In this section, we explore fundamental concepts and practical approaches to building a successful financial strategy. Understanding how different elements of the market interact can empower individuals to make informed decisions and improve their overall wealth management.

Developing a clear plan requires careful analysis of various tools and methods available to investors. With the right knowledge, it becomes easier to navigate complex financial landscapes, minimize risks, and maximize potential gains.

Adapting to market fluctuations is an essential skill for anyone looking to grow their wealth over time. Whether you’re new to the field or an experienced participant, grasping the key factors at play will help you make smarter, more confident choices.

Module 4 Investing Answers

This section delves into core concepts that drive successful financial decision-making. By understanding various techniques and frameworks, individuals can develop a robust approach to managing their assets, improving both short- and long-term results.

Grasping the different strategies available for wealth growth allows individuals to make well-rounded decisions, reducing risks while taking advantage of market opportunities. Each method has its unique benefits and challenges, which makes it important to evaluate options thoroughly.

| Strategy | Description | Potential Benefits | Considerations |

|---|---|---|---|

| Growth Investment | Focusing on assets expected to increase significantly in value. | High returns, increased wealth over time. | Higher risk, long-term commitment required. |

| Value Investment | Identifying undervalued assets with potential for appreciation. | Strong returns with disciplined evaluation. | Requires in-depth analysis and market patience. |

| Income Investment | Focusing on investments that provide regular income, such as dividends. | Steady cash flow, more predictable returns. | Lower growth potential, may require substantial initial investment. |

| Index Funds | Investing in a diversified portfolio that tracks a market index. | Lower fees, broad market exposure. | Limited control over specific assets, moderate growth. |

Understanding Key Investment Principles

Mastering the foundational concepts of asset management is essential for anyone looking to build a sustainable financial strategy. By applying core principles, individuals can enhance their decision-making process, assess opportunities, and manage risks effectively.

The following are fundamental concepts to understand in order to develop a sound approach to wealth growth:

- Diversification: Spreading investments across various assets helps reduce risk by preventing exposure to a single market downturn.

- Risk and Return: Higher potential returns often come with higher risks. Balancing these two factors is crucial for a successful strategy.

- Time Horizon: The length of time you plan to hold investments affects your choices. Longer horizons allow for more risk, while shorter ones require stability.

- Liquidity: This refers to how quickly an asset can be converted into cash without affecting its price. It’s important to consider liquidity based on your financial needs.

Understanding these principles helps investors stay focused on their long-term goals, while managing both the uncertainties and opportunities that arise within the financial markets.

How to Analyze Market Trends

Understanding the movement of financial markets is crucial for making informed decisions. By recognizing patterns, economic indicators, and market signals, individuals can gain insight into potential shifts in asset values. Effective trend analysis helps predict future market behavior and tailor investment strategies accordingly.

Identifying Key Indicators

To properly assess market trends, it’s important to focus on key indicators that influence price movements:

- Price Action: Monitoring historical price changes provides valuable context for predicting future movements.

- Volume: Changes in trading volume often signal the strength or weakness of a trend.

- Moving Averages: Tracking averages over time helps smooth out price fluctuations, identifying general trends.

Utilizing Technical and Fundamental Analysis

Both technical and fundamental analysis offer complementary methods for understanding market trends:

- Technical Analysis: Focuses on chart patterns, historical data, and statistical measures to predict future trends.

- Fundamental Analysis: Involves evaluating underlying economic factors, such as interest rates, GDP growth, and company performance.

Combining both approaches gives a comprehensive view of market conditions, allowing for better decision-making in dynamic financial environments.

Common Mistakes in Investment Strategies

While developing a financial strategy, many individuals make missteps that can significantly impact their returns. Understanding common pitfalls and learning to avoid them is crucial for long-term success. In this section, we highlight several errors that can derail even the most well-thought-out plans.

Chasing Short-Term Gains

One of the most frequent mistakes is focusing too heavily on short-term profits. While quick returns may seem appealing, they often come with increased risk and uncertainty. Relying on short-term fluctuations can lead to impulsive decisions, which may not align with long-term financial goals.

- Emotional Decision Making: Reacting to market volatility out of fear or greed can result in buying or selling at the wrong times.

- Lack of Patience: Investors who focus on immediate results often miss the bigger picture and the power of compound growth over time.

