Preparing for an important assessment in the field of economics requires a clear understanding of core topics and the ability to apply theoretical knowledge in practical scenarios. Students often face a wide range of concepts, each playing a critical role in understanding how economies function at a larger scale. A solid grasp of these ideas not only helps during tests but also contributes to a deeper comprehension of real-world financial systems.

In this section, we explore various key areas that are essential for mastering economic principles. From the fundamentals of government policy to the complexities of financial markets, understanding how different factors interact is vital. With the right preparation, you can tackle challenging questions and demonstrate your ability to think critically about economic systems.

Principles of Macroeconomics Final Exam Answers

Understanding the key elements of economic theory is essential for success in any comprehensive assessment on the subject. This section covers the essential topics and core concepts that form the foundation of economic analysis. Whether you’re reviewing policy effects, market structures, or national economic strategies, a clear understanding of these ideas will help you approach questions with confidence.

Core Economic Concepts to Focus On

Throughout your preparation, it’s crucial to prioritize certain topics that are frequently tested. These concepts shape the way economies operate on both a national and global scale. Key areas to focus on include the role of government policies, inflationary pressures, unemployment, and the overall functioning of financial markets. The more you can connect these concepts to real-world examples, the better you will be able to demonstrate your knowledge during the assessment.

Commonly Tested Economic Theories

Many assessments include questions on specific economic models and theories that explain behavior within markets. Some of the most widely tested theories include supply and demand analysis, Keynesian and Classical economic approaches, and the study of economic cycles. Each of these theories provides a unique lens through which economic phenomena can be understood and explained.

| Concept | Description | Importance |

|---|---|---|

| Supply and Demand | The interaction between the availability of goods and services and the desire of consumers. | Essential for understanding price fluctuations and market equilibrium. |

| Government Policy | Measures taken by the government to regulate or stimulate economic activity. | Important for analyzing fiscal and monetary policy impacts on growth and stability. |

| Inflation and Unemployment | Economic conditions that measure price level changes and the labor force. | Critical for understanding economic health and making policy decisions. |

Key Concepts for Your Macroeconomics Exam

To excel in your assessment, it’s essential to focus on the fundamental ideas that shape economic systems. A strong understanding of these core concepts not only prepares you for testing scenarios but also helps you make connections between theory and real-world events. Mastering the basics allows you to approach complex questions with clarity and confidence.

Some of the most important topics include the relationship between government policies and economic growth, the factors influencing inflation, and the ways in which markets interact. By familiarizing yourself with these key areas, you’ll be better equipped to address a variety of questions and demonstrate a deeper understanding of the subject matter.

Understanding Aggregate Demand and Supply

At the heart of economic analysis lies the interaction between total demand and total supply within an economy. These two forces are fundamental to understanding how economies adjust to changes in production, consumption, and pricing. The balance between these factors shapes key outcomes such as inflation, unemployment, and overall economic growth.

Aggregate demand refers to the total amount of goods and services that consumers, businesses, and the government are willing to purchase at different price levels. On the other hand, aggregate supply represents the total output that producers are willing to produce at varying price levels. Together, these concepts help explain economic fluctuations and the impact of policy decisions on a national scale.

Money Supply and Economic Stability

The availability and regulation of money within an economy play a crucial role in maintaining its overall stability. When money is abundant or scarce, it directly impacts inflation, interest rates, and economic growth. Understanding how central banks control the money supply is key to grasping how economies navigate periods of expansion and contraction.

Role of Central Banks in Managing Money

Central banks have the power to influence the economy by adjusting the supply of money. They do this through various tools such as interest rates, open market operations, and reserve requirements. By either increasing or decreasing the amount of money circulating in the economy, they can help control inflation, stabilize currency values, and promote sustainable growth.

Impact of Money Supply on Inflation and Growth

Changes in the money supply can have a significant impact on inflation rates and economic growth. An excessive increase in money supply can lead to inflation, reducing the purchasing power of consumers. On the other hand, insufficient money supply may lead to deflation and slow down economic activity. Striking the right balance is essential for maintaining long-term stability.

The Role of Central Banks in Economies

Central banks are pivotal institutions that help manage a nation’s economy by controlling the supply of money, regulating interest rates, and ensuring financial stability. Their actions can influence inflation, employment, and overall economic growth. Understanding their role is crucial to grasping how national economies function and how monetary policy is used to stabilize or stimulate economic activity.

