When preparing for a financial certification, understanding the key principles and frameworks is essential for success. This guide is designed to help individuals sharpen their knowledge and enhance their problem-solving skills in the field of financial modeling and analysis.

To excel in this type of certification, it’s important to approach your preparation strategically. By working through a series of detailed questions and challenges, you will gain the experience needed to tackle complex scenarios effectively. This process not only improves your technical skills but also boosts your confidence for the official assessment.

Throughout this guide, we will provide insights on the most common obstacles faced during preparation, offering tips and methods for overcoming them. A well-rounded approach is key, from mastering theoretical concepts to applying them in practical situations, ensuring a comprehensive understanding of the material.

FMVA Practice Exam Answers Guide

Preparing for a financial certification involves much more than simply studying textbooks. It’s about actively engaging with questions and scenarios that reflect the complexity of real-world challenges. This section will provide you with essential guidance to approach the evaluation process with confidence, ensuring that you not only understand the material but can apply it effectively when faced with intricate problems.

Effective Strategies for Answering Financial Questions

To succeed in your certification, it’s crucial to approach each question systematically. Break down each problem into smaller components, identify the key concepts being tested, and apply relevant techniques. Understanding the underlying principles behind the problems will allow you to approach them from different angles, increasing your chances of selecting the correct solution. Practice will refine your analytical skills and make you more adept at recognizing the most efficient methods to tackle each scenario.

Key Areas to Focus On for Success

There are several critical areas to concentrate on during your preparation. Financial modeling, valuation techniques, and analysis of financial statements are often core components of assessments. By mastering these concepts and practicing with real-world examples, you can increase your accuracy in solving problems and make smarter decisions under pressure. Don’t overlook the importance of time management; balancing speed with precision is crucial when taking an official evaluation.

Key Concepts Tested in FMVA Exams

In any advanced financial certification, certain concepts are consistently evaluated to ensure a thorough understanding of financial analysis and modeling techniques. This section highlights the core principles that are essential for mastering the subject and performing well in assessments. By focusing on these concepts, you can better prepare yourself to tackle complex questions and demonstrate your expertise.

