Understanding the complexities of estate management and inheritance law is crucial for anyone preparing for a legal assessment in this field. The process involves a series of critical decisions about how assets will be distributed after death, ensuring that both legal formalities and individual preferences are respected. This section will guide you through the essential topics to focus on when preparing for such an evaluation, equipping you with the necessary knowledge to tackle various scenarios confidently.

Effective preparation requires familiarity with legal principles, key terminology, and the procedures involved in estate administration. From the creation of legal documents to the handling of beneficiaries’ interests, the ability to interpret and apply these concepts correctly is vital. By reviewing common scenarios and challenges, you will develop a deeper understanding of how to navigate complex situations effectively.

Anticipating potential challenges and refining your problem-solving skills will help you achieve a solid grasp of the material. With thorough preparation, you will be ready to address any situation that arises in this area of law, demonstrating both your technical knowledge and ability to apply it in practical contexts.

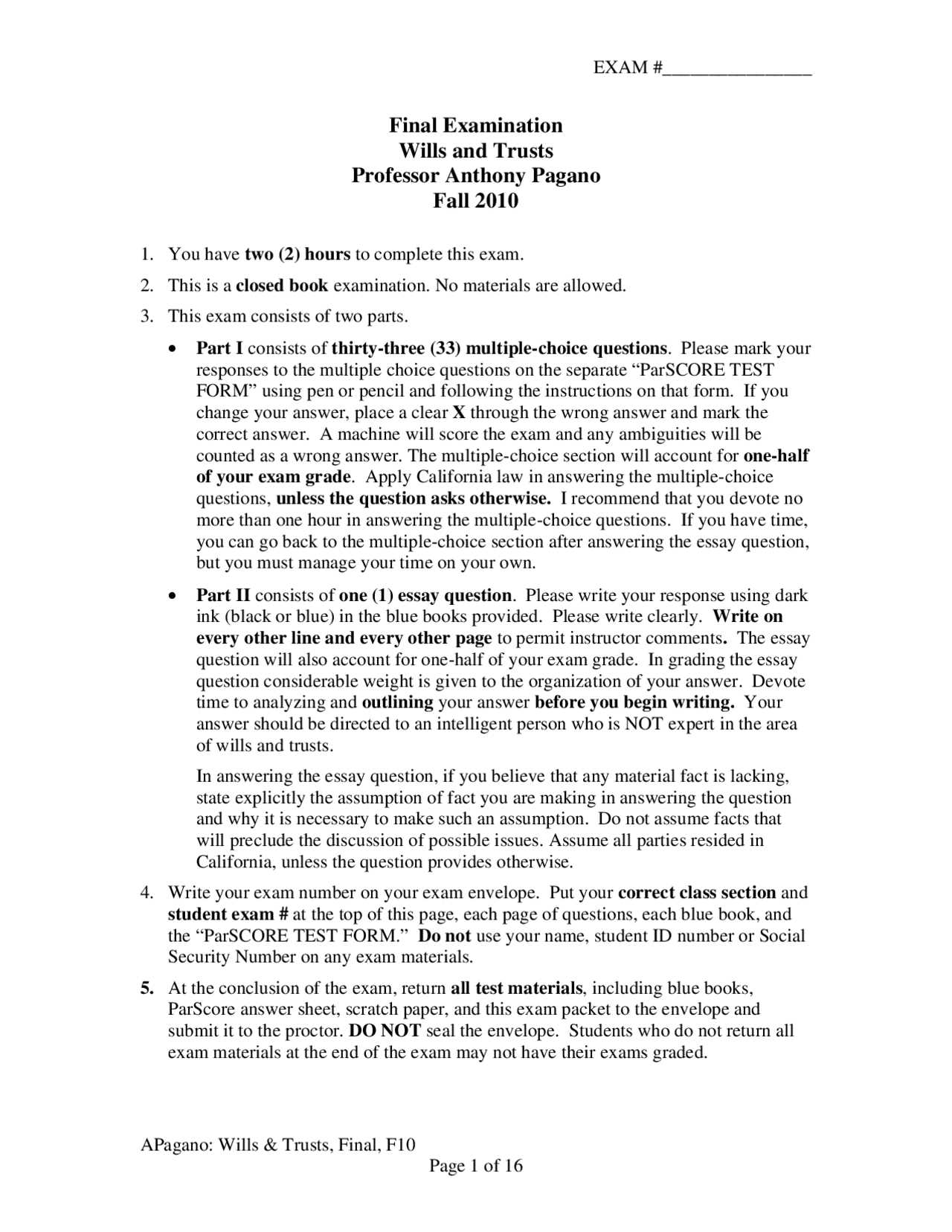

Wills and Trusts Exam Preparation

Successfully navigating the intricacies of estate law requires a solid understanding of the core concepts and procedures involved in managing an individual’s assets after death. Preparing for an evaluation in this field involves more than memorizing definitions; it requires a comprehensive understanding of legal structures, documents, and responsibilities. Familiarity with various legal instruments, as well as the rules governing their execution, is essential for anyone looking to perform well.

Essential Concepts to Focus On

To prepare effectively, it’s important to familiarize yourself with the most common scenarios that may appear during assessments. Key areas include the creation of legal documents, the process of appointing individuals to manage estates, and understanding how assets are transferred according to established legal guidelines. Knowing how different instruments work together and their practical implications will help you tackle complex questions with confidence.

Study Strategies for Success

Effective preparation involves active engagement with the material. Instead of just reading through textbooks, practice applying the concepts to hypothetical situations. Test your understanding by analyzing case studies or discussing different scenarios with peers. This approach will help reinforce your knowledge and improve your ability to respond to unexpected situations. The goal is not only to learn the material but also to develop the skills necessary for critical thinking and problem-solving in the field of estate management.

Understanding Key Legal Terminology

Mastering the language of estate planning is essential for anyone preparing for an evaluation in this field. Legal terminology plays a pivotal role in shaping how documents are drafted, how decisions are made, and how disputes are resolved. A thorough understanding of the terms used in this area will not only help you navigate the material more effectively but will also increase your confidence in addressing complex scenarios.

Common Terms to Know

