Understanding personal finance is a vital skill that can shape your future. Gaining knowledge about how to manage income, track expenses, and make informed decisions plays a critical role in building a stable financial life. This section focuses on essential concepts that will guide you toward better financial health and long-term success.

Effective budgeting, wise investment choices, and understanding debt are just a few of the areas you’ll explore. These topics are designed to help you gain a solid foundation in handling money responsibly, setting you up for a more secure and informed financial journey.

As you dive into the material, remember that the goal is not only to pass assessments but also to develop a practical understanding of managing resources wisely. With the right tools and insights, you can build strong financial habits that will benefit you in both the short and long term.

Understanding Key Concepts for Money Management

In this section, we will explore the core principles of managing personal finances and preparing for real-world financial scenarios. By familiarizing yourself with these concepts, you’ll be better equipped to navigate the challenges that come with budgeting, saving, and investing wisely.

Key Areas of Focus

- Budget Creation: Learn the importance of tracking income and expenses.

- Debt Awareness: Understand how debt impacts your financial well-being and how to manage it.

- Building Savings: Discover strategies to grow and protect your savings.

- Credit Management: Gain insights into building and maintaining good credit.

- Understanding Interest: Know how interest rates affect loans and savings.

Practical Tips for Success

- Start by creating a simple budget and track your spending habits.

- Always pay attention to interest rates when borrowing money.

- Consistently save a portion of your income to build financial security.

- Monitor your credit score and take steps to improve it.

- Seek advice when necessary and use available resources to stay informed.

By applying these techniques, you can build a solid foundation for managing your resources effectively and making informed decisions. This knowledge not only prepares you for tests and assessments but also sets you up for financial success in the real world.

Understanding Basic Money Management Concepts

Grasping essential money management principles is crucial for building a secure financial future. It involves knowing how to handle your resources wisely, set realistic goals, and make informed decisions that align with your long-term aspirations. This section will introduce the foundational ideas that will help you take control of your personal finances.

Managing income, controlling spending, and planning for the future are key aspects of personal financial well-being. Whether you are looking to save for big goals, minimize debt, or simply live within your means, understanding these basic principles will give you the tools to succeed.

Learning how to budget effectively, save for emergencies, and make strategic decisions about debt and investments are all part of creating a strong financial foundation. By applying these concepts, you can begin to develop healthy financial habits that will serve you for years to come.