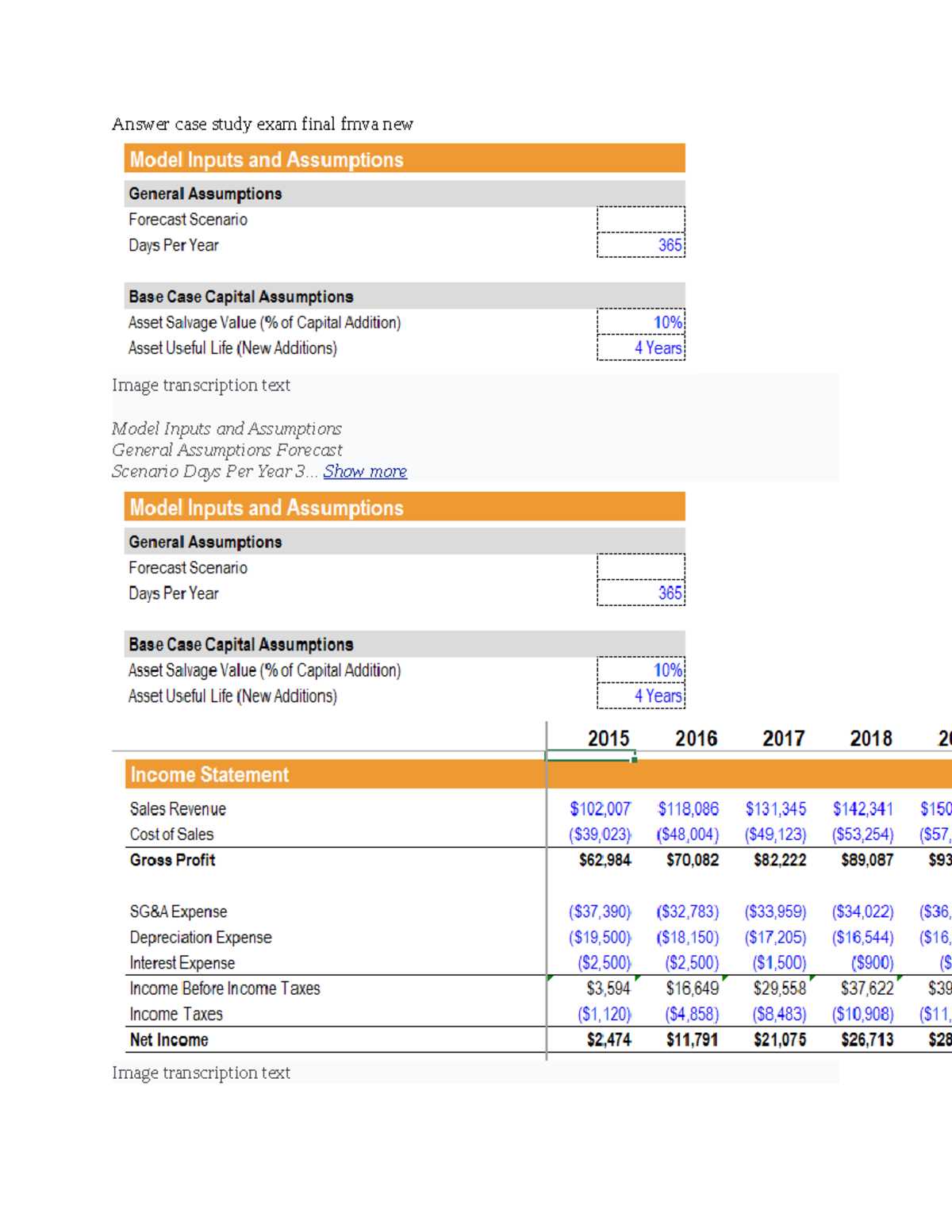

Financial Modeling Techniques

One of the primary areas tested is financial modeling, which involves constructing models to analyze a company’s financial performance. Understanding how to build projections for balance sheets, income statements, and cash flow statements is critical. The ability to create accurate models will enable you to assess a company’s value, risk, and potential growth. Mastering these techniques helps to simplify the more intricate aspects of financial analysis.

Valuation Methods and Analysis

Valuation is another key topic, with a focus on understanding how to determine the value of a business or asset. Common methods, such as discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions, are frequently evaluated. A strong grasp of these techniques will allow you to accurately assess investments and make informed decisions. Additionally, critical thinking is required to interpret financial statements and make well-rounded judgments about a company’s financial health.

How to Approach FMVA Practice Questions

When preparing for a financial certification, working through sample questions is an essential part of the study process. These questions are designed to simulate the challenges you’ll face during the official assessment. By developing an effective approach to answering these problems, you can improve your problem-solving abilities and better understand the material. This section will guide you through strategies to approach these practice scenarios with confidence and efficiency.

Breaking Down Each Problem

The first step in tackling any financial scenario is to break it down into smaller, more manageable parts. Identify the key components of the problem, such as the variables involved and the calculations required. By organizing the information, you’ll be able to understand what’s being asked and how to proceed. Focus on the core concepts at play and apply your knowledge to each element of the question, ensuring you’re not overwhelmed by the complexity.

Managing Time Effectively

Another critical aspect of handling practice questions is time management. During the official assessment, you’ll need to balance accuracy with speed. To develop this skill, set time limits when working through practice problems and simulate real exam conditions. Track your progress to ensure you can answer questions efficiently without rushing or sacrificing quality. By practicing under time constraints, you’ll be better prepared for the pressure of the actual test.

Understanding FMVA Exam Format

Knowing the structure and layout of the assessment is crucial for success. Familiarity with how the questions are presented and what is expected will help you approach the material with a clear strategy. In this section, we’ll explore the typical format of such evaluations, so you can be prepared for the kind of challenges you’ll face.

- Multiple-choice questions: These are designed to test your theoretical knowledge of financial concepts. You’ll need to identify the correct answer based on the given scenarios.

- Case studies: Real-world scenarios that require you to apply your skills in financial modeling and analysis. These often test your ability to think critically and provide detailed solutions.

- Calculations: You will be asked to perform various financial calculations, such as discounted cash flow analysis, financial ratios, and valuation techniques. Precision and understanding of key formulas are essential.

