Mastering the fundamentals of money management is crucial for achieving long-term success in both personal and professional life. A solid understanding of core financial principles enables individuals to make informed decisions about budgeting, investments, and debt management. As you prepare to demonstrate your knowledge, it’s important to focus on the key concepts and strategies that form the foundation of sound economic planning.

In this section, we’ll walk through various critical topics that are essential for anyone aiming to excel in their understanding of wealth management. From building a strong credit history to planning for the future, we’ll highlight the most important areas to focus on. This guide will equip you with the insights needed to confidently approach assessments and apply financial strategies effectively in real-world situations.

Comprehensive Guide to Financial Assessment Success

Achieving proficiency in managing monetary resources requires a deep understanding of various strategies and principles. Whether it’s planning for the future, managing daily expenses, or investing for growth, mastering these concepts can lead to more informed decisions and financial stability. This section is designed to provide clarity and focus on the crucial topics necessary for anyone looking to demonstrate their financial literacy and pass assessments with confidence.

Key Areas of Focus

To excel in any financial evaluation, it’s important to focus on fundamental areas like budgeting, risk management, and investment strategies. Understanding how these elements interconnect is essential to making sound decisions. With the right approach, it’s possible to navigate complex financial scenarios and apply learned concepts to real-world challenges.

Practical Tips for Success

One of the most effective ways to ensure mastery over the subject is by reviewing key practices and understanding the practical application of financial strategies. Key concepts such as effective debt management, tax implications, and credit building should be revisited regularly. Additionally, learning how to assess financial reports and interpret numbers can greatly enhance decision-making skills in both professional and personal contexts.

Key Concepts in Financial Management

Understanding the foundational principles of wealth management is crucial for anyone looking to make informed decisions about their resources. These concepts form the basis for financial success and are essential for managing income, expenditures, investments, and future goals effectively. A strong grasp of these ideas will help individuals make strategic choices that lead to long-term stability and growth.

Below are some of the key topics that play a significant role in financial decision-making:

- Budgeting: The process of planning how to allocate income for various expenses. A well-structured budget allows for better control over spending and saving.

- Debt Management: Strategies to manage and reduce outstanding obligations. Understanding interest rates and payment schedules is essential to minimizing financial strain.

- Investments: The process of allocating funds to assets or ventures that have the potential to generate income or appreciate in value over time.

- Credit Management: Maintaining a healthy credit score by managing borrowing habits, repayment timelines, and understanding credit terms.

- Risk Assessment: Evaluating the potential risks involved in financial decisions and finding ways to mitigate or manage those risks effectively.

By mastering these key elements, individuals can ensure that their financial decisions align with their goals and secure a stable financial future.

