Successfully navigating evaluations related to public sector finance requires a strong grasp of key principles, concepts, and practical applications. Mastering these areas will significantly improve performance when facing various challenges. Understanding the core material helps in building confidence and ensuring clarity when responding to complex scenarios.

In this guide, we’ll focus on typical inquiries that may arise in such evaluations. We will explore strategies for approaching each topic, alongside examples that illustrate the thought process required to tackle them. By breaking down the material systematically, you will be better prepared to address even the most intricate tasks.

Focus is essential when preparing for assessments that test knowledge and application skills. Clear comprehension of basic frameworks, along with an ability to interpret real-world situations, will help navigate the entire process with efficiency. Mastering these aspects will ensure readiness for any financial challenges posed by these evaluations.

Public Sector Financial Assessments and Solutions

Preparing for evaluations in the field of public finance requires familiarity with core concepts, methodologies, and practices. This section delves into common challenges encountered during such evaluations, providing insights on how to effectively address them. By understanding the typical scenarios posed in these tests, you can sharpen your problem-solving skills and improve your ability to provide accurate responses under pressure.

Key Areas to Focus On

Understanding the essential elements of public sector financial management is crucial for excelling in any assessment. Key topics include revenue recognition, expenditure tracking, budgeting, and the management of public funds. Preparing for tasks that require you to calculate, analyze, and interpret financial data will ensure that you’re ready for any scenario.

Sample Scenarios

Below is a table illustrating common tasks often encountered in these assessments. These examples demonstrate the types of financial problems you may be asked to resolve, with a focus on analyzing and applying relevant financial information.

| Scenario | Objective | Approach |

|---|---|---|

| Analyzing Budget Deficit | Determine the root cause of a budget shortfall and propose solutions | Identify key financial discrepancies and recommend corrective actions |

| Revenue Forecasting | Estimate future revenue based on historical data | Utilize past trends and adjust for potential future changes |

| Expenditure Allocation | Assess the distribution of funds across various programs | Ensure proper alignment with financial regulations and policy priorities |

Key Topics for Public Sector Financial Assessments

When preparing for evaluations in public sector finance, focusing on core subjects is essential for success. These topics often cover a broad range of financial practices that are vital for managing public resources effectively. A deep understanding of these areas ensures a solid foundation when facing complex scenarios and challenges in this field.

Key areas include the management of funds, budget creation and oversight, financial reporting, and compliance with relevant regulations. Proficiency in these topics is crucial for analyzing fiscal health, making informed decisions, and ensuring transparency in financial processes. By mastering these areas, individuals are better equipped to handle both theoretical and practical aspects of public finance assessments.

Understanding the Basics of Public Sector Finance

Grasping the fundamental concepts in public financial management is essential for navigating evaluations related to fiscal responsibilities. The principles that guide these practices provide a framework for managing public resources, ensuring that funds are allocated properly and used effectively. These foundational elements help in understanding the structure of budgets, financial statements, and regulatory compliance within the public sector.

Key Principles to Focus On

At the heart of public finance lies the need to adhere to specific rules and procedures that govern fund distribution and usage. These rules ensure that financial activities are conducted transparently, with an emphasis on accountability. Transparency and accuracy are paramount when handling public funds, and mastering these concepts will prepare you for real-world applications.

Critical Areas of Study

Familiarizing yourself with core topics such as revenue management, expenditure tracking, and financial reporting is key. In-depth knowledge of these areas equips you to understand how financial data is compiled, analyzed, and presented in the public sector. Moreover, a strong understanding of fiscal policies and procedures ensures that all financial operations are compliant with the relevant standards and regulations.

Common Assessment Challenges and Response Techniques

Facing challenges in public sector financial assessments requires both a solid understanding of the material and effective strategies for addressing various tasks. These assessments typically feature problems that test your ability to apply theoretical knowledge to real-world scenarios. Developing a structured approach to tackling these challenges can significantly improve performance and ensure accurate responses.

