Preparing for an evaluation in the field of compensation management requires a solid grasp of several core topics. Whether you’re new to the subject or refining your knowledge, it’s essential to understand the different processes involved in handling employee wages, taxes, and deductions. A thorough understanding of these topics will help you excel in any related evaluation.

In this guide, we will explore the most commonly tested areas, offering practical examples and insights. From understanding employee benefits to mastering the intricacies of tax withholding, we cover everything needed for effective preparation. With clear explanations and practice opportunities, you’ll gain the confidence to approach your assessment with ease.

We also focus on real-world scenarios that are often encountered in compensation-related tests. By applying your knowledge to these examples, you can build both your theoretical understanding and your problem-solving skills. Success is not just about memorizing rules, but about knowing how to apply them in various contexts.

Payroll Exam Questions and Answers Guide

Understanding the key areas covered in a compensation-related assessment is crucial for success. This section provides a comprehensive guide to the topics you are likely to encounter, focusing on practical examples that help reinforce your knowledge. By examining these areas, you’ll be better prepared to tackle any challenges that may arise during the evaluation.

Key Concepts to Master

Familiarity with the various elements of employee compensation management is essential. These include calculations, tax considerations, and legal compliance. Below is a breakdown of important topics that often appear in assessments.

| Topic | Description |

|---|---|

| Employee Earnings | Understanding the different types of compensation, including hourly, salaried, and incentive-based pay. |

| Tax Withholding | Familiarity with tax rules and calculations for federal, state, and local deductions. |

| Benefit Plans | Knowledge of employee benefits like health insurance, retirement plans, and other deductions. |

| Compliance Issues | Understanding legal requirements related to compensation, including wage laws and tax obligations. |

Practical Scenarios for Review

To truly master the concepts, it’s important to apply your knowledge to real-life examples. Practice with various scenarios helps solidify your understanding and prepares you for any questions or situations you may face. Below are a few sample problems to consider when studying:

- Calculating the net pay after deductions for a given salary

- Identifying the correct tax rates for various income brackets

- Determining the impact of employee benefits on total compensation

By reviewing these topics and solving relevant problems, you can build a strong foundation for success in any related assessments.

Understanding Payroll Exam Basics

To succeed in a compensation-related assessment, it’s essential to grasp the foundational principles that govern employee remuneration. These core concepts cover a wide range of topics, including wage calculation, taxation, benefits, and compliance with legal standards. A solid understanding of these areas ensures that you’re prepared to handle any task or question that may arise during an evaluation.

One of the first things to focus on is the various components that make up an employee’s earnings. This includes regular wages, bonuses, overtime, and additional incentives. It’s important to know how each of these is calculated, as they form the basis for most scenarios you’ll encounter in a related test.

Taxation is another critical area to study. Understanding how to calculate deductions for federal, state, and local taxes is essential for any compensation-related assessment. In addition, knowing the legal requirements for withholdings, such as Social Security and Medicare contributions, is vital for accurate calculations.

Finally, it’s important to familiarize yourself with compliance standards. This includes staying up-to-date with wage laws, tax regulations, and any other legal obligations employers must adhere to when compensating their workforce. Mastering these fundamentals will provide a strong foundation for tackling more complex topics in assessments.

Common Payroll Topics You Need to Know

To prepare for any assessment in the field of employee compensation, it’s crucial to understand the fundamental topics that are commonly tested. These areas cover everything from wage calculations to legal requirements, and mastering them will ensure that you’re ready to tackle a wide variety of challenges. Each of these topics plays a key role in the accurate management of compensation and benefits.

One of the most important subjects is how to calculate an employee’s total earnings, taking into account hourly rates, overtime, commissions, and bonuses. A clear understanding of how to handle these different forms of compensation is necessary to solve many of the problems typically presented in related assessments.

Tax deductions are another critical aspect to study. Knowing the rules for withholding federal, state, and local taxes, as well as contributions to Social Security and Medicare, is essential for any compensation-related evaluation. Being able to accurately calculate the amount to withhold from an employee’s paycheck is a skill that will be tested regularly.

In addition to earnings and taxes, employee benefits also play a significant role. Understanding the different types of benefits offered to employees, such as health insurance, retirement plans, and paid time off, is key to accurately accounting for total compensation. Knowing how these benefits are calculated and deducted is essential for complete and accurate reporting.

Key Concepts in Payroll Calculation

Accurate compensation management requires a solid understanding of several key concepts that govern the calculation of employee earnings. These principles form the foundation for all related tasks, ensuring that wages, deductions, and benefits are properly accounted for. Mastering these concepts will help you navigate through various scenarios and ensure accuracy in financial reporting.

Understanding the Components of Earnings

When calculating an employee’s compensation, it’s essential to consider all possible types of earnings. These can include:

- Base Salary: The fixed amount paid regularly, usually on an hourly, weekly, or monthly basis.

- Overtime: Additional pay for hours worked beyond the standard workweek, often calculated at a higher rate.

- Bonuses: Extra payments made based on performance or milestones.

- Commissions: Payments based on sales or performance targets achieved.

Calculating Deductions and Withholdings

In addition to earnings, deductions play a crucial role in determining the net pay. These deductions include taxes, benefits, and other withholdings that reduce the total amount an employee takes home. Common deductions include:

- Federal and State Taxes: Mandatory withholdings that vary based on income levels and location.

- Social Security and Medicare: Contributions to federal programs that provide social insurance.

- Retirement Contributions: Employee contributions to pension plans or 401(k) accounts.

- Health Insurance Premiums: Deductions for health plans, dental, or vision coverage.

Once earnings and deductions are calculated, the net pay can be determined by subtracting the total deductions from the gross earnings. This step ensures the employee receives the correct amount after all relevant factors are considered.