Understanding these different question types allows you to tailor your study methods. Focusing on both theoretical knowledge and practical application will ensure that you’re ready for the variety of challenges presented during the assessment.

Common Mistakes in FMVA Practice Exams

While preparing for a financial certification, many candidates fall into common traps that can impact their performance. Recognizing these frequent errors can help you avoid them and ensure a smoother preparation process. This section highlights some of the most typical mistakes made during sample assessments, along with tips on how to overcome them.

| Mistake | Cause | Solution |

|---|---|---|

| Rushing through questions | Overconfidence or misjudging time requirements | Practice time management and review before submitting |

| Skipping key details in case studies | Failure to read the entire scenario carefully | Take the time to read thoroughly and highlight key information |

| Misapplying formulas | Not fully understanding the formula’s context or variables | Review core formulas regularly and understand their application |

| Neglecting to check calculations | Lack of attention to detail or confidence in initial answers | Always double-check calculations and results |

By being mindful of these common pitfalls and implementing strategies to avoid them, you can improve your performance and increase your chances of success in the official assessment.

Essential Tips for Passing the FMVA

Successfully completing a financial certification requires more than just understanding the core concepts. It’s about applying that knowledge effectively under pressure. In this section, we’ll explore key strategies that can help you perform at your best when facing challenging financial scenarios.

Time Management Techniques

One of the most important skills to develop is the ability to manage your time wisely during the assessment. Here are some tips to optimize your time:

- Set time limits for each section: Break the assessment into timed intervals to ensure you spend enough time on each question.

- Prioritize easy questions: Answer the simpler questions first to build confidence before tackling more difficult ones.

- Allocate time for review: Make sure to leave a few minutes at the end to go over your answers and check for errors.

Deepening Your Understanding of Key Topics

Understanding theory is critical, but the ability to apply it in real-world contexts is what sets top performers apart. Focus on mastering these key areas:

- Financial modeling: Be comfortable building models from scratch and interpreting their results.

- Valuation techniques: Know how to use different methods to determine the value of assets and companies.

- Financial statements analysis: Learn how to interpret balance sheets, income statements, and cash flow statements.

By honing these skills and practicing consistently, you’ll be well-equipped to succeed when it’s time to face the official assessment.

Time Management for FMVA Practice

Effective time management is a key factor in successfully navigating any financial assessment. Balancing speed with accuracy is essential when facing a series of complex problems, and without proper time allocation, even the most knowledgeable individuals can struggle. This section outlines strategies for managing your time efficiently during preparation and practice sessions, ensuring that you’re both well-prepared and confident under time constraints.

The first step in managing your time is to develop a plan. Identify how much time you’ll dedicate to each section of your preparation and simulate actual conditions. By practicing under time limits, you’ll be able to build a rhythm that allows you to tackle problems more effectively without rushing or overthinking.

Another crucial aspect is prioritizing the more straightforward questions first, leaving more time for the complex ones that require deeper analysis. This ensures that you’re not caught off-guard and can allocate sufficient time to the challenging sections of your study sessions.

Where to Find Reliable FMVA Practice Tests

Finding high-quality resources for sample assessments is essential for effective preparation. Reliable practice tests can help simulate real-world scenarios, offering insight into the types of challenges you will encounter. In this section, we will explore various trusted sources where you can access top-notch practice materials to sharpen your skills and boost your confidence.

Official Resources

One of the best places to start is with the official study materials provided by the certification organization. These resources are tailored specifically to the content and format of the assessment. They often include sample questions, case studies, and comprehensive guides to help you prepare effectively. Official practice tests ensure that you are familiar with the types of scenarios and questions you will face on the actual assessment.

Online Learning Platforms

There are many reputable online platforms that offer practice tests and mock assessments designed for financial certifications. Websites such as financial education portals and forums provide users with access to high-quality materials. These platforms often offer a variety of practice questions, with explanations and solutions to help deepen your understanding. Additionally, many of these resources come with progress tracking tools to monitor your performance and highlight areas for improvement.

