Securing a position in a financial oversight position requires not only expertise but also the ability to demonstrate your skills effectively during the hiring process. Understanding the expectations and challenges of the role is crucial for standing out among other candidates. Thorough preparation and insight into the kinds of inquiries you might face will increase your chances of success.

In this guide, we explore common areas of focus that interviewers typically address when assessing candidates for roles in financial monitoring. You’ll find advice on how to present your technical knowledge, problem-solving capabilities, and professional experience in a way that aligns with the specific demands of the job. With the right approach, you can approach the process with confidence and clarity.

Mastering the key competencies needed for this role will not only help you in the interview itself but also ensure that you are well-prepared for the challenges you may face once hired. From demonstrating a solid grasp of regulations to showing an ability to analyze complex situations, preparation is key to succeeding in this competitive field.

Financial Oversight Role Interview Inquiries

During the selection process for financial oversight positions, candidates can expect a range of inquiries designed to evaluate their ability to manage regulatory compliance, assess financial risk, and demonstrate analytical thinking. These discussions aim to reveal how well candidates understand industry standards, their problem-solving approach, and their capacity to handle real-world challenges in financial environments.

In many cases, interviewers seek to uncover not only technical knowledge but also the practical application of that expertise. Questions may delve into how you would handle complex financial scenarios or interpret industry regulations to ensure compliance and safety. Additionally, candidates may be asked to reflect on past experiences where they identified risks or implemented solutions in a high-stakes situation.

Behavioral questions are also common, as interviewers try to gauge your interpersonal skills and ability to work in teams or under pressure. It’s important to demonstrate how your background and experience align with the core competencies required for this type of role. In this section, we explore several types of inquiries you might encounter and provide tips on how to craft responses that highlight your strengths.

Understanding the Role of a Financial Supervisor

In financial institutions, the role of a supervisor is pivotal in maintaining the integrity of the system and ensuring compliance with regulations. These professionals are tasked with monitoring the operations of financial organizations, identifying potential risks, and ensuring that industry standards are upheld. Their responsibilities extend beyond routine checks, as they also play a crucial role in safeguarding the stability of the financial system as a whole.

Those in this line of work are expected to possess a deep understanding of financial laws and regulations, as well as the ability to analyze complex financial data. They must assess the operations of institutions, identifying areas of concern, and recommend corrective actions when necessary. The role requires a keen eye for detail and a thorough understanding of how various factors affect financial performance and risk.

Critical thinking and analytical skills are essential in this field, as supervisors must often make quick decisions based on incomplete or ambiguous information. Furthermore, they must be adept at communicating findings and making suggestions to improve compliance and performance. Ultimately, these professionals ensure that organizations operate within legal frameworks, minimizing risk and fostering financial stability.

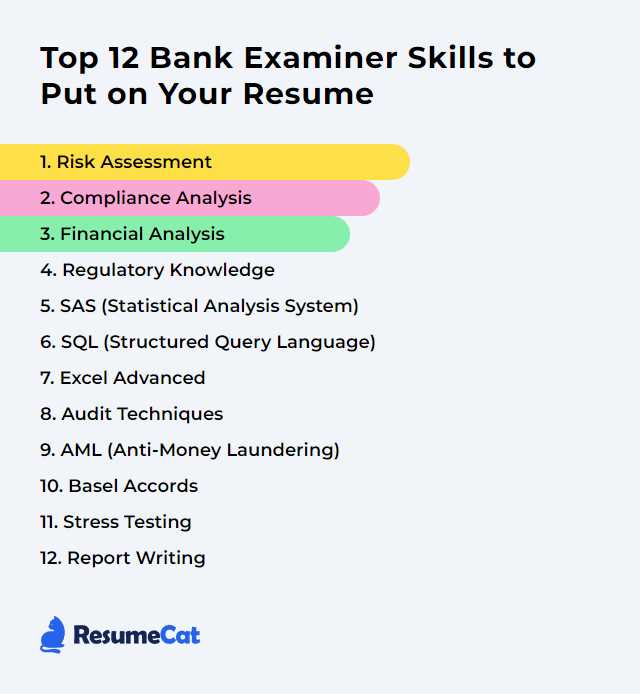

Key Skills for Financial Oversight Roles

In financial monitoring positions, success relies heavily on a combination of technical expertise, critical thinking, and interpersonal skills. Professionals must possess a broad understanding of financial systems and regulations, alongside the ability to assess risk, detect potential issues, and communicate their findings clearly. Below are some of the most important competencies required for these roles:

- Analytical Abilities: The capacity to interpret complex financial data, recognize trends, and draw meaningful conclusions is fundamental in this field. Professionals must identify risks and irregularities that may impact the stability of financial systems.

- Attention to Detail: Small discrepancies or overlooked details can lead to significant issues. Being meticulous and ensuring accuracy in data analysis and reporting is a key skill for anyone in financial oversight.

- In-Depth Knowledge of Regulations: A thorough understanding of the regulatory environment is crucial. Professionals need to be familiar with various laws and industry standards that govern financial institutions and their operations.

- Problem-Solving Skills: Financial supervisors must be able to quickly identify problems, analyze root causes, and implement effective solutions. Critical thinking and creativity are essential for addressing challenges in the field.

- Effective Communication: The ability to clearly convey complex financial concepts, both in writing and orally, is necessary for presenting findings to stakeholders, regulators, and other professionals.

- Decision-Making Under Pressure: The nature of financial oversight often involves high-pressure situations. Being able to make informed, quick decisions while managing risk is a valuable trait in this field.

- Technical Proficiency: Familiarity with financial software tools and data analysis techniques is important. Professionals need to be comfortable using various technologies to assess and report on financial activities.

Developing these skills will help ensure that professionals in financial oversight roles can effectively manage the complexities of the industry and contribute to maintaining the stability and integrity of financial systems.

Preparing for Financial Oversight Interviews

Preparing for a role in financial oversight requires more than just technical knowledge. Candidates must be ready to showcase their expertise, problem-solving abilities, and understanding of the regulatory environment. The interview process will often challenge you to demonstrate your skills, experience, and ability to perform under pressure. With the right preparation, you can confidently navigate these discussions and leave a lasting impression on interviewers.

Research the Role and Responsibilities

Start by thoroughly understanding the specific requirements of the position you’re applying for. Familiarize yourself with the core responsibilities, key challenges, and expectations. Review the job description in detail, and research the organization’s goals and values. This will help you tailor your responses to reflect how your background aligns with the needs of the position.

Practice Answering Behavioral and Situational Scenarios

In addition to discussing your technical skills, expect questions that explore how you approach real-world situations. Practice answering behavioral and situational questions that ask you to describe how you handled challenges in previous roles. Be prepared to explain the thought process behind your decisions, how you managed risks, and how your actions contributed to successful outcomes. Using specific examples from your experience will help demonstrate your qualifications in a concrete way.

Common Inquiries for Financial Oversight Roles

During the hiring process for financial oversight positions, interviewers often ask a mix of general and role-specific questions to gauge a candidate’s suitability. These inquiries are designed to assess both technical knowledge and the ability to navigate real-world challenges. While questions may vary depending on the organization, there are several common themes and areas that are likely to be covered during the discussion.

One common area of focus is understanding how candidates approach risk assessment and problem-solving. Expect to discuss how you identify potential issues, analyze financial data, and implement solutions. Interviewers may also inquire about your experience working within regulatory frameworks and your ability to ensure compliance in a fast-paced environment. Additionally, situational questions that test your judgment and decision-making process are often used to assess your capability to handle the pressures of the role.

How to Answer Behavioral Questions

Behavioral inquiries are designed to assess how candidates have handled situations in the past and predict how they might perform in similar scenarios in the future. These questions often focus on key competencies like problem-solving, communication, leadership, and adaptability. Answering them effectively requires a structured approach to provide clear, specific examples of your past experiences that demonstrate your qualifications for the role.

One of the most effective methods for responding to these types of inquiries is the STAR technique:

- Situation: Describe the context or challenge you faced. Be specific about the circumstances that led to the situation.

- Task: Explain the responsibility or task you were assigned in that situation.

- Action: Detail the steps you took to address the issue. Focus on your role and the decisions you made.

- Result: Conclude with the outcome of your actions. Highlight any positive results or lessons learned from the experience.

By following this framework, you can ensure that your responses are comprehensive, organized, and relevant to the role you’re applying for. Tailoring your examples to reflect the skills and qualities that are most important to the position will also help you make a strong impression.

Technical Knowledge Required for the Position

For professionals in financial oversight roles, a solid technical foundation is essential to effectively assess the stability and compliance of financial institutions. Understanding complex financial systems, regulatory requirements, and industry standards is crucial to performing the responsibilities of the job. In addition to analytical and problem-solving skills, technical expertise helps ensure accurate assessments and informed decision-making.

Key Areas of Knowledge

Below are the key technical areas that candidates should be familiar with for this role:

- Financial Regulations: A comprehensive understanding of financial laws, regulatory bodies, and compliance standards is essential. This includes knowledge of industry-specific rules and regulations that govern financial operations and practices.

- Risk Assessment and Management: The ability to identify and assess potential financial risks, such as credit, liquidity, and operational risks, is critical. Knowledge of risk management strategies and tools is required to mitigate these risks effectively.

- Financial Statements and Reports: Proficiency in reading and interpreting financial statements, balance sheets, income statements, and cash flow reports is necessary. Understanding how to analyze these documents helps in evaluating an institution’s financial health.

- Accounting Principles: A strong grasp of generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) is vital for evaluating the accuracy and consistency of financial records.

- Data Analysis and Software Tools: Familiarity with financial analysis software and data tools is crucial. Candidates should be proficient in tools such as Excel, SQL, or other specialized software for data management and financial modeling.

Staying Current with Industry Trends

It’s also important to stay up to date with changes in financial regulations and industry trends. Ongoing education and professional development are essential for ensuring that your technical knowledge remains relevant and sharp in a constantly evolving field.

What to Expect During the Selection Process

The selection process for financial oversight roles typically involves multiple stages designed to assess both your technical expertise and your ability to fit within the organization’s culture. The experience can vary depending on the employer, but there are common elements across most hiring processes for these positions. Understanding what to expect can help you prepare and approach each step with confidence.

Initially, you may undergo an introductory phone screen or video call with a recruiter or HR representative. This part of the process is typically brief and focused on confirming basic qualifications, discussing your background, and gauging your interest in the role. If you pass this stage, you may be invited for a more in-depth conversation with the hiring team, which could include both technical and behavioral assessments.

During the main interview phase, expect to be asked about your relevant experiences, problem-solving abilities, and your approach to challenges. Interviewers will likely present you with scenarios to test your judgment, decision-making, and knowledge of financial regulations. There may also be case studies or practical tasks to evaluate how well you can analyze data and interpret financial information. Be prepared to explain your thought process clearly and demonstrate how your skills align with the position.

In some cases, you may also meet with senior leaders or members of other departments. These discussions may focus on your understanding of the organization’s mission, your ability to collaborate with different teams, and how you handle high-pressure situations. Interviews in financial oversight roles often include questions about your ability to adapt to changing environments and maintain accuracy under tight deadlines.

Top Questions on Financial Regulations

When applying for roles focused on financial oversight, a significant portion of the discussion will center on your understanding of the regulatory landscape. These roles require candidates to be familiar with the laws, standards, and frameworks that govern financial activities. It’s crucial to demonstrate not only your knowledge of regulations but also how you apply this understanding to ensure compliance and manage risks effectively.

Understanding Key Regulatory Frameworks

One common area that interviewers will focus on is your familiarity with major regulatory frameworks and standards. You may be asked about your experience with:

- Compliance with Financial Laws: How well do you understand the specific regulations that apply to the industry? Be prepared to discuss key laws, such as those related to anti-money laundering (AML), know-your-customer (KYC), and data privacy.

