In the world of international taxation, certain complex principles are regularly tested, requiring a deep understanding of various laws and regulations. This section will guide you through essential topics and provide useful strategies to handle related tasks effectively. Whether you are preparing for an academic challenge or enhancing your professional expertise, a comprehensive grasp of these concepts is crucial.

Tax strategies play a pivotal role in managing cross-border transactions and ensuring compliance with both local and global standards. Understanding the intricacies of how companies manage internal resource allocation is essential for anyone aiming to excel in this field. By exploring fundamental theories and practical examples, you’ll be well-equipped to approach various scenarios confidently.

To succeed in assessments related to global taxation systems, it’s important to develop a systematic approach. Reviewing common case studies, understanding regulatory frameworks, and honing your analytical skills will prepare you for any situation you might face. With careful study and strategic thinking, you can gain a significant advantage in tackling even the most challenging topics in this domain.

Transfer Pricing Exam Questions and Answers

In any assessment focused on international taxation, understanding how companies allocate resources across borders is a key area of focus. The complexity of these financial transactions often presents significant challenges, but with the right approach, it’s possible to navigate even the most demanding scenarios. This section will guide you through essential strategies for tackling such assessments effectively.

Key Areas to Focus On

When preparing for a test on this subject, it’s essential to master the core concepts of intercompany transactions, allocation methods, and their impact on tax obligations. Reviewing how various systems work, including the different methods used to determine value within multinational entities, will give you the tools needed to address a wide range of tasks. Understanding the reasoning behind these methods is just as important as memorizing the rules themselves.

Approaching Case Scenarios

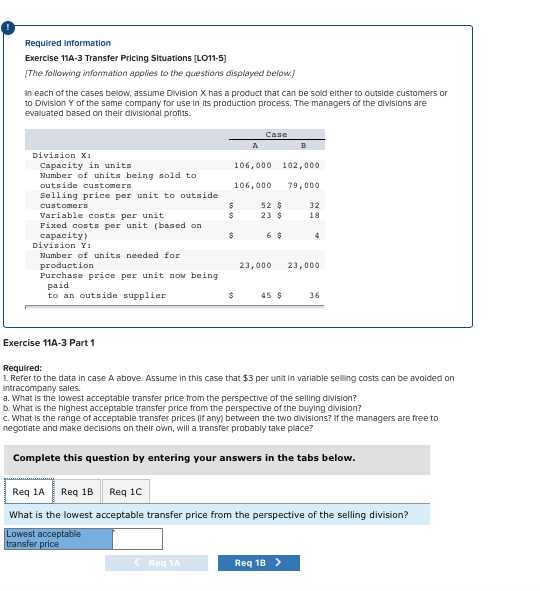

Practical case scenarios are a common feature in assessments, and they require you to apply theoretical knowledge to real-world situations. These exercises often involve calculating values, analyzing agreements between entities, or identifying potential tax risks. Being able to break down complex problems into manageable parts, while staying aware of relevant regulations, will greatly improve your chances of success.

Understanding the Basics of Transfer Pricing

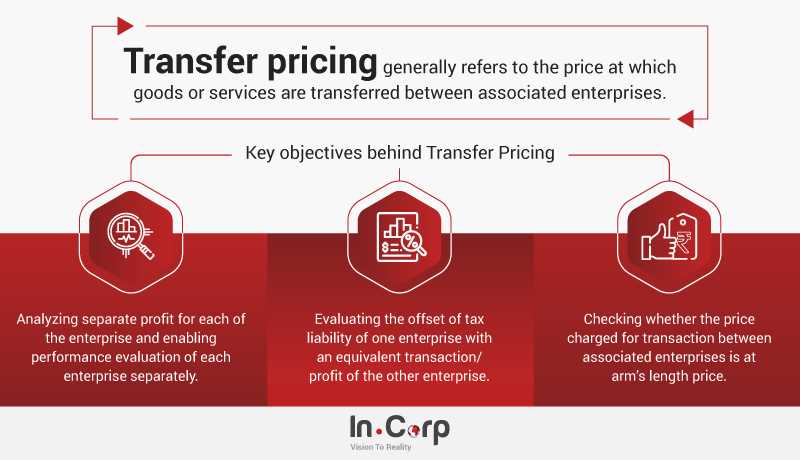

At the core of global taxation lies the process of setting financial terms between affiliated companies operating in different countries. This mechanism ensures that transactions between these entities are carried out at fair values, reflecting their actual market worth. A solid grasp of the underlying principles is essential for navigating the complexities of multinational tax regulations.