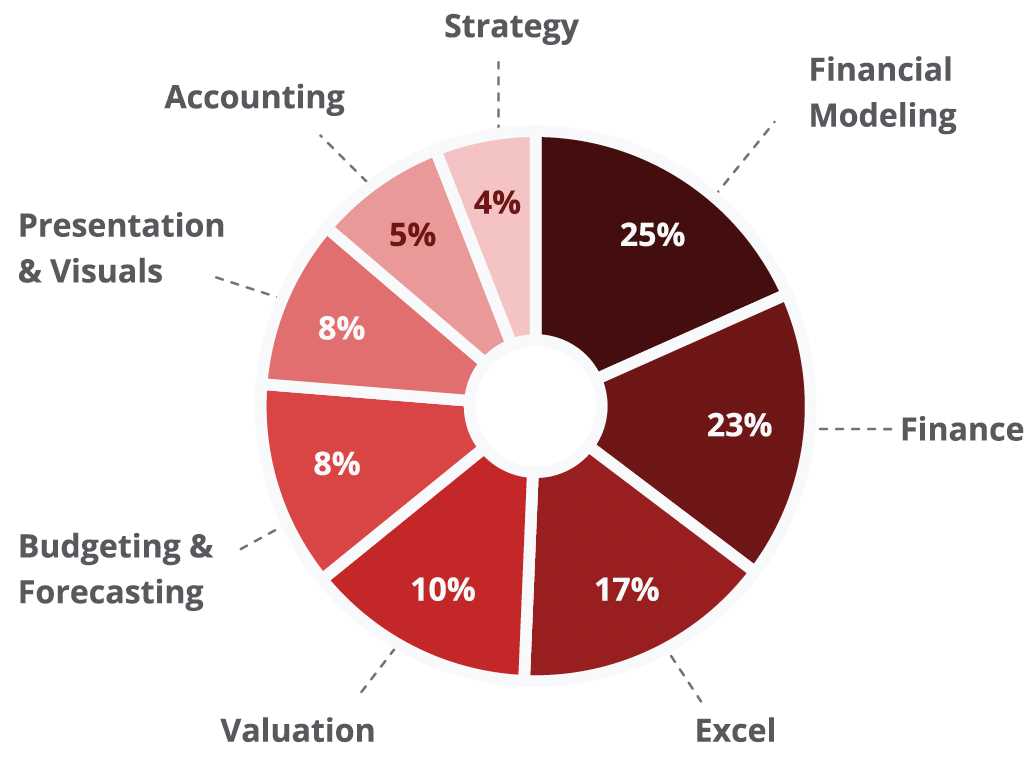

Role of Financial Modelling in FMVA

Financial modelling plays a critical role in preparing for financial certifications, as it is the foundation for many analytical tasks and decision-making processes. It is a vital skill that enables professionals to represent real-world financial situations with accuracy and clarity. This section will explore how financial modelling is integrated into the learning path and why it is essential for success in the certification process.

Applications of Financial Modelling

Financial models are used to forecast future performance, evaluate investment opportunities, and assess business strategies. Understanding how to create and interpret financial models is essential for demonstrating analytical proficiency. Key applications include:

- Valuation: Modelling company values based on various metrics like cash flow, assets, and market performance.

- Budgeting and Forecasting: Projecting future financial outcomes to guide business planning and strategy.

- Risk Assessment: Analyzing potential risks and determining their impact on financial stability.

Benefits of Mastering Financial Modelling

Proficiency in financial modelling not only strengthens your analytical abilities but also enhances your ability to communicate complex financial data to stakeholders. By mastering this skill, you will:

- Develop deeper insights: Gain a better understanding of financial systems and how different factors influence business decisions.

- Improve problem-solving skills: Learn to approach financial challenges with structured, data-driven solutions.

- Increase career prospects: Financial modelling is a highly sought-after skill in many industries, increasing your value in the job market.

By focusing on mastering financial modelling, you’ll be well-equipped to tackle the challenges presented in the certification process and in real-world financial analysis.

FMVA Certification and Career Opportunities

Achieving financial certification opens doors to a range of exciting career opportunities. With this qualification, professionals are equipped with advanced financial knowledge and skills, positioning them as valuable assets in the finance industry. This section highlights the career benefits of obtaining this certification and the potential career paths it can unlock.