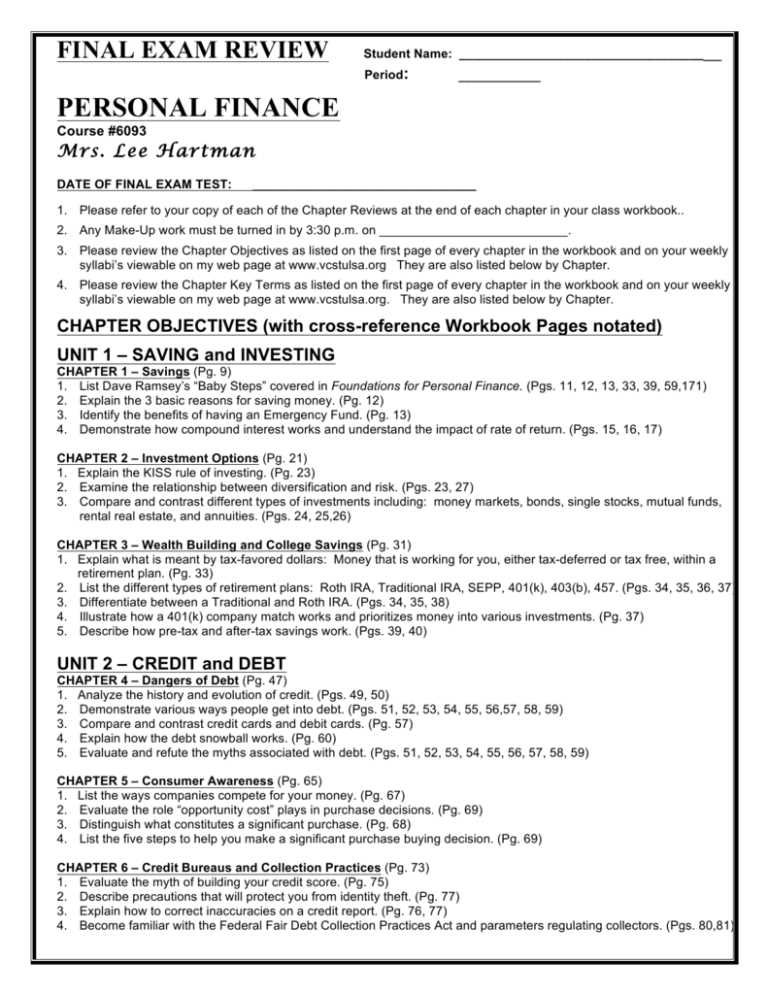

Understanding Budgeting and Savings

Effective management of resources begins with a clear understanding of how to allocate funds for both immediate and future needs. Planning expenses and setting aside a portion of income for savings are vital practices that ensure long-term financial security. These strategies are key to avoiding debt and building wealth over time. By balancing current spending with future goals, individuals can create a sustainable financial plan.

Creating a Practical Budget

A well-designed budget helps track income and expenses, ensuring that spending aligns with financial goals. It involves categorizing expenditures, identifying areas to reduce costs, and prioritizing essential items. A practical budget should be flexible enough to adapt to unexpected changes while keeping long-term goals in mind.

- Track Income: Record all sources of income, including salaries, freelance work, or other earnings.

- Prioritize Essentials: Allocate funds for necessities such as housing, utilities, and food before non-essential items.

- Adjust Expenses: Find areas where spending can be reduced, like dining out or subscription services.

The Importance of Saving

Setting aside a portion of income for future needs or emergencies is a fundamental aspect of financial well-being. Savings provide a buffer against unexpected costs and offer the means to achieve larger goals, such as purchasing a home or preparing for retirement. The key to successful saving is consistency, no matter how small the contributions may seem.

- Emergency Fund: Build a safety net that can cover unexpected expenses, such as medical bills or car repairs.

- Retirement Savings: Contribute regularly to retirement accounts to ensure a comfortable future.

- Short-Term Goals: Set aside funds for immediate goals, such as travel or home improvements.

Debt Management Strategies for Success

Effectively managing obligations is crucial for achieving financial stability. Without a clear strategy, outstanding debts can become overwhelming, leading to financial stress and limiting future opportunities. A well-thought-out approach to handling debt can help reduce interest costs, improve credit scores, and ensure that payments remain manageable over time. By implementing proven strategies, individuals can regain control of their finances and work towards achieving their long-term goals.

Prioritize High-Interest Debts

One of the most effective strategies for managing multiple debts is to focus on paying off high-interest obligations first. These types of debts, such as credit card balances or payday loans, can quickly accumulate and make it harder to pay off other debts. By eliminating high-interest debts, individuals can reduce the overall amount paid in interest and free up more resources for saving and investing.

- List all debts: Start by identifying all outstanding debts and their respective interest rates.

- Focus on one debt at a time: Direct extra payments towards the highest-interest debt while maintaining minimum payments on others.

- Consider balance transfers: If possible, move high-interest balances to accounts with lower rates to save money.

Consolidating and Refinancing Options

Another powerful technique for simplifying debt management is consolidation or refinancing. This approach involves combining multiple debts into a single loan or line of credit, ideally with a lower interest rate. It can help streamline monthly payments and reduce the complexity of managing various due dates and interest rates. However, it’s important to ensure that the new loan terms are favorable and don’t extend the repayment period unnecessarily.

- Debt Consolidation Loan: Combine several high-interest debts into one loan with a lower rate.

- Refinancing Options: Refinance existing loans to lower interest rates, reducing monthly payments.

- Explore professional help: Consider working with a financial advisor or credit counselor to determine the best strategy.

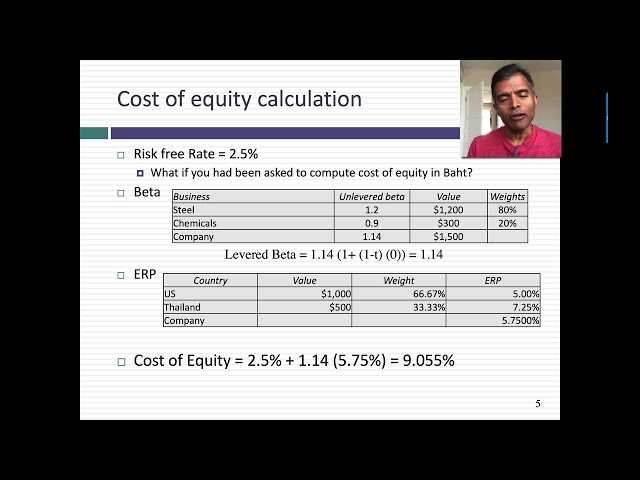

Investment Basics for Financial Growth

Building wealth over time often requires making money work for you through smart investments. While saving is important, investing offers the potential for higher returns and growth, allowing individuals to achieve their financial goals more efficiently. By understanding the fundamentals of investment options and strategies, anyone can begin to grow their wealth and secure a more stable future.

