Preparing for an important test in the field of finance requires a strong understanding of key principles and the ability to apply them in various scenarios. Whether you’re tackling problem-solving questions or analyzing complex data, developing the right approach can make a significant difference in your performance.

Clear strategies are essential for handling different types of challenges, from numerical calculations to written explanations. Practicing common types of questions and understanding the underlying concepts will help you respond confidently and accurately under time pressure.

In this section, we will explore techniques to enhance your preparation, offering tips and insights that will equip you to tackle various tasks effectively. With the right mindset and tools, you can approach your test with clarity and focus.

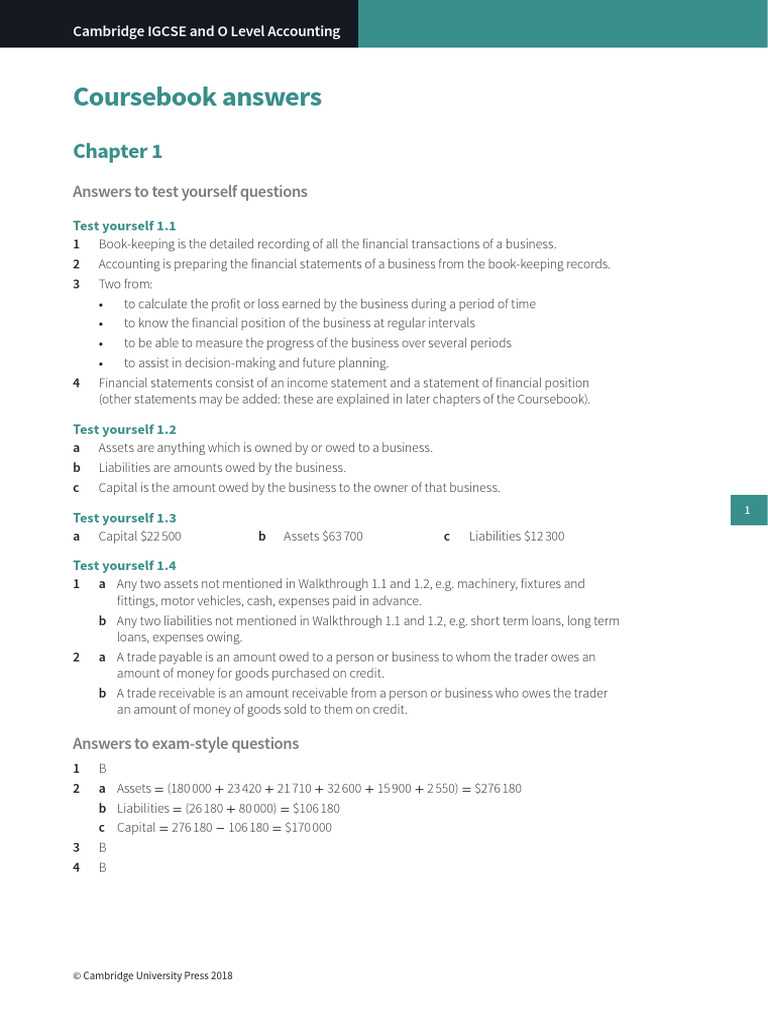

Comprehensive Guide to Accounting Exam Answers

Successfully navigating a challenging test in the finance field requires more than just memorizing facts. It involves understanding core principles, developing strong analytical skills, and applying your knowledge effectively under pressure. This section aims to equip you with essential techniques to approach a wide range of questions with confidence and clarity.

Clear structure and logical thinking are key when responding to questions. Whether you are solving numerical problems or providing detailed explanations, organizing your thoughts is crucial. Break down each problem into manageable parts, ensuring that each step follows a logical progression.

Preparation is critical when dealing with complex scenarios. Practicing various problem types and reviewing previous materials will enhance your ability to identify patterns and quickly tackle unfamiliar situations. Keep in mind that understanding the theory behind each question will help you craft more accurate and thoughtful responses.

By mastering these techniques, you’ll not only improve your performance but also reduce the stress associated with high-pressure tests. With the right strategies in place, you will approach each question with confidence, increasing your chances of success.

Understanding Key Accounting Concepts

Grasping fundamental principles is essential for tackling any finance-related test. These core ideas serve as the foundation for solving complex problems and making informed decisions. A solid understanding allows you to apply theory to practical scenarios, ensuring that you can approach each task with clarity and precision.

Key principles such as financial reporting, budgeting, and cost management form the backbone of any analysis. Each concept has its unique set of rules and methodologies that guide the way information is recorded, interpreted, and communicated. Mastering these ideas will not only improve your problem-solving skills but also help you make well-informed judgments in various situations.

By focusing on the critical components and their interrelationships, you can build a deeper comprehension of the material. This approach helps in addressing questions accurately and efficiently, ultimately leading to more successful outcomes.

How to Tackle Accounting Exam Questions

Approaching questions effectively is a key factor in achieving success during any assessment. Whether faced with numerical problems or theoretical inquiries, a systematic approach helps to ensure that each task is handled efficiently and accurately. Developing a strategy allows you to stay focused and maximize your performance within the given time constraints.

Start by carefully reading each question to identify its key components. Break the problem down into smaller parts, addressing each aspect separately before piecing them together for a complete solution. This method ensures that you don’t overlook important details and that your response remains clear and structured.

Additionally, practice makes perfect. The more familiar you become with different types of problems, the quicker you can recognize patterns and apply the correct techniques. Consistent practice not only helps reinforce your knowledge but also builds confidence, allowing you to tackle each question with ease.

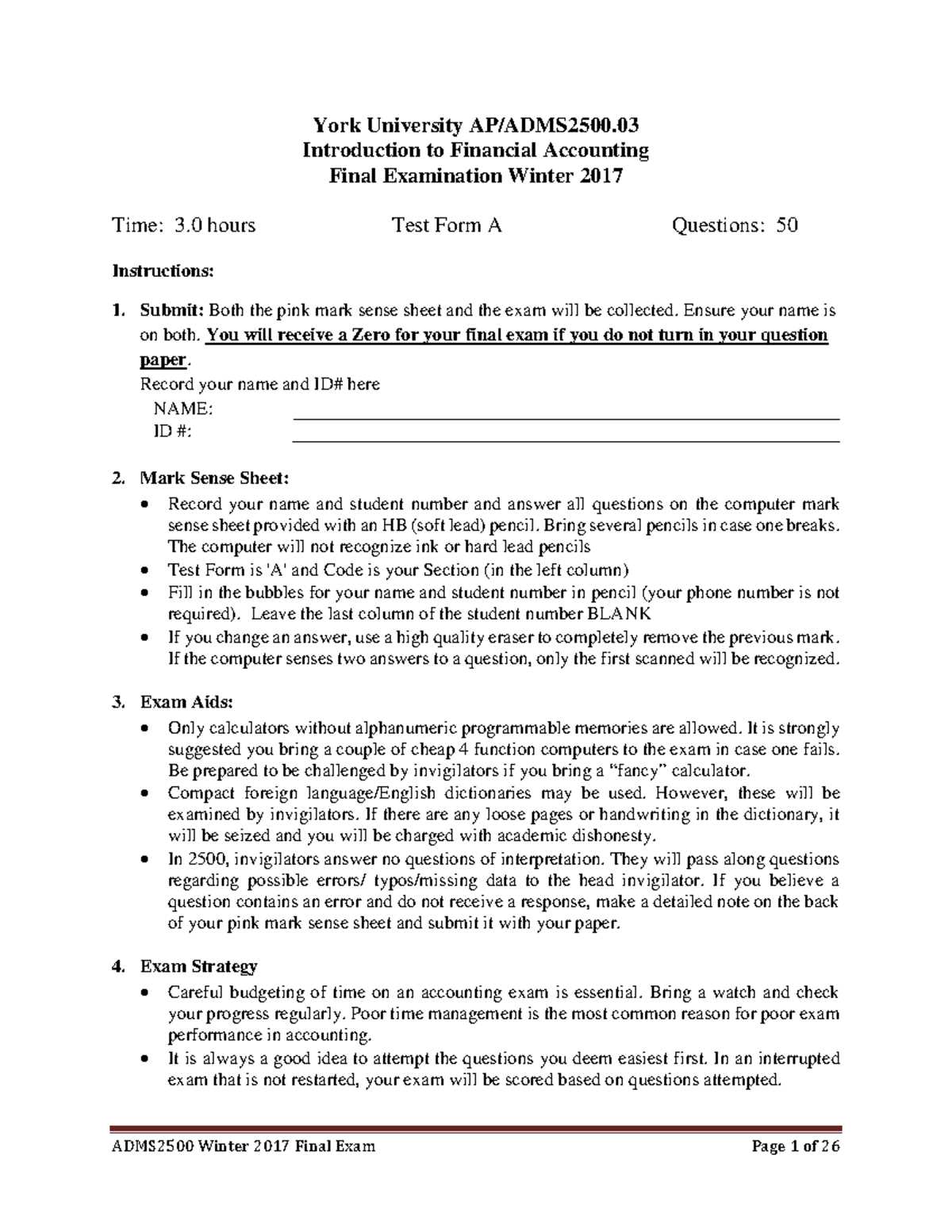

Time Management Tips for Accounting Exams

Effective time management is crucial when preparing for and taking any challenging test. With a limited amount of time, it is essential to prioritize tasks and approach each section strategically. A well-planned approach ensures that you allocate enough time for every question, reducing stress and maximizing performance.

One key strategy is to allocate time based on difficulty. Start by quickly assessing the complexity of each task. Spend more time on the challenging ones, but avoid getting stuck for too long. If you’re unsure about a particular question, move on and return to it later if time permits.

Another useful tip is to practice under timed conditions. Simulating real test scenarios helps you get accustomed to working under pressure. This allows you to refine your ability to pace yourself, ensuring you don’t rush through simple tasks or overthink more complex ones.

Common Accounting Problems and Solutions

In the world of finance, certain issues frequently arise during assessments that can challenge even the most prepared individuals. Recognizing these common problems and understanding how to address them can significantly improve your problem-solving abilities. Below, we highlight some of the most encountered issues and provide effective solutions to tackle them.

| Problem | Solution |

|---|---|

| Incorrectly balancing financial statements | Review each step carefully, ensuring all entries are accurate. Double-check for missing or duplicated items that may cause discrepancies. |

| Misunderstanding depreciation methods | Understand the difference between straight-line and declining balance depreciation. Always apply the correct formula depending on the given scenario. |

| Inaccurate cost allocation | Ensure proper classification of fixed and variable costs, and apply cost allocation methods that match the nature of the expenses. |

| Difficulty with ratio analysis | Familiarize yourself with key ratios, such as liquidity and profitability. Practice applying them to sample scenarios to improve efficiency. |

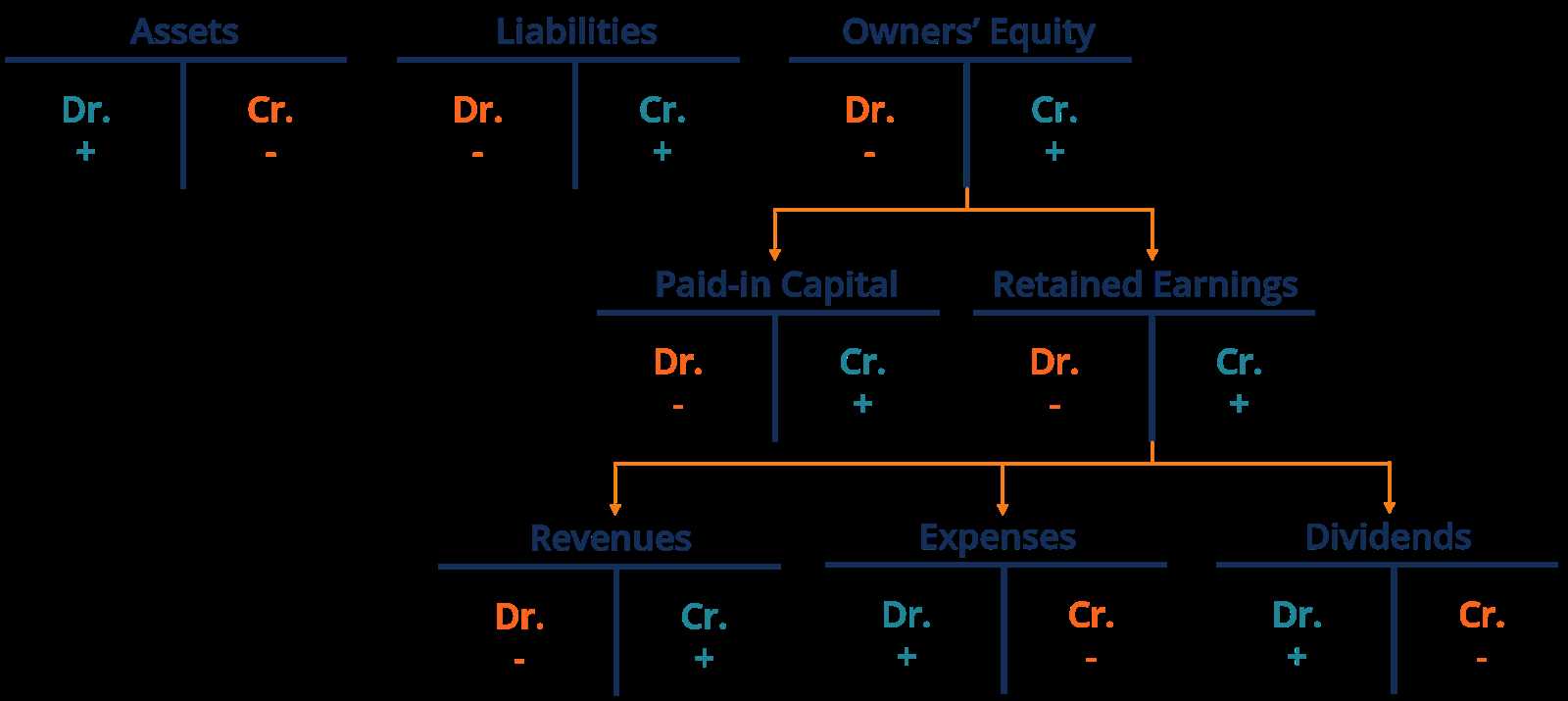

| Errors in journal entