In today’s world, it is essential to develop a strong foundation in financial knowledge. From managing daily expenses to understanding the intricacies of long-term savings, mastering key concepts can empower individuals to make informed decisions that impact their economic future. Financial education plays a critical role in equipping people with the tools necessary to navigate complex money-related decisions.

Mastering personal finance involves more than just understanding numbers–it’s about gaining the ability to effectively budget, save, and manage financial risks. With the right tools, anyone can improve their financial literacy, no matter their background or experience. This section delves into the skills needed to take control of your financial life and build lasting wealth.

Developing these skills not only fosters responsible spending habits but also encourages smart investments, credit management, and planning for unforeseen events. With improved financial knowledge, individuals are better positioned to make choices that align with their long-term goals and security.

Everfi Answers for Banking

Understanding financial institutions and the services they offer is crucial in today’s economic landscape. With the right guidance, individuals can gain the knowledge needed to make sound decisions about money management, savings, and credit. The following guide highlights key aspects of personal finance, focusing on the importance of recognizing how different systems work and how to effectively use them to manage financial goals.

Core Principles of Financial Systems

When learning about financial institutions, it’s important to grasp the fundamentals of how they operate. This includes understanding the different types of accounts, the role of credit, and how money flows within the economy. Key concepts include:

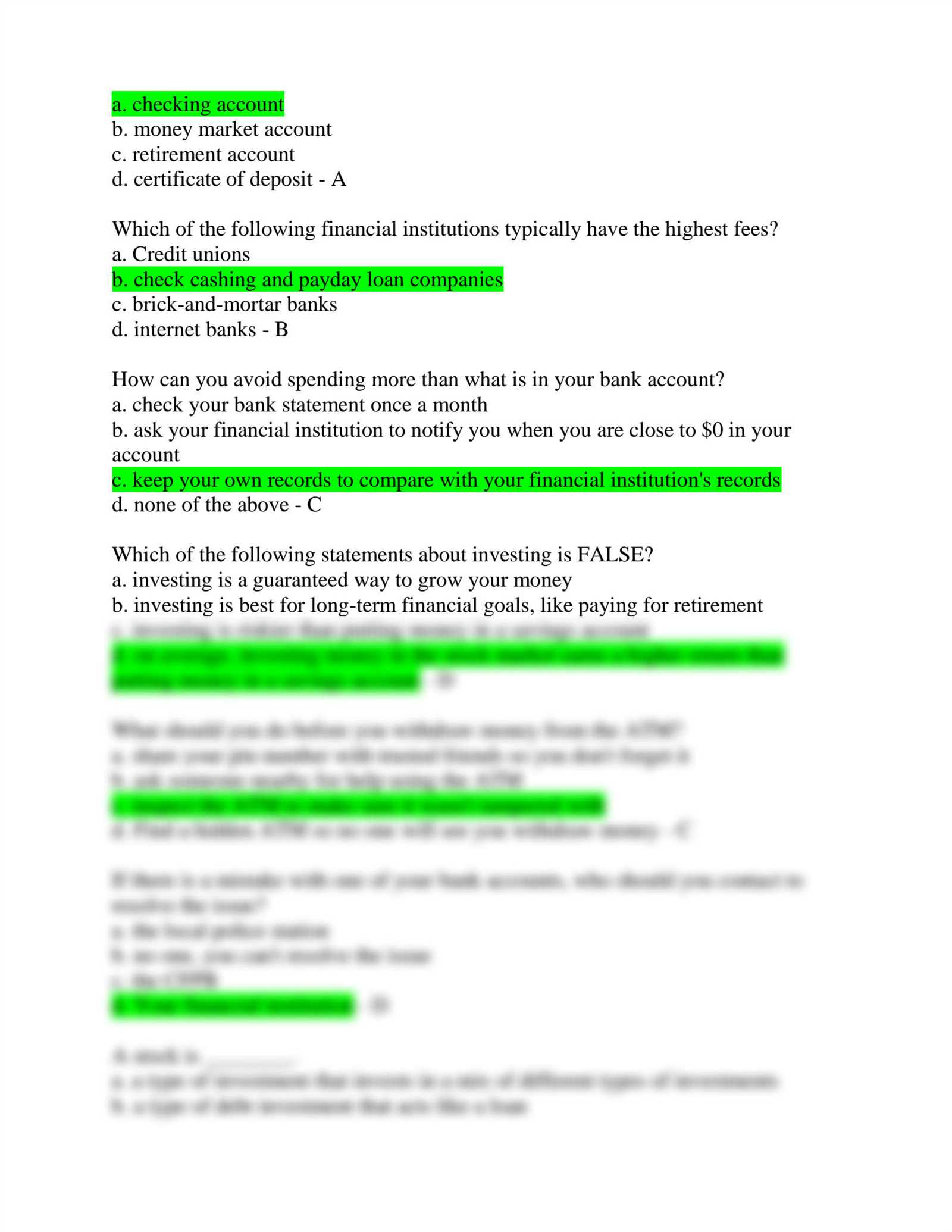

- Types of Accounts: Checking, savings, and investment accounts each serve different purposes and offer varying benefits.

- Interest Rates: How interest works, including how it affects loans, savings, and investments.

- Credit Management: How to manage credit responsibly to maintain a healthy financial profile.

- Investments: The basics of investing and how it can help grow wealth over time.

Practical Tools for Managing Personal Finance

To fully benefit from financial education, individuals need practical tools that can help them manage their daily finances and long-term planning. Some of the key resources include:

- Budgeting Tools: Software or apps that allow individuals to track their income and expenses, ensuring they live within their means.

- Credit Reports: Regularly reviewing credit reports can help identify errors and areas for improvement in credit management.

- Financial Goal Setting: Techniques to set and track personal finance goals, whether it’s saving for a home, paying off debt, or planning for retirement.

- Emergency Savings Plans: Understanding the importance of having a financial cushion for unexpected expenses.

