This section provides essential lessons aimed at strengthening your financial literacy and personal decision-making skills. It offers an in-depth exploration of key concepts designed to prepare you for real-world scenarios. By engaging with the content, you’ll gain a better understanding of important financial principles and how to apply them in everyday life.

The material is structured to help you grasp the core ideas quickly and effectively, building a solid foundation for your future learning. Through interactive tasks and quizzes, you can enhance your comprehension while testing your knowledge along the way. Success in this section will not only improve your understanding of financial management but also equip you with practical tools to make informed choices.

Solutions for the Third Learning Section

This section focuses on providing the essential guidance needed to successfully complete the tasks and challenges presented in the third learning chapter. By reviewing the key content and strategies, you will be able to approach each quiz and assignment with confidence. Understanding the core concepts will not only help you in passing but also reinforce practical skills that apply to real-life situations.

Breaking Down Key Concepts

To navigate through this part of the course, it is important to familiarize yourself with the main topics covered. Concepts such as budgeting, savings, and managing debt are crucial and will be explored in depth. Mastering these subjects will enable you to make informed decisions regarding personal finances.

How to Apply Knowledge Effectively

Once the foundational ideas are understood, applying them to real-world scenarios becomes the next step. Using critical thinking, problem-solving skills, and the practical tools provided, you can tackle questions with greater ease. The focus should be on understanding, rather than memorization, to ensure long-term retention of the material.

Overview of Third Learning Section Content

The third chapter dives into critical financial concepts that are essential for managing personal resources. The content is designed to help you develop a deep understanding of fundamental topics such as budgeting, managing expenses, and saving for future goals. Each part of the section builds upon previous knowledge, reinforcing key ideas that help you make informed choices in everyday life.

Throughout this chapter, you will encounter a range of exercises and scenarios aimed at testing your ability to apply the knowledge gained. The focus is on real-world applications, ensuring that you not only understand the theory but are also prepared to put it into practice.

| Topic | Description |

|---|---|

| Budgeting Basics | Learn how to create a budget and manage expenses effectively to avoid overspending. |

| Saving Strategies | Explore different methods for saving money and setting financial goals for the future. |

| Debt Management | Understand how to manage and reduce debt, and the importance of making smart financial choices. |

| Investing Fundamentals | Gain insight into the basics of investing and how to start growing your wealth. |