Career Advancement with Financial Certification

Certification in financial modelling and valuation can significantly enhance your career trajectory. It demonstrates a high level of competence in key areas such as financial analysis, valuation techniques, and business strategy. Here are some key advantages of having this certification:

- Enhanced Credibility: A recognized certification sets you apart in a competitive job market and builds trust with clients and employers.

- Increased Earning Potential: Certified professionals often command higher salaries due to their specialized skills and expertise.

- Career Flexibility: Financial modelling and analysis skills are applicable across various sectors, providing opportunities in investment banking, consulting, corporate finance, and more.

Potential Career Paths

With a certification in financial analysis, you can pursue several career paths across industries. Some of the most common roles include:

- Investment Banking Analyst: Focus on assessing investment opportunities, mergers, and acquisitions.

- Financial Consultant: Advise businesses on strategies for improving financial performance and managing risks.

- Corporate Finance Professional: Manage financial planning, budgeting, and investment strategies for companies.

- Private Equity Associate: Work in assessing investments, managing portfolios, and maximizing returns in private equity firms.

Whether you’re looking to advance within your current role or switch industries, the knowledge gained through financial certification will help you stand out in a competitive job market and prepare you for a successful career in finance.

Strategies for Tackling Difficult FMVA Questions

When faced with challenging questions in financial assessments, having a clear strategy can make all the difference. Difficult problems often require a combination of technical knowledge, critical thinking, and effective time management. This section explores practical strategies to approach tough questions and ensure you are well-prepared to solve even the most complex scenarios.

Breaking Down Complex Problems

One of the most effective techniques when encountering a difficult question is to break it down into smaller, more manageable parts. Start by identifying the core issue and focusing on the key information provided in the question. Highlighting relevant details will help you avoid unnecessary distractions and allow you to focus on the critical elements needed to find the solution.

Additionally, take a step-by-step approach to solving the problem. Start with any known formulas or principles and apply them systematically. This method helps build a structured framework for tackling even the most intricate calculations or concepts.

Managing Time and Stress

Time pressure can add to the difficulty of a question, especially when you feel uncertain about the answer. To manage this, prioritize your time effectively. If a question is taking too long, it may be wise to move on and return to it later with a fresh perspective. Practice under timed conditions to simulate the pressure of the actual test and train your mind to stay focused and calm under stress.

It’s also essential to maintain a positive mindset. Challenging questions are a natural part of any assessment, and approaching them with confidence can help you think more clearly. If you encounter a particularly tough question, don’t panic–take a deep breath, review the material, and apply your strategies with patience and precision.

How to Review Your FMVA Practice Answers

Reviewing your responses to financial assessment questions is a crucial step in reinforcing your understanding and improving your performance. It’s not just about identifying the right or wrong answers, but also about understanding why certain approaches work and others do not. This section outlines effective strategies for reviewing your responses and maximizing learning from each question.

Analyzing Correct Responses

When reviewing the questions you answered correctly, take the time to understand why your approach was successful. Reflect on the thought process that led to the right solution. Did you use the correct formulas? Did you identify all relevant variables? By analyzing your correct answers, you can reinforce the methods and techniques that worked and commit them to memory.

It is also helpful to identify patterns in your correct answers. Are there specific topics or types of questions where you consistently perform well? This insight can help you focus on areas where your strengths lie and further develop those skills.

Learning from Mistakes

Equally important is learning from your mistakes. When you identify incorrect answers, it’s essential to understand the root cause of the error. Did you misinterpret the question, overlook critical information, or apply the wrong method? Review the material related to the question to identify where your understanding may have faltered. Focus on the concepts and principles behind the question rather than simply memorizing the correct answer.

Consider revisiting these difficult areas in-depth and reattempting similar problems until you gain confidence. A key part of mastering financial assessments is turning weaknesses into strengths, and thorough review is the best way to achieve this.

Maximizing Your Study Plan for FMVA

Creating an effective study plan is crucial to mastering the material and performing well in financial assessments. A well-structured approach helps you stay focused, cover all necessary topics, and efficiently manage your time. This section will guide you through strategies to optimize your study schedule and ensure you are fully prepared for success.