Understanding how to allocate costs, profits, and other financial factors within a corporate group allows businesses to comply with international rules while maintaining financial efficiency. The approach used to determine the price of goods, services, or intangible assets between related companies is not arbitrary but based on specific guidelines that aim to replicate the conditions of independent market exchanges.

In this context, it is important to familiarize oneself with various methods used to calculate values, each tailored to different transaction types. Familiarity with these approaches ensures a deeper comprehension of how businesses are expected to report intercompany activities, thus helping to avoid legal disputes and tax penalties.

Key Concepts in Transfer Pricing Laws

Understanding the legal framework governing intercompany transactions is crucial for navigating international tax regulations. These laws aim to ensure that businesses operating across borders allocate resources and set prices in a way that is consistent with market principles, preventing tax avoidance and ensuring fair competition. Comprehending the key concepts behind these regulations is fundamental for anyone involved in multinational financial activities.

Among the most important elements of these laws are the arm’s length principle, which ensures that transactions between related companies reflect the prices that would be agreed upon between independent entities, and the documentation requirements, which ensure that proper records are kept to demonstrate compliance with tax obligations. Additionally, comparable analysis is often used to assess whether intercompany pricing aligns with market standards, relying on a detailed comparison of similar transactions between unrelated companies.

Another essential aspect is the economic substance of the transactions, which means that agreements and pricing must reflect actual business activities and not be structured solely to minimize tax liabilities. Understanding these core principles provides the foundation needed to address complex issues that arise in multinational tax systems.

Types of Transfer Pricing Methods Explained

When businesses engage in cross-border transactions within a corporate group, it is essential to determine how to allocate values accurately. Different approaches are employed to ensure that these allocations reflect the true market value of goods, services, or assets exchanged between related entities. Each method aims to align with the economic realities of independent market transactions, helping to prevent tax discrepancies and compliance issues.

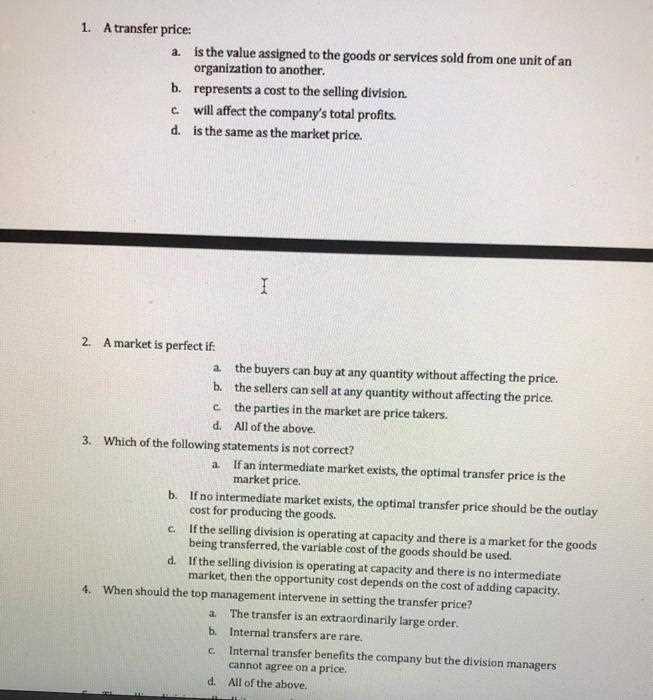

One commonly used approach is the comparable uncontrolled price (CUP) method, which compares the price charged in a controlled transaction with that in a similar transaction between unrelated parties. This method relies on finding accurate, reliable data from independent market sources. Another widely used method is the cost-plus method, where a markup is added to the cost of producing a good or service to determine an appropriate price for intercompany transactions.

