Preparing for an assessment in personal finance and budgeting requires a deep understanding of practical calculations and real-world applications. It involves mastering basic principles that will help you make informed decisions in managing money, from savings to investments.

Success in these evaluations depends on recognizing patterns, applying formulas accurately, and efficiently solving word problems that reflect everyday financial scenarios. With the right approach, it’s possible to not only ace the test but also gain skills that will be useful in real-life financial decisions.

Focus and practice are crucial. The more time you dedicate to reviewing key areas like interest rates, budgeting techniques, and financial planning, the more confident you will feel when faced with various challenges. Remember, consistent practice is the key to mastering complex topics and ensuring your readiness.

Assessment Preparation for Financial Calculations

When approaching an assessment focused on personal finance, it’s essential to have a strong foundation in essential concepts. These concepts are designed to equip you with practical skills for managing and analyzing monetary situations. The goal is to ensure that you can navigate complex financial scenarios with ease, using the right methods and tools for each situation.

To achieve success, it is crucial to understand key processes such as budgeting, interest calculation, and interpreting financial data. These skills are not only useful in the classroom but will help you make informed decisions in everyday life. Proper preparation involves reviewing relevant techniques, solving practice problems, and ensuring you are familiar with common financial terms and formulas.

Having a clear strategy for approaching each problem type and mastering the required formulas will significantly boost your confidence. Effective problem-solving starts with carefully reading each question, identifying what is being asked, and applying the right approach for the solution.

Overview of Financial Literacy Concepts

Understanding the principles of personal finance is fundamental to managing your money effectively. This section introduces the key concepts that form the foundation of real-world financial decisions, from budgeting to savings and investments. Mastering these topics is essential for handling day-to-day financial responsibilities.

Core Areas of Focus

Key topics covered include:

- Budgeting and managing income

- Interest rates and how they affect savings and loans

- Understanding taxes and deductions

- Loan and credit management

- Evaluating discounts and markups

- Analyzing investment options

Applying Concepts in Real Life

These principles are not just theoretical; they play a crucial role in daily financial choices. Whether it’s planning a monthly budget, calculating interest on a loan, or understanding how taxes impact earnings, these concepts help you make informed and effective decisions. Knowing how to apply these techniques will improve your financial stability and ensure you are prepared for unexpected situations.

Common Topics Covered in Financial Assessments

Financial assessments typically focus on a range of topics that are essential for managing personal finances. These areas test your ability to apply practical financial principles to real-world situations, from budgeting to calculating loan payments. Understanding these topics will help you solve problems efficiently and accurately under exam conditions.

Key Areas of Focus

- Budgeting and Expense Management: Knowing how to allocate income and plan for various expenses is crucial for maintaining financial stability.

- Interest and Loans: Understanding how interest rates impact loans and savings is a critical skill for managing debt and building wealth.