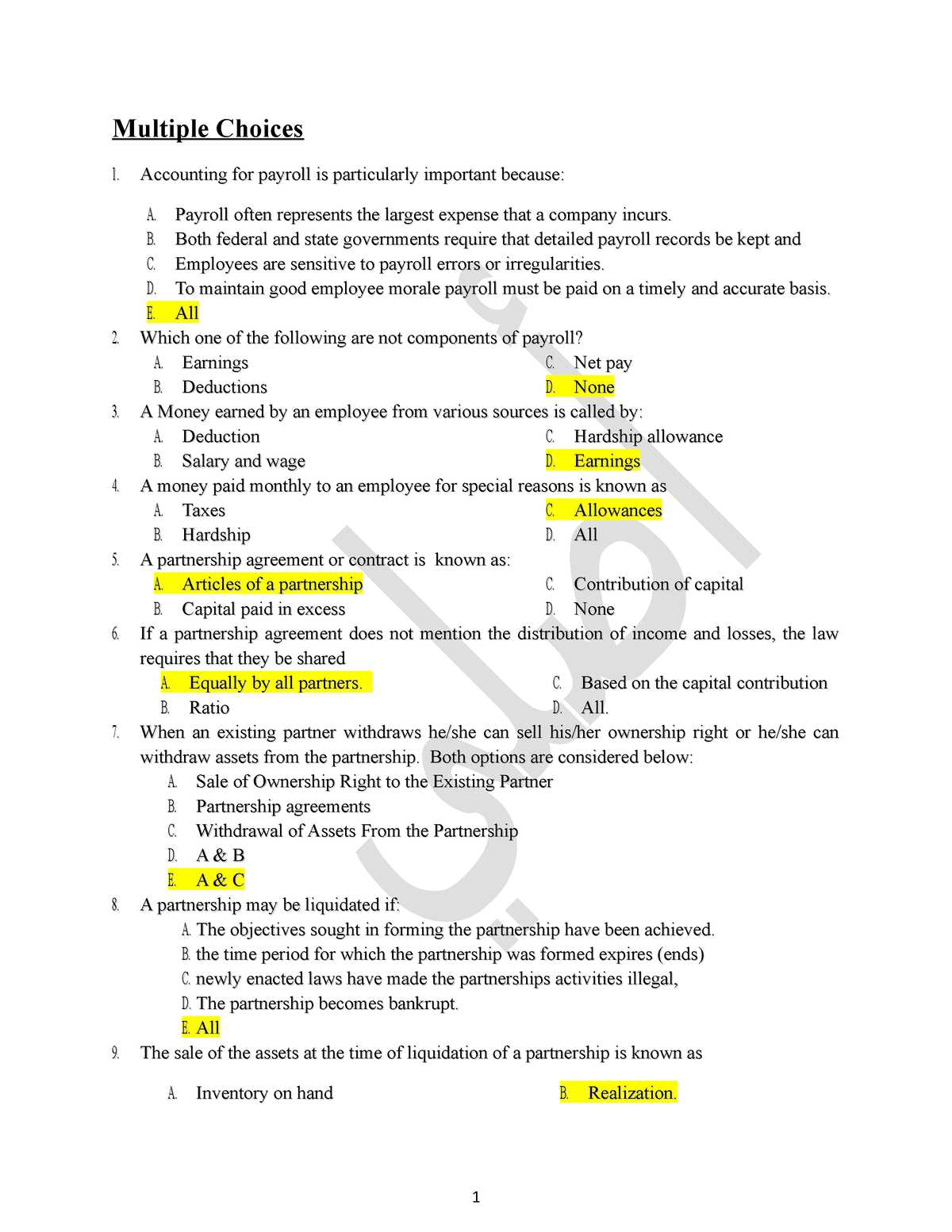

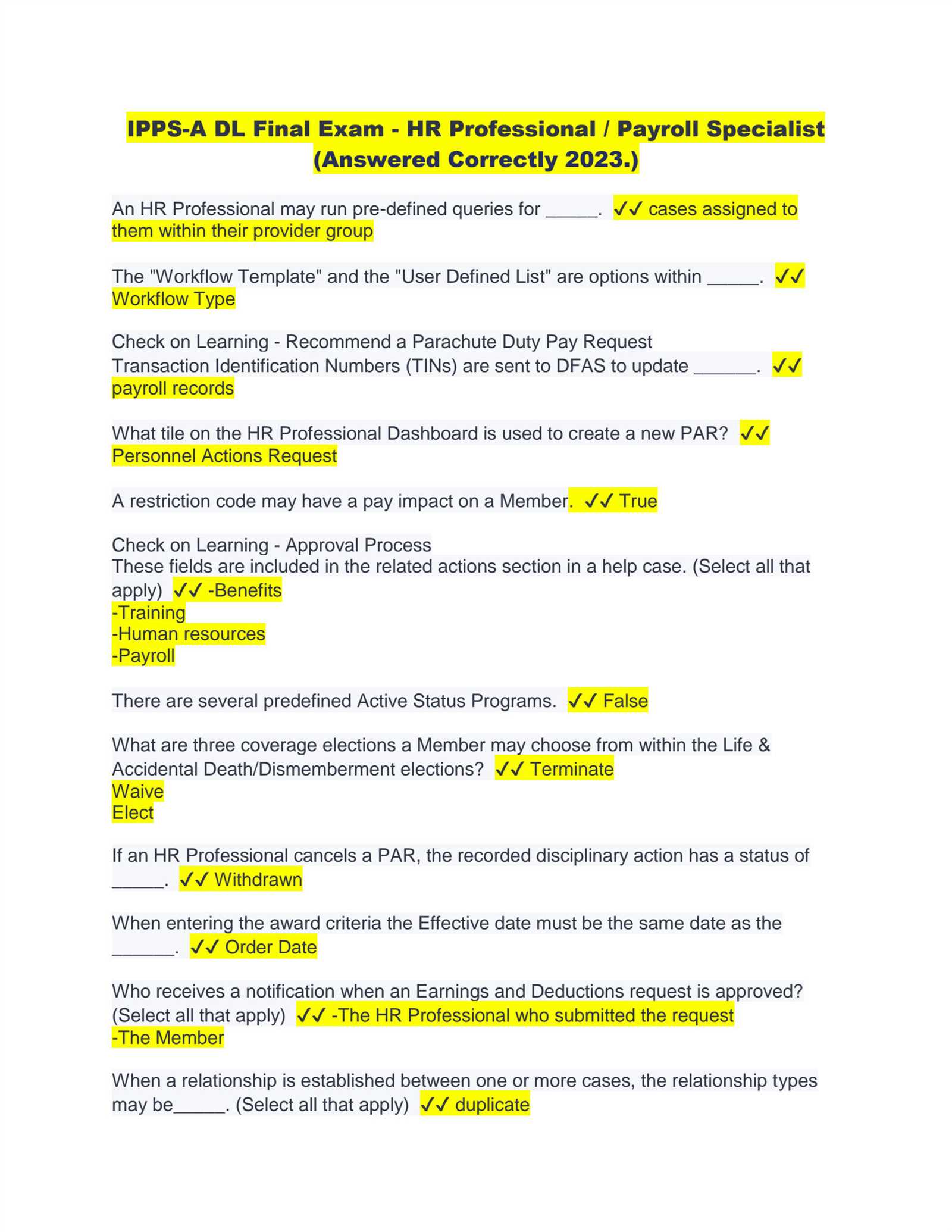

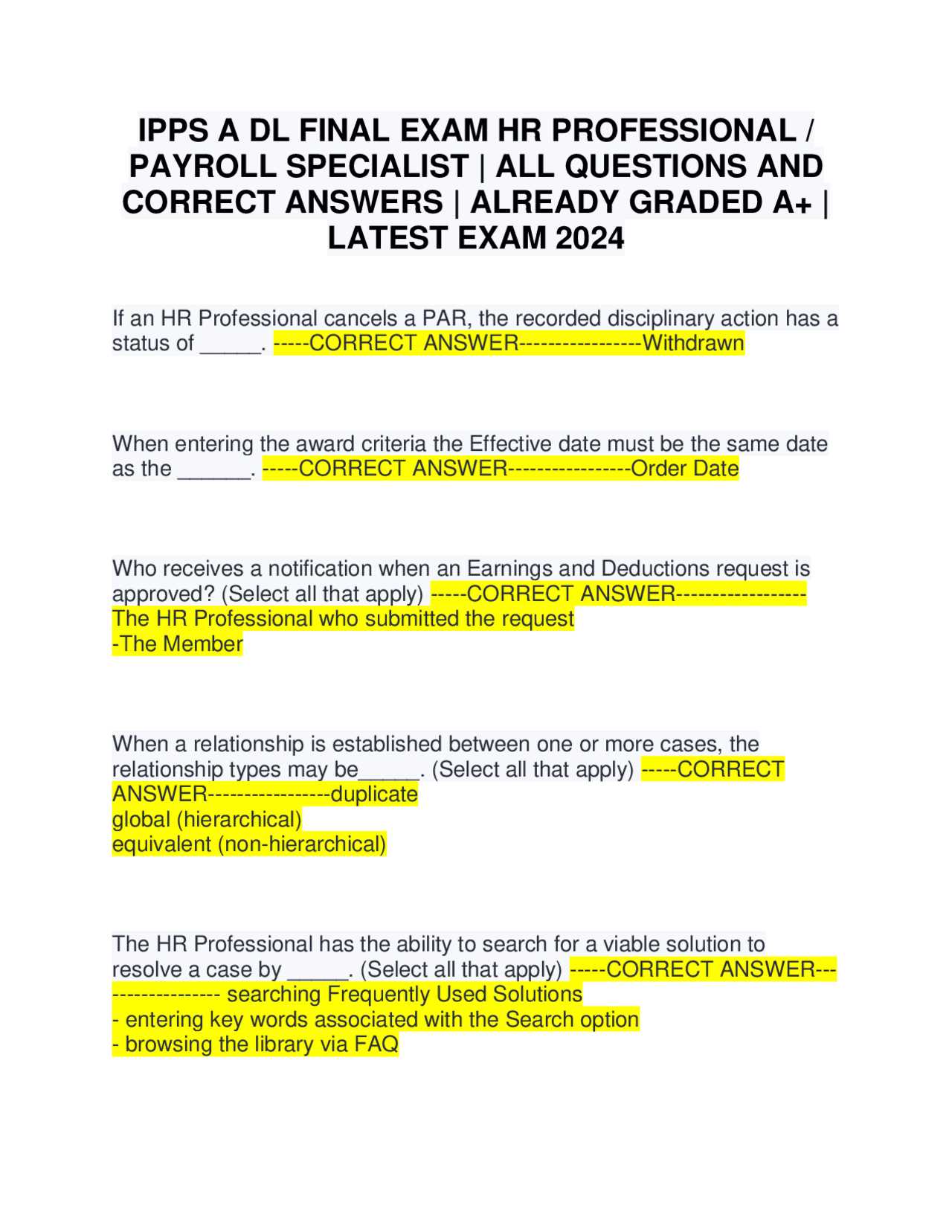

Commonly Asked Questions in Payroll Exams

When preparing for a test in the field of compensation management, it’s important to focus on the topics and tasks that are most commonly featured. These assessments typically revolve around understanding and applying key principles, such as earnings calculations, tax deductions, and legal compliance. Familiarizing yourself with the types of problems you’ll likely encounter will help you approach the test with confidence.