Familiarize yourself with key phrases such as beneficiary, executor, probate, and intestate. Each term holds significant legal weight and can impact how an individual’s assets are distributed. For example, the term executor refers to a person appointed to carry out the instructions in a legal document, while probate is the legal process of validating a document and ensuring its instructions are followed. Understanding these terms is crucial for interpreting legal scenarios accurately.

Clarifying Legal Roles

Another area to focus on is the distinction between different legal roles, such as testator and trustee. While both are key figures in the creation and administration of legal documents, their responsibilities differ greatly. The testator is the person who creates a legal directive regarding the distribution of assets, while the trustee is responsible for managing and distributing those assets according to the terms outlined. Clear knowledge of these roles ensures you can confidently approach any topic related to estate management.

Types of Wills and Their Requirements

When preparing legal documents for asset distribution, it is important to understand the different types of directives available and their unique legal requirements. Each type serves a distinct purpose and has specific conditions that must be met for it to be valid. These variations can affect how assets are handled and who can administer the instructions. Understanding these differences will ensure proper application in real-life scenarios.

For instance, one type of directive may require specific witnesses to verify the document’s authenticity, while another might allow a person to make changes during their lifetime. The conditions for each type also vary based on jurisdiction and the nature of the assets involved. Some are straightforward, while others may require more detailed legal oversight to ensure their execution aligns with the individual’s wishes.

It’s crucial to know the requirements for creating a valid legal directive in order to prevent disputes and ensure that the intentions of the individual are followed as intended. Familiarity with the specifics of each type will allow you to confidently address any issues that arise in legal planning.

Test Your Knowledge of Trusts

One of the best ways to strengthen your understanding of estate planning is to actively engage with the material. By challenging yourself with practical scenarios and problem-solving exercises, you can assess your grasp of important concepts and identify areas that need further review. This approach helps solidify key principles and ensures you are prepared for any situation that may arise.

Start by reviewing common situations where the administration of assets is involved. Consider how different types of legal arrangements are set up and how the appointed parties manage those assets. Think about the responsibilities of the individuals involved, such as the person in charge of managing assets and the beneficiaries who stand to gain. Testing your knowledge through hypothetical situations allows you to practice applying what you’ve learned and improves your ability to think critically when confronted with real-life challenges.

Additionally, consider the most common legal hurdles that may arise, such as disputes over terms or issues with compliance. Working through these scenarios will give you confidence in your ability to navigate complex legal landscapes and make informed decisions.