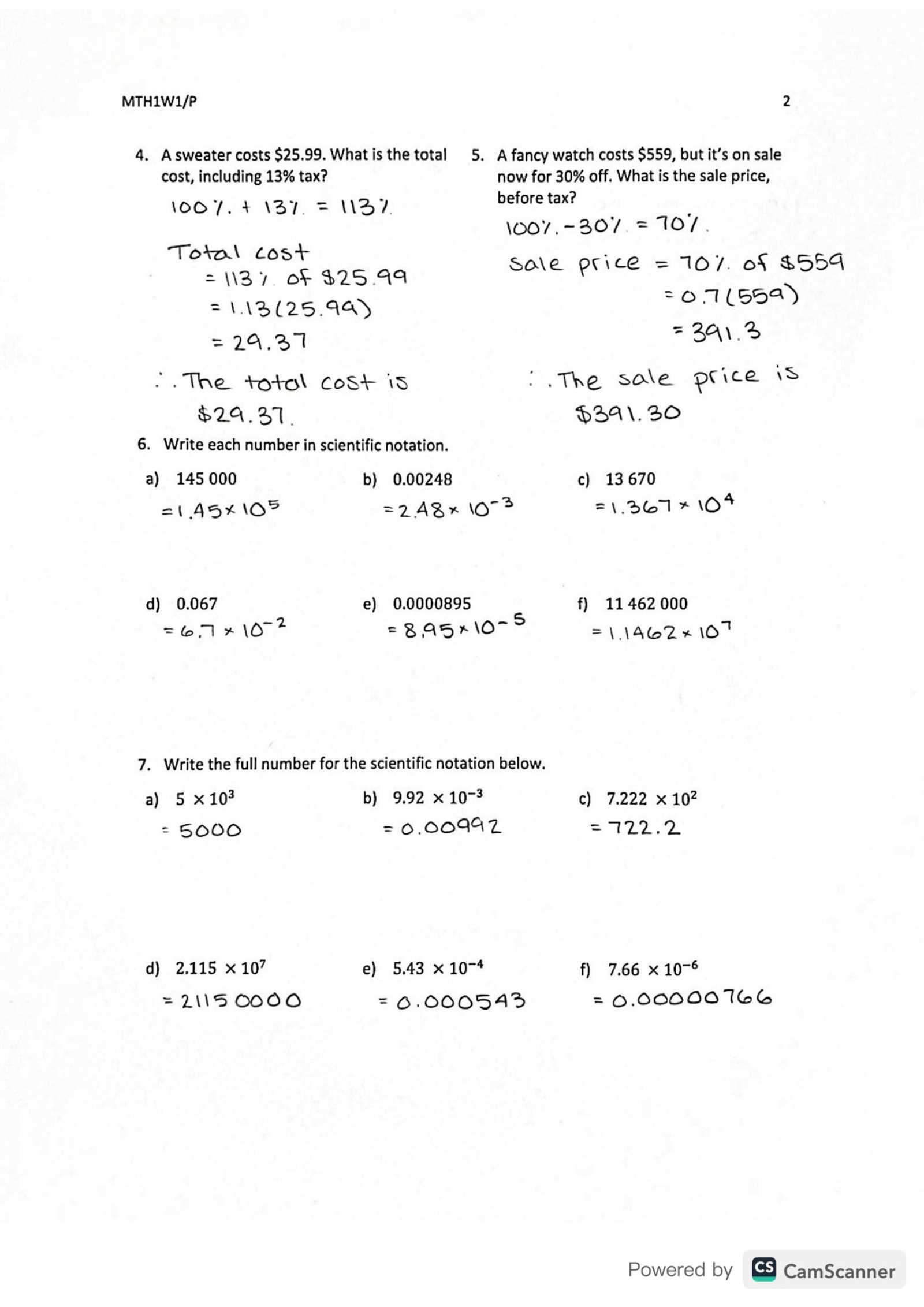

- Discounts and Markups: Calculating discounts, sales tax, and profit margins is essential for evaluating prices and making purchasing decisions.

- Tax Calculations: Familiarity with tax deductions, credits, and rates ensures you can estimate net income accurately.

- Investment Basics: Knowing how to assess different investment options and calculate potential returns helps you plan for future growth.

Problem-Solving Strategies

When preparing for this type of evaluation, it’s important to practice solving word problems that involve these topics. Approach each problem systematically, breaking it down into smaller steps. By focusing on key concepts like percentages, proportions, and algebraic equations, you can increase your speed and accuracy during the test.