Understanding Different Investment Options

There are several investment vehicles available, each with its own risk and reward profile. Choosing the right one depends on your financial goals, risk tolerance, and investment timeline. Diversifying investments across multiple asset classes can reduce risk and enhance potential returns over the long term.

- Stocks: Purchasing shares in companies provides opportunities for growth but comes with a higher level of risk due to market volatility.

- Bonds: Lending money to governments or corporations in exchange for interest payments, usually considered lower risk than stocks.

- Real Estate: Investing in property can generate passive income and appreciate over time, though it requires significant capital.

- Mutual Funds: Pooled investments that allow individuals to diversify across a variety of stocks, bonds, and other assets with professional management.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on exchanges, offering flexibility and low fees.

Evaluating Risk and Return

Before committing to any investment, it is essential to assess both the risk and potential return. High-return investments usually come with greater volatility, meaning that the value can fluctuate significantly. Understanding your own risk tolerance and financial objectives will help guide your investment decisions, ensuring that you don’t take on more risk than you can handle.

- Risk Tolerance: Determine how much risk you are willing to take on based on your goals, time horizon, and comfort level with market fluctuations.

- Time Horizon: The longer you can leave your investments to grow, the more risk you can generally afford to take on, as the market can even out over time.

- Asset Allocation: Diversifying across different types of investments can help balance risk and maximize returns.

Understanding Credit and Loans

Credit and loans are essential tools for managing financial needs and achieving major goals, such as buying a home or starting a business. However, understanding how they work and how they affect your financial health is crucial for making informed decisions. Credit allows individuals to borrow money with the agreement to repay it later, often with interest. Loans, on the other hand, are typically larger amounts of money borrowed with a defined repayment schedule.

Types of Credit and Loans

There are various types of credit and loans, each serving different purposes and offering distinct terms. Whether you’re applying for a credit card, a mortgage, or a personal loan, it’s important to understand the differences in their interest rates, repayment periods, and potential impact on your credit score.

| Type | Purpose | Repayment Terms | Interest Rates |

|---|---|---|---|

| Credit Cards | Short-term borrowing for everyday purchases | Revolving, minimum payments due monthly | Higher interest rates, varies by provider |

| Mortgage Loans | Buying a home or property | Fixed or adjustable rates, long-term (15-30 years) | Lower interest rates, depending on credit score |

| Personal Loans | Consolidating debt, covering personal expenses | Fixed monthly payments, usually 2-5 years | Varies widely based on credit and lender |

| Auto Loans | Purchasing a vehicle | Fixed monthly payments, typically 3-7 years | Moderate interest rates, depending on loan term and credit score |

Building and Maintaining Good Credit

Maintaining good credit is essential for securing favorable loan terms and ensuring long-term financial stability. Key factors in determining your credit score include your payment history, the amount of debt you owe, and the length of your credit history. By paying bills on time, minimizing credit card balances, and limiting new credit applications, you can build and maintain a strong credit profile.

- Timely Payments: Always pay your bills on time to avoid late fees and negative impacts on your credit score.

- Debt-to-Income Ratio: Keep your debt levels manageable to ensure that you don’t overextend yourself.

- Credit Monitoring: Regularly check your credit report to identify any errors or discrepancies.

Retirement Planning and Its Importance

Planning for the later stages of life is one of the most crucial financial steps you can take. Without careful preparation, the lack of sufficient savings can lead to financial insecurity in retirement. Effective planning ensures that you will have the necessary resources to maintain your lifestyle, cover healthcare costs, and enjoy a comfortable, stress-free retirement. By starting early and making consistent contributions, individuals can significantly reduce the financial burden in their later years.

The importance of planning lies not only in saving money, but also in understanding how to invest those savings wisely. Creating a strategy that includes diversifying investments, setting clear goals, and regularly reviewing progress is essential to achieving long-term success. Additionally, considering factors such as inflation, expected lifespan, and potential emergencies can help create a well-rounded retirement plan.

