This section covers essential topics that will guide you through complex scenarios. The focus is on providing clarity and insights into various financial principles that are fundamental to achieving success. Each part is designed to break down intricate ideas into manageable sections for better understanding.

By reviewing the materials carefully, you will strengthen your grasp on critical concepts and enhance your problem-solving skills. Understanding these principles is crucial for applying the knowledge to real-world situations, where practical decisions often depend on such knowledge.

While navigating through the exercises, the goal is to not only find the right solutions but also to understand the reasoning behind them. This approach will allow you to apply these concepts confidently and accurately in future tasks.

Everfi Chapter 7 Answers Guide

This section aims to provide a comprehensive guide to navigating the most important aspects of the learning module. It focuses on offering clear instructions for solving problems and understanding key concepts that are essential for mastering the material. By breaking down the content into manageable steps, you can develop a strong understanding of the principles involved.

Key Steps for Understanding the Material

To ensure a solid grasp of the material, it is essential to follow a structured approach. Start by reviewing the main topics covered in the section. Break down each problem into smaller parts, and apply the knowledge step-by-step. This method will help you understand the logic behind the correct solutions and make it easier to tackle more complex tasks in the future.

Common Pitfalls to Avoid

While working through the exercises, there are common mistakes that many learners make. Avoid rushing through the questions and ensure you understand each concept before moving forward. Additionally, double-check your calculations and make sure all information is applied correctly to avoid errors.

| Step | Action | Notes |

|---|---|---|

| 1 | Review main concepts | Understand the basic principles |

| 2 | Break down each problem | Divide complex issues into smaller tasks |

| 3 | Check calculations | Ensure accuracy to avoid mistakes |

Overview of Everfi Chapter 7

This section provides an in-depth look at critical financial concepts and decision-making processes. It explores essential principles that will help you understand how to manage finances effectively and make informed choices in real-life scenarios. The focus is on building a solid foundation that prepares you to handle various challenges with confidence.

Key Learning Areas

The primary focus of this section is to equip you with the necessary tools for managing personal finances. Topics include budgeting, saving, and making smart financial decisions. By learning these fundamental concepts, you will be better prepared to navigate the complexities of managing money in your everyday life.

Practical Applications

Understanding these core concepts is not only beneficial for passing assessments but also for applying the knowledge in practical situations. Whether you’re managing personal expenses or planning for future financial goals, the skills learned here are directly applicable to real-world scenarios.

Important Concepts in Chapter 7

This section covers the fundamental ideas that are crucial for mastering key financial concepts. These principles are designed to help you make informed decisions about money management and provide a solid foundation for understanding personal finances. By focusing on these critical areas, you can develop practical skills that will benefit you in real-life situations.

Core Financial Principles

Understanding basic financial concepts is essential for building a strong foundation. Here are the key principles you should focus on:

- Budgeting: The process of planning and controlling your spending to ensure financial stability.

- Savings: Setting aside money for future goals or emergencies.

- Debt Management: Learning how to manage loans and credit responsibly.

- Investing: Understanding how to grow your wealth through various financial instruments.

Practical Applications of Key Ideas

Applying these concepts in real-life situations helps reinforce the material. These skills can be used to:

- Manage monthly expenses and ensure you live within your means.

- Save effectively for long-term financial goals such as buying a house or retirement.

- Make informed choices about borrowing and repaying loans.

- Understand the basics of investing to grow your financial portfolio over time.

Important Concepts in Chapter 7

This section focuses on the essential ideas that help you understand the basics of managing personal finances. These key concepts are designed to guide you through the process of making informed decisions about money, budgeting, and financial planning. Mastering these areas will provide a strong foundation for achieving long-term financial stability.

Key Financial Concepts

Here are the fundamental concepts that are crucial for financial success:

- Budgeting: The act of creating a plan to track income and expenses, ensuring you live within your means.

- Saving: Setting aside money for future needs, including emergency funds, large purchases, and retirement.