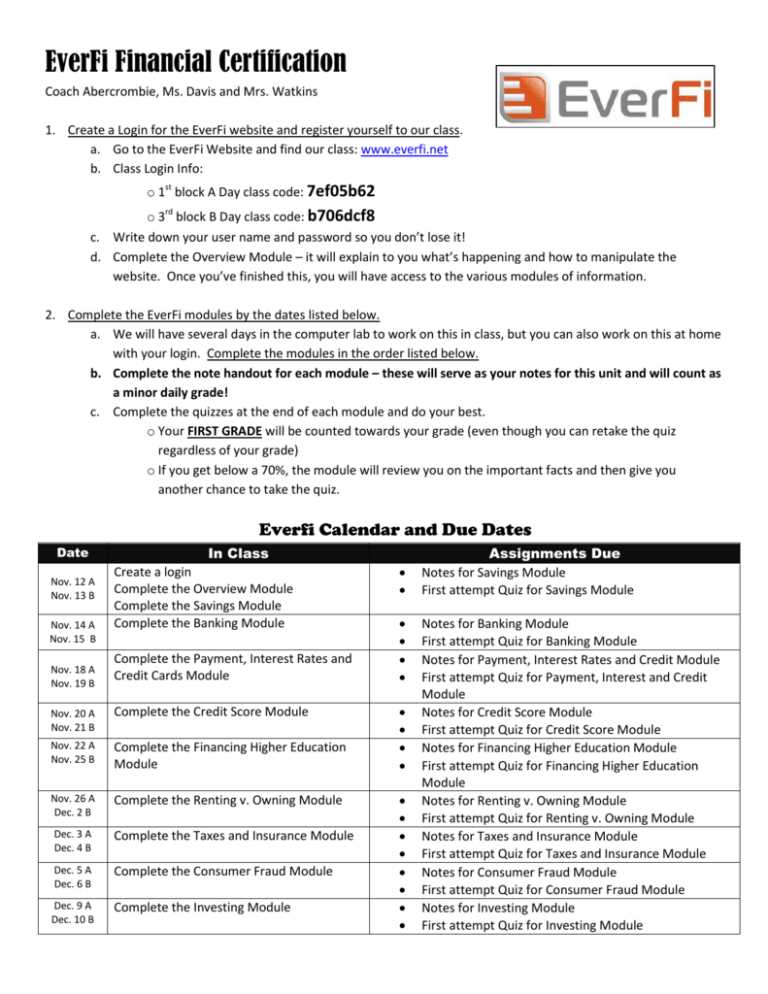

How to Navigate the Learning Platform

Understanding how to efficiently navigate the online learning platform is key to successfully completing the course. The interface is designed to help you access content quickly, track your progress, and engage with interactive elements. Familiarizing yourself with the layout and available tools will streamline your learning experience and help you stay on track.

Accessing Course Content

Upon logging in, you will be directed to your dashboard, where you can find the available lessons. Each lesson is structured in a clear sequence, with progress markers indicating how far you’ve advanced. You can click through to access reading materials, videos, and interactive activities designed to test your knowledge.

Tracking Progress and Completing Tasks

The platform offers progress tracking features, allowing you to monitor your completion status for each section. After finishing a task or quiz, your results will be immediately visible, providing instant feedback. This helps you identify areas that may need more attention while giving you a sense of accomplishment as you move forward.

Key Concepts Covered in the Third Section

This section introduces several foundational ideas that are essential for understanding personal finance and financial decision-making. The content is designed to provide a solid grasp of crucial financial topics, with a focus on developing practical skills that can be applied in real-life situations. By mastering these core concepts, you will be better equipped to handle your finances and plan for the future.