One of the primary functions of central banks is to oversee and adjust the money supply in response to economic conditions. By using various tools, central banks can either increase or decrease the flow of money in the economy, which directly impacts inflation rates, currency strength, and economic expansion or contraction. In this way, central banks work to create a balanced economic environment.

| Central Bank Function | Description | Impact on Economy |

|---|---|---|

| Monetary Policy | Adjustment of interest rates and money supply to control inflation and support economic growth. | Helps maintain price stability and avoid excessive inflation or deflation. |

| Regulation of Financial Institutions | Ensures banks and financial systems operate within safe and sound frameworks. | Promotes stability and trust in the banking system. |

| Currency Stabilization | Manages the value of the national currency through foreign exchange reserves. | Helps maintain the value of the currency in global markets. |

Understanding Fiscal Policy in Practice

Government fiscal decisions play a central role in shaping the overall health of an economy. By adjusting spending levels and taxation, the government can influence economic activity, stabilize markets, and foster conditions for growth. These policy measures are often used to counteract economic downturns or to prevent the economy from overheating during periods of expansion.

Government Spending and Economic Growth

One of the most direct tools in fiscal policy is government spending. By increasing expenditure on infrastructure, education, or welfare, the government can stimulate demand, create jobs, and boost economic activity. On the other hand, reducing spending may help cool down an economy experiencing high inflation, leading to a more sustainable growth path.

The Role of Taxation in Stabilization

Taxation is another key component of fiscal policy. By adjusting tax rates, governments can directly influence consumer spending and business investment. Lower taxes can provide individuals and companies with more disposable income, stimulating demand and investment. Alternatively, higher taxes can help reduce inflationary pressures and manage budget deficits.

The Impact of Inflation on Economies

Inflation, or the general rise in prices over time, has a significant effect on the stability and growth of an economy. When inflation is moderate, it can indicate a growing economy, but if it becomes too high or too low, it can cause serious economic disruptions. Understanding its impact is critical for policymakers and businesses to ensure economic stability and sustainable development.

Effects of High Inflation

When inflation accelerates rapidly, it can have several negative consequences, including:

- Decreased Purchasing Power: As prices rise, the value of money decreases, leading to reduced consumer spending power.

- Uncertainty in Business Planning: High inflation creates instability, making it difficult for businesses to set prices, wages, and long-term strategies.

- Interest Rate Increases: Central banks may raise interest rates to control inflation, which can lead to higher borrowing costs for businesses and consumers.

- Income Redistribution: Inflation often benefits borrowers but harms savers, as the real value of debt decreases while savings lose value.

Consequences of Low Inflation or Deflation

On the other hand, very low inflation or deflation, where prices decline over time, can also be problematic:

- Delayed Spending: Consumers may postpone purchases, expecting that prices will continue to fall, which can slow down economic growth.

- Increased Debt Burden: Deflation raises the real value of debt, making it harder for borrowers to repay loans, potentially leading to defaults.

- Stagnant Wages: Low inflation can result in stagnant wages, reducing disposable income and limiting overall demand within the economy.

Unemployment and Its Economic Consequences

Unemployment is a critical issue that affects not only individuals but the entire economy. When people who are willing and able to work cannot find employment, it creates a ripple effect that impacts various sectors, from productivity to government spending. Understanding the causes and consequences of unemployment is essential for designing effective policies to reduce its negative impact and promote economic stability.

High unemployment rates can lead to a range of economic challenges. These challenges can hinder growth, increase government debt, and reduce overall consumer confidence. Additionally, when a significant portion of the population is unemployed, it can lead to social unrest and further exacerbate inequality.

Global Trade and Its Economic Effects

International trade plays a fundamental role in shaping the economies of nations around the world. By exchanging goods, services, and capital across borders, countries can access resources they lack, enhance productivity, and stimulate economic growth. However, the benefits of global trade come with both opportunities and challenges, influencing everything from local industries to international relations.

Engaging in global trade can lead to increased efficiency and a wider variety of products for consumers. It also encourages specialization, where countries focus on producing goods and services that they can make most efficiently. Despite these benefits, global trade can also have negative effects, such as job displacement in certain sectors and the widening of income inequality between countries or regions.

Monetary Policy Tools and Their Use

Central banks utilize a range of tools to manage the economy by controlling the money supply, influencing interest rates, and stabilizing inflation. These tools are vital for regulating economic activity, especially in times of economic instability or rapid growth. By adjusting these instruments, central banks aim to foster a healthy economic environment, ensuring that inflation remains under control and that employment levels are maintained.