Frequently Covered Topics

Many assessments focus on the practical application of compensation concepts. Below are some areas that tend to be tested regularly:

- Calculating Gross Earnings: How to determine an employee’s total pay before any deductions are made.

- Tax Withholding: Questions about the correct amount of federal, state, and local taxes to withhold from an employee’s paycheck.

- Benefits Administration: Understanding how to account for employee benefits such as health insurance, retirement plans, and other perks.

- Overtime Pay: How to calculate additional pay for hours worked beyond the standard workweek, often at a higher rate.

- Compliance with Legal Standards: Questions about laws governing compensation, including minimum wage, tax rates, and employment benefits.

Sample Scenarios You Might Encounter

In addition to theoretical questions, practical scenarios are often included to test your problem-solving skills. These could involve:

- Calculating the net pay of an employee based on their gross earnings, deductions, and tax rates.

- Identifying the correct tax rate for an employee based on their income bracket and location.

- Determining the appropriate deductions for employee benefits, including retirement contributions or health insurance premiums.

- Analyzing a payroll system for compliance with local, state, and federal regulations.

Being well-versed in these common topics will ensure that you’re prepared to answer both theoretical and practical questions accurately.

Payroll Taxation: What to Study

Understanding the various taxation rules that impact employee compensation is crucial for anyone involved in financial management. Tax calculations play a significant role in determining the correct amount of withholdings from an employee’s paycheck. This section highlights the key areas you should focus on when studying tax-related topics in relation to employee earnings.

Key Tax Components to Understand

There are several critical tax areas that need attention when preparing for any assessment related to compensation calculations. These include:

- Federal Income Tax: Knowledge of tax brackets, withholding allowances, and federal tax rates is essential for accurate deductions.

- State and Local Taxes: Different states and localities have varying tax rates, so understanding these variations is important for accurate calculation.

- Social Security and Medicare: These mandatory federal programs require specific contribution rates based on employee earnings.

- Other Deductions: Contributions to unemployment insurance, state disability, and other local programs can also affect employee paychecks.

Practical Application of Tax Calculations

Beyond the theory, it’s vital to be able to apply tax rules to real-world situations. Here are some common scenarios you should practice:

- Calculating the correct federal income tax withholding based on an employee’s filing status and allowances.

- Determining the proper contributions for Social Security and Medicare based on different wage levels.

- Adjusting for local and state tax differences, particularly for employees who work in multiple jurisdictions.

- Applying tax credits and deductions that may affect the total amount withheld.

By mastering these key tax concepts, you’ll be well-prepared to accurately determine the amount to withhold from employees’ earnings and ensure compliance with tax regulations.

Employee Benefits and Payroll Questions

When managing employee compensation, it’s crucial to account for the various benefits provided in addition to regular wages. These benefits can significantly impact both the overall compensation package and the employer’s responsibilities in terms of deductions and compliance. Understanding how to handle these elements properly is a key area of focus in assessments related to financial management of employee compensation.

Common Benefits to Consider

Employee benefits encompass a wide range of offerings that go beyond base salary. Some of the most common benefits that must be accounted for include:

- Health Insurance: Coverage options provided to employees, often including medical, dental, and vision insurance plans.

- Retirement Plans: Contributions to 401(k) or pension plans that both employees and employers may fund.

- Paid Time Off (PTO): Vacation, sick leave, and other paid days off that employees are entitled to take.

- Bonuses and Profit Sharing: Extra financial compensation based on company performance or individual achievements.

- Life Insurance: Employer-sponsored life insurance policies that provide financial support to employees’ families in case of death.

Understanding Benefit Deductions and Contributions

For many benefits, employers must make contributions, and employees often face deductions from their paychecks to cover a portion of these costs. Key areas to understand include:

- Employee Contributions: Understanding how much employees need to contribute for health insurance or retirement funds and how to deduct these amounts from their earnings.

- Employer Contributions: Knowing the employer’s share of benefit costs and ensuring it is properly accounted for in company budgets and reports.

- Tax Implications: Understanding how different types of benefits are treated for tax purposes, including which benefits are taxable and which are tax-free.

By mastering the complexities of employee benefits and their impact on compensation, you will ensure proper administration of these crucial elements and remain compliant with legal and regulatory standards.

How to Handle Payroll Deductions

Managing deductions from employee earnings is a crucial part of compensation administration. These subtractions are often mandatory, such as taxes or social security, but can also include voluntary contributions like retirement savings or health insurance premiums. Understanding how to properly calculate and apply these deductions is essential for compliance with legal requirements and ensuring that employees receive accurate paychecks.

Types of Deductions to Consider

There are several categories of deductions that must be accurately handled. These include both statutory and voluntary withholdings:

- Statutory Deductions: These are required by law and include federal, state, and local taxes, as well as social security and Medicare contributions. Employers are responsible for correctly calculating these amounts based on applicable tax rates.

- Voluntary Deductions: These include contributions for health insurance, retirement plans, and other benefits chosen by employees. It’s important to track these deductions accurately to ensure that both employee and employer contributions are accounted for.

- Other Deductions: Some deductions might be tied to specific company policies, like wage garnishments or union dues. These must also be managed carefully to avoid errors.

Steps to Properly Apply Deductions

To ensure that all deductions are handled correctly, follow these steps:

- Calculate Gross Earnings: Before any deductions, determine the total earnings of the employee, which may include base salary, overtime, commissions, or bonuses.

- Apply Statutory Deductions: Deduct the required federal, state, and local taxes, as well as social security and Medicare, based on the employee’s earnings and applicable tax brackets.

- Subtract Voluntary Contributions: Deduct any contributions for benefits, such as retirement accounts or insurance premiums, as specified by the employee.

- Ensure Compliance: Verify that all deductions comply with relevant laws and regulations to avoid legal issues or fines.