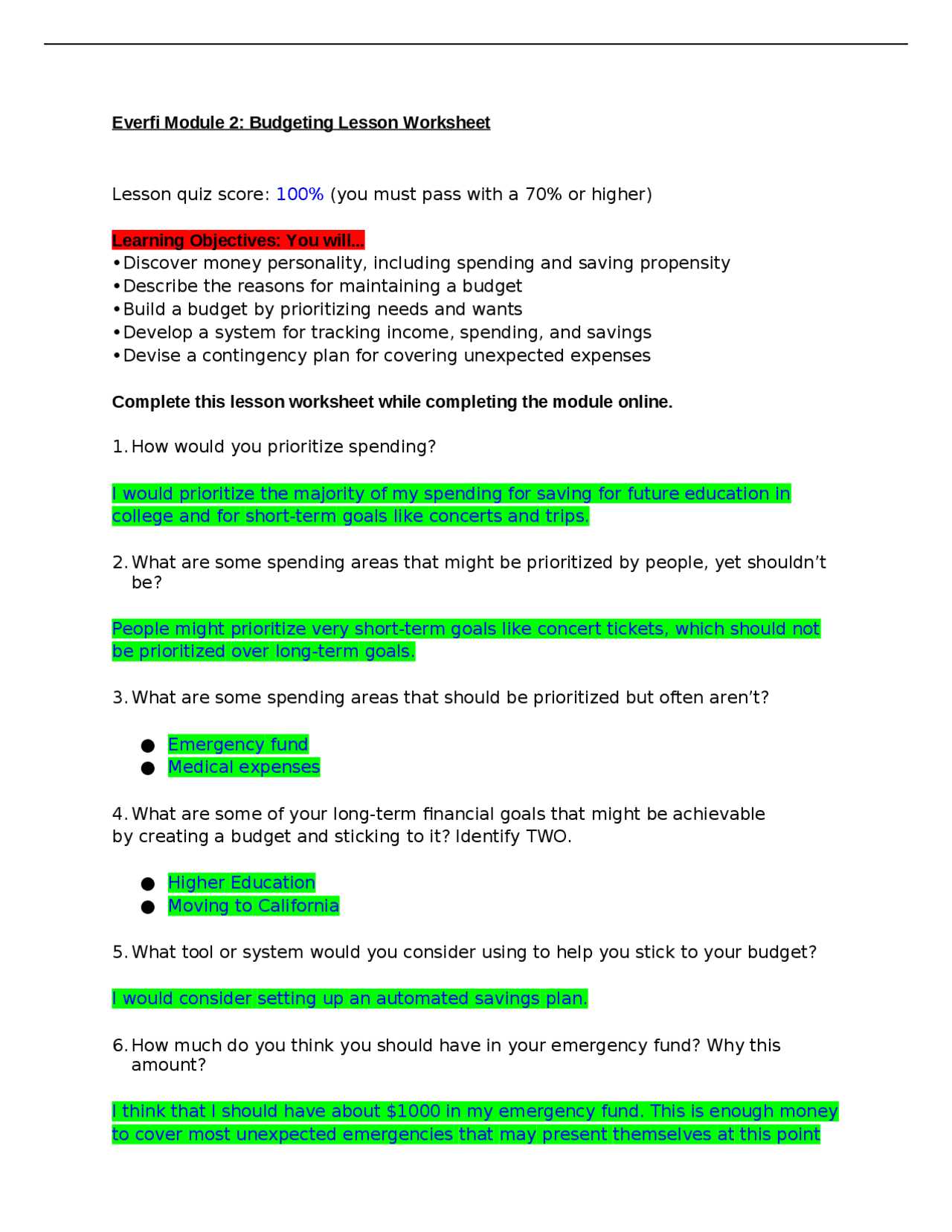

Budgeting and Financial Planning

One of the primary areas explored is the importance of budgeting. You will learn how to allocate your income effectively, track expenses, and set realistic financial goals. This concept is key to maintaining control over your money and ensuring that you are making the most of your resources.

Saving and Investing

The section also covers strategies for saving and investing, emphasizing the significance of setting aside money for future goals, whether short-term or long-term. You will gain insights into different types of savings accounts, investment options, and the importance of starting early to build wealth.

Step-by-Step Guide to Complete the Third Section

Completing this part of the course requires a clear, structured approach to ensure that all tasks are finished efficiently. By following a systematic method, you can navigate through the lessons, quizzes, and activities without feeling overwhelmed. This guide outlines the steps you need to take to successfully complete each component and move forward with confidence.

Understanding the Requirements

Before you begin, it is essential to familiarize yourself with the overall goals of this section. Each task will build upon the previous one, so understanding what is expected at each stage is crucial. Pay attention to any specific instructions or criteria provided for quizzes and assignments to avoid common mistakes.

Completing the Tasks

Now that you understand the requirements, follow these steps to stay organized and efficient throughout the process:

| Step | Action | Tip |

|---|---|---|

| 1 | Review the course material | Make sure you understand key concepts before attempting tasks. |

| 2 | Complete the interactive exercises | Apply what you’ve learned by participating in simulations or quizzes. |

| 3 | Submit assignments or tests | Check your work for accuracy before submitting. |

| 4 | Review feedback | Use any feedback to improve your understanding and performance. |

Common Challenges in the Third Section

Throughout this part of the course, learners often encounter several obstacles that can hinder progress. These challenges are common but can be overcome with the right strategies and mindset. Understanding these hurdles in advance will help you approach the material with greater confidence and persistence.

One of the primary difficulties faced by many is grasping the more complex financial concepts, such as budgeting techniques and long-term savings strategies. These topics require careful attention to detail and a solid understanding of the foundational ideas covered earlier. Without a clear understanding of how each element fits together, it can be easy to become overwhelmed.

Time Management

Another challenge that many learners face is managing their time effectively. With a variety of interactive tasks, quizzes, and reading materials, it can be difficult to stay on top of everything. It is important to set aside dedicated time for each section to ensure that you are not rushing through the content, which could affect your comprehension and retention.

Staying Motivated

Staying motivated throughout the course is another common challenge. With a focus on self-paced learning, it can be tempting to procrastinate or lose focus. To overcome this, setting clear goals and celebrating small victories along the way can help maintain momentum and keep you engaged with the material.

Tips for Successfully Passing the Third Section

To succeed in this section, it is essential to approach the material strategically and stay focused on the key objectives. By following a few practical tips, you can improve your understanding, manage your time effectively, and increase your chances of success. These strategies will help you navigate the tasks with greater ease and ensure that you retain the most important concepts.

