In today’s procurement landscape, understanding the rules and processes involved in managing financial transactions is crucial for efficiency and legal compliance. This section aims to equip individuals with the knowledge needed to navigate the complex regulations that govern the handling of official funds.

Successful completion of the relevant assessments requires a solid grasp of the core principles that drive purchasing activities. It involves mastering a variety of key concepts, from understanding the specific rules for authorized expenditures to knowing how to manage and report financial transactions correctly. Failing to comply with these rules can lead to significant consequences, making proper preparation vital.

Whether you are preparing for an assessment or simply looking to improve your skills, this guide provides the essential insights to help you achieve a high level of competence in managing procurement-related tasks. Stay informed, stay compliant, and ensure that you are fully equipped to handle the responsibilities entrusted to you.

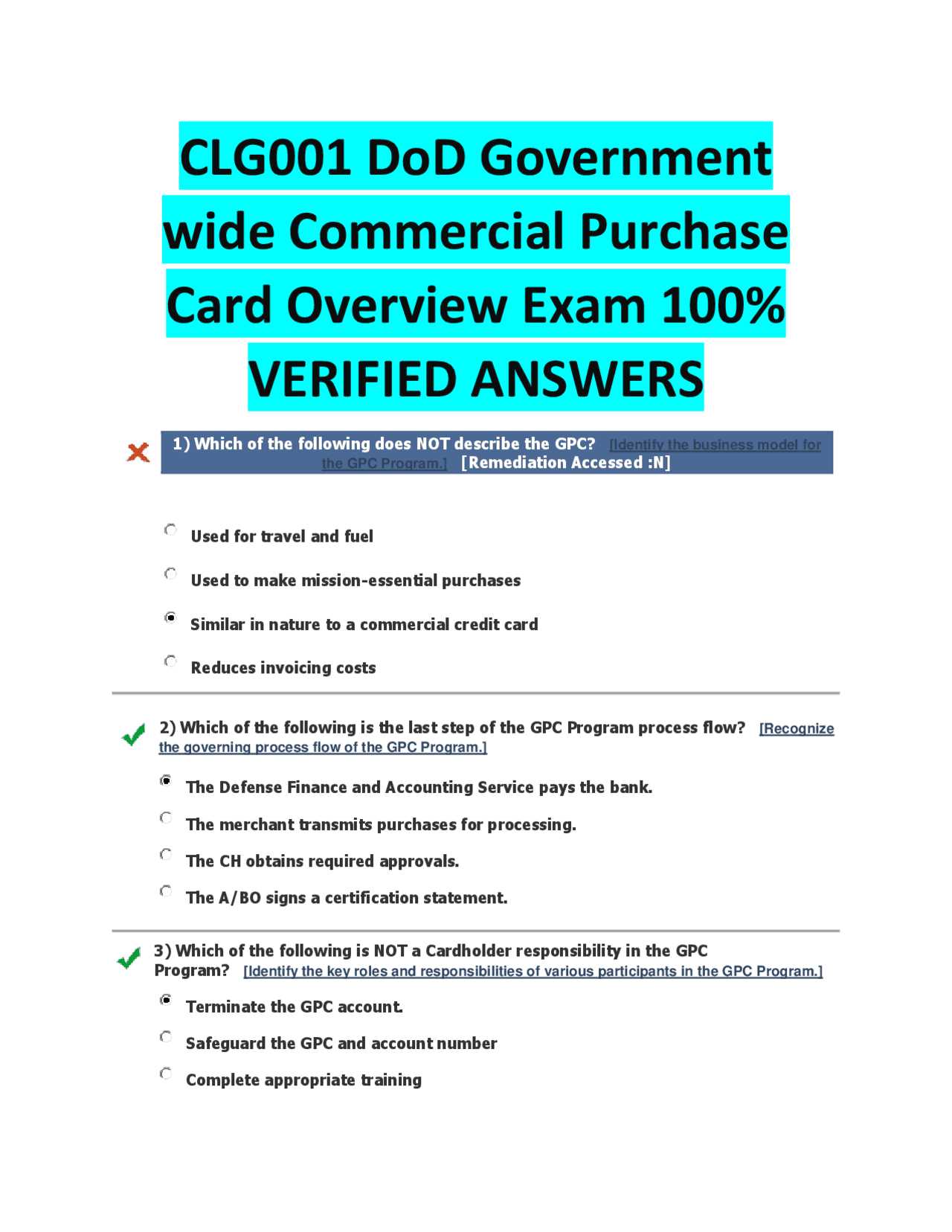

Government Purchase Card Training Exam Answers

Mastering the key aspects of managing official financial transactions is essential for anyone involved in procurement processes. This section highlights the critical areas to focus on in order to excel in assessments related to handling and reporting expenditure responsibilities. Proper understanding of the fundamental rules and procedures ensures both compliance and efficiency in financial operations.

