Successfully navigating the challenges of a financial management assessment requires more than just memorizing facts. It’s about developing a deep understanding of core principles and applying them to solve complex problems efficiently. Whether you are reviewing key concepts or practicing real-world scenarios, effective preparation is crucial to boosting your confidence and performance.

In this section, we will explore essential techniques and strategies to help you tackle a variety of tasks that you may encounter. From identifying common pitfalls to mastering specific problem-solving methods, the goal is to provide you with the tools necessary for success. By focusing on both theory and practical application, you’ll be better prepared to handle any question with ease.

By following the insights shared here, you can approach the assessment with clarity and a structured plan, ensuring that you are not only ready to answer questions, but also to demonstrate a strong grasp of financial concepts.

Exam 2 Review

Reviewing for a financial management assessment requires a strategic approach to ensure that all important topics are covered effectively. The key to success lies in understanding the underlying principles and practicing their application through various problem-solving techniques. This section will guide you through a comprehensive review of the essential areas you need to focus on to achieve a high score.

Key Topics to Master

In order to perform well, you should be familiar with the following key concepts:

| Topic | Description |

|---|---|

| Financial Ratios | Understand how to calculate and interpret key financial ratios, including liquidity, profitability, and solvency metrics. |

| Cost Allocation | Learn how to allocate costs effectively across different business segments and products to maximize efficiency. |

| Budgeting Techniques | Become familiar with various budgeting methods, such as zero-based and flexible budgeting, and their application in decision-making. |

| Financial Statements | Develop a strong grasp of the balance sheet, income statement, and cash flow statement to analyze business performance. |

Effective Review Strategies

It’s essential to develop a focused study plan to cover all topics systematically. Start by reviewing your notes and identifying areas where you may need further clarification. Practice with sample problems, and make sure to go over any past assessments for a better understanding of the types of questions you might encounter. Additionally, using online resources and textbooks can provide deeper insights into difficult topics.

Key Concepts for Assessment Preparation

To succeed in a financial management test, it’s crucial to grasp a set of fundamental principles that form the basis of problem-solving in this field. A strong understanding of these core concepts will not only help you tackle individual problems but also improve your ability to interpret complex financial scenarios effectively.

The following concepts are essential for success and should be thoroughly reviewed before the assessment:

- Financial Statements – Understanding the structure and purpose of balance sheets, income statements, and cash flow statements is vital. These documents provide a snapshot of a company’s financial health.

- Cost Behavior – Be familiar with how costs behave in response to changes in production levels, including fixed, variable, and mixed costs.

- Break-even Analysis – Master the techniques for determining the break-even point, which is the level of sales at which total revenues equal total costs.

- Depreciation Methods – Know the various methods used to allocate the cost of tangible assets over their useful life, including straight-line and accelerated depreciation.

- Financial Ratios – Understand how to calculate and interpret key ratios that measure profitability, liquidity, and solvency.

- Budgeting and Forecasting – Learn different methods for preparing and adjusting budgets to predict future financial performance and allocate resources efficiently.

In addition to understanding these topics, practicing real-life examples and applying the concepts to case studies will strengthen your knowledge and problem-solving skills. Reviewing key formulas and concepts regularly will also ensure that you are well-prepared for any challenge you may encounter in the assessment.

Important Topics to Focus On

To achieve success in any financial management test, focusing on the most critical topics is essential. Concentrating your efforts on these key areas will help you tackle a wide range of questions and scenarios efficiently. These topics are foundational and frequently appear in assessments, so mastering them will significantly improve your performance.

Core Areas for Review

The following topics are vital for a comprehensive understanding of the subject matter:

- Budgeting and Forecasting – Mastering the principles of creating and adjusting budgets is essential for accurate financial planning and decision-making.

- Cost Behavior Analysis – Be able to distinguish between fixed, variable, and mixed costs and understand how they influence business decisions.

- Financial Ratios – Calculating and interpreting ratios such as liquidity, profitability, and leverage is crucial for assessing a company’s financial health.

- Capital Budgeting – Understand the methods for evaluating investment opportunities, such as net present value (NPV) and internal rate of return (IRR).

- Depreciation and Amortization – Know how to calculate and apply different methods for depreciating assets and amortizing intangible assets over time.

Additional Topics to Consider

In addition to the core concepts, review the following topics to ensure a well-rounded preparation:

- Variance Analysis – Analyze the difference between budgeted and actual figures to assess performance and identify areas for improvement.