Additionally, the resale price method focuses on the price at which a product is sold to an independent party, subtracting the gross margin to calculate the appropriate transfer price for the earlier transaction. For more complex scenarios, the profit split method is used, where profits are divided between entities based on their respective contributions to the overall value of the transaction. Understanding these methods provides the foundation for properly determining values and ensuring compliance with international tax regulations.

Common Challenges in Transfer Pricing Exams

When tackling assessments related to international taxation and intercompany transactions, several obstacles can arise. The complexity of these subjects, along with the need for a deep understanding of financial principles, often leads to confusion and mistakes. Many students and professionals face similar difficulties when approaching these tests.

- Understanding Complex Methods: There are various methods to determine pricing between related entities, each with its own rules and exceptions. Mastering these techniques can be overwhelming, especially when multiple methods are tested simultaneously.

- Interpreting Case Scenarios: Case-based questions require the application of theoretical knowledge to practical situations. These scenarios often involve intricate financial data that must be analyzed carefully to derive the correct approach.

- Dealing with Ambiguous Data: Sometimes, questions may present incomplete or ambiguous information. The ability to make reasonable assumptions and fill in the gaps while maintaining compliance with relevant regulations is a key skill that can be difficult to master.

- Comparing International Regulations: Different countries have varying rules for allocating costs and setting values, which can lead to confusion when comparing methodologies. Understanding the global framework and how different jurisdictions impact calculations is critical for success.

By practicing under timed conditions and refining analytical techniques, students can better navigate these challenges. Being prepared for such hurdles not only helps in achieving higher scores but also ensures a clearer understanding of real-world application.

Important Topics for Transfer Pricing Exams

In assessments related to global taxation and intercompany financial transactions, there are several key areas that are crucial to understand. These topics form the foundation of the subject and are often tested in various forms, from theoretical questions to practical case studies. A solid grasp of these concepts ensures you can confidently approach a wide range of scenarios and successfully navigate the complexities of international business operations.

| Topic | Description |

|---|---|

| Arm’s Length Principle | The core concept that ensures pricing between related entities reflects market conditions as if the companies were independent. |

| Methods for Valuation | Various approaches like cost-plus, comparable uncontrolled price, and profit split, each used to determine appropriate pricing for intercompany transactions. |

| Documentation Requirements | The need for accurate and detailed records that demonstrate compliance with global tax regulations, particularly for multinational companies. |

| Comparability Analysis | The process of identifying similar independent transactions to ensure the arm’s length principle is adhered to in pricing decisions. |

| Dispute Resolution Mechanisms | Methods for resolving conflicts that arise from audits or disagreements between tax authorities and companies regarding intercompany transactions. |

Focusing on these core topics will provide a strong foundation for addressing various types of questions and ensuring accurate application of global tax laws in real-world scenarios. Mastery of these subjects is essential for anyone preparing for an assessment in this area.

How to Tackle Transfer Pricing Case Studies

Case studies in global taxation often present real-world scenarios where businesses must allocate values between related entities. These exercises require you to apply theoretical knowledge to practical situations, carefully analyzing the financial data and applying the appropriate methods to determine fair pricing. Approaching these tasks systematically is essential for success.

Start by reading the scenario carefully and identifying the key details, such as the parties involved, the type of transaction, and the geographic locations. Focus on understanding the nature of the transaction and the business context, as this will guide you in choosing the right methodology. Once you’ve identified the key elements, you can then decide which method–such as the comparable uncontrolled price or cost-plus approach–best suits the case.

Next, ensure that you have all the necessary information to apply the chosen method. Look for comparable data, transaction costs, or market prices, depending on the method being used. If certain information is missing, make reasonable assumptions based on the data provided and clearly state these assumptions in your solution. Finally, ensure that your calculations are accurate, and double-check your final results to ensure compliance with the established guidelines.

