Financial evaluations play a crucial role in maintaining the integrity of economic systems. Professionals responsible for assessing institutions’ operations need a comprehensive understanding of regulations, procedures, and analytical techniques. The process of evaluating financial entities involves a mix of theoretical knowledge and practical skills, making the preparation for such evaluations both challenging and rewarding.

To succeed in this field, individuals must develop a solid grasp of key concepts related to monetary systems, risk management, and compliance. This type of assessment is designed to test not only technical expertise but also problem-solving abilities under pressure. Preparation requires dedication, attention to detail, and a strategic approach to mastering various subjects that contribute to the overall understanding of financial structures.

Financial Assessment Overview

Assessing the operations of financial institutions is a complex task that requires a deep understanding of various regulations, practices, and analytical methods. The process evaluates the ability of professionals to scrutinize an organization’s financial health, compliance with laws, and overall operational effectiveness. It is essential for individuals in this role to demonstrate proficiency in identifying potential risks, ensuring regulatory adherence, and offering actionable recommendations.

Skills and Knowledge Areas

The evaluation process involves multiple areas of expertise. Candidates are tested on their knowledge of financial principles, legal frameworks, and risk management techniques. In addition, practical problem-solving abilities are examined through real-world scenarios, requiring evaluators to demonstrate their decision-making skills and ability to interpret financial data accurately.

Preparation for the Assessment

Preparing for such an evaluation requires more than just understanding theoretical concepts. Successful candidates must engage in comprehensive study, practice exercises, and simulations to hone their skills. Familiarity with the current regulatory environment and an ability to apply knowledge in dynamic situations are essential for achieving success in this demanding field.

What is a Financial Institution Assessor?

A financial institution assessor is a professional responsible for evaluating the operational health and compliance of financial organizations. They review records, policies, and internal controls to ensure that companies follow regulatory standards, manage risks effectively, and operate with financial integrity. Their role is pivotal in maintaining the stability and trustworthiness of the economic system by identifying potential issues before they escalate into larger problems.

Core Responsibilities

Individuals in this role carry out a wide range of duties, from auditing financial statements to assessing an organization’s adherence to laws and regulations. They are responsible for investigating discrepancies, analyzing risk management strategies, and recommending improvements to ensure organizational stability. Their evaluations often require a blend of technical knowledge, critical thinking, and effective communication.

Key Skills and Expertise

To perform effectively, financial assessors must possess a combination of technical skills and soft skills. The following table outlines some of the essential qualities required for the role:

| Skill | Description |

|---|---|

| Analytical Ability | The capacity to evaluate financial data, identify patterns, and detect potential issues. |

| Regulatory Knowledge | Understanding of financial laws, regulations, and compliance standards to ensure that organizations are following proper procedures. |

| Attention to Detail | The ability to carefully examine financial statements and internal processes to spot discrepancies or irregularities. |

| Communication Skills | Effective communication to report findings, explain recommendations, and collaborate with other professionals. |

| Problem-Solving | Developing strategies to mitigate risks and improve processes based on findings during evaluations. |

Key Skills Required for the Evaluation

Success in evaluating financial institutions relies on a blend of technical expertise and critical thinking. Professionals must be able to assess complex financial data, interpret regulations, and make informed decisions under pressure. Mastering these skills not only helps in passing the evaluation but also ensures accuracy and effectiveness in day-to-day tasks.

Analytical and Problem-Solving Abilities

One of the most important skills is the ability to analyze large amounts of data and extract meaningful insights. Evaluators must be able to identify discrepancies, trends, and potential risks. This requires a high level of analytical thinking, as well as the ability to propose solutions to mitigate any issues discovered during the review process.

Understanding of Regulatory Frameworks

Evaluators need to be well-versed in the legal and regulatory standards governing financial institutions. An in-depth understanding of these frameworks is crucial for ensuring that organizations remain compliant with industry standards and avoid costly mistakes. Familiarity with both local and international regulations will also give evaluators a competitive edge during the assessment.