Successfully navigating these assessments requires not only memorizing guidelines but also applying them in practical situations. It is crucial to be familiar with the common scenarios tested and the standard protocols for authorizing and tracking transactions. With the right preparation, individuals can demonstrate their ability to manage funds accurately while adhering to established regulations.

By focusing on key topics such as expenditure limits, documentation requirements, and reporting methods, individuals can confidently approach assessments and fulfill their duties with competence. Knowledge of these areas is invaluable for anyone looking to perform their role effectively and maintain integrity in financial transactions.

Understanding the Importance of Compliance

Adhering to established rules and regulations is crucial in any financial environment. It ensures that individuals act within the boundaries of legal and organizational expectations, thereby preventing misuse of resources and promoting accountability. Non-compliance can result in severe consequences, both for individuals and organizations, making it essential to understand the principles that guide responsible expenditure management.

In many organizations, financial transactions are governed by strict protocols that require individuals to act with integrity. These protocols are not merely suggestions but mandatory guidelines that ensure transparency, ethical behavior, and proper allocation of funds. Whether managing small or large budgets, every decision impacts the overall efficiency and credibility of the organization.

| Key Compliance Areas | Impact of Non-Compliance |

|---|---|

| Authorization Procedures | Potential misuse of funds and unauthorized purchases |

| Documentation Standards | Issues with recordkeeping and potential audits |

| Transaction Limits | Violation of financial regulations and penalties |

| Reporting Accuracy | Inaccurate financial statements leading to loss of trust |

By following these protocols, individuals help protect their organization from financial discrepancies and legal issues. In turn, their efforts contribute to a culture of transparency and responsibility, which is fundamental for long-term success.

Key Concepts to Master for Success

To excel in managing financial responsibilities, it is crucial to grasp several core principles that underpin effective expenditure management. These fundamental concepts ensure that individuals understand how to operate within established boundaries while maintaining ethical and efficient practices. Mastery of these topics is not just about passing assessments, but about building a foundation for success in real-world applications.

Authorization Processes are among the first concepts to master. Knowing when and how to approve transactions within set guidelines is essential to avoid errors and ensure proper allocation of funds. Understanding the criteria for valid purchases prevents misuse and helps in maintaining control over expenditures.

Documentation and Recordkeeping is another key area. Proper documentation ensures that all transactions are traceable and transparent, facilitating audits and compliance checks. Inaccurate or incomplete records can lead to complications during reviews and may undermine the credibility of the financial management system.

Transaction Limits and Spending Policies are also critical to grasp. Each transaction must fall within predefined limits, and understanding these thresholds helps to avoid violations. Staying within limits ensures that financial resources are used appropriately and that the organization adheres to budgetary constraints.

Lastly, reporting and accountability are crucial for success. Individuals must be able to generate accurate financial reports and provide justifications for expenditures. Transparency in reporting ensures that all actions align with organizational goals and regulatory requirements, building trust and maintaining operational integrity.

Common Pitfalls in Exam Preparation

When preparing for assessments related to financial responsibility, many individuals fall into the trap of focusing only on memorization rather than truly understanding key concepts. Without a deeper grasp of the material, passing the test becomes more difficult, and the ability to apply knowledge in real situations is compromised. Recognizing these common mistakes can help improve the quality of your preparation and increase your chances of success.

- Overlooking Practical Application – It’s easy to focus on theoretical knowledge, but real-world application is equally important. Understanding how to manage financial tasks in everyday scenarios is crucial for passing assessments and succeeding in the role.

- Relying Solely on Past Materials – Many people make the mistake of only studying from previous tests or sample questions. While this can help, it is essential to review the latest guidelines and regulations to ensure all material is covered.

- Neglecting Time Management – Procrastination and poor time management can lead to rushed studying. Allocate enough time to review all topics thoroughly and avoid cramming the night before.