Mastering these areas not only improves financial literacy but also promotes long-term stability and independence in managing personal wealth. By building a strong financial foundation, individuals can confidently navigate the complexities of their financial future.

Mastering Banking Concepts with Everfi

Building a strong understanding of financial systems is crucial to making informed choices about money management. By mastering essential concepts, individuals can gain better control over their financial lives and achieve their long-term goals. This section focuses on core topics related to financial institutions and how they affect personal financial planning.

Understanding Key Financial Components

When it comes to managing finances, there are several fundamental components that every individual should understand. These concepts help demystify the workings of money management and empower people to make smarter choices:

| Concept | Explanation | Importance |

|---|---|---|

| Bank Accounts | Different types of accounts like checking and savings allow users to store and manage money. | Essential for daily transactions and saving for future goals. |

| Credit | The ability to borrow money with a promise to repay it, often with interest. | Critical for making large purchases and building financial history. |

| Loans | Borrowing funds with an agreement to repay over time, typically with interest. | Important for major investments such as buying a house or car. |

| Interest | The cost of borrowing money or the return on savings. | Affects both how much you owe and how much you earn on investments. |

Practical Applications in Personal Finance

Understanding these concepts is just the beginning. To effectively manage finances, individuals must apply this knowledge in real-life situations. Whether setting up accounts, applying for credit, or planning for retirement, using these principles in everyday life will lead to better financial outcomes.

By incorporating these concepts into your daily decision-making process, you can work towards achieving financial security and independence. These skills will enable you to navigate the complexities of personal finance with confidence and ease.

Understanding Financial Transactions through Everfi

Financial transactions are the foundation of everyday economic activity. They involve the exchange of money or assets between individuals or institutions and are essential for managing personal finances. By gaining a deep understanding of how these transactions work, individuals can make smarter financial decisions and better navigate their financial lives.

Financial transactions include activities such as depositing money into a bank account, transferring funds between accounts, paying bills, or purchasing goods and services. Each transaction requires careful consideration of the parties involved, the amounts exchanged, and the purpose of the transaction. Understanding these elements is key to managing finances effectively.