Common Mistakes in Estate Planning

When planning for the distribution of assets after death, it’s easy to overlook key details that can lead to serious complications. Estate planning requires careful attention to detail, as even small errors can have a significant impact on how assets are distributed or managed. Understanding these common mistakes will help you avoid pitfalls and ensure that your intentions are clearly communicated and legally enforceable.

Failure to Update Documents Regularly

One of the most frequent errors is neglecting to review and update legal documents regularly. Life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets should prompt a revision of estate plans. Without updates, outdated provisions could lead to unintended beneficiaries or conflicts among surviving family members.

- Failure to reflect new relationships or responsibilities.

- Inaccurate beneficiary designations due to outdated information.

- Omission of newly acquired property or assets.

Overlooking Tax Implications

Another common mistake is not considering the potential tax impact when transferring assets. Estate taxes, inheritance taxes, and capital gains taxes can reduce the value of the estate and ultimately affect beneficiaries. Proper planning and tax strategies can help mitigate these costs and ensure that as much of the estate as possible goes to the intended recipients.

- Not understanding the differences between tax laws for different asset types.

- Failure to plan for potential estate taxes at the time of death.

- Ignoring the need for professional advice on tax-saving strategies.

By recognizing these frequent errors and taking proactive steps to address them, individuals can ensure their estate plans are effective, clear, and legally sound.

Revocable vs Irrevocable Trusts

When creating a legal arrangement for managing assets, it’s essential to understand the key differences between flexible and non-flexible options. The primary distinction lies in whether the creator retains the ability to modify or revoke the arrangement after it is established. Each option has distinct advantages and drawbacks depending on the individual’s goals, such as asset control, tax considerations, and long-term planning.

A flexible arrangement allows the creator to make changes during their lifetime, offering more control over the distribution of assets or the terms of the agreement. However, this flexibility comes with limitations, especially regarding tax benefits and the protection of assets from creditors. On the other hand, a non-flexible arrangement offers more security and potential tax advantages but restricts the creator’s ability to alter or terminate the agreement once it is in place.

Understanding the implications of both choices will guide individuals in selecting the best option for their circumstances, balancing control, security, and future financial planning needs.

Will Validity and Legal Challenges

The validity of a legal document outlining asset distribution is critical to ensuring that the creator’s wishes are carried out. However, there are several factors that can lead to disputes or challenges regarding the legitimacy of such a document. It’s important to understand the common causes of these challenges and the legal requirements that must be met for a document to be recognized as valid.

Legal disputes often arise when the terms of the document are unclear, when proper procedures were not followed during its creation, or when there is a question of the creator’s mental capacity at the time of signing. Additionally, family members or other interested parties may challenge the document on the grounds of undue influence or fraud.

Common Grounds for Legal Challenges

- Improper witnessing or notarization of the document.

- Lack of mental capacity of the individual creating the document.

- Claims of undue influence or coercion during the creation process.

- Failure to meet legal requirements for valid execution in the jurisdiction.

Protecting Validity from Challenges

To minimize the risk of challenges, it is important to ensure that all legal formalities are observed during the creation of a document. This includes having the required number of witnesses, obtaining professional advice when necessary, and regularly reviewing the document to ensure it remains accurate and reflective of the creator’s current intentions.

By taking proactive steps to ensure validity, individuals can reduce the likelihood of legal disputes and ensure that their assets are distributed according to their wishes.

Key Questions About Trust Administration

Effective management of an estate arrangement requires a clear understanding of the responsibilities and processes involved. For those tasked with overseeing such arrangements, several critical inquiries arise. Addressing these questions ensures that the responsibilities are met, and the estate’s goals are fulfilled in accordance with the creator’s intentions.

These inquiries typically center around the roles of the individuals involved, the management of assets, and the adherence to legal requirements. Properly answering these questions helps avoid mismanagement, confusion, and potential conflicts among beneficiaries.

Essential Considerations for Administrators

- What are the fiduciary duties of the individual overseeing the arrangement?

- How should assets be managed to align with the terms outlined in the legal document?

- What legal steps must be taken to ensure the validity of the arrangement?

- How should disputes or disagreements between beneficiaries be handled?

- What actions should be taken if the terms of the arrangement are unclear or need modification?