- Ignoring Regulations and Procedures – Not paying attention to updates in rules and policies can result in a lack of understanding of current practices. Regulations evolve, so staying updated is crucial for success.

- Skipping Review of Key Concepts – Failing to revisit important areas such as authorization processes or spending limits can lead to confusion during the assessment. A comprehensive review ensures a well-rounded understanding of the subject matter.

Avoiding these common pitfalls can make a significant difference in your preparation, enabling you to approach the assessment with confidence and clarity. Understanding the material, rather than simply memorizing answers, is the key to long-term success.

Essential Regulations for Government Purchases

When managing official financial transactions, understanding the key rules and guidelines is essential for maintaining compliance and transparency. These regulations ensure that resources are allocated appropriately and that all expenditures align with organizational goals. Adhering to these principles is critical for preventing misuse, ensuring accountability, and maintaining the integrity of financial systems.

One of the primary areas to focus on is authorization procedures. This includes knowing who has the authority to approve transactions and under what circumstances. These procedures prevent unauthorized spending and ensure that funds are used only for their intended purpose.

Another important regulation is spending limits. Each transaction must fall within defined budgetary thresholds. Exceeding these limits can lead to serious consequences, including financial penalties or legal issues. It is crucial to stay informed about these thresholds and ensure all purchases remain within prescribed limits.

Recordkeeping and documentation are also key aspects of compliance. Accurate and detailed records of all transactions must be maintained for transparency and auditing purposes. This includes keeping receipts, invoices, and other relevant documents to verify the legitimacy of expenditures and to comply with regulatory standards.

Additionally, understanding the reporting requirements is essential for ensuring that all financial activities are properly tracked and reported. Timely and accurate reporting provides a clear overview of spending and helps to identify any discrepancies or irregularities in the financial process.

By mastering these essential regulations, individuals can ensure that they are managing funds responsibly, maintaining compliance with applicable laws, and contributing to the effective operation of their organization.

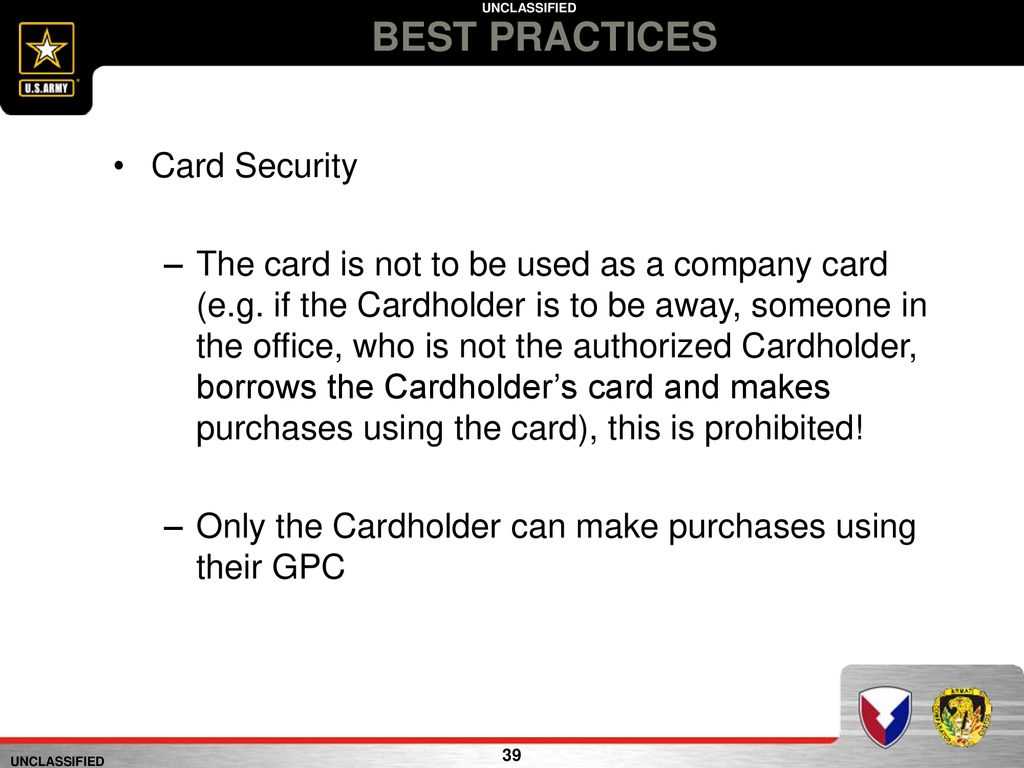

Best Practices for Cardholders

Managing official funds requires both responsibility and attention to detail. To ensure effective financial practices, individuals must follow specific guidelines that promote accountability, prevent misuse, and guarantee proper tracking of all expenditures. By adhering to best practices, cardholders can maintain compliance and make informed decisions about spending.