Failure to Diversify

Another significant mistake is putting all resources into a single asset or sector. A lack of diversification exposes investors to unnecessary risk, as market downturns can have a disproportionately large impact on an undiversified portfolio. Spreading investments across different asset classes helps protect against such risks.

- Concentration Risk: Relying on one asset or sector increases the chances of major losses if that particular investment performs poorly.

- Missed Opportunities: Failing to explore various markets or asset classes can limit growth potential and overlook profitable avenues.

By recognizing these common mistakes and making strategic adjustments, individuals can better navigate the complexities of the financial world and improve their investment outcomes.

Risk Management for Investors

Managing risk is a critical aspect of any financial strategy. By understanding potential threats and taking proactive measures, individuals can safeguard their portfolios against significant losses. Effective risk management allows investors to make informed decisions and balance potential rewards with acceptable levels of risk.

Implementing a strong risk management strategy involves several key techniques to minimize exposure and maximize returns over time.

| Strategy | Purpose | Benefit | Consideration |

|---|---|---|---|

| Diversification | Spread investments across various asset types to reduce risk. | Reduces the impact of poor performance in any one area. | May limit high returns from single, high-growth assets. |

| Setting Stop-Loss Orders | Automatically sell assets if their value drops below a certain level. | Helps minimize losses during market downturns. | Could trigger sales during temporary market fluctuations. |

| Hedging | Use financial instruments like options or futures to offset potential losses. | Provides protection against adverse price movements. | Can be costly and complex to implement. |

| Risk Tolerance Assessment | Determine how much risk you are willing to take based on your financial goals. | Helps align investment choices with personal comfort levels. | Risk tolerance can change over time due to life events or financial shifts. |

By employing these techniques, investors can ensure their strategies are well-positioned to handle market uncertainties while achieving their financial objectives.

Evaluating Stocks and Bonds Effectively

Assessing financial assets such as stocks and bonds is an essential part of building a strong portfolio. By understanding key factors that influence the performance of these assets, investors can make more informed decisions and choose the right opportunities for their financial goals. A thorough evaluation process involves both quantitative analysis and qualitative factors that reveal an asset’s potential for growth and stability.

When evaluating stocks, key indicators such as earnings growth, price-to-earnings ratio, and dividend yield are crucial. For bonds, understanding the interest rate environment, credit ratings, and maturity structure is essential to gauge the risk and return trade-off. Combining these factors allows investors to make decisions based on both risk tolerance and expected returns.

Impact of Economic Indicators on Investments

Economic indicators play a vital role in shaping financial markets and influencing investment decisions. These indicators provide insight into the overall health of an economy, which in turn affects asset values, investor sentiment, and market trends. By understanding how factors such as inflation, unemployment, and GDP growth interact, investors can better navigate the complexities of the market and make informed choices.

For instance, a strong GDP growth rate typically signals a healthy economy, which can lead to higher corporate earnings and rising stock prices. Conversely, high inflation or increasing unemployment may point to economic instability, causing volatility in the markets. By monitoring these indicators, investors can adjust their strategies to mitigate risks and take advantage of emerging opportunities.

Diversification Techniques for Better Returns

Spreading investments across a variety of asset classes is one of the most effective ways to reduce risk and enhance overall returns. By diversifying, investors can mitigate the impact of market fluctuations in any single area, ensuring more stable performance in the long term. Different techniques can be applied to create a well-balanced portfolio that aligns with both risk tolerance and financial goals.

Types of Diversification Strategies

- Asset Class Diversification: Allocating funds among various types of investments such as stocks, bonds, real estate, and commodities reduces the impact of any single asset’s poor performance.

- Geographical Diversification: Investing in different regions or countries can protect against the risks specific to a particular economy or market.

- Sector Diversification: Spreading investments across various industries, such as technology, healthcare, and energy, reduces the risk of sector-specific downturns.

Benefits of Diversification

- Risk Reduction: By balancing investments, potential losses in one area can be offset by gains in another, reducing overall volatility.

- Consistent Returns: Diversification helps smooth out performance over time, leading to more consistent returns in different market conditions.

- Maximized Growth Potential: A well-diversified portfolio can capture growth in various markets and sectors, providing a higher chance for long-term gains.

Implementing these techniques requires careful planning and ongoing review to ensure the portfolio remains balanced and aligned with evolving financial objectives.