Taxation and Its Role in Finances

Taxes are an essential part of the financial system, impacting both individuals and businesses. They fund government services and infrastructure, from public education to healthcare and national defense. Understanding how taxes work and how they influence personal wealth is vital for making informed financial decisions. Effective tax planning can help individuals reduce their tax liabilities, maximize their savings, and ensure compliance with the law.

Taxes can affect many aspects of your financial life, including your income, investments, and retirement savings. It’s important to understand the different types of taxes, such as income tax, capital gains tax, and sales tax, and how each one applies to your situation. With proper strategies, individuals can navigate their tax obligations more efficiently, minimizing their tax burden and optimizing their financial outcomes.

Insurance Essentials You Should Know

Insurance is a critical element of managing risk in your financial life. It helps protect you and your loved ones from unexpected events that can have financial consequences, such as accidents, illness, or damage to property. By purchasing the right types of coverage, individuals can safeguard their assets and ensure they are financially prepared in times of need. Understanding the different types of insurance and their benefits is essential for making informed decisions that support long-term financial stability.

Types of Insurance Coverage

There are various forms of insurance, each designed to provide specific protection. Choosing the right coverage depends on your personal needs, lifestyle, and financial situation. Here are some of the most common types of insurance to consider:

| Type of Insurance | Purpose | Coverage |

|---|---|---|

| Health Insurance | To cover medical expenses, including doctor visits, hospital stays, and prescriptions. | Varies based on plan, often includes preventive care, emergency care, and specialist visits. |

| Life Insurance | To provide financial support for your family in case of death. | Benefits paid to beneficiaries after death, can cover funeral costs, debt repayment, and living expenses. |

| Auto Insurance | To protect against financial loss from car accidents or theft. | Includes coverage for property damage, bodily injury, and medical expenses. |

| Homeowners Insurance | To protect your home and possessions from damage or loss. | Typically covers property damage, theft, and liability for accidents on your property. |

| Disability Insurance | To provide income in case you become unable to work due to illness or injury. | Typically covers a portion of your salary if you are unable to perform your job duties. |

Choosing the Right Coverage

When selecting insurance, it’s important to assess your personal risks and determine the types of coverage that best meet your needs. Evaluate factors like the value of your property, your health status, and your family’s financial situation. Also, consider the level of coverage required, as opting for too little insurance can leave you exposed to significant financial loss, while excessive coverage may result in unnecessary premiums.

- Assess your needs: Review your assets, health, and family situation to determine the types of insurance that offer the best protection.

- Compare providers: Different insurance companies may offer varying rates and coverage options, so it’s important to shop around.

- Understand the policy terms: Be aware of deductibles, premiums, exclusions, and limits when choosing an insurance plan.

Goal Setting Tips for Financial Success

Setting clear and achievable goals is a crucial part of building a secure financial future. By outlining specific objectives, you can create a roadmap for managing your money effectively, prioritizing savings, and making informed decisions. Proper goal setting helps you stay focused, track progress, and measure success over time. It’s essential to set goals that align with your values and long-term vision, while also being flexible enough to adjust as circumstances change.

The first step in effective goal setting is to determine what you want to accomplish. Whether it’s saving for a home, eliminating debt, or building an emergency fund, each goal should be specific, measurable, attainable, relevant, and time-bound (SMART). Once you have identified your financial goals, break them down into smaller, manageable steps that you can take action on regularly.

- Define your goals: Start by identifying your primary objectives, whether it’s saving for retirement, purchasing a home, or paying off debt.

- Set realistic timelines: Break larger goals into smaller, actionable milestones with clear deadlines to help maintain momentum.

- Track progress: Regularly review your progress and adjust your strategy as needed to stay on course.

Remember that goal setting is not a one-time activity. It’s an ongoing process that requires attention and adaptability. Life circumstances may change, and financial priorities may shift, so it’s important to remain flexible and adjust your goals accordingly. With dedication and consistency, you can achieve your financial objectives and create lasting security for your future.

Common Pitfalls in Financial Planning

When it comes to managing money, many individuals make missteps that can hinder long-term success. Poor planning or overlooking key elements can result in missed opportunities, unnecessary debt, or a lack of savings. Avoiding these common traps is essential to creating a solid financial foundation. By recognizing potential mistakes early, individuals can take proactive steps to stay on track with their goals and safeguard their financial well-being.

One of the most frequent mistakes in financial planning is failing to create a clear and actionable strategy. Without a well-defined plan, it’s easy to drift, overspend, or neglect critical financial obligations. Additionally, a lack of knowledge about investment options, taxes, and debt management can prevent individuals from maximizing their financial potential. It’s important to regularly review your plans and adjust them as needed to reflect changing circumstances or goals.