Start by reviewing the content thoroughly before attempting any quizzes or assignments. Take your time to understand each concept fully, as this will not only help you perform well in the assessments but also equip you with practical knowledge. Additionally, breaking the tasks down into smaller, manageable parts can help prevent feeling overwhelmed and keep you on track throughout the process.

Another effective tip is to regularly test your knowledge through the practice exercises and self-assessments provided. This will help reinforce what you’ve learned and identify areas that need more attention. It’s also a good idea to revisit challenging topics and review any feedback you receive on completed tasks to refine your understanding and improve your performance.

Understanding the Quiz Format

The quizzes in this section are designed to test your knowledge and understanding of key concepts covered throughout the lessons. They typically consist of multiple-choice questions, true or false statements, and scenario-based problems that assess your ability to apply the material in real-world contexts. Understanding the structure of the quizzes will help you prepare effectively and approach each question with confidence.

Types of Questions

The majority of the questions you will encounter are multiple-choice, requiring you to choose the correct answer from a list of options. Some may involve scenarios where you need to identify the best solution based on the information provided. It’s important to read each question carefully, as the correct answer may depend on subtle details.

Strategies for Success

To perform well, make sure to review the course material thoroughly before attempting the quiz. Focus on understanding the reasoning behind each concept, rather than memorizing answers. During the quiz, if you’re unsure of an answer, try to eliminate obviously incorrect options, which increases your chances of selecting the right one. Additionally, don’t rush; take your time to think through each question carefully.

How to Approach the Third Section Assignments

Successfully completing the assignments in this section requires a structured and thoughtful approach. These tasks are designed to reinforce your understanding of the material and apply the concepts you’ve learned to practical scenarios. By breaking down each assignment into smaller steps, you can ensure that you are addressing all key points and submitting high-quality work.

Start by carefully reading the instructions and requirements for each assignment. This will give you a clear understanding of what is expected and help you avoid common mistakes. Take your time to analyze any questions or scenarios presented in the task before you begin writing or answering. It’s also helpful to review related lessons or materials before diving into the assignment to refresh your memory on key concepts.

Once you begin the assignment, focus on clarity and precision in your responses. Make sure your answers are well-thought-out and reflect a solid understanding of the topic. If the assignment involves multiple steps, take time to review each part before moving on to the next. This will ensure that you don’t overlook any details and that your final submission is thorough and accurate.

Best Practices for Retaining Information

Retaining information is a critical aspect of mastering the content in any educational program. To ensure that the knowledge you gain is not only understood but also retained for long-term application, it is essential to adopt effective learning techniques. These practices can improve your ability to remember key concepts and apply them successfully in real-world scenarios.

Active Engagement with the Material

One of the most effective ways to retain information is through active engagement. Instead of passively reading or listening, take notes, highlight key points, and ask questions. Engage with the material by summarizing it in your own words or discussing it with others. The more actively involved you are with the content, the better you will retain it.

Regular Review and Reinforcement

Spaced repetition is another powerful technique for retention. Regularly reviewing the material over time helps to reinforce your memory and prevent forgetting. Set aside time each week to go over previously learned concepts. By revisiting the information in intervals, you will solidify your understanding and keep the knowledge fresh in your mind.

Frequently Asked Questions for the Third Section

As learners progress through the lessons in this part of the program, certain questions tend to arise more frequently. These inquiries typically focus on navigating the content, completing tasks effectively, and addressing common challenges. Below, we have compiled answers to some of the most commonly asked questions to help you move through the material with greater confidence.

How do I prepare for the quizzes?

To prepare for the quizzes, ensure that you have thoroughly reviewed all related lessons and materials. Take notes during the lessons and make sure to revisit key concepts before attempting the quizzes. Practicing with sample questions, if available, can also help familiarize you with the types of questions you might encounter. Focus on understanding the underlying principles rather than memorizing answers.

What should I do if I don’t understand a concept?

If you find yourself struggling with a concept, try to revisit the lesson and break it down into smaller parts. Look for alternative explanations or resources that can offer a different perspective. Sometimes discussing the material with a peer or mentor can also help clarify things. Don’t hesitate to review relevant sections multiple times until you feel confident.