Set Clear Goals and Deadlines

Start by setting specific goals for each study session. These goals should be measurable and realistic, such as mastering a particular financial modeling technique or reviewing a set number of practice questions. Break down complex topics into smaller, manageable sections and allocate a set amount of time to each. Setting deadlines for each goal helps keep you on track and prevents procrastination.

Be mindful of your progress and adjust your plan if necessary. If a certain area is proving to be more challenging than expected, allow additional time for review and practice. Consistently track your improvement to stay motivated throughout your preparation process.

Incorporate Active Learning Techniques

Passive reading and note-taking are important, but active learning techniques can significantly enhance your retention and understanding. Engage with the material by solving problems, applying concepts to real-world scenarios, and testing your knowledge through mock exercises. Active learning allows you to identify areas of weakness, refine your skills, and reinforce what you’ve learned.

Additionally, incorporate spaced repetition into your study routine. Revisit previously covered topics at regular intervals to ensure long-term retention. Using flashcards, creating summaries, or teaching the material to someone else are all effective strategies to solidify your knowledge.

Resources to Support FMVA Exam Preparation

Preparing for financial assessments requires the right resources to enhance your understanding and help you practice effectively. The right tools can make a significant difference in your study journey by providing valuable insights, offering practice opportunities, and helping you focus on essential concepts. In this section, we’ll explore various resources that can support your preparation efforts.

Online Learning Platforms

Online learning platforms offer structured courses, video tutorials, and interactive content designed to break down complex topics. These platforms often provide access to expert instructors and forums where you can ask questions and share knowledge. Look for reputable platforms that cover a broad range of financial topics, including financial modeling, analysis, and valuation techniques. Many platforms also provide practice quizzes and mock exams to help solidify your understanding.

Study Guides and Textbooks

Study guides and textbooks are excellent resources for deepening your knowledge of financial concepts and methodologies. They often contain comprehensive explanations, worked examples, and sample questions. Consider using resources that are specifically tailored to the financial sector, with content that aligns with the skills being tested. A good textbook will allow you to go beyond memorization and develop a deeper understanding of the material.

Practice Tests and Simulations

While textbooks and guides are helpful, practice tests are essential for reinforcing your knowledge and honing your problem-solving skills. Simulating the conditions of the actual assessment allows you to become familiar with the question formats and time constraints. These tests provide immediate feedback, enabling you to identify areas where you may need further improvement. Make sure to use reliable practice tests that reflect the scope and difficulty of the actual assessment.

Peer Groups and Study Forums

Collaborating with others can enhance your learning experience. Join study groups or online forums where you can discuss difficult topics, share tips, and learn from others’ experiences. Engaging with peers allows you to get different perspectives on challenging subjects, clarifies doubts, and reinforces your understanding of key concepts. Being part of a study group can also motivate you to stay on track and maintain a consistent study schedule.

What to Expect on Test Day

On the day of your financial assessment, being well-prepared both mentally and logistically is key to ensuring a smooth experience. Understanding what to expect can help ease any anxiety and allow you to focus entirely on performing your best. From the check-in process to the time constraints, it’s essential to know what will unfold so you can manage the situation effectively.

Arrival and Check-In Process

Upon arriving at the testing center or logging into the online platform, you’ll need to complete the check-in process. This may involve verifying your identity with an ID card or other form of authentication, especially if the assessment is being taken remotely. Make sure to arrive early to allow time for any potential delays or technical checks. For online assessments, ensure that your internet connection and device are working properly before the scheduled start time.

Time Management and Question Format

Once the test begins, you’ll be presented with a series of questions that assess your knowledge in financial analysis, valuation, and modeling. Be mindful of the time limits for each section. The assessment may include multiple-choice questions, short-answer questions, and practical scenarios requiring calculations or analysis. It’s important to stay focused and pace yourself to avoid spending too much time on any single question.

Prepare for the possibility of complex scenarios where you will need to apply concepts learned during your studies. Try not to rush through the questions, but rather read each one carefully and prioritize your answers based on the level of difficulty. Practicing with time constraints beforehand can help you get a feel for how to manage your time effectively during the actual test.