Successfully tackling assessments in the field of statistical analysis requires a strong understanding of core principles and practical application. The ability to confidently address various theoretical and practical challenges plays a crucial role in demonstrating proficiency in this discipline. Developing a systematic approach to these tasks ensures clear and effective communication of complex ideas.

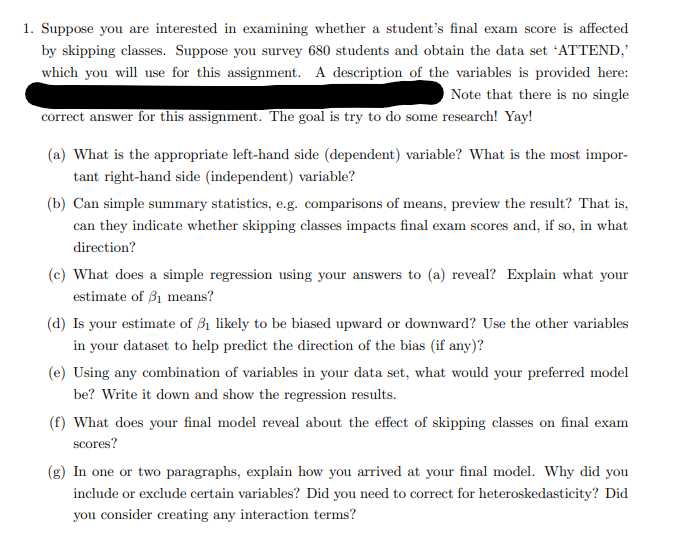

In this section, we explore common topics and methodologies that students encounter in their studies. Focusing on key techniques, we delve into the structure of problems, offering guidance on how to break down complex scenarios into manageable components. By practicing these strategies, you can approach each task with greater accuracy and confidence.

Understanding the fundamental concepts and mastering essential techniques will help you not only during evaluations but also in real-world situations. This knowledge empowers you to critically analyze data and provide insights, making it indispensable in both academic and professional settings.