Key Pitfalls to Avoid

- Neglecting an Emergency Fund: Many people focus on long-term goals but forget the importance of having an emergency fund to cover unexpected expenses. Without it, you may resort to high-interest debt during difficult times.

- Underestimating Retirement Needs: It’s easy to assume that retirement is far off, but failing to save early enough can leave you without sufficient funds for your later years. Begin saving for retirement as early as possible.

- Ignoring Debt Management: Allowing debt to accumulate without a clear repayment strategy can result in high-interest costs and reduced financial flexibility. Create a debt reduction plan and prioritize paying off high-interest debt first.

- Overestimating Future Income: Relying on future raises or bonuses when planning for major expenses can set unrealistic expectations. It’s important to base your budget on current income and adjust as needed.

How to Overcome These Challenges

- Set Realistic Goals: Define achievable financial goals that take into account your income, expenses, and life circumstances. Regularly evaluate and update them as needed.

- Educate Yourself: Take the time to learn about different financial strategies, including investing, tax planning, and debt management, to make informed decisions.

- Monitor Your Spending: Keep track of your expenses to identify unnecessary spending and allocate more towards savings and investments.

- Consult a Professional: Working with a financial advisor can help you avoid common mistakes and provide guidance in developing a comprehensive plan.

By being aware of these common pitfalls and taking proactive steps to avoid them, you can achieve greater financial stability and work towards your long-term financial goals with confidence.

Assessing Risk in Personal Investments

Understanding risk is a fundamental aspect of making informed decisions about investments. Every investment carries some level of risk, which can vary depending on factors such as the type of asset, market conditions, and the investor’s financial goals. A key to successful investing is assessing and managing these risks to align with your personal objectives. Whether aiming for growth, income, or preservation of capital, recognizing potential risks helps you make strategic choices and avoid costly mistakes.

Risk assessment begins with understanding the different types of risks associated with various investment options. Some risks are inherent in the market itself, such as volatility or economic downturns, while others are specific to particular investments, like company performance or industry shifts. Balancing risk and reward is essential, as higher returns typically come with higher risk. Assessing your tolerance for risk will determine how you allocate assets and diversify your portfolio.

Types of Investment Risks

- Market Risk: This type of risk stems from the overall performance of the financial markets, which can be affected by external factors such as interest rates, inflation, or geopolitical events.

- Credit Risk: Associated with the possibility that a bond issuer or borrower may default on their obligations, leading to a loss for the investor.

- Liquidity Risk: The risk that an asset cannot be quickly bought or sold without significantly affecting its price.

- Inflation Risk: The risk that inflation will erode the purchasing power of returns, particularly in low-interest investments.

How to Mitigate Investment Risks

- Diversification: Spread investments across different asset classes to reduce the impact of any single investment’s poor performance on your overall portfolio.

- Research and Analysis: Conduct thorough research on potential investments to understand their risks and expected returns. Utilize resources such as financial reports, expert opinions, and market trends.

- Regular Portfolio Review: Continuously monitor and adjust your investment strategy to account for changes in the market or your financial situation.

- Consider Professional Guidance: Consulting a financial advisor can help you assess risks and develop a balanced investment plan based on your goals and risk tolerance.

By carefully assessing the risks associated with various investments, you can make smarter decisions that align with your financial goals and risk tolerance, ultimately helping you build a more secure future.

Building and Maintaining Credit Scores

A strong credit history is essential for achieving financial stability and accessing favorable loan terms. Maintaining a good credit rating allows individuals to secure lower interest rates on loans, rent properties with ease, and even secure jobs that require financial responsibility. The process of building and maintaining a positive credit score involves responsible credit use, consistent monitoring, and understanding the factors that influence your score.

Establishing a solid credit score begins with building a strong credit history. This involves demonstrating the ability to manage credit responsibly over time. By making timely payments, keeping credit utilization low, and avoiding excessive debt, individuals can steadily improve their credit ratings. Regularly reviewing credit reports ensures that no errors are affecting the score, allowing for timely corrections if necessary.

Factors That Impact Your Credit Score

- Payment History: Timely payments on loans, credit cards, and other financial obligations are the most significant factor in determining your score.

- Credit Utilization: The ratio of your current credit card balances to your credit limits. Keeping this ratio low can positively impact your score.

- Length of Credit History: A longer history of managing credit accounts demonstrates stability and reliability, which can enhance your score.

- Types of Credit: A mix of different types of credit, such as credit cards, installment loans, and mortgages, can have a positive effect on your credit score.