One common approach to handling these tasks involves breaking down the problem into manageable components. By identifying key information, organizing your thoughts, and applying the appropriate methods, you can efficiently resolve complex issues. Time management also plays a crucial role, ensuring that you allocate sufficient time for each task and avoid rushing through critical steps.

When confronted with calculation-based problems, it’s important to review the data thoroughly before attempting any solutions. For qualitative assessments, a clear explanation of your reasoning and the logical steps taken will demonstrate a strong understanding of the material. By practicing these techniques, you can approach these challenges with confidence and clarity.

Preparation Tips for Public Sector Financial Tests

Effective preparation is crucial for performing well in assessments related to public finance. A thorough understanding of the material, combined with practical study strategies, can greatly enhance your ability to tackle various tasks. By following a structured approach and honing specific skills, you can improve your chances of success and navigate challenges with confidence.

Focus on mastering the core topics, while also practicing time management and problem-solving techniques. Identifying weak areas and reviewing past examples is another important part of the preparation process. The more you familiarize yourself with the structure of these tests, the more comfortable you’ll become in applying your knowledge under pressure.

The following table outlines key strategies to incorporate into your study routine:

| Strategy | Tip |

|---|---|

| Topic Review | Study essential concepts and focus on areas where you feel less confident |

| Practice Problems | Work through sample problems to strengthen problem-solving skills |

| Mock Assessments | Simulate test conditions to build familiarity and reduce anxiety |

| Time Management | Set time limits for each section to practice answering efficiently |

Essential Financial Principles for Public Sector Assessments

Understanding the core principles that govern the management of public resources is crucial for success in assessments related to fiscal responsibilities. These foundational rules provide the framework for tracking revenues, managing expenditures, and ensuring that financial operations align with legal and regulatory standards. Mastering these principles allows individuals to approach complex financial tasks with clarity and confidence.

Key Concepts to Understand

At the heart of public finance management are principles such as transparency, accountability, and compliance. These concepts ensure that public funds are used efficiently and responsibly. By adhering to these standards, financial professionals can contribute to maintaining public trust and ensuring that resources are managed effectively for the benefit of society.

Critical Areas for Study

Focus on understanding topics such as budgeting processes, fund allocation, and financial reporting. Familiarity with how funds are distributed across various programs and how expenditures are tracked is essential. A solid grasp of the principles of fund balance and the differences between various types of financial statements will also help in interpreting and applying financial data effectively during assessments.

Common Pitfalls in Public Sector Financial Assessments

While preparing for evaluations related to public financial management, it’s essential to be aware of potential pitfalls that can undermine your performance. These challenges often arise from common mistakes or misunderstandings that can lead to incorrect conclusions or missed opportunities to demonstrate your knowledge. Recognizing these issues ahead of time helps in avoiding them and ensures a more successful experience.

Overlooking Key Information

A frequent mistake is failing to carefully analyze all available data. It’s easy to miss important details in complex scenarios, especially when under time pressure. Always take the time to review each section thoroughly, ensuring that you address all aspects of the task. Skipping steps or assuming information is less relevant can lead to incomplete or inaccurate solutions.

Misunderstanding Financial Terminology

Another common challenge is confusion with financial terminology. Terms like “liabilities,” “fund balances,” and “expenditures” may seem straightforward, but their application can vary depending on the context. Ensure you understand not only the definitions but also how these terms apply in public sector settings. Clarifying terminology in the context of each problem will help avoid errors in your response.