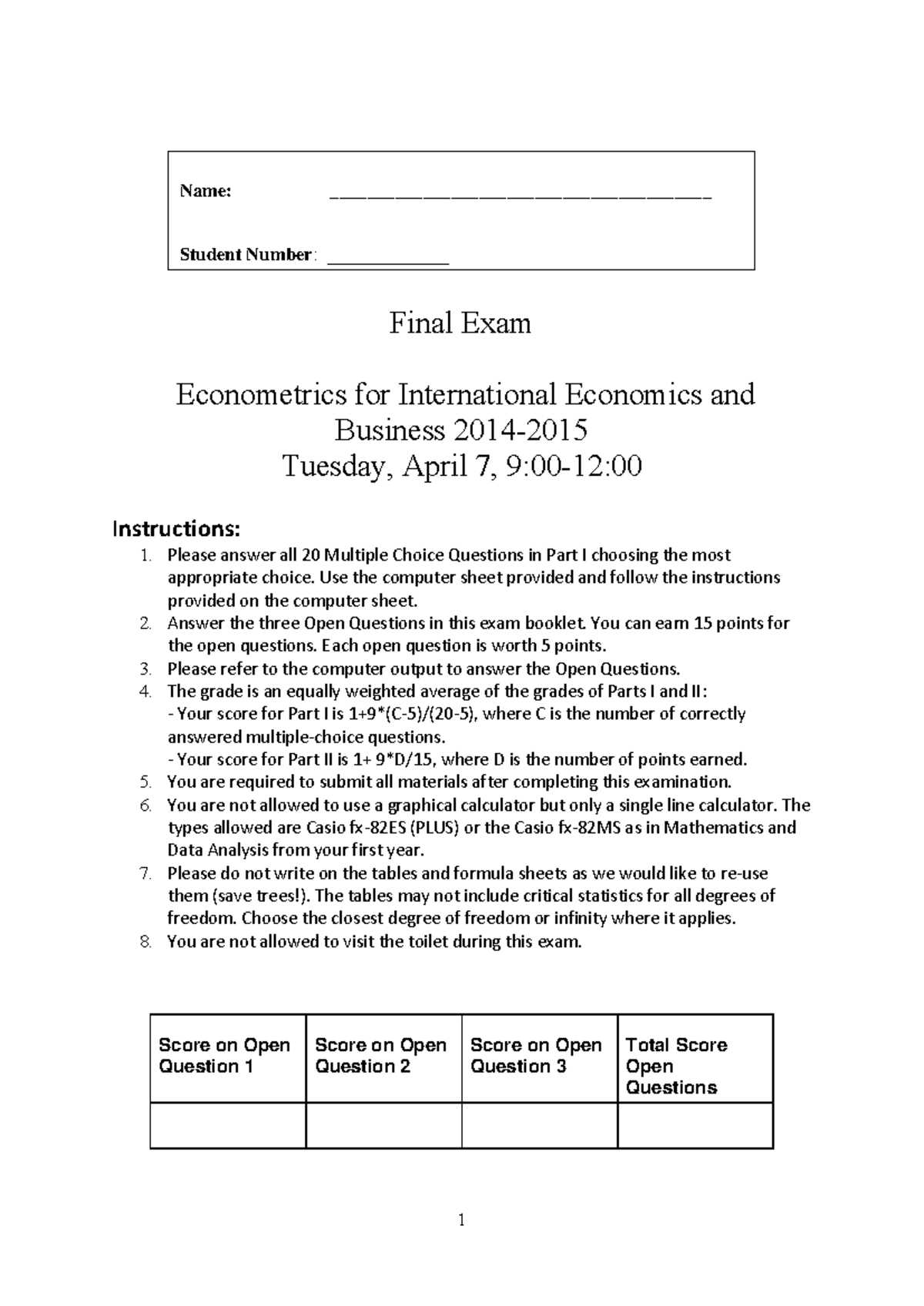

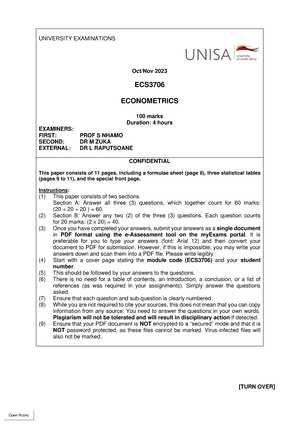

Econometrics Exam Questions and Answers

Preparing for assessments in the field of applied statistical analysis involves understanding key concepts and mastering the techniques required to solve complex problems. By familiarizing yourself with the most common challenges, you can develop a systematic approach to addressing them effectively. This section provides an overview of typical tasks, offering insight into how to tackle each type with precision.

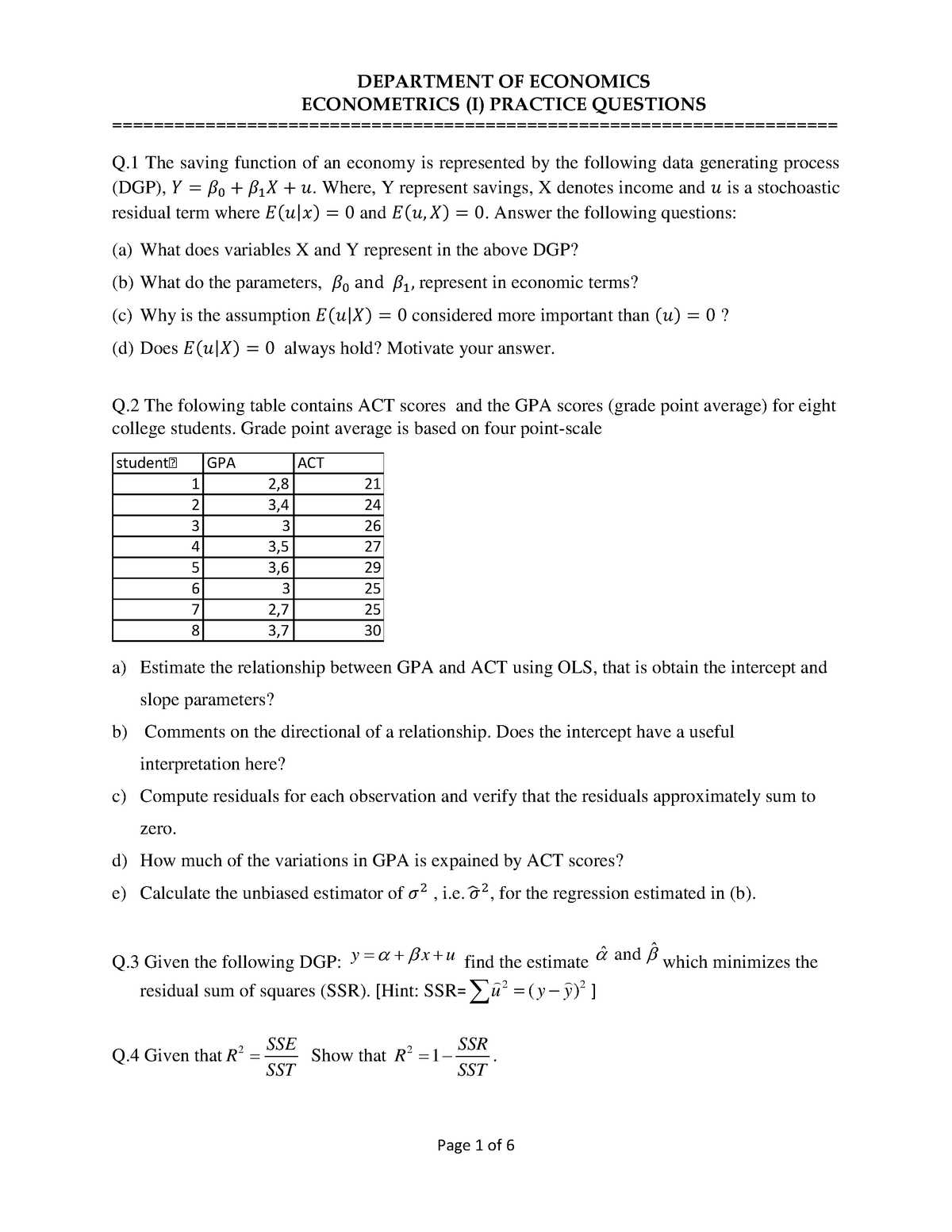

Below is a table highlighting common types of problems encountered during evaluations. For each category, we provide examples and strategies for deriving the correct solutions. Understanding the structure of these tasks is essential to ensuring that your responses are both accurate and well-organized.