- Debt Management: Strategies for handling loans and credit responsibly, avoiding excessive borrowing and high-interest debt.

- Investing: Understanding different investment options and how to grow wealth over time with a diverse portfolio.

Practical Financial Strategies

Applying these concepts effectively in everyday life involves:

- Creating a detailed budget that allows you to track spending and save for future goals.

- Building an emergency fund to provide financial security in case of unexpected events.

- Managing debt wisely to avoid excessive interest payments and maintain good credit.

- Learning about various investment tools to make informed choices about growing wealth.

How to Approach Chapter 7 Questions

When tackling questions related to personal finance, it’s important to follow a structured approach. By understanding the material thoroughly and applying key concepts step-by-step, you can answer each question with confidence. This method ensures that you not only find the correct solutions but also develop a deeper understanding of the financial principles involved.

Step-by-Step Strategy

Here is a simple strategy to help you approach each question effectively:

- Read the Question Carefully: Ensure you fully understand what is being asked before jumping to conclusions.

- Identify Key Concepts: Look for specific terms or financial concepts mentioned in the question that relate to budgeting, savings, or investing.

- Break Down the Problem: Divide the question into smaller, more manageable parts if it seems complex.

- Apply Relevant Knowledge: Use the information and principles you’ve learned to solve the problem logically.

Common Pitfalls to Avoid

While working through the exercises, there are several common mistakes you should be aware of:

- Not paying attention to the details in the question, which could lead to misunderstanding.

- Rushing through calculations or steps without verifying the accuracy of your work.

- Overlooking key financial concepts or terms that are critical to solving the problem.

Common Mistakes in Chapter 7

When working through financial concepts, learners often make a few common mistakes that can negatively impact their understanding and results. These errors generally stem from a lack of attention to detail or a misunderstanding of key principles. By recognizing and correcting these issues early on, you can improve both your comprehension and ability to apply the material effectively.

Frequently Made Errors

Here are some of the most common mistakes to avoid when tackling financial problems:

- Confusing Financial Terminology: It’s easy to mix up terms like savings, expenses, and debt management, which can lead to incorrect conclusions.

- Rushing Through Calculations: Skipping steps or failing to check work can lead to simple errors that impact your final answer.

- Overcomplicating Simple Problems: Trying to apply complex methods to basic tasks can cause confusion and unnecessary mistakes.

- Neglecting Practical Examples: Focusing too much on theoretical concepts without relating them to real-life situations can reduce understanding.

How to Avoid These Mistakes

Here are a few tips to help you stay on track and avoid these common errors:

| Mistake | Solution |

|---|---|

| Confusing financial terminology | Review definitions of key terms to ensure you understand them clearly. |

| Rushing through calculations | Take your time with each step and double-check your work to catch errors. |

| Overcomplicating simple problems | Focus on breaking down each problem into manageable parts and use appropriate techniques. |

| Neglecting practical examples | Relate theoretical knowledge to everyday scenarios to enhance your understanding. |

Strategies for Success in Chapter 7

Mastering personal finance topics requires a combination of focused study, practical application, and consistent review. By following effective strategies, you can enhance your understanding, improve retention, and increase your confidence when approaching financial concepts. Whether you are preparing for an exam or seeking to apply these skills in real life, these approaches will guide you to success.

Proven Study Methods

These techniques will help you study more effectively and retain key financial concepts:

- Active Engagement: Don’t passively read through the material. Take notes, summarize key points, and actively engage with the content by asking questions or teaching others.

- Practice with Real-World Examples: Apply concepts to everyday financial decisions, such as budgeting or saving for goals, to see how the theory translates into practical actions.

- Repetition and Review: Revisit concepts regularly to strengthen memory retention. Solve practice problems repeatedly to improve your skills and boost confidence.

- Stay Organized: Create clear outlines or mind maps to organize complex topics, making it easier to break down and digest each section.

Additional Tips for Success

To ensure deeper understanding and better performance, consider the following strategies:

- Break Down Complex Problems: If a problem seems difficult, break it into smaller, more manageable parts and solve each step methodically.