- Break-even Analysis – Understanding how to determine the break-even point helps in making pricing and production decisions.

- Working Capital Management – Learn how to manage a company’s short-term assets and liabilities to maintain liquidity and operational efficiency.

- Financial Statement Analysis – Review how to interpret balance sheets, income statements, and cash flow statements to evaluate a company’s performance.

Focusing on these important areas will not only help you score well but also equip you with a deep understanding of essential financial principles that are widely applicable in various business contexts.

Strategies for Effective Exam Preparation

Effective preparation for a financial management assessment requires more than simply reviewing material; it involves strategic planning and active engagement with the content. The key to success lies in structuring your study time efficiently, reinforcing key concepts, and practicing problem-solving skills. With the right approach, you can maximize your performance and feel confident when facing the test.

Time Management and Study Planning

One of the first steps to effective preparation is creating a study schedule. Prioritize the topics that are most challenging or have the greatest weight in the assessment. Set aside dedicated blocks of time each day to review material, and avoid cramming the night before. Breaking your study sessions into smaller, focused intervals can help improve retention and reduce fatigue.

- Set Specific Goals – Focus on mastering one or two key concepts per session rather than trying to cover everything at once.

- Take Regular Breaks – Studies show that taking breaks improves focus and prevents burnout during long study sessions.

- Practice with Timed Quizzes – Simulate test conditions by practicing with timed quizzes to improve your speed and accuracy.

Active Learning Techniques

Active learning methods, such as summarizing, teaching, or applying concepts to real-world scenarios, can enhance understanding and retention. Simply reading through notes passively is less effective than engaging with the material through active practice.

- Work Through Practice Problems – Solving a variety of problems allows you to apply theories and formulas in different contexts, strengthening your problem-solving abilities.

- Form Study Groups – Discussing difficult concepts with peers can provide new insights and help reinforce what you’ve learned.

- Review Mistakes – Focus on understanding why an answer is wrong and how to avoid similar mistakes in the future.

By combining time management with active learning techniques, you will be better prepared and more confident when tackling your assessment.

Common Mistakes in Assessments

When preparing for a financial management assessment, avoiding common pitfalls is just as important as mastering key concepts. Many students make similar mistakes that can easily be prevented with a more careful approach. Understanding these common errors will help you approach your preparation and test-taking strategy with greater confidence.

Here are some of the most frequent mistakes to watch out for:

- Rushing Through Questions – Many students rush through questions, especially under time pressure, leading to careless errors. It’s essential to read each question carefully and understand exactly what is being asked before answering.

- Forgetting to Show Work – In subjects involving calculations, not showing your work can cost valuable points. Even if the final answer is correct, failing to demonstrate how you arrived at it may result in losing marks.

- Misinterpreting Formulas – Using the wrong formula or misunderstanding its application is a common mistake. Always double-check that you’re using the correct formula for the given problem and understand its components.

- Skipping Review Time – Many students fail to leave enough time to review their answers. Taking a few minutes at the end of the test to double-check your work can help catch any errors that you might have missed during the first pass.

- Overlooking Key Assumptions – Sometimes, it’s easy to overlook assumptions or conditions given in the question that can drastically change the way a problem should be solved. Pay close attention to any specific instructions or details that might influence your approach.

- Ignoring Units of Measurement – Whether it’s dollars, units, or percentages, always ensure that you’re using the correct units throughout your calculations. Converting or omitting units can lead to incorrect answers.

By recognizing these common mistakes, you can take proactive steps to avoid them. Careful reading, organized work, and thorough review will help you perform more accurately and confidently during your assessment.

How to Solve Problems Quickly

Solving financial problems efficiently requires a combination of understanding core concepts, practicing specific techniques, and managing time effectively during assessments. By applying certain strategies, you can reduce the amount of time spent on each problem, ensuring that you can complete the test while maintaining accuracy. These methods will help you tackle even the most complex problems with confidence and speed.

Preparation and Strategy

Before you even start solving problems, make sure you’re fully prepared by mastering the key concepts. Here’s how you can increase your speed:

- Familiarize Yourself with Common Formulas – Knowing the most frequently used formulas by heart allows you to quickly apply them without wasting time looking them up.

- Understand Problem Structure – Recognize common problem types, such as variance analysis or cash flow calculations, so you can instantly identify the right approach.

