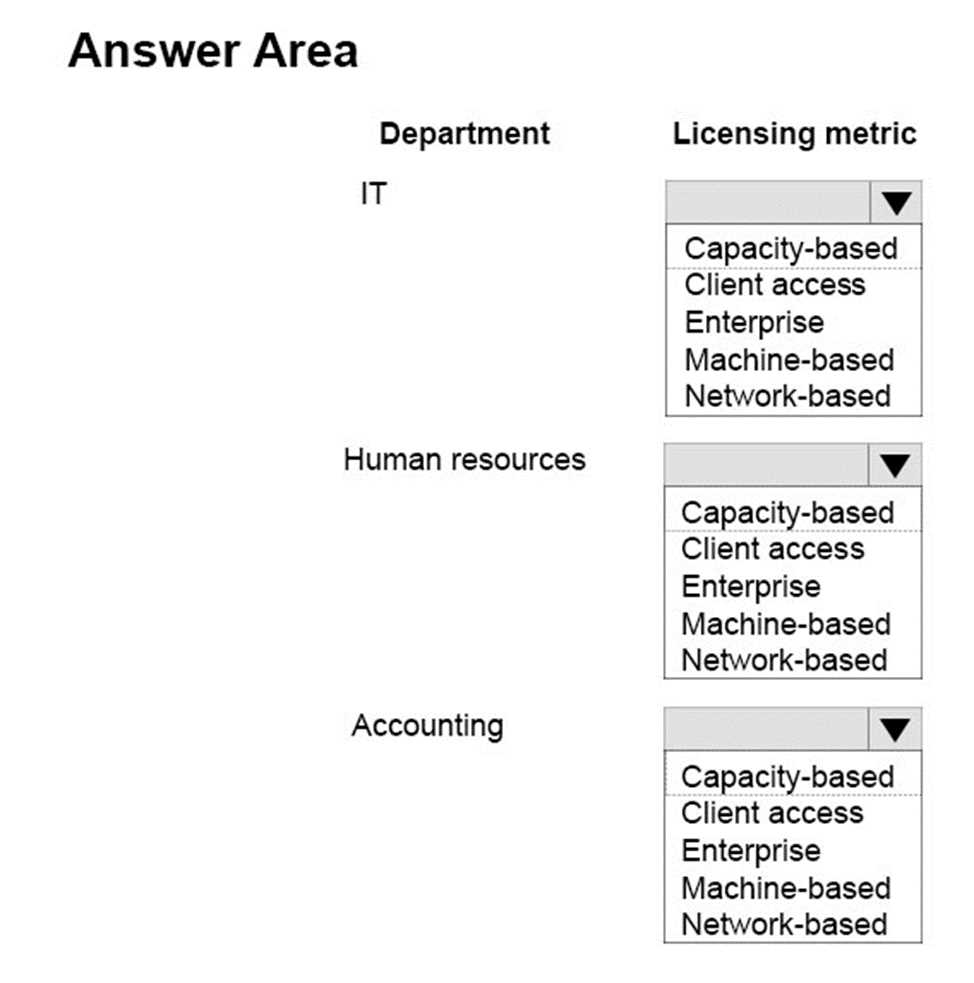

Understanding Different Asset Types in Assessments

In financial evaluations, understanding the various classes of resources is critical. These resources are typically divided into different categories based on their characteristics, risk profiles, and potential returns. Each class presents unique challenges and opportunities, which is why it’s essential to grasp their fundamental properties when preparing for assessments. The ability to differentiate between these categories can help individuals make informed decisions when managing portfolios or investment strategies.

Types of Financial Resources

There are several primary categories of resources that are commonly assessed. Each has its own set of characteristics that affect their risk and return potential:

- Equities: Represent ownership in a company, with the potential for capital appreciation and dividends. However, they come with higher volatility.

- Bonds: Debt securities issued by corporations or governments, offering lower risk compared to equities but generally providing lower returns.

- Commodities: Physical goods such as oil, gold, or agricultural products, often used for diversification or hedging against inflation.

- Real Estate: Involves investing in physical properties or real estate funds, with income generated from rents and potential for long-term value growth.

