Success in any test depends on a deep understanding of the subject matter and the ability to apply that knowledge under pressure. It is crucial to approach the challenges methodically, using efficient study techniques and practicing key concepts regularly. By focusing on the most important areas, you can maximize your potential and boost your confidence.

Preparation is not just about memorizing facts, but about building a solid foundation that enables you to solve complex problems with ease. Analyzing the material from various angles and understanding the underlying principles is the key to performing well. Effective planning, time management, and consistent practice are essential components of success.

Whether tackling theory-based questions or numerical problems, approaching each task with a clear strategy can make all the difference. Focus on refining your skills, strengthening your weaknesses, and practicing with real-world examples to prepare yourself for the challenges ahead.

Preparation Tips for Success

Achieving success in any assessment requires more than just studying the material; it involves understanding the structure of the test, managing your time efficiently, and developing a clear strategy for approaching each section. By focusing on the most important topics and practicing regularly, you can increase your confidence and readiness.

Start by identifying the key areas that are most likely to appear. Review past materials and test formats to get a sense of common question types. Break down complex topics into smaller, more manageable pieces to avoid feeling overwhelmed. Consistent, focused study sessions are far more effective than cramming at the last minute.

In addition, practicing under test-like conditions can help you become familiar with time constraints and pressure. Use practice questions to simulate the actual environment and assess your performance. This will help you identify areas where you need improvement and allow you to fine-tune your strategy.

Finally, don’t underestimate the value of rest and mental preparation. A well-rested mind is far more effective than one that is fatigued. Ensure that you get enough sleep before the test day and approach the assessment with a calm, focused mindset.

Understanding Key Concepts

Grasping the core principles behind financial management and reporting is essential for success. A strong foundation in these principles allows you to tackle a wide range of scenarios and problems effectively. It is not enough to memorize definitions; understanding how and why these concepts apply in real-world situations is critical.

Focus on mastering the following essential topics:

- Financial Statements: Know how to prepare and interpret balance sheets, income statements, and cash flow statements.

- Cost Structures: Understand fixed and variable costs and how they impact profitability.

- Budgets and Forecasting: Learn how to create budgets and forecast future financial performance based on historical data.

- Break-even Analysis: Understand the point at which total revenues equal total costs and the importance of this in decision-making.

- Depreciation: Grasp the concept of asset depreciation and its impact on financial statements over time.

Mastering these concepts will give you the tools to solve complex problems and make informed decisions. Additionally, practice applying them through real-life examples and problem-solving exercises. This will help reinforce your understanding and improve your ability to think critically during assessments.

Common Mistakes to Avoid in Exams

When preparing for a challenging assessment, it’s just as important to know what not to do as it is to understand the material. Many individuals make avoidable errors that can significantly impact their performance. By being aware of these common pitfalls, you can better position yourself for success.

Overlooking Key Instructions

One of the most frequent mistakes is not carefully reading the instructions provided for each question or section. Missing critical details can lead to incorrect answers or wasted time. Pay attention to every directive, including whether you need to provide detailed explanations or simply select the correct option.

- Failing to read time limits for each section

- Misunderstanding the format of the question (e.g., multiple-choice vs. short answer)

- Ignoring special instructions such as rounding numbers or showing your work

Time Mismanagement

Time is one of the most valuable resources during any assessment. Poor time management can lead to unfinished questions or hasty, incorrect responses. It’s essential to allocate time wisely across different sections to ensure that each question receives sufficient attention.

- Spending too much time on one difficult question

- Rushing through easier questions without double-checking your work

- Failing to leave time for review at the end

Avoiding these common errors by developing a solid strategy and staying focused can dramatically improve your performance and increase your chances of achieving the results you’re aiming for.

How to Manage Time During the Test

Efficiently managing your time during a test can be the key to performing well. With a limited amount of time to complete a series of questions, prioritizing tasks and pacing yourself is essential. The ability to allocate the right amount of time to each section or question can make a significant difference in your final score.