- Practice, Practice, Practice – Regularly solve practice problems to develop a quick and accurate problem-solving rhythm. The more you practice, the faster and more efficient you become.

Problem-Solving Techniques

When solving problems, apply these techniques to work more efficiently:

- Read the Problem Carefully – Take a moment to understand exactly what is being asked before jumping into calculations. This prevents costly mistakes that could take extra time to correct.

- Break the Problem into Steps – Break complex problems into smaller, manageable steps. This prevents overwhelm and ensures that each part is solved correctly.

- Use Estimation for Large Numbers – If the problem involves large figures, use estimation to quickly check if your answer makes sense before proceeding with more precise calculations.

- Skip Difficult Problems and Return Later – If you encounter a particularly challenging question, move on to the next one. This prevents you from wasting time on a single problem when you can tackle others more easily.

By implementing these strategies and practicing regularly, you can solve financial problems more quickly and accurately, giving you the best chance to succeed on your assessment.

Understanding Financial Statements for the Exam

Financial statements provide a snapshot of a company’s performance and financial position, and understanding how to analyze them is critical for success. Whether it’s interpreting profitability, liquidity, or overall financial health, mastering these statements will enable you to answer related questions with confidence. Knowing what to look for in each document allows you to assess a company’s situation and make informed decisions quickly during assessments.

Key Financial Statements to Review

The three main financial statements you will encounter are the balance sheet, income statement, and cash flow statement. Each one serves a different purpose and offers unique insights into a company’s financial status:

- Balance Sheet – This statement shows the company’s assets, liabilities, and equity at a specific point in time. Understanding how assets are financed (debt vs. equity) and the company’s overall financial position is essential.

- Income Statement – The income statement outlines the company’s revenue, expenses, and profits over a given period. Mastering this document helps in evaluating profitability and understanding cost structures.