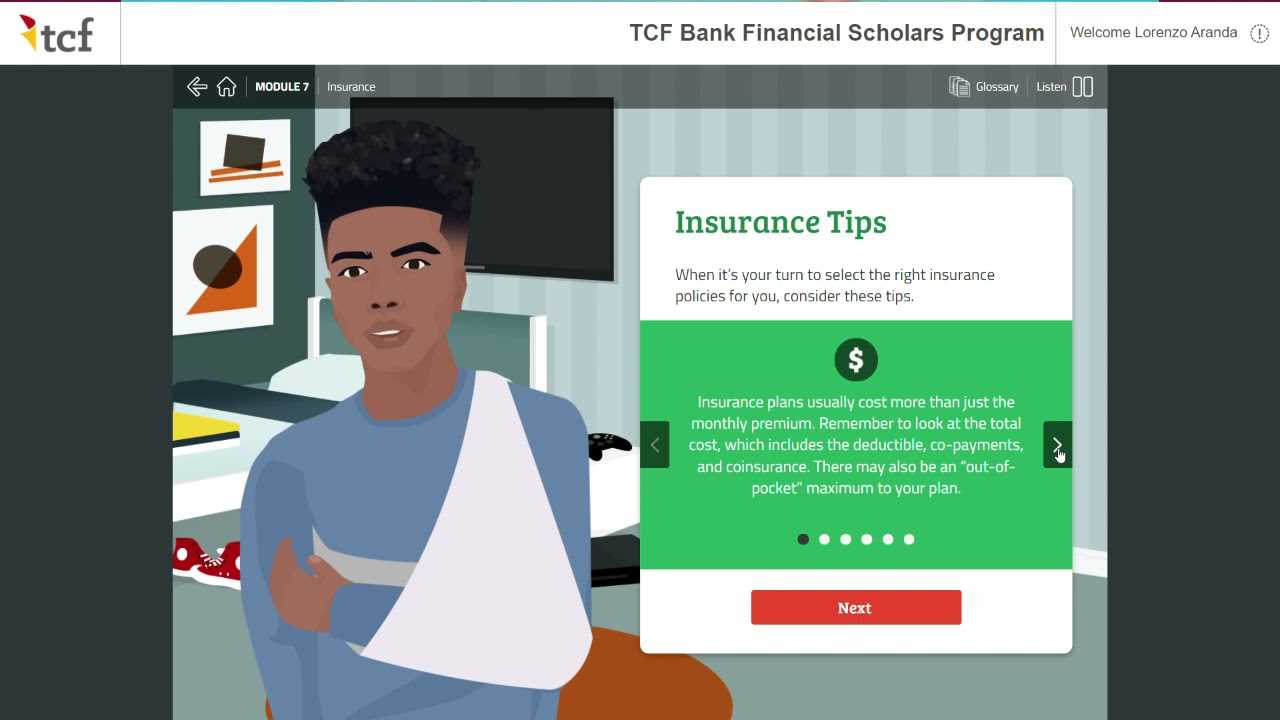

Key Concepts in Module 7

This section focuses on the fundamental ideas related to managing resources and making sound financial decisions. Understanding these concepts is essential for building a solid foundation in personal money management. The topics covered will help you apply practical knowledge to real-life scenarios and navigate complex financial choices effectively.

The following table summarizes the most important concepts explored in this section:

| Concept | Description |

|---|---|

| Budgeting | Tracking income and expenses to manage spending and savings effectively. |

| Debt Management | Strategies to reduce and control personal debt while maintaining financial stability. |

| Savings Plans | Setting aside money for future needs or emergencies to ensure financial security. |

| Interest Rates | Understanding how interest affects loans, savings, and investments. |

| Credit Building | Learning how to establish and maintain a good credit history to access better financial opportunities. |

By mastering these core concepts, you can start making more informed and confident decisions that will benefit your financial future.

How to Approach Quizzes Effectively

Taking quizzes is an essential part of testing your understanding of key financial concepts. To succeed, it’s important to approach each assessment with a clear strategy and mindset. This section will guide you on how to prepare, focus, and perform well during these tests, ensuring that you not only get the correct answers but also deepen your understanding of the material.

Preparation is key before attempting any quiz. Review the relevant topics thoroughly, and make sure you have a solid grasp of the core concepts. It’s also helpful to revisit any notes or study guides that summarize key points.

During the quiz, read each question carefully and take your time to consider all the options. Pay attention to details, as some questions may have subtle distinctions that could influence the correct answer. Remember that quizzes are designed to test your comprehension, so don’t rush through the questions.

If you come across a difficult question, don’t panic. Instead, eliminate obviously incorrect answers and narrow down your choices. This strategy will improve your chances of selecting the correct option. Additionally, trust your instincts and avoid second-guessing too much.

Finally, after completing the quiz, take time to review your answers if possible. This helps reinforce the concepts and identify areas that may need further review.

Common Questions in Module 7

As you work through the content, you may encounter some recurring questions that many learners have. These questions often relate to key concepts, problem-solving strategies, and how to apply knowledge effectively in real-life situations. In this section, we will address the most common inquiries to help you clarify any doubts and ensure you understand the material thoroughly.

Understanding Budgeting and Expenses

One frequent question is how to create a realistic budget that aligns with your goals. A common misunderstanding is the balance between income and necessary expenses. It’s essential to track all sources of income and categorize expenses accurately. Creating categories like “needs” and “wants” can help prioritize spending and ensure you’re saving enough.

Managing Debt and Credit

Another common concern involves how to manage debt effectively and how credit scores are impacted by borrowing habits. Many people wonder how to improve their credit score while paying off existing loans. The key is to make timely payments, reduce outstanding balances, and avoid taking on excessive debt.

By addressing these common questions, you can gain more confidence in managing your resources and making well-informed financial decisions moving forward.

