Learning about managing money is a crucial skill that can shape your future. Gaining knowledge about how to allocate resources, plan for long-term goals, and make informed financial decisions is essential for building a solid foundation. Understanding these key principles will not only help you in your personal life but also prepare you for real-world financial challenges.

Building financial literacy involves mastering various topics, such as budgeting, saving, and setting realistic financial goals. It’s important to explore different strategies and techniques that can enhance your ability to make smart choices with money. As you delve deeper into these concepts, you’ll be better equipped to navigate the complexities of finances.

Whether you’re just starting to manage your finances or looking to sharpen your knowledge, there are numerous ways to develop a strong financial mindset. This guide will walk you through some important insights, helping you develop the skills needed to make sound financial decisions and achieve your objectives.

Everfi Savings Module Answers

Understanding the basics of financial planning and resource management is crucial for making informed decisions about your future. Mastering these concepts can empower you to make smarter choices with your finances and achieve long-term goals. This section will guide you through essential principles that help in grasping key topics related to money management and setting yourself up for success.

Key Concepts to Focus On

- Budgeting: Learning how to manage your income and expenses effectively is fundamental for financial stability.

- Setting Goals: Understanding how to define clear and achievable financial goals can guide your spending and saving habits.

- Interest Rates: Comprehending how interest works will help you make better decisions about loans, investments, and saving accounts.

- Compound Interest: This principle shows how your money grows over time, making it essential for long-term financial growth.

Helpful Strategies for Financial Learning

- Practice budgeting: Track your income and spending to gain control over your finances and understand where adjustments may be needed.

- Start with small goals: Setting achievable targets helps build good financial habits and makes larger goals seem more attainable.

- Understand debt management: Learn how to pay off debt efficiently to avoid unnecessary financial strain and interest charges.

- Review your progress regularly: Continuously monitor your financial situation to ensure you’re staying on track toward your goals.

By mastering these concepts and applying them consistently, you’ll be well-equipped to manage your finances more effectively. The ability to navigate these financial principles will provide a solid foundation for your future planning and help you make sound decisions that lead to financial security.

Understanding the Financial Learning Program

Mastering money management is essential for anyone looking to build a secure financial future. By gaining a deeper understanding of how to handle your resources, you can make informed decisions about budgeting, saving, and planning. This guide will introduce key financial principles designed to improve your financial literacy and set you on the path to smarter money management.

Core Concepts of Financial Literacy

At the heart of personal finance is the ability to manage money effectively. This includes a variety of concepts that guide individuals toward making better financial decisions. Key topics often covered include:

- Budgeting: Learning how to track and allocate income to different expenses is the foundation of financial health.

- Saving: Setting aside funds for both short-term and long-term goals is a key strategy for financial stability.

- Investing: Understanding how to grow your money through various investment options allows for future financial security.

- Debt Management: Knowing how to responsibly handle debt is crucial to avoid financial setbacks and maintain good credit.

How These Concepts Are Applied

Once you are familiar with these principles, applying them to real-life scenarios becomes much easier. By actively budgeting, setting goals, and managing debt, you can make steady progress toward financial well-being. The program is designed to provide practical tools and resources to help learners take control of their financial future and make empowered decisions with their money.

Key Concepts in Saving and Budgeting

Managing money effectively is built on a strong foundation of two key practices: allocating funds wisely and preparing for future needs. Understanding how to prioritize expenses, set aside money for goals, and track your financial activities is essential for achieving long-term stability. These principles empower individuals to make decisions that align with their values and future aspirations.

One of the first steps in mastering personal finance is developing a budget. A well-structured budget allows you to balance your income and expenditures, ensuring that you are living within your means while preparing for upcoming financial needs. The next critical aspect is saving, which involves setting aside a portion of your income regularly for emergencies, retirement, and other future objectives.

By applying these concepts consistently, you can ensure that your financial decisions support your overall goals. Effective budgeting and saving not only provide security but also help you achieve milestones like purchasing a home, funding education, or traveling. These habits, when practiced over time, become the cornerstone of a strong financial future.