Risk Profiles and Returns

Different categories come with varying levels of risk and potential return. Typically, riskier resources such as equities or commodities offer the possibility of higher returns, while more stable options like bonds or real estate provide lower but steadier income. Understanding these trade-offs is key to answering questions related to resource allocation and portfolio diversification effectively.

Using Past Papers for Practice

Practicing with previous assessments can be one of the most effective strategies to prepare for an upcoming evaluation. By reviewing past materials, individuals can gain a better understanding of the structure, types of tasks, and common themes that are likely to appear. This practice not only builds familiarity with the format but also helps develop time-management skills, allowing for a more confident approach when facing similar challenges in the future.

Analyzing past papers helps identify recurring topics and question formats. This enables focused study on the areas most likely to appear, ensuring a more efficient preparation process. Additionally, working through these exercises under timed conditions can simulate the pressure of real scenarios, allowing individuals to assess their performance and make necessary adjustments.

Key Benefits of Using Past Materials

| Benefit | Explanation |

|---|---|

| Familiarity with Format | Helps to understand how the tasks are structured and the type of content that is commonly tested. |

| Identification of Key Topics | Reveals which topics are frequently covered, allowing for targeted revision. |

| Improved Time Management | Simulating real test conditions under timed practice helps develop efficient time allocation strategies. |

| Building Confidence | By practicing with real tasks, individuals gain confidence in their abilities, reducing anxiety. |

Resources for Studying Asset Management

Access to the right study materials can make a significant difference when preparing for a certification or evaluation in the field. Using a variety of resources ensures a well-rounded understanding of the topics and concepts. These materials include books, online courses, practice exercises, and forums, all of which can complement traditional classroom learning and provide deeper insights into key concepts.

Incorporating various types of resources allows for both theoretical learning and practical application. For example, textbooks can provide detailed explanations, while interactive online platforms offer opportunities for real-time practice and engagement. Additionally, peer discussions and case studies allow for practical understanding and problem-solving in real-world scenarios.

Essential Study Materials

- Textbooks: Comprehensive books provide foundational knowledge and detailed explanations on fundamental concepts.

- Online Courses: Many platforms offer interactive lessons, videos, and quizzes that allow for self-paced learning.

- Practice Papers: Past papers and mock exams offer valuable practice to test your understanding and identify areas of weakness.

- Forums & Study Groups: Participating in discussion groups can help clarify difficult concepts and offer insights from other learners.

Additional Tools for Effective Learning

- Flashcards: Useful for memorizing key terms, definitions, and formulas, especially in more technical subjects.

- Webinars & Workshops: Live sessions with industry professionals or educators can provide practical tips and updates on current trends.

- Podcasts & Audiobooks: Convenient for learning on the go, these resources can help reinforce key concepts during commutes or breaks.

Tips for Maintaining Exam Confidence

Staying confident during preparation and on the day of the assessment is crucial to performing well. The key to maintaining self-assurance lies in effective strategies, positive thinking, and proper preparation. By focusing on mental readiness and staying organized, individuals can reduce stress and perform at their best under pressure.

It is important to remember that confidence is built over time through consistent effort. A balanced study schedule, realistic goal-setting, and a focus on progress rather than perfection can foster the right mindset. Additionally, understanding common challenges and how to address them can make the process smoother and more manageable.

Key Strategies to Boost Confidence

- Plan Ahead: Break down study sessions into manageable segments and stick to a realistic timetable.

- Practice Regularly: Repeated practice helps reinforce concepts and increases familiarity with the content.

- Stay Positive: Keep a positive mindset by visualizing success and focusing on achievements, no matter how small.

- Rest and Relax: Ensure adequate rest and relaxation to avoid burnout and keep mental clarity sharp.

Common Mistakes to Avoid

- Overloading Information: Trying to absorb too much at once can lead to confusion and increased anxiety.

- Skipping Breaks: Not taking breaks during study sessions can lead to fatigue and reduce productivity.

- Self-Doubt: Avoid negative thoughts or comparisons to others, as they can diminish self-confidence.

By implementing these tips and maintaining a focused, balanced approach, individuals can improve their performance and face challenges with greater confidence.