Preparing for a professional financial management exam requires a deep understanding of essential principles and practical tools. As you work through the material, it becomes clear that success hinges not just on memorization but on the ability to apply concepts in real-world situations. With the right approach, you can confidently navigate the challenges presented by this rigorous assessment.

The test evaluates your expertise in handling a variety of complex tasks, focusing on your ability to process information efficiently and solve problems with accuracy. Key topics will push your limits and test how well you know the intricacies of financial software and business operations. This preparation demands both theoretical knowledge and hands-on experience, ensuring you’re ready for anything the test may throw your way.

Strategic preparation is the key to passing with confidence. Understanding the structure of the material and knowing how to manage your study time will be essential for achieving a top score. By focusing on critical concepts and applying them in practice exams, you’ll be well on your way to mastering the content and achieving your professional goals.

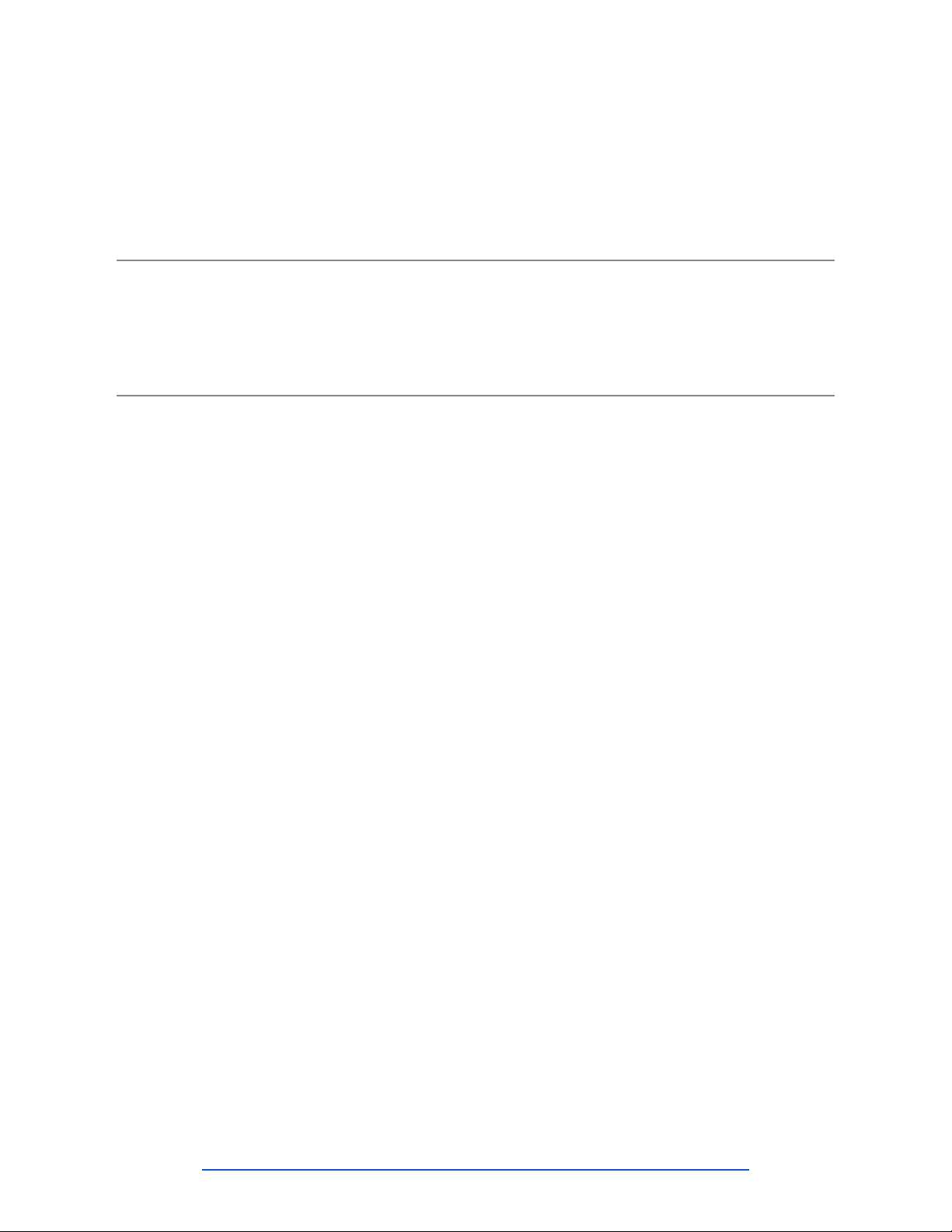

QuickBooks Online Advanced Certification Overview

Obtaining a professional qualification in financial software management opens doors to advanced roles in the accounting field. This qualification challenges individuals to demonstrate their command over critical financial tools and software, ensuring they possess the necessary expertise to handle complex business operations. Preparing for this credential involves mastering a broad range of topics, from financial reporting to system management, and applying knowledge in a practical context.