By mastering the process of handling these subtractions, you ensure that employees receive their rightful pay while maintaining full compliance with regulatory standards.

Payroll Compliance: Key Exam Focus

Ensuring adherence to legal standards in compensation management is a critical responsibility. Compliance involves following specific regulations set by federal, state, and local governments, as well as ensuring that deductions, benefits, and record-keeping meet established requirements. This section highlights the key areas of focus that are essential for successfully navigating the complexities of legal requirements in employee compensation.

Essential Areas for Compliance

When preparing for assessments related to financial management and employee compensation, there are several areas that demand careful attention. These include tax obligations, reporting duties, and proper handling of employee records. Understanding how to comply with these laws is crucial for avoiding penalties and ensuring smooth operations.

| Compliance Area | Key Focus |

|---|---|

| Tax Regulations | Ensure accurate calculation and timely submission of taxes for both employees and employers, including federal, state, and local obligations. |

| Employee Benefits | Confirm proper documentation and handling of benefits such as health insurance, retirement plans, and paid time off. |

| Wage and Hour Laws | Verify that employee wages comply with minimum wage laws and ensure proper classification of exempt and non-exempt employees. |

| Record Keeping | Maintain accurate records for all compensation-related activities, including deductions, hours worked, and tax forms, for the required duration. |

Strategies for Ensuring Compliance

Adopting the right approach to compliance involves both preventive measures and regular reviews. Here are some strategies to ensure adherence:

- Stay Updated on Regulations: Laws and regulations often change. Regularly review updates from governmental agencies to stay informed.

- Implement Automated Systems: Use software tools to automate tax calculations, benefits administration, and record-keeping, reducing human error.

- Conduct Regular Audits: Periodically audit compensation processes to ensure all policies and procedures are being followed correctly.

By focusing on these key compliance areas and strategies, you can ensure that your organization’s compensation practices are legally sound and avoid costly penalties.

Exam Preparation Strategies for Payroll

Preparing for assessments related to employee compensation management requires a strategic approach. Effective preparation involves not only reviewing key concepts but also honing your ability to apply them in practical scenarios. By focusing on both theoretical knowledge and hands-on practice, you can build confidence and increase your chances of success.

Study Plan and Key Topics

A well-structured study plan is essential for mastering the material. Prioritize areas that are most frequently tested and focus on understanding the underlying principles. Some key topics to concentrate on include:

- Tax Calculations: Familiarize yourself with the various taxes applicable to wages, including income, social security, and Medicare.

- Benefits Administration: Learn how to calculate and manage benefits such as retirement contributions, health insurance, and bonuses.

- Legal Compliance: Understand the laws that govern wage calculations, deductions, and employee classifications.

- Record Keeping: Know the requirements for maintaining accurate documentation and submitting reports as needed.

Practical Application and Mock Scenarios

While theoretical knowledge is important, applying that knowledge to real-world situations is equally crucial. Try the following strategies to prepare:

- Take Practice Tests: Mock scenarios allow you to apply your knowledge in simulated settings, helping you identify areas that need improvement.

- Review Case Studies: Real-life case studies can help you understand how concepts are applied in actual situations, making them easier to recall during assessments.

- Join Study Groups: Collaborating with peers can offer new perspectives and insights into challenging topics.

By following a structured approach and focusing on both understanding and application, you can confidently tackle any assessment related to employee compensation management.

Top Mistakes in Payroll Exams

When preparing for assessments on compensation management, certain errors can hinder success. Often, these mistakes stem from misunderstanding key concepts, overlooking details, or misapplying rules. Identifying common pitfalls beforehand can help you avoid these missteps and improve your performance.

Common Errors in Calculation

One of the most frequent mistakes involves incorrect calculations, especially when it comes to tax rates, deductions, and overtime. These errors are often due to:

- Incorrect Tax Rates: Failing to apply the right tax rates for different income brackets or neglecting state-specific variations.

- Misclassifying Employees: Confusing exempt and non-exempt statuses, leading to improper wage calculations.

- Overlooking Overtime: Forgetting to account for overtime pay, particularly for hourly workers exceeding the standard hours.

Neglecting Legal Requirements

Many candidates overlook or misinterpret legal regulations. These mistakes can be costly, especially when it comes to employee classification and mandatory deductions. Common oversights include:

- Incorrect Benefit Deductions: Failing to properly deduct or report benefits like healthcare or retirement contributions.

- Non-Compliance with Reporting: Missing deadlines for filing necessary forms or inaccurately reporting data on tax forms.

- Inaccurate Record Keeping: Not maintaining complete or accurate records, which can lead to penalties during audits or reviews.

By recognizing these common mistakes and focusing on accuracy and attention to detail, you can reduce errors and increase your chances of success.

Tax Forms and Payroll Exam Insights

Understanding the various forms used for reporting employee earnings and taxes is crucial for success in assessments related to compensation management. These documents play a key role in ensuring compliance and accuracy in financial reporting. Familiarity with each form and its specific purpose will enhance your ability to navigate the complex landscape of tax-related requirements.

Important Tax Forms to Know

There are several critical forms that must be understood and accurately filled out. Below are the key documents that often appear in assessments:

- W-2 Form: This form is used to report an employee’s annual wages and the taxes withheld from their paycheck. Knowing how to correctly complete and file the W-2 is essential.

- W-4 Form: Employees use this form to indicate their tax withholding preferences, including exemptions and additional amounts to be withheld.

- 1099 Form: This form reports income earned by independent contractors or freelancers, as opposed to employees, and is critical for understanding non-employee compensation.

- 941 Form: This quarterly form reports the total taxes withheld from employee wages and is used to remit federal income tax, Social Security, and Medicare taxes.

Key Insights for Success

When it comes to completing assessments, focusing on the following insights can greatly improve your understanding and accuracy:

- Be Detail-Oriented: Pay close attention to the specific instructions for each form, as small errors can lead to larger mistakes or delays.