| Problem Type | Example | Strategy |

|---|---|---|

| Data Interpretation | Interpreting the results of a regression analysis | Focus on identifying the key coefficients and their significance. |

| Model Selection | Choosing the appropriate statistical model for a dataset | Consider the assumptions of each model and match them to the data characteristics. |

| Hypothesis Testing | Testing the validity of a given hypothesis | Ensure the test is appropriate and pay attention to p-values and confidence intervals. |

| Calculation of Metrics | Calculating measures like R-squared or p-values | Understand the formulas and the interpretation of each metric in context. |

Familiarity with these types of problems will help you approach each task methodically, ensuring a clear path to the correct solution. By practicing these techniques, you’ll gain confidence in both handling theoretical challenges and applying them to practical situations.

Key Topics for Econometrics Exams

To excel in statistical analysis assessments, it’s essential to focus on several core areas that are frequently tested. Mastering these subjects will not only improve your problem-solving abilities but also help you to demonstrate a deep understanding of analytical techniques. These topics form the foundation for most tasks, allowing you to tackle complex scenarios with confidence.

The following subjects are central to most evaluations in this field. A strong grasp of these concepts will provide you with the tools needed to address various challenges, ensuring you are well-prepared for any task that may arise. Familiarity with these areas will also enhance your ability to apply theoretical knowledge to practical problems.

Key topics include regression analysis, time series forecasting, hypothesis testing, and model diagnostics. Understanding how to apply these concepts in different contexts is crucial for deriving accurate conclusions. With practice and study, you can develop the skills to navigate even the most difficult questions.

Commonly Asked Econometrics Questions

In assessments focused on statistical methods and analysis, certain topics tend to recur more frequently due to their foundational importance. Familiarizing yourself with these common inquiries allows you to practice efficiently and build a strong understanding of core concepts. Being prepared for these types of problems ensures you can approach any task with clarity and precision.

Understanding Key Statistical Methods

Many tasks involve interpreting results from common techniques like regression models or hypothesis tests. It’s essential to be comfortable with how to read output, interpret coefficients, and identify the significance of various variables. Additionally, recognizing when to apply specific methods is crucial for providing accurate solutions.

Application of Assumptions and Models

Another frequent area of focus is understanding the assumptions behind different models. Being able to explain why a certain model is used in a given context and how its assumptions affect the results is essential. This helps in answering questions that involve model selection, verification, and adjustments based on data characteristics.