Open Market Operations

One of the most widely used tools is open market operations, where central banks buy or sell government securities in the open market. When the central bank purchases securities, it injects money into the economy, stimulating spending and investment. Conversely, when it sells securities, it removes money from circulation, helping to slow down economic activity and control inflation.

Interest Rate Adjustments

Adjusting interest rates is another key method for influencing economic conditions. By lowering interest rates, central banks make borrowing cheaper, encouraging businesses and consumers to spend and invest more. Raising interest rates has the opposite effect, discouraging borrowing and spending to reduce inflationary pressures and cool down an overheated economy.

Government Spending and Economic Growth

Government expenditure plays a crucial role in stimulating economic activity and fostering long-term growth. Through strategic investments in infrastructure, education, and public services, the government can create a stable environment for businesses to thrive and individuals to prosper. The allocation of resources to key sectors can influence overall productivity, employment levels, and innovation.

Key Areas of Government Investment

There are several key areas where government spending can have a direct impact on economic development:

- Infrastructure Development: Investment in transportation, communication, and energy systems can reduce business costs, improve efficiency, and promote trade.

- Education and Workforce Skills: Spending on education and training programs can boost human capital, leading to higher productivity and innovation.

- Healthcare: Public spending on healthcare improves population health, reduces inequality, and boosts labor market participation.

- Research and Innovation: Government funding for research and development can foster technological advancements and create new industries.