- New Credit: Frequently opening new credit accounts or having too many inquiries in a short period can negatively affect your score.

Tips for Maintaining a Strong Credit Score

- Pay Your Bills on Time: Late or missed payments are a major contributor to a low credit score. Set up reminders or automatic payments to ensure consistency.

- Keep Credit Card Balances Low: Aim to use no more than 30% of your available credit limit to avoid negatively affecting your credit utilization ratio.

- Monitor Your Credit Reports: Regularly check your credit reports for accuracy and dispute any discrepancies that may lower your score.

- Limit New Credit Applications: Opening multiple credit accounts in a short period can lower your score. Only apply for new credit when necessary.

- Build a Diverse Credit Portfolio: Having a variety of credit accounts–credit cards, mortgages, and installment loans–can enhance your credit rating.

Building and maintaining a strong credit score requires discipline and time. By following these strategies, individuals can ensure long-term financial success and gain access to more favorable financial opportunities.

Emergency Funds and Financial Security

Building a financial safety net is essential for long-term stability and peace of mind. An emergency fund acts as a buffer against unexpected expenses, such as medical bills, car repairs, or sudden job loss. Without such a fund, individuals may find themselves relying on credit cards or loans, potentially leading to financial strain and debt accumulation. The key to financial security is preparing for the unexpected by saving a portion of income for emergencies.

Establishing an emergency fund requires discipline, but the benefits are worth the effort. By having readily accessible savings set aside, individuals can navigate unexpected situations without derailing their financial plans. This reserve also reduces stress and provides a sense of control over one’s financial future. However, determining the right amount for an emergency fund and how to build it efficiently is crucial for maximizing its effectiveness.

How Much Should You Save?

The amount needed for an emergency fund depends on individual circumstances, including monthly living expenses and income stability. Financial experts typically recommend saving three to six months’ worth of expenses to cover unforeseen situations. For those with less stable incomes or additional dependents, a larger fund may be necessary to provide peace of mind during turbulent times.

Building Your Emergency Fund

- Start Small: Begin with a modest goal, such as $500 to $1,000, and gradually increase the amount as your financial situation improves.

- Set Up Automatic Transfers: Automate contributions to your emergency fund to ensure consistent saving each month.

- Cut Unnecessary Expenses: Review your spending habits and identify areas where you can reduce costs to increase savings.

- Use Windfalls: Allocate bonuses, tax refunds, or other unexpected income to your emergency fund for faster growth.

- Prioritize Accessibility: Keep your emergency fund in a high-yield savings account or money market account for easy access without penalties.

Creating an emergency fund is a foundational step toward financial independence. It ensures that unexpected events don’t compromise your overall financial health and gives you the confidence to manage life’s uncertainties. With careful planning and consistent saving, an emergency fund can become an essential tool for maintaining stability and security.

Financial Statements and Their Uses

Understanding the key components of financial health is essential for both individuals and businesses. Financial statements offer a snapshot of one’s economic standing, providing vital information that helps with decision-making. These documents play a crucial role in assessing financial performance, planning for future expenses, and securing funding. They allow you to evaluate the stability, profitability, and liquidity of your finances, ensuring that informed choices can be made at every stage of financial planning.

While financial statements may seem complex, they are instrumental in understanding where money comes from, where it goes, and how to manage it effectively. These statements are not only for accountants or business owners; individuals also use them to track personal wealth, make savings decisions, or apply for loans. Knowing how to interpret these statements can significantly impact one’s ability to manage debt, investments, and overall wealth-building strategies.

Key Types of Financial Statements

- Income Statement: This document shows the flow of income and expenses over a specific period, providing insight into profitability. It helps assess how much you earn versus how much you spend.

- Balance Sheet: A snapshot of assets, liabilities, and equity at a given point in time. It reveals the financial position of an individual or business, illustrating what is owned and owed.

- Cash Flow Statement: This statement tracks the movement of cash in and out, ensuring there is enough liquidity to meet obligations. It highlights operational efficiency and financial solvency.

How Financial Statements Are Used

- Budgeting and Planning: Financial statements are key tools for creating realistic budgets, as they reflect actual income, expenses, and overall cash position.

- Evaluating Investments: Investors use financial statements to assess the health of a company before making decisions about buying stocks or bonds.

- Loan Applications: Lenders often require financial statements to evaluate the creditworthiness of an individual or a business, helping them decide whether to approve loans.

- Tax Reporting: These documents provide necessary information for tax filings, ensuring that all income and deductible expenses are accounted for.