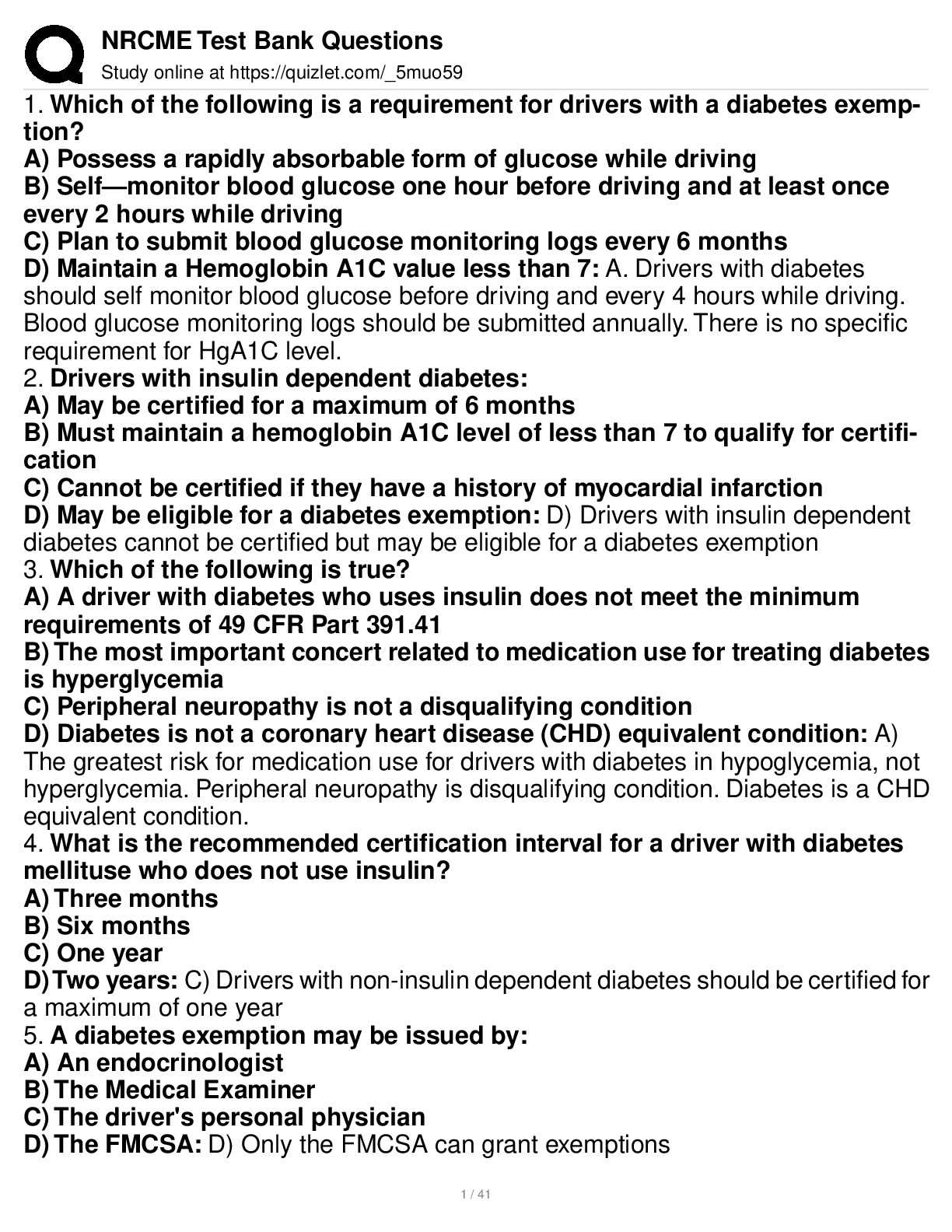

Types of Questions on the Evaluation

The evaluation for assessing financial institutions includes a variety of question types designed to test both theoretical knowledge and practical application. These questions challenge candidates to demonstrate their understanding of financial concepts, legal requirements, and problem-solving abilities. The format is intended to evaluate how well candidates can apply their knowledge in real-world scenarios and under time constraints.