How to Approach Financial Learning Questions

When engaging with any financial learning platform or quiz, it’s important to approach questions with a clear understanding of the concepts being tested. The goal is not only to answer correctly but to deepen your knowledge of financial principles. By breaking down each question and focusing on the key information, you can approach them with confidence and accuracy.

Start by reading the question carefully to ensure you understand what is being asked. Pay attention to keywords that might indicate whether you need to calculate, define, or apply a concept. Next, eliminate any obviously incorrect options to narrow down your choices. This method allows you to focus on the most likely answers, making the process more efficient.

Additionally, reviewing any related content before tackling the questions can help reinforce the concepts you need to remember. This will improve your ability to quickly recognize the right answers and apply your knowledge in practical situations. With practice, answering these questions becomes an effective way to measure your understanding and build confidence in your financial decision-making skills.

Tips for Success in Financial Learning Platforms

Achieving success in any educational program requires a mix of focus, preparation, and consistent effort. When navigating through financial literacy content, it’s essential to approach the material strategically to maximize understanding and retention. By applying effective study techniques and engaging with the material actively, you can improve your ability to grasp complex concepts and perform well in assessments.

One key tip is to break down the content into manageable sections. Instead of attempting to learn everything at once, focus on smaller chunks of information and absorb them thoroughly before moving on. This approach ensures that you fully understand each concept before progressing to the next, preventing overwhelm and fostering deeper comprehension.

Additionally, take advantage of any practice exercises or quizzes available. These activities are excellent tools for reinforcing what you’ve learned and identifying areas where further review is needed. By testing yourself regularly, you can track your progress and become more confident in applying your knowledge to real-world situations.

Finally, stay engaged with the material by asking questions and seeking clarification when necessary. If a particular concept is unclear, take the time to review it or look for additional resources to deepen your understanding. This proactive approach will not only help you succeed in the program but also ensure that you retain and apply what you’ve learned long after completing the lessons.

Common Challenges in Financial Learning

When learning about managing finances, many individuals encounter challenges that can make the process feel overwhelming. These difficulties can range from understanding key concepts to applying them in real-life scenarios. Recognizing common obstacles allows learners to develop strategies for overcoming them and achieving better results in their financial education.

Common Obstacles in Financial Education

One of the main challenges students face is grasping the complex terminology associated with managing money. Terms like interest rates, investments, and budgeting strategies may seem difficult at first. Additionally, applying these concepts in real-world situations can be challenging without prior experience. It’s crucial to take the time to thoroughly understand the terminology before attempting to implement these strategies in your own life.

Strategies to Overcome These Challenges

To address these obstacles, students can utilize various approaches to make the material more accessible. Breaking down complex concepts into smaller, digestible parts can make them easier to understand. Additionally, applying what you’ve learned through practical exercises or simulations can help reinforce your understanding. Below is a table outlining some of the most common challenges and suggested solutions:

| Challenge | Solution |

|---|---|

| Difficult terminology | Study key terms and definitions to build a strong vocabulary. Use examples to see how the terms apply in real-world contexts. |

| Difficulty in applying concepts | Practice applying principles with real-life budgeting, saving, and investing exercises to build confidence. |

| Overwhelm with information | Break down material into smaller sections and focus on one concept at a time to avoid information overload. |

| Lack of practical experience | Seek out additional resources or simulations that offer hands-on experience with financial decision-making. |

By addressing these common challenges head-on and using effective strategies, learners can improve their financial literacy and confidently apply what they have learned in their personal lives.

Exploring Financial Goal Setting

Setting clear financial objectives is a key aspect of managing personal finances effectively. By identifying specific targets and planning how to achieve them, individuals can stay motivated and on track. This section explores the importance of goal-setting in the context of money management, providing insights on how to set realistic, measurable, and attainable financial goals.