- Seek Help When Needed: If you’re struggling with a particular concept, don’t hesitate to ask for clarification from a teacher, peer, or online resource.

- Practice Time Management: Set aside dedicated study time, avoid procrastination, and pace yourself to avoid last-minute cramming.

- Reflect on Mistakes: Review any incorrect answers or misunderstandings to learn from them and avoid repeating the same mistakes in the future.

Tips for Completing Chapter 7

Successfully navigating through financial lessons requires careful planning, effective study techniques, and a strategic approach to each task. By understanding the key concepts and applying efficient methods, you can complete the exercises with ease and confidence. The following tips are designed to help you stay on track and maximize your success as you work through the material.

Effective Strategies for Completion

These strategies will help you approach each section with focus and clarity:

- Read the Instructions Carefully: Make sure you fully understand the task before jumping into any questions. This will save time and ensure you don’t miss any important details.

- Work Step-by-Step: Break each task into smaller, manageable steps. Tackle each section one at a time, and avoid rushing through them.

- Stay Organized: Keep your notes, worksheets, and digital tools organized for easy access. This will make it easier to find information when needed.

- Ask for Help When Needed: If you encounter difficult questions, don’t hesitate to seek assistance from a tutor, peer, or online resource to clarify concepts.

Common Pitfalls to Avoid

While working through the material, avoid these common mistakes to ensure accuracy and efficiency:

| Mistake | Solution |

|---|---|

| Skipping reading material | Ensure you read through all relevant content before starting tasks to build a strong foundation of knowledge. |

| Rushing through problems | Take your time, focus on understanding the process, and avoid making careless errors by hurrying. |

| Not reviewing answers | Always go back and review your work before submitting it to catch mistakes and improve accuracy. |

| Ignoring key terms | Pay close attention to definitions and terminology to avoid misunderstandings and incorrect conclusions. |

