Understanding how to manage money effectively is a crucial life skill that everyone should develop. With the right knowledge, individuals can make informed decisions about budgeting, saving, investing, and more. This guide provides insights into the key concepts that will help you succeed in any financial assessment.

Whether you’re preparing for a quiz or aiming to improve your overall financial competence, mastering these topics will give you the tools you need to navigate the complexities of personal finance. By focusing on practical applications, you can turn theoretical knowledge into everyday actions that lead to financial well-being.

Confidence in managing your finances can open doors to long-term success, ensuring you’re well-equipped to tackle challenges such as debt management, planning for the future, and achieving your financial goals. Through this guide, you’ll gain a deeper understanding of the most important money management concepts that form the foundation of financial education.

Everfi Financial Literacy Final Exam Answers

Preparing for a comprehensive test on money management requires a deep understanding of various principles, from budgeting to investments. Knowing the right strategies to answer questions based on real-world financial situations can help you perform well and grasp essential concepts. This section will walk you through key topics that are commonly assessed and provide insights on how to approach each one effectively.

By focusing on the most important areas, you’ll gain the ability to make informed decisions that contribute to your financial success. Whether you’re reviewing material or looking for additional clarification, mastering these concepts will equip you with the knowledge needed to excel.

| Topic | Description |

|---|---|

| Budgeting | Learn how to allocate resources for everyday expenses and long-term goals. |

| Saving | Understand strategies for building an emergency fund and saving for future needs. |

| Debt Management | Get familiar with ways to handle and reduce debt effectively. |

| Investing | Understand the basics of investing to grow wealth over time. |

| Insurance | Learn how insurance can protect against financial risks and losses. |

| Taxes | Gain knowledge on how taxes impact your finances and how to file them properly. |

Understanding Financial Literacy Concepts

Grasping key money management principles is crucial for making sound decisions in everyday life. Whether it’s managing your income, saving for the future, or understanding credit, these concepts lay the foundation for your financial stability. By mastering these ideas, you will be better equipped to navigate complex situations and avoid common pitfalls.

Core Concepts to Master

- Budgeting: The process of planning your spending based on income and expenses.

- Saving: Setting aside a portion of your earnings for future needs or emergencies.

- Debt Management: Understanding how to handle loans, credit, and avoid falling into excessive debt.

- Investing: Using money to generate more wealth through various financial instruments.

- Risk Management: Learning how to protect yourself from financial loss through insurance and other tools.

Why These Concepts Matter

- They help you manage your money effectively and make informed choices.

- They promote long-term financial health and security.

- They empower you to make decisions that support your goals and aspirations.

How to Prepare for the Test

Preparation is key to success when it comes to assessing your knowledge of essential money management principles. By reviewing key concepts and practicing with real-life scenarios, you can ensure you’re ready to handle questions with confidence. This section will guide you through effective strategies to maximize your readiness for the assessment.

Steps to Take Before the Test

- Review Key Topics: Focus on core subjects such as budgeting, saving, credit, and investing.

- Practice with Sample Questions: Go through practice tests or quizzes to familiarize yourself with the question format.

- Understand Practical Applications: Think about how these concepts apply to real-world situations and personal finances.

- Take Notes: Write down key points and formulas that are frequently tested or important for understanding complex topics.

Effective Study Techniques

- Break Down Complex Concepts: Tackle difficult material in smaller chunks to make it easier to digest.

- Group Study: Consider studying with others to discuss and reinforce difficult topics.

- Rest and Focus: Ensure you’re well-rested before the test to maintain focus and clear thinking during the assessment.