What You Need to Know About Budgets

Creating and managing a budget is one of the most important steps in gaining control over your finances. A budget helps you track your income, expenses, and savings goals, providing clarity on where your money is going. It allows you to make informed decisions about spending, saving, and investing, while also helping you avoid unnecessary debt.

Here are some key points to keep in mind when building a budget:

- Track all sources of income: Include your salary, bonuses, and any additional income streams.

- List all monthly expenses: Break down your spending into categories such as housing, food, transportation, and entertainment.

- Prioritize essential expenses: Make sure to cover necessities like rent, utilities, and insurance first.

- Set savings goals: Allocate a portion of your income towards savings, including emergency funds and long-term investments.

- Monitor and adjust regularly: Review your budget monthly to ensure you’re staying on track and adjust if necessary.

By following these steps, you can gain better control of your money, reduce financial stress, and work toward achieving your long-term goals. Remember, a well-structured budget is a tool that helps you make more informed financial decisions every day.

Debt Management in Financial Education

Understanding how to manage debt is a crucial aspect of personal finance education. Effective debt management can prevent financial instability, help individuals build good credit, and allow them to maintain a healthy financial future. By learning how to control and reduce debt, you can make better financial decisions and avoid the pitfalls of high-interest rates and overwhelming repayment schedules.

Debt management involves several strategies, including prioritizing high-interest debt, creating a repayment plan, and understanding the long-term impact of borrowing. It’s important to differentiate between necessary debt, such as a mortgage or student loan, and discretionary debt, like credit card balances. Properly managing these debts ensures you can continue to meet your financial obligations while working toward financial goals.

Educating yourself on debt management practices not only helps you avoid financial stress but also allows you to build stronger financial habits that will benefit you throughout your life.

Understanding Credit and Loans

Credit and loans are essential financial tools that can help you manage large purchases, invest in opportunities, and handle emergencies. However, understanding how they work, the different types available, and the implications of borrowing is critical to making sound financial decisions. This section will explore key concepts related to credit and loans, helping you navigate these financial products wisely.

Types of Credit

There are various types of credit, each designed for different purposes. Here are the most common forms:

- Revolving Credit: Credit lines like credit cards allow you to borrow up to a certain limit and repay over time.

- Installment Credit: Loans where you borrow a lump sum and repay in equal installments, such as car loans or personal loans.

- Secured Credit: A loan backed by collateral, such as a mortgage or a car loan, where the lender can seize the asset if you fail to repay.

Understanding Loans

Loans are a way to borrow a set amount of money that must be paid back over time with interest. When considering a loan, it’s important to understand the following factors:

- Interest Rates: The cost of borrowing, which can vary depending on your credit score and the type of loan.

- Loan Terms: The length of time you have to repay the loan, which affects the monthly payment and the total interest paid.

- Repayment Schedule: Know when and how much you need to pay each month to avoid late fees and maintain a good credit score.

By understanding how credit works and the responsibilities of taking out a loan, you can use these tools to your advantage while avoiding common pitfalls like high-interest debt and missed payments.

How Savings Impact Financial Health

Having a solid savings plan is one of the most important factors in maintaining good financial health. Regularly setting aside money for both short-term and long-term goals helps protect you from unexpected expenses, reduces financial stress, and provides a foundation for achieving your future ambitions. In this section, we’ll explore how saving money can positively influence your overall financial wellbeing.

The Role of Emergency Funds

One of the key components of a strong savings strategy is having an emergency fund. This fund acts as a safety net, covering unexpected costs such as medical bills, car repairs, or job loss. By keeping money aside specifically for emergencies, you prevent these unplanned expenses from derailing your financial stability.

Long-Term Savings for Future Goals

Beyond emergencies, savings also play a crucial role in securing long-term goals, such as buying a home, paying for education, or preparing for retirement. Consistent saving over time can help you accumulate the necessary funds to achieve these objectives without relying on credit or loans. The earlier you start saving, the more your money can grow through interest or investments, setting you on a path to greater financial security.

Ultimately, having a strong savings habit leads to greater control over your financial life, provides peace of mind, and ensures that you’re prepared for both planned and unexpected events.