Below is a table outlining the different categories of questions you can expect on the evaluation:

| Category | Question Type |

|---|---|

| Regulatory Knowledge | Questions that assess understanding of laws and regulations governing financial operations, compliance standards, and reporting requirements. |

| Financial Analysis | Questions focusing on interpreting financial statements, analyzing data trends, and identifying potential risks in an organization’s financial practices. |

| Risk Management | Scenarios that test the candidate’s ability to evaluate and address potential financial or operational risks within an institution. |

| Problem-Solving | Situational questions that require candidates to apply their knowledge to solve complex issues that may arise in the course of financial assessments. |

| Ethical Considerations | Questions that evaluate the candidate’s ability to navigate ethical dilemmas and make decisions that align with industry standards. |

Understanding the Evaluation Format

The format of the assessment for evaluating financial institutions is designed to test a candidate’s depth of knowledge, analytical skills, and ability to apply what they’ve learned in practical scenarios. The structure ensures that candidates are evaluated on multiple fronts, including theoretical knowledge, problem-solving, and real-world applications. Understanding the format is essential for effective preparation and successful completion of the evaluation.

The evaluation typically consists of multiple-choice questions, scenario-based problems, and practical exercises. These components are designed to test the candidate’s ability to handle both standard and complex situations that may arise in the field of financial oversight. The assessment is time-bound, requiring careful planning and effective time management to ensure all sections are completed.

Components of the Evaluation

- Multiple-Choice Questions: These questions assess basic knowledge and understanding of financial principles, laws, and regulations.

- Scenario-Based Questions: These questions present real-world situations requiring critical thinking and decision-making skills to solve complex problems.

- Practical Exercises: Hands-on tasks that involve analyzing data, financial statements, or identifying discrepancies in hypothetical cases.

- Time Management: The evaluation is often timed, and candidates must efficiently allocate time to complete each section without rushing or missing key details.

Preparation Tips for the Format

- Familiarize yourself with the structure and types of questions included in the evaluation.

- Practice time management during mock exercises to ensure you can complete all sections on time.

- Review real-world scenarios and case studies that simulate the problems you might encounter.

- Test your knowledge with quizzes that focus on the key areas covered in the assessment.

How to Prepare for the Evaluation

Preparation for an evaluation in the field of financial oversight requires a structured approach that combines both theoretical knowledge and practical skills. Success depends on understanding the key areas being assessed, mastering the content, and developing the ability to apply that knowledge in real-world scenarios. The more focused and organized your preparation, the more confident you will feel on the day of the evaluation.

Study Key Areas

To begin, it is essential to review the core concepts and subjects that will be covered. Focus on topics such as financial regulations, risk management practices, and the interpretation of financial data. Break down complex concepts into manageable sections and spend adequate time on each to ensure a deep understanding. Consistency is key, so create a study schedule and stick to it.

Practice with Real-World Scenarios

In addition to theoretical study, practicing real-world scenarios is crucial. These exercises help you develop problem-solving skills and apply your knowledge in a practical context. Use practice tests, case studies, and simulations to familiarize yourself with the type of questions and situations that might arise during the evaluation. Simulating actual conditions will help you build confidence and improve your time management during the assessment.

Study Materials and Resources

Effective preparation for an assessment in the financial sector requires the use of high-quality study materials and resources. These tools help candidates gain a comprehensive understanding of the key concepts, regulations, and practical skills necessary for success. Choosing the right resources is crucial for building a strong foundation and ensuring thorough preparation across all relevant topics.