Why Financial Goals Matter

Having well-defined goals helps create a clear roadmap for your financial future. It provides a sense of direction and purpose, making it easier to prioritize your spending and saving habits. Whether you’re aiming to save for an emergency fund, a big purchase, or retirement, understanding the importance of goal-setting will set you up for success.

Types of Financial Goals

- Short-Term Goals: These are goals you aim to achieve within the next year, such as building an emergency fund or paying off small debts.

- Medium-Term Goals: These goals are typically achieved within 1-5 years, like buying a car or saving for a vacation.

- Long-Term Goals: These goals take 5 years or more to achieve, such as saving for retirement or purchasing a home.

Steps to Achieve Your Financial Goals

- Define Your Goals: Be specific about what you want to achieve and set a clear timeline.

- Create a Budget: Establish a plan for how you will allocate your income to support your goals.

- Track Your Progress: Regularly monitor your savings and expenses to stay on track and adjust as needed.

- Stay Committed: Consistency is key. Regularly review your goals and make necessary adjustments to stay motivated.

By following these steps and staying focused on your goals, you can make steady progress towards achieving financial success. Setting realistic and attainable goals, coupled with disciplined budgeting and saving, is a powerful strategy for long-term financial well-being.

Steps to Complete Financial Education Program

Successfully completing a financial education program requires a structured approach that involves understanding the content, applying the concepts, and following through with all necessary tasks. By breaking down the process into clear steps, learners can stay organized and ensure they absorb the material effectively. This section outlines the key actions you need to take to complete the program and master the skills being taught.

Step 1: Review the Learning Objectives

Before diving into the lessons, it’s important to familiarize yourself with the program’s learning goals. Understanding what you are expected to achieve will help guide your focus throughout the course. These objectives often include topics such as budgeting, goal-setting, and financial planning, which will form the foundation of your learning experience.

Step 2: Engage with the Content

Once you have a clear understanding of the program’s objectives, actively engage with the materials. Read through the lessons carefully, take notes, and pause to reflect on key points. If the program includes interactive exercises or quizzes, make sure to complete them as they provide valuable practice and reinforce your understanding of the concepts.

Step 3: Apply What You’ve Learned

Learning about finances is most effective when you can relate it to real-world scenarios. As you progress through the program, find opportunities to apply the concepts to your own financial situation. This could involve setting up a budget, tracking your expenses, or creating a savings plan. Applying the material ensures that you gain practical experience and can easily recall the information when needed.

Step 4: Complete Assessments

Many programs include quizzes or assessments to test your knowledge. Take these assessments seriously, as they help reinforce the material and gauge your understanding. If you encounter any questions that are difficult to answer, review the related sections again to strengthen your comprehension before retaking the quiz.

Step 5: Review and Reflect

After completing the program, take time to review what you’ve learned. Reflect on the key takeaways and think about how you can apply these lessons moving forward. Revisiting the material and reviewing your progress helps solidify your understanding and ensures that the knowledge will stick in the long term.

By following these steps, you will not only complete the program but also gain the skills and confidence needed to manage your finances effectively. Whether you’re just starting out or looking to improve your financial literacy, a structured approach to learning is essential for success.

Learning About Interest and Deposits

Understanding how interest works and the role of deposits is crucial in managing personal finances. These concepts are fundamental to building wealth and making informed decisions about where to place your money. Interest allows your funds to grow over time, while deposits provide a secure place for storing your savings. In this section, we’ll explore how interest is earned and how deposits can help you achieve your financial goals.

Interest is the money paid by financial institutions for the use of your funds. It is typically calculated as a percentage of the amount you deposit into an account, such as a savings account or a certificate of deposit. The more money you deposit and the longer you leave it in the account, the more interest you can earn. There are different types of interest, including simple interest and compound interest, each with its own way of calculating earnings.