Developing a clear understanding of financial transactions allows individuals to avoid common pitfalls, such as overdraft fees, missed payments, or fraud. By knowing how money moves through different systems, individuals can ensure their financial activities align with their long-term goals and maintain financial stability.

Key Banking Terms You Should Know

In order to effectively navigate financial systems, it is essential to familiarize yourself with key terminology. Understanding these terms helps individuals make informed decisions about their finances and avoid confusion when managing accounts, loans, and other financial products. Below are some of the most important terms you should know to gain a solid grasp of the financial world.

Important Financial Terms

These terms are foundational when interacting with financial institutions, whether you’re opening an account, taking out a loan, or investing in products:

- Principal: The original amount of money borrowed or invested, excluding any interest or earnings.

- Interest: The cost of borrowing money, typically expressed as a percentage of the principal amount.

- Credit Score: A numerical representation of an individual’s creditworthiness, used by lenders to assess the risk of lending money.

- Overdraft: A situation where withdrawals from a bank account exceed the available balance, often resulting in fees.

- APR (Annual Percentage Rate): The yearly interest rate charged on loans or earned on investments, including fees.

Key Concepts for Financial Planning

In addition to basic banking terms, there are several concepts related to managing your finances effectively. Knowing these terms helps you create a strong financial plan:

- Budget: A plan for managing income and expenses to ensure you live within your means.

- Savings Account: A bank account that earns interest and is designed for setting aside money for future needs.

- Debt-to-Income Ratio: A measure of an individual’s monthly debt payments in relation to their income, used by lenders to evaluate loan eligibility.

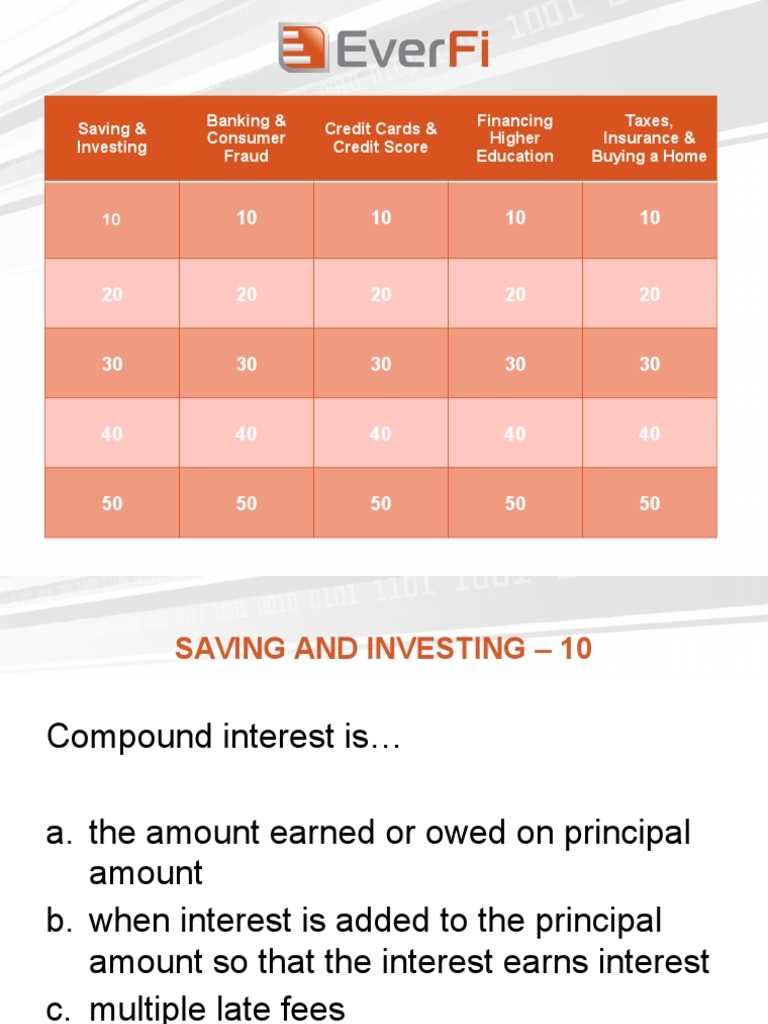

- Compound Interest: Interest that is calculated on both the initial principal and the accumulated interest from previous periods.