Plan Your Time Wisely

Before diving into the questions, take a moment to assess the test format and the time you have available. Quickly determine how much time you should allocate to each section based on its complexity and weight. A clear plan will help you stay focused and avoid rushing through important sections.

- Break the test into manageable segments

- Estimate how much time each section will take

- Set a mental timer for each section

Strategies to Stay on Track

During the test, it’s important to keep track of your progress to ensure you’re staying on schedule. If you get stuck on a difficult question, don’t waste time trying to solve it immediately. Move on and come back to it later if you have time.

- Start with the easiest questions to build momentum

- Use a rough estimate of time for each section

- If stuck, skip and return later

By implementing these strategies, you can ensure that you finish the test on time, with well-thought-out responses and minimal stress. Time management is a skill that can be developed with practice, so make sure to incorporate it into your preparation routine.

Effective Study Strategies for Success

To excel in any challenging test, a well-structured study plan is crucial. Simply reviewing notes is not enough; it’s important to adopt focused, active learning methods that help retain information and improve problem-solving skills. Consistent practice and a strategic approach to studying can significantly boost performance.

One of the most effective study techniques is the use of active recall, where you actively test yourself on the material rather than passively reviewing notes. Another powerful approach is spaced repetition, which helps reinforce memory retention over time. Incorporating these methods into your routine can maximize your understanding and retention of key concepts.

Study Schedule and Focus Areas

Creating a study schedule ensures that you cover all necessary topics without feeling overwhelmed. Prioritize areas where you need the most improvement and allocate more time to them. Here’s a sample study plan for a balanced approach:

| Study Topic | Time Allocation | Method |

|---|---|---|

| Basic Concepts | 30 minutes | Active Recall |

| Problem-Solving Techniques | 45 minutes | Practice Questions |

| Complex Topics | 60 minutes | Spaced Repetition |

| Review and Revision | 30 minutes | Self-Testing |

By sticking to a study schedule and consistently practicing the material, you can significantly improve your comprehension and problem-solving abilities. Tailor the schedule to fit your needs, and always remember that quality is more important than quantity when it comes to studying effectively.

Top Resources for Success

Utilizing the right resources can significantly enhance your preparation and boost your confidence before a challenging test. From textbooks and online tutorials to practice materials and study groups, selecting the most effective tools can make all the difference in achieving your desired results. A combination of high-quality resources can provide the knowledge, practice, and insight needed to excel.

Here are some top resources to consider for your preparation:

- Online Tutorials and Video Lessons: Platforms like YouTube and educational websites offer step-by-step lessons and visual explanations for complex topics. These can help clarify difficult concepts and provide alternative explanations to what you may have learned in class.

- Practice Problem Databases: Websites offering practice questions and mock tests are invaluable. They allow you to test your understanding under exam conditions and identify areas where you need improvement.

- Textbooks and Study Guides: A comprehensive study guide or textbook tailored to the specific content being tested can provide clear explanations and numerous examples to help reinforce your understanding.

- Peer Study Groups: Collaborating with classmates or study partners can be an excellent way to clarify difficult topics. Group discussions allow you to learn from different perspectives and can also help you stay motivated.

- Flashcards and Mobile Apps: Flashcards are a great tool for memorizing key concepts, terms, and formulas. Mobile apps can help you test yourself on the go, making it easier to study during short breaks or while commuting.

By incorporating a variety of resources into your study routine, you can strengthen your understanding, practice effectively, and stay engaged throughout the preparation process. Choose the resources that align with your learning style and make the most out of each one.

Practice Questions for Success

One of the most effective ways to prepare for any assessment is by actively testing yourself with practice questions. These questions not only reinforce your understanding of the material but also help familiarize you with the format and types of problems you may encounter. Regular practice ensures that you become more comfortable with the material and boosts your confidence for the actual test.

Here are some sample questions to test your knowledge and enhance your preparation:

- Question 1: What is the difference between fixed and variable costs, and how do they affect profitability?

- Question 2: Calculate the break-even point given the following: fixed costs = $10,000, selling price per unit = $50, and variable cost per unit = $30.