By breaking down each case study into manageable steps, you can confidently navigate complex situations and demonstrate your understanding of the underlying principles.

Tips for Answering Transfer Pricing Questions

When tackling assessments related to intercompany financial dealings, it’s essential to approach each task strategically. These challenges often require a deep understanding of both theoretical concepts and practical application. By following a few key strategies, you can efficiently navigate the complexities and ensure your responses are both accurate and well-structured.

Understand the Key Principles

- Know the core concepts: Make sure you understand essential topics such as the arm’s length principle, methods for valuing transactions, and documentation requirements.

- Familiarize with different methodologies: Be prepared to choose the right method (e.g., cost-plus, comparable uncontrolled price, or profit split) depending on the scenario and available data.

- Interpret real-world scenarios: Practice applying concepts to real-life situations, understanding how financial data interacts with regulatory frameworks.

Approach Each Problem Systematically

- Read carefully: Take your time to analyze each scenario thoroughly. Identify key data points, such as entities involved, the nature of the transaction, and any geographical considerations.

- Stay organized: Break down the problem into manageable parts. Start by gathering necessary information and applying the correct methodology step-by-step.

- Show your reasoning: Always explain your thought process, even if the answer seems straightforward. Demonstrating how you arrived at your conclusions is essential.

By focusing on these strategies, you can enhance the clarity and accuracy of your responses, ultimately improving your performance in assessments related to global taxation and intercompany dealings.

Common Mistakes in Transfer Pricing Exams

When addressing challenges related to intercompany financial transactions, there are several common pitfalls that many individuals encounter. These errors often stem from misunderstandings of key concepts, oversights in calculations, or misapplications of methods. Recognizing these mistakes in advance can help prevent them and ensure a more accurate and thorough response.

| Mistake | Description |

|---|---|

| Ignoring the Arm’s Length Principle | Failing to properly apply this fundamental concept can lead to unrealistic or non-compliant pricing decisions. |

| Incorrect Method Selection | Choosing an inappropriate method for valuing transactions based on incomplete data or misunderstanding the nature of the exchange. |

| Overlooking Market Comparability | Not properly considering market data or similar independent transactions when applying methods like the comparable uncontrolled price approach. |

| Misinterpretation of Data | Incorrectly analyzing financial figures, which may lead to flawed conclusions or inaccurate pricing determinations. |

| Insufficient Documentation | Failing to include enough detailed records or explanations to support the chosen method or the final pricing decisions. |

By being aware of these common mistakes, individuals can approach challenges with greater confidence, ensuring a deeper understanding and more effective application of key principles in intercompany transactions.

Real-World Applications of Transfer Pricing

In the global business environment, pricing between related entities plays a crucial role in determining the financial outcomes of multinational companies. The application of proper methods helps ensure that transactions are priced fairly, reflecting market conditions, while also adhering to the regulatory requirements of different countries. This practice is essential for both financial performance and compliance with international tax laws.

Tax Planning and Risk Management

One of the primary applications of intercompany pricing is in tax planning. Companies often structure their transactions to optimize tax obligations, taking advantage of favorable tax rates in certain jurisdictions. By adjusting the pricing of goods, services, or intellectual property, organizations can manage their global tax liabilities effectively. However, this must be done carefully to avoid scrutiny from tax authorities who may challenge pricing strategies that deviate from market norms.

Compliance with International Regulations

Another critical aspect is ensuring compliance with the complex regulations set by tax authorities worldwide. Different countries have stringent guidelines for intercompany transactions, which businesses must follow to avoid penalties. By applying the correct methodologies and maintaining proper documentation, companies can ensure they meet these regulatory requirements while minimizing the risk of audits and legal disputes.

These real-world applications highlight the importance of understanding the principles behind intercompany pricing decisions and the careful balancing act required to achieve both financial optimization and legal compliance. Effective use of these practices can provide businesses with a competitive advantage while mitigating potential risks.

Transfer Pricing and International Taxation

In the context of global business, the methods used to allocate revenues and costs between related entities are vital for both financial performance and adherence to international tax laws. Multinational corporations must navigate complex regulations to ensure compliance with local and international tax rules while optimizing their overall tax position. This intersection of financial strategy and legal requirements is a key area of focus in cross-border trade.