Ensuring Smooth Administration

By carefully considering these questions, individuals can effectively navigate the complexities of overseeing an arrangement. Seeking professional guidance, adhering to the terms laid out, and communicating openly with all parties involved can help ensure that the estate is managed with integrity and in accordance with the original intent.

Estate Taxes and Trusts Explained

When managing the distribution of assets after death, it’s essential to understand the tax implications that can significantly impact the estate’s value. The way assets are structured and transferred can affect how much of the estate will be subject to taxation. By planning ahead, individuals can minimize tax liabilities, ensuring that more of the estate’s value is passed to beneficiaries rather than being consumed by taxes.

Tax obligations may arise at different stages of the estate planning process, including during the transfer of assets, at the time of death, and through ongoing income generated by assets held in legal arrangements. Various strategies can be used to reduce the estate’s exposure to taxes, such as creating specific legal frameworks that allow for tax deferral or exemption.

Understanding the Role of Taxable Transfers

Many assets transferred after death are subject to estate or inheritance taxes, which can substantially reduce the total value passed to heirs. The rates and exemptions vary depending on the jurisdiction and the size of the estate. It’s important to understand the specific rules governing these taxes to plan effectively.

Strategies to Minimize Estate Taxes

- Establishing legal frameworks that are exempt from taxation.

- Utilizing lifetime gift exemptions to reduce taxable amounts.

- Allocating assets to minimize the overall value subject to tax.

- Choosing tax-efficient investment vehicles that generate income in a way that reduces taxable gains.

By incorporating these strategies into an estate plan, individuals can significantly reduce the tax burden on their estate, preserving wealth for future generations.

Executor’s Role in Will Execution

The individual appointed to oversee the fulfillment of a deceased person’s final instructions holds significant responsibilities. This role involves managing the assets, settling debts, and ensuring that the wishes expressed are carried out according to the legal document. The duties are not only administrative but also require adherence to specific legal processes to ensure proper distribution of the estate.

Executors are tasked with gathering the deceased’s assets, paying any outstanding debts or taxes, and distributing the remaining assets to the beneficiaries. They must also ensure that all legal formalities are met, such as notifying relevant authorities and filing the necessary documentation with the court. The process requires attention to detail, efficiency, and an understanding of the legal framework surrounding estate administration.

In addition to these basic duties, an executor may need to handle disputes or conflicts that arise among beneficiaries. Communication and transparency are key to ensuring that the administration process proceeds smoothly and that the final wishes are respected.

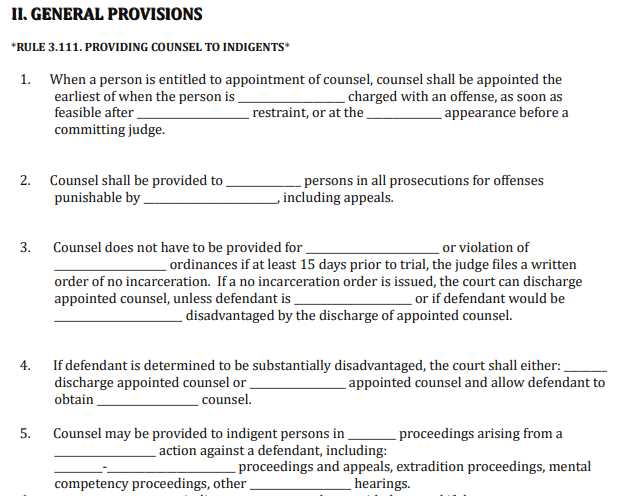

Legal Requirements for Will Witnesses

The presence of witnesses during the creation of a legal document is essential to ensure its validity. Witnesses play a crucial role in confirming that the individual creating the document did so voluntarily, with a clear mind, and in accordance with the law. Understanding the specific legal requirements for witnesses is important to avoid potential disputes or challenges later on.

In most jurisdictions, there are strict criteria regarding who can serve as a witness. These requirements are in place to ensure that the witness can attest to the authenticity of the document and the intentions of the person who created it. A failure to meet these criteria can result in the document being deemed invalid.

Key Requirements for Witnesses

- The witness must be at least 18 years old and of sound mind.

- They should not be a beneficiary or a related party who stands to gain from the document.

- Witnesses must sign the document in the presence of the individual creating it, and in some cases, each other.

- The witness should have no financial interest or stake in the document’s contents.

Common Mistakes to Avoid

- Using an individual who is also named as a beneficiary.