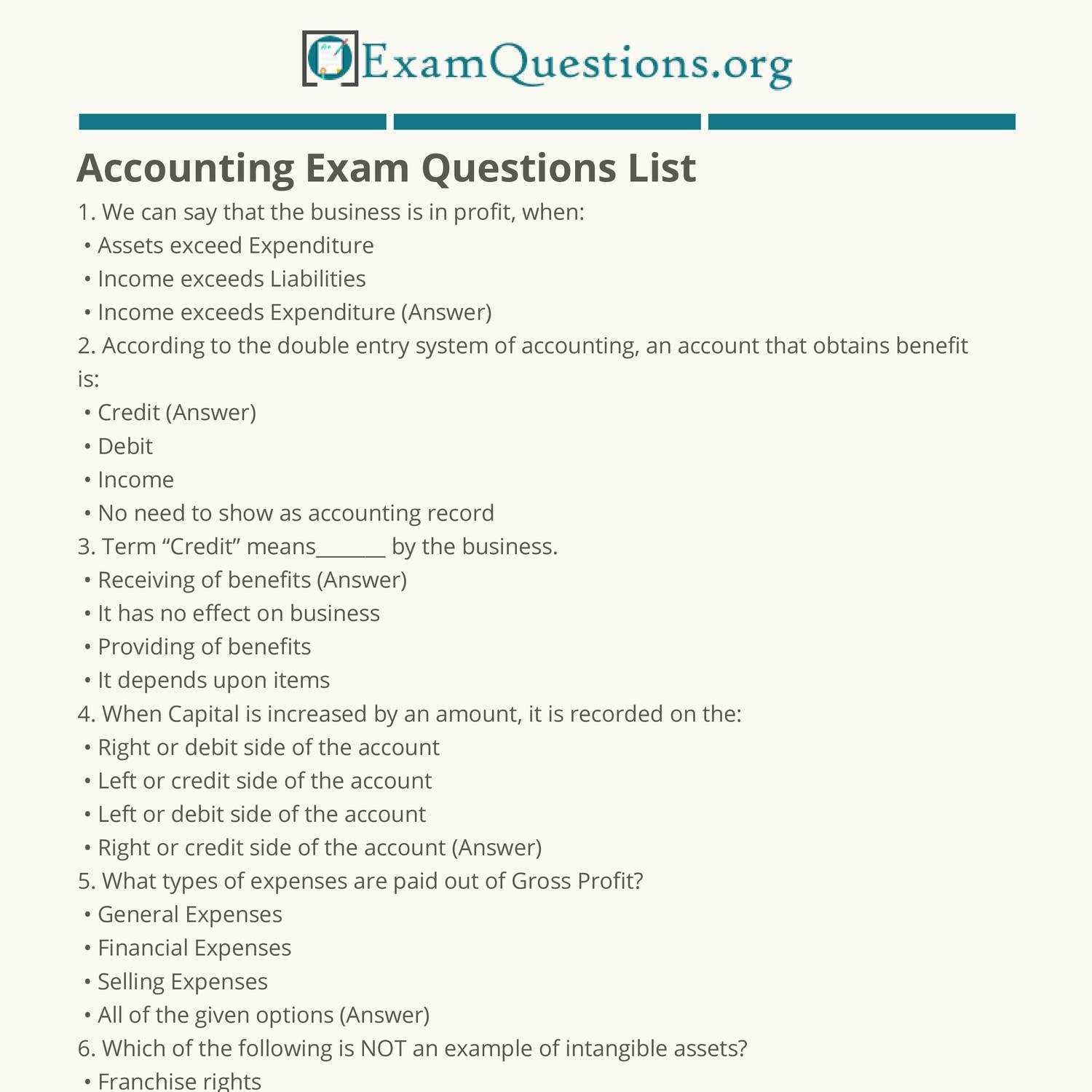

How to Tackle Multiple Choice Challenges

Multiple choice problems are a common format in assessments, often testing your ability to recall key information and apply it to specific scenarios. While these tasks may seem straightforward, they require a strategic approach to maximize your performance. Knowing how to effectively narrow down options and avoid common traps can help you make the right choices under time constraints.

Read Each Option Carefully

One of the most important steps is to read each available choice thoroughly. Even though some options may seem similar, subtle differences can be the key to selecting the correct one. Take the time to compare all the alternatives before making your final selection. Eliminating incorrect options can help you focus on the most likely answers and improve your chances of success.