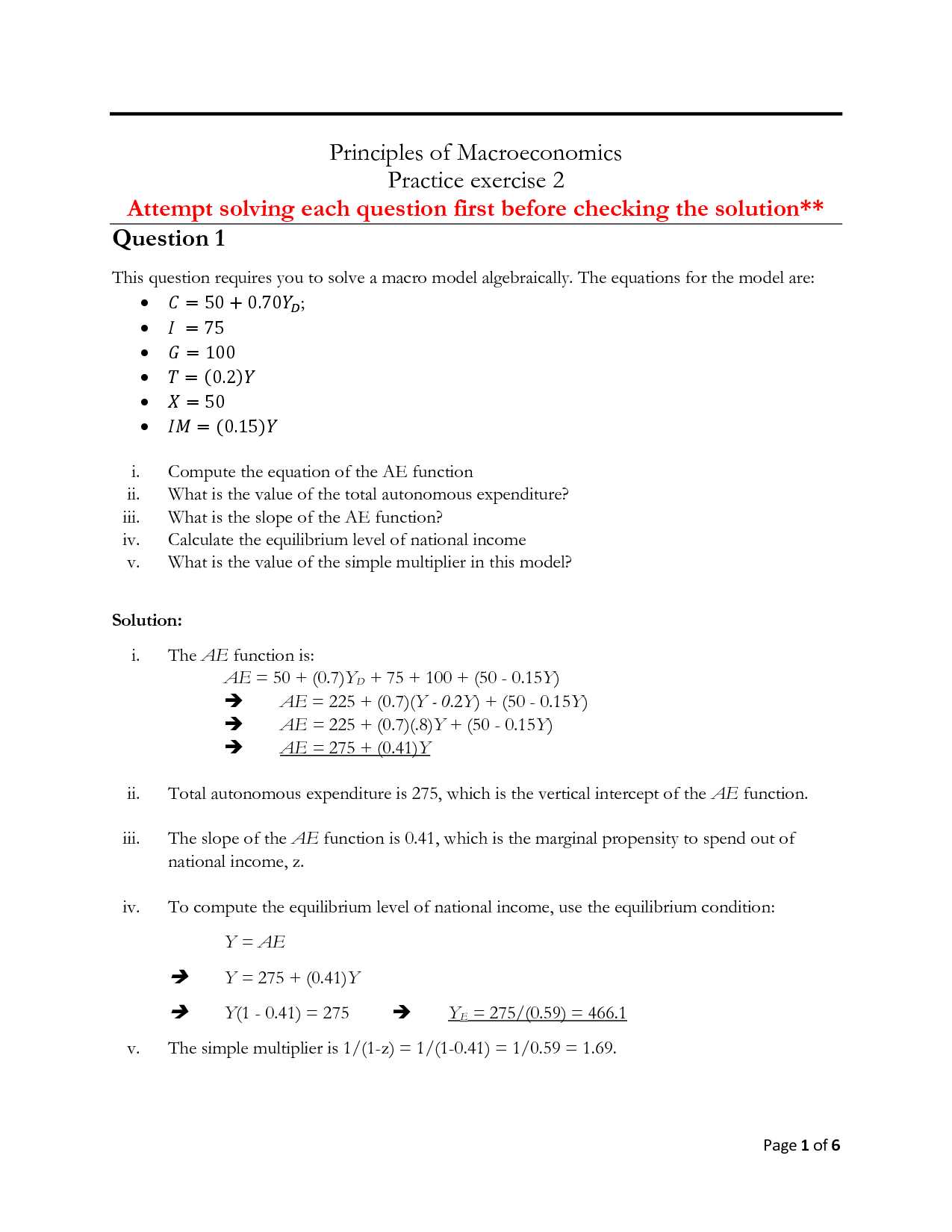

The Multiplier Effect

When the government spends money, it often leads to a “multiplier effect” in the economy. This refers to the idea that every dollar spent by the government can result in a greater increase in economic output. For instance, when the government builds a new highway, it creates construction jobs, which in turn increases demand for materials and services. These workers then spend their wages, further stimulating the economy.

Economic Theories to Know for the Exam

Understanding various economic theories is essential for grasping how economies function and how policymakers make decisions. These theories help explain the behavior of markets, businesses, and consumers, providing insights into how economies grow, stabilize, or experience downturns. By familiarizing yourself with these key concepts, you can better analyze economic situations and understand the logic behind different policy choices.

Key Economic Theories

Several foundational economic theories offer valuable frameworks for understanding economic dynamics:

- Classical Economics: This theory emphasizes the idea that markets function best with minimal government intervention. It focuses on the idea of an “invisible hand” where supply and demand naturally balance out.

- Keynesian Economics: Named after John Maynard Keynes, this theory suggests that government intervention is necessary to manage demand and address economic recessions. It advocates for fiscal policies like increased government spending to boost economic activity.

- Monetarism: This theory, advanced by Milton Friedman, focuses on controlling the money supply to maintain price stability and manage inflation. Monetarists believe that inflation is always a result of excess money in the economy.

- Supply-Side Economics: This approach focuses on boosting economic growth by lowering taxes and reducing regulation to encourage production and investment. Proponents argue that businesses and individuals will invest more when tax burdens are reduced.

The Role of Economic Models

Economic models are essential tools used to understand and predict economic behavior. These models simplify complex real-world phenomena by focusing on key variables and relationships. Some widely studied models include the Aggregate Demand and Supply model, the IS-LM model, and the Phillips Curve, each of which provides insights into how different factors influence an economy’s overall performance.

Evaluating Economic Models and Frameworks

Economic models and frameworks are essential tools used to simplify complex economic systems and provide insights into how different factors interact within an economy. These models help economists predict outcomes, analyze policy effects, and guide decision-making. However, it is crucial to understand their limitations and the assumptions on which they are built. By critically evaluating these models, one can determine their relevance and applicability to real-world situations.

Key Aspects to Consider in Evaluation

When evaluating economic models and frameworks, several factors must be taken into account to understand their strengths and weaknesses:

- Assumptions: Every model is based on certain assumptions about how markets and agents behave. These assumptions must be realistic and appropriate for the context in which the model is applied.

- Simplicity vs. Complexity: While models need to simplify reality for analysis, they must also retain enough complexity to reflect the key dynamics at play. Overly simplistic models may overlook critical factors.

- Empirical Validation: A model’s usefulness is often measured by how well its predictions align with real-world data. It is important to test a model’s validity through empirical research.

- Policy Relevance: Economic frameworks are often used to inform policy decisions. Evaluating how well a model can inform government or central bank actions is crucial for its practical application.

Types of Economic Models

There are several types of economic models, each serving different purposes in analysis. Some common models include:

- Static Models: These models analyze a system at a specific point in time, assuming that variables do not change over time.

- Dynamic Models: These models look at how variables evolve over time, capturing the effects of changes in policy or external shocks.

- Computable General Equilibrium Models: These models are used to analyze the overall economy and simulate the effects of policy changes or shocks across multiple sectors.

Short-term vs Long-term Economic Analysis

Economic analysis can be approached from two perspectives: short-term and long-term. While both offer valuable insights, they differ in terms of time horizon, objectives, and the factors considered. Short-term analysis typically focuses on immediate changes and their effects on the economy, while long-term analysis looks at broader, more enduring trends and structural changes. Understanding these differences is essential for making informed decisions and crafting effective policies.