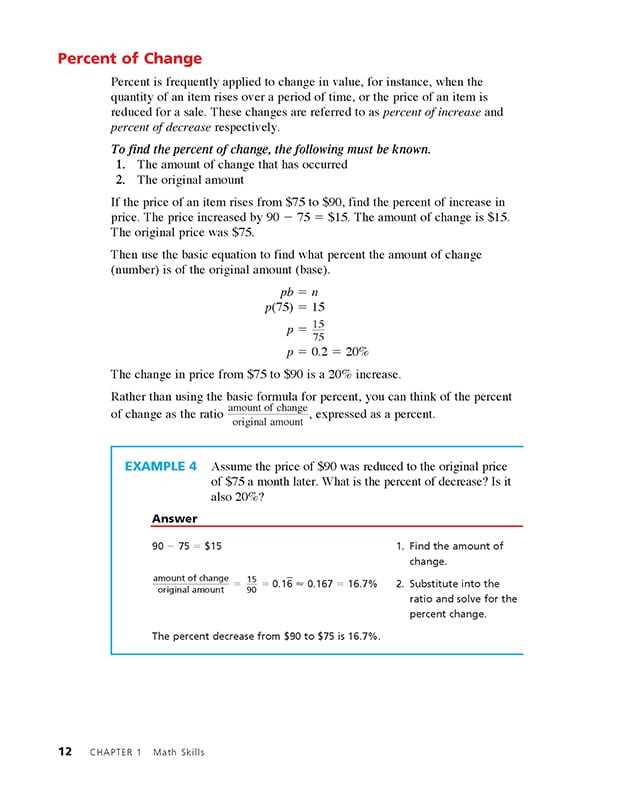

Mastering Percentage Calculations

Percentage calculations are a fundamental skill in managing finances, as they appear in many real-life situations, from calculating discounts to determining interest rates. Mastering this skill will help you solve problems quickly and accurately, whether you’re budgeting, comparing prices, or assessing loan terms.

Key Percentage Concepts

- Finding the Percentage of a Number: This involves multiplying the number by the percentage, then dividing by 100. For example, to find 25% of 200, multiply 200 by 25 and divide by 100, resulting in 50.

- Calculating Percent Increase or Decrease: To calculate the change in a value as a percentage, subtract the original value from the new value, divide by the original, and then multiply by 100. This is useful for determining price changes or financial growth.

- Converting Percentages to Decimals: To convert a percentage into a decimal, divide the percentage by 100. For example, 30% becomes 0.30.

Tips for Efficient Calculations

- Practice Regularly: The more you practice, the more comfortable you will become with percentages, making calculations faster and easier.

- Use Estimation: When exact calculations aren’t necessary, estimating percentages can save time, especially when dealing with larger numbers.

- Break Down Complex Problems: For more complicated percentage problems, break them into smaller steps to ensure accuracy and reduce mistakes.

Understanding Budgeting and Financial Planning

Effective budgeting and financial planning are crucial skills for managing personal finances and achieving long-term financial goals. Whether you’re saving for a large purchase, paying off debt, or building an emergency fund, creating a clear plan helps ensure that you can meet your goals without unnecessary stress.

A well-organized budget allows you to track income and expenses, allocate resources wisely, and identify areas where you can save. Financial planning, on the other hand, focuses on setting goals and creating a strategy to achieve them, whether for short-term needs or long-term aspirations like retirement or purchasing a home.

Basic Components of a Budget

| Category | Example | Percentage of Income |

|---|---|---|

| Income | Salary, Freelance work | 100% |

| Fixed Expenses | Rent, Utilities | 30%-50% |

| Variable Expenses | Groceries, Transportation | 20%-30% |

| Savings | Emergency Fund, Investments | 10%-20% |

| Discretionary Spending | Entertainment, Dining | 10%-20% |

By organizing your finances into categories like fixed expenses, savings, and discretionary spending, you can better control where your money goes. A clear financial plan helps you prioritize your spending, manage debt, and achieve your financial goals.