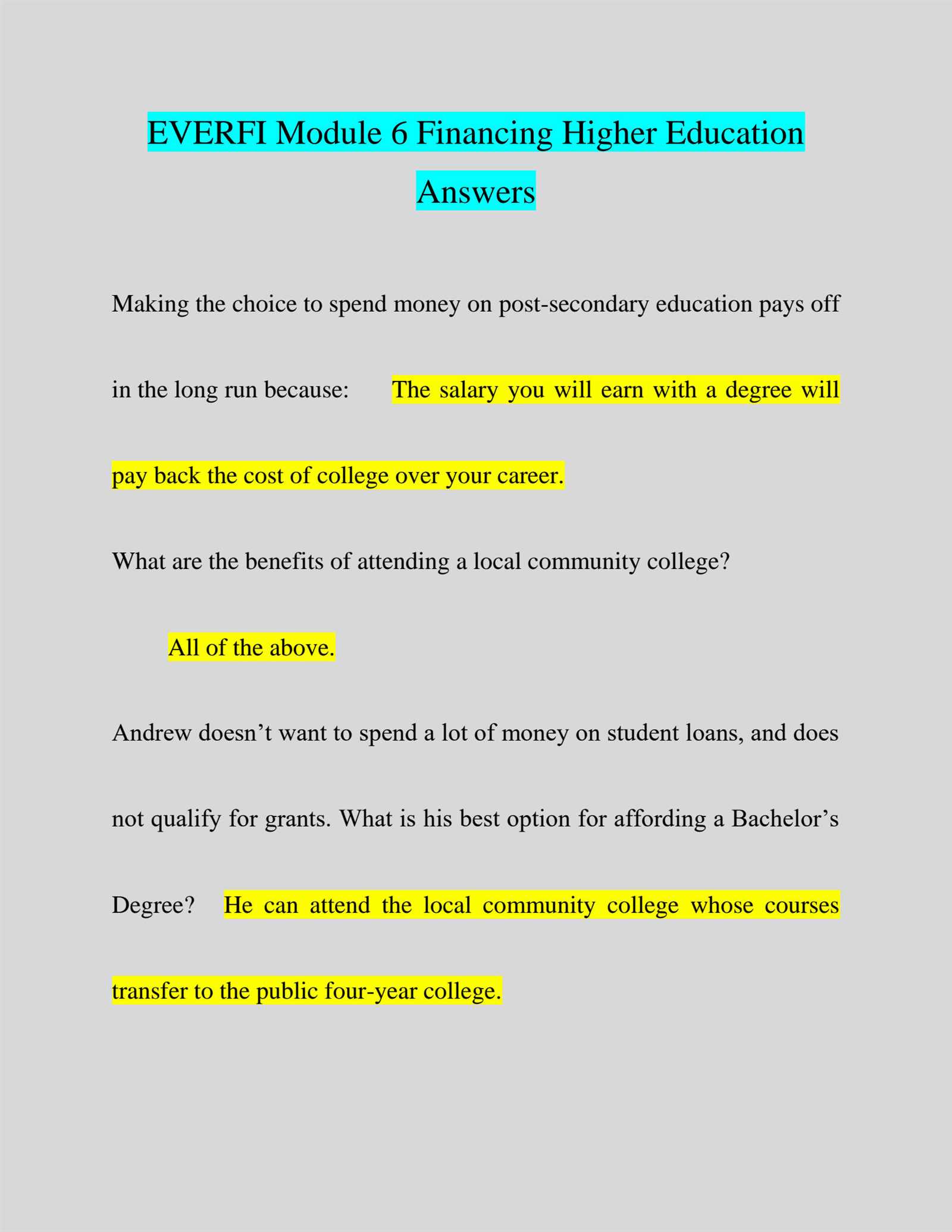

Understanding Financial Concepts in the Third Section

Mastering financial principles is essential for making informed decisions in both personal and professional contexts. In this section, various financial concepts are explored to provide you with a foundational understanding of key topics. These concepts serve as building blocks for managing money, budgeting, and making wise financial choices in everyday life.