Use Logical Reasoning

Sometimes, the correct choice may not be immediately obvious. In these cases, logical reasoning plays a crucial role. If you’re unsure of an answer, try to deduce the correct one based on what you know about the topic. Look for clues in the phrasing or context that could guide your decision. In some cases, the wrong answers will contain exaggerated or impractical information, helping you rule them out.

Breaking Down Financial Statements in Assessments

When confronted with financial statements during an assessment, it’s crucial to approach them methodically. These documents can appear complex at first glance, but understanding their structure and purpose will allow you to analyze the data effectively. By breaking down the key sections and focusing on important figures, you can accurately interpret the information and respond with confidence.

Key Components to Focus On

The first step is to familiarize yourself with the major components of a financial statement. Typically, you’ll encounter elements such as revenue, expenditures, assets, and liabilities. Each of these categories provides insight into the financial health and operations of the entity in question. Paying attention to the relationships between these components will help you understand how different figures interact and impact overall financial performance.

Common Mistakes to Avoid

One common mistake is overlooking subtleties in the details. Numbers may appear to match, but discrepancies in classification or timing could lead to misinterpretation. Always double-check calculations and ensure you’re interpreting the information based on the correct context. Understanding the context–such as whether a figure represents a current or non-current asset–is essential for making the right conclusions.

Important Rules and Regulations in Public Sector Finance

In public sector financial management, adhering to the correct rules and regulations is essential for ensuring transparency, accountability, and compliance with legal standards. These guidelines govern how funds are handled, reported, and allocated. Understanding these frameworks is crucial for accurately managing finances and ensuring the proper use of public resources.

Key Principles to Follow

The foundation of managing public resources effectively lies in several key principles. These regulations are designed to maintain integrity in financial operations and ensure the proper use of taxpayer money. Some of the critical rules include:

- Transparency: Financial records must be open and accessible to the public, ensuring that expenditures and allocations can be tracked and verified.

- Accountability: Public officials are responsible for managing funds according to established procedures, ensuring proper use and addressing any misuse.

- Compliance: Financial operations must align with legal requirements and regulatory standards, avoiding violations that could lead to penalties or loss of trust.

Common Regulatory Frameworks

There are several widely recognized frameworks that govern the management of public funds. These frameworks help standardize processes and ensure consistency across different levels of government. Some examples include:

- International Public Sector Accounting Standards (IPSAS): Provides global standards for reporting public sector finances.

- Generally Accepted Accounting Principles (GAAP): A set of rules commonly used in many countries for preparing financial statements.

- Government Financial Reporting Frameworks: Specific national or regional frameworks designed to align with local legal and financial requirements.

By understanding and applying these rules, individuals working in public finance can ensure that funds are handled responsibly, ethically, and in accordance with legal obligations.

Handling Complex Scenarios in Financial Tasks

When faced with intricate financial tasks, the key to success lies in breaking down the problem into manageable steps. These scenarios often involve multiple variables, requiring a deeper understanding of the concepts involved. By following a structured approach and applying logical reasoning, you can navigate even the most complex cases with confidence and accuracy.

Step-by-Step Analysis

The first step in tackling complex situations is to carefully read the entire problem. Understand what is being asked and identify the key figures involved. Breaking the problem down into smaller sections allows you to focus on each element without feeling overwhelmed. This approach also makes it easier to spot inconsistencies or missing information that could impact your solution.

Use of Logical Frameworks

Another effective method is to apply relevant frameworks or formulas that help organize your thinking. In financial tasks, understanding how different elements interact–such as revenues, expenses, and assets–can guide your analysis. Applying these frameworks systematically ensures you address every aspect of the problem, leading to a well-rounded and accurate response.

Examining Revenue Recognition in Public Sector Context

Revenue recognition plays a crucial role in how financial transactions are recorded and reported. In the public sector, understanding when and how to recognize income is vital to ensuring transparency and accountability. Unlike the private sector, where revenue recognition is primarily tied to performance and contracts, the public sector involves different rules and considerations, including grant allocations, taxes, and other government-related sources of income.