- Allowing a witness to sign without being present at the same time as the individual creating the document.

- Failing to ensure that witnesses are legally competent to confirm the document’s authenticity.

By adhering to these legal requirements, the individual creating the document can ensure that it is properly executed, reducing the risk of challenges or disputes in the future.

Creating Trusts for Minor Beneficiaries

When planning for the financial future of children or other young individuals, it is essential to ensure that they are provided for in a way that protects their assets and ensures their well-being. Establishing legal arrangements for minor beneficiaries allows parents or guardians to control how funds are distributed until the beneficiary reaches adulthood. These arrangements offer both financial security and peace of mind.

Minor beneficiaries are not legally able to manage assets themselves, so it is crucial to appoint a responsible adult to oversee the distribution. In many cases, a legal structure is set up to manage the assets on behalf of the minor until they are of age. These frameworks can provide financial support for education, healthcare, or other needs during the minor’s childhood and beyond.

Key Considerations for Creating Legal Arrangements

- Designating a trustee to manage assets until the minor reaches a certain age or milestone.

- Specifying how and when funds can be accessed, such as for educational expenses or medical bills.

- Clarifying the terms under which the beneficiary gains full control of the assets once they reach legal adulthood or another age as specified.

Benefits of Legal Arrangements for Minors

- Ensures that assets are protected and used for the minor’s benefit.

- Provides flexibility in terms of access and distribution based on age or circumstances.

- Minimizes potential conflicts by clearly outlining how the assets should be managed and distributed.

Creating a legal arrangement for minors ensures that their future financial security is managed appropriately, avoiding complications that may arise from improper asset distribution or mismanagement.

Factors Affecting Trust Distribution

The way in which assets are allocated within a legal arrangement depends on several critical factors that shape both the intentions of the creator and the legal framework. These elements can influence how the funds or property are distributed, who receives what, and when. Understanding these factors is crucial for ensuring that the intended goals are met, whether they involve supporting a family, charitable causes, or specific individuals.

Factors that affect the allocation process include the terms set forth by the individual establishing the arrangement, the needs of the beneficiaries, and any external circumstances like tax obligations or changes in law. The management and oversight of the assets are equally important to ensure that everything is executed according to plan.

Key Influences on Asset Distribution

| Factor | Description |

|---|---|

| Beneficiary’s Age | The age of the beneficiary can determine when they gain access to the assets and how they are distributed over time. |

| Trustee’s Discretion | The person managing the arrangement may have the authority to make decisions based on the beneficiary’s needs or other criteria. |

| Legal Requirements | Certain legal frameworks, such as tax laws or state-specific regulations, may influence how assets can be distributed. |

| Purpose of the Arrangement | Whether the arrangement is set up for educational purposes, health care, or general financial support, this will guide the allocation process. |

Common Challenges in Distribution

- Unclear instructions or vague terms within the legal structure may lead to disputes among beneficiaries or heirs.

- Unexpected tax liabilities or changes in the financial landscape can alter how assets are distributed, affecting the final outcome.

- Beneficiary needs may change over time, making it difficult to predict how to best distribute assets as circumstances evolve.

By carefully considering these influencing factors, a creator can ensure that their arrangements are tailored to meet the specific needs of those they wish to provide for, while also minimizing potential conflicts or legal challenges down the line.

Testamentary Capacity and Mental State

The mental condition of an individual when making important legal decisions plays a significant role in determining whether their instructions will be legally recognized. It is essential that the person has the mental ability to understand the nature of their decisions and the potential consequences. This is particularly relevant when it comes to the disposition of assets after death, as the validity of such decisions can be challenged if the individual is found to lack the necessary cognitive capacity.

In legal settings, this capacity is assessed by considering the person’s ability to comprehend the act they are engaged in, the objects they are benefitting, and the implications of their choices. Mental health conditions or impairments can affect an individual’s capability to make informed decisions, which may result in invalidating certain decisions made in a state of diminished mental clarity.