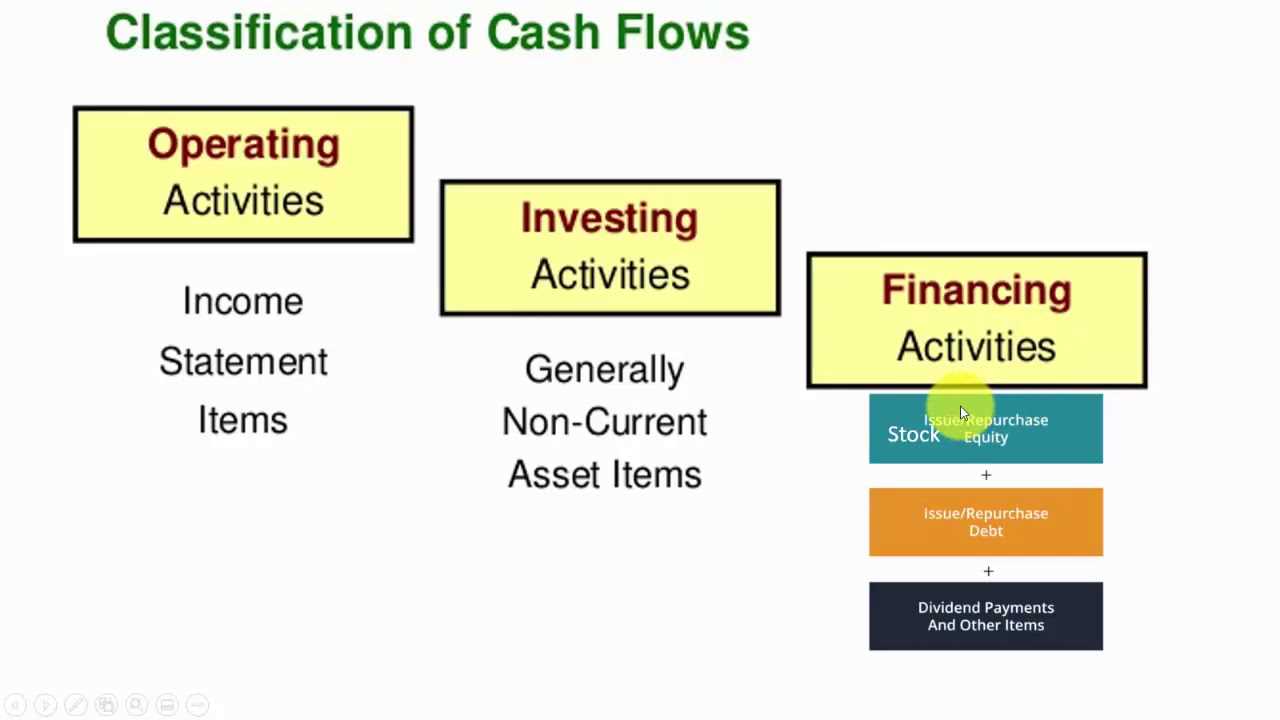

- Cash Flow Statement – This statement tracks the flow of cash in and out of the business, highlighting operational, investing, and financing activities. It’s crucial for assessing a company’s liquidity and ability to sustain operations.

How to Analyze Financial Statements

Knowing the structure of financial statements is important, but being able to analyze them effectively is the next step. Here are some tips to improve your ability to extract valuable insights:

- Focus on Key Metrics – Look for key ratios such as return on assets, profit margins, and current ratios. These will give you quick insights into the company’s performance and financial stability.

- Understand Trends – Compare financial statements over several periods to identify trends in revenue growth, profitability, and cash flow. Analyzing trends helps in understanding long-term performance.

- Compare to Industry Benchmarks – Knowing how a company performs relative to its competitors or industry standards allows you to assess its financial health more effectively.

Mastering the analysis of these financial statements is essential for tackling related questions efficiently. The better you understand them, the easier it will be to interpret the information and apply it in your assessment.

Tips for Time Management During the Exam

Effective time management during an assessment is crucial for ensuring you have enough time to complete all tasks while maintaining accuracy. Without a solid strategy, it’s easy to feel overwhelmed or rush through questions, which can lead to mistakes. Planning your time wisely allows you to work efficiently and make the most of the limited time available.

Here are some practical tips to help you manage your time effectively during your assessment:

- Prioritize the Questions – Start by quickly scanning the entire test and identifying questions you can answer easily. Tackle these first to build confidence and secure quick points. Leave more challenging questions for later.

- Allocate Time per Section – Divide the total time by the number of sections or questions to get an idea of how much time to spend on each. Stick to this allocation as closely as possible to avoid spending too long on any one part.

- Use a Timer – Keep an eye on the clock or set periodic reminders. If you’re working digitally, most devices have timers, and if it’s a paper test, glance at the clock periodically to ensure you’re on track.

- Don’t Get Stuck on One Question – If you find yourself struggling with a particular question, move on and come back to it later. Spending too much time on one question can cause unnecessary stress and prevent you from completing the rest of the test.

- Practice Under Timed Conditions – Before the assessment, simulate timed practice tests. This helps you get used to the pressure of working under a time limit and improve your pacing.

By following these tips and staying calm and focused, you’ll be able to manage your time effectively, ensuring you have enough time to carefully review and complete your answers.

What to Expect on Exam 2

During the second assessment of this course, you will encounter a range of topics designed to test your understanding and application of the material covered so far. The test will challenge you to demonstrate both theoretical knowledge and practical skills, with a focus on problem-solving and analysis. Be prepared to tackle a variety of questions, each aimed at assessing your ability to interpret data, solve problems, and apply key concepts accurately.

Expect a mix of multiple-choice, short-answer, and calculation-based questions. Some questions may require you to analyze financial scenarios and make decisions based on the data provided, while others might test your understanding of key formulas and concepts. There may also be sections that require you to explain your reasoning or describe the steps taken to arrive at your answer.

Overall, the test will be structured to assess your ability to apply what you have learned in real-world contexts, making it important to not only memorize information but also understand how to use it effectively. With adequate preparation, you will be able to approach the test with confidence and complete it successfully.

Practice Problems for Exam Success

One of the best ways to prepare for an assessment is by working through practice problems. These problems help reinforce your understanding of key concepts and give you a feel for the types of questions you might encounter. By regularly practicing different types of problems, you not only strengthen your skills but also build confidence for the actual test.

Here are some practice problem types you can focus on to maximize your success:

- Calculation-Based Problems – These problems will test your ability to apply formulas and solve numerical questions accurately. Practice solving problems that involve key calculations such as ratios, profit margins, and balance sheets.

- Scenario-Based Questions – These types of questions present a financial situation or case study, requiring you to analyze the information and make decisions based on the data. Focus on identifying relevant factors and making logical conclusions.