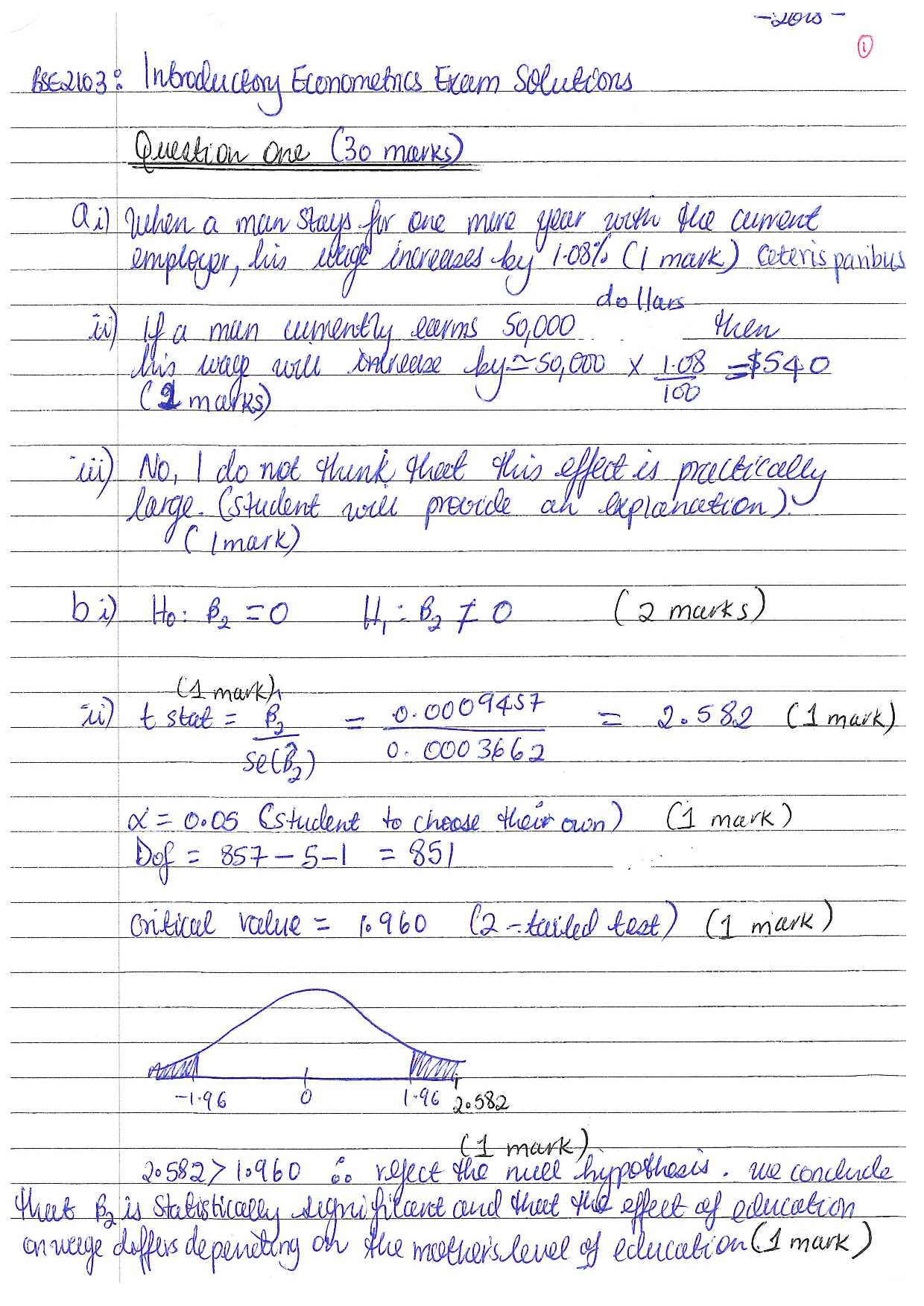

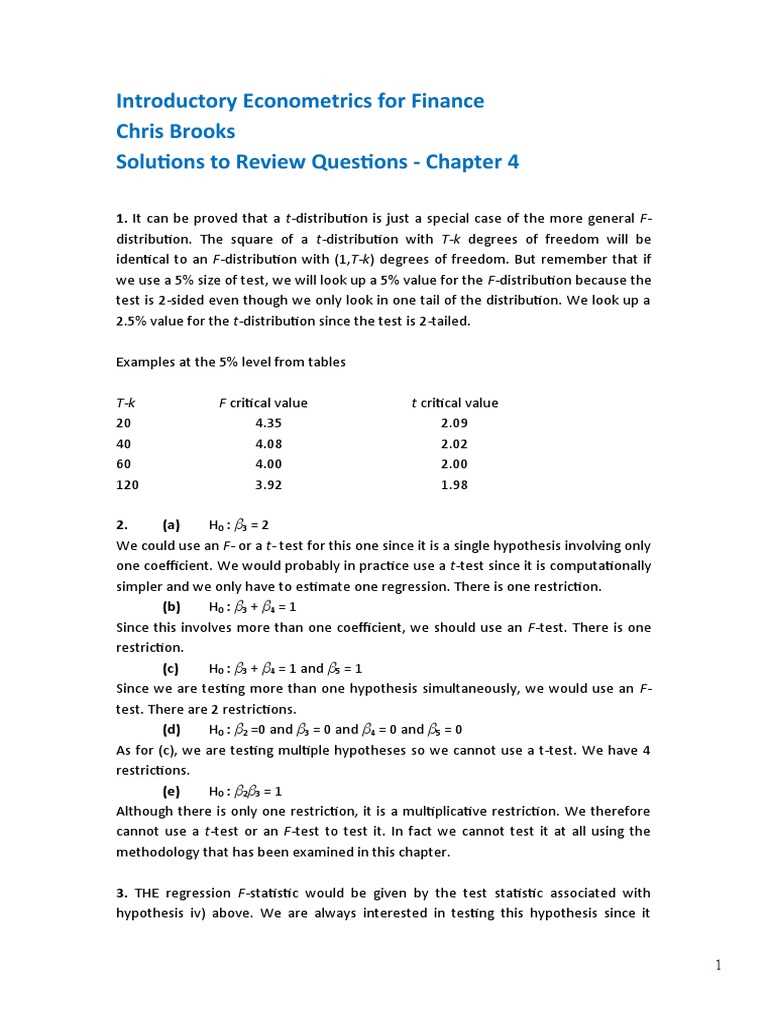

Understanding Hypothesis Testing in Econometrics

Hypothesis testing is a crucial component of statistical analysis, allowing researchers to assess the validity of assumptions made about a population based on sample data. This process involves making an initial claim, then using data to either support or reject that claim. By conducting these tests, you can make informed decisions about the relationships between variables and determine the significance of those relationships.

Steps in Hypothesis Testing

The procedure typically starts with formulating a null hypothesis, which represents the assumption that there is no effect or relationship between the variables. Then, an alternative hypothesis is developed, suggesting that there is indeed a relationship. Next, statistical tests are performed to evaluate the data, and a decision is made based on the results.

Key Concepts: p-Value and Significance

One of the critical aspects of hypothesis testing is the p-value, which measures the strength of the evidence against the null hypothesis. If the p-value is lower than a pre-set significance level (typically 0.05), the null hypothesis is rejected in favor of the alternative hypothesis. This helps in determining whether the observed effects are statistically significant or likely due to random chance.