- Question 3: Explain the purpose of a balance sheet and what key information it provides about a company’s financial health.

- Question 4: How do depreciation and amortization impact the income statement and cash flow statement?

- Question 5: What is the significance of cash flow in evaluating a company’s performance, and how do operating, investing, and financing activities affect it?

By practicing these types of questions, you can identify areas where you need to improve and refine your understanding of key concepts. Be sure to review your answers critically and seek explanations for any areas of uncertainty. Consistent practice is a powerful tool in building mastery and increasing your chances of success.

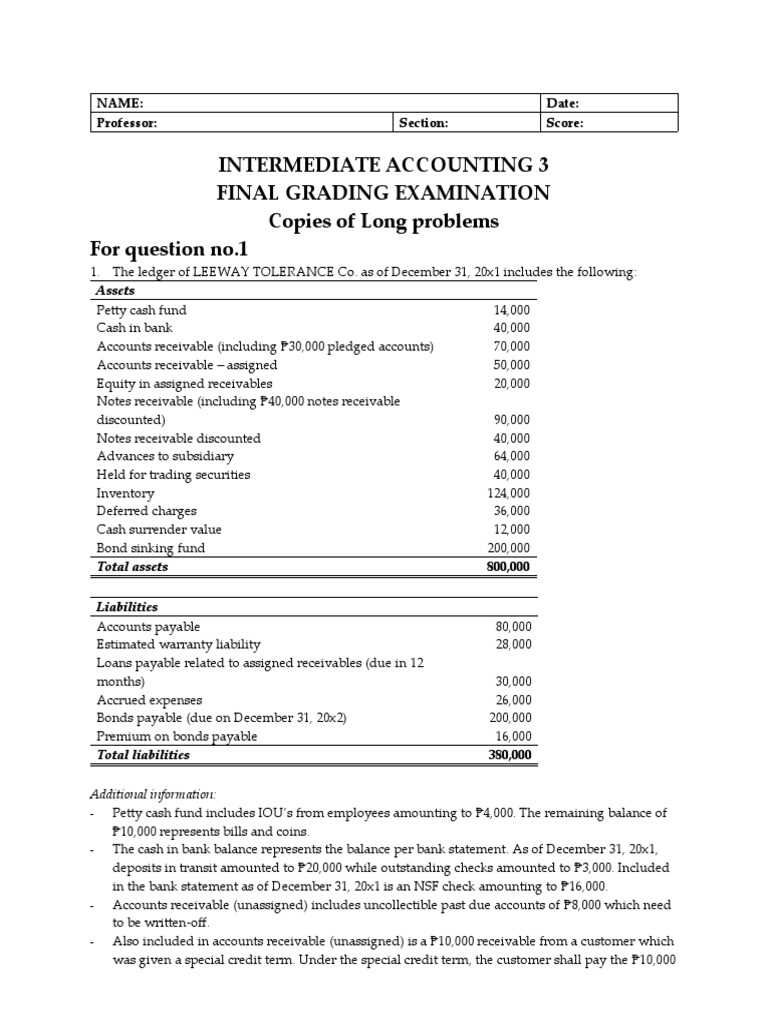

How to Analyze Financial Statements

Understanding and analyzing financial reports is essential for evaluating a company’s performance and making informed decisions. These documents provide valuable insights into a business’s profitability, financial health, and operational efficiency. By mastering the key components of financial statements, you can assess the overall well-being of an organization and identify potential areas for improvement.

Key Components of Financial Statements

Financial statements typically include three primary documents: the income statement, the balance sheet, and the cash flow statement. Each offers unique insights into different aspects of a company’s finances. The income statement shows how well the company performs over a period of time, the balance sheet outlines the company’s financial position at a specific point, and the cash flow statement tracks the movement of cash in and out of the business.

| Document | Purpose | Key Metrics |

|---|---|---|

| Income Statement | Shows profitability over a period | Revenue, Net Income, Gross Profit |

| Balance Sheet | Shows financial position at a point in time | Assets, Liabilities, Equity |

| Cash Flow Statement | Tracks cash inflows and outflows | Operating Activities, Investing Activities, Financing Activities |