- Assets: Anything of value owned by an individual, including cash, property, and investments.

Mastering these terms will help you better understand the financial landscape and empower you to make informed decisions when managing your money.

How Everfi Enhances Financial Education

In today’s fast-paced world, understanding financial principles is more important than ever. With the right resources, individuals can gain the skills needed to manage their finances effectively, make informed decisions, and plan for the future. Digital platforms designed to teach financial literacy provide accessible, engaging content that empowers people to take control of their economic well-being.

One such resource focuses on providing interactive lessons and tools that help users grasp essential financial concepts. These platforms break down complex topics into easy-to-understand modules, ensuring that learners can master key concepts at their own pace. By offering practical scenarios and real-world applications, users are better prepared to manage their personal finances and make wise choices in areas like budgeting, saving, and investing.

Additionally, these platforms offer quizzes and activities that reinforce learning, allowing individuals to test their knowledge and track their progress. The ability to access financial education anytime, anywhere, makes it easier for people to improve their financial literacy, whether they are students, young professionals, or anyone seeking to enhance their understanding of money management.

Exploring Budgeting Skills in Banking

Developing effective budgeting skills is crucial for anyone looking to manage their finances successfully. Budgeting helps individuals prioritize their spending, set aside savings, and avoid unnecessary debt. By learning how to track and plan for income and expenses, people can create a financial roadmap that supports both short-term needs and long-term goals.

In the context of financial institutions, budgeting plays a vital role in how individuals interact with their accounts, loans, and other services. Understanding how to allocate funds across various categories allows consumers to use their banking tools more effectively and make well-informed financial decisions.

Key Budgeting Strategies

Several essential strategies can help improve budgeting skills:

- Track Your Income and Expenses: Regularly monitor your income and expenditures to ensure that you are staying within your financial limits.

- Set Realistic Goals: Establish both short-term and long-term financial goals to help guide your spending and saving habits.

- Emergency Fund: Always set aside money for unexpected expenses to prevent financial stress during emergencies.

- Use Digital Tools: Take advantage of apps and online resources that help automate tracking and provide budgeting insights.

- Review and Adjust Regularly: Periodically assess your budget to ensure it aligns with your changing financial situation and goals.

Benefits of Strong Budgeting Skills

Mastering budgeting not only helps individuals avoid financial pitfalls but also promotes overall financial health. Some key benefits include:

- Debt Reduction: A well-planned budget helps individuals manage debt by ensuring that payments are prioritized.

- Increased Savings: Budgeting ensures that money is allocated to savings goals, building wealth over time.

- Better Financial Decisions: With a clear budget, individuals can make informed decisions about major purchases, investments, and lifestyle changes.

- Improved Financial Security: Regularly reviewing and adjusting a budget provides a stronger foundation for financial stability.

By developing and applying strong budgeting skills, individuals can enhance their financial literacy, build security, and achieve their personal and financial goals with confidence.

Building Financial Security with Everfi

Establishing financial security is essential for maintaining long-term stability and peace of mind. By understanding key financial principles, individuals can make decisions that promote wealth-building, safeguard against unexpected events, and ensure a comfortable future. Achieving financial security involves managing income, expenses, and savings effectively, while also preparing for both short-term and long-term financial goals.

Building a solid financial foundation starts with mastering the basics of money management. By creating a well-structured plan for budgeting, saving, and investing, individuals can protect themselves from financial stress and take proactive steps towards their goals. Developing good financial habits also allows people to navigate life’s challenges, from unexpected medical expenses to retirement planning.