Deposits, on the other hand, are amounts of money placed into a financial institution for safekeeping. These funds may earn interest depending on the type of account. Common types of deposit accounts include savings accounts, checking accounts, and money market accounts. Each account type offers different features, such as access to your money or higher interest rates, and understanding these differences is key to making the right choice for your financial needs.

By learning how interest is calculated and understanding the advantages of different deposit accounts, you can make smarter decisions about where to keep your money. Whether you’re saving for a short-term goal or preparing for long-term financial security, knowing how to maximize your earnings through interest and selecting the right type of deposit account will play a significant role in your overall financial success.

How to Manage Your Finances Effectively

Proper financial management is essential for achieving both short-term and long-term goals. It involves planning, organizing, and controlling your finances to ensure you live within your means while also saving for future needs. Effective money management not only helps you avoid debt but also provides a path toward financial security and independence. In this section, we’ll outline key strategies to help you take control of your financial situation and make informed decisions about your spending and saving.

Track Your Spending

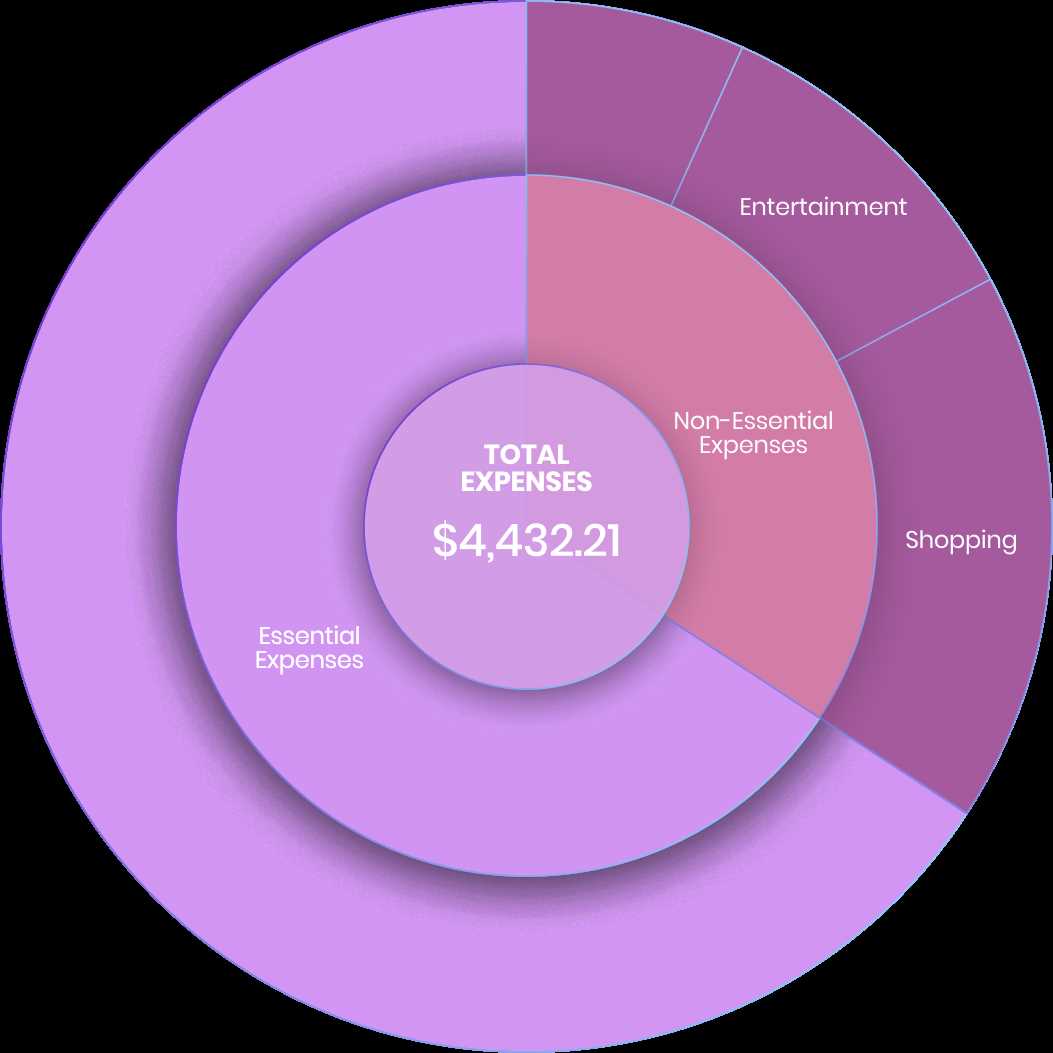

The first step in managing your finances is understanding where your money goes. By tracking your expenses, you can identify unnecessary spending and adjust your habits. Use tools like budgeting apps or spreadsheets to record daily expenses, categorize them, and see where you can cut back. Regularly reviewing your spending ensures that you are not overspending and can help you allocate funds towards more important financial goals.

Create a Budget

Once you have a clear picture of your expenses, the next step is to create a budget. A well-organized budget helps you set spending limits for different categories, such as housing, groceries, entertainment, and savings. By allocating specific amounts for each expense category, you can prevent overspending and ensure that you’re putting money toward your priorities, such as building an emergency fund or saving for a large purchase. Regularly adjusting your budget to reflect changes in your income or spending habits is crucial for long-term success.

In addition to budgeting, it’s also important to set financial goals and prioritize them. Whether you’re saving for a down payment on a house or paying off credit card debt, having clear goals will guide your financial decisions. By effectively managing your money, you’ll be able to make the most of your resources and work toward achieving both your short- and long-term financial aspirations.

Understanding Financial Terms