- Role of Regulatory Bodies: Interviewers might want to know your knowledge of regulatory bodies like the SEC, CFTC, or others, and how they influence financial institutions. You should be able to discuss how different agencies work together to maintain the integrity of the financial system.

- International Regulations: Many financial organizations operate across borders, so understanding international regulations like MiFID II or Basel III can be a point of discussion.

Applying Regulations to Real-World Scenarios

In addition to theoretical knowledge, you will likely be tested on your ability to apply these regulations in practical situations. Expect questions such as:

- Risk Management: How do you assess and mitigate risks related to regulatory compliance? Interviewers might present a case where you need to identify potential violations and suggest corrective actions.

- Handling Regulatory Changes: Given the constantly evolving nature of financial laws, you may be asked how you stay updated on new regulations and how you implement changes within an organization.

Evaluating Risk Management Experience

In roles focused on oversight and regulation, the ability to identify, assess, and manage risks is crucial. Risk management is a cornerstone of financial stability, and employers will assess how well candidates can apply their knowledge to mitigate various risks. This includes the ability to evaluate financial, operational, and compliance risks while ensuring that the organization adheres to the necessary legal and regulatory frameworks.

During the selection process, you may be asked about past experiences where you were responsible for identifying and managing risks. Interviewers will want to understand your approach to risk assessment, the tools you use to measure potential threats, and how you develop strategies to mitigate them. They may also be interested in your understanding of risk controls, and how you evaluate the effectiveness of these measures over time.

Some areas that are likely to come up include:

- Risk Identification: How do you identify potential risks within an organization or system? Candidates should be prepared to discuss methods for detecting both obvious and hidden risks.

- Risk Assessment Techniques: Be ready to explain the tools and techniques you’ve used to assess risks, such as risk matrices, scenario analysis, or financial modeling.

- Mitigation Strategies: How have you successfully mitigated risks in past roles? Discuss any risk management frameworks you have used and specific actions taken to reduce exposure.

- Monitoring and Reporting: Effective risk management also involves constant monitoring. Interviewers may ask about how you track risks over time and communicate findings to key stakeholders.

Your ability to demonstrate a comprehensive understanding of risk management will be a key factor in determining your suitability for the role. Sharing examples of your past work, the results you achieved, and how you handled complex situations will show employers that you have the experience necessary to excel in a financial oversight role.

How to Demonstrate Analytical Abilities

In roles focused on financial oversight and regulation, analytical thinking is a critical skill that employers seek in candidates. The ability to break down complex data, identify patterns, and draw insightful conclusions is essential for making informed decisions. Demonstrating strong analytical abilities during the selection process involves showcasing how you approach problems, analyze information, and make decisions based on your findings.

To effectively highlight your analytical skills, you can share examples from your past experiences where you were tasked with solving difficult problems. Discuss how you approached the situation, the methods you used to analyze the data, and the outcomes of your actions. Highlighting specific tools or techniques, such as data analysis software, financial modeling, or quantitative analysis, can further emphasize your proficiency.

Additionally, interviewers may present you with case studies or hypothetical scenarios to assess your analytical thinking in real-time. Be prepared to walk them through your thought process, demonstrating how you break down complex information into manageable parts, weigh various factors, and make reasoned conclusions. Show that you can not only analyze but also apply your insights to drive effective decision-making in financial environments.

Importance of Attention to Detail

In roles related to financial regulation and oversight, the ability to focus on the smallest details can make a significant difference in the accuracy and effectiveness of decision-making. Attention to detail is crucial in identifying discrepancies, ensuring compliance, and maintaining the integrity of financial systems. Without this skill, even minor errors could lead to costly mistakes or missed opportunities for improvement.

When evaluating candidates for roles in oversight, employers look for individuals who can meticulously review data, documentation, and processes. Small errors often lead to larger problems, and those in regulatory roles are expected to spot these issues before they escalate. Demonstrating your attention to detail can set you apart, especially in situations that require precision and careful analysis.