Analyzing Key Ratios

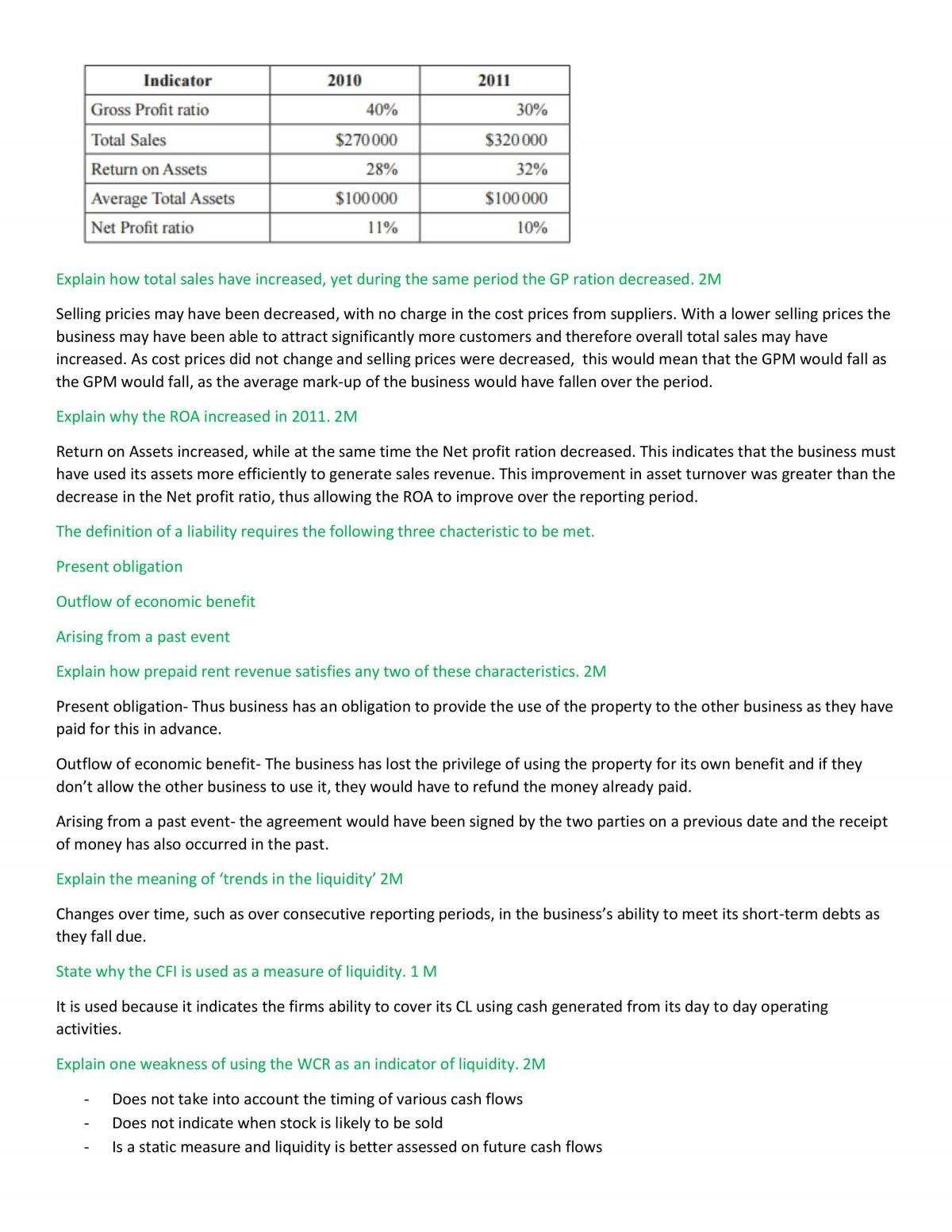

To gain deeper insights, it’s essential to calculate and analyze financial ratios derived from these statements. These ratios provide a more refined understanding of the company’s performance, liquidity, profitability, and efficiency. Some common ratios include:

- Profitability Ratios: Measure a company’s ability to generate profit relative to its revenue or assets. Example: Net Profit Margin.