Time Horizon and Investment Decisions

The length of time an investor expects to hold a particular asset plays a crucial role in shaping investment choices. Understanding the time horizon helps determine the level of risk an investor can take, as well as the types of assets that are most suitable. A longer time horizon allows for more aggressive strategies, while a shorter horizon may require more cautious approaches to preserve capital.

Short-Term vs. Long-Term Strategies

Investment strategies should align with the expected duration for holding assets. Here’s how time horizon affects decision-making:

- Short-Term: Investors with a short time frame (typically less than 5 years) often seek stability and liquidity. These individuals may focus on low-risk assets, such as bonds or money market funds, to avoid potential volatility.

- Long-Term: Those with a longer time horizon can afford to take on more risk. This allows them to consider growth-oriented investments, such as stocks or real estate, which may provide higher returns over time despite short-term market fluctuations.

Adapting Portfolio Based on Time Horizon

Adjusting the asset allocation as the time horizon shifts is crucial for maintaining an appropriate risk level. For example:

- As time shortens: Investors may gradually shift from riskier assets to safer ones, reducing exposure to market volatility.

- As time lengthens: More risk can be taken on with the expectation that short-term losses will be recovered over time, especially if compounding growth is a key goal.

By understanding how the time horizon impacts investment decisions, individuals can create strategies that better align with their financial objectives and risk tolerance.

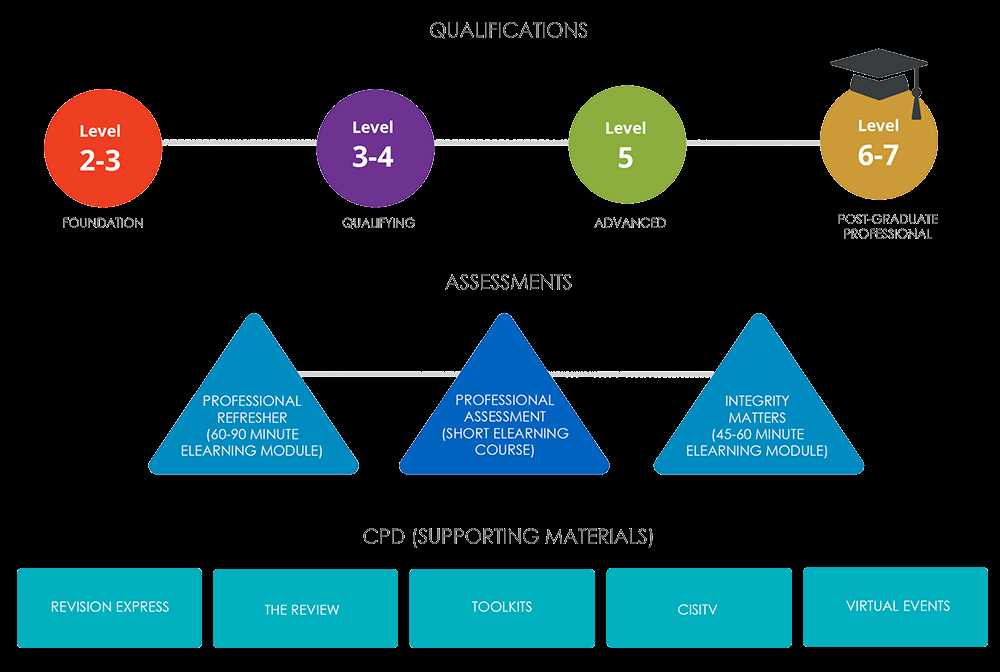

Types of Investment Funds Explained

Investment funds provide a way for individuals to pool their money and diversify their portfolios without having to manage each asset individually. These funds are managed by professionals who allocate resources across various assets, aiming to achieve specific financial goals. Understanding the different types of funds available helps investors make informed decisions based on their risk tolerance, time horizon, and investment objectives.

Common Types of Investment Funds

- Mutual Funds: These funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. Mutual funds are typically actively managed, meaning fund managers make decisions to buy or sell assets based on market conditions.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks. They offer flexibility in trading and usually track a specific index, sector, or asset class, making them a popular choice for passive investors.

- Hedge Funds: These funds typically target high-net-worth individuals and employ various strategies, such as short selling or leveraging, to achieve higher returns. Hedge funds often take on more risk and are less regulated than mutual funds or ETFs.

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500. They are typically low-cost, passively managed, and provide broad market exposure with relatively lower risk.

Choosing the Right Fund

The choice of fund depends on the investor’s goals, risk tolerance, and investment horizon:

- Low-Risk Tolerance: Investors with a lower risk tolerance may prefer index funds, ETFs, or mutual funds that focus on bonds or other stable assets.

- High-Risk Tolerance: For those willing to take on more risk in exchange for potentially higher returns, hedge funds or actively managed mutual funds may be appropriate options.

- Long-Term Investment Goals: Long-term investors may lean toward index funds or ETFs, which offer diversification and are well-suited for compounding growth over time.

By understanding the differences between various types of funds, investors can select the best options that align with their financial objectives and risk preferences.

Building a Solid Investment Portfolio

Creating a well-rounded portfolio is crucial for achieving long-term financial goals while managing risk. A solid portfolio is one that is diversified across various asset classes, providing a balance between stability and growth potential. The goal is to optimize returns by spreading investments across different sectors, geographies, and risk levels, allowing for greater protection against market volatility.

To build a strong portfolio, it’s important to first assess your financial goals, risk tolerance, and time horizon. These factors help guide the selection of appropriate assets, ensuring the portfolio aligns with both short-term and long-term objectives. Once goals are defined, the next step is to allocate assets effectively, ensuring a proper balance between safer, income-generating investments and more aggressive, growth-oriented options.

As the market evolves and personal circumstances change, it’s essential to regularly review and adjust the portfolio. Rebalancing helps maintain the desired asset allocation and ensures the portfolio continues to reflect your financial priorities.

Exploring Active vs Passive Investing

When it comes to managing a portfolio, two main strategies dominate the landscape: active and passive management. Both approaches aim to achieve strong returns, but they differ in terms of involvement, risk, and cost. Understanding the key differences between these strategies is essential for making informed decisions about how to allocate assets in line with personal financial goals.

Active management involves a hands-on approach, where fund managers or investors make frequent decisions about buying and selling assets based on market research, trends, and predictions. The goal is to outperform the market or a specific benchmark by capitalizing on opportunities and timing trades effectively. While this approach can yield high rewards, it often comes with higher fees and greater risks due to the frequent adjustments made to the portfolio.

On the other hand, passive management is centered around tracking a market index or a specific sector, with minimal intervention. The idea is to replicate the performance of a particular benchmark, often through low-cost funds like index funds or ETFs. Passive strategies are typically less expensive to manage and are favored by those who believe the market will generally rise over the long term, offering steady growth with lower associated costs and risks.

Each approach has its pros and cons, and the choice between active and passive management depends on the investor’s objectives, risk tolerance, and investment horizon. A well-balanced strategy might even combine both methods to achieve optimal diversification and risk management.

Assessing Your Risk Tolerance

Understanding your own comfort with risk is crucial when making financial decisions. Risk tolerance refers to the level of volatility an individual is willing to accept in pursuit of financial returns. It varies from person to person, influenced by factors such as financial situation, personal goals, and emotional resilience to market fluctuations. Accurately assessing this tolerance helps guide investment choices, ensuring they align with both short-term needs and long-term aspirations.

Factors Influencing Risk Tolerance

- Financial Situation: The amount of capital available for investing and the need for liquidity can significantly impact one’s willingness to take risks. Those with more disposable income may be more inclined to invest in higher-risk assets.

- Time Horizon: The length of time an individual plans to hold investments plays a role in their risk tolerance. A longer time horizon generally allows for greater risk, as there is more time to recover from potential losses.

- Emotional Resilience: Some investors may find it difficult to handle market volatility, which can affect their risk tolerance. Emotional readiness to cope with ups and downs is a key consideration in determining suitable investment strategies.

Tools for Assessing Risk Tolerance

There are various tools and questionnaires available to help assess risk tolerance. These often include questions about financial goals, personal circumstances, and reactions to hypothetical market situations. By carefully evaluating these factors, investors can make more informed choices and select investments that suit their capacity for risk.

Understanding Capital Gains and Taxes

When engaging in financial markets, one of the most important concepts to grasp is how profits from asset sales are taxed. Capital gains refer to the profit made from selling an asset for more than its purchase price. While this might seem straightforward, the tax treatment of these gains varies based on several factors, including the type of asset and the holding period. Understanding how these factors influence taxation is essential for managing potential liabilities and optimizing investment returns.