For example, consider how you handle financial statements, compliance reports, or risk assessments. Employers will look for evidence that you can accurately review these documents, identify inconsistencies, and address issues proactively. Your ability to perform detailed checks can showcase your diligence and commitment to quality.

| Scenario | Expected Attention to Detail | Outcome |

|---|---|---|

| Reviewing financial reports | Identifying errors in calculations, discrepancies in transactions | Accurate financial reporting and compliance |

| Risk assessment analysis | Spotting inconsistencies in risk factors or miscalculations | Early identification of potential risks |

| Ensuring regulatory compliance | Reviewing contracts and documents for missing or incorrect information | Ensuring that all processes meet legal requirements |

Employers often assess this skill through practical tests or case scenarios. By showcasing your meticulous nature and ability to identify key details, you can demonstrate your readiness to handle the responsibilities of a highly demanding role.

Key Challenges for Financial Regulators

Working in a regulatory role that involves overseeing financial institutions comes with a range of challenges. The complexity of the financial world, along with the need for precision and timely decisions, means that professionals in this field must be prepared to navigate a variety of difficult situations. These challenges can range from maintaining compliance with evolving regulations to handling large volumes of data under tight deadlines. Understanding and overcoming these hurdles is crucial for anyone looking to succeed in this type of position.

Complex Regulatory Frameworks

One of the major challenges faced by professionals in this field is keeping up with constantly changing laws and regulations. Financial institutions operate in a highly regulated environment, and staying up-to-date with new rules can be demanding. The ability to interpret and apply these regulations effectively is essential for ensuring compliance across all levels of operations.

Risk Management and Financial Integrity

Another critical challenge is assessing and managing risks. Professionals in this role need to evaluate financial stability, identify potential risks, and recommend actions to mitigate those risks. This responsibility requires a deep understanding of financial systems and the potential impact of various risk factors on the overall stability of institutions.

| Challenge | Required Skillset | Possible Impact |

|---|---|---|

| Adapting to Regulatory Changes | Knowledge of financial laws, adaptability | Ensuring compliance and avoiding penalties |

| Managing Financial Risk | Analytical thinking, risk assessment skills | Protecting financial stability, preventing loss |

| Handling High-Volume Data | Attention to detail, data analysis proficiency | Ensuring accuracy and reducing errors |

These challenges require a combination of technical knowledge, analytical skills, and attention to detail. Professionals in this field must be able to balance the demands of regulatory compliance with the need to manage financial risks effectively, all while ensuring the stability and integrity of the system.

Preparing for Case Study Questions

When preparing for a professional evaluation, candidates can expect to encounter case study scenarios that assess their decision-making and problem-solving abilities. These exercises typically present a real-world situation that requires careful analysis and a strategic response. The purpose of these scenarios is to test how well candidates can apply their knowledge to complex problems, think critically, and make sound decisions under pressure.

To excel in these assessments, it’s essential to practice structuring your responses clearly and logically. Focus on breaking down the problem, identifying key issues, and proposing practical solutions based on available information. Demonstrating your ability to consider multiple perspectives and weigh potential outcomes is key to showcasing your analytical skills.

Here are some tips for preparing effectively:

- Understand the problem: Read the case carefully and ensure you comprehend all aspects before formulating your response.

- Identify the key issues: Highlight the core challenges or areas that need attention and focus your analysis on these points.

- Formulate a structured approach: Use a clear, logical process to address the problem, ensuring that your solution is both practical and feasible.

- Support your decisions: Provide evidence or reasoning to back up your suggestions, demonstrating your thought process and rationale.

- Manage time wisely: Keep an eye on the clock to ensure you can thoroughly address each part of the case within the time limit.

Case studies are an opportunity to demonstrate your expertise and reasoning abilities. Practicing in advance can help you feel more confident and prepared when tackling these types of exercises in a professional evaluation setting.

Understanding the Federal Reserve’s Mission

At the core of the nation’s economic structure lies an institution tasked with promoting financial stability and ensuring a healthy economic environment. This institution works to foster a sound, stable, and efficient monetary system that supports sustainable growth, low unemployment, and stable prices. Understanding its mission is essential for anyone involved in financial oversight or decision-making processes.