- Understand Deadlines: Be aware of the due dates for filing and remitting taxes associated with each form to avoid penalties or fines.

- Stay Current: Tax laws and forms can change, so it’s important to keep up-to-date with any modifications to ensure accurate reporting.

- Practice with Mock Forms: Use practice tests to get comfortable with filling out forms under time constraints and to identify areas that may need additional review.

Mastering the various forms and understanding the key insights will ensure you are well-prepared for any task related to financial reporting and compliance in employee compensation management.

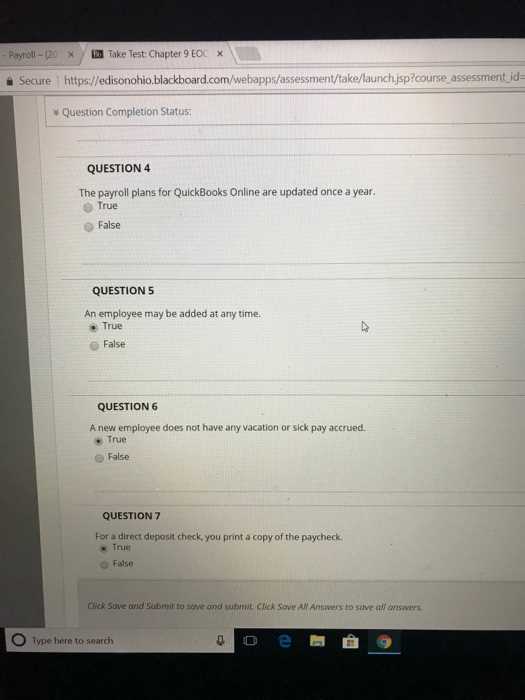

Understanding Payroll Software for Exams

Familiarity with automated tools designed for managing compensation systems is essential for success in assessments related to financial calculations. These software platforms simplify complex processes such as deductions, tax calculations, and report generation. Knowing how to efficiently navigate and use these tools can provide a significant advantage during practical evaluations or real-world applications.

Key Features of Compensation Software

There are several key features of these software platforms that every candidate should be familiar with. Understanding how these components work can improve accuracy and efficiency:

- Tax Calculations: Most platforms are designed to automatically compute federal, state, and local taxes based on employee data and current rates.

- Employee Records Management: These tools allow users to manage and store employee information, including wages, deductions, and benefits.

- Report Generation: Comprehensive reporting tools enable users to generate statements such as earnings reports, tax filings, and end-of-year summaries.

- Direct Deposit Integration: Many platforms offer features that enable direct deposit, eliminating the need for paper checks and improving processing times.

How to Effectively Use Compensation Software

While the tools are designed to streamline tasks, proficiency is essential for optimal use. Below are a few tips for getting the most out of these platforms:

- Practice with Software Simulations: Take time to practice using software simulations or demo versions to familiarize yourself with the interface and functionality.

- Double-Check Data: Even though the software automates many tasks, it’s crucial to verify that all employee data is accurate and up-to-date.

- Master the Reporting Features: Learn how to generate and interpret reports, as these will be useful for understanding your financial results and making adjustments if needed.

- Stay Updated: Compensation management tools often update to comply with new laws or regulations, so staying informed about updates will ensure compliance and accuracy.

By mastering these software platforms, candidates can streamline their preparation process and improve their ability to handle tasks efficiently in real-world settings.

Real-World Payroll Scenarios for Practice

To enhance your skills and prepare effectively for practical assessments, it’s essential to engage with scenarios that mirror real-world challenges. These situations help you apply theoretical knowledge in practical contexts, ensuring that you’re ready for actual tasks in the field. By practicing various scenarios, you can develop the critical thinking and problem-solving abilities needed for success.

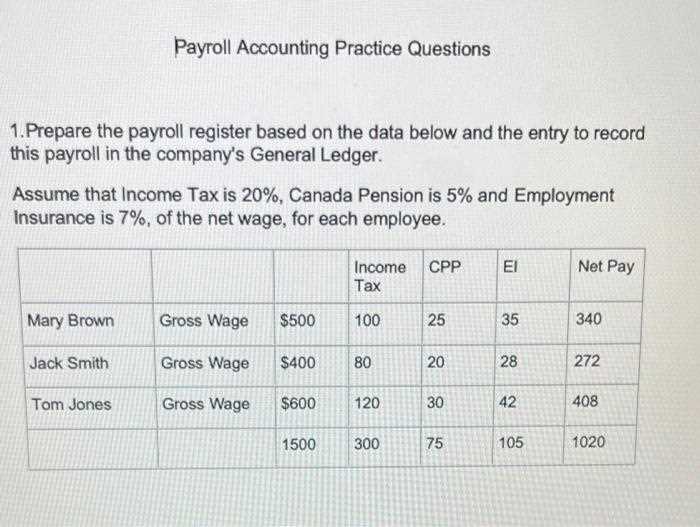

Scenario 1: Calculating Gross and Net Pay

In many workplaces, employees have varying work hours and pay structures. One common scenario involves calculating the total earnings (gross pay) and the take-home amount (net pay) after deductions. This task includes factoring in overtime, bonuses, and tax withholdings. For example, if an employee worked 40 hours at $20 per hour, earned a $200 bonus, and had $300 in tax deductions, you would calculate the following:

- Gross Pay: 40 hours x $20/hour = $800, plus $200 bonus = $1000

- Deductions: $300 for taxes

- Net Pay: $1000 – $300 = $700

This scenario helps you understand how to apply different pay rates and deductions to calculate an employee’s final earnings.