Key Principles of Revenue Recognition

In the public sector, revenue recognition is typically governed by a set of guidelines that focus on the timing and conditions under which revenue should be reported. Here are some of the core principles to keep in mind:

- Earned Income: Revenue should be recognized when it is earned, such as when a service is provided or a tax obligation is met.

- Availability: Income is recognized only when it is available for spending within the fiscal year, ensuring that funds are reported accurately.

- Grant Recognition: Grants should be recognized when eligibility requirements are met, and funds are expected to be received.

Examples of Revenue Recognition

Different sources of revenue require different methods for recognition. The following table outlines some common examples in the public sector:

| Source | Recognition Method | Timing |

|---|---|---|

| Taxes | Recognized when assessed and due | Upon assessment |

| Government Grants | Recognized when conditions for receipt are met | Upon meeting grant conditions |

| Fees for Services | Recognized when services are rendered | When the service is provided |

By understanding these principles and applying them correctly, public sector entities can ensure accurate financial reporting, contributing to better resource management and public trust.

Understanding Expenditures and Liabilities

In the context of financial management, it is essential to distinguish between expenditures and liabilities. These two concepts represent different aspects of a financial entity’s obligations and outflows, yet they are interconnected. Expenditures refer to the actual outflow of resources to meet operational needs, while liabilities represent the future financial obligations that a group must settle. Both are crucial for assessing an organization’s financial health and ensuring compliance with fiscal responsibilities.

Expenditures

Expenditures are the costs incurred in the process of carrying out activities, whether for operational purposes, acquisitions, or providing services. These outflows are recorded when resources are used, and they affect the overall financial position. Below are some key types of expenditures:

- Capital Expenditures: These are long-term investments made in assets such as buildings, infrastructure, or equipment.

- Operational Expenditures: These involve the day-to-day expenses necessary for running an organization, such as salaries, utilities, and supplies.

- Transfer Payments: Payments made to individuals or other entities, such as subsidies, grants, or welfare payments.

Liabilities

Liabilities, on the other hand, refer to the financial obligations an organization must settle in the future. These can arise from borrowing, contractual commitments, or other legal responsibilities. Properly managing liabilities is crucial to maintaining a stable financial condition. The key categories include:

- Short-Term Liabilities: Obligations that must be paid within one year, such as accounts payable and short-term loans.

- Long-Term Liabilities: These include debts or obligations that are due after more than a year, such as bonds, pensions, and long-term loans.

- Contingent Liabilities: Potential obligations that may arise depending on the outcome of future events, such as lawsuits or warranty claims.

Both expenditures and liabilities are fundamental components in preparing financial statements and ensuring the accurate representation of an organization’s fiscal standing. A solid understanding of how they work together allows for better financial planning and management.

How to Approach Budgeting and Forecasting Questions

When faced with inquiries related to financial planning and projections, it is essential to understand the principles behind resource allocation and future estimations. These areas require not only mathematical accuracy but also an understanding of the broader financial context. Effective strategies for approaching these types of questions involve breaking down complex scenarios into manageable components and applying relevant financial models to generate precise predictions.

Understanding the Basics of Budgeting

Budgeting involves planning and allocating financial resources for specific activities or projects within an organization. In such questions, focus on identifying the primary objectives of the budget, the key categories of expenditure, and how resources are prioritized. Common steps include:

- Identifying Financial Goals: Understand the overall goals of the budget and how they align with the organization’s strategic objectives.

- Determining Key Categories: Categorize expenses into fixed, variable, and one-time costs.

- Allocating Resources: Allocate funds appropriately based on the importance and urgency of each activity or department.

Forecasting Future Financial Outcomes

Forecasting, on the other hand, focuses on predicting future financial results based on historical data and trends. For these types of inquiries, concentrate on understanding the methodologies used in forecasting, such as trend analysis or regression models. Key elements include:

- Analyzing Historical Data: Look for trends or patterns that can help predict future financial conditions.