Key Areas of Focus

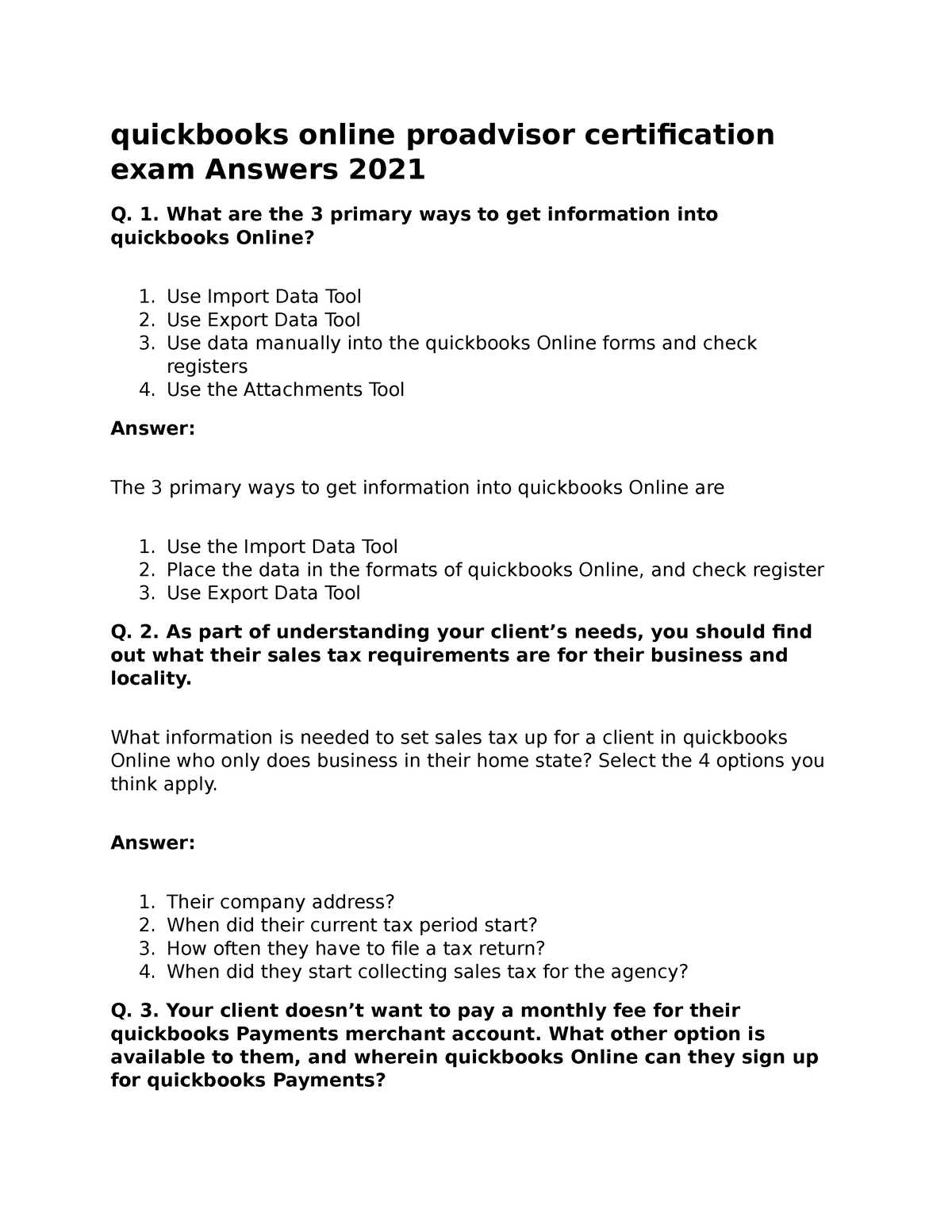

The preparation process is structured around several key areas that are crucial for a comprehensive understanding of financial software. These topics are carefully selected to ensure that individuals are well-versed in the technical and theoretical aspects required in modern business environments. Below is an overview of the most important topics covered:

| Topic | Description |

|---|---|

| Financial Reporting | Understanding how to create and analyze balance sheets, income statements, and cash flow statements. |

| Client Management | Techniques for managing multiple clients and keeping track of their financial data efficiently. |

| Inventory Control | Managing and tracking inventory, including stock levels and cost of goods sold. |

| Bank Reconciliation | Reconciling financial records with bank statements to ensure accuracy and consistency. |

| Advanced Features | Exploring features such as multi-currency management, project tracking, and payroll processing. |