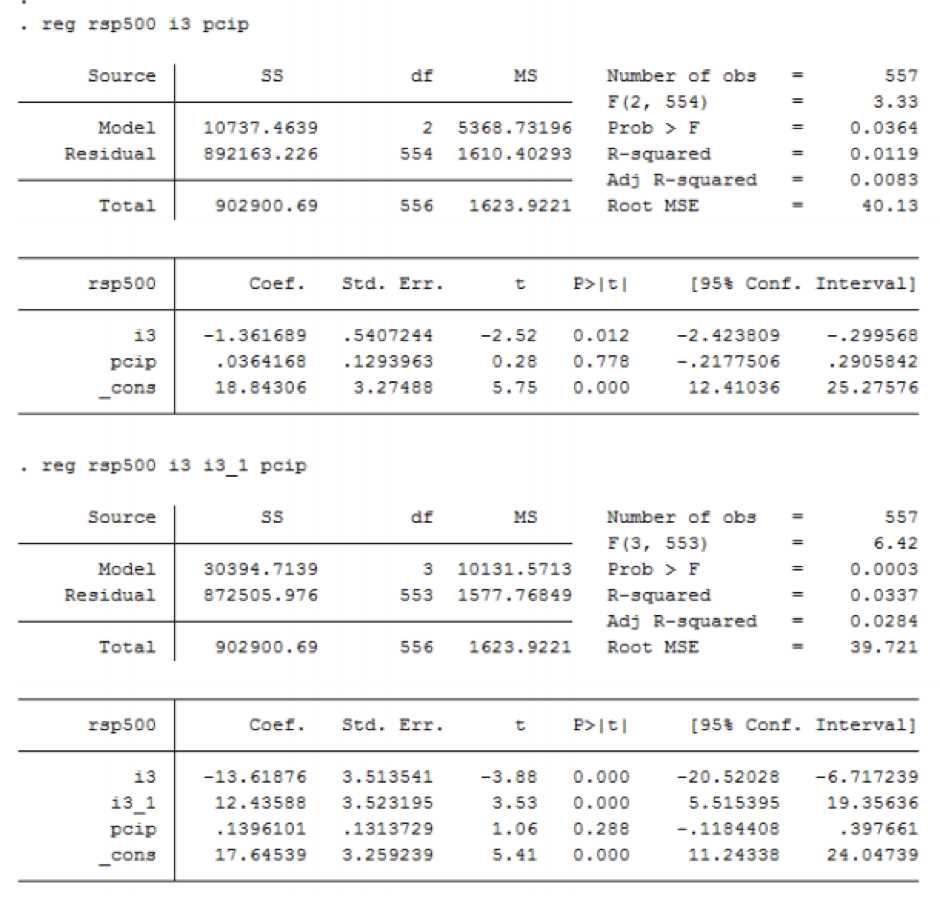

How to Interpret Regression Outputs

Interpreting regression results is essential for understanding the relationships between variables in statistical models. Once a model has been estimated, the output provides various statistics that help assess the fit of the model and the significance of the predictors. Proper interpretation ensures that conclusions drawn from the analysis are valid and meaningful.

Understanding Coefficients

The coefficients in a regression output represent the estimated change in the dependent variable for a one-unit change in the independent variable, assuming all other factors remain constant. For example, a coefficient of 2.5 for a variable indicates that for every one-unit increase in that variable, the dependent variable is expected to increase by 2.5 units, holding all other variables constant.

Assessing Model Fit: R-squared and Adjusted R-squared

R-squared is a key measure of how well the model explains the variability in the dependent variable. A higher R-squared value suggests that the model explains a large portion of the variance, while a lower value indicates that the model might not be capturing the underlying patterns well. Adjusted R-squared adjusts this measure for the number of predictors, providing a more accurate evaluation of model fit when multiple variables are included.

Top Econometric Models You Should Know

Understanding various analytical models is crucial for tackling real-world problems in data analysis. Different models serve different purposes depending on the nature of the data and the relationships you are trying to explore. Familiarity with these key models equips you with the tools needed to interpret data accurately and derive meaningful insights.

Some of the most commonly used techniques in this field include linear regression, time series models, and panel data analysis. Each of these methods provides a framework for analyzing relationships between variables, making predictions, and testing hypotheses. Mastering these models is essential for anyone involved in statistical analysis or data-driven decision-making.

Strategies for Solving Econometrics Problems

Approaching statistical analysis tasks requires a methodical and strategic mindset. Whether dealing with data interpretation or model selection, having a structured plan ensures that complex problems can be broken down into manageable steps. These strategies help ensure accuracy, efficiency, and clarity when deriving conclusions.

Step-by-Step Problem Solving

Following a systematic process is essential for tackling any problem in this field. Here are some important steps to consider:

- Understand the problem: Carefully read the task to identify key variables and the goal of the analysis.

- Select the appropriate model: Choose the most suitable statistical method based on the problem’s structure and available data.

- Check data assumptions: Verify assumptions for any models you plan to use (e.g., linearity, normality, homoscedasticity).

- Perform calculations: Apply the model and interpret the results carefully.

- Check robustness: Assess the stability of your results through sensitivity analysis or alternative specifications.

Efficient Techniques for Interpretation

Once the analysis is complete, interpreting the results accurately is key. Focus on these areas:

- Coefficient significance: Determine if the variables significantly influence the outcome.

- Model fit: Review metrics like R-squared and residual analysis to evaluate the overall performance of the model.

- Hypothesis testing: Use p-values and confidence intervals to draw conclusions about the relationships between variables.

By applying these strategies, you will be better equipped to solve problems efficiently and derive insightful conclusions from your data.