Taxes on capital gains are typically categorized into two types: short-term and long-term. The distinction between these two depends on how long an asset is held before being sold. Short-term capital gains are generally taxed at a higher rate than long-term gains, which can provide substantial tax benefits for investors who adopt a buy-and-hold strategy.

| Holding Period | Tax Rate | Example |

|---|---|---|

| Short-term (less than 1 year) | Higher rate, similar to ordinary income | Buying and selling a stock within 6 months |

| Long-term (more than 1 year) | Lower rate, typically 0% to 20% | Holding a stock for over a year before selling |

By strategically managing holding periods and understanding the nuances of capital gains taxes, investors can maximize their after-tax returns. Knowing when to sell and the potential tax impact helps ensure a more efficient approach to building wealth over time.

The Role of Dividends in Investing

Dividends are a key component of many investment strategies, offering a reliable income stream in addition to potential price appreciation. These periodic payments are made by companies to their shareholders as a portion of the profits. Investors who prioritize steady income or prefer a more conservative approach often turn to dividend-paying assets. While not all stocks or assets provide dividends, those that do can play a significant role in building wealth over time, particularly for long-term investors.

Benefits of Receiving Dividends

- Steady Income: Dividends offer a regular income source, making them especially attractive for retirees or those seeking to generate passive income from their investments.

- Reinvestment Opportunities: Reinvesting dividends can compound returns over time, as the reinvested funds are used to purchase more shares, potentially increasing future dividends.

- Reduced Volatility: Dividend-paying companies are often more established and stable, which can help mitigate the effects of market fluctuations on an investor’s portfolio.

How Dividends Impact Investment Decisions

For many, the decision to invest in dividend-paying stocks is driven by the desire for income in addition to capital growth. Dividends can provide a cushion during market downturns, as the regular payouts help offset any losses in asset value. Additionally, consistent dividend payments often signal financial health and stability within a company, making such investments appealing to risk-averse investors.

Market Timing and Long-Term Investment

In the world of financial planning, the debate between market timing and long-term strategy is ongoing. Market timing involves attempting to predict short-term market movements in order to buy low and sell high. While this approach can yield quick profits, it is often seen as speculative and risky. On the other hand, long-term investment focuses on holding assets over extended periods, relying on their growth potential and compounding returns, regardless of short-term market fluctuations. Both approaches have their advantages, but understanding their key differences is essential to making informed decisions.

The Challenges of Market Timing

- Unpredictable Movements: Markets are influenced by a vast array of factors, including geopolitical events, economic indicators, and investor sentiment, making short-term predictions highly uncertain.

- Timing Errors: Even experienced investors can struggle to enter or exit the market at the right moment, leading to potential losses or missed opportunities.

- Emotional Decision-Making: Attempting to time the market can result in emotional decisions, such as panic selling during a downturn or overconfidence during a rally.

Benefits of Long-Term Investing

- Compounding Growth: Holding investments over the long term allows returns to compound, creating exponential growth that can be far more powerful than short-term gains.

- Reduced Stress: Long-term investors are less likely to react to day-to-day market fluctuations, leading to a more stable approach to wealth accumulation.

- Lower Costs: Long-term strategies typically involve fewer transactions, reducing fees and taxes compared to active trading or market timing.

Ultimately, while market timing may work for some in the short term, a long-term approach to asset management tends to provide more reliable, sustainable returns, particularly for those looking to build wealth over decades. Understanding the risks and benefits of both strategies allows investors to tailor their approach to suit their individual goals and risk tolerance.

How to Review Your Investment Progress

Regularly assessing your financial growth is a vital step in ensuring you are on track to meet your long-term financial goals. Tracking your progress allows you to identify whether your strategies are yielding the expected results and if adjustments are needed to improve performance. This process involves reviewing your portfolio’s returns, evaluating your asset allocation, and understanding how external factors might affect your plan. Taking a proactive approach helps ensure that your financial resources are working efficiently towards achieving your objectives.

To begin, it’s essential to establish clear metrics for measuring progress. This can include comparing your returns against relevant benchmarks, analyzing risk-adjusted returns, and assessing the overall diversification of your holdings. Regular reviews provide insights into whether your current approach still aligns with your evolving goals, especially in the face of changing market conditions or personal circumstances.

Tracking performance is not just about identifying gains but also understanding the reasons behind fluctuations. Are your investments performing as expected? Are there underperforming assets that need attention? Monitoring these aspects will help you make informed decisions, optimize your portfolio, and stay focused on your long-term vision.