Scenario 2: Handling Employee Benefits

Another crucial task involves calculating the cost of employee benefits. Companies often offer various benefits such as health insurance, retirement plans, and paid leave. Each of these benefits may have different rules regarding eligibility, contribution amounts, and tax implications. For instance, if an employee is enrolled in a health plan costing $100 per month, the employer may pay half, and the employee would cover the rest. You would need to factor this into their total compensation package:

- Health Insurance Deduction: $50 employee contribution

- Retirement Contribution: $100 (company matches 5%)

- Total Benefits Cost: $150 for employee and employer contributions

Understanding how to manage benefits is key to providing accurate compensation reports and ensuring compliance with company policies.

Scenario 3: Addressing Tax Withholding Errors

Errors in tax withholding can lead to complications, and handling these issues properly is essential. For example, if an employee’s withholding is calculated incorrectly, it can result in too much or too little tax being deducted. Practicing how to address these issues involves recalculating the correct amount based on updated tax tables or employee data. For instance, if an employee’s tax withholding rate is 10% but should be 12%, you need to adjust their withholding accordingly and make sure the corrected amount is reflected in future pay cycles.

By simulating these real-world cases, you can build confidence in managing complex tasks and learn how to resolve issues efficiently while ensuring compliance with legal requirements.

Tips for Managing Payroll Errors

Handling errors in compensation processes is a critical part of maintaining a smooth operation within any organization. Mistakes can arise for a variety of reasons, such as incorrect data entry, miscalculations, or misunderstandings of tax laws. However, knowing how to effectively identify, address, and prevent these issues can minimize their impact and ensure that employees are paid correctly and on time.

1. Double-Check All Employee Information

Before processing any payments, verify that all employee details are accurate. This includes checking tax forms, banking information, and pay rates. Even small discrepancies in addresses, Social Security numbers, or account numbers can lead to significant issues later on.

2. Keep Detailed Records

Maintaining accurate records is essential for tracking any changes or adjustments made to compensation. It’s crucial to have a system in place to log corrections and communicate those changes to the relevant parties. Keeping clear documentation ensures transparency and helps avoid future mistakes.

3. Utilize Automated Software

Using automated systems for calculations and deductions can significantly reduce human errors. These tools are often designed to stay updated with changing tax laws and other regulations. They can help verify the accuracy of deductions and ensure compliance with legal requirements.

4. Conduct Regular Audits

Performing audits on a regular basis helps to catch any errors before they become serious problems. A periodic review of compensation records, deductions, and tax filings can help identify mistakes or areas for improvement. This proactive approach can help maintain accuracy in the long run.

5. Address Errors Immediately

If an error is discovered, it’s essential to resolve it promptly. Delaying corrections can lead to dissatisfaction among employees and legal complications. Address the mistake by calculating the difference and issuing any necessary adjustments as quickly as possible to ensure fairness.

6. Implement Clear Communication Channels

Clear communication between HR, accounting, and employees is essential to prevent and resolve errors. If an employee notices a discrepancy, they should be able to report it easily. Likewise, the team responsible for compensation should be prepared to address concerns in a timely and transparent manner.

7. Educate Employees

Providing employees with clear guidelines on how to read their pay statements and what to do if they notice discrepancies can help reduce the occurrence of errors. Ensuring that everyone is informed about how deductions and benefits are calculated can help minimize confusion.

8. Keep Up with Legal Changes

Legislation affecting compensation, tax withholding, and benefits can change frequently. Staying up to date with these changes is critical to avoid non-compliance. Subscribing to updates from official agencies or using resources provided by industry groups can ensure that your organization is always in compliance with the latest rules.

9. Test Your System Regularly

Performing test runs using various compensation scenarios can help identify potential issues before they happen in real time. By simulating different pay periods, pay rates, and deduction combinations, you can uncover any weaknesses in the system and address them proactively.

| Tip | Action |

|---|---|

| Double-Check Employee Information | Verify tax forms, banking, and personal details before processing payments. |

| Keep Detailed Records | Log any changes or corrections made to employee compensation. |

| Utilize Automated Software | Use systems designed to reduce errors and ensure compliance. |

| Conduct Regular Audits | Review records periodically to identify discrepancies and fix them promptly. |

By following these best practices and fostering an environment of attention to detail, you can significantly reduce the likelihood of errors in compensation processes and ensure smooth, accurate payment management for all employees.

Preparing for Legal Questions Related to Compensation

Understanding the legal framework surrounding employee remuneration is essential for anyone involved in managing compensation processes. There are various regulations that govern how wages should be calculated, taxed, and distributed, and being prepared for questions related to these laws can ensure compliance and minimize potential issues. It is crucial to be familiar with federal, state, and local laws to answer concerns effectively and accurately.

1. Understand Wage and Hour Laws

Familiarize yourself with the rules concerning minimum wage, overtime pay, and working hours. These regulations are essential to ensure that employees are compensated fairly based on the hours they work. Knowing when overtime pay is required and how it should be calculated can prevent legal complications.

2. Be Aware of Tax Withholding Requirements

Employees’ wages are subject to various tax withholdings, including federal income tax, state taxes, and Social Security contributions. Make sure to understand the specific tax obligations that apply to different compensation scenarios and how to properly withhold the correct amount from employees’ paychecks.

3. Learn About Employee Benefits Laws

Legal guidelines related to employee benefits such as health insurance, retirement plans, and paid leave must also be understood. The laws surrounding eligibility, coverage, and the rights of employees to access these benefits can vary depending on the organization and jurisdiction.

4. Familiarize Yourself with Employee Classification

Understanding the distinction between employees and independent contractors is crucial. Misclassifying workers can lead to legal consequences, including tax penalties and issues with benefit eligibility. Be clear on the criteria that define different employment relationships and how compensation should be handled in each case.

5. Know How to Handle Termination and Severance Pay

Legal requirements for severance pay and compensation during termination should be clearly understood. It’s important to know when these payments are due and the steps involved in providing appropriate compensation to employees leaving the organization.