One of the most important aspects of this practice is understanding how different jurisdictions tax cross-border transactions. Each country has its own rules for allocating profits, and these rules often differ significantly. Businesses must carefully analyze their operations to ensure that they align with the relevant regulations, avoiding potential penalties or double taxation.

Key Challenges in Global Tax Compliance

- Double Taxation: Multinational companies may be taxed in multiple jurisdictions for the same income, which can lead to higher tax burdens.

- Local Legislation Variance: Different countries have different methods for determining the correct allocation of income and expenses, requiring businesses to stay updated on each jurisdiction’s rules.

- Documentation and Reporting: Proper documentation is essential to prove that intercompany transactions are compliant with the arm’s length principle, avoiding disputes with tax authorities.

Tax Strategies for Multinational Corporations

- Utilizing Tax Treaties: Tax treaties between countries can help prevent double taxation by providing mechanisms for allocating taxing rights between jurisdictions.

- Choosing the Right Jurisdictions: Many corporations establish subsidiaries in jurisdictions with favorable tax rates, but they must ensure that the intercompany pricing remains compliant with international standards.

- Managing Risk Exposure: Companies should evaluate their risk exposure when structuring cross-border transactions to ensure they are not vulnerable to audits or legal challenges.

By carefully navigating the complex world of global taxation and pricing strategies, businesses can optimize their operations, reduce their tax liability, and ensure compliance with international regulations, ultimately achieving a balance between financial efficiency and legal adherence.

How to Analyze Transfer Pricing Documentation

Properly reviewing financial documentation for intercompany transactions is a critical part of ensuring compliance with legal standards and supporting the fairness of the allocated values. This documentation provides essential evidence that the pricing methods used by businesses align with regulatory requirements. It also serves as a defense against potential audits and disputes with tax authorities.

When analyzing such records, it is important to focus on verifying that the methods used for determining intercompany values are consistent with the relevant principles. The analysis should be thorough, examining the logic behind pricing decisions, the data used, and how well the documentation supports the claimed pricing strategy.

Key Aspects to Review in Documentation

- Methodology Consistency: Ensure that the pricing methods applied throughout the transactions are consistent and well-documented, adhering to the arm’s length principle.

- Comparability Analysis: Check if the documentation provides appropriate benchmarks and comparisons to similar market transactions or independent parties.

- Financial Information: Verify the financial data supporting the pricing structure, such as profit margins, costs, and other relevant financial metrics.

- Compliance with Local Regulations: Examine how the documentation aligns with the tax laws and guidelines of each jurisdiction involved in the intercompany transactions.

- Supporting Documentation: Assess the availability of contracts, agreements, and other legal documents that support the pricing decisions made between entities.

Steps to Ensure Accuracy in Analysis

- Review the Contracts: Start by carefully examining the contracts between the related parties to understand the terms and conditions governing the transactions.

- Analyze Financial Data: Verify that the financial data used in pricing decisions accurately reflects actual market conditions and the financial performance of the entities involved.

- Compare with Independent Transactions: Cross-check the pricing applied against similar transactions between unrelated parties to ensure that the values align with industry standards.

- Check for Adequate Documentation: Ensure that all necessary supporting documentation is present and organized, including detailed records of how prices were set and the rationale behind the methods chosen.

By following these guidelines, businesses can ensure that their documentation is complete, accurate, and compliant, thus reducing the risk of challenges by tax authorities and reinforcing the integrity of their pricing strategies.

Understanding Transfer Pricing Disputes

Disputes related to intercompany financial arrangements arise when tax authorities challenge the allocation of income or expenses between different branches or subsidiaries of multinational companies. These disagreements often stem from differences in how each jurisdiction interprets the pricing methods used to allocate profits, and whether they align with local and international tax standards. As a result, these disputes can lead to costly audits, adjustments, or penalties for companies if not handled effectively.