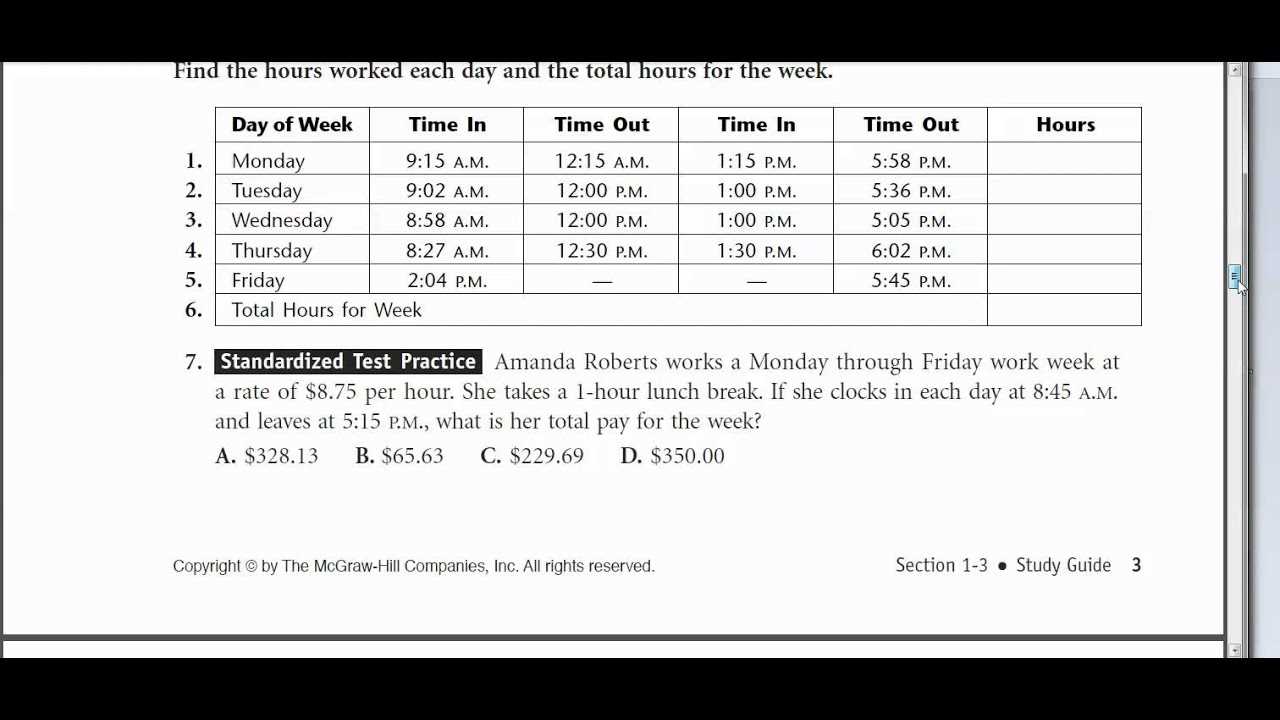

How to Tackle Word Problems Efficiently

Word problems can be one of the most challenging parts of any financial assessment. They require not just understanding the underlying concepts but also the ability to translate real-world situations into solvable equations. The key to solving these problems quickly and accurately lies in breaking them down into manageable steps.

Start by reading the problem carefully and identifying the key information. Often, word problems are filled with extraneous details that are meant to distract you. Focus on the numbers and the question being asked. Once you have the important data, organize it logically to create a clear plan for solving the problem.

Next, translate the situation into a mathematical expression or formula. Depending on the problem, this could involve calculating percentages, working with ratios, or using simple addition and subtraction. Make sure to check your work at each step to avoid making mistakes that could lead to incorrect answers.

Finally, practice regularly with different types of word problems to become more comfortable and confident in your problem-solving abilities. Over time, you’ll recognize common patterns and techniques that will help you solve even the trickiest problems efficiently.

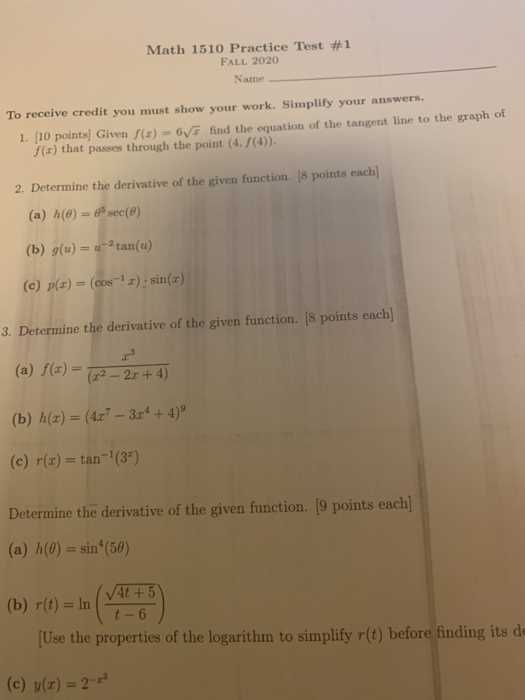

Key Formulas for Exam Success

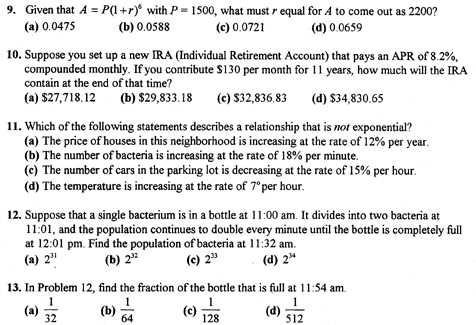

Having a solid grasp of essential formulas is crucial for success in any financial assessment. These formulas serve as the building blocks for solving problems quickly and accurately. Familiarizing yourself with these key equations can save you valuable time and boost your confidence during the test.