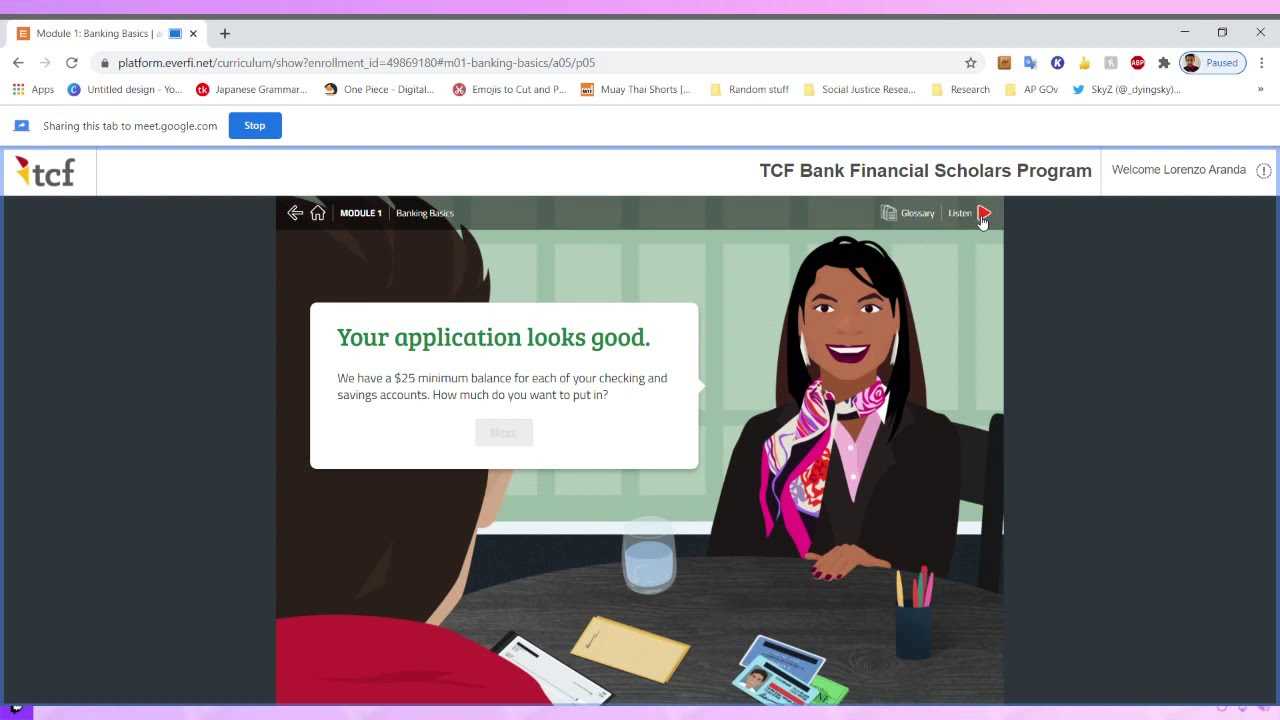

Key Topics Covered in Everfi

The program covers a range of essential concepts that are crucial for understanding personal money management. These topics aim to equip individuals with the skills needed to make informed decisions about their finances. The focus is on practical applications, ensuring learners can easily transfer what they’ve learned into their daily financial choices.

| Topic | Description |

|---|---|

| Budgeting | Learn the importance of tracking income and expenses to make smart spending choices. |

| Saving and Emergency Funds | Understand how to build a safety net and save for future needs or unexpected events. |

| Credit and Debt Management | Gain insight into managing loans and credit responsibly to avoid financial strain. |

| Investing | Discover the basics of investing to grow wealth over time, including types of investments. |

| Insurance | Learn about different types of insurance and how they help protect financial well-being. |

| Taxes | Get familiar with the tax system and understand how taxes affect income and savings. |

Commonly Asked Questions in the Test

When preparing for a test on managing personal finances, it’s helpful to familiarize yourself with the types of questions that may appear. These questions often focus on assessing your ability to apply key concepts to real-life situations. Understanding these common questions will help you feel more confident and prepared when it’s time to take the assessment.

Types of Questions You May Encounter

- Budgeting and Expenses: How to allocate your income for everyday spending and savings.

- Debt and Credit: Questions related to how credit works and strategies for managing debt effectively.

- Saving Strategies: How to plan and prioritize saving for future goals and emergencies.

- Investing: Basic questions about different investment options and how they grow wealth over time.

- Insurance and Protection: How different types of insurance can protect against financial risks.

Sample Question Formats

- Multiple Choice: Choose the best option based on your understanding of financial concepts.