Recommended Books and Guides

Books that cover financial regulations, accounting principles, and risk management are essential for building knowledge. Look for textbooks and professional guides that offer in-depth explanations, real-world examples, and practice exercises. Key resources should provide clear explanations of complex topics and include practical applications to ensure you can transfer your learning to real-life scenarios.

Online Courses and Practice Exams

In addition to traditional study materials, online courses and practice exams can significantly enhance your preparation. Interactive platforms often provide video lectures, quizzes, and mock evaluations that simulate the actual assessment experience. These resources allow you to gauge your progress, identify areas for improvement, and gain familiarity with the format and structure of the evaluation.

Effective Time Management Strategies

Time management is a critical skill when preparing for any rigorous evaluation. Organizing study sessions, balancing multiple topics, and ensuring adequate review time can make a significant difference in your performance. By adopting effective strategies, you can ensure that you cover all necessary material without feeling overwhelmed.

Create a Structured Study Plan

One of the best ways to manage your time is by creating a detailed study schedule. Break your preparation into manageable chunks, allocating specific time slots for each topic or area of focus. Set clear, achievable goals for each session, ensuring you cover key concepts without rushing through them. A structured approach will help you stay on track and prevent last-minute cramming.

Practice Time-Limited Mock Scenarios

Simulating the actual conditions of the evaluation can greatly improve your time management. Practice with timed mock exams or exercises to replicate the pressure of completing the assessment within a set time frame. This will help you develop strategies for pacing yourself, prioritizing questions, and identifying which areas to focus on to maximize efficiency during the real evaluation.

Common Mistakes to Avoid

When preparing for an evaluation in the financial field, it is important to be aware of common pitfalls that can hinder your performance. Many candidates fall into the trap of poor time management, ineffective study strategies, or lack of understanding in key areas. By recognizing and avoiding these mistakes, you can improve your chances of success and feel more confident in your preparation.

Common Pitfalls

- Procrastination: Putting off studying until the last minute can lead to rushed preparation and gaps in knowledge.

- Ignoring Key Topics: Focusing too much on familiar material while neglecting less comfortable areas can leave you unprepared for certain questions.

- Overloading Study Sessions: Trying to cram too much information in one sitting can lead to burnout and reduce retention.

- Underestimating Time Management: Failing to allocate enough time to complete all sections of the evaluation can leave you scrambling at the end.

Strategies to Overcome Mistakes

- Develop a realistic study schedule and stick to it to avoid procrastination.

- Make sure to cover all topics, even those you find difficult, to ensure comprehensive preparation.

- Take regular breaks to avoid fatigue and improve focus during study sessions.

- Practice with timed mock scenarios to improve your ability to manage time effectively during the evaluation.

Understanding Financial Regulations and Laws

A solid understanding of financial regulations and legal frameworks is crucial for anyone involved in oversight activities within the financial sector. These rules and laws are designed to ensure transparency, fairness, and stability within the industry. Familiarity with the relevant legislation allows individuals to identify compliance issues, assess risks, and ensure that financial institutions are operating within the boundaries set by law.

Key Regulations to Know

- Anti-Money Laundering (AML): Laws that require financial institutions to monitor and report suspicious activities that might involve money laundering or fraud.

- Dodd-Frank Act: A U.S. law aimed at reducing risks in the financial system by enforcing stricter regulations on institutions and improving transparency.

- Basel III: International regulations that set minimum capital requirements and stress testing for financial institutions to prevent another global financial crisis.

- Financial Privacy Laws: Regulations that protect consumer financial information from unauthorized access or disclosure.

How to Stay Updated

- Regularly review updates and amendments to financial regulations to ensure compliance with the latest laws.

- Participate in training programs or webinars focused on financial compliance and regulatory changes.

- Consult legal professionals or industry experts to clarify complex legal provisions and their implications for financial institutions.

The Role of Financial Institutions in the Evaluation

Financial institutions play a critical role in the evaluation process, as they are central to the areas being assessed. Understanding their operations, regulatory compliance, and financial practices is essential for those preparing for an evaluation in the financial oversight sector. The ability to assess how these organizations meet legal and operational standards is a key part of the evaluation process.