Important Econometrics Formulas to Remember

Mastering the key formulas used in statistical analysis is essential for solving complex problems and interpreting results effectively. These formulas serve as the foundation for conducting various types of data analysis, from model estimation to hypothesis testing. Familiarity with these equations will allow you to apply the right methods to different situations with confidence and accuracy.

Linear Regression Formula

One of the most important formulas in statistical analysis is the linear regression equation. It models the relationship between a dependent variable and one or more independent variables. The formula is typically expressed as:

Y = β0 + β1X1 + β2X2 + … + βnXn + ε

Where:

- Y is the dependent variable (the outcome you are predicting),

- β0 is the intercept term (the value of Y when all Xs are zero),

- β1, β2, …, βn are the coefficients (representing the change in Y for a one-unit change in each X variable),

- X1, X2, …, Xn are the independent variables,

- ε is the error term (accounting for unexplained variance).

Standard Error of the Estimate

The standard error is crucial for assessing the precision of the regression coefficients. It is used to calculate confidence intervals and conduct hypothesis tests. The formula for the standard error of the estimate is:

SE(β) = √[ Σ(y – ŷ)² / (n – k) ]

Where:

- y is the observed value,

- ŷ is the predicted value,

- n is the number of observations,

- k is the number of independent variables in the model.

Understanding these formulas will help you better interpret model outputs and assess the reliability of your estimates.

How to Prepare for Econometrics Exams

Preparation for assessments in this field requires a structured approach that combines understanding theoretical concepts with applying practical techniques. Success comes from consistent practice, mastering core methods, and developing the ability to analyze data effectively. Here are key strategies to help you prepare efficiently.

Focus on Core Concepts

Before diving into problem-solving, it’s essential to build a strong foundation. Focus on the key principles that underpin the techniques you’ll be tested on. Consider the following:

- Understand the theoretical foundations: Review the core concepts and assumptions behind models and methods.

- Master important formulas: Be able to recall and apply the formulas used in regression, hypothesis testing, and model estimation.

- Grasp the underlying assumptions: Make sure you understand the conditions necessary for various methods to be valid.

Practice Problem Solving

Hands-on practice is vital for reinforcing theoretical knowledge. Working through problems helps solidify your understanding and prepares you for the variety of tasks you might encounter. Tips for effective practice include:

- Solve past exercises: Review previous practice sets and problems to familiarize yourself with the question types and problem-solving approaches.

- Work on data interpretation: Practice interpreting statistical outputs, such as regression results, hypothesis tests, and confidence intervals.

- Focus on time management: Simulate the test environment by timing yourself while working through problems to improve efficiency.

By focusing on these key areas, you will be well-prepared to tackle any challenges and perform confidently during the assessment.

Interpreting Results from Statistical Tests

Understanding the output from statistical tests is essential for drawing accurate conclusions from your data. Interpreting these results allows you to assess the significance of relationships between variables and evaluate whether the assumptions of your model are met. Proper interpretation involves examining key metrics, making sense of p-values, and evaluating model fit.

Key Metrics to Understand

When reviewing the output of statistical tests, several key metrics play a crucial role in interpretation. These include:

| Metric | Explanation |

|---|---|

| p-value | The probability of obtaining a test statistic at least as extreme as the one observed, assuming the null hypothesis is true. A p-value less than the significance level (usually 0.05) indicates statistical significance. |

| Confidence Interval | Represents the range within which the true population parameter is likely to fall. A 95% confidence interval means you can be 95% confident that the parameter lies within that range. |

| R-squared | Indicates the proportion of variance in the dependent variable that is explained by the independent variables in the model. A higher R-squared value indicates a better fit. |

Interpreting the Results

Once you have reviewed the key metrics, it’s time to interpret the results in the context of your study. Consider these points:

- Statistical Significance: If the p-value is below your chosen significance level, you can reject the null hypothesis and conclude that the relationship between variables is statistically significant.

- Model Fit: If R-squared is high, the model explains a significant portion of the variance. However, be cautious of overfitting–high R-squared doesn’t always mean a good model.

- Confidence Intervals: Use these intervals to assess the precision of your estimates. A narrow confidence interval suggests more precision, while a wide interval indicates uncertainty.

By carefully evaluating these results, you can draw meaningful insights from your statistical analysis and ensure that your conclusions are well-supported by the data.

Econometrics Theories You Must Master

Understanding key theories is crucial for success in this field. These foundational concepts form the backbone of the methods used to analyze data, interpret relationships between variables, and draw conclusions. Mastering these theories enables you to build and evaluate models effectively, ensuring that your results are both accurate and meaningful. Below are the most important theories you should focus on.

Classical Linear Regression Model is the cornerstone of many statistical analyses. This theory underpins the method used to estimate relationships between independent and dependent variables. It assumes linearity, independence, homoscedasticity, and normality of errors. Understanding these assumptions helps ensure the validity of your results.

Maximum Likelihood Estimation (MLE) is another critical method. It provides a framework for estimating the parameters of a model by maximizing the likelihood function. This approach is particularly useful when dealing with non-normal data or more complex models, offering flexibility in estimation.

Instrumental Variables (IV) are essential when dealing with endogeneity issues. In situations where explanatory variables are correlated with the error term, IV provides a way to obtain consistent estimates. Mastering the theory behind this method is key for dealing with omitted variable bias and measurement errors in your models.