- Scenario-Based: Apply what you’ve learned to solve a hypothetical financial problem or decision.

- True or False: Assess the accuracy of statements related to money management principles.

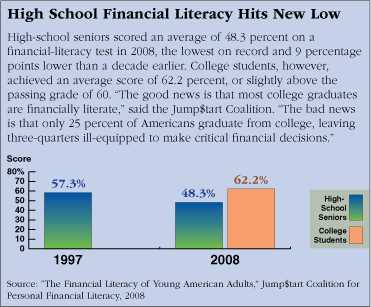

Why Financial Literacy Matters

Understanding how to manage money is essential for making sound decisions in both your personal and professional life. With the right knowledge, individuals can navigate financial challenges, plan for the future, and avoid common pitfalls. The ability to make informed choices directly impacts long-term security and success.

Empowerment Through Knowledge

When you grasp the core principles of budgeting, saving, and investing, you’re in a better position to take control of your financial destiny. This knowledge empowers you to make choices that align with your goals, whether it’s purchasing a home, saving for retirement, or handling unexpected expenses.

Prevention of Financial Strain

Without a solid understanding of money management, it’s easy to fall into debt or miss opportunities for growth. Proper financial education helps prevent these issues by teaching you how to handle money responsibly, reduce unnecessary costs, and build wealth over time.

Mastering Budgeting and Savings Skills

Developing strong budgeting and saving habits is fundamental to maintaining financial stability and achieving long-term goals. With these skills, individuals can manage their expenses, prioritize savings, and ensure they are prepared for both planned and unexpected financial needs. Mastering these techniques empowers you to make smarter choices with your money and build a secure financial future.

Key Budgeting Techniques

- Track Your Income and Expenses: Keep a detailed record of all your earnings and spending to understand where your money goes.

- Create a Spending Plan: Set clear categories for your expenses, including necessities and discretionary items, and stick to your limits.

- Adjust Your Budget Regularly: Review and adjust your budget to reflect changes in your income or living situation.

- Use the 50/30/20 Rule: A simple way to allocate your income–50% for needs, 30% for wants, and 20% for savings and debt repayment.

Effective Saving Strategies

- Pay Yourself First: Prioritize saving by setting aside a portion of your income before covering other expenses.

- Build an Emergency Fund: Save for unexpected expenses to avoid relying on credit when life throws a curveball.

- Set Specific Savings Goals: Whether for a vacation, a home, or retirement, clear goals help you stay focused and motivated.

- Automate Your Savings: Set up automatic transfers to savings accounts to make saving a consistent habit.

Understanding Credit and Debt Management

Managing borrowed money responsibly is a critical skill for ensuring long-term financial health. By understanding how credit works and how to manage debt effectively, individuals can avoid financial pitfalls and work toward building a stable financial future. Effective credit management allows you to leverage resources for important purchases while keeping debt under control.

The Basics of Credit

- What is Credit? Credit refers to the ability to borrow money and repay it later, often with interest. Common forms of credit include credit cards, personal loans, and lines of credit.

- Credit Scores: A numerical representation of your creditworthiness. Lenders use it to determine your likelihood of repaying borrowed funds.

- Credit Reports: Detailed records of your credit history, including loans, credit cards, payment history, and current balances.

- Building Credit: Start by using credit responsibly, paying bills on time, and maintaining low balances relative to credit limits.

Debt Management Strategies

- Prioritize High-Interest Debt: Focus on paying off high-interest debt first, such as credit cards, to reduce the overall cost of borrowing.

- Consolidation: Combine multiple debts into one loan with a lower interest rate to simplify repayment.

- Set a Budget: Allocate a portion of your income specifically for debt repayment to ensure you stay on track.

- Avoiding Further Debt: Limit taking on new debt while repaying existing obligations to avoid accumulating interest charges.

Insurance Basics for Financial Success

Understanding insurance is a key component of securing your financial future. By protecting yourself and your assets, insurance helps mitigate the risks that could otherwise lead to significant financial strain. Whether for health, property, or life, the right insurance policies can safeguard you against unexpected expenses and provide peace of mind in times of need.