Exam Structure and Requirements

This professional qualification is designed to test not only your knowledge but also your ability to apply it effectively. The structure of the assessment includes multiple-choice questions, scenario-based queries, and practical tasks that require candidates to demonstrate their problem-solving abilities. The focus is on real-world applications, and each section challenges participants to manage data with accuracy and efficiency.

What to Expect from the Exam

The assessment designed to test your proficiency in financial management tools will cover a wide array of topics aimed at evaluating both your theoretical understanding and practical skills. The focus will be on real-world scenarios where your ability to manage complex tasks efficiently will be tested. From handling transactions to generating financial reports, the questions are structured to gauge how well you can apply your knowledge in a professional setting.

Structure and Format of the assessment involves multiple types of questions, including multiple-choice, scenario-based problems, and hands-on tasks. Expect to encounter practical exercises where you will need to solve issues that businesses commonly face, such as reconciling accounts or generating reports under tight deadlines.

Real-world Application is at the core of the test. The goal is to assess how effectively you can use financial tools to streamline business processes, track performance, and resolve issues. Your responses will demonstrate how well you understand the complexities of financial management and your ability to adapt to different business needs.

Key Topics Covered in 2025 Exam

The assessment focuses on a comprehensive range of topics designed to test your expertise in managing business finances with software tools. These areas are carefully selected to ensure that candidates are well-equipped to handle the complexities of modern financial tasks. Below are the key topics that you will encounter during the evaluation:

- Financial Reporting – How to create and interpret financial documents such as balance sheets, profit and loss statements, and cash flow reports.

- Transaction Management – Handling day-to-day transactions, including accounts payable and receivable, with precision and efficiency.

- Bank Reconciliation – Methods for matching company records with bank statements to ensure consistency and accuracy.

- Tax Compliance – Knowledge of tax laws and how to apply them in financial software for accurate reporting.

- Payroll Management – Tools and techniques for processing payroll, managing deductions, and complying with employment laws.

- Inventory Tracking – Managing inventory levels, cost of goods sold, and understanding stock turnover ratios.

- Project Costing – How to track project budgets, expenses, and profitability using financial software.

- Multi-Currency Support – Working with clients and suppliers in multiple currencies and handling exchange rates effectively.

These topics form the foundation of the test, and mastering them will be essential for performing well. A strong grasp of each area will ensure that you’re prepared to face the challenges of managing a company’s financial data and making sound business decisions.

Top Study Resources for Success

To succeed in the professional assessment of financial software management, using the right study resources is crucial. These resources can guide you through the complex material and provide practice exercises that mimic real-world tasks. Whether you’re learning from books, videos, or interactive content, a combination of different materials will give you a well-rounded understanding of the topics.

Here are some of the most effective study tools you can use to prepare:

| Resource Type | Description |

|---|---|

| Official Training Materials | These materials offer in-depth lessons, interactive tutorials, and practice tasks directly from the software providers, ensuring you’re learning exactly what the test covers. |

| Practice Tests | Simulated practice tests provide an accurate representation of the actual assessment, allowing you to familiarize yourself with the format and types of questions. |

| Online Courses | Comprehensive online classes taught by professionals guide you step-by-step through the topics, providing valuable tips and insights into key concepts. |

| Books and Guides | Study guides and textbooks give you a structured overview of the material, breaking down difficult concepts into easily understandable sections. |

| Webinars and Tutorials | Live or recorded webinars and video tutorials can be excellent for visual learners, offering demonstrations of software features and troubleshooting techniques. |

By utilizing these diverse resources, you can enhance your preparation and increase your chances of achieving success in the test. Combining theoretical knowledge with hands-on practice is key to mastering the skills needed for the assessment.

How to Prepare for Financial Software Assessment

Preparation for a financial software proficiency assessment requires a structured approach. To succeed, candidates need to focus on understanding the core concepts and applying them in realistic business scenarios. By developing a study plan that includes both theoretical learning and hands-on practice, you can build the confidence needed to perform well in the assessment.