- Multiple-Choice Questions – Multiple-choice questions often test your ability to identify correct concepts quickly. Practice selecting the most accurate answer by reviewing both the question and all possible answers carefully.

- Conceptual Understanding – Some problems will test your grasp of fundamental principles. Practice explaining key concepts, definitions, and the reasoning behind your decisions to ensure you can articulate your understanding clearly.

Consistent practice with a variety of problem types will help ensure that you are well-prepared for your assessment. Don’t just focus on one type of problem–mix them up to improve both your technical and conceptual skills.

Common Formulas to Remember

In any field that involves financial analysis, certain formulas are essential to quickly and accurately solve problems. Understanding and memorizing these key formulas is vital for both test preparation and practical application. Whether you’re analyzing a company’s financial health or calculating various ratios, these formulas form the backbone of financial decision-making.

Here are some of the most important formulas you should be familiar with:

Basic Financial Ratios

- Profit Margin = Net Income / Revenue

- Return on Assets (ROA) = Net Income / Total Assets

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Common Costing Formulas

- Break-even Point = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

- Contribution Margin = Sales Revenue – Variable Costs

- Cost of Goods Sold (COGS) = Beginning Inventory + Purchases – Ending Inventory

Mastering these formulas will greatly improve your ability to solve related problems and interpret financial data effectively. Practicing their use will ensure that you can quickly apply them in a variety of situations, enhancing both your theoretical knowledge and practical skills.

How to Approach Multiple-Choice Questions

Multiple-choice questions often test your ability to recall information and apply concepts efficiently. While they may seem straightforward, a strategic approach is essential to maximize accuracy and minimize errors. By carefully analyzing each question and considering all the available options, you can significantly improve your chances of selecting the correct answer.

Here are some effective strategies for tackling multiple-choice questions:

- Read the Question Carefully – Always begin by reading the entire question thoroughly to ensure you understand what is being asked. Pay attention to key terms or instructions that may impact your answer, such as “not” or “always.”

- Eliminate Obviously Wrong Answers – Quickly dismiss any options that are clearly incorrect. This narrows down your choices, giving you a better chance of selecting the right answer from the remaining options.

- Look for Clues in the Question – Sometimes, the question itself contains hints that can help guide you toward the correct answer. Look for keywords or phrases that match the content you’ve studied.

- Use the Process of Elimination – If you’re unsure about the correct answer, eliminate any obviously incorrect options first. Then, compare the remaining choices to see which one fits best with the context of the question.

- Watch for Trick Questions – Be cautious of questions designed to mislead or test your attention to detail. Focus on the phrasing to avoid common pitfalls, such as assumptions or misinterpretations.

- Don’t Overthink It – Trust your first instinct, especially if you have studied well. Overthinking can lead to second-guessing and may result in errors.

By following these strategies, you’ll be able to approach multiple-choice questions with greater confidence and efficiency, allowing you to allocate more time to other parts of the test. Practicing these techniques will help you feel more prepared and comfortable during your assessments.

Exam Day Tips for Students

On the day of your assessment, it’s crucial to be well-prepared both mentally and physically. Ensuring that you’re organized, focused, and relaxed can significantly enhance your performance. Effective planning and adopting the right mindset will help you manage the stress and perform at your best.

Here are some essential tips to keep in mind for a smooth and successful day:

| Tip | Description |

|---|---|

| Get Plenty of Rest | Ensure you have a full night’s sleep before the test. Rest is essential for cognitive function and focus during the assessment. |

| Eat a Balanced Meal | Start your day with a nutritious breakfast to fuel your body and brain. Avoid heavy, greasy foods that can make you feel sluggish. |

| Arrive Early | Arriving early helps you settle in and reduces anxiety. It also gives you time to check your materials and get comfortable in the exam environment. |

| Bring Necessary Materials | Make sure to pack all required materials, such as pens, pencils, a calculator, or any other specific tools needed for the assessment. |

| Stay Calm | Take deep breaths and stay calm. Managing stress effectively can improve concentration and clarity of thought during the assessment. |

| Read Instructions Carefully | Take a few moments to read through all instructions thoroughly before you start answering questions to avoid misunderstandings. |

| Manage Your Time | Divide your time wisely across sections and questions. Don’t spend too long on any one question; move on if you’re stuck and come back later if necessary. |

By following these tips, you’ll ensure a more organized and stress-free experience on the day of the test, allowing you to focus on performing at your best. With the right preparation, you’ll be equipped to tackle the challenge with confidence and clarity.