Calculating Interest Rates Effectively

Understanding how interest is calculated is a fundamental aspect of managing loans and investments. Whether you are borrowing money or earning interest on savings, knowing how to calculate the rate of return or cost can help you make more informed decisions. In this section, we’ll discuss the basics of calculating interest rates, how they are applied to various financial products, and strategies to minimize the impact of high-interest charges.

Interest rates determine how much extra you pay on loans or how much you earn on deposits over time. They are typically expressed as a percentage and can be either simple or compound. Here’s a breakdown of how each works:

Simple Interest

Simple interest is calculated on the initial amount of money you borrow or invest. The formula to calculate simple interest is:

Simple Interest = Principal × Rate × Time

For example, if you borrow $1,000 at an interest rate of 5% for 3 years, the simple interest would be:

$1,000 × 0.05 × 3 = $150

This means you would pay $150 in interest over the 3 years in addition to the principal amount.

Compound Interest

Compound interest differs in that it is calculated on the initial principal, plus any accumulated interest from previous periods. This can result in interest being charged on interest, making the total cost of borrowing or the return on investment higher over time. The formula for compound interest is:

Compound Interest = Principal × (1 + Rate / n)^(n × Time) – Principal

Where n is the number of times interest is compounded per year. The more frequently the interest is compounded, the more you will pay (or earn) over time.

Understanding the difference between simple and compound interest is crucial when making decisions about borrowing or investing money. By calculating these rates effectively, you can choose the best financial options for your needs and manage your finances more efficiently.

Evaluating Your Financial Goals

Setting clear and measurable goals is essential for achieving long-term success in managing your money. Whether you are planning for a major purchase, saving for retirement, or paying off debt, evaluating your goals regularly helps you stay on track and make necessary adjustments. In this section, we’ll discuss how to assess your financial objectives, prioritize them, and take actionable steps toward fulfilling them.

To evaluate your goals effectively, it’s important to consider several key factors:

- Specificity: Your goals should be clear and detailed. Instead of just “saving money,” define an amount and timeline, like “save $5,000 for an emergency fund in 12 months.”

- Realism: Ensure that your goals are achievable based on your income, expenses, and financial situation. Set targets that challenge you, but are still attainable.

- Time Frame: Categorize your goals as short-term, medium-term, or long-term. Knowing when you want to achieve each goal allows you to prioritize and plan effectively.

- Progress Tracking: Regularly check your progress. This allows you to adjust strategies and make sure you’re on track to meet your objectives.

Regularly reviewing your financial objectives also means adjusting them as your circumstances change. If an emergency arises or a significant opportunity presents itself, reassessing your priorities ensures that you remain adaptable while still focused on achieving your broader aspirations. By evaluating your goals, you take control of your finances and create a clearer path to success.

Strategies for Effective Money Management

Managing your money wisely is a key aspect of building long-term stability and achieving financial independence. Effective money management allows you to control your expenses, save for future goals, and prepare for unexpected situations. In this section, we’ll explore several strategies to help you manage your finances more efficiently and make informed decisions about your spending, saving, and investing habits.

To achieve effective money management, consider implementing the following strategies:

- Track Your Expenses: Keeping a record of your spending is the first step in understanding where your money goes. Use budgeting apps or simple spreadsheets to categorize your expenses and identify areas where you can cut back.

- Set Clear Budgeting Goals: Create a budget that aligns with your income and financial objectives. Allocate funds for necessary expenses, savings, and discretionary spending. Stick to your budget to avoid overspending and ensure you’re consistently saving.

- Build an Emergency Fund: An emergency fund acts as a financial safety net in case of unexpected expenses, such as medical bills or car repairs. Aim to save three to six months’ worth of living expenses to cover emergencies without resorting to credit cards or loans.

- Pay Off Debt Strategically: If you have outstanding debts, prioritize paying them off with a strategy that works best for you, such as the snowball or avalanche method. Reducing high-interest debt will free up resources for savings and investment opportunities.

- Save and Invest for the Future: Consistently setting aside money for long-term goals such as retirement, homeownership, or education ensures that you can meet your financial aspirations. Consider automating your savings to make the process easier and more consistent.

By adopting these strategies, you can take control of your finances and set yourself on the path to financial success. The key to managing money effectively is discipline, consistency, and regular evaluation of your financial situation. With the right approach, you’ll be able to make smarter financial decisions and achieve your financial goals over time.