Key Areas of Focus

- Compliance with Regulations: Institutions must adhere to both local and international laws to ensure the safety and integrity of the financial system.

- Risk Management: Assessing how institutions manage and mitigate risks, such as credit, operational, and market risks, is essential to understanding their stability.

- Financial Reporting: Institutions are required to provide accurate financial statements that reflect their performance and health. Understanding these reports is crucial during the evaluation.

- Internal Controls: Analyzing the effectiveness of internal controls that prevent fraud, error, and mismanagement is vital for ensuring transparency and trustworthiness.

How Institutions are Evaluated

- Through on-site inspections that review documents, processes, and financial records to ensure compliance with laws and regulations.

- By conducting interviews with key personnel to understand internal policies and risk management strategies.

- Through the review of audits and past performance reports to identify any systemic issues or areas of concern.

Mock Tests and Practice Questions

Practicing with simulated assessments and sample questions is an essential part of preparing for any evaluation in the financial oversight sector. These exercises help familiarize candidates with the format, types of questions, and time constraints they will face. By regularly engaging with practice materials, individuals can identify areas where they need improvement and refine their problem-solving skills, ensuring they are better equipped for the actual evaluation.

Mock assessments offer a chance to experience real-world conditions, allowing candidates to test their knowledge, practice time management, and adjust their approach based on feedback. Regular practice also boosts confidence, as candidates become more comfortable navigating various scenarios and responding effectively under pressure.

Sample questions, ranging from theoretical concepts to practical applications, provide insight into the content and structure of the evaluation. Working through these examples helps reinforce key concepts and prepares candidates to tackle the challenges they will encounter during the official assessment.

Test-Taking Tips for Success

Effective strategies during the evaluation can make a significant difference in performance. A well-prepared individual, who approaches the assessment with confidence and a clear plan, will have a higher chance of success. It’s not only about what you know, but how you manage your time, approach questions, and stay focused throughout the process.

Key Strategies to Enhance Performance

- Read Instructions Carefully: Before starting, ensure you understand all guidelines and instructions. This can help you avoid unnecessary mistakes and save time.

- Manage Your Time: Allocate time for each section or question and stick to it. If you’re unsure about a question, move on and come back to it later.

- Stay Calm and Focused: Keeping a clear mind throughout the evaluation is essential. If you start feeling anxious, take a few deep breaths and regain your focus.

- Eliminate Incorrect Answers: When faced with multiple-choice questions, try to eliminate obviously incorrect answers first. This increases your chances of selecting the right one.

Post-Evaluation Reflection

- Review Mistakes: After completing a mock or practice assessment, always go back and review incorrect answers to understand your mistakes.

- Seek Feedback: If possible, ask an expert or mentor to review your approach to the evaluation and provide constructive feedback.

What to Expect on Evaluation Day

The day of the evaluation is an important moment in the preparation process. It’s crucial to be mentally and physically ready for what lies ahead. Being well-prepared not only helps reduce stress but also ensures that you can approach the evaluation with confidence. On the day of the assessment, you will be expected to demonstrate both your knowledge and your ability to manage time effectively under pressure.

Preparation for the Day

- Arrive Early: Arriving ahead of time will allow you to settle in and get comfortable with the environment. This can help reduce any last-minute stress.

- Bring Required Documents: Ensure you have all necessary identification and paperwork ready. Double-check the requirements before leaving for the venue.

- Bring Essential Materials: Make sure you have all the tools you may need, such as pens, pencils, calculators, or any other materials specified by the guidelines.

- Get a Good Night’s Sleep: Rest is key to maintaining focus. Make sure you get adequate sleep the night before so that you’re alert and prepared for the challenge.

During the Evaluation

- Follow Instructions Carefully: Pay attention to the instructions provided at the start. If anything is unclear, ask for clarification to avoid mistakes.