The content covered includes essential topics that can have a direct impact on financial well-being. Understanding these principles not only enhances financial literacy but also helps in setting realistic goals and developing effective strategies for achieving them. Below are some of the main financial concepts that are emphasized:

- Budgeting: Learning how to manage income and expenses effectively.

- Saving and Investing: The importance of setting aside money for future needs and growing wealth.

- Credit and Debt Management: How to handle loans, credit cards, and avoid common pitfalls.

- Financial Planning: Setting long-term goals and planning for major life events.

By understanding these core concepts, you can begin to build a solid financial foundation that will help you navigate various situations, from everyday spending decisions to planning for retirement. The skills gained will empower you to take control of your finances and make choices that align with your personal goals.

How the Third Section Prepares You for Real Life

The third section of the program is designed to equip you with practical skills that are directly applicable to real-life scenarios. The lessons aim to provide not just theoretical knowledge, but actionable insights that you can use to navigate everyday financial decisions, manage personal finances, and make informed choices that impact your future.

By learning about essential financial concepts such as budgeting, saving, credit management, and goal setting, you are gaining tools that will help you make smarter financial decisions. These skills are invaluable in daily life, from planning for large purchases to ensuring you have enough savings for emergencies. In this section, the emphasis is placed on real-world applications, ensuring that you can translate the information into tangible actions.

Building Financial Confidence

One of the primary ways this section prepares you for real life is by building your financial confidence. Understanding how money works–how to save, invest, and manage debt–gives you the confidence to take charge of your financial future. This knowledge allows you to avoid common pitfalls, such as overspending or accumulating unnecessary debt, and helps you to make decisions with a clearer, more informed perspective.

Practical Decision Making

In real life, financial decisions often come with long-term consequences. This section teaches you how to assess financial situations, weigh options, and choose the best course of action based on your goals and priorities. Whether you’re planning a budget, saving for a big purchase, or making long-term financial plans, the lessons learned here will help guide your decision-making process and lead to more positive outcomes.

How to Improve Your Scores

Improving your performance in any learning environment requires a combination of preparation, focus, and strategic study techniques. In this section, we will explore effective methods for boosting your results and increasing your understanding of key concepts. By employing the right approaches, you can enhance your scores and strengthen your grasp of the material.

Review and Reinforce Key Concepts

One of the most effective ways to improve your scores is to regularly review the material and reinforce key concepts. Ensure that you understand the core ideas presented in each lesson before moving on. Take the time to revisit sections where you might feel unsure, and test your knowledge by summarizing key points or discussing them with a study partner. The more familiar you become with the material, the easier it will be to answer questions accurately and efficiently.

Practice with Sample Questions

Many assessments include question formats that may seem challenging at first. To become more comfortable, seek out practice questions or quizzes related to the content. Practicing with sample questions will help you familiarize yourself with the format and types of questions you may encounter. Additionally, this practice will allow you to identify areas where you need to focus more attention. The more you practice, the more confident and prepared you will feel when it’s time to take the actual quiz or test.

Additional Resources for Module 3

In addition to the core lessons, there are various supplementary materials available that can further enhance your understanding of the topics covered. These resources provide deeper insights, practical examples, and extra practice opportunities to help you master the concepts. Exploring these additional materials will not only reinforce your learning but also broaden your perspective on the subject.

Online Tools and Websites

Many websites offer interactive tools and resources that complement the lessons you’ve already completed. These sites provide simulations, quizzes, and educational games that can make learning more engaging. Below are some valuable online platforms to consider:

- Financial Literacy Sites: Websites that provide in-depth articles, calculators, and budgeting templates.

- Interactive Learning Tools: Tools that simulate real-world scenarios, such as managing a budget or making investment decisions.

- Practice Quizzes: Online quizzes that allow you to test your knowledge in a stress-free environment.

Books and Articles

Reading articles and books related to personal finance can provide you with additional context and examples. Many financial experts have written extensively on topics such as budgeting, saving, and credit management. These readings can offer alternative approaches and new strategies that may resonate with you.

- Books on Personal Finance: Titles that cover a wide range of financial topics, from basics to advanced strategies.

- Articles from Reputable Sources: Look for financial news and blogs from respected websites such as Forbes or The Financial Times.