- Using Statistical Models: Apply methods like time-series analysis or moving averages to estimate future income or expenditure.

- Considering External Factors: Take into account market trends, inflation rates, and other external variables that might impact financial projections.

In both budgeting and forecasting, practice is essential. Being able to analyze data critically and apply appropriate methodologies ensures the most accurate results. By mastering these approaches, you will be able to effectively navigate related financial challenges and scenarios.

Key Formulas to Know for the Exam

In the world of financial assessments, understanding key mathematical formulas is crucial for success. These formulas help solve common scenarios related to budgeting, forecasting, and financial analysis. Familiarity with these calculations will enable you to quickly and efficiently answer questions that require numerical solutions. Below are some of the most important formulas to remember.

Essential Financial Ratios

Several formulas focus on assessing the financial health of an organization. These ratios provide insights into liquidity, profitability, and efficiency. Key ratios to understand include:

- Liquidity Ratio: Current Assets / Current Liabilities – Measures an entity’s ability to pay short-term obligations.

- Profit Margin: Net Income / Revenue – Indicates how much profit is generated from sales after expenses.

- Return on Investment (ROI): (Net Profit / Investment) * 100 – Calculates the return on an investment relative to its cost.

- Debt-to-Equity Ratio: Total Debt / Total Equity – Shows the proportion of debt used to finance the company’s assets.

Budgeting and Forecasting Formulas

When working with financial planning and projections, it is important to know formulas for estimating future values and allocating resources effectively. Some of the commonly used formulas include:

- Budget Variance: Actual Budget – Planned Budget – Measures the difference between what was planned and what was spent.

- Forecasting Formula: Future Value = Present Value * (1 + Interest Rate) ^ Time – Used to project future values based on current data and expected growth rates.

- Fixed Cost Allocation: Fixed Costs / Total Units Produced – Helps to determine how much fixed cost applies to each unit produced.

Mastering these formulas will not only help you approach financial challenges with confidence but also streamline your ability to work through complex numerical problems. Being able to recall and apply these key calculations efficiently will greatly enhance your performance.

Time Management Strategies During the Exam

Efficient time management during assessments is essential for achieving the best possible outcomes. By allocating the right amount of time to each task, you can ensure that every section receives the attention it deserves. Strategic planning and pacing will prevent unnecessary stress and allow for a thorough review of your work. Below are several key strategies to help you maximize your performance under time constraints.

Preparation Before the Test

Effective time management begins long before the actual test day. By preparing in advance, you can avoid feeling rushed during the assessment. Consider the following tips:

- Familiarize Yourself with the Format: Understand the types of tasks you will be asked to complete. This helps you allocate the appropriate amount of time to each section based on difficulty.

- Practice Timed Mock Tests: Simulate the test environment by completing practice tests under timed conditions. This will help you get comfortable with the pacing.

- Review Key Material Efficiently: Focus on high-priority topics that are most likely to appear. A targeted review will ensure that you are well-prepared without wasting time on less relevant content.

During the Test

Once you are in the middle of the assessment, it is important to keep track of time and maintain a steady pace. Follow these steps to manage your time effectively:

- Scan the Entire Test First: Quickly review the entire test to get an overview. This will allow you to identify easier questions that can be answered quickly, saving more time for challenging ones.

- Prioritize Easy Tasks: Start with the questions that are easiest for you. This will help build confidence and ensure that you don’t miss any simple points.

- Set Time Limits: Allocate a specific amount of time for each section or question. Stick to this limit to avoid spending too much time on any one task.

- Leave Time for Review: Reserve the last few minutes of the test to review your answers. This final check can help you spot any errors or missed details.

By employing these strategies, you will improve your ability to manage time effectively and approach the assessment with greater focus and confidence. Time management is not just about speed but also about making thoughtful decisions about where to direct your energy for optimal results.