Typically, tax authorities will question the fairness and transparency of the pricing methods applied, seeking to ensure that transactions between related entities are conducted at arm’s length. This means that the pricing used should reflect what independent parties would agree upon under similar circumstances. When discrepancies arise, businesses must demonstrate the legitimacy of their pricing arrangements through documentation, financial analysis, and supporting evidence.

Common Causes of Disputes

- Inconsistent Methodology: When a company applies different methods for pricing transactions across its various subsidiaries, this inconsistency can raise red flags for tax authorities.

- Lack of Sufficient Documentation: Insufficient or poorly organized supporting documentation can lead to disputes, as authorities may question the rationale behind the chosen pricing methods.

- Inaccurate Comparisons: If a company fails to properly benchmark its intercompany pricing against comparable transactions, this can lead to disagreements about the fairness of the prices set.

- Non-Compliance with Local Laws: Different countries may have specific regulations that require certain approaches to intercompany pricing, and failure to adhere to these can result in disputes.

Strategies for Resolving Disputes

- Comprehensive Documentation: Ensuring that detailed and accurate records are kept can be critical in defending against challenges. This includes contracts, financial statements, and any external comparisons.

- Engaging in Advance Pricing Agreements (APAs): Companies can work proactively with tax authorities to agree on pricing methods before disputes arise, reducing the risk of future conflicts.

- Seeking Mediation or Arbitration: When a dispute becomes contentious, utilizing independent third-party mediation or arbitration can help resolve issues without resorting to lengthy legal battles.

- Regular Reviews: Regular internal audits and reviews of intercompany pricing policies can help identify potential issues before they escalate into full-blown disputes.

By understanding the common causes and resolution strategies for intercompany pricing disputes, businesses can better navigate the complexities of global taxation and minimize the risk of costly conflicts.

Best Resources for Transfer Pricing Study

For those seeking to deepen their knowledge in the field of intercompany financial arrangements, there are various resources available that can significantly enhance understanding and provide practical insights. Whether you’re a student preparing for assessments or a professional looking to stay updated with the latest practices and regulations, utilizing the right materials is crucial. These resources offer both theoretical frameworks and real-world applications, helping learners build a solid foundation in this complex area of taxation and financial management.

Among the best study tools are textbooks, online courses, and official guidelines from tax authorities. Each resource offers different perspectives and approaches, making it important to combine several to get a well-rounded understanding. For instance, textbooks provide in-depth knowledge and theoretical underpinnings, while online courses can offer practical examples and real-life case studies. Additionally, consulting official guidelines ensures that you stay compliant with the latest regulatory standards.

Recommended Textbooks

- Principles of International Taxation: This comprehensive book covers the fundamentals of cross-border taxation, including intercompany arrangements and global tax compliance.

- International Business Taxation: A valuable resource for understanding how global businesses handle financial transactions between subsidiaries and branches.

- Global Taxation Handbook: This guide offers practical insights and examples, making it a great reference for both beginners and experienced professionals.

Online Learning Platforms

- Coursera: Provides various courses on international taxation, including topics related to intercompany arrangements and their taxation.

- Udemy: Offers practical courses designed to simplify complex concepts and prepare students for real-world financial challenges.

- LinkedIn Learning: Features tutorials and expert-led courses that cover both foundational knowledge and advanced techniques in international financial management.

Incorporating these resources into your study plan will help build the necessary skills to navigate the complexities of cross-border financial arrangements, preparing you for both theoretical and practical challenges in the field.

Transfer Pricing and OECD Guidelines Overview

Understanding the framework of cross-border financial arrangements is essential for compliance with global standards. The Organisation for Economic Co-operation and Development (OECD) has developed a set of guidelines that offer valuable recommendations on how multinational corporations should approach intra-group financial transactions. These guidelines ensure that businesses comply with tax laws while promoting fairness and transparency in international trade.

The OECD guidelines provide a detailed approach for determining arm’s length prices and preventing practices that could lead to tax avoidance. By adhering to these recommendations, companies can establish prices for intercompany transactions that are consistent with what independent businesses would agree upon in similar circumstances. These principles are critical in minimizing the risks associated with tax audits and disputes between countries.