Steps to Effective Preparation

Follow these steps to maximize your chances of success:

- Understand the Scope: Review the key topics and ensure you have a solid grasp of financial management tools, reporting systems, and data handling.

- Practice Regularly: Work through practical exercises and case studies that simulate real-world situations. This will help you build the skills necessary for the test.

- Use Study Materials: Utilize official training resources, study guides, and books to get a structured overview of the concepts and procedures covered in the assessment.

- Take Practice Tests: Engage in practice exams to familiarize yourself with the question format and timing. This will help reduce test-day anxiety.

- Join Discussion Forums: Engage with other candidates and professionals in online communities. Exchanging ideas and solutions can help reinforce your learning.

Time Management Tips

Efficient time management is key to mastering the material. Here are some tips to help you stay on track:

- Create a Study Schedule: Break down the topics into manageable sections and allocate time for each. Be consistent and set realistic goals for each study session.

- Set Milestones: Track your progress and set specific milestones to ensure you’re progressing steadily towards mastering all the required topics.

- Prioritize Weak Areas: Identify areas where you may be struggling and focus extra time on improving your understanding in those subjects.

By following these steps and utilizing the right resources, you can ensure that you’re well-prepared to tackle the assessment and achieve success. Consistent preparation and strategic study will set you up for a strong performance.

Common Mistakes to Avoid During Certification

When preparing for a professional qualification assessment, it’s easy to make mistakes that can hinder your progress and affect your performance. Many candidates overlook critical details or mismanage their study strategies, which can lead to unnecessary stress or poor results. Recognizing these common pitfalls and learning how to avoid them is essential for successful preparation.

Frequent Mistakes and How to Avoid Them

Below is a list of common errors that candidates make and tips for preventing them:

| Mistake | How to Avoid It |

|---|---|

| Procrastination | Create a study schedule and stick to it. Break the material into manageable chunks to prevent last-minute cramming. |

| Relying Too Much on One Resource | Use a variety of study materials, including books, practice tests, and online courses to ensure a well-rounded understanding. |

| Ignoring Hands-On Practice | Focus on real-world application. Simulate tasks that you will face in the assessment to improve your practical skills. |

| Skipping Review Sessions | Consistently review what you’ve learned. Revisiting previous topics helps reinforce your knowledge and improve retention. |

| Overlooking Time Management | Practice under timed conditions and familiarize yourself with the time constraints of the assessment to avoid rushing through questions. |

Overcoming Test Anxiety

Many candidates experience anxiety during the preparation phase or on the day of the assessment. Test anxiety can be detrimental to your performance, leading to poor concentration and increased stress. To manage anxiety, practice relaxation techniques, take regular breaks during study sessions, and ensure you’re well-rested before the test. Confidence comes from preparation, so the more you practice, the more comfortable you will feel.

By avoiding these common mistakes and maintaining a disciplined, focused approach, you can maximize your chances of success and approach the assessment with confidence. Proper planning and effective study strategies will allow you to perform at your best.

Time Management Tips for Financial Software Assessment

Effective time management is crucial for success in any professional assessment. Without a proper plan, it can be easy to feel overwhelmed by the breadth of material to cover or to run out of time during the actual test. By applying specific time management techniques, you can ensure that you cover all the necessary topics, practice thoroughly, and approach the assessment with confidence.

Planning Your Study Time

Here are some tips to help you optimize your study sessions:

- Set Realistic Goals: Break down the material into manageable chunks and set daily or weekly goals. This way, you can track your progress and avoid cramming at the last minute.

- Prioritize Key Areas: Identify the most challenging topics or areas where you need the most practice and allocate more time to them.

- Use a Timer: During study sessions, use a timer to create a sense of urgency and stay focused. The Pomodoro Technique, which involves studying for 25 minutes followed by a 5-minute break, is an effective method for maintaining concentration.

- Set a Study Schedule: Plan your study sessions in advance. Allocate time for each subject and include time for both theory and practical application.

Maximizing Time During the Assessment

Managing your time effectively during the assessment is equally important. Here are some strategies for staying on track:

- Read the Instructions Carefully: Before starting, take a few minutes to read all the instructions thoroughly. This will help avoid confusion and ensure you’re not wasting time on unnecessary steps.

- Work on Easier Questions First: If you’re unsure about a question, move on and return to it later. Answering the easier questions first builds confidence and leaves more time for the harder ones.