Time Series Analysis is a must for anyone working with data collected over time. This theory covers methods such as autoregressive models, moving averages, and co-integration, which help in understanding trends, seasonality, and the long-term relationships between variables.

By mastering these core theories, you’ll be well-equipped to analyze complex datasets, apply advanced methods, and interpret the results accurately in a wide range of research and practical applications.

Key Assumptions in Econometric Models

For any statistical model to provide reliable and valid results, certain assumptions must hold true. These foundational conditions shape the way data is processed, analyzed, and interpreted. Inaccurate or violated assumptions can lead to misleading conclusions, so it’s essential to understand and verify them when working with econometric models.

Some of the most important assumptions to consider include:

- Linearity: The relationship between the independent and dependent variables should be linear. This assumption is crucial for ensuring that predictions made by the model are valid over the range of data.

- Independence of Errors: The residuals (or error terms) should be independent of each other. This assumption prevents correlation between the errors and the explanatory variables, ensuring the accuracy of the parameter estimates.

- Homoscedasticity: The variance of the errors should remain constant across all levels of the independent variables. If the variance changes, the model may produce biased standard errors, leading to unreliable hypothesis testing.

- Normality of Errors: The error terms should follow a normal distribution. This assumption is essential for conducting valid statistical tests, especially for hypothesis testing and confidence intervals.

- No Endogeneity: The explanatory variables should not be correlated with the error term. Endogeneity can lead to biased and inconsistent parameter estimates, which can severely impact the model’s reliability.

By ensuring these assumptions hold, you can maintain the integrity of your model and make sound inferences based on the data at hand. In practice, violating any of these assumptions often requires adjusting the model, using alternative methods, or applying techniques like robust standard errors to correct for biases.

Practical Tips for Answering Exam Questions

Successfully tackling written assessments requires a combination of strategic planning, clear communication, and efficient time management. When faced with a set of problems, it’s essential to approach each one systematically to maximize your chances of providing thorough and accurate responses. The following tips will help ensure that you are well-prepared and able to answer each part with confidence.

- Understand the Instructions: Carefully read the instructions for each task to ensure you understand what is being asked. Pay close attention to any specific requirements, such as the format or method to use.

- Manage Your Time: Allocate a set amount of time to each section of the test based on its difficulty and length. Avoid spending too much time on any single problem, and move on if you feel stuck.

- Break Down Complex Problems: If a question seems complicated, break it down into smaller, more manageable parts. Identify the key concepts involved, and solve step by step, ensuring you tackle each component thoroughly.

- Show Your Work: Even if you know the answer, always show your thought process and calculations. This not only helps you keep track of your steps but also demonstrates your understanding of the underlying principles.

- Use Clear Terminology: Use precise terminology when explaining your reasoning. This helps convey your understanding clearly and leaves little room for confusion.

- Review Your Responses: If time allows, revisit your answers to ensure there are no mistakes or incomplete explanations. A quick review can help catch small errors or omissions.

By applying these strategies, you will improve your ability to approach questions methodically, manage time effectively, and present your solutions clearly and logically. These techniques can increase both the quality and accuracy of your responses, helping you achieve better results.

Common Mistakes to Avoid in Econometrics

When working through statistical models and solving complex numerical problems, it’s easy to fall into certain traps that can lead to incorrect conclusions or incomplete solutions. Recognizing and avoiding common pitfalls can improve both the quality and accuracy of your work. Here are a few of the most frequent errors encountered in this field, along with tips to prevent them.

Rushing Through Assumptions

One of the most common mistakes is overlooking or misinterpreting the assumptions that underlie a model. Each method relies on a set of assumptions that must be validated for the results to be reliable. For instance, assuming independence when there is autocorrelation can lead to biased estimates. Always check that the assumptions of the model are met before interpreting the output.

Ignoring Data Preprocessing

Another frequent issue is neglecting to properly prepare the data before analysis. Missing values, outliers, or improperly scaled variables can significantly skew results. It’s essential to clean and preprocess the data thoroughly. This includes checking for errors, handling missing data, and ensuring that variables are appropriately transformed if needed.

Additionally, failing to visualize the data or understand its distribution can lead to misinterpretation. Proper exploratory data analysis (EDA) can uncover patterns and relationships that may not be obvious from raw data alone. Ignoring this step can result in overlooking key factors that affect the outcomes.

Avoiding these and other common mistakes is crucial for accurate and meaningful analysis. By carefully considering assumptions and ensuring data quality, you can avoid pitfalls that undermine your work and lead to more reliable conclusions.

Using Software Tools for Econometrics

Modern data analysis heavily relies on various software programs that streamline the process of running complex models and performing statistical tests. These tools help researchers and practitioners handle large datasets, perform regressions, and interpret results with efficiency and accuracy. Choosing the right software and mastering its functionalities can greatly enhance the effectiveness of any analytical task.

R is one of the most widely used tools due to its flexibility and the vast number of packages available for specialized analyses. It is especially valuable for tasks such as regression analysis, hypothesis testing, and visualization. With an extensive community of users and developers, R provides both support and continuous updates to stay relevant in the field.