Resources for Further Study

Expanding your knowledge and understanding of key concepts is essential for long-term success. Utilizing a variety of resources can help reinforce the material and provide different perspectives. Whether you prefer reading, watching, or engaging in interactive exercises, there are numerous options available to enhance your skills and deepen your comprehension.

Here are some valuable resources to consider for continued learning:

- Textbooks and Study Guides: Comprehensive books and specialized study guides are excellent for in-depth review and practice. They often include examples, exercises, and practice problems to help reinforce your understanding.

- Online Learning Platforms: Platforms such as Coursera, Udemy, and LinkedIn Learning offer structured courses taught by experts in the field. These platforms often provide video lessons, quizzes, and interactive tools to deepen your learning.

- Educational YouTube Channels: Many YouTube channels offer free tutorials and explanations of complex topics. Channels dedicated to financial studies and related subjects can provide step-by-step breakdowns of key concepts.

- Practice Problem Sets: Websites and apps that offer practice problems allow you to test your knowledge and improve problem-solving skills. Regular practice is one of the best ways to master any subject.

- Peer Study Groups: Studying with classmates or forming a study group can be an effective way to exchange knowledge and clarify doubts. Collaborative learning helps you view problems from different angles and solidify your understanding.

- Academic Forums and Websites: Websites such as StackExchange, Reddit, or specialized educational forums can offer support from a community of learners and professionals who can answer questions and provide helpful tips.

- Tutoring Services: If you need personalized help, hiring a tutor can be beneficial. Tutors can provide tailored guidance, focusing on areas where you need the most improvement.

By exploring these resources, you can broaden your knowledge, reinforce your learning, and feel more confident when tackling new challenges. Continuous study and review will help you build a strong foundation for future success.

Reviewing Past Papers Effectively

Reviewing previous assessments is one of the most powerful ways to prepare for future challenges. By analyzing past papers, you can identify recurring themes, question formats, and common areas of difficulty. This method helps you gain a deeper understanding of what to expect and how to approach similar questions in your future tests.

Identifying Key Patterns and Topics

When reviewing past papers, start by focusing on the types of questions that appear regularly. Take note of frequently tested topics, as these are likely to be crucial areas of study for future assessments. Understanding the types of questions–whether they focus on calculations, theory, or application–will help you prioritize your review sessions more effectively.

Practicing Under Timed Conditions

To get the most out of your review, simulate exam conditions as much as possible. Set a timer and attempt to complete past papers within the given time limit. This not only improves your time management skills but also helps you become more comfortable with the pressure of working within time constraints. By practicing under real-time conditions, you can develop strategies for handling difficult questions and ensure that you pace yourself appropriately during future assessments.

Additionally, after completing a past paper, take the time to review your answers thoroughly. Identify areas where you made mistakes and understand why you made those errors. This self-reflection will help you avoid similar mistakes in the future and solidify your understanding of key concepts.

Final Tips Before the Exam

As the day of your assessment approaches, it’s crucial to focus on the final preparations. In the last stretch of your study period, aim to solidify your understanding of key concepts, refine your time management skills, and ensure you’re mentally prepared for the challenge ahead. These final steps can significantly influence your performance, so it’s important to approach them strategically.

Last-Minute Review Strategies

Before the big day, it’s essential to prioritize what you review. Rather than attempting to learn new material, focus on revisiting key topics and concepts you’ve already studied. Here are some strategies to maximize your review time:

| Tip | Purpose |

|---|---|

| Review Summaries and Notes | Condense your study material into key points and focus on important formulas or concepts. |

| Work on Practice Problems | Focus on solving problems similar to what you expect in the test to enhance speed and accuracy. |

| Revisit Mistakes | Go over your previous mistakes to avoid repeating them during the real test. |

Physical and Mental Preparation

It’s just as important to prepare your mind and body for the test as it is to prepare academically. Ensure you get a good night’s sleep before the assessment, as rest is crucial for optimal cognitive function. On the day of the test, make sure to eat a balanced meal to fuel your body and mind, and stay hydrated. Stress can negatively impact your performance, so try relaxation techniques to maintain a calm and focused mindset.

Remember that the final moments before your test are a time to consolidate your knowledge, not cram new information. Trust in your preparation, and approach the exam with confidence and composure.