- Monitor Your Time: Keep an eye on the clock throughout the assessment. If you notice you’re spending too much time on one section, gently move on to avoid getting stuck.

- Don’t Rush: While time is limited, rushing can lead to careless mistakes. Stay calm and focus on accuracy. You can review your answers during the last few minutes.

By implementing these time management techniques, you can maximize your productivity during preparation and stay calm and focused on the day of the test. With careful planning, you’ll be ready to tackle the assessment efficiently and effectively.

Understanding the Assessment Format and Questions

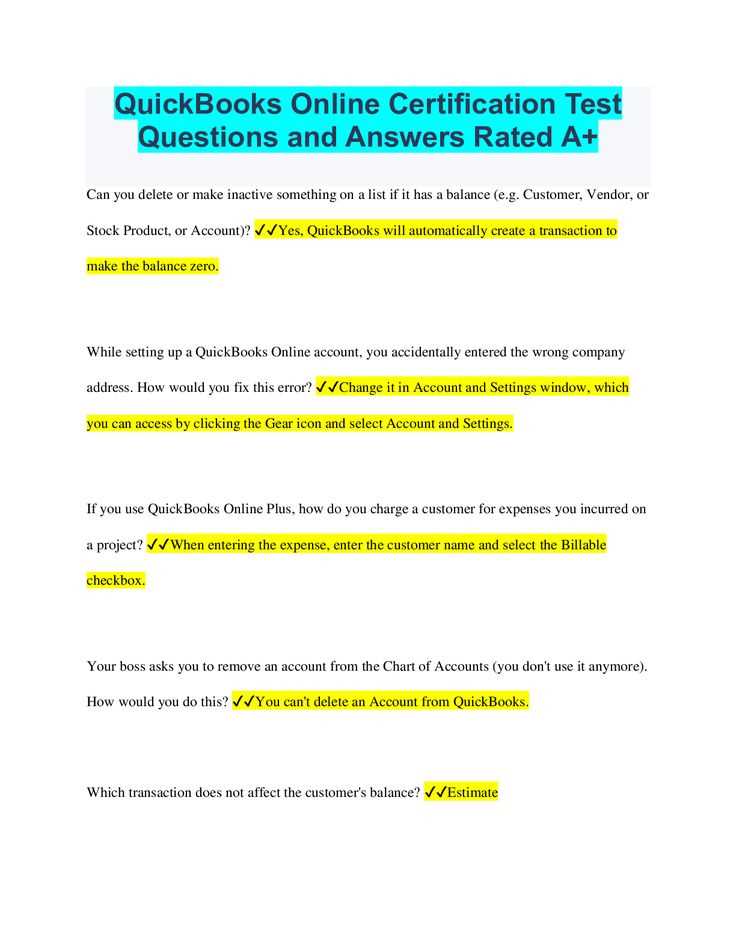

Knowing the structure of the assessment and the types of questions you will encounter is essential for effective preparation. Familiarity with the format allows you to approach each section with a clear strategy, reducing anxiety and increasing efficiency. This section covers the key elements of the assessment format and provides insight into the types of questions that may be asked.

Types of Questions

The assessment typically includes several types of questions designed to test both your theoretical knowledge and practical skills. Here are the most common formats:

- Multiple Choice: These questions test your ability to recall specific information and concepts. They may include scenarios where you need to select the most appropriate solution.

- True/False: Aimed at testing your understanding of fundamental principles, these questions require you to evaluate statements as either correct or incorrect.

- Scenario-Based: These questions simulate real-world situations. You’ll be asked to make decisions or choose actions based on the given scenario, reflecting your ability to apply what you’ve learned in practical contexts.

- Fill-in-the-Blanks: These questions assess your knowledge of specific terminology and concepts. You may need to complete statements or equations with the correct terms or values.

Key Focus Areas in the Assessment

To perform well, it’s important to understand the key topics that are often tested. Here are some areas to focus on:

- Financial Reporting: Many questions will revolve around the creation, interpretation, and analysis of financial reports. Make sure you’re familiar with balance sheets, income statements, and cash flow statements.

- Data Entry and Management: Expect questions that assess your ability to accurately enter and manage financial data, including handling invoices, expenses, and transactions.

- System Settings and Customization: You may be asked about setting up the software, customizing settings for specific business needs, and troubleshooting configuration issues.

- Problem Solving and Application: Scenario-based questions will test how well you apply your knowledge to resolve common business challenges, such as reconciling accounts or managing budgets.

