Mastering key concepts in finance is crucial for anyone looking to excel in the field. This guide will provide you with valuable insights into understanding the most important areas of the assessment. By focusing on core principles and practical applications, you can ensure a strong performance and deeper grasp of the material.

Effective preparation requires a structured approach, making sure you cover both theoretical knowledge and real-world scenarios. A thorough review of essential topics, coupled with strategic study methods, can significantly improve your readiness.

In this article, we will explore practical techniques and tips to help you navigate through various financial principles, offering a clear path to success. Whether you’re new to the subject or refining your expertise, the right tools and mindset are key to achieving your goals.

Financial Knowledge Assessment Preparation

Successfully navigating a finance-related assessment requires a solid understanding of core principles and the ability to apply them to real-world scenarios. This section is designed to guide you through the key areas of focus and strategies that will help you perform at your best. By mastering these concepts, you will be well-prepared for a comprehensive financial test.

Core Topics to Focus On

Familiarizing yourself with the critical areas of the financial markets is essential. These topics often include market structures, interest rate mechanisms, and the dynamics between different asset classes. Understanding how these elements work together will give you a well-rounded perspective that is key to answering questions effectively during the assessment.

Effective Study Techniques

To ensure success, a focused study plan is crucial. Prioritize key topics, practice with sample problems, and make use of any available resources to reinforce your understanding. Active learning methods such as quizzes and flashcards can also help solidify the material, while time management strategies will ensure you allocate enough time to each section.

Overview of Financial Market Assessment

Understanding the fundamentals of financial markets and instruments is essential for anyone working in or entering the finance industry. This section provides an introduction to the key components of the evaluation process, outlining what is typically covered and how to approach the material effectively. A solid grasp of these topics will lay the foundation for success in any related financial certification.

Key Areas of Focus

The assessment typically includes a variety of financial topics, ranging from market structures to the mechanics of debt securities. Topics like risk management, valuation, and pricing models are also central to the process. Candidates must understand not only theoretical concepts but also how to apply these principles in practical, real-world situations.

Preparing for Success

A comprehensive preparation plan should include reviewing study materials, practicing calculations, and understanding key financial formulas. Familiarizing yourself with the terminology and tools used in the industry will also help boost confidence and performance. By addressing these areas, candidates can approach the assessment with clarity and preparedness.

Key Topics Covered in the Assessment

The evaluation process includes a broad range of financial concepts and principles that candidates must be familiar with. These topics are essential for understanding the dynamics of the financial world and provide the necessary knowledge to answer practical and theoretical questions with confidence. In this section, we will outline the core areas that are commonly included in such assessments.

Fundamental Financial Concepts

A strong foundation in key financial principles is crucial. Some of the main topics include:

- Bond market dynamics

- Interest rate calculations

- Yield curves and their interpretation

- Risk assessment and mitigation strategies

- Understanding of credit ratings

Practical Applications and Calculations

In addition to theoretical knowledge, practical skills are vital for solving real-world financial problems. These include:

- Bond pricing and yield calculations

- Duration and convexity measures

- Valuation of different asset classes

- Understanding investment strategies and portfolio management

Understanding Financial Market Concepts

Grasping the fundamental concepts of financial markets is critical for anyone working with investment products and strategies. In this section, we will explore the key elements of financial instruments, their pricing models, and how market data is interpreted. A clear understanding of these topics will help build a strong foundation for any financial assessment or application.

One of the central aspects of financial markets is the relationship between risk and return, especially when dealing with debt securities. Understanding the various factors that influence asset prices, such as interest rates, maturity, and credit risk, is essential for making informed decisions.

Key Factors in Financial Instrument Pricing

The pricing of debt securities and related financial instruments depends on several key variables. Below is a table summarizing these factors:

| Factor | Description |

|---|---|

| Interest Rates | Interest rates affect the discount rate used in pricing, influencing the present value of future cash flows. |

| Maturity | The time to maturity impacts the duration and price sensitivity of a financial instrument. |

| Credit Risk | The likelihood of a borrower defaulting on a debt obligation, influencing the yield spread over risk-free rates. |

| Market Liquidity | Liquidity affects the ease with which an instrument can be bought or sold without affecting its price. |

Each of these factors plays a role in determining the value of financial products in real-time market conditions. Understanding how they interact is crucial for assessing market trends and making accurate predictions in the financial world.

How to Approach Test Questions Effectively

When faced with a financial knowledge test, the key to success lies not only in understanding the material but also in knowing how to approach each question strategically. This section will discuss how to tackle questions in a structured and methodical way, helping you maximize your performance.

A well-planned approach can make all the difference. Start by reviewing all the questions quickly, marking those you can answer with certainty. For the more challenging ones, break them down into smaller parts, and use your knowledge of financial principles to guide your reasoning.

Effective Techniques for Answering Questions

Here are some techniques to help you answer questions efficiently:

| Technique | Description |

|---|---|

| Read Carefully | Ensure that you fully understand the question before answering. Look for key terms and focus on what is being asked. |

| Eliminate Obvious Errors | When unsure, rule out answers that are clearly incorrect to narrow down your choices. |

| Apply Formulae and Concepts | Utilize relevant financial formulas and concepts to guide your responses. This will increase the accuracy of your answers. |

| Manage Your Time | Allocate time to each section based on difficulty, ensuring you complete the entire test within the allotted time. |

By following these steps, you can approach each question with confidence and efficiency, improving your chances of achieving a high score. Time management, careful analysis, and the application of financial knowledge are the pillars of success in any assessment.

Common Mistakes to Avoid in the Assessment

When preparing for a financial knowledge assessment, being aware of common pitfalls can make a significant difference in your performance. Many candidates fall into certain traps that can easily be avoided with proper strategy and focus. Understanding these mistakes and how to prevent them will improve your chances of success.

Frequent Errors to Watch Out For

Here are some of the most common mistakes that test-takers make:

- Misunderstanding the Question: Always read each question carefully to ensure that you know exactly what is being asked. Misinterpretation can lead to incorrect answers, even if you know the material.

- Rushing Through Questions: Time pressure can lead to hasty decisions. Avoid rushing through the test; instead, allocate sufficient time to carefully evaluate each question.

- Overlooking Key Details: Some questions include critical information that can change the answer. Pay attention to all details, such as terms, units, and context.

- Not Showing Your Work: In questions that require calculations, it’s important to demonstrate your process. This not only helps you check your work but also ensures partial credit in case of minor errors.

- Neglecting Review Time: Always leave time at the end to review your answers. This gives you the opportunity to catch any mistakes or incomplete responses.

How to Prevent These Mistakes

To avoid these common mistakes, try implementing these strategies during your preparation:

- Practice with Sample Questions: Familiarize yourself with the question format and test structure. This will help reduce anxiety and improve accuracy during the real test.

- Work on Time Management: Practice pacing yourself during mock tests to ensure you don’t rush or spend too much time on any single question.

- Double-Check Calculations: Always check your math, especially in questions involving financial formulas or numerical data.

- Stay Calm: Keep a steady pace and stay calm under pressure. If you don’t know an answer immediately, move on and return to it later with a fresh perspective.

By avoiding these common mistakes, you can approach the assessment with greater confidence and increase your chances of achieving a top score.

Preparation Strategies for Success

To succeed in any financial assessment, effective preparation is crucial. A well-structured study plan not only helps you cover the necessary material but also ensures you approach the test with confidence and clarity. This section outlines the key strategies for successful preparation that will help you maximize your performance on the test day.

Successful preparation goes beyond just reviewing notes. It involves understanding key concepts, applying them through practice, and managing your time effectively. Below are some strategies that can significantly improve your readiness for the assessment.

Effective Study Plan

A detailed and focused study plan is essential for success. Below is a table outlining important components of a good preparation strategy:

| Strategy | Description |

|---|---|

| Set Clear Goals | Define specific topics and areas to cover, setting realistic goals for each study session. |

| Use Multiple Resources | Combine textbooks, online courses, and practice tests to reinforce your understanding of concepts. |

| Practice Regularly | Consistent practice is crucial. Work through sample questions and mock tests to familiarize yourself with the format and timing. |

| Focus on Weak Areas | Identify areas where you struggle the most and dedicate extra time to improving those concepts. |

Time Management

Effective time management is another key factor for success. Allocate enough time for each topic, and ensure you don’t spend too much time on any one area. Practice under timed conditions to simulate the pressure of the actual test and improve your pacing.

By following these strategies, you will be better prepared to tackle the assessment confidently and increase your chances of success.

Essential Resources for Study Materials

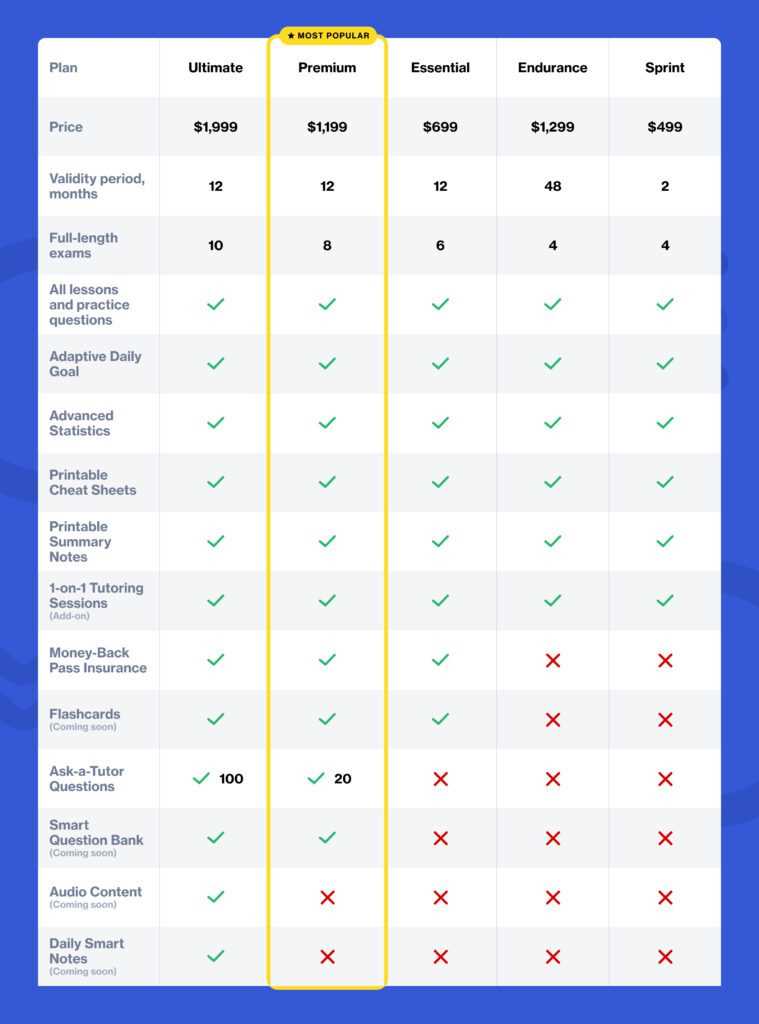

When preparing for a financial knowledge assessment, selecting the right study materials is key to mastering the content. Accessing reliable resources ensures that you cover all necessary topics in depth and have the tools to apply your knowledge effectively. In this section, we explore some of the most useful study materials that will help you succeed in your preparation.

Effective resources range from textbooks to online platforms and practice tests. Each resource serves a different purpose, whether it’s providing theoretical knowledge, helping you test your understanding, or giving insight into real-world applications. A combination of these materials can help solidify your grasp of key concepts.

Recommended Books and Texts

Books are an excellent resource for in-depth understanding of core concepts. Below are some types of books that are particularly helpful for mastering financial principles:

- Comprehensive Textbooks: Detailed guides that cover fundamental financial principles, market theories, and calculation methods.

- Study Guides: Concise materials that summarize key concepts and provide practice questions to test your knowledge.

- Reference Manuals: Books that offer practical insights and real-world applications of financial strategies and tools.

Online Platforms and Practice Tools

In addition to traditional textbooks, online resources can provide interactive learning experiences and real-time data. Here are some helpful platforms:

- Online Courses: These platforms offer structured learning, covering everything from basic principles to advanced strategies. Many include quizzes and assignments for hands-on practice.

- Practice Tests: Taking timed practice tests helps simulate the real assessment and improves time management skills. These tests often mirror the format and difficulty level of the actual test.

- Forums and Study Groups: Engaging in discussions with peers or experts allows for better understanding and clarification of complex concepts.

By combining textbooks, online courses, and practice tools, you can build a solid foundation and ensure you’re fully prepared for the assessment.

Time Management Tips for Assessment Day

Effective time management on the day of the assessment is essential to ensure you complete all questions accurately and within the allotted time. With proper planning, you can avoid rushing through difficult sections and leave time to review your answers. In this section, we explore key strategies to help you manage your time effectively during the test.

By following a structured approach to time allocation, you can balance speed with precision, ensuring that you don’t miss any critical details while avoiding spending too much time on any one section. Time management is about being strategic, not hasty.

- Read Through the Entire Test First: Before diving into the questions, take a few minutes to skim through the entire test. This gives you a sense of what to expect and helps you plan your time accordingly.

- Prioritize Easy Questions: Begin with the questions you find easiest to build confidence and gain momentum. This will help you save time for more challenging questions later on.

- Set Time Limits for Each Section: Break the assessment into sections and allocate a specific amount of time to each. Stick to your time limits to ensure you don’t get bogged down in any one area.

- Leave Difficult Questions for Later: If you come across a particularly tough question, skip it and return to it after completing the easier ones. This helps you maintain a steady pace and avoid getting stuck.

- Review Your Answers: If time permits, set aside the last few minutes to go over your answers. Double-check calculations, ensure your responses are complete, and correct any obvious errors.

By implementing these time management strategies, you can approach the assessment with a clear plan, reduce stress, and increase your chances of performing well.

What to Expect During the Test

Understanding the structure and format of the test is essential for performing well on the day. Knowing what to expect allows you to manage your time effectively and approach each section with confidence. This section will give you an overview of the test environment, the types of questions you may encounter, and how to navigate the assessment process.

The test typically includes a variety of question formats, ranging from multiple-choice questions to scenario-based tasks. Familiarizing yourself with these question types will help you prepare for what lies ahead and ensure you’re able to answer efficiently. Here’s what you can expect when you sit down for the assessment:

Test Format

The test will generally consist of a series of timed sections, each focused on different aspects of the material. The structure often includes:

- Multiple Choice Questions: These questions test your knowledge and ability to apply key concepts. They typically present a scenario followed by several possible answers.

- Practical Scenarios: Some sections may involve applying your knowledge to real-world financial situations, requiring critical thinking and problem-solving skills.

- True/False Statements: These questions assess your understanding of specific statements, testing your ability to identify accurate or inaccurate information.

Test Environment

The testing environment will be focused on providing a fair and structured setting. You may be given access to online resources or tools, depending on the format. Here are a few things to keep in mind:

- Time Constraints: Expect a time limit for each section of the test. Be mindful of how much time you spend on each question, aiming to balance accuracy with speed.

- Technical Tools: Some assessments may provide calculators, financial models, or other tools to assist with solving problems. Make sure you are familiar with these tools before the test.

By knowing what to expect during the test, you can reduce anxiety and improve your ability to stay focused and manage your time effectively. Proper preparation ensures you approach the test with the confidence needed to succeed.

Breaking Down Key Financial Instruments

Understanding the core financial tools used in markets is essential for anyone working in the field of finance. Each instrument serves a specific purpose and comes with unique characteristics that affect how it is valued and traded. This section will break down some of the most common financial instruments, helping you understand their roles and how they function within a broader financial ecosystem.

Financial instruments can be broadly classified into several categories, each with its own set of rules and uses. Some are designed for long-term investment, while others are short-term instruments meant for liquidity management. Knowing how each instrument works and its potential risks and rewards will help you navigate financial markets more effectively.

Debt Instruments

Debt instruments are one of the most common types of financial instruments, often used by corporations, governments, and individuals to raise capital. These instruments involve borrowing funds that must be repaid with interest. The key types of debt instruments include:

| Instrument | Description |

|---|---|

| Bonds | Long-term debt securities that pay periodic interest and return the principal amount at maturity. |

| Loans | Agreements between a borrower and a lender where the borrower receives funds upfront and agrees to repay over time. |

| Commercial Paper | Short-term debt instruments used by companies to finance their immediate operational needs. |

Equity Instruments

Equity instruments represent ownership in a company or asset. Investors in equity instruments have the potential to earn dividends and benefit from the appreciation of the underlying asset. The most common types of equity instruments are:

| Instrument | Description |

|---|---|

| Stocks | Shares that represent ownership in a company and entitle the shareholder to a portion of the company’s profits. |

| Preferred Stock | Equity that provides dividends before common stockholders but typically does not carry voting rights. |

| Convertible Securities | Debt or preferred stock that can be converted into common stock, offering potential for capital appreciation. |

Each of these instruments plays a vital role in the financial markets, offering different benefits and risks to investors. Understanding the characteristics of each instrument allows you to make informed decisions when managing financial portfolios.

Tips for Mastering Fixed Income Calculations

Mastering the calculations behind debt securities is crucial for anyone involved in finance. Whether you’re assessing bond yields, calculating duration, or determining present value, a clear understanding of these calculations is essential for making informed investment decisions. This section provides key strategies and tips for navigating the complexities of fixed income math, ensuring accuracy and efficiency in your work.

Fixed income calculations often involve mathematical formulas to determine values such as price, yield, and duration. These calculations are critical for valuing bonds and other debt instruments, helping investors make strategic choices based on the expected return and risk. Here are some tips to help you improve your skills and become more confident with these important calculations.

Understand Key Formulas

It’s important to familiarize yourself with the essential formulas used in fixed income analysis. Some of the most commonly used include:

- Present Value (PV): This formula helps you determine the current value of a bond or other debt instrument based on future cash flows and discount rates.

- Yield to Maturity (YTM): The total return expected on a bond if held until maturity, taking into account the bond’s current market price, interest payments, and time to maturity.

- Duration: A measure of a bond’s price sensitivity to interest rate changes. It helps determine the bond’s risk in relation to market fluctuations.

Practice with Real-World Scenarios

One of the best ways to reinforce your understanding of fixed income calculations is to apply them to real-world scenarios. Use financial calculators, spreadsheet software, or online tools to work through bond pricing and yield calculations. By practicing regularly, you’ll become more comfortable with different situations and refine your ability to perform these calculations quickly and accurately.

By mastering these techniques and familiarizing yourself with essential formulas, you will build the foundation needed to navigate the complexities of debt securities with ease. Consistent practice and understanding the underlying principles will help you excel in fixed income analysis and investment decision-making.

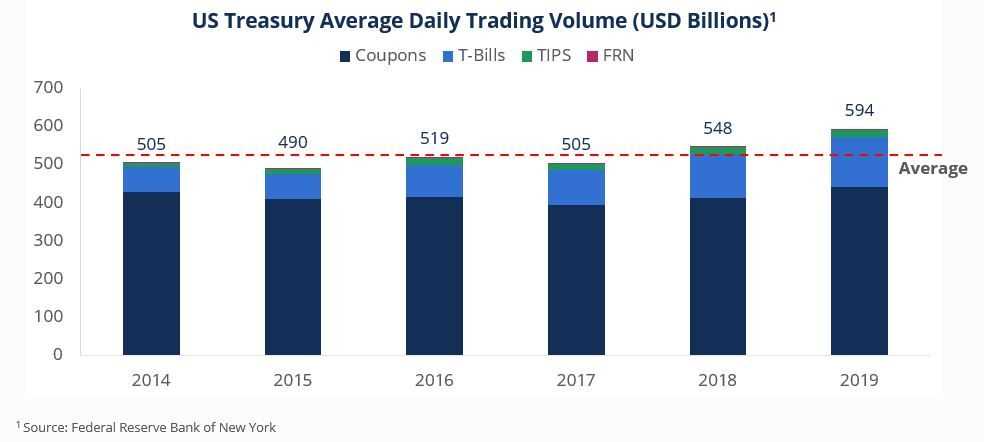

How to Interpret Bond Market Data

Interpreting data from the debt market is essential for making informed investment decisions. Understanding key indicators such as yields, prices, and spreads allows investors to evaluate the attractiveness of different debt securities. By interpreting these metrics correctly, you can assess risks, forecast trends, and determine the potential return on investment. This section will explore the key components of bond market data and provide guidance on how to analyze them effectively.

The primary data points to focus on when analyzing bonds include the bond’s price, yield, coupon rate, and duration. Each of these components provides insight into the bond’s potential performance and market behavior. Below are some key factors to consider when evaluating bond market data.

Key Data Points to Analyze

- Price: The market price of a bond indicates its current value in the market. A bond’s price may be at a premium, discount, or at par, depending on interest rate movements and other market conditions.

- Yield: Yield represents the bond’s return based on its current market price. This can be broken down into various measures, including the coupon yield, current yield, and yield to maturity (YTM), each offering different perspectives on potential returns.

- Coupon Rate: This is the fixed interest rate the bond issuer pays to bondholders. It is typically expressed as a percentage of the face value and determines the regular income a bondholder receives.

- Duration: Duration measures the sensitivity of a bond’s price to interest rate changes. A higher duration means the bond’s price is more sensitive to interest rate movements, which can impact its volatility.

Reading Yield Curves and Spreads

One of the most critical elements of bond market analysis is the yield curve, which shows the relationship between bond yields and their maturities. A normal upward-sloping curve indicates that longer-term bonds offer higher yields, reflecting the greater risk associated with longer investment horizons. An inverted yield curve, on the other hand, may signal an economic downturn.

In addition to the yield curve, analyzing yield spreads is essential for understanding credit risk. The spread between a corporate bond’s yield and a government bond’s yield of similar maturity indicates the level of risk perceived in the corporate bond. A wider spread suggests higher perceived risk, while a narrower spread indicates lower risk.

By mastering the interpretation of these key metrics, you will be better equipped to navigate the debt market and make well-informed investment decisions. Consistent analysis of bond market data helps to identify opportunities and risks, ensuring a more effective investment strategy.

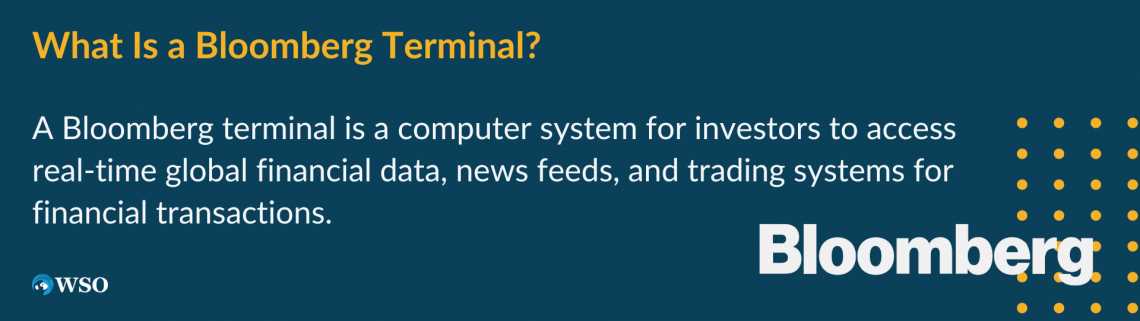

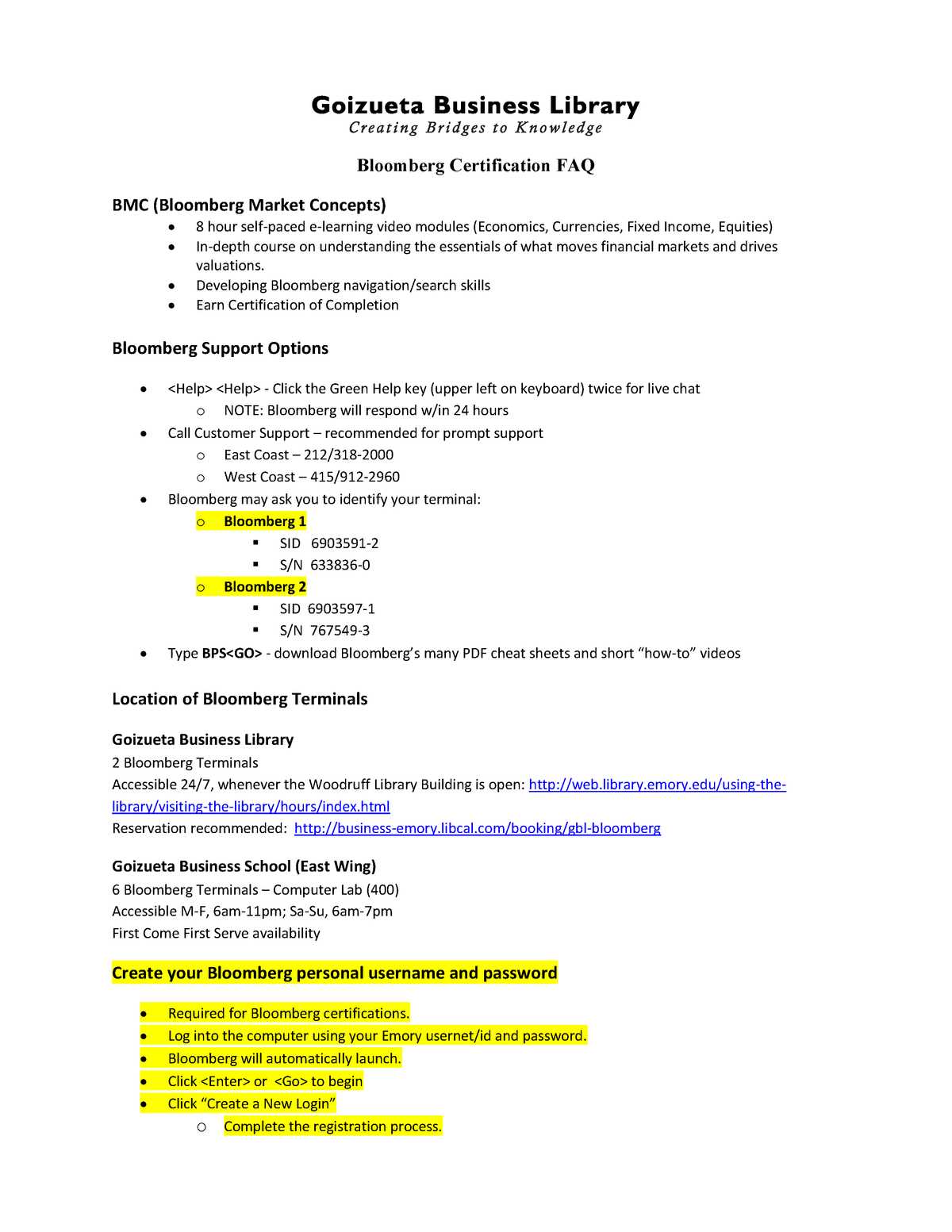

Key Functions for Exam Preparation

When preparing for a financial certification or any other related assessment, mastering the platform’s tools can significantly enhance your study efficiency. The platform provides a range of functions that allow users to access detailed market data, analyze trends, and simulate various investment scenarios. By understanding these essential features, you can improve both your understanding and retention of complex concepts, ensuring you are well-prepared for the assessment.

Here are some of the key features that are particularly useful during preparation:

Key Features for Analysis and Data Access

- Function A: This function provides real-time access to market data, including bond prices, yields, and related financial indicators. It’s an excellent tool for practicing with live data and analyzing trends.

- Function B: Use this feature to access detailed reports and financial analysis tools. You can create custom charts, graphs, and models to better understand key concepts.

- Function C: This tool allows you to simulate different market conditions, helping you to understand how various factors affect asset prices and yields.

- Function D: A powerful feature that helps you track the performance of specific financial instruments over time, offering insight into price volatility and other critical metrics.

Practical Tools for Studying

- Custom Alerts: Set up alerts to notify you when specific data points change or when predefined thresholds are met. This can be a valuable tool for staying updated on market shifts that are relevant to your studies.

- Interactive Tutorials: Many platforms offer tutorials that walk you through different concepts and strategies, providing hands-on experience with key functions and data analysis techniques.

- Test Simulations: Some platforms offer simulated practice tests, which mimic the structure and content of the actual assessment. This allows you to familiarize yourself with the format and types of questions that may appear.

By incorporating these features into your study routine, you can reinforce your understanding of critical financial principles and improve your ability to navigate complex market data. Regular practice with these tools will make you more confident and prepared for the upcoming test.

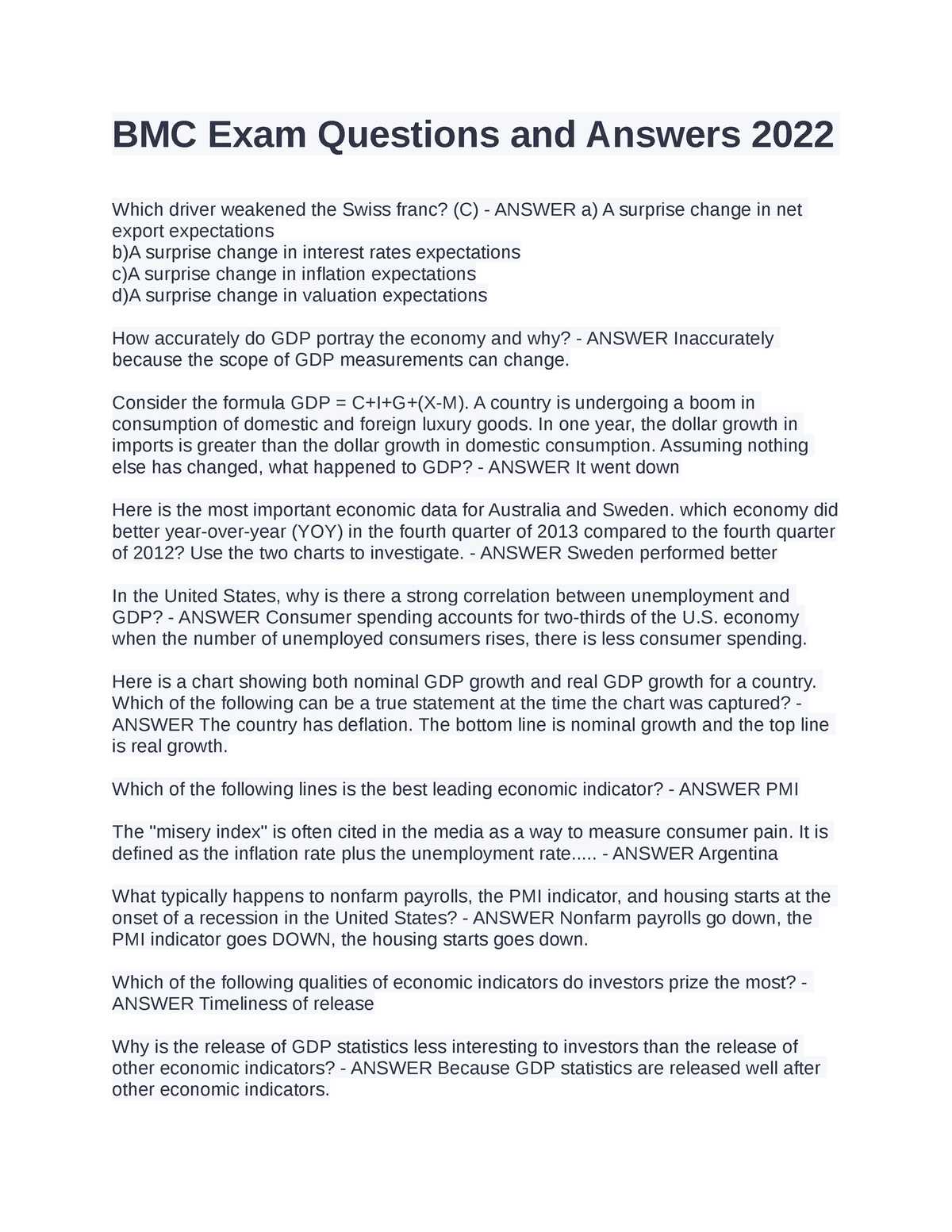

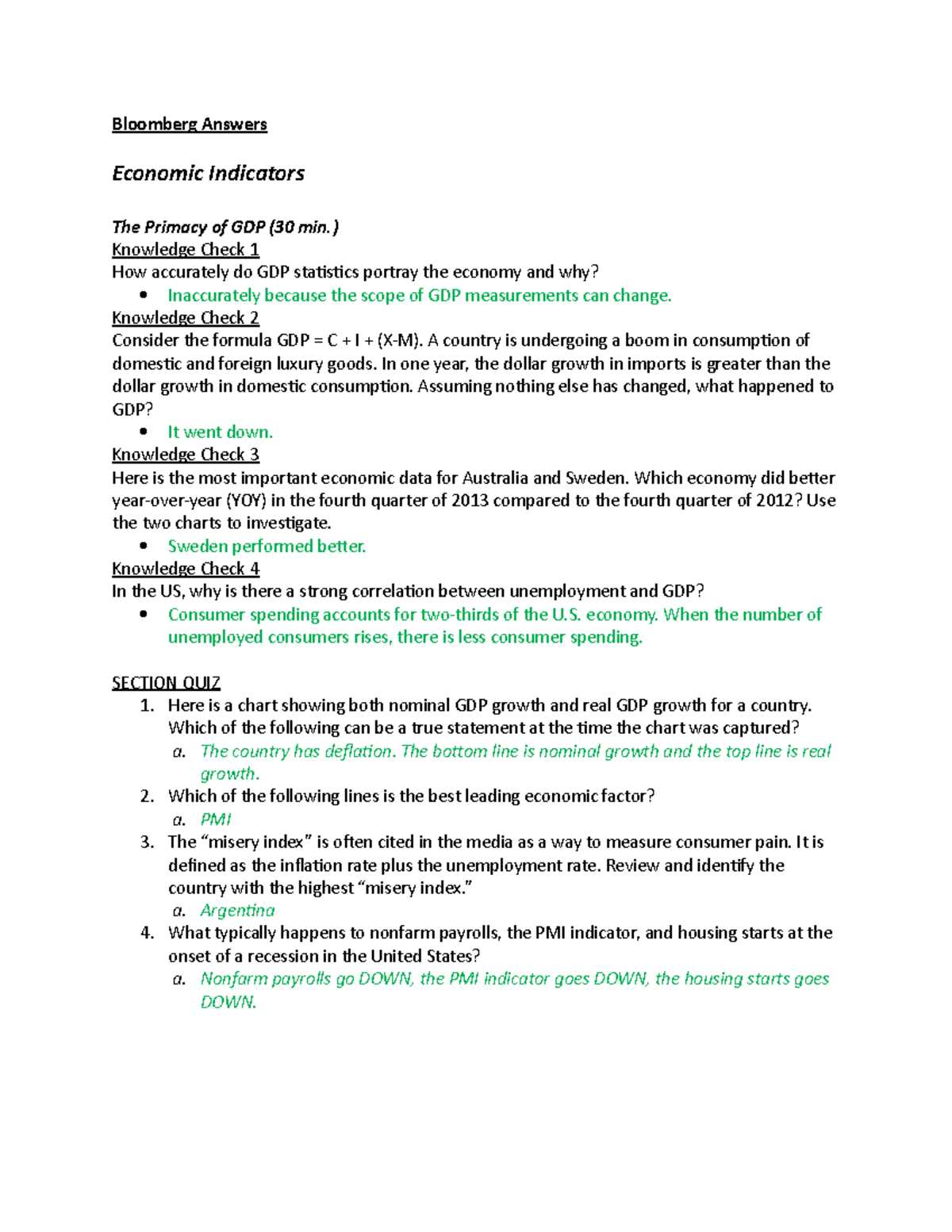

Reviewing Sample Questions and Answers

One of the most effective ways to prepare for any assessment is to review sample questions and solutions. This practice not only helps to familiarize yourself with the structure and format of the test but also reinforces key concepts and problem-solving strategies. By working through various examples, you can identify common question types and understand the best approaches to answering them accurately.

Understanding the Structure of Sample Questions

Sample questions are designed to mirror the types of queries you will encounter during the actual assessment. They typically cover a wide range of topics and test your ability to apply theoretical knowledge in practical situations. Here are a few common types of questions you might encounter:

- Calculation-Based Questions: These questions test your ability to perform financial calculations such as pricing, yield analysis, and risk assessment. Practicing these will help you become more comfortable with numerical methods and formulas.

- Conceptual Questions: These questions evaluate your understanding of key concepts and theories related to market operations, financial instruments, and investment strategies.

- Scenario-Based Questions: In these questions, you are presented with a market scenario and asked to analyze it and propose an appropriate strategy or decision based on the information provided.

How to Approach Sample Answers

Once you’ve reviewed the sample questions, it’s equally important to study the solutions provided. By analyzing the answers, you can gain insight into the reasoning behind each response and understand the steps involved in arriving at the correct conclusion. Consider the following strategies:

- Step-by-Step Review: Break down each answer into smaller steps. This will help you understand the logical progression and ensure you don’t miss any important details.

- Identify Patterns: Look for recurring themes or types of questions. Identifying these patterns will allow you to focus on areas where you may need additional practice.

- Check for Mistakes: If you make an error while practicing, analyze the sample answer to see where you went wrong and make a note of any mistakes to avoid in the future.

By regularly reviewing sample questions and answers, you can enhance your comprehension of complex topics, improve your problem-solving skills, and build confidence in your ability to perform well on the test.

Post-Exam: Next Steps After Completion

Once you have finished the assessment, the process does not end there. It’s crucial to understand what steps to take after completing a test in order to maximize the benefits of your efforts and continue your learning journey. This stage is about reflecting on your performance, identifying areas for improvement, and planning your next move based on the results.

Reflect on Your Performance

Before moving forward, take a moment to evaluate how you performed during the test. Did you feel confident in your responses? Were there areas where you struggled? Reflecting on these points can provide valuable insight into both your strengths and weaknesses. Consider the following:

- Review Areas of Difficulty: Identify the topics or question types that were most challenging for you. These areas should be your focus for further study.

- Assess Time Management: Reflect on how you managed your time during the test. Did you spend too much time on difficult questions? Did you have enough time to review your answers?

- Note Stress or Anxiety Levels: Consider how stress affected your performance. Developing strategies to manage anxiety in future assessments could be key to improving your results.

Analyze the Results and Plan Ahead

After receiving your results, it’s essential to assess the feedback and plan accordingly. Whether you passed or need to retake the test, there are steps you can take to continue your growth:

- Review Correct and Incorrect Answers: If possible, analyze which questions you answered correctly and which you didn’t. Understanding why certain answers were incorrect helps you avoid similar mistakes in the future.

- Set Clear Goals: Based on your performance, set specific goals for improvement. This could include revisiting certain topics, practicing specific skills, or taking a deeper dive into areas that need work.

- Retake the Test if Needed: If your performance was below expectations, don’t be discouraged. Retaking the test can be a great way to gauge your progress and solidify your understanding of challenging material.

Taking these post-test actions seriously will help you continue to refine your skills, enhance your knowledge, and prepare for future challenges in the financial field. Keep track of your progress, and stay committed to your learning goals.