Building Good Credit Habits Early

Establishing healthy credit habits from an early age is crucial for long-term financial well-being. A strong credit history opens doors to better loan terms, lower interest rates, and increased financial opportunities. By practicing responsible borrowing and repayment, you can build a solid foundation for your financial future. In this section, we’ll explore the steps you can take to cultivate positive credit habits and avoid common pitfalls that can damage your credit score.

Here are key steps to take when working on building good credit:

Start with a Secured Credit Card

For those new to credit, a secured credit card is an excellent starting point. With a secured card, you provide a deposit as collateral, which acts as your credit limit. By using the card responsibly–making timely payments and keeping your balance low–you can begin building your credit history. Over time, your issuer may increase your limit and offer you unsecured credit options.

Pay Your Bills on Time

Consistently paying bills on time is one of the most effective ways to build a positive credit history. Late payments can have a significant negative impact on your credit score. Set up reminders or automatic payments to ensure you never miss a due date. Remember, your payment history accounts for a large portion of your credit score.

- Make Minimum Payments: If you can’t pay the full balance, always make at least the minimum payment to avoid late fees and damage to your credit score.

- Avoid Maxing Out Credit Cards: Using too much of your available credit–typically over 30%–can hurt your score. Keep balances low to maintain a healthy credit utilization ratio.

- Monitor Your Credit Report: Regularly check your credit report for errors and report any discrepancies immediately. Free credit reports are available annually from the three major credit bureaus.

By following these steps and being disciplined in your approach, you can establish a strong credit foundation early on. Building good credit habits takes time, but the benefits are well worth the effort, as a solid credit history can save you money and provide greater financial flexibility in the future.

Overcoming Common Mistakes in Finance

When it comes to managing money, mistakes can be costly, but they also offer valuable learning opportunities. Many people make the same errors repeatedly, which can have long-lasting consequences on their financial health. Understanding and recognizing these common pitfalls is the first step toward making better decisions and improving financial stability. In this section, we will explore some of the most frequent mistakes people make and offer practical advice for avoiding them.

Not Setting a Budget

One of the most common errors individuals make is failing to create a budget. Without a clear plan, it becomes difficult to track spending, save money, or avoid debt. A budget helps you control your expenses, prioritize savings, and ensure you’re living within your means. It’s essential to track both fixed costs (like rent or utilities) and discretionary spending (such as entertainment or dining out) to get an accurate picture of your financial situation.

| Expense Type | Example | Percentage of Income |

|---|---|---|

| Housing | Rent/Mortgage | 25-35% |

| Transportation | Car Payment/Insurance | 10-15% |

| Savings | Emergency Fund | 10-15% |

Accumulating High-Interest Debt

Another critical mistake people often make is accumulating high-interest debt, particularly credit card balances. While credit cards can offer convenience, carrying a balance from month to month can lead to substantial interest charges, making it harder to pay down debt. It’s important to pay off credit cards in full each month or seek to pay down high-interest debts as quickly as possible. Consider consolidating debt or transferring balances to cards with lower interest rates to reduce your financial burden.

- Use Credit Wisely: Keep credit card balances below 30% of your credit limit to maintain a healthy credit score.

- Pay More Than the Minimum: Paying only the minimum balance will keep you in debt longer and result in more interest paid over time.

By recognizing these common financial mistakes and taking proactive steps to avoid them, you can improve your financial well-being. Being mindful of budgeting, managing debt wisely, and making informed decisions will set you on the path toward greater financial success.