Types of Insurance to Consider

- Health Insurance: Provides coverage for medical expenses, ensuring you’re not burdened with large healthcare costs during illness or emergencies.

- Life Insurance: Offers financial protection to your dependents in the event of your passing, ensuring they can maintain their quality of life without financial strain.

- Auto Insurance: Protects you financially in case of car accidents, damage, or theft, covering repair costs, medical expenses, and liability.

- Homeowners or Renters Insurance: Covers the loss or damage of property and possessions, and protects you against liability for accidents that occur on your property.

- Disability Insurance: Provides income replacement if you become unable to work due to injury or illness, helping you meet financial obligations during recovery.

How to Choose the Right Insurance

- Evaluate Your Needs: Assess your lifestyle, health, and financial responsibilities to determine the types of coverage you need.

- Compare Policies: Shop around for the best coverage options, considering factors such as premiums, deductibles, and coverage limits.

- Understand the Fine Print: Be sure to read and understand the terms of your policy, including exclusions, limits, and claim processes.

- Review Regularly: As your life circumstances change, so should your insurance coverage. Regularly review and adjust your policies as necessary.

How to Handle Taxes Effectively

Managing taxes efficiently is crucial to maintaining financial stability and ensuring compliance with the law. By understanding tax obligations and planning ahead, you can reduce your tax liability, avoid penalties, and keep more of your hard-earned money. Proactive tax management allows individuals to navigate deductions, credits, and other strategies that help minimize tax burdens.

Key Tax Concepts to Understand

- Income Tax: Taxes on the money you earn, whether from salary, business profits, or investments. Understanding the tax brackets and rates that apply to your income is essential for effective tax planning.

- Tax Deductions: Certain expenses that can reduce your taxable income, such as mortgage interest, charitable donations, and medical costs. Maximizing these deductions can lower your overall tax bill.

- Tax Credits: Direct reductions in the amount of tax you owe, such as credits for education expenses or energy-efficient home improvements. Credits are often more valuable than deductions.

- Self-Employment Taxes: If you’re a freelancer or run your own business, you must pay both the employer and employee portions of Social Security and Medicare taxes. Proper record-keeping and tax planning are essential to managing these responsibilities.

Tax Strategies for Success

- Keep Detailed Records: Maintain organized records of all income, expenses, and receipts to make tax filing easier and ensure you don’t miss out on deductions.

- File On Time: Meeting deadlines helps avoid penalties and interest on overdue payments. Consider filing early to get any refunds sooner.

- Consider Professional Help: If your tax situation is complex, it may be worth consulting with a tax professional to ensure you’re taking advantage of all possible tax-saving strategies.

- Plan Ahead: Tax planning should be a year-round activity. Estimate your taxes and adjust withholding or quarterly payments to avoid large bills at the end of the year.

Investment Fundamentals You Need to Know

Understanding the basics of investing is essential for building long-term wealth and securing your financial future. Investments offer a way to grow your money, but it’s important to grasp key concepts such as risk, return, and diversification before diving in. By making informed decisions, you can work towards achieving your financial goals while managing potential risks.

One of the most important aspects of investing is understanding that all investments carry some degree of risk. Risk is the possibility that you may not achieve the expected return or could even lose part or all of your initial investment. However, risk can be managed through strategies like diversification, which involves spreading investments across different asset classes to reduce exposure to any one risk.

Another critical element is the potential for returns, or the profit you earn from your investments. While returns can vary, the goal of investing is typically to earn more than what you would have through traditional savings methods. However, it’s important to remember that higher potential returns are often accompanied by higher levels of risk.

Exploring Career and Salary Management

Understanding how to manage your career and salary is crucial for long-term financial success and personal fulfillment. Effectively navigating your professional journey involves not only advancing in your career but also ensuring that your income is aligned with your goals and lifestyle. By learning how to manage salary expectations, negotiate pay, and plan for future earnings, you can make informed decisions that support both short-term stability and long-term growth.

One of the first steps in managing your career is understanding the relationship between your skills, experience, and market demand. These factors play a key role in determining your earning potential. Whether you’re just starting out or have years of experience, understanding the benchmarks in your industry helps set realistic expectations and gives you a clearer picture of where you stand in the market.