One of the first steps in building financial security is creating an emergency fund, which provides a financial cushion in times of need. Additionally, understanding how to manage debt and invest wisely can help individuals grow their wealth and achieve financial independence. With the right knowledge and resources, people can take control of their financial futures and build lasting security.

Approach to Financial Solutions

Effective financial solutions play a crucial role in helping individuals and institutions manage money, plan for the future, and navigate economic challenges. A comprehensive approach to personal finance incorporates essential concepts like saving, investing, and budgeting, while also providing tools to make informed financial decisions. By offering interactive, educational resources, individuals can learn how to make smarter choices about their money and financial goals.

One method of achieving this is through accessible platforms that teach essential financial concepts, helping users understand complex financial products and services. These tools guide users through various financial topics, making it easier to develop healthy financial habits and a strong foundation for long-term financial success.

Key Features of Financial Solutions

These platforms typically offer a wide range of features designed to improve financial literacy and decision-making:

- Interactive Lessons: Engaging, hands-on lessons designed to explain essential financial concepts and strategies.

- Personalized Plans: Tools that help individuals create customized financial strategies based on their income, goals, and spending habits.

- Real-World Scenarios: Examples that simulate real-life financial situations, helping users apply their knowledge to practical situations.

- Assessment Tools: Quizzes and tests that measure users’ understanding of various financial topics and track their progress over time.

Benefits of Financial Learning Platforms

Adopting these types of financial learning solutions provides many benefits, including:

| Benefit | Description |

|---|---|

| Increased Financial Confidence | With improved knowledge, individuals feel more confident in making financial decisions and managing their resources effectively. |

| Better Money Management | Education equips users with the skills to create budgets, manage debt, and save for future goals. |

| Financial Independence | Learning how to build wealth and invest wisely allows individuals to work towards greater financial freedom. |

By offering tailored financial resources, users are empowered to manage their finances, make smarter financial decisions, and ultimately build a more secure financial future.

Understanding Credit and Loans

Grasping the fundamentals of credit and loans is essential for navigating the world of personal finance. These financial tools are used to borrow money and pay it back over time, but they come with varying terms and conditions that can significantly impact one’s financial health. By understanding how credit works, the different types of loans available, and the responsibilities that come with borrowing, individuals can make informed decisions and avoid financial pitfalls.

Credit allows individuals to access funds upfront and pay them back later, usually with interest. Loans, on the other hand, are typically used for larger purchases or investments, such as buying a car or home. Both credit and loans can be useful financial instruments when managed responsibly, but it’s important to understand their features, how to apply for them, and how to use them wisely.

Types of Credit and Loans

There are various types of credit and loan options, each designed for different needs:

- Revolving Credit: This type of credit allows users to borrow up to a certain limit and repay the balance over time. Credit cards are a common example.

- Installment Loans: These loans are typically used for larger purchases and involve borrowing a fixed amount of money to be repaid in equal monthly installments, such as personal loans or auto loans.

- Mortgages: A loan specifically for purchasing real estate, which is typically paid off over a long period (e.g., 15 to 30 years).

- Student Loans: A loan designed to cover educational expenses, which may have flexible repayment options based on income.

Important Considerations

Before applying for credit or a loan, it’s essential to consider several factors:

- Interest Rates: The cost of borrowing, usually expressed as an annual percentage rate (APR), can vary significantly depending on the type of loan or credit.

- Credit Score: Your credit history and score determine your eligibility for loans and credit, as well as the interest rate you will receive.

- Repayment Terms: It’s crucial to understand the repayment schedule, as well as any penalties for late payments or early repayment.

- Borrowing Limits: Each credit or loan product has a maximum amount you can borrow, and it’s important to only borrow what you can afford to repay.

By understanding these key elements, individuals can better navigate the complexities of borrowing and make sound financial choices. Whether it’s using credit responsibly or taking out a loan for a significant purchase, knowledge and careful planning are essential to avoiding debt-related challenges and building a strong financial future.