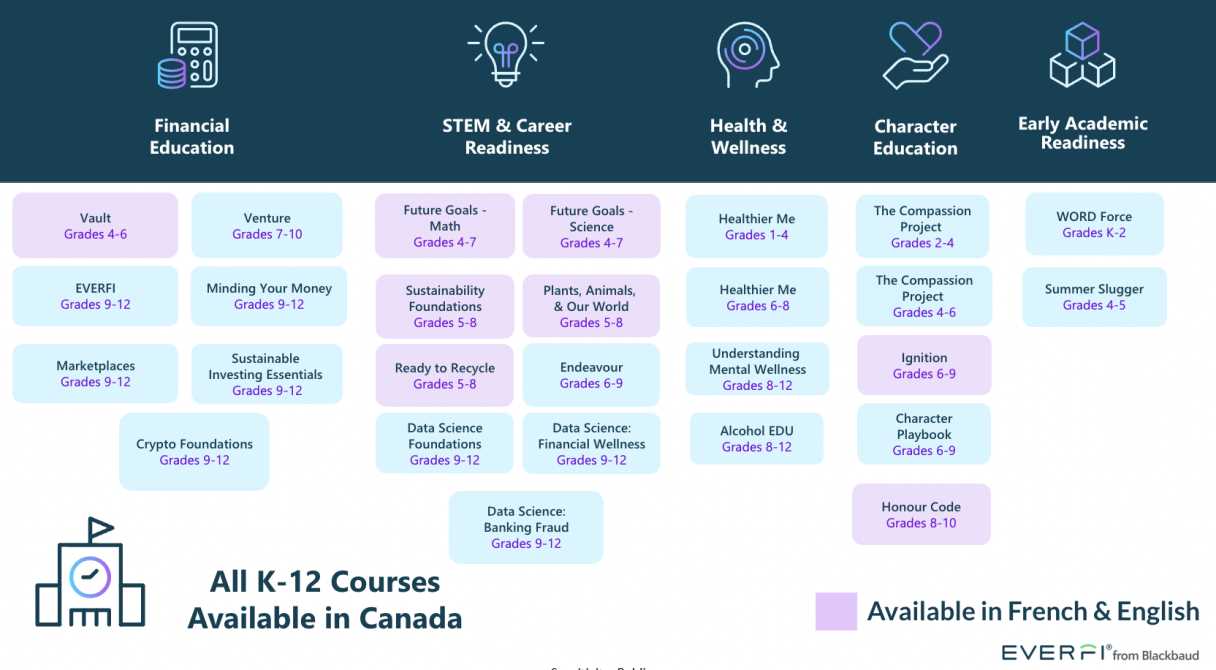

Resources for Financial Literacy Support

Gaining a solid understanding of money management is essential for making informed decisions about your personal finances. Fortunately, there are numerous resources available to help individuals build their knowledge, from online platforms to community-based support groups. Whether you are looking to improve your budgeting skills, understand credit better, or learn about investing, these resources can provide valuable tools to guide you on your financial journey.

Many organizations, websites, and educational platforms offer free or low-cost resources designed to help individuals improve their money management skills. These resources are designed for people at all stages of their financial journey, from beginners just starting out to those looking to refine their strategies for long-term success.

Online Tools and Courses

Online platforms provide a wide range of courses, articles, and interactive tools designed to teach essential financial skills. Many of these are accessible for free, and they offer structured lessons that cover topics like saving, budgeting, debt management, and more. Some well-known websites that offer financial education include:

- MyMoney.gov: A U.S. government website that provides resources for learning about managing money, from budgeting to retirement planning.

- National Endowment for Financial Education (NEFE): Offers free resources and tools designed to help individuals make informed decisions about money.

- Investopedia: A widely-used resource for learning about investment, finance, and economics through articles, tutorials, and online courses.

Books and Podcasts

For those who prefer reading or listening to learn, books and podcasts are excellent resources. Many authors and financial experts offer practical advice on managing money, understanding investments, and creating long-term financial plans. Here are a few suggestions:

- Books: Titles such as “The Millionaire Next Door” by Thomas Stanley or “Your Money or Your Life” by Joe Dominguez offer insights into personal finance and wealth-building.

- Podcasts: Shows like “The Dave Ramsey Show” or “Planet Money” provide easy-to-understand financial advice in audio format, perfect for listening during your commute.

By leveraging these resources, you can strengthen your financial knowledge and make more confident decisions regarding your money. Whether you’re just getting started or you’re looking to refine your existing skills, there is no shortage of support available to guide you along the way.

How Module 7 Prepares for Real Life

Understanding money management is crucial for navigating adult responsibilities. Real-life financial situations, such as budgeting, saving, and making informed investment choices, require practical knowledge and decision-making skills. This section focuses on how the lessons provided in this educational series equip individuals with the tools needed to handle day-to-day financial challenges, preparing them for financial independence and success in the real world.