- Liquidity Ratios: Indicate a company’s ability to meet its short-term financial obligations. Example: Current Ratio.

- Leverage Ratios: Assess a company’s debt levels and its ability to meet long-term obligations. Example: Debt-to-Equity Ratio.

By analyzing these components and ratios, you can make more informed assessments about a company’s financial stability and performance. Understanding these reports is a critical skill for anyone involved in business decision-making or investment analysis.

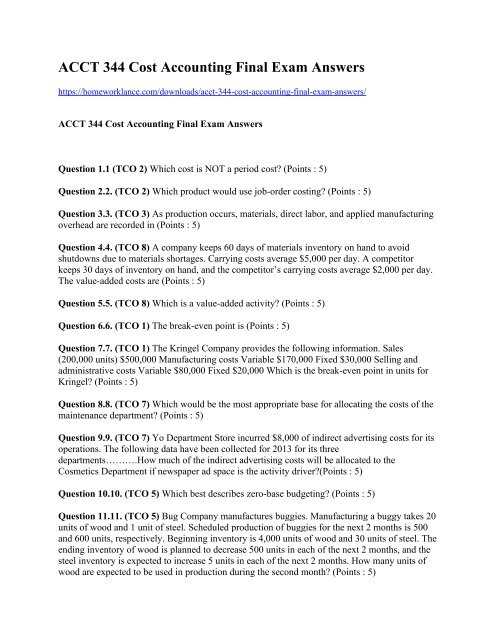

Understanding Cost Accounting for Success

Cost analysis plays a vital role in understanding how expenses affect overall performance. It provides a framework for determining how costs are assigned to different products, services, or departments within an organization. Mastering cost-related concepts is essential for evaluating efficiency, profitability, and financial sustainability in any business setting. By understanding these principles, you can better approach related problems and apply the concepts in various scenarios.

Key Cost Components

There are several types of costs that businesses track and allocate to ensure accurate financial reporting and decision-making. These costs can be categorized into direct and indirect costs:

- Direct Costs: Expenses directly tied to the production of goods or services, such as raw materials or labor costs.

- Indirect Costs: Costs that are not directly tied to production but are necessary for operations, such as utilities, rent, and administrative salaries.

- Fixed Costs: Costs that remain constant regardless of production volume, such as rent or insurance.

- Variable Costs: Expenses that fluctuate with production levels, like raw materials or commission-based wages.

Cost Allocation Methods

Proper cost allocation is crucial for accurate pricing, budgeting, and profitability analysis. Several methods can be used to allocate costs, including:

- Job Order Costing: Used for businesses that produce custom products, this method assigns costs to specific jobs or orders.

- Process Costing: Suitable for companies that produce large quantities of identical products, this method averages costs over all units produced during a period.

- Activity-Based Costing: Allocates costs based on the activities that drive expenses, providing a more accurate cost allocation method for complex operations.

By understanding these core concepts, you will be better equipped to solve problems related to cost management, analyze financial data, and make more informed decisions in both real-world and test situations.

Key Formulas You Must Memorize

Understanding essential formulas is a fundamental aspect of preparing for any financial assessment. These formulas provide the foundation for solving various problems related to costs, profits, and performance. By memorizing key equations, you’ll be able to quickly apply them to different scenarios and improve your efficiency during tests and real-world analysis.

Profitability and Efficiency Formulas

- Gross Profit Margin: Gross Profit / Revenue × 100 – Measures the percentage of revenue that exceeds the cost of goods sold.

- Net Profit Margin: Net Income / Revenue × 100 – Shows the percentage of revenue that remains as profit after all expenses are deducted.

- Return on Investment (ROI): Net Profit / Cost of Investment × 100 – Assesses the profitability relative to the cost of the investment.

Cost and Break-even Formulas

- Break-even Point (Units): Fixed Costs / (Selling Price per Unit – Variable Cost per Unit) – Determines the number of units needed to cover all costs.