Setting Financial Goals

Establishing clear financial goals is an important step toward achieving long-term financial stability. By setting both short-term and long-term targets, individuals can better manage their money, prioritize their spending, and take concrete steps towards reaching their objectives. Whether it’s saving for an emergency fund, purchasing a home, or preparing for retirement, goal-setting provides direction and focus for financial decision-making.

Financial goals should be specific, measurable, and achievable. It’s crucial to break down large, overarching goals into smaller, more manageable milestones. By doing so, it becomes easier to track progress and adjust plans as needed. With a structured approach, anyone can take control of their financial future and steadily work toward their aspirations.

Steps to Setting Effective Financial Goals

Here are key steps to help set financial goals:

- Identify Your Objectives: Understand what you want to achieve, whether it’s short-term (e.g., paying off debt) or long-term (e.g., saving for retirement).

- Make Goals Specific: Instead of a vague goal like “save more money,” specify the amount and time frame, such as “save $5,000 by the end of the year.”

- Set a Realistic Timeline: Establish a reasonable time frame for achieving each goal based on your income, expenses, and financial situation.

- Break Down Large Goals: Divide big goals into smaller, actionable steps to make them more attainable and less overwhelming.

Tracking Your Progress

Monitoring your progress is essential to stay motivated and on track. Consider the following methods to help evaluate your financial progress:

- Regularly Review Your Budget: Ensure that your spending aligns with your goals and adjust where necessary.

- Use Financial Tools: Leverage apps or spreadsheets to track savings, investments, and debt repayment.

- Celebrate Milestones: Acknowledge your achievements as you reach each milestone, whether it’s paying off a small debt or reaching a savings target.

- Adjust as Needed: Life changes, and so may your financial situation. Be flexible and willing to update your goals based on new circumstances.

By following these steps, individuals can build a clear path to financial success and remain focused on achieving their goals, no matter how large or small. With dedication and discipline, it’s possible to turn financial dreams into reality.

The Role of Interest Rates in Banking

Interest rates play a significant role in personal and business finance by influencing the cost of borrowing and the return on savings. They act as a key factor in the economy, shaping decisions regarding loans, investments, and savings. Understanding how interest rates affect financial products is essential for making informed decisions, whether you’re borrowing money or looking to grow your savings.

For borrowers, a higher interest rate means paying more over time for loans, while a lower interest rate reduces the cost of borrowing. Conversely, for savers and investors, the interest rate determines the earnings they can expect from deposits or other financial products. These rates are influenced by various factors, including central bank policies, inflation, and overall economic conditions.

How Interest Rates Affect Loans

When you take out a loan, the interest rate directly impacts how much you’ll repay over the loan’s term. Here’s how:

- Higher Interest Rates: Borrowing costs increase, leading to higher monthly payments and more money paid in total over time.

- Lower Interest Rates: Loans become more affordable with reduced monthly payments and lower total repayment amounts.

- Fixed vs. Variable Rates: Fixed rates remain the same throughout the loan, while variable rates can change, affecting how much interest you’ll pay.

Interest Rates on Savings and Investments

Interest rates also influence how much your savings can grow or how profitable an investment might be:

- High-Interest Rates: Offer greater returns on savings accounts, certificates of deposit (CDs), and other fixed-income investments.

- Low-Interest Rates: Offer lower returns, which may discourage saving and prompt investors to seek riskier assets to earn higher returns.

- Impact on Market Behavior: Central banks can manipulate interest rates to encourage or slow down economic activity, affecting investor sentiment and stock market trends.

In conclusion, interest rates are a crucial component of the financial system. They affect borrowing costs, savings growth, and overall economic conditions. Understanding how they work can help individuals and businesses make better financial decisions, optimize savings, and manage debt more effectively.

Managing Bank Accounts Effectively

Proper management of your financial accounts is key to maintaining control over your money and achieving financial goals. By staying organized, regularly monitoring account activity, and taking advantage of available tools, you can ensure that your finances are in good shape. Whether you are managing personal or business accounts, understanding how to use these tools wisely can help prevent unnecessary fees, increase savings, and improve overall financial health.