In the short run, economic conditions can be highly volatile, with demand fluctuations, government interventions, and external shocks influencing market dynamics. In contrast, long-term analysis examines the fundamental drivers of growth, such as technological advancements, demographic shifts, and the accumulation of capital. The way policymakers approach these two types of analysis often determines the success of economic strategies.

Key Differences Between Short-term and Long-term Analysis

| Aspect | Short-term Analysis | Long-term Analysis |

|---|---|---|

| Focus | Immediate effects of changes in policy, demand, or supply | Broader economic trends and growth drivers |

| Time Horizon | Short period (months to a few years) | Long period (decades or more) |

| Factors Considered | Short-term shocks, business cycles, inflation, unemployment | Technological progress, population growth, education, infrastructure development |

| Policy Implications | Quick interventions, fiscal stimulus, interest rate adjustments | Investment in education, infrastructure, sustainable growth strategies |

When to Use Each Type of Analysis

Short-term analysis is particularly useful for responding to immediate economic crises, such as recessions or natural disasters, where rapid government intervention or monetary policy adjustments are necessary. On the other hand, long-term analysis is essential for shaping policies that ensure sustainable economic growth, such as investing in education, innovation, and infrastructure development.

Both short-term and long-term analyses complement each other, as understanding immediate challenges and future potential is key to formulating comprehensive economic strategies. By balancing these two perspectives, policymakers can foster economic stability while paving the way for future prosperity.

The Importance of Economic Indicators

Economic indicators play a crucial role in shaping economic analysis and decision-making. These metrics provide valuable insights into the performance and health of an economy, allowing governments, businesses, and individuals to make informed choices. By monitoring trends and fluctuations in key indicators, analysts can predict future economic conditions and identify potential risks and opportunities.

These indicators can be broadly classified into three categories: leading, lagging, and coincident. Leading indicators provide early signals of future economic activity, helping predict expansions or contractions. Lagging indicators, on the other hand, reflect past economic performance, offering confirmation of trends that have already occurred. Coincident indicators move in sync with the economy, providing a real-time snapshot of current conditions.

Understanding these indicators is essential for effective economic planning. Policymakers use them to guide monetary and fiscal decisions, while businesses rely on them to adjust strategies, plan investments, and manage risks. For example, a sharp rise in unemployment or inflation may signal a slowdown, prompting necessary policy adjustments. Conversely, a rise in consumer confidence or a surge in GDP growth could indicate a thriving economy, encouraging further investments.

Common Economic Indicators to Track

- Gross Domestic Product (GDP): Measures the total value of goods and services produced within a country. A rising GDP signals economic growth, while a decline can indicate a recession.

- Unemployment Rate: Reflects the percentage of the labor force that is unemployed and actively seeking work. High unemployment suggests economic distress, while low unemployment typically indicates a healthy economy.

- Inflation Rate: Tracks the increase in prices of goods and services. Moderate inflation is often a sign of a growing economy, while hyperinflation can lead to instability.

- Consumer Price Index (CPI): Measures changes in the cost of living for households. It is a key indicator of inflation and purchasing power.

- Consumer Confidence Index (CCI): Reflects consumers’ sentiment about the economy. High confidence often correlates with increased spending and economic growth.

In conclusion, economic indicators are essential tools for understanding the dynamic forces that drive economic activity. Whether monitoring the health of a nation’s economy or predicting future trends, these metrics help inform critical decisions at every level of society, from individual households to multinational corporations and governments. By staying informed about key economic indicators, stakeholders can better navigate the complexities of the global economy.