- Assessing Financial Health: Regular analysis of financial statements helps identify trends, such as increasing debt or improving profitability, allowing for more informed financial decisions.

In summary, financial statements are invaluable tools that offer critical insights into an individual or organization’s financial status. By regularly reviewing and understanding these documents, you can make smarter financial choices, reduce risks, and achieve greater financial success.

Strategies for Financial Independence

Achieving financial independence is a goal that many strive for, as it offers the freedom to live without relying on a paycheck or financial assistance. The path to becoming financially independent involves making deliberate choices to build wealth, reduce unnecessary expenses, and create income streams that work for you. While the journey may seem long, implementing a set of clear strategies can significantly accelerate progress toward this goal. By adopting smart financial habits, understanding how to manage resources, and making informed decisions, individuals can pave the way to a life of financial security and freedom.

One of the most important aspects of becoming financially independent is understanding the balance between earning, saving, and investing. With consistent effort, it is possible to build a strong financial foundation that supports long-term goals. Regardless of your starting point, focusing on specific actions can bring you closer to achieving independence and living life on your own terms.

Key Strategies for Building Wealth

- Increase Your Income Streams: Relying on a single source of income can limit financial growth. Consider exploring side businesses, investments, or additional career opportunities that can generate extra cash flow.

- Minimize Debt: Reducing high-interest debt is one of the fastest ways to build wealth. Prioritize paying off credit cards, loans, or other forms of debt that carry heavy interest rates.

- Live Below Your Means: Adopt a frugal lifestyle by cutting unnecessary expenses. Tracking spending habits and being conscious of consumption will enable you to save more and invest towards your future.

- Automate Savings and Investments: Set up automatic transfers to savings accounts and investment portfolios. By doing so, you ensure that a portion of your income is consistently allocated towards building wealth.

Effective Investment Strategies

- Diversify Your Investments: Invest in a range of assets such as stocks, bonds, real estate, and other forms of passive income. Diversification helps protect against market volatility and increases the likelihood of sustained growth.

- Focus on Long-Term Goals: Patience is key when it comes to investing. Focus on long-term growth rather than short-term gains. Compounding interest and sustained investments can significantly multiply your wealth over time.

- Maximize Tax-Advantaged Accounts: Take advantage of retirement accounts, tax-deferred growth, and other investment vehicles that offer tax benefits. This can help you save more and grow your wealth without incurring unnecessary tax liabilities.

Achieving financial independence requires discipline, patience, and a commitment to making smart choices. By following these strategies and staying focused on your goals, you can ultimately reach the point where you have full control over your financial future and the freedom to live life on your own terms.