Criteria for Assessing Mental Capacity

| Criteria | Description |

|---|---|

| Understanding the Nature of the Act | The individual must comprehend that they are making a decision that will affect the distribution of their estate after death. |

| Awareness of Property | They should have knowledge of the assets they own and the potential impact of distributing them to various beneficiaries. |

| Comprehension of Beneficiaries | The person must be aware of who will benefit from their decisions and how those individuals are related to them. |

| Lack of Mental Impairment | There should be no significant cognitive dysfunction or mental illness that hinders the individual’s understanding of their choices. |

Common Mental States Affecting Decision-Making

- Delirium: Temporary confusion or disorientation that can arise from illness, medication, or substance abuse.

- Dementia: Chronic conditions like Alzheimer’s disease that progressively impair cognitive functions, including memory and judgment.

- Depression: Severe depression can affect decision-making abilities, leading to questions about whether the individual fully understood their actions.

Establishing mental capacity is vital to ensuring that legal instructions are honored as intended. If there is any doubt about an individual’s cognitive state at the time of making decisions, their capacity may be legally challenged, making it crucial to document and assess mental clarity before making significant decisions.

Strategies for Avoiding Probate

One of the primary concerns when it comes to the distribution of assets after death is the lengthy and costly process of estate administration. In many cases, individuals seek methods to bypass this process altogether, ensuring that their loved ones can access their assets quickly and without significant legal delays. There are several strategies available that can effectively help individuals avoid probate, each with its own set of advantages and considerations.

By utilizing certain planning tools, it is possible to transfer property and assets without requiring them to go through the court system. This can streamline the entire process, reduce administrative fees, and offer more privacy to the beneficiaries. Below are some key strategies for bypassing probate.

| Strategy | Description |

|---|---|

| Joint Ownership | Assets held in joint ownership, particularly with right of survivorship, pass automatically to the surviving co-owner upon death, avoiding the need for court intervention. |

| Payable-on-Death (POD) Accounts | Designating beneficiaries for bank or financial accounts allows the assets to transfer directly to the designated person upon death without probate. |

| Transfer-on-Death (TOD) Deeds | In some jurisdictions, real estate can be transferred to a beneficiary upon the owner’s death without going through the probate process by using a TOD deed. |

| Living Trust | Creating a revocable living trust allows assets to be placed under the control of a trustee, ensuring they pass to the beneficiaries directly without the need for probate. |

| Gifting During Lifetime | Giving away assets while still alive is another way to avoid probate, as these assets are no longer part of the estate upon death. |

Each of these strategies has different legal and financial implications, and what works best will depend on individual circumstances, such as the size of the estate and the types of assets involved. It is advisable to consult with an estate planning professional to determine which options are most appropriate for your needs. By carefully planning ahead, it is possible to minimize delays, reduce costs, and ensure that your assets are distributed according to your wishes without the need for a lengthy court process.

Exam Tips for Estate Planning Success

When preparing for assessments related to the management and distribution of assets, it’s crucial to develop a strategic approach. A strong foundation in key concepts, combined with effective study techniques, can significantly enhance your chances of success. By focusing on core principles, understanding legal frameworks, and practicing problem-solving, you can approach the assessment with confidence and clarity.

One of the most important aspects of mastering the material is a deep understanding of the various mechanisms involved in asset management, inheritance, and legal procedures. This knowledge will allow you to answer questions with precision and apply concepts effectively. Below are some strategies that can help you succeed:

Organize Your Study Material

Start by organizing all relevant materials into manageable sections. Break down complex topics into smaller, more digestible parts. Group similar concepts together, such as methods of transferring assets, roles of different parties, and specific legal requirements. By categorizing the material, you make it easier to review and retain critical information.

Focus on Key Principles and Legal Frameworks

Understanding the fundamental principles behind asset distribution, taxation, and legal responsibilities is essential. Pay close attention to the key frameworks, such as the process of transferring ownership, types of legal instruments, and the role of individuals like executors and fiduciaries. Strong familiarity with these areas will help you tackle even the most complex problems presented in the assessment.

Practice with Real-Life Scenarios

Test your knowledge by applying your understanding to real-life examples. This approach helps bridge the gap between theory and practice. By reviewing case studies, you can sharpen your ability to analyze various situations, identify issues, and offer solutions based on legal principles.

Time Management

Effective time management is crucial when tackling lengthy assessments. Allocate specific amounts of time to each section, and make sure you address all aspects of the problem. Prioritize areas where you feel less confident, ensuring that you give yourself ample time to review your work.

By focusing on these strategies, you will build both your confidence and competence in estate planning concepts, giving you the best chance to succeed in your assessment.