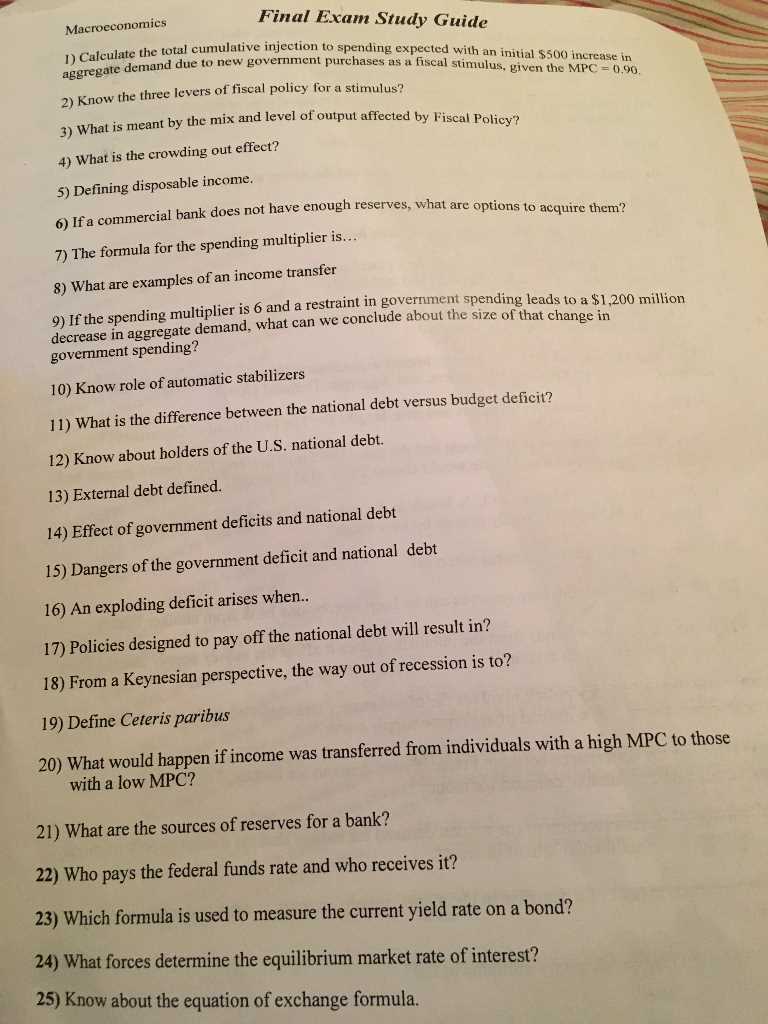

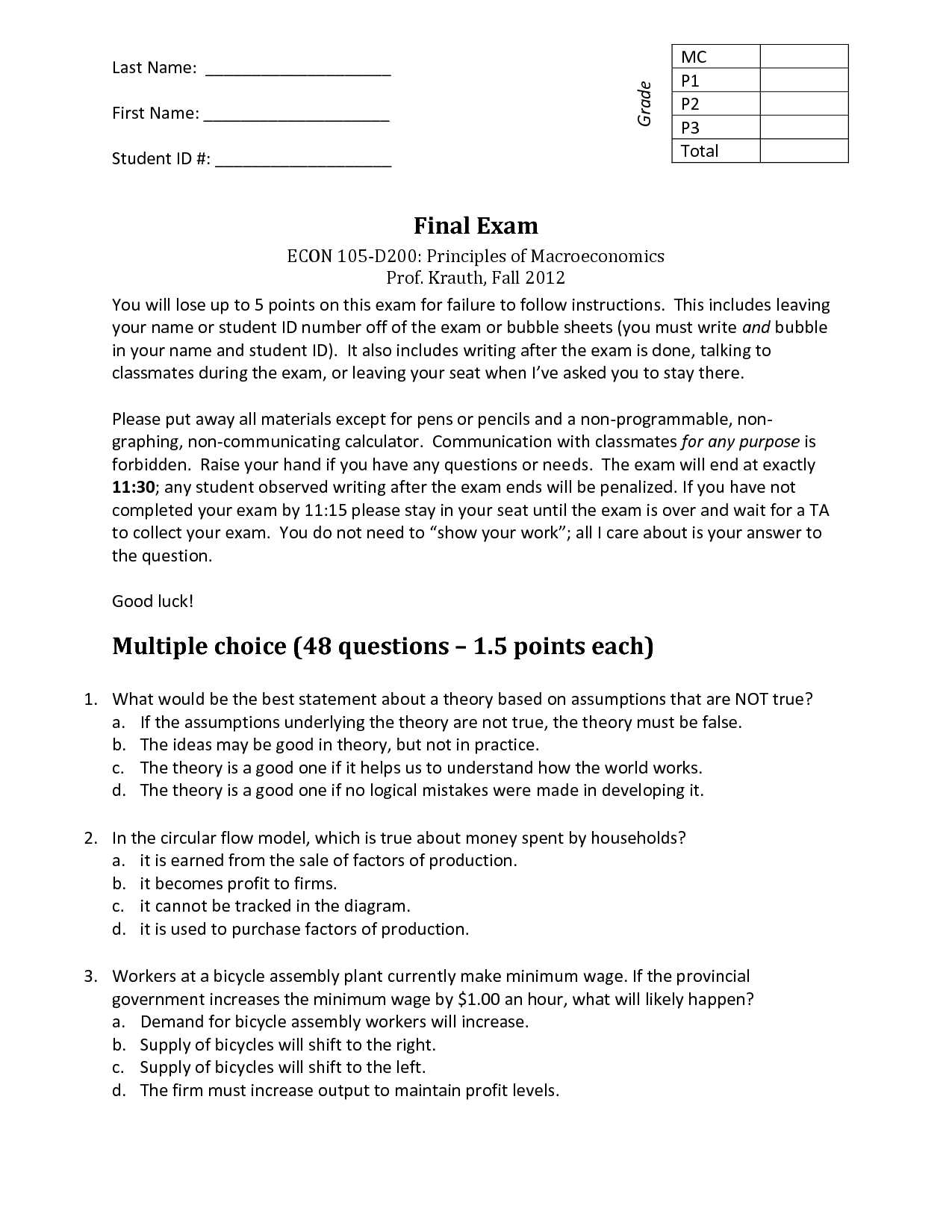

Preparing for Common Economic Assessment Questions

Preparing for any type of assessment in economics requires a solid understanding of the key concepts and the ability to apply them to real-world scenarios. Whether it’s analyzing the effects of government policies or understanding how markets operate, being well-prepared means knowing the typical questions that may arise. Familiarity with these questions helps you think critically and formulate clear, concise responses under pressure.

In this section, we focus on some of the most common themes that are typically tested, ranging from fundamental economic models to the real-world impact of economic policies. The key to success lies in breaking down these topics into manageable components and practicing them through various example questions. The more prepared you are for typical inquiries, the better your ability to approach unexpected challenges during the assessment.

Key Areas to Focus On

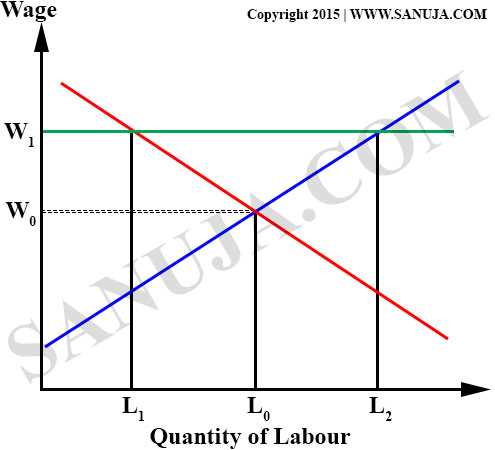

- Supply and Demand Analysis: Be ready to explain how changes in supply and demand influence prices and quantities in different markets. Practice drawing and interpreting supply and demand curves to illustrate various scenarios.

- Government Intervention: Understand the effects of taxation, subsidies, and regulation on markets. Prepare for questions that ask how government actions affect market equilibrium and economic welfare.