Important Formulas to Know

- Percentage Calculation:

Percentage = (Part / Whole) × 100

This formula helps you find the percentage of any given number.

- Simple Interest:

I = P × R × T / 100

Where I is the interest, P is the principal amount, R is the rate of interest, and T is the time in years.

- Discounts:

Discount = Original Price × Discount Rate

Use this to calculate how much you save when a product is on sale.

- Loan Payments:

Payment = Principal × (Interest Rate / (1 – (1 + Interest Rate)^-Number of Payments))

This formula is used for calculating monthly payments on a loan.

Tips for Applying Formulas

- Ensure that you understand the meaning behind each formula and when to use it.

- Work through practice problems to become familiar with the steps involved in applying each formula.

- Double-check your calculations to ensure accuracy.

Time Management Tips for the Test

Effective time management is one of the most important strategies for success in any assessment. Being able to allocate your time wisely ensures that you can complete all tasks, avoid rushing, and reduce stress during the process. Properly managing your time allows you to focus on solving problems accurately while maintaining a steady pace.

Strategies to Improve Time Efficiency

- Preview the Entire Test: Quickly skim through the test before starting. This helps you gauge the difficulty of each section and allocate more time to challenging problems.

- Set Time Limits: Set a specific amount of time for each section or question. Stick to these limits to ensure you don’t spend too much time on any one part of the assessment.

- Prioritize Easy Questions: Start with the questions you find easiest to build confidence and get through them quickly. This will free up more time for difficult questions later.

- Leave Difficult Questions for Last: If you’re stuck on a question, move on and come back to it later. This prevents wasting time on problems that may require more thought.

Additional Tips for Staying on Track

- Keep an Eye on the Clock: Regularly check the time to make sure you’re staying within your limits.

- Stay Calm and Focused: Don’t let stress overwhelm you. Stay calm and approach each problem methodically.

Important Practice Resources for Students

Practicing regularly is key to mastering any subject. Accessing a variety of resources can help reinforce your knowledge, sharpen your skills, and build the confidence needed to perform well. Whether you’re looking for interactive exercises, real-life applications, or detailed explanations, there are plenty of tools to support your learning process.

Many online platforms offer practice questions and quizzes that simulate real-world problems, allowing students to apply what they’ve learned. Additionally, textbooks and workbooks provide step-by-step guidance and explanations for common challenges, helping students to understand concepts in-depth. Consistent practice with these resources can help solidify knowledge and prepare students for success.

Useful Practice Resources

- Online Quiz Websites: Platforms like Khan Academy and Quizlet offer a wide range of practice problems and interactive exercises for different skill levels.

- Study Apps: Mobile apps such as Photomath or Wolfram Alpha can help students solve problems and provide step-by-step solutions, making it easier to understand the process.

- Textbooks and Workbooks: Standard educational books offer practice problems with detailed solutions to reinforce key concepts.

- Video Tutorials: YouTube and other video-based platforms feature free tutorials that explain various concepts and techniques, making learning more visual and interactive.

Exam Strategies for Problem Solving

Approaching complex problems during an assessment requires a structured and methodical strategy. Being able to break down a problem into manageable steps and staying calm under pressure can make all the difference. The key is to focus on understanding the problem first, before jumping into calculations or solutions.

One of the most effective strategies is to organize the information clearly. This could involve highlighting important details, writing down what is given, and identifying what needs to be found. Additionally, it’s important to choose the most efficient method for solving the problem, whether it’s using formulas, logical reasoning, or drawing diagrams for visualization.

Effective Problem-Solving Techniques

- Read Carefully: Before attempting any solution, read the problem thoroughly. Make sure you understand what is being asked, and identify the key information provided.

- Break It Down: Divide the problem into smaller, more manageable parts. Solve each part step-by-step to avoid feeling overwhelmed.

- Use Estimation: For many problems, estimating the answer first can help guide your approach and make calculations easier.

- Double-Check Your Work: After solving, quickly review each step to ensure you haven’t missed any critical details or made any mistakes.