By understanding the types of questions and the topics covered, you can better prepare for the assessment and approach each question with confidence. Regular practice with these question types will ensure you’re comfortable with the format and ready for the real thing.

How to Use Practice Tests Effectively

Practice tests are an essential part of any preparation process, as they help you become familiar with the question format and timing constraints. However, it’s important to use them strategically to maximize their effectiveness. Simply taking a practice test isn’t enough; you must analyze your performance, learn from mistakes, and refine your approach. Here’s how to make the most out of practice tests.

Preparing with Practice Tests

To ensure practice tests are beneficial, follow these steps to use them effectively:

- Start Early: Begin taking practice tests well in advance of your assessment date. This will allow you to identify areas of weakness and give you enough time to review those areas thoroughly.

- Simulate Real Conditions: Try to replicate the conditions of the actual assessment, including the time limit. This helps you build endurance and understand how to pace yourself during the real test.

- Focus on Key Areas: Use practice tests to target specific subjects or skills that need improvement. For example, if you struggle with data entry, prioritize practice questions that focus on this area.

- Take Notes: As you work through each practice test, take notes on the questions you find challenging. Reviewing these notes will help reinforce concepts and prevent similar mistakes in the future.

Reviewing Your Performance

The key to learning from practice tests lies in reviewing your answers and understanding where you went wrong. Here’s how to analyze your performance:

- Identify Mistakes: Carefully go through the questions you answered incorrectly. Determine whether the mistakes were due to a lack of knowledge or simple misunderstandings of the question.

- Understand Correct Answers: After reviewing incorrect answers, take the time to understand why the correct answers are what they are. This deeper understanding will help reinforce your knowledge for the future.

- Revisit Weak Areas: If you consistently make errors in certain topics, devote extra study time to those areas. Don’t simply move on after completing a test; address your weaknesses before they become a bigger issue.

- Track Progress: Keep a record of your practice test scores over time. As your scores improve, you’ll gain confidence in your preparation and see where further focus is required.

When used strategically, practice tests can provide valuable insights into your readiness. Incorporating them into your study routine ensures you are well-prepared for the actual assessment, enhancing both your knowledge and your test-taking skills.

Best Strategies for Mastering Key Features

Mastering the features of accounting software requires a structured approach and consistent practice. As the platform offers a wide range of tools designed to streamline financial management, it’s essential to familiarize yourself with each of them to work efficiently and accurately. The following strategies will help you navigate and excel in using the most important features of the software.

1. Start with the Basics

Before diving into complex functionalities, ensure that you have a solid understanding of the core features. Familiarize yourself with essential tasks such as creating invoices, tracking expenses, managing reports, and reconciling accounts. A strong grasp of these basics forms the foundation for mastering more advanced features.

2. Use Built-In Help and Tutorials

Leverage the platform’s built-in help guides, tutorials, and knowledge base. These resources are designed to walk you through common processes step by step, making it easier to understand how each feature works and how to apply them in real scenarios. Completing tutorials will reinforce your learning and help you become more comfortable using various tools.

3. Experiment with Advanced Features in a Sandbox

If the software allows, use a sandbox or test environment where you can explore advanced features without worrying about real data. This hands-on practice enables you to experiment with complex tasks like setting up automated workflows, managing custom reports, and configuring advanced settings, all while making mistakes in a risk-free space.

4. Break Down Complex Features into Manageable Segments

Some features, such as custom reporting or managing multiple accounts, can feel overwhelming due to their complexity. Break these tasks down into smaller, manageable segments. Focus on mastering one subtask at a time, whether it’s understanding the principles behind reporting tools or learning to handle multi-currency transactions.

5. Integrate Features into Daily Workflow

To build proficiency, try to integrate the software’s features into your daily routine. Whether it’s automating invoicing or regularly checking cash flow reports, applying the tools in real work situations helps reinforce their usefulness and ensures you stay comfortable with their functions.

6. Join Online Communities and Forums

Engage with online communities, forums, or user groups dedicated to discussing the platform’s features. By sharing experiences and asking questions, you can gain insights from other users who may have faced similar challenges. These interactions can help you discover shortcuts, tips, and best practices for mastering various tools.

By following these strategies, you will improve your understanding and proficiency in using the software’s features, ultimately enhancing your efficiency and effectiveness in managing financial tasks.

Essential Tools You Must Know

Effective financial management relies on understanding and utilizing key tools that help streamline tasks and ensure accuracy. Whether managing accounts, tracking expenses, or generating reports, mastering these tools can significantly enhance productivity. Below are some of the most crucial tools to know and leverage in your workflow.