Establish Clear Spending Guidelines

Before making any purchase, it is essential to understand the specific limits and restrictions set by the organization. This includes knowing the budget for different categories, recognizing approved vendors, and ensuring that purchases align with organizational goals. Cardholders should always verify that the intended purchase meets all necessary criteria before proceeding.

Maintain Accurate Records

Documentation is a critical aspect of responsible financial management. Cardholders must keep detailed records of all transactions, including receipts, invoices, and relevant correspondence. These documents serve as proof of purchases and are essential for audit purposes. Timely submission of records ensures transparency and helps to avoid potential issues during reviews.

By following these best practices, individuals can enhance the integrity of financial processes and contribute to the efficient management of funds within their organization.

Strategies for Retaining Important Information

Effectively retaining critical information is key to performing well in assessments and real-world tasks related to managing financial responsibilities. Without strong memory techniques, it becomes easy to forget essential details, which can lead to costly mistakes. By employing the right strategies, individuals can enhance their ability to recall important concepts and apply them when needed.

Active Engagement with Material

One of the most effective methods for retaining information is actively engaging with the content. Rather than passively reading through materials, individuals should take notes, highlight key points, and ask questions. This interactive approach reinforces learning and helps commit important concepts to long-term memory. Summarizing key points in your own words can also aid in retention by forcing you to process the information more deeply.

Regular Review and Practice

Retention improves with consistent review. Spaced repetition is a proven technique for reinforcing memory. Set aside time to periodically go over the material, especially the areas that are more complex or challenging. Practice tests can also help solidify knowledge by testing recall under timed conditions, simulating the actual assessment environment.

By applying these strategies, individuals can build a solid foundation of knowledge that not only helps in assessments but also ensures they can perform their roles with confidence and accuracy.

How to Navigate Procurement Procedures

Successfully navigating procurement processes requires a solid understanding of organizational protocols and a clear approach to managing transactions. These procedures ensure that all purchases are legitimate, within budget, and compliant with regulatory standards. By following established steps and knowing the key requirements, individuals can avoid mistakes and maintain control over spending.

Steps for Efficient Procurement

- Understand the Policies: Familiarize yourself with the specific rules governing spending and procurement within your organization. This includes knowing what items can be purchased, from which vendors, and under what circumstances.

- Ensure Proper Authorization: Before making any purchase, confirm that it has been properly authorized by the relevant department or personnel. This step prevents unauthorized expenditures.

- Verify Budget Availability: Check if the required funds are available within the allocated budget. Staying within budget is crucial to ensure that financial limits are not exceeded.

- Maintain Accurate Documentation: Keep detailed records of all transactions, including receipts, invoices, and any relevant approvals. Proper documentation ensures transparency and accountability.

Common Challenges and How to Overcome Them

- Delays in Authorization: Delays in obtaining approval can slow down the procurement process. To avoid this, ensure that all required forms and documentation are submitted promptly and in the correct format.

- Vendors Not Meeting Requirements: Always verify vendor qualifications and product specifications before proceeding. This will help avoid purchasing items that do not meet organizational needs.

- Inaccurate Recordkeeping: Disorganized documentation can lead to confusion and errors. Regularly update and organize records to ensure everything is accounted for properly.

By following these steps and addressing common challenges, individuals can navigate procurement procedures with ease, ensuring efficiency and compliance at every stage.