Effective account management involves more than just keeping track of balances. It includes making informed decisions about how to allocate funds, when to withdraw, and how to use various account features to your advantage. By staying proactive, you can avoid common pitfalls such as overdrafts or missed payments and maximize the benefits of your accounts.

Strategies for Effective Account Management

Here are some best practices for managing your accounts:

- Monitor Account Activity: Regularly check your account statements to ensure that there are no discrepancies or unauthorized transactions.

- Set Up Alerts: Use account notifications to stay informed about low balances, deposits, and due dates for payments.

- Maintain a Budget: Ensure that your spending aligns with your financial goals by using your accounts to track expenses and savings.

- Avoid Overdraft Fees: Link your checking account to a savings account or credit line to prevent overdraft charges in case of insufficient funds.

Optimizing Account Features

To maximize the benefits of your financial accounts, it’s important to understand and make use of available features:

- Use Automatic Transfers: Set up automatic transfers to savings or investment accounts to help meet long-term goals without manual effort.

- Take Advantage of Rewards: Some accounts offer cashback, points, or other rewards for certain types of spending. Use these to enhance your financial portfolio.

- Minimize Fees: Choose accounts that have no or low fees, and consider avoiding unnecessary services or transactions that incur charges.

By adopting these strategies, you can keep your accounts organized, save time, reduce fees, and ultimately make smarter financial decisions. This level of control will not only help in managing day-to-day finances but also support your long-term financial objectives.

Saving Money and Avoiding Debt

Building a secure financial future requires disciplined saving habits and a strong understanding of how to avoid excessive borrowing. Whether it’s setting aside money for short-term goals or planning for retirement, the ability to save and manage debt is essential for financial health. By adopting practical strategies for saving and taking steps to minimize debt, individuals can improve their financial stability and work toward long-term success.

Successful money management involves a combination of planning, consistency, and awareness. Regular savings can provide a safety net during emergencies, while minimizing debt helps prevent financial strain. The following approaches are designed to help individuals save more efficiently while avoiding the pitfalls of excessive borrowing.

Key Strategies to Save Money

- Create a Budget: Establish a clear monthly budget that outlines your income and expenses. This helps identify areas where you can reduce spending and allocate more toward savings.

- Automate Savings: Set up automatic transfers to your savings account to make saving a consistent habit. This way, you won’t be tempted to spend the money before saving it.

- Set Financial Goals: Define clear financial goals, such as saving for an emergency fund or a vacation. Having specific objectives helps keep you motivated and focused.

- Track Expenses: Regularly review your spending to see where you can cut back. Small adjustments, such as reducing discretionary spending, can add up over time.

Smart Debt Management Techniques

Managing debt is just as important as saving. Here are some ways to keep borrowing under control:

- Avoid Unnecessary Debt: Only borrow when absolutely necessary, and prioritize essential purchases that will provide long-term benefits.

- Pay Off High-Interest Debt First: Focus on paying off high-interest debts, such as credit card balances, to reduce the total amount of interest you pay over time.

- Make Payments on Time: Ensure that all bills and loans are paid on time to avoid late fees and negative impacts on your credit score.

- Use Credit Responsibly: Limit credit card usage to what you can afford to pay off in full each month, and avoid carrying balances that accrue interest.

Building a Strong Financial Foundation

Incorporating both saving and debt management strategies into your financial plan allows you to build a strong foundation for future success. By keeping track of your finances, automating savings, and staying on top of debt, you can create a more secure financial future.

| Action | Impact |

|---|---|

| Create a Budget | Helps allocate money effectively and cut unnecessary expenses. |

| Automate Savings | Ensures consistency in savings and reduces temptation to spend. |

| Pay Off High-Interest Debt | Reduces long-term debt obligations and saves on interest. |

| Track Expenses | Identifies areas where spending can be reduced for more savings. |