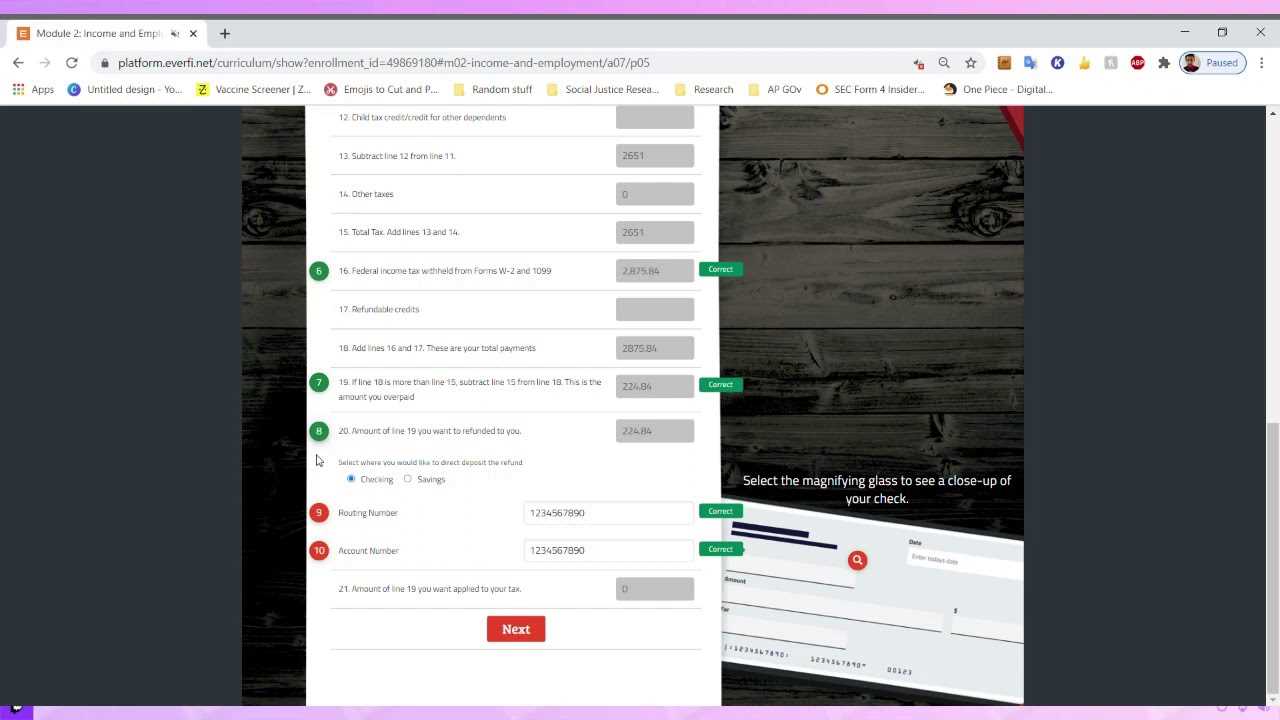

How to Understand Chapter 7 Answers

Understanding the reasoning behind your responses is key to mastering the material. It’s not just about getting the right answer but knowing why it is correct and how the concepts apply in various scenarios. By following a systematic approach to analyze each solution, you will deepen your understanding and be better prepared for future challenges.

Step-by-Step Breakdown

To fully grasp the answers, follow these steps to improve your comprehension:

- Review the Question: Begin by revisiting the question to ensure you understand what is being asked. Make note of any keywords or phrases that guide your answer.

- Identify Key Concepts: Pinpoint the main ideas or financial principles related to the question. This will help you relate the response to broader themes.

- Understand the Process: Focus on the logic and methods used to reach the solution. Whether it involves calculations or reasoning, recognizing the steps taken is essential for understanding.

- Check for Assumptions: Evaluate any underlying assumptions that may have influenced the answer. This helps ensure that you are not overlooking important context.

Using Examples for Clarity

Applying real-life examples can make abstract concepts more tangible. Here are some techniques for connecting theory to practice:

- Relate to Personal Finance: For example, if a question involves budgeting or saving, think about how these concepts apply to managing your own finances.

- Simulate Scenarios: Create hypothetical situations that mirror the questions. This will allow you to test your understanding and see how the answer fits within various contexts.

- Use Visual Aids: Diagrams or charts can help visualize complex ideas and make the solution process clearer.

What You Need to Know About Chapter 7

To successfully navigate through the material, it’s essential to grasp the key concepts and the core ideas presented. The lessons focus on practical knowledge that can help you build a solid foundation for future topics. By understanding the context, terminology, and processes involved, you will be better equipped to tackle each section effectively and confidently.

Pay special attention to the financial principles being discussed. Recognizing how these principles interconnect with real-world scenarios can enhance your ability to apply them in different situations. Mastering the content requires not just memorizing facts, but also understanding the reasoning and logic behind each step, which will help you in both practical applications and assessments.

Breaking Down Chapter 7 Assignments

Understanding the tasks ahead is the first step to success. Each assignment is designed to help you apply the concepts you’ve learned, reinforcing both theoretical and practical knowledge. By breaking each task into smaller steps, you can approach them systematically and avoid feeling overwhelmed.

Start with Clear Objectives: Each assignment has a specific goal, whether it’s mastering a concept or solving a problem. Ensure you understand what is expected before diving into the details.

Focus on Key Elements: Pay attention to the main components of the task. Identify important facts or instructions that will guide you through the assignment. This helps prioritize your efforts and direct your focus to what really matters.

Work through the Problem: Break down the questions into manageable parts. Tackle each section one by one to avoid confusion. This approach will also make it easier to spot errors and adjust your reasoning if needed.

Everfi Chapter 7: Question Walkthrough

Understanding how to approach each question is crucial for effectively navigating through the material. By carefully reviewing each question and breaking down its components, you can build a solid strategy to arrive at the correct answers. This walkthrough will guide you step by step, helping you grasp key concepts and think critically about each task.