6. Stay Updated on Changing Laws

Labor laws are constantly evolving, with changes to tax rates, wage laws, and benefits requirements occurring frequently. Keeping up with these changes is essential to ensure that all compensation practices are compliant with the most current legal standards.

| Area of Focus | Key Legal Considerations |

|---|---|

| Wage and Hour Laws | Know the rules regarding minimum wage, overtime, and working hours. |

| Tax Withholding | Understand the federal, state, and local tax requirements for employee compensation. |

| Employee Benefits | Be aware of the legal guidelines surrounding health benefits, retirement plans, and paid leave. |

| Employee Classification | Ensure proper classification of employees vs. independent contractors. |

| Termination and Severance | Understand the legal requirements for severance and termination pay. |

By understanding the core legal concepts related to employee compensation and staying informed about any changes, you can be better prepared to address any issues that arise and ensure that all practices comply with applicable laws.

Timekeeping and Compensation Assessment Insights

Accurate tracking of working hours is crucial in ensuring that employees are compensated correctly. Understanding the various systems for recording time and the regulations surrounding them can help prevent errors and ensure compliance. This section covers the key concepts you need to grasp when dealing with timekeeping processes, focusing on how to handle various scenarios related to time tracking and compensation determination.

Key Considerations in Timekeeping

To effectively manage work hours and ensure proper compensation, it’s essential to understand the following principles:

- Recordkeeping Requirements: Ensure accurate documentation of employees’ hours worked, including regular and overtime hours. This documentation must be kept for a certain period to comply with regulations.

- Overtime Rules: Know when overtime pay applies, typically when employees work more than a standard 40-hour workweek. Understanding the rules for overtime calculation is critical for proper compensation.

- Break and Rest Periods: Be aware of required breaks and rest periods for employees, as these can impact the total hours worked and thus affect compensation.

- Types of Timekeeping Systems: Understand different systems such as manual time cards, electronic time clocks, or software-based time tracking, each with its pros and cons in terms of accuracy and efficiency.

Challenges and Solutions in Time Tracking

Timekeeping systems can sometimes present challenges. Below are common issues and suggested strategies for addressing them:

- Employee Misreporting: Some employees may accidentally or intentionally misreport their hours. Solutions include regular audits, implementing self-check tools, and providing training on accurate reporting.

- System Errors: Technical issues with timekeeping systems can lead to inaccuracies. Regular updates and maintenance of time tracking software can help mitigate such problems.

- Complex Work Schedules: Employees with non-standard work schedules (e.g., varying shifts) require careful tracking to ensure all hours are accounted for. Implementing flexible time systems and clearly defining schedules can help avoid errors.

Common Scenarios in Timekeeping Assessments

Being familiar with the types of situations you might face in real-world assessments is vital. Here are a few scenarios you should be prepared for:

- Adjusting Time for Missed Punches: Understanding the proper method for adjusting time entries when an employee forgets to clock in or out is a common concern.

- Handling Paid and Unpaid Time: Knowing the difference between paid time off (PTO), vacation hours, and unpaid time, and how to account for each, is essential for accurate compensation.

- Calculating Regular vs. Overtime Pay: Make sure you can accurately calculate the difference between regular and overtime pay, especially when an employee works beyond the normal weekly limit.

By mastering these concepts, you’ll be well-equipped to handle any situation related to time tracking and compensation processes, ensuring fairness and legal compliance in the workplace.

Best Resources for Assessment Preparation

Preparing for any type of evaluation in the field of compensation management requires both foundational knowledge and practical tools. The right resources can help strengthen your understanding of key concepts and give you the confidence needed to succeed. Whether you prefer self-study materials, online courses, or expert-led tutorials, there are many ways to enhance your learning experience. In this section, we will explore the most effective resources that will guide you through your preparation journey.

Top Books and Study Guides

Books are an excellent way to build a comprehensive understanding of the topics you need to know. Some highly recommended study guides offer in-depth coverage of compensation laws, calculation methods, and timekeeping practices. These resources are structured to guide learners step by step through the various processes involved, with examples and practice scenarios to solidify knowledge.

- Comprehensive Guides: Look for books that cover the full range of topics within compensation management, from calculations to compliance.

- Practice Tests: Many study guides include practice questions that mimic real-world scenarios, which will help you prepare for any challenging situations.

- Official Manuals: Industry-standard manuals often provide essential information, offering a more detailed and authoritative perspective on the subject matter.

Online Courses and Webinars

For those who prefer interactive learning, online courses and webinars are invaluable resources. They often provide flexibility in scheduling and access to expert instructors who can explain difficult concepts in real-time. Many online platforms offer certification programs or preparatory courses tailored to individuals looking to enhance their practical skills.

- Interactive Learning: Courses that include quizzes, discussion forums, and assignments are especially helpful in reinforcing key concepts.

- Expert-Led Webinars: Live webinars hosted by professionals provide insights into current trends and regulations in compensation management.

- Accredited Platforms: Look for programs hosted by accredited institutions or professional organizations to ensure you’re receiving high-quality, reliable instruction.

Forums and Study Groups

Sometimes the best way to learn is through collaboration. Engaging with a community of peers or mentors can provide clarity on tricky topics and allow you to exchange tips and strategies. Forums and study groups create opportunities for discussion and shared learning experiences, which can complement individual study efforts.

- Online Communities: Participate in forums or social media groups where individuals share advice, experiences, and resources.

- Study Groups: Joining a study group provides a chance to learn together and keep each other motivated.

- Expert Mentors: Some platforms connect learners with experienced professionals who can provide guidance and answer questions.

Utilizing these resources will provide you with a well-rounded approach to mastering the necessary skills and knowledge, preparing you thoroughly for any assessment. Make use of books, courses, and communities to ensure you’re ready for success.