Key Strategies for Salary Management

- Know Your Worth: Research typical salaries for your role, industry, and location to ensure you are compensated fairly. Websites like Glassdoor and Payscale can provide valuable insights into salary ranges.

- Negotiate Pay: When offered a job or promotion, don’t be afraid to negotiate. Having data and a clear understanding of your value can empower you to ask for a competitive salary.

- Track Your Progress: Regularly assess your career milestones, promotions, and salary increases to ensure you’re on track. Set clear goals for professional development to increase your earning potential.

Investing in Career Growth

Continually investing in your career by upgrading skills, seeking new opportunities, and expanding your network can enhance your salary over time. Attending workshops, obtaining certifications, and staying current with industry trends will improve your expertise, making you more valuable in the job market.

| Years of Experience | Average Salary |

|---|---|

| Entry-Level | $40,000 – $50,000 |

| Mid-Career | $60,000 – $80,000 |

| Senior-Level | $90,000 – $120,000 |

Building Good Financial Habits

Developing strong money management practices is essential for achieving long-term stability and success. The habits you form today can set the foundation for your future, helping you navigate challenges and make informed decisions. By adopting smart, consistent behaviors related to budgeting, saving, and spending, you can create a solid financial framework that supports your goals and aspirations.

One of the most important habits to cultivate is creating and sticking to a budget. A clear budget allows you to track your income and expenses, ensuring that you live within your means. Regularly reviewing and adjusting your budget can help you stay on track and avoid unnecessary debt.

Another key habit is saving regularly, even if it’s a small amount. Setting aside money for emergencies, retirement, or future goals can provide a sense of security and reduce financial stress. Building an emergency fund, for instance, ensures you’re prepared for unexpected expenses without relying on credit.

It’s also essential to be mindful of your spending habits. Being intentional about where your money goes can help you avoid impulse purchases and focus on what truly matters. Keeping track of your spending, setting limits, and prioritizing needs over wants are effective strategies to control unnecessary outflows.

Avoiding Common Mistakes in Finance

Many individuals fall into certain traps when managing their money, which can lead to unnecessary financial stress or setbacks. By understanding and avoiding these common pitfalls, you can protect your assets and make smarter decisions. Recognizing these mistakes early and taking proactive steps to prevent them is key to achieving long-term financial well-being.

One of the most frequent errors people make is living beyond their means. This often occurs when expenses consistently outpace income, leading to debt accumulation. It’s essential to create a realistic budget that ensures your spending aligns with your earnings. Living within your means is one of the fundamental principles of sound money management.

Another common mistake is not saving enough for the future. While it may seem tempting to spend rather than save, failing to put money aside for emergencies or retirement can be detrimental. A lack of an emergency fund or retirement savings plan can lead to financial instability when unexpected situations arise. Prioritizing savings, even in small amounts, is crucial for long-term security.

Additionally, many individuals neglect to track their spending. Without understanding where money is going, it’s difficult to identify areas for improvement or unnecessary expenditures. Keeping track of your monthly expenses and reviewing your financial statements regularly can help you identify patterns and make adjustments where necessary.

Finally, avoiding high-interest debt is another crucial factor in maintaining financial health. Relying too heavily on credit cards or loans with high interest rates can quickly spiral into unmanageable debt. It’s important to use credit responsibly and to pay off balances as soon as possible to avoid unnecessary interest charges.

The Role of Financial Planning in Life

Effective financial planning plays a critical role in shaping a stable and secure future. It involves setting clear goals, managing resources wisely, and preparing for unexpected events. Whether you’re planning for retirement, buying a home, or saving for education, a structured approach to handling your resources can provide peace of mind and open doors to new opportunities.

One of the key benefits of financial planning is the ability to anticipate and manage future needs. By creating a budget that aligns with your goals, you can ensure that you’re allocating enough funds for essential needs while also saving for long-term objectives. This proactive approach reduces the risk of financial stress and helps you stay on track toward achieving your aspirations.