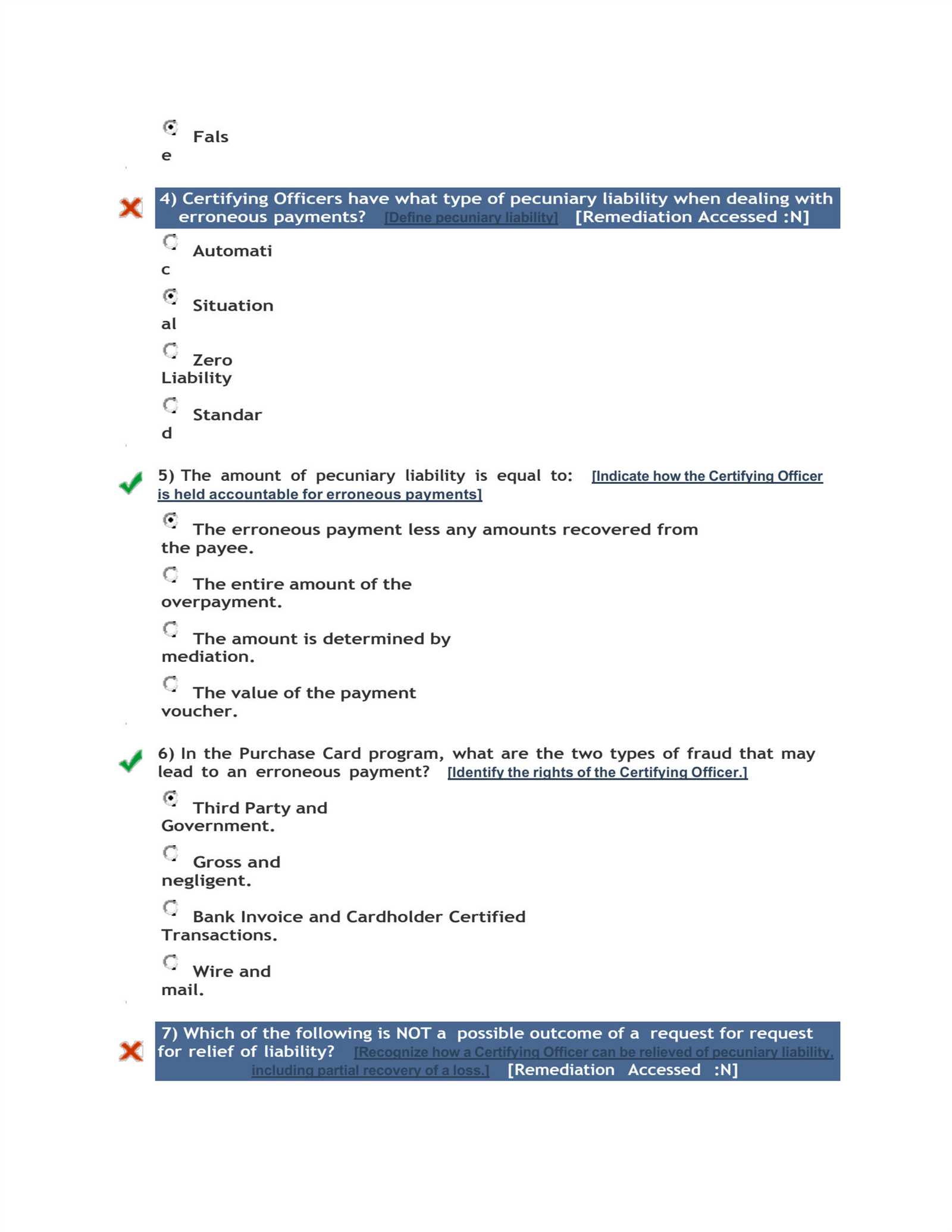

Reviewing Commonly Tested Scenarios

When preparing for assessments related to financial transactions, it’s crucial to understand the various situations that are commonly tested. These scenarios often reflect real-world challenges that individuals may encounter while handling organizational funds. Reviewing these scenarios helps to ensure that you can apply knowledge effectively and make informed decisions during the assessment or in practice.

Key Scenarios to Study

Below are some of the most frequently tested situations you may encounter. These scenarios test your ability to navigate challenges, manage resources responsibly, and follow the appropriate protocols:

| Scenario | Key Focus | Resolution |

|---|---|---|

| Unauthorized Purchases | Identifying when a purchase exceeds authority limits | Ensure prior approval is obtained and verify spending falls within authorized guidelines |

| Over Budget Spending | Managing expenses within the allocated budget | Review budget before making a purchase and seek approvals for any excess amounts |

| Failure to Maintain Documentation | Understanding the importance of proper record-keeping | Keep detailed receipts, invoices, and approval forms for every transaction |

| Vendor Compliance Issues | Ensuring purchases align with approved vendors and requirements | Verify vendor credentials and product specifications before completing any transaction |

How to Approach These Scenarios

When faced with any of these scenarios, the best approach is to stay calm, follow the correct procedures, and ensure that all necessary documentation is in place. Practicing these situations and knowing how to handle them can help build confidence and ensure that you are well-prepared for any challenges that arise.