Key Aspects of the OECD Guidelines

| Key Aspect | Description |

|---|---|

| Arm’s Length Principle | The foundation of the OECD guidelines, which asserts that transactions between related parties should be priced as if they were conducted between independent entities. |

| Comparable Uncontrolled Price (CUP) | This method suggests comparing controlled transactions with those that are uncontrolled to determine a fair price. |

| Documentation Requirements | Companies must maintain detailed records to demonstrate that their intercompany pricing practices comply with the arm’s length principle. |

Implementing the OECD Guidelines in Practice

Implementing the OECD’s framework requires businesses to carefully analyze their internal processes and determine how best to set prices for cross-border transactions. In practice, companies often use a combination of pricing methods outlined by the OECD, such as the Comparable Uncontrolled Price method or the Cost Plus method, depending on the nature of the transactions involved.

Furthermore, adherence to these guidelines helps businesses avoid disputes with tax authorities, as they provide a clear basis for the pricing of goods, services, and intellectual property between related entities. Keeping thorough documentation of pricing policies and justifications also plays a crucial role in ensuring transparency and reducing compliance risks.

Impact of Transfer Pricing on Multinationals

In the global business landscape, the way multinational corporations set internal prices for goods and services exchanged between their subsidiaries plays a critical role in their overall financial strategy. This practice affects everything from profit allocation and tax obligations to regulatory compliance across various jurisdictions. The pricing of cross-border transactions within such companies can significantly influence both their financial performance and the risk they face from tax authorities.

For multinational enterprises, the establishment of intercompany prices has far-reaching implications, especially in terms of tax liabilities. The ability to allocate profits to subsidiaries in low-tax jurisdictions can result in substantial tax savings. However, this practice also attracts the scrutiny of tax authorities worldwide, leading to the potential for audits, disputes, and adjustments. As such, it is crucial for businesses to strike a balance between optimizing their tax position and complying with international regulations.

In addition to tax considerations, setting internal transaction prices impacts the financial reporting and management of multinational companies. Accurate cost allocation and pricing ensure fair profit distribution across different units of the business, which is essential for evaluating performance and making strategic decisions. Properly managed, it can improve operational efficiency and foster trust with stakeholders.

Ultimately, the impact of internal pricing decisions on multinationals is profound. Companies must not only manage their pricing strategies in alignment with local tax laws but also consider the broader implications of international tax frameworks and trade agreements. Failure to comply with these regulations could lead to financial penalties, damage to reputation, and strained relationships with tax authorities.

Preparing for Transfer Pricing Exam Questions

Proper preparation for assessments involving the regulation of internal transactions within multinational companies requires a deep understanding of the concepts, methods, and frameworks that govern these practices. Focusing on both theoretical knowledge and practical application is essential for performing well in such assessments. It’s crucial to familiarize oneself with the principles that guide pricing strategies, as well as the common pitfalls to avoid when answering scenario-based questions.

Key Areas to Focus On

When preparing for tests in this field, concentrate on the following areas:

| Topic | Details |

|---|---|

| International Guidelines | Understand the regulations set by international bodies, such as the OECD, which help ensure fair pricing between subsidiaries. |

| Methods of Determination | Familiarize yourself with the various techniques used to set intercompany prices, including cost-plus, comparable uncontrolled price, and profit split methods. |

| Documentation Standards | Learn the importance of maintaining proper records and compliance documentation to avoid penalties or disputes. |

| Risk Management | Study how businesses mitigate risks associated with tax audits and potential adjustments from tax authorities. |

Practice with Case Studies

One of the best ways to prepare is through case studies. These real-world examples often test the application of theoretical concepts. By reviewing past case studies, you can better understand how to analyze data, identify issues, and apply the correct methodology. It also helps to improve time management during assessments, allowing you to effectively structure your responses and prioritize key points.

By focusing on the above areas and incorporating practical case studies into your preparation, you’ll be better equipped to navigate the complexities of internal pricing regulations and succeed in any related assessment.