Time Allocation for Each Problem

| Task | Suggested Time |

|---|---|

| Reading and Understanding the Problem | 3-5 minutes |

| Solving the Problem | 10-15 minutes |

| Reviewing the Solution | 3-5 minutes |

Common Mistakes to Avoid in the Exam

During an assessment, it’s easy to make mistakes that can cost valuable points, often due to a rush to finish or overlooking important details. Being aware of these common pitfalls and taking the time to double-check your work can help ensure that you’re giving each problem the attention it deserves. Staying calm and focused is key to avoiding errors that are often preventable.

Many mistakes happen because of misreading instructions, overlooking units, or failing to follow a logical process. By being mindful of these issues and using proven strategies, you can reduce the likelihood of making simple errors that impact your score.

Top Mistakes to Watch Out For

- Misunderstanding the Question: Always read the question carefully. It’s easy to overlook what is being asked, leading to incorrect answers.

- Skipping Steps: Skipping steps in calculations or problem-solving can result in missed information or errors. Always follow the correct process and double-check each part.

- Incorrect Units: Failing to convert or use the correct units for calculations is a common mistake. Ensure that all units are consistent throughout the problem.

- Rushing Through: Many students rush to complete the test and end up making simple errors in arithmetic or logic. Take your time to review your work.

Helpful Tips to Avoid Mistakes

| Mistake | How to Avoid |

|---|---|

| Misunderstanding the Question | Read each question thoroughly and underline key information. |

| Skipping Steps | Write out all steps clearly and don’t skip any calculations. |

| Incorrect Units | Ensure all units are consistent; convert units where necessary. |

| Rushing Through | Set time limits but avoid hurrying through each question. |

Understanding Interest and Loans

Understanding how interest works and the basics of borrowing is essential for making informed financial decisions. Whether you’re taking out a loan, saving money, or considering an investment, knowing how interest affects the total amount paid or earned over time is crucial. Interest rates determine the cost of borrowing money or the return on savings, and can significantly impact your financial planning.

There are two main types of interest: simple and compound. Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal and the accumulated interest. Understanding these concepts can help you make better choices when dealing with credit or investment opportunities.

Types of Interest

- Simple Interest: This type is calculated on the initial principal amount throughout the term of the loan or investment.

- Compound Interest: With compound interest, the interest is added to the principal, and new interest is calculated on the increased amount, leading to faster growth over time.

Key Concepts in Loans

- Principal: The initial amount of money borrowed or invested.

- Interest Rate: The percentage charged on the principal, usually expressed annually.

- Loan Term: The length of time over which the loan is to be repaid.

- Monthly Payments: Regular payments made to repay a loan, often including both principal and interest.

How to Interpret Financial Graphs

Understanding financial graphs is an important skill for interpreting and analyzing financial data. These visual representations can provide valuable insights into trends, patterns, and relationships within the data, making it easier to make informed decisions. Whether it’s a line graph tracking market performance or a bar chart illustrating expenses, interpreting these visuals accurately is crucial for effective financial analysis.

By learning to read various types of graphs, you can quickly assess important information like growth rates, fluctuations, and comparisons. Understanding the axes, labels, and scale of each graph will help you extract the most relevant details for your analysis.

Common Types of Financial Graphs

- Line Graphs: Used to show trends over time, such as the performance of an investment or stock prices.

- Bar Charts: Useful for comparing different categories or amounts, such as monthly expenses or sales figures.

- Pie Charts: Helpful for visualizing proportions, such as how a budget is allocated across different categories.

Key Elements to Look for in Financial Graphs

- Axes and Labels: Understand what each axis represents and ensure the units are clearly marked.

- Data Points: Pay attention to the individual data points and how they relate to each other across the graph.

- Trends: Look for upward or downward trends, significant spikes, or patterns that indicate shifts in financial data.

Tax Calculations on the Final Exam

Understanding how to calculate taxes is an essential skill for many real-life financial scenarios, and it often appears as a key topic in assessments. Whether it’s computing sales tax, income tax, or property tax, knowing how to correctly apply percentages to different situations is crucial for success. Being able to calculate taxes accurately ensures you understand how much to pay or save, which can affect overall financial planning.