By reviewing and understanding these common scenarios, you will be better equipped to handle the responsibilities of managing financial transactions accurately and effectively, both during the assessment and in your everyday role.

Tips for Answering Multiple-Choice Questions

Multiple-choice questions are a common assessment format, designed to test your knowledge and decision-making skills efficiently. While they may seem straightforward, answering them correctly requires strategy and careful consideration. By understanding the key approaches to tackling these types of questions, you can improve your chances of selecting the correct option every time.

Here are some valuable strategies to follow when facing multiple-choice questions:

- Read the Question Carefully: Before looking at the answer choices, read the question thoroughly. Ensure you fully understand what is being asked, as sometimes the wording can be tricky.

- Eliminate Clearly Incorrect Answers: If you can immediately identify one or more incorrect options, eliminate them. This increases your chances of choosing the correct answer from the remaining options.

- Look for Keywords in the Question: Certain words in the question or answer choices, like “always,” “never,” or “sometimes,” can give you clues about the right answer. Pay close attention to these details.

- Don’t Overthink: Often, the first option that comes to mind is the correct one. Avoid second-guessing yourself unless you’re certain there is a better choice.

- Stay Calm and Manage Your Time: Time management is key during multiple-choice assessments. Don’t spend too much time on any single question. Move on and come back if needed.

By following these strategies, you’ll be better prepared to navigate multiple-choice questions with confidence and accuracy. With practice, these techniques will become second nature, helping you achieve the best possible results.

Understanding the Role of Cardholders

Individuals entrusted with financial tools play a key role in ensuring that organizational resources are spent responsibly and in accordance with policies. These individuals are responsible for making purchases, adhering to approved budgets, and maintaining transparency in all transactions. It is crucial for those in these positions to understand not only their responsibilities but also the processes and guidelines that govern their actions.

The role of a cardholder goes beyond just making purchases. It involves managing the entire process–from selecting vendors and verifying products to ensuring proper documentation is kept for each transaction. These duties require attention to detail and a strong understanding of financial compliance.

Key Responsibilities Include:

- Adherence to Policy: Cardholders must follow all established rules and guidelines to ensure that purchases align with organizational standards and budget constraints.

- Documenting Transactions: Keeping accurate records of every purchase is vital for accountability and audit purposes. This documentation includes receipts, invoices, and any necessary approvals.

- Ensuring Budget Compliance: Monitoring spending to make sure it stays within allocated limits is one of the cardholder’s most important tasks. Unauthorized or overspent transactions can lead to serious consequences.

- Reporting Issues: If issues arise, such as discrepancies or violations of policy, cardholders are responsible for reporting them promptly to the relevant authorities.

In summary, cardholders must be diligent in their approach to purchasing and financial management. Their actions directly impact the integrity and financial health of the organization. With a clear understanding of their role and the expectations that come with it, cardholders can ensure they fulfill their duties efficiently and in full compliance with established guidelines.

Exam Structure and Time Management Tips

Effective preparation for assessments relies on understanding the format and structuring your time wisely. Knowing how many sections there are, the types of questions to expect, and the time allocated for each part helps reduce stress and boosts performance. Time management during a test is crucial for ensuring all questions are answered thoroughly while maintaining a steady pace.

Key Components of the Assessment

Typically, assessments are divided into different sections, each focusing on various aspects of the material. Whether it’s multiple-choice, true/false, or short-answer questions, each format requires a tailored approach. Below is an example of a general structure for most assessments:

| Section | Type of Questions | Time Allocation |

|---|---|---|

| Section 1 | Multiple-Choice | 30 Minutes |

| Section 2 | Short Answer | 40 Minutes |

| Section 3 | Scenario-Based | 30 Minutes |

Effective Time Management Strategies

Proper time management can make a significant difference in your overall performance. Here are some helpful tips for managing your time during an assessment:

- Prioritize Easy Questions: Start by answering questions that you find easiest. This helps build confidence and ensures you collect the low-hanging fruit.

- Set Time Limits: Stick to the time allocated for each section. If a question is taking too long, move on and come back to it later.

- Leave Room for Review: Always leave a few minutes at the end of the assessment to review your answers and check for any errors or missed questions.

- Stay Calm: If you feel stuck, take a deep breath and move on. The more relaxed you are, the more efficiently you will work through each part of the assessment.

With a clear understanding of the structure and a solid time management plan, you’ll approach your assessments with confidence, increasing your chances of success.

Frequently Asked Questions About the Exam

Many individuals preparing for assessments have similar questions about the process, structure, and expectations. Understanding common queries can help ease any uncertainties and ensure a smoother experience. Below are some frequently asked questions that can guide your preparation and participation in the assessment.

General Questions

- How long does the assessment take?

The typical duration varies, but most assessments are designed to be completed within a set time limit of 1-2 hours, depending on the number of sections and types of questions. - What is the format of the assessment?

The assessment usually includes multiple-choice, true/false, and short-answer questions. Some may also include scenario-based or case study questions to test practical knowledge. - Are there any study materials available?

Yes, most organizations provide study guides or recommended resources to help you prepare. Additionally, practice assessments are often available to familiarize yourself with the format. - Is there a passing score?

Yes, each assessment has a required passing score, which is typically set to ensure a strong understanding of the material. Be sure to check the specific requirements for your situation.

Preparation Tips

- How should I prepare?

Focus on understanding key concepts and guidelines that relate to your responsibilities. Reviewing past materials, studying the policies, and completing practice questions are essential steps. - Can I take notes during the assessment?

Notes are usually not allowed during the test. It is important to rely on your preparation and memory for answering questions. However, you may be given reference materials for certain sections. - What happens if I don’t pass?

If you do not pass, you will typically be given an opportunity to retake the assessment. Some organizations may require additional training or review before allowing another attempt.

By addressing these common questions, you can feel more confident and prepared as you approach your upcoming assessment. Understanding the key details of the process can help reduce stress and ensure you perform at your best.

How to Handle Procurement Violations

When violations occur during the acquisition process, it’s essential to address them swiftly and effectively to maintain integrity and compliance. Whether due to human error or oversight, it’s critical to have a clear understanding of the steps involved in handling such breaches. Corrective actions should be taken promptly to minimize risk and prevent future occurrences.

The first step is to identify the nature and scope of the violation. This can range from improper documentation to non-compliance with established guidelines. Once a violation is identified, it’s important to conduct a thorough investigation to understand the full context. In some cases, this might involve reviewing transactions, interviewing involved parties, and assessing the overall impact on operations.

After the investigation, take the necessary corrective actions. This may include requiring additional training for individuals involved, issuing formal warnings, or revising processes to prevent similar issues in the future. In more severe cases, disciplinary actions may be necessary to uphold organizational standards and policies.

It’s also vital to document the entire process to ensure transparency and accountability. Maintaining accurate records of the violation, investigation, and subsequent actions ensures that the situation is handled appropriately and can serve as a reference for future occurrences.

Ultimately, managing procurement violations effectively helps organizations stay compliant and safeguard against risks, ensuring smooth and efficient acquisition practices moving forward.

Real-World Applications of Training Knowledge

Applying the knowledge gained through formal education or instructional programs can have a significant impact in real-world scenarios. It allows individuals to navigate complex situations and make informed decisions based on best practices and compliance standards. The skills acquired are not just theoretical–they translate into practical, effective actions that drive success across various sectors.

One of the most prominent applications is in enhancing operational efficiency. For instance, individuals who understand procurement protocols can streamline the purchasing process, ensuring that every transaction follows the appropriate procedures. This leads to better budget management, quicker turnaround times, and reduced chances of errors or fraud. Knowledge in this area also aids in maintaining accountability, fostering a culture of transparency within organizations.

Managing Risk and Ensuring Compliance

In addition to improving efficiency, this knowledge is critical in managing risks associated with acquisition practices. Understanding the rules and guidelines helps mitigate legal, financial, and reputational risks. Professionals who apply this expertise can quickly identify potential compliance issues and address them before they escalate, safeguarding their organizations from unnecessary penalties or lawsuits.

Training for Future Leadership Roles

Moreover, mastering these concepts not only improves current job performance but also positions individuals for future leadership roles. The ability to make sound decisions based on structured processes makes professionals more qualified for managerial positions. In a leadership role, the application of these principles ensures that an organization remains efficient, ethical, and competitive in its operations.

Ultimately, the knowledge gained through specialized training helps professionals contribute meaningfully to their organizations, ensuring smoother operations and fostering a strong foundation for long-term success.

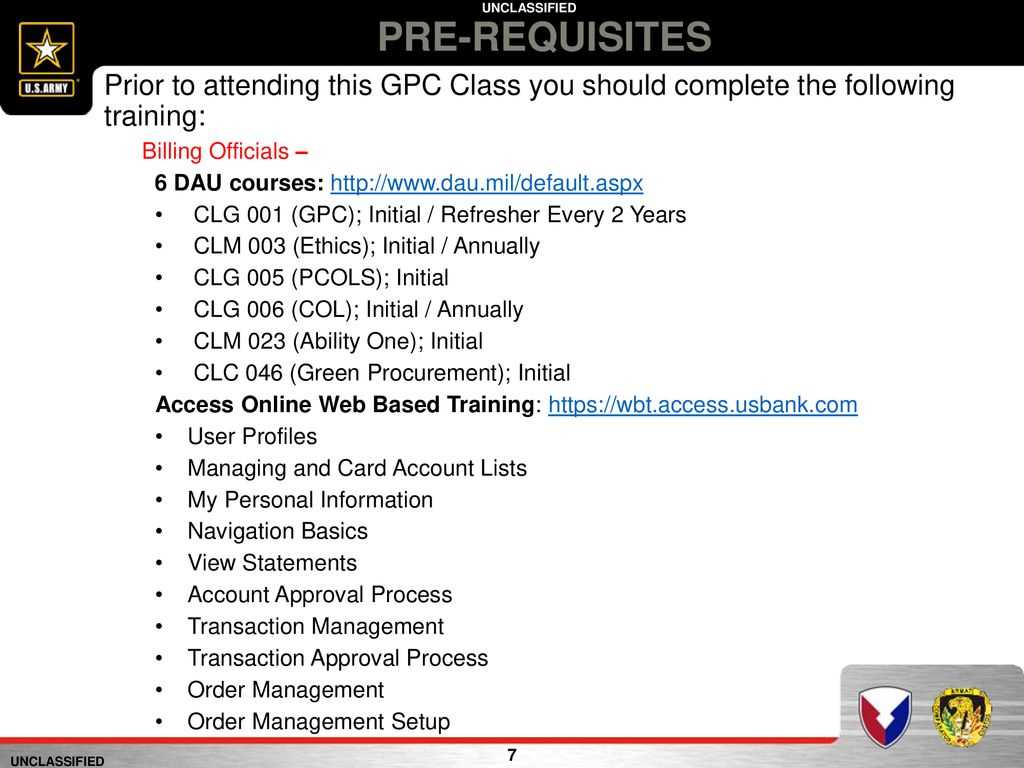

Resources for Further Study and Preparation

When preparing for assessments or enhancing your expertise, accessing the right resources is crucial for success. The more you explore various materials, the better your understanding of key concepts and best practices will be. Whether you’re looking to reinforce foundational knowledge or dive into specialized topics, there are many tools available to help you prepare efficiently and thoroughly.

Below are some excellent resources that can assist you in furthering your learning:

- Official Government Websites: Many agencies offer valuable documentation and guidelines regarding regulations and policies that will help you grasp the necessary compliance standards and procedures.

- Online Learning Platforms: Websites like Coursera, Udemy, and LinkedIn Learning offer a wide range of courses related to procurement, finance, and compliance, often with interactive components and expert-led instruction.

- Books and Guides: There are numerous comprehensive guides and textbooks that cover the principles, laws, and ethical considerations in procurement practices. These resources are ideal for in-depth study and reference.

- Peer Forums and Online Communities: Engaging with online forums and communities where industry professionals share their experiences can provide real-world insights and tips for mastering concepts.

- Practice Tests and Sample Scenarios: Many websites offer mock exams and sample case studies, which can help you practice applying your knowledge in realistic situations, helping you to refine your decision-making skills.

By using a combination of these resources, you can ensure you’re well-prepared to tackle any challenges and stay up-to-date with the latest industry standards and practices.