- Stay Calm Under Pressure: While it’s normal to feel some nervousness, staying calm will help you think more clearly and manage time effectively.

- Keep Track of Time: Monitor the clock regularly to ensure that you are staying on pace. Don’t spend too much time on any one question.

Importance of Analytical Thinking

Strong analytical skills are essential for evaluating complex information and making informed decisions. In any evaluation, the ability to break down problems, identify key components, and assess various solutions is vital. This approach not only helps in understanding the material better but also aids in effectively applying knowledge to practical scenarios.

Being able to think analytically means you can approach problems methodically, evaluate different perspectives, and draw logical conclusions. This skill is particularly valuable in high-pressure situations, where clear thinking and problem-solving abilities are needed to achieve success.

Those who excel in analytical thinking are better equipped to handle challenging questions that require more than just rote memorization. Instead, they use reasoning and critical thinking to arrive at well-supported answers, making this skill crucial for anyone preparing for a demanding evaluation process.

How to Handle Evaluation Anxiety

Anxiety is a natural response to high-stakes situations, especially when facing assessments that test your knowledge and skills. However, managing this stress is crucial for performing well. Understanding how to calm your nerves and stay focused can make a significant difference in your ability to think clearly and tackle challenges effectively during the evaluation.

One effective method for managing anxiety is practicing deep breathing techniques. Taking slow, deep breaths helps to activate the body’s relaxation response, reducing tension and allowing you to approach the evaluation with a clearer mind. Additionally, adopting a positive mindset and focusing on preparation can help shift attention away from worries about the outcome.

It’s also important to recognize that a little bit of stress can be motivating. Embrace this natural energy, and channel it into staying alert and attentive. Remember, preparation is key–knowing you’ve put in the work will help boost your confidence and minimize feelings of uncertainty.

Reviewing Your Results After the Evaluation

Once the evaluation process is complete, it’s essential to review your performance thoroughly. Analyzing your results allows you to understand where you excelled and where improvement is needed. This step is not just about reflecting on scores but also about gaining insight into how you approached the questions and what strategies worked or could be improved.

After receiving your results, take the time to go through each section carefully. Identify the areas where you struggled, as these will highlight key areas for further development. Focus on the questions that you found challenging, and consider how you might approach similar questions differently in the future.

Assessing Your Strengths

Recognizing your strengths is just as important as identifying your weaknesses. Reflecting on the sections where you performed well can boost your confidence and motivate you for future challenges. It’s helpful to acknowledge the strategies that helped you succeed, so you can continue applying them.

Setting Goals for Improvement

Based on your review, set specific goals for areas that need improvement. Break down these goals into manageable tasks, and establish a timeline to work on them. Consistent practice and focused learning will help you approach the next challenge with greater confidence and readiness.

Next Steps After Passing the Evaluation

Successfully completing the evaluation is a significant achievement, but it’s only the first step in your professional journey. Once you have passed, it’s essential to focus on what comes next. This involves not just celebrating your success but also understanding the path ahead, which includes applying your knowledge, gaining practical experience, and continuing to grow in your career.

After passing, you will likely need to proceed with the necessary formalities, such as submitting additional documentation, attending training sessions, or preparing for on-the-job tasks. The next phase is about transitioning from theoretical knowledge to practical application in the field.

Prepare for Practical Implementation

Now that you’ve demonstrated your knowledge, the next step is to apply it in real-world scenarios. Whether it involves conducting assessments, analyzing financial practices, or ensuring compliance, you will need to be ready to use what you’ve learned. Gaining hands-on experience is crucial to strengthening your understanding and excelling in your role.

Continue Professional Development

Passing the evaluation is not the end of your learning journey. The professional world is ever-changing, and continuous development is necessary to stay ahead. Enroll in additional training, attend workshops, and stay up-to-date with industry regulations and best practices. This commitment to ongoing learning will not only enhance your skills but also open doors to new career opportunities.