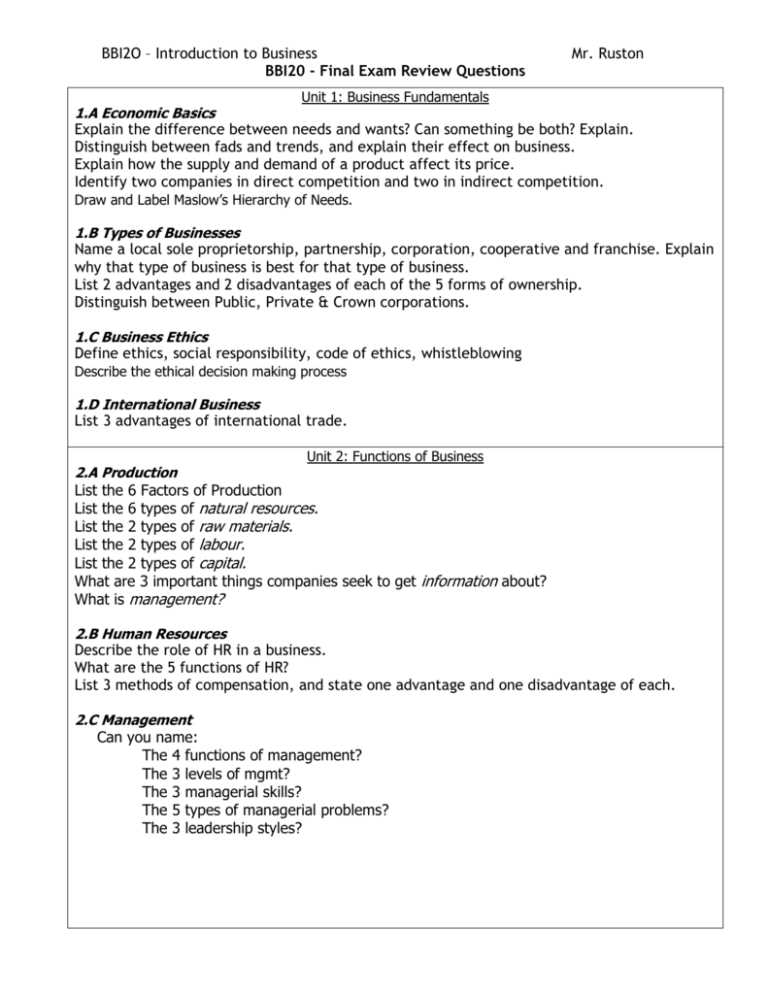

Preparing for a Financial Assessment

Effective preparation for a financial evaluation requires a systematic approach. Focus on mastering the fundamental concepts, practicing problem-solving, and improving recall under pressure. The key to success lies in breaking down the material into digestible chunks, dedicating time to weak areas, and actively testing your understanding. By incorporating a variety of resources and study techniques, you can enhance both your confidence and your performance in the assessment.

Core Areas to Focus On

- Budgeting: Understand how to manage income, expenses, and savings through effective budgeting techniques.

- Investment Knowledge: Review types of investments, risk assessment, and strategies for portfolio management.

- Financial Statements: Learn how to interpret balance sheets, income statements, and cash flow statements.

- Risk Management: Focus on identifying, assessing, and mitigating financial risks through diversification and strategic planning.

Effective Preparation Techniques

- Practice Problems: Regularly solve sample problems to familiarize yourself with different types of questions and improve your analytical skills.

- Interactive Study: Engage in group discussions, teach the material to others, or create mind maps to reinforce key concepts.

- Mock Assessments: Take timed practice tests to simulate the real testing environment and identify areas for improvement.

- Focused Review: Prioritize areas that are most challenging and allocate additional time to studying those topics.

Recommended Resources for Preparation

| Resource | Purpose | Examples |

|---|---|---|

| Textbooks | Provide comprehensive explanations and examples of key topics. | Investment Strategies, Financial Accounting |

| Online Platforms | Offer interactive lessons, quizzes, and discussions to enhance learning. | Coursera, Udemy |

| Study Guides | Summarize core material and provide practice questions for quick reviews. | Kaplan, Wiley |

| Practice Tests | Help familiarize with test formats and pinpoint areas of weakness. | Previous assessments, mock exams |

In summary, proper preparation for a financial evaluation involves a blend of strategic study methods, hands-on practice, and utilizing various resources. By focusing on both theory and practical application, you can boost your readiness and perform confidently during the assessment.

Exam Tips for Finance Students

Preparing for an assessment in financial subjects requires both strategic planning and focused effort. It’s not just about memorizing concepts but also about applying them in real-life situations. Effective preparation includes understanding the core principles, practicing problem-solving techniques, and refining your test-taking skills. Here are some useful tips to help you approach the evaluation with confidence and maximize your chances of success.

Preparation Strategies

- Understand Key Concepts: Make sure you have a solid grasp of the fundamental principles, such as budgeting, investing, and risk management. These concepts often serve as the foundation for more complex questions.

- Review Past Assignments: Going through previous homework or assignments can help you identify patterns in the types of questions that may appear on the assessment.

- Use Practice Questions: Test yourself with sample questions to become familiar with the format and types of problems you might encounter. This also helps you develop speed and accuracy under timed conditions.

- Create a Study Plan: Break down the material into manageable sections and schedule study sessions to cover all topics. Prioritize areas that need more attention.

Test-Taking Tips

- Manage Your Time: Time management is crucial during the test. Make sure to allocate enough time to each section and don’t get stuck on a single problem for too long.

- Read Questions Carefully: Before answering, carefully read each question to ensure you fully understand what’s being asked. Pay attention to any keywords or specific instructions.

- Answer Easy Questions First: Start with the questions you feel most confident about. This helps build momentum and ensures you score easy points before moving on to more challenging ones.

- Double-Check Your Work: If time permits, go back and review your answers to catch any mistakes or overlooked details. This could make a significant difference in your final score.

Helpful Resources

- Textbooks: Use your course textbook as a primary resource for understanding theories and solving problems.

- Study Guides: Review any study guides or summaries provided by the instructor. These can help highlight the most important concepts to focus on.

- Online Tools: Explore online platforms offering practice tests, quizzes, or video tutorials for additional support.

In conclusion, succeeding in a finance-related assessment involves more than just reviewing materials. It requires strategic study habits, effective time management during the test, and the ability to apply learned concepts to real-world scenarios. By following these tips and staying consistent with your preparation, you’ll be well-equipped to achieve your best performance.