What to Do if You Fail

It can be discouraging to face setbacks, but failure is often a valuable opportunity for growth. If you don’t pass the assessment or test on your first attempt, there are several steps you can take to improve your performance. Rather than feeling defeated, view this as a chance to reassess your approach and refine your understanding of the content.

Reflect on the Mistakes

Before moving forward, take a moment to review your performance. Understand where you went wrong and identify the areas where you struggled the most. Knowing which concepts or questions gave you trouble can help you target your studies more effectively.

- Identify Knowledge Gaps: Look at the questions you missed and pinpoint which topics you didn’t fully understand.

- Analyze Mistakes: Examine whether your mistakes were due to misunderstandings, carelessness, or time management issues.

- Learn from Feedback: If available, check any feedback or explanations provided to help clarify concepts you missed.

Steps to Improve and Try Again

Once you’ve reflected on your performance, it’s time to take proactive steps to increase your chances of success on the next attempt. Use the resources at your disposal to strengthen your knowledge and improve your test-taking strategies.

- Review Course Materials: Go back to the study materials, focusing on the sections where you encountered difficulties.

- Practice Regularly: Repetition can help reinforce your learning. Take practice quizzes or review flashcards to test your knowledge.

- Seek Help if Needed: If you continue to struggle, consider reaching out to a mentor, tutor, or peer to get additional clarification.

Remember, it’s not about how many times you fail, but how you bounce back and improve each time. With dedication and a proactive mindset, you’ll be well on your way to mastering the material and achieving success in the future.

Benefits of Completing Module 3

Successfully finishing a learning unit provides several important advantages that extend beyond just achieving a passing score. Completing the tasks and assessments in this section not only enhances your knowledge but also helps you build critical skills that are useful in everyday situations. The process of working through the content reinforces your ability to apply concepts in real-world scenarios, equipping you with valuable tools for the future.

By completing this section, you gain a deeper understanding of essential concepts, which can boost your confidence and readiness for other related challenges. Additionally, it promotes personal growth and helps sharpen your problem-solving abilities, which are crucial in both academic and professional settings.

Enhanced Financial Literacy

One of the key benefits of finishing this section is the improvement in financial literacy. As you explore various topics, you will develop a better understanding of budgeting, saving, and making informed financial decisions. These skills are essential in managing your finances effectively, whether for personal use or in a professional capacity.

Improved Decision-Making Skills

Successfully completing the tasks will also improve your decision-making abilities. You will learn how to assess risks, weigh options, and make choices based on data and analysis. These critical thinking skills are valuable for tackling complex problems and making sound judgments in various aspects of life.

Overall, completing the section strengthens your foundation for future challenges, providing not only knowledge but also practical skills that contribute to your personal and professional growth. The sense of accomplishment gained from completing this section is also a motivating factor as you move forward in your learning journey.

Preparing for Future Modules

Successfully completing a learning section is just the beginning. As you progress through each stage, it’s essential to stay focused on enhancing your skills and preparing for the next set of challenges. With each unit, you gain foundational knowledge that will help you tackle more complex topics ahead. Understanding the structure and requirements of upcoming units allows you to develop a strategic approach and excel in future assignments.

Here are a few strategies to help you effectively prepare for the next stages of your learning journey:

Develop a Study Routine

Consistency is key when preparing for more advanced topics. A well-structured study routine helps reinforce what you’ve learned and ensures you stay on track for future lessons. Consider these steps:

- Review key concepts from previous sections regularly to reinforce your knowledge.

- Set aside dedicated time each week to focus on upcoming material and assignments.

- Practice problem-solving to improve your critical thinking and application of learned concepts.

Master Related Concepts

As you move forward, many upcoming sections will build on the concepts you’ve already learned. Strengthening your grasp on related topics is essential for success. Take the time to:

- Identify topics that directly connect to future lessons.

- Seek additional resources to deepen your understanding of complex concepts.

- Engage in discussions with peers or instructors to clarify any doubts or expand your knowledge.

By proactively preparing for upcoming lessons, you set yourself up for success and ensure that you’re ready to tackle more advanced material with confidence and clarity. The ability to build on your current knowledge and stay organized will keep you on the path to achieving your learning goals.