Financial literacy involves being able to understand and apply key terms related to money management. Whether you are learning how to save, invest, or create a budget, familiarizing yourself with common financial terminology is essential for making informed decisions. Understanding these terms helps you better navigate financial documents, communicate with advisors, and effectively plan for your financial future. In this section, we’ll break down some important financial terms and explain their significance in personal finance.

One of the most fundamental financial terms is “interest,” which refers to the cost of borrowing money or the return on investment earned from savings. Understanding how interest works–both simple and compound–can help you make better decisions about loans and savings accounts. Similarly, terms like “principal” and “credit” are crucial when evaluating loans or managing credit cards, as they define the amounts of money involved and the conditions under which you must repay or manage debt.

Other terms to be familiar with include “assets” and “liabilities.” Assets refer to anything of value you own, such as property or investments, while liabilities represent what you owe, such as loans or bills. Knowing the difference between these terms is crucial for assessing your net worth and planning your financial future. Understanding how to balance assets and liabilities helps ensure you are not overburdened by debt and can work towards accumulating wealth.

Additionally, terms like “budgeting,” “cash flow,” and “emergency fund” are also vital for effective money management. A budget helps you track and allocate your income, cash flow refers to the movement of money in and out of your accounts, and an emergency fund provides financial security in case of unexpected expenses. By grasping these financial concepts, you will be better equipped to manage your money responsibly and make sound financial decisions for the future.

Why Saving Early Is Important

Starting to set aside money at an early stage in life can have a profound impact on your financial well-being. By beginning to save sooner rather than later, you take advantage of the time you have to build wealth, even with smaller contributions. The key benefit of saving early lies in the power of compounding, where the interest earned on your initial savings generates additional interest over time. This can significantly accelerate your financial growth, helping you reach your goals faster.

When you start early, you give yourself a longer horizon for your money to grow, whether for retirement, purchasing a home, or simply creating a financial safety net. The longer your funds are invested, the more potential they have to grow without needing to contribute as much. Even small, consistent deposits can add up over the years, demonstrating how early saving can create financial security down the road.

Another advantage of saving early is that it helps reduce stress later in life. Having a robust savings plan means you’re less likely to face financial hardship or struggle with debt in the future. Early saving provides a cushion during unexpected circumstances, such as job loss or medical emergencies. It also allows you to take advantage of opportunities–whether it’s making an investment, going on a dream vacation, or pursuing further education–without jeopardizing your long-term financial goals.