- Contribution Margin: Sales Revenue – Variable Costs – Represents the portion of sales revenue that contributes to fixed costs and profit.

- Contribution Margin Ratio: Contribution Margin / Sales Revenue × 100 – Expresses the contribution margin as a percentage of sales revenue.

Liquidity and Solvency Formulas

- Current Ratio: Current Assets / Current Liabilities – Evaluates a company’s ability to pay short-term obligations.

- Quick Ratio (Acid-Test Ratio): (Current Assets – Inventory) / Current Liabilities – A more stringent measure of liquidity that excludes inventory.

- Debt-to-Equity Ratio: Total Liabilities / Shareholders’ Equity – Measures the company’s leverage by comparing debt to equity.

By mastering these key formulas, you will gain the confidence to tackle problems related to costs, profitability, and financial stability. These equations are essential tools in navigating any financial analysis, whether in academic assessments or professional practice.

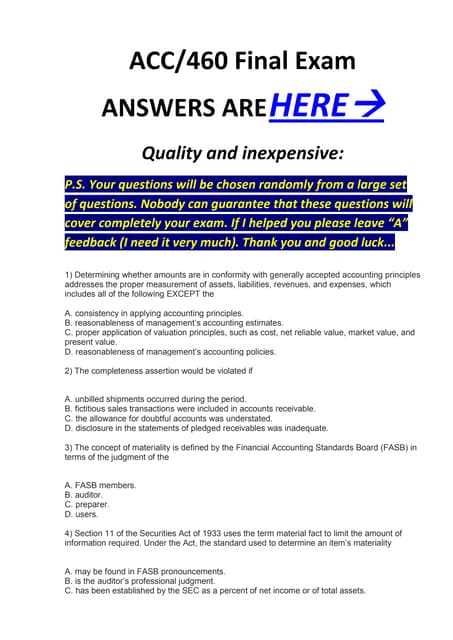

Reviewing Past Exams for Insights

Looking back at previous assessments is an invaluable strategy for improving future performance. By analyzing past tests, you can uncover recurring themes, identify commonly tested topics, and understand the types of questions typically asked. This review process helps you gauge the areas where you might need further study and reinforces the skills needed to answer similar questions in the future.

When revisiting past assessments, it’s important to focus on the following key aspects:

- Question Patterns: Identifying trends in how questions are framed and what key concepts they focus on can help you anticipate what might appear in future tests.

- Areas of Weakness: Reviewing mistakes made in prior assessments allows you to pinpoint gaps in knowledge or areas of confusion that need more attention.

- Time Management: Analyzing how long you took to complete each section provides valuable insight into how to allocate time more efficiently during future assessments.

In addition to reviewing mistakes, it’s helpful to consider the format and structure of past questions. This can guide your preparation by allowing you to practice answering questions that are likely to appear in a similar form.

By consistently reviewing past assessments, you can gain confidence, improve your problem-solving abilities, and develop a more strategic approach to approaching future challenges.

Tips for Answering Multiple-Choice Questions

Multiple-choice questions are a common format in many assessments, offering a set of possible answers from which the correct one must be chosen. These questions are designed to test your understanding and ability to apply knowledge in different scenarios. Developing effective strategies for answering them can help increase your accuracy and boost your confidence when tackling this type of question.

Approach the Question Strategically

- Read Carefully: Ensure you understand the question fully before jumping to the options. Pay attention to key words like “not,” “always,” or “except” that may change the meaning of the question.

- Eliminate Wrong Choices: If you’re unsure, rule out the obviously incorrect answers. Narrowing down the options increases your chances of choosing the right one.

- Look for Keywords: Certain phrases or terms in the question can point to the correct answer. Look for clues in the wording that match concepts you’ve studied.

How to Manage Your Time

- Don’t Overthink: If you know the answer immediately, choose it. Spending too much time on one question can reduce the time available for others.

- Skip and Return: If you’re unsure, move on to the next question and return to the difficult one later. This ensures you answer the easier questions first.

- Keep Track of Time: Ensure that you allocate enough time to review your answers, especially when time is limited. Set small time goals for each section.

By following these strategies, you can effectively navigate multiple-choice questions, increase your accuracy, and improve your overall performance. Practicing these techniques will make you more comfortable with this question format and help you approach them with greater ease.

How to Handle Exam Stress

Stress is a common response when preparing for or taking assessments, and it can negatively impact both your performance and well-being. However, by understanding the causes of stress and implementing effective strategies, you can minimize its effects and approach your tests with confidence and clarity.

Identifying the Sources of Stress

Recognizing the factors that contribute to your stress is the first step in managing it. Common causes include:

- Time Pressure: Tight deadlines and the fear of not having enough time to review material can cause anxiety.

- Lack of Preparation: Feeling unprepared for a test can create overwhelming stress.

- High Expectations: Pressure to perform well, whether self-imposed or from external sources, can elevate stress levels.

Effective Stress-Management Techniques

Once you’ve identified the sources, here are some ways to reduce stress and maintain focus:

- Stay Organized: Break down your study schedule into manageable blocks of time. Prioritize tasks and avoid cramming.

- Practice Relaxation Techniques: Deep breathing, meditation, or even short breaks during study sessions can help reduce stress and improve focus.

- Stay Positive: Cultivate a positive mindset by reminding yourself of your preparation and past successes.

Maintaining a Balanced Lifestyle

It’s important to look after both your mind and body. Make sure to:

| Activity | Benefits |

|---|---|

| Regular Exercise | Reduces anxiety and increases focus and energy levels. |

| Healthy Diet | Supports cognitive function and helps maintain energy throughout the day. |

| Enough Sleep | Restores mental clarity and reduces the likelihood of burnout. |

By integrating these strategies into your routine, you can reduce stress, improve performance, and approach assessments with a calm, focused mindset. The key is balance–ensuring that you are mentally and physically prepared without overwhelming yourself.

Importance of Reviewing Instructions

Before diving into any assessment, it’s crucial to take the time to carefully review the guidelines provided. Many students rush through this step, focusing more on the content than the structure, which can lead to missed opportunities or misunderstandings that negatively affect their performance. Understanding the specific requirements and instructions can make a significant difference in how you approach the test, saving you time and effort in the long run.

Understanding the Format and Requirements

Clear instructions outline how the questions should be answered, the time limits, and any additional materials needed. Reviewing these details can help you avoid common mistakes:

- Question Format: Identifying whether the assessment consists of multiple-choice, true/false, short-answer, or essay questions can help you allocate your time effectively.

- Special Instructions: Some questions may have specific rules, such as selecting the most accurate answer or providing evidence for your response. Misinterpreting these can cost valuable points.

- Time Management: Knowing how much time is allotted for each section allows you to pace yourself and ensures you have enough time to complete everything.

Minimizing Mistakes and Maximizing Efficiency

Failing to review instructions can result in simple but costly mistakes. For example, skipping a question because you misunderstood the requirement or miscounting your answers can cause unnecessary stress. By thoroughly reading the guidelines, you ensure that you’re following the assessment’s structure and that your responses meet all the expectations. This proactive approach not only saves time but also boosts your overall confidence.

Ultimately, reviewing instructions is an easy yet effective way to maximize your performance and minimize the chance of making avoidable errors. It is an essential habit that pays off during any test or assessment process.

How to Tackle Calculation-Based Questions

When faced with problems requiring numerical analysis, it’s essential to approach them methodically to ensure accuracy. These questions often seem daunting at first, but with the right strategy, you can solve them with confidence. The key is to break down the problem into manageable steps, carefully follow the formulas, and avoid rushing through calculations.

Step-by-Step Problem Solving

To ensure that you tackle each question correctly, follow these steps:

- Read the Problem Carefully: Make sure you understand what’s being asked before starting any calculations. Identify the key information and what needs to be calculated.

- Identify the Correct Formula: Recall the appropriate formula or method for solving the problem. If necessary, write down the formula to avoid confusion during the calculation process.

- Work through the Calculation: Perform each step of the calculation slowly and carefully, double-checking each part before moving on to the next.

- Check Your Answer: After completing the calculation, review the answer to ensure that it makes sense in the context of the problem. A quick check can often catch small errors.

Common Pitfalls to Avoid

There are several common mistakes that can occur when solving numerical problems, and it’s crucial to stay mindful of them:

- Forgetting Units: Always pay attention to units (e.g., dollars, percentages, quantities) and ensure consistency throughout the problem.

- Skipping Steps: Rushing through calculations without showing intermediate steps can lead to mistakes. Keep track of each part of the process.

- Misinterpreting Data: Ensure that you’re using the correct data in your calculations. Double-check values before using them in formulas.

By following these strategies and being vigilant about potential errors, you can effectively tackle calculation-based questions and increase your chances of achieving the correct results. Confidence and precision are key when dealing with numbers.

Focus Areas for Accounting Exam 3

To succeed in assessments that require numerical analysis and financial concepts, it is important to identify and concentrate on the most critical areas. These sections of the syllabus tend to form the foundation of many problems, and a thorough understanding will significantly enhance your ability to answer complex questions accurately. Focusing on the right topics not only helps in efficient preparation but also improves your overall performance during the test.

Key Topics to Master

There are several fundamental areas that require special attention, as they are frequently tested in assessments:

- Financial Statements: Understanding how to prepare, interpret, and analyze balance sheets, income statements, and cash flow statements is crucial. These documents form the backbone of most questions.

- Cost Analysis: Grasping the concepts behind cost behavior, cost allocation, and budgeting is vital. These areas are often involved in problem-solving tasks.

- Ratios and Metrics: Being familiar with key financial ratios such as profitability, liquidity, and efficiency ratios will help in assessing the financial health of a business.

- Break-Even Analysis: Knowing how to calculate and interpret break-even points can aid in solving real-world financial problems.

Advanced Topics for Deep Dive

For more complex scenarios, a deeper understanding of advanced topics will set you apart:

- Variance Analysis: Mastering how to calculate and interpret variances for materials, labor, and overhead is important for understanding performance differences.

- Investment Appraisal: Familiarity with methods like Net Present Value (NPV) and Internal Rate of Return (IRR) is essential for assessing the value of investment opportunities.

- Cost-Volume-Profit Analysis: Knowing how changes in cost structures affect profit margins and decision-making is key for tackling dynamic scenarios.

By concentrating your efforts on these essential areas, you can optimize your preparation and confidently approach the test. Reviewing past materials and focusing on these core topics will provide a solid foundation for addressing both fundamental and advanced questions.

Post-Assessment Review and Reflection

After completing any evaluation, taking time to reflect on your performance is essential for personal and academic growth. A thorough review allows you to identify areas of improvement, recognize patterns in your responses, and solidify your understanding of the material. This reflection process helps to refine your approach, making you better prepared for future challenges.

By systematically analyzing your work after an assessment, you gain valuable insights into where things went well and where adjustments are needed. This process not only enhances your learning experience but also helps you develop a more strategic mindset for tackling similar tasks moving forward.

Key Steps for Post-Assessment Review

To make the most of your post-assessment review, follow these important steps:

| Step | Action |

|---|---|

| 1. Review Incorrect Responses | Carefully examine any mistakes made during the assessment. Understand the reasoning behind the correct answers and compare them with your responses to learn from your errors. |

| 2. Identify Recurrent Themes | Look for common areas where mistakes occurred. This could indicate gaps in your understanding or the need for more focused preparation on specific topics. |

| 3. Highlight Strengths | Recognize the sections or topics where you performed well. Acknowledging your strengths boosts confidence and helps solidify your grasp on the material. |

| 4. Set Improvement Goals | Based on your analysis, set clear, achievable goals for improvement. Focus on areas that require more attention and plan actionable steps to address them in your future studies. |

Incorporating regular review and reflection into your study routine will not only enhance your understanding of the material but also improve your ability to approach similar tasks with greater efficiency and confidence in the future.