One of the key benefits of this series is its hands-on approach. Instead of focusing solely on theory, it offers practical scenarios and strategies that can be applied to everyday financial situations. By breaking down complex concepts into digestible lessons, it prepares learners to handle real-world financial decisions with confidence and foresight.

Practical Applications of Financial Knowledge

The content not only covers the basics of managing money but also delves into real-world applications, such as:

- Budgeting: Learning how to track and control spending is essential for staying within your means and achieving financial goals.

- Saving: Building savings for emergencies or future goals helps create financial security.

- Investing: Basic principles of investing teach how to grow wealth over time and make informed decisions about risk.

Table: Key Skills and Real-Life Relevance

| Skill | Real-Life Relevance |

|---|---|

| Budgeting | Helps you manage monthly expenses and avoid debt accumulation. |

| Saving | Ensures you have funds for emergencies, large purchases, and future goals. |

| Debt Management | Prevents financial stress by teaching how to manage and reduce debt effectively. |

| Investing | Allows you to make smart decisions to grow your wealth over time and prepare for retirement. |

By providing these practical tools, the lessons empower individuals to take control of their finances and build a secure financial future. The knowledge gained here prepares individuals to face real-life challenges with the confidence to make sound financial decisions that align with their goals and values.

Why Financial Education is Crucial

Understanding how to manage money is one of the most important skills for living a successful and stress-free life. Without a solid grasp of key concepts, people often make costly mistakes that can lead to long-term challenges, including debt, financial insecurity, and poor decision-making. This section explores why it’s essential to gain knowledge in this area and how it can positively impact overall well-being.

The ability to make informed financial decisions affects almost every aspect of life, from managing everyday expenses to planning for the future. Learning how to properly handle money not only creates stability but also empowers individuals to reach their personal goals, build security, and take control of their financial future.

Long-Term Benefits of Financial Understanding

- Increased Confidence: Knowing how to manage money reduces stress and builds confidence when making decisions related to spending, saving, and investing.

- Avoiding Debt: With the right knowledge, individuals can avoid taking on excessive debt and learn how to effectively manage any existing financial obligations.

- Building Wealth: A solid understanding of how to allocate resources wisely helps individuals grow their wealth over time and achieve long-term goals.

Essential Areas to Focus On

- Budgeting: Developing a budget allows individuals to track their income and expenses, ensuring that they live within their means.

- Saving: Building savings for both short-term needs and long-term objectives, such as retirement, ensures financial security.

- Investing: Knowing how to grow wealth through investments and making informed choices enables people to achieve financial independence.

In a world that’s increasingly dependent on smart financial decisions, education in this area provides the foundation for a more secure and prosperous life. The earlier these concepts are learned and applied, the better prepared individuals are for the financial challenges they will inevitably face.

Tips for Acing the Course

Mastering any educational program requires focus, strategy, and understanding of the core concepts. When preparing for assessments in this type of program, it’s important to be methodical in your approach. This section provides practical advice to help you perform your best, ensuring that you retain the information and apply it effectively during quizzes and evaluations.

Preparation Strategies

- Review Key Concepts: Before diving into the lessons, take time to familiarize yourself with the core ideas. Knowing what topics will be covered helps you focus your attention where it matters most.

- Take Notes: While going through the material, jot down important details. Writing things down helps reinforce what you’ve learned and gives you a valuable resource to refer to later.

- Break Down Complex Topics: If certain concepts seem overwhelming, break them into smaller, more digestible parts. Focus on understanding each part before moving on to the next.

During the Assessment

- Read Questions Carefully: Pay close attention to each question, making sure you understand what is being asked before answering. Misinterpreting a question can lead to mistakes.

- Eliminate Incorrect Answers: If you’re unsure of an answer, start by eliminating options that are clearly wrong. This increases your chances of choosing the correct response.

- Manage Your Time: Don’t rush through the test. Pace yourself, ensuring you have enough time to thoughtfully consider each question.

With these strategies, you can approach each part of the program with confidence. The more prepared you are, the easier it will be to apply your knowledge effectively, leading to better results and a deeper understanding of the material.