Core Financial Management Tools

These tools are essential for managing day-to-day financial operations efficiently:

| Tool | Description | Key Features |

|---|---|---|

| Invoice Management | Track and create professional invoices for customers with ease. | Custom templates, recurring billing, payment tracking |

| Expense Tracking | Record and categorize business expenses in real-time to ensure accuracy. | Automatic receipt capture, expense categorization |

| Bank Reconciliation | Match your transactions with bank statements to keep your financials up to date. | Automatic transaction matching, reconciliation reports |

Advanced Analytical Tools

For deeper financial insights and better decision-making, these tools offer advanced reporting and tracking capabilities:

| Tool | Description | Key Features |

|---|---|---|

| Custom Reports | Create detailed, customizable reports to analyze key financial data. | Multiple report templates, customization options, export functionality |

| Dashboard | View real-time data and metrics through a visual summary. | Customizable widgets, financial snapshot, performance tracking |

| Cash Flow Forecasting | Predict future cash flow based on historical data to manage business finances effectively. | Automatic projections, trend analysis, scenario modeling |

By mastering these essential tools, you will be well-equipped to handle day-to-day financial tasks, ensure accuracy, and gain valuable insights for better business management.

Preparation Schedule for Financial Mastery

Creating a well-structured preparation plan is key to mastering complex financial concepts and passing any evaluation that tests your skills. A disciplined study schedule ensures that you stay on track, manage time effectively, and cover all the critical topics. Below is a suggested schedule that will guide your preparation, helping you feel confident and well-prepared for the assessment.

Week 1: Foundation and Overview

- Review basic principles of financial management.

- Understand core tools and functions used in business accounting.

- Familiarize yourself with the platform’s layout and features.

- Set realistic goals for each section of your study material.

Week 2: Core Features and Functions

- Study key processes such as invoicing, tracking expenses, and reconciling accounts.

- Practice using transaction templates and generating reports.

- Review financial statement creation and analysis techniques.

- Engage with practice exercises to reinforce your understanding.

Week 3: Advanced Features and Problem Solving

- Focus on more complex functionalities like budgeting, forecasting, and custom reporting.

- Practice handling different types of financial transactions and adjustments.

- Work through case studies and real-world examples to apply what you’ve learned.

- Prepare a list of challenging topics for additional focus.

Week 4: Review and Test Simulations

- Review all major topics, reinforcing weak areas from the previous weeks.

- Take practice tests under timed conditions to simulate the actual evaluation environment.

- Assess your progress and address any remaining gaps in knowledge.

- Rest and relax before the final assessment to ensure you are mentally prepared.

By following this structured plan, you’ll systematically build your skills and confidence, ensuring a comprehensive understanding of all critical concepts needed to succeed.

Key Competencies to Hone for the Year Ahead

To excel in any professional evaluation, it’s essential to focus on mastering advanced capabilities that align with evolving industry standards. Sharpening these abilities ensures not only success in assessments but also enhanced efficiency and effectiveness in real-world scenarios. Below are the core areas to prioritize for comprehensive preparation.

One critical area is mastering the intricacies of financial reporting. Developing a deep understanding of how to create, interpret, and customize financial statements equips you to make data-driven decisions. This includes working with multi-layered reports and ensuring compliance with established standards.

Another vital skill is proficiency in workflow automation. Leveraging automation tools to manage tasks such as invoice generation, payment reminders, and reconciliation significantly improves productivity. Understanding these tools’ customization options is key to tailoring solutions for specific business needs.

Budget management expertise is also crucial. Learning to set realistic budgets, monitor spending patterns, and forecast future trends provides a solid foundation for strategic planning. Focus on advanced techniques for variance analysis and cost control to maximize value.

Lastly, enhance your problem-solving skills by tackling complex scenarios. Engage with advanced case studies that involve irregular transactions, adjustments, and multi-currency management to build confidence in handling unique challenges effectively.

Focusing on these advanced areas will solidify your expertise and prepare you to navigate any professional assessment or real-world task with confidence and competence.

How to Handle Complex Scenarios in Assessments

When faced with intricate or challenging situations during an assessment, it’s important to approach them methodically and stay calm under pressure. These scenarios often test your ability to analyze information, apply your knowledge, and make sound decisions quickly. Below are strategies to tackle complex questions effectively.