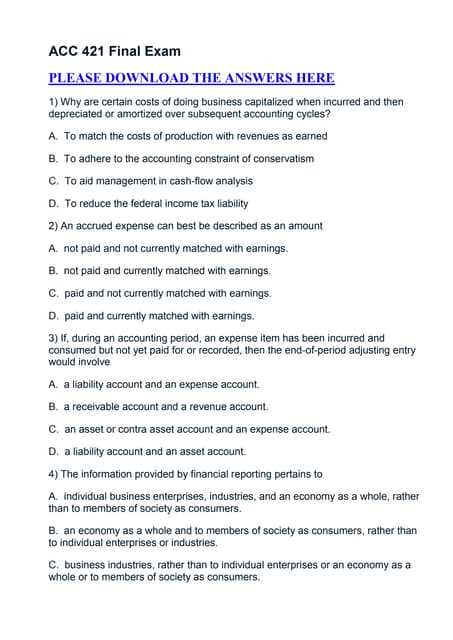

Sample Government Accounting Exam Questions

This section provides examples of common tasks and scenarios you may encounter during assessments. These tasks are designed to evaluate your understanding of core principles and your ability to apply them in practical situations. Reviewing these examples can help you familiarize yourself with the types of challenges you might face and the critical thinking required to tackle them effectively.

Example 1: Financial Reporting

Given the following financial data, prepare a summary report that outlines the key figures and highlights any discrepancies. Focus on identifying trends and anomalies.

- Revenue: $500,000

- Expenses: $350,000

- Assets: $200,000

- Liabilities: $100,000

- Net Income: $150,000

What insights can be drawn from these figures? Are there any potential issues with the financial structure?

Example 2: Budget Analysis

Your task is to review the following budget and make recommendations for reducing expenses without compromising essential services. List three areas where savings could be achieved, and explain your reasoning.

- Personnel Costs: $300,000

- Operational Expenses: $150,000

- Capital Expenditures: $50,000

- Maintenance Costs: $30,000

What measures could be implemented to optimize the budget, and which areas should remain prioritized?

Example 3: Policy Compliance

Evaluate the following scenario in which the department failed to comply with certain regulations. Identify the potential consequences and suggest corrective actions that should be taken.

- Policy: The department must adhere to annual financial audits.

- Scenario: No audit was conducted in the last fiscal year.

What steps should be taken to resolve this issue, and what are the possible legal or financial repercussions of non-compliance?

These examples reflect the kinds of practical situations that may require detailed analysis, critical thinking, and knowledge of the regulations governing financial management. Being prepared for these scenarios will help ensure a stronger performance.

Reviewing Past Papers and Solutions

Going through previous assessments and their corresponding solutions is a valuable way to reinforce your understanding of key concepts. By reviewing past materials, you can familiarize yourself with the types of scenarios and tasks commonly presented. This exercise not only enhances your problem-solving skills but also helps identify areas where further study is necessary.

Benefits of Reviewing Past Materials

- Familiarity with Question Formats: Understanding the typical structure and style of tasks helps reduce surprises and boosts confidence.

- Identifying Common Topics: Recognizing recurring themes allows you to focus your preparation on areas most likely to be tested.

- Practice Problem Solving: Revisiting solved examples enables you to apply your knowledge and refine your reasoning techniques.

- Time Management: Analyzing past papers can improve your ability to manage time effectively during the actual assessment.

Approaching Solutions for Better Understanding

Merely reviewing questions is not enough; it is crucial to examine the provided solutions thoroughly. Consider how the solutions are structured, why certain methods are used, and whether there are alternative approaches that could yield the same result. The goal is to gain a deeper understanding of how to break down complex problems and systematically solve them.

- Step-by-step Analysis: Pay close attention to how each solution is developed and the rationale behind every calculation.

- Identifying Mistakes: If any errors are present in the solutions, challenge yourself to pinpoint them and learn from them.

- Alternative Methods: Look for different ways to approach problems and assess which techniques are most efficient and appropriate.

By dedicating time to this review process, you can significantly improve your preparation, develop a sharper focus on the key areas, and build confidence in your ability to tackle similar problems during the actual assessment.