Ultimately, starting early sets the foundation for long-term financial health. By committing to saving early, you give yourself more freedom and flexibility in life. It’s never too soon to begin building a more secure and prosperous future.

How to Set Financial Goals

Setting clear and achievable financial goals is a critical step in managing your money effectively. Whether you’re aiming to save for a specific purchase, build an emergency fund, or plan for retirement, establishing concrete objectives helps you stay focused and motivated. By defining your financial priorities and breaking them into manageable steps, you can create a roadmap to financial success. The key is to set realistic and measurable goals that align with your long-term aspirations while taking into account your current financial situation.

The first step in setting financial goals is to identify what you want to achieve. Think about both short-term goals, such as paying off credit card debt, and long-term goals, like saving for a home or building a retirement nest egg. Once you’ve identified your goals, it’s important to prioritize them based on urgency and importance. This will allow you to direct your efforts toward the most pressing needs while still working toward other objectives over time.

Next, break down each goal into smaller, actionable steps. For example, if your goal is to save a certain amount of money, figure out how much you need to save each month to reach that target by a specific date. Setting a clear timeline and tracking your progress helps maintain focus and ensures that you’re on track. Additionally, it’s important to review and adjust your goals periodically to reflect changes in your income, expenses, or life circumstances.

By setting thoughtful financial goals, you not only gain clarity on where you want to go, but also develop a plan to get there. Remember that financial success is a marathon, not a sprint. With patience, consistency, and careful planning, you’ll be able to reach your financial goals and secure a stable and prosperous future.

Financial Questions Explained

Understanding key financial concepts is essential for making informed decisions and achieving financial stability. Often, when navigating through various educational platforms or financial planning tools, you’ll encounter a set of questions designed to test your understanding of personal finance. These questions are not just about recalling facts but also about applying what you’ve learned to real-life situations. By breaking down these questions, you can better understand how to manage your money and plan for your future.

Breaking Down Common Financial Queries

One of the most important aspects of mastering financial education is understanding the context behind each question. Let’s explore some of the key areas that often arise in financial discussions:

- Budgeting Basics: Questions about budgeting help you identify how to allocate income to various categories such as savings, debt repayment, and daily expenses. It’s essential to understand the balance between earning and spending to create a sustainable financial plan.

- Understanding Interest: Many questions revolve around how interest rates work, whether for savings accounts or loans. Being able to calculate and understand the impact of interest can help you make better choices regarding borrowing and saving.

- Setting Financial Goals: Questions often ask about how to set realistic and achievable financial goals. Understanding how to prioritize and structure your financial objectives is key to long-term success.

How to Approach Financial Scenarios

When dealing with financial questions, it’s important to approach them strategically. Here are a few tips to help you break down and answer these questions effectively:

- Understand the context: Before answering any question, ensure that you fully understand the situation being described. Is it about short-term or long-term planning? Does it involve budgeting, saving, or investing?

- Apply your knowledge: Use what you’ve learned about finance to apply to the scenario. How would your personal financial decisions affect the outcome? Think about past experiences or best practices that you can relate to the situation.

- Check your calculations: Whether you’re working with numbers for budgeting or calculating interest, ensure that your math is correct. Accuracy is key when handling finances.

By carefully analyzing and understanding financial questions, you’ll not only improve your knowledge but also gain confidence in managing your money effectively. Remember, financial literacy is a lifelong process that requires ongoing learning and application of your skills in everyday life.

Strategies for Effective Budgeting

Creating a balanced budget is crucial for maintaining financial health and achieving long-term goals. Effective budgeting allows you to manage your income, control your spending, and save for the future. By adopting proven strategies, you can ensure that your money works for you and helps you avoid unnecessary debt. This section explores practical techniques for building a budget that meets your needs and ensures financial stability.