Step 1: Break Down the Problem

The first step is to break the problem into smaller, manageable parts. This helps to reduce overwhelming feelings and makes it easier to focus on each aspect. Identify the key elements of the scenario, such as:

- The type of task or process being described

- The stakeholders involved

- The main issues or challenges presented

Step 2: Prioritize Information

Once the scenario is broken down, prioritize the most critical information. Pay attention to the facts that are directly related to the task at hand. Dismiss irrelevant data and focus your attention on what can help solve the problem effectively. This might involve:

- Identifying key variables

- Understanding the desired outcome

- Recognizing constraints or limitations

Step 3: Use Logical Reasoning

Apply logical reasoning to connect the dots. Analyze how different components of the scenario interact and what sequence of actions will lead to the desired outcome. A few key tactics include:

- Looking for cause-and-effect relationships

- Evaluating potential outcomes before deciding

- Testing multiple scenarios to see which approach fits best

Step 4: Review Your Answers

Before finalizing your response, review your solution to ensure that it aligns with the requirements of the scenario. Check for any overlooked details, and verify that the solution addresses all the key issues. It’s also a good idea to:

- Double-check calculations, if applicable

- Ensure that you’ve followed any given instructions or guidelines

- Assess whether the solution is practical and feasible

By staying organized, focusing on the critical information, and applying logical reasoning, you can effectively manage complex assessment scenarios and navigate them with confidence.

Benefits of Earning a Professional Qualification

Obtaining a professional qualification in accounting and financial management offers numerous advantages. It provides individuals with the skills and knowledge to excel in their field while enhancing their credibility and career prospects. Earning this qualification can open doors to better job opportunities, increased earning potential, and personal growth in a competitive market.

One of the primary benefits is the improvement in expertise and efficiency. Gaining specialized knowledge allows professionals to handle complex tasks with greater ease and precision. This leads to increased productivity, enabling individuals to provide high-quality work that meets or exceeds industry standards.

Additionally, earning a recognized qualification helps boost professional reputation. It demonstrates a commitment to ongoing education and a deep understanding of key concepts, which can make candidates stand out to potential employers or clients. Employers often seek qualified professionals to manage critical financial responsibilities, which can lead to greater job stability and career advancement.

Another advantage is the potential for higher salaries. Professionals with recognized qualifications are often compensated at a higher rate due to their proven skills and the value they bring to an organization. Moreover, such credentials can facilitate career transitions, allowing individuals to move into more specialized or senior roles within the industry.

Furthermore, obtaining this qualification provides access to a network of professionals and resources, offering continuous learning and growth opportunities. Whether through industry groups, webinars, or additional training, professionals can stay updated with the latest trends, tools, and best practices.

Overall, acquiring a professional qualification enhances not only technical abilities but also provides the personal satisfaction of achieving a significant career milestone, which can lead to long-term professional success.

Exam Day Tips for Success

The day of a professional assessment can be both exciting and stressful. Proper preparation leading up to the event is essential, but the actions taken on the day itself can greatly impact the outcome. A calm and strategic approach will help ensure a smooth experience and increase your chances of success. Here are some essential tips to keep in mind when it’s time to take the test.

Stay Calm and Focused

Before entering the test, take a deep breath and clear your mind. A relaxed state will help you stay focused and prevent anxiety from affecting your performance. Consider using relaxation techniques like deep breathing or visualization to calm your nerves. A positive mindset is just as important as your knowledge.

Manage Your Time Wisely

Effective time management is key to completing all sections of the test without feeling rushed. Allocate a specific amount of time to each question or task, and avoid spending too long on any one item. If you come across a particularly challenging question, move on and return to it later if needed. Strategic pacing can help you cover more ground with confidence.

Read Questions Carefully

One of the most common mistakes during assessments is misinterpreting questions. Take your time to read each question thoroughly and ensure you understand what is being asked before providing an answer. Look for keywords that indicate what the question is really about, and avoid making assumptions. Rushed responses often lead to simple errors that can cost valuable points.

Review Your Work

If time permits, always review your answers before submitting them. This final check can help you catch any mistakes or overlooked details that might impact your score. Ensure that your responses are clear, complete, and well-organized.

Stay Hydrated and Take Breaks

Hydration and small breaks can improve your concentration and stamina. Bring a water bottle and snack if permitted, and take a short pause if you feel your energy waning. A well-rested mind performs much better than one that is tired and sluggish.

By following these tips, you can maximize your performance and approach the test with confidence, ensuring that you are fully prepared to succeed.