In assessments, questions may ask you to calculate taxes on various items, services, or income. You’ll need to interpret the percentage provided and apply it correctly to determine the total amount owed or received. Tax calculations are often straightforward but require careful attention to details, such as understanding the tax rate and the amount to which it should be applied.

Types of Tax Calculations

- Sales Tax: Calculated by multiplying the price of an item or service by the applicable tax rate.

- Income Tax: Determined by applying the tax rate to the income earned, typically after deductions or exemptions.

- Property Tax: Based on the value of real estate or property, calculated by applying a specific tax rate to the assessed value.

Steps for Calculating Taxes

- Identify the Tax Rate: Determine the percentage rate that applies to the item, service, or income.

- Determine the Base Amount: Find the amount on which the tax will be applied, such as the price of an item or total income.

- Calculate the Tax: Multiply the base amount by the tax rate (expressed as a decimal).

- Add the Tax: If necessary, add the calculated tax to the base amount to find the total cost or income.

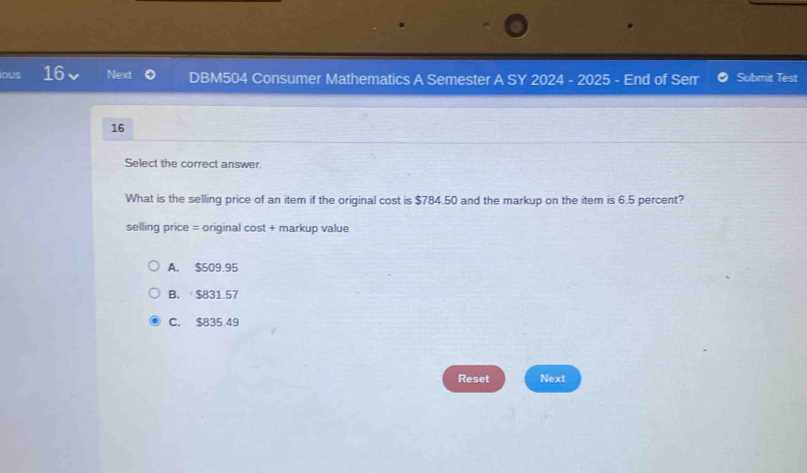

Reviewing Discount and Markup Formulas

Understanding the calculations for discounts and markups is essential for analyzing prices in various business scenarios. These formulas are commonly used to adjust original prices, either lowering them through discounts or increasing them through markups. Mastering these calculations helps you accurately assess the cost of products and services, whether for retail, sales, or budgeting purposes.

Discounts are reductions applied to the original price, while markups are increases added to the base cost to determine the final selling price. Both calculations are based on percentages and require careful attention to the initial price and the percentage rate involved. Whether you’re determining the sale price of an item or setting a price with a profit margin, understanding these formulas is key to making informed financial decisions.

Discount Calculation

- Formula: Discount Amount = Original Price × Discount Rate

- Sale Price: Sale Price = Original Price – Discount Amount

Markup Calculation

- Formula: Markup Amount = Cost Price × Markup Rate

- Final Price: Final Price = Cost Price + Markup Amount

By understanding how to apply these formulas, you can determine both discounted prices and final selling prices based on desired profit margins. Practice using these formulas in different scenarios to improve accuracy and efficiency when making financial calculations.

Preparing for the Test Day

Proper preparation is key to performing well on any assessment. The day before the test is critical for reviewing important concepts, reinforcing knowledge, and building confidence. Knowing what to expect and organizing your study time efficiently will help reduce anxiety and ensure you are fully equipped to tackle the challenges ahead.

It’s essential to focus on understanding core concepts, practicing with sample problems, and ensuring that all necessary materials are ready. Planning your study sessions in advance and prioritizing areas where you feel less confident will maximize your chances of success. On the test day, being well-rested, having a clear mind, and staying organized will give you the best possible advantage.

Review Key Topics

- Focus on key concepts like percentages, budgeting, and financial calculations.

- Practice problem-solving techniques for different question formats.

- Identify any areas of weakness and dedicate extra time to reviewing them.

Prepare Materials and Mindset

- Ensure all required materials (calculator, notes, etc.) are ready the night before.

- Get plenty of rest to stay alert and focused during the test.

- Visualize your success and approach the test with confidence.

By following these strategies, you can approach test day with a calm, prepared mindset, which will help you perform to the best of your ability.