Key Budgeting Techniques

To build a strong financial plan, you need to implement key strategies that help you allocate resources efficiently. Here are some effective approaches:

- 50/30/20 Rule: This classic budgeting rule divides your income into three categories: 50% for needs (housing, utilities, food), 30% for wants (entertainment, dining out, leisure activities), and 20% for savings and debt repayment.

- Envelope System: A hands-on approach where you allocate cash for specific categories (e.g., groceries, gas) in separate envelopes. This helps you visually track spending and stay within limits.

- Zero-Based Budgeting: This method involves allocating every dollar of your income to specific categories, including savings and discretionary spending, leaving no funds unassigned at the end of the month.

Tips for Staying on Track

Sticking to your budget can be challenging, especially when faced with unexpected expenses or temptations. Here are some strategies to help you stay disciplined:

- Track Your Spending: Regularly monitor your expenses to ensure that you are staying within your limits. Use budgeting apps or spreadsheets to keep an accurate record of where your money goes.

- Set Realistic Goals: Make sure that your budget reflects your actual financial situation. Setting achievable goals, whether it’s saving for an emergency fund or paying off debt, makes the budgeting process less overwhelming.

- Adjust as Needed: Life changes, and so should your budget. Revisit your budget monthly or quarterly to adjust for changes in income, expenses, or goals. Flexibility is key to long-term budgeting success.

By implementing these strategies, you can create a budget that not only helps you control spending but also sets you on the path to financial freedom. Effective budgeting is a powerful tool for managing your resources and achieving your financial aspirations.

How to Maximize Savings Knowledge

Understanding how to effectively manage and grow your financial resources is essential for securing your financial future. A solid foundation of knowledge empowers you to make informed decisions about budgeting, investing, and planning for long-term goals. In this section, we will explore strategies that can help you enhance your understanding of personal finance, enabling you to make smarter choices and improve your financial well-being.

Key Areas to Focus On

To develop a deep understanding of how to maximize your financial potential, it’s important to focus on several key areas:

- Basic Financial Concepts: Begin by learning the fundamentals of personal finance, including the concepts of income, expenses, and the importance of budgeting. This is the foundation for building more advanced knowledge.

- Investing Principles: Understanding how different investment vehicles work (stocks, bonds, mutual funds, etc.) is crucial for making informed decisions about growing your wealth over time.

- Compound Interest: One of the most powerful concepts in personal finance, compound interest allows your savings to grow exponentially over time. The earlier you start investing, the more you benefit from compound growth.

Practical Steps to Expand Your Knowledge

Beyond learning the basics, there are practical steps you can take to continuously expand your financial literacy:

- Read Financial Books: There are numerous books dedicated to personal finance that cover everything from saving to investing. Reading regularly will help you gain a broader perspective and deepen your understanding of money management.

- Take Online Courses: Many platforms offer free or low-cost financial education courses. These can cover a range of topics, from managing debt to understanding investment strategies.

- Track Financial News: Keeping up with financial news helps you stay informed about market trends, economic changes, and new opportunities for growth or risk mitigation.

Using Tools to Enhance Your Knowledge

To fully grasp the concepts you learn, it’s essential to apply them through practical tools that can provide insights into your financial situation:

| Tool | Description | Benefit |

|---|---|---|

| Budgeting Apps | These apps help you track income and expenses, giving you a clear picture of your financial habits. | Improves your ability to manage money and stay within your financial goals. |

| Investment Calculators | Investment calculators help estimate how much you need to invest to reach your financial goals based on different variables. | Helps you plan for the future and understand the impact of different investment strategies. |

| Financial Planning Tools | Comprehensive tools that help you create a roadmap for your financial future, including debt repayment, saving, and investing strategies. | Ensures you stay on track with long-term goals and provides actionable insights for improvement. |

Maximizing your financial knowledge requires consistent effort and application. By focusing on these key areas and using the right tools, you can confidently manage your resources and make informed decisions that lead to a secure financial future.