At the heart of this mission is a commitment to maintaining economic stability through a variety of mechanisms, including regulating financial institutions, managing inflation, and monitoring overall market health. Those who operate within this framework must align their goals with the overarching objective of contributing to long-term economic security.

Key Objectives of the Institution

The primary focus of this organization revolves around:

- Promoting maximum employment: Creating an environment where the economy can support a healthy labor market with job opportunities for all segments of society.

- Maintaining stable prices: Ensuring that inflation remains low and manageable, fostering a predictable environment for businesses and consumers alike.

- Ensuring moderate long-term interest rates: Keeping borrowing costs stable, which in turn supports business investment and consumer spending.

The Importance of Financial Oversight

In addition to these objectives, a critical role of this organization is to monitor and regulate financial institutions to ensure they operate safely and soundly. By doing so, it helps prevent risks that could undermine the financial system, such as liquidity crises, fraud, or mismanagement. In this way, it safeguards the overall health of the economy, ensuring that financial institutions can continue to provide critical services without jeopardizing the system’s stability.

Understanding the mission of this organization is key to grasping the broader context in which financial regulations and oversight are implemented, making it an essential consideration for those pursuing roles related to financial governance.

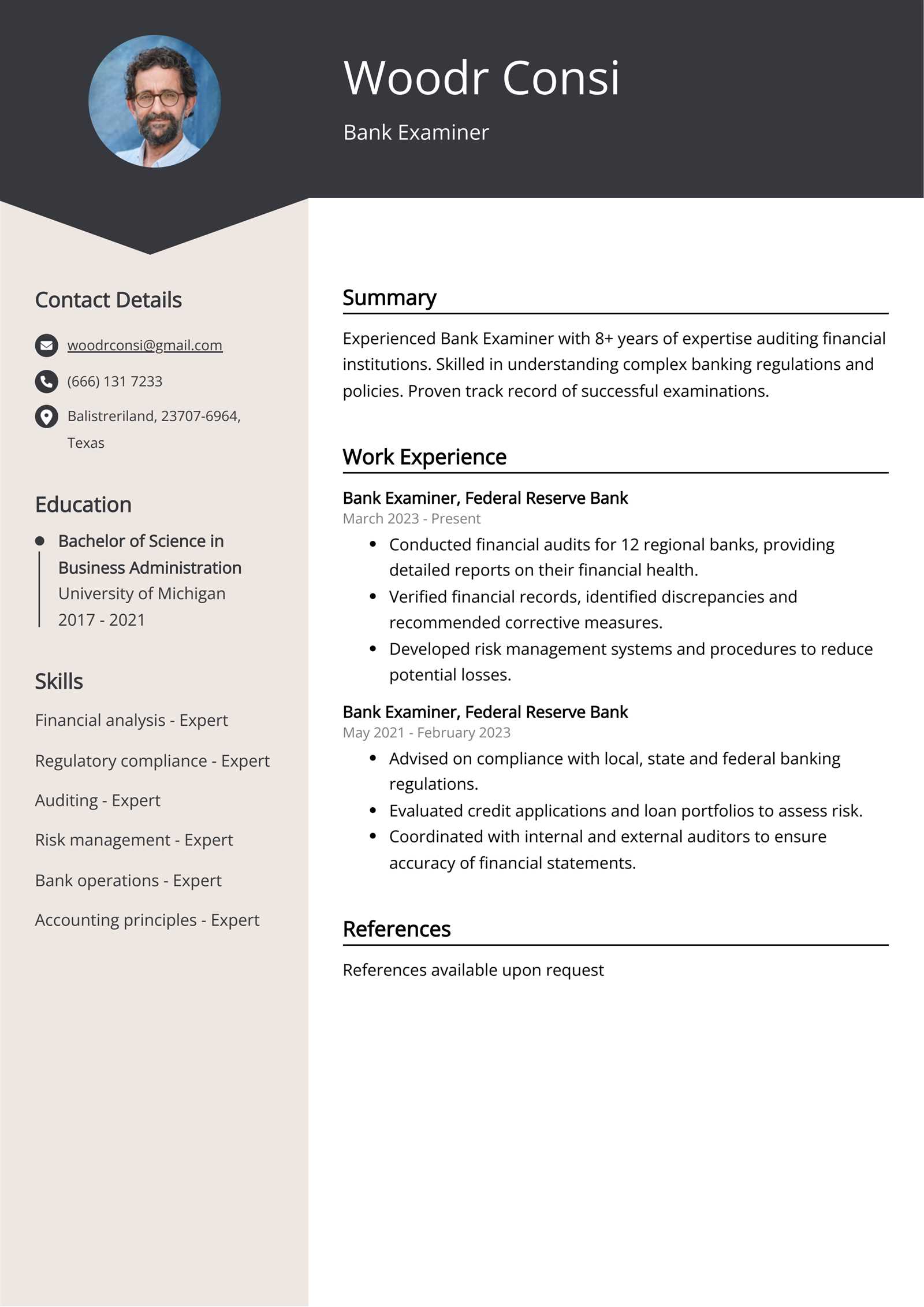

Personal Strengths for the Examiner Role

Individuals pursuing roles within regulatory and oversight functions must possess a specific set of qualities that enable them to effectively carry out their responsibilities. These strengths go beyond technical knowledge and include personal attributes that ensure sound judgment, attention to detail, and the ability to navigate complex situations. Having the right personal traits can make a significant difference in performing well in these roles.

The ability to critically assess situations, work under pressure, and communicate clearly are essential skills for anyone in this line of work. Additionally, an unwavering commitment to ethical standards and the ability to maintain objectivity are foundational qualities that guide decision-making and ensure that regulatory processes are executed with integrity.

Key Personal Strengths for Success

Some of the most important qualities for professionals in this field include:

- Critical thinking: The ability to assess situations from multiple angles and make informed decisions based on evidence and analysis.