Stata is another powerful tool commonly used for economic and statistical modeling. Its user-friendly interface allows for quick application of a variety of tests and models, making it a go-to option for many professionals. Stata’s built-in commands also enable streamlined data cleaning, making it easier to prepare data for analysis.

Python, with libraries like pandas for data manipulation and statsmodels for statistical models, has become increasingly popular due to its versatility. It is ideal for handling complex data workflows and automating tasks that might otherwise be tedious. Python’s ability to integrate with other tools, along with its growing range of machine learning packages, has made it a powerful resource for advanced analysis.

By mastering these tools, professionals can perform tasks more efficiently, ensure reproducibility, and ultimately gain deeper insights from their data. Whether it’s basic regression or advanced machine learning techniques, these software programs provide the foundation for tackling modern challenges in data analysis.

Advanced Topics in Econometrics Exams

As you delve deeper into the subject of data analysis, certain advanced concepts become crucial for tackling complex problems and applying sophisticated techniques. Mastering these topics is essential for those looking to excel in this field, as they form the foundation for addressing real-world challenges in data-driven decision making. These advanced methods often require a deeper understanding of theory, mathematical rigor, and computational skills.

One of the critical areas of focus is time series analysis, which examines data points collected or indexed in time order. Understanding concepts such as stationarity, autocorrelation, and cointegration is essential for building accurate models that predict future trends based on historical data. Advanced techniques like Vector Autoregressive (VAR) models and cointegration testing are often tested, requiring careful application of theory to real datasets.

Panel data analysis is another key topic in advanced studies. It involves examining datasets that track multiple subjects over time, combining cross-sectional and time-series data. Techniques such as fixed effects and random effects models help address the complexities of such datasets, allowing for more robust and reliable inferences. Panel data methods are widely used in economics, finance, and social sciences, making them highly relevant for assessments.

Instrumental variables is an advanced technique employed to address endogeneity problems in regression analysis. This is particularly important when dealing with situations where explanatory variables are correlated with the error term. Understanding how to correctly apply instrumental variables can prevent biased estimates and lead to more accurate conclusions in econometric models.

Advanced topics also include maximum likelihood estimation (MLE), generalized method of moments (GMM), and other estimation techniques used for handling complex models and data structures. These methods are essential for cases where traditional ordinary least squares (OLS) regression does not provide reliable results due to issues like heteroskedasticity or model misspecification.

| Topic | Key Concepts | Common Applications |

|---|---|---|

| Time Series Analysis | Stationarity, autocorrelation, cointegration | Forecasting, economic modeling, financial analysis |

| Panel Data | Fixed effects, random effects | Firm performance, longitudinal studies |

| Instrumental Variables | Endogeneity, valid instruments | Policy analysis, causal inference |

| Maximum Likelihood Estimation | Likelihood functions, model fitting | Advanced econometric modeling, parameter estimation |

Thoroughly understanding these advanced topics not only enhances your analytical skills but also prepares you for tackling the most challenging problems in statistical analysis. Whether you’re conducting empirical research or applying methods to real-world scenarios, these concepts are fundamental for any advanced-level data analysis. Make sure to study these topics in-depth to succeed in more rigorous assessments and practical applications.

Time Management During Econometrics Exams

Effective time allocation is a crucial skill when tackling assessments that involve complex data analysis and modeling. With multiple tasks to complete within a limited period, managing your time wisely can make a significant difference in your performance. A well-organized approach allows you to address each part of the assessment thoroughly while ensuring you have enough time for review and refinement.

One of the first steps to efficient time management is understanding the structure of the task. Before starting, take a moment to assess the number of sections, the complexity of the problems, and the time allotted. This initial overview will guide your approach, helping you prioritize your efforts and avoid spending too much time on any one item.

- Plan Ahead: Begin by reading through all the sections to understand the types of tasks. Estimate how much time to allocate to each part based on its difficulty and length.

- Allocate Time Proportionally: Divide your time based on the weight or importance of each section. For instance, allocate more time to complex analysis tasks than to simpler questions.

- Start with What You Know: Tackle questions you feel most confident about first. This strategy helps you gain momentum and ensures that you complete the easier tasks with more time left for the challenging ones.

- Keep Track of Time: Regularly monitor the time as you progress. If a particular task is taking too long, move on to the next and return to it later, if necessary.

- Review Your Work: Always leave some time at the end for a final review. This allows you to check for any mistakes or oversights and ensure the clarity of your explanations and calculations.

By following these time management strategies, you can approach your tasks with a clear mind and avoid feeling rushed. The ability to allocate time wisely not only helps you cover all parts of the assessment but also reduces stress, making the overall experience more manageable.

Here are a few tips to further improve time efficiency:

- Practice Under Time Constraints: Before the actual assessment, simulate timed practice sessions to develop a better sense of pacing.

- Stay Focused: Minimize distractions during the task. A focused mindset will allow you to work more efficiently and prevent unnecessary delays.

- Don’t Overthink: While it’s important to analyze problems carefully, avoid spending too much time on second-guessing. Trust your knowledge and instincts to make the best decisions.

Ultimately, mastering time management is essential for performing at your best under pressure. With these techniques, you can tackle each challenge confidently and effectively, ensuring that you make the most of the time you have available.