- Economic Growth and Development: Expect to explain factors that contribute to long-term economic growth. Be able to identify the roles of capital accumulation, technological innovation, and human capital in driving progress.

- Fiscal and Monetary Policies: Know how government spending, taxation, and central bank actions can influence overall economic activity. Practice applying these concepts to real-life examples, such as how to address a recession or inflation.

- Inflation and Unemployment: Be prepared to discuss the causes and consequences of inflation and unemployment. Understand key concepts like the Phillips Curve and how policy can be used to stabilize the economy.

Tips for Success

- Understand the Theories: Review the core concepts and theories thoroughly. Ensure you can explain each concept with clarity and apply it to different economic contexts.

- Practice with Real-World Scenarios: Use examples from current economic events to illustrate your understanding of theory. This will help you show how economic principles work in practice.

- Master Graphs and Diagrams: Many questions will require you to interpret or draw graphs. Practice labeling and interpreting economic diagrams accurately.

- Stay Organized: During the assessment, organize your answers logically. Start with definitions, followed by analysis, and end with a clear conclusion.

By preparing in these key areas, you’ll be well-equipped to tackle a variety of questions, demonstrating both your theoretical knowledge and practical understanding of economic principles. The key is consistent practice and applying concepts in different contexts to solidify your knowledge and build your confidence.