Step 1: Analyze the Question

The first step in answering any question is to fully understand what is being asked. Take time to identify the key points in the question. Are there specific instructions or details you need to focus on? This will help you frame your approach to finding the answer.

Step 2: Apply Relevant Concepts

Once you understand the question, recall the concepts that are relevant to it. Look for patterns or strategies that have been emphasized in previous lessons. By applying these ideas, you can make logical connections and solve the question more effectively.

Reviewing Essential Topics in Chapter 7

To successfully tackle the tasks ahead, it’s important to review the fundamental topics that form the backbone of the material. These key concepts provide the foundation for understanding more complex ideas and solving problems effectively. By revisiting the core subjects, you reinforce your understanding and gain confidence in applying the knowledge.

Focus on the primary ideas discussed and ensure you understand their practical applications. Whether it’s mastering specific skills, grasping theoretical principles, or learning how to apply those concepts in real-world situations, a thorough review will set you up for success.

Real-Life Applications of Chapter 7

Understanding how theoretical knowledge applies in real-world scenarios is key to making concepts more relatable and practical. The principles explored in this section have direct applications in everyday situations and various professional fields. By recognizing how these concepts influence daily decisions and actions, you can better appreciate their relevance.

Financial Decision-Making

One of the primary real-life applications of these topics is in making informed financial decisions. Whether it’s budgeting, investing, or managing personal finances, the concepts learned help individuals assess risks and make better financial choices.

Career and Professional Growth

Many of the ideas covered are essential for career development. From understanding business strategies to managing resources effectively, these concepts play a significant role in shaping professional success and leadership capabilities.

Common Challenges in Chapter 7

As learners progress through this section, several common obstacles often arise. These difficulties can stem from the complexity of the material, unfamiliar terminology, or the need to connect abstract ideas to real-world scenarios. By identifying these challenges early on, individuals can adopt effective strategies to overcome them and deepen their understanding.

1. Grasping New Concepts

One of the most significant challenges faced in this section is understanding the key concepts presented. Many of these ideas may feel new or difficult to relate to, which can lead to confusion. To address this issue:

- Take time to break down complex terms into simpler components.

- Use diagrams or visual aids to map out relationships between concepts.

- Seek additional resources like tutorials or explanatory videos to reinforce understanding.

2. Applying Theory to Real-World Scenarios

Another common hurdle is applying theoretical knowledge to practical situations. While the material may make sense in a theoretical context, it can be challenging to translate it into everyday applications. To make this transition easier:

- Relate the concepts to familiar situations or current events.

- Participate in hands-on exercises or case studies to see how ideas play out in real-life contexts.

- Collaborate with peers or mentors to discuss how to apply the material effectively.

3. Overcoming Test Anxiety

Many learners experience stress when it comes time to assess their knowledge, which can lead to performance issues. Overcoming this anxiety requires preparation and confidence. Strategies include:

- Regularly review the material to build familiarity and comfort.

- Practice under timed conditions to simulate test environments.

- Adopt relaxation techniques like deep breathing to manage anxiety during assessments.

Mastering Everfi Chapter 7 Content

Understanding the core concepts of this section is crucial for building a solid foundation. It focuses on practical knowledge that can be applied to real-life situations. By mastering these key topics, learners can improve their skills and make more informed decisions. The goal is to ensure a deep comprehension of the material, enabling students to tackle related tasks with confidence.

Key themes to focus on include:

- Understanding fundamental principles and their real-world applications

- Analyzing financial concepts that can directly impact everyday life

- Improving decision-making abilities through effective strategies

In this section, you’ll be guided through various learning exercises designed to reinforce these concepts. The process includes:

- Engaging with interactive tasks that provide immediate feedback

- Exploring case studies to see how theories are applied in practice

- Assessing your understanding through quizzes and assessments

By following this structured approach, you’ll not only gain a deeper understanding but also enhance your ability to apply what you’ve learned to new situations.