Another vital aspect of financial planning is risk management. Life is full of uncertainties, and unexpected events can disrupt your financial stability. Planning ahead for things like medical emergencies, job loss, or accidents by having an emergency fund and appropriate insurance can help protect you and your family from financial hardship. It’s not just about saving–it’s about preparing for life’s uncertainties.

Moreover, financial planning enables you to make informed decisions. With a clear picture of your income, expenses, and savings, you are in a better position to make smart choices regarding investments and other opportunities. With a solid financial plan, you can confidently explore options that align with your values and long-term goals.

In conclusion, financial planning is not just a tool for managing money–it’s a strategic approach to creating a life that reflects your priorities. Whether you’re just starting out or preparing for retirement, taking the time to plan financially can make all the difference in securing a future of stability and growth.

Tips for Managing Student Loans

Managing student loans can be a daunting task, but with the right approach, it is possible to navigate this financial challenge effectively. By taking proactive steps and staying informed, you can make the repayment process smoother and avoid common pitfalls. Whether you are just starting your education or are nearing graduation, understanding your loans and how to manage them is key to reducing stress and building a solid financial foundation.

Understand Your Loan Terms

The first step in managing your student loans is to fully understand the terms of each loan. This includes the interest rates, repayment options, and the total amount borrowed. Each loan may have different terms, and it’s important to know how they will impact your financial situation. Be sure to review any loan agreements or documentation and clarify any doubts with your loan servicer.

Consider Repayment Plans

There are several repayment plans available, each with its own benefits. Some plans are based on your income, while others are fixed or extended over a longer period. Research different repayment options to find the one that works best for your financial situation. If you’re struggling with payments, some servicers offer temporary deferment or forbearance to help you manage payments during challenging times.

- Income-driven plans: These plans adjust your payments based on your income and family size, which can help reduce monthly payments.

- Standard repayment: This plan has fixed monthly payments and a set loan term, allowing you to pay off loans faster.

- Graduated repayment: This option starts with lower payments that gradually increase over time.

Being proactive and aware of your options is crucial in managing student debt. By staying on top of your loans and exploring available repayment options, you can work toward financial freedom and minimize the impact of student loan debt on your future.

Resources for Further Financial Education

Expanding your knowledge about managing money, investments, and budgeting is an ongoing process. There are many resources available to help you build a stronger understanding of personal finance, whether you are a beginner or looking to deepen your expertise. By exploring these materials, you can stay informed about the latest financial strategies and make more confident decisions in managing your wealth.

Online Courses and Platforms

One of the most accessible ways to gain more knowledge is through online platforms that offer free or affordable courses on various money-related topics. These courses often cover everything from basic budgeting to advanced investment strategies. Some popular websites to explore include:

- Coursera: Offers financial courses from universities and institutions worldwide.

- edX: Provides free courses and certifications on personal finance management.

- Udemy: A platform with a wide range of affordable personal finance courses.

- Khan Academy: Offers free lessons on the basics of economics, taxes, and financial planning.

Books and Publications

Books can be a great resource for those who prefer in-depth, structured information. Many authors and experts have written books that explain key financial concepts and offer practical tips. Consider reading:

- “The Total Money Makeover” by Dave Ramsey: A guide to taking control of your finances and getting out of debt.

- “Rich Dad Poor Dad” by Robert Kiyosaki: A popular book that focuses on wealth-building and financial independence.

- “The Millionaire Next Door” by Thomas Stanley and William Danko: Insights into the habits and strategies of wealthy individuals.

Government and Nonprofit Resources

Government websites and nonprofit organizations often provide free resources to help individuals make informed financial decisions. These resources can be especially helpful for understanding taxes, credit, and consumer protection laws:

- The U.S. Financial Literacy and Education Commission (MyMoney.gov): Offers tools and resources to help individuals improve their financial well-being.

- The Consumer Financial Protection Bureau (CFPB): Provides tips, guides, and tools to understand financial products and services.

- The National Endowment for Financial Education (NEFE): A nonprofit organization focused on helping people make sound financial choices.

By utilizing these resources, you can continue learning about personal finance and improve your decision-making skills. Whether you prefer structured courses, self-paced reading, or expert guidance, there is always a way to advance your financial knowledge.