- Attention to detail: Being meticulous in identifying discrepancies or potential risks, ensuring thoroughness in all evaluations.

- Integrity: Maintaining a strong ethical framework, ensuring that all actions are in line with professional standards and legal requirements.

- Communication skills: The ability to clearly articulate findings, recommendations, and concerns in a manner that is understandable to all stakeholders.

- Adaptability: Being flexible and responsive to changes in regulations, policies, or economic conditions that may affect operations.

Why These Strengths Matter

These personal strengths are essential for handling the dynamic nature of the role. In addition to helping professionals navigate the complexities of financial oversight, they also foster an environment of trust and transparency within the organizations they serve. Having a strong foundation in these areas ensures that the individual is well-prepared to manage both routine responsibilities and unexpected challenges that may arise.

Building Confidence for the Interview

Approaching an evaluation process with confidence is key to showcasing your qualifications and abilities. Having a solid understanding of your skills, experience, and how they align with the position can greatly boost your self-assurance. Preparation, combined with the right mindset, can make all the difference in how you present yourself to the selection panel.

Confidence does not stem from knowing everything, but rather from knowing that you are prepared to handle the questions that come your way. The more you understand the requirements of the role and anticipate the types of assessments you may face, the more composed and confident you will feel. Recognizing your strengths and being able to communicate them clearly can have a powerful impact on your performance.

To build your confidence, consider the following strategies:

- Thorough Preparation: The more you study the core aspects of the role and related concepts, the more comfortable you will feel during the discussion.

- Mock Sessions: Practice answering questions with a friend or mentor to simulate the real experience. This helps to build fluency in your responses and makes the process feel less daunting.

- Positive Self-Talk: Focus on your strengths and past successes. A positive mindset can help reduce nervousness and enhance your presence during the evaluation.

- Understanding the Organization: Familiarize yourself with the organization’s mission, values, and key challenges. This will help you speak with more insight and alignment with the role.

- Active Listening: Focus on understanding the intent behind the questions, which allows you to respond more effectively and with confidence.

By focusing on these areas, you can approach the process with a stronger sense of self-assurance, knowing that you are well-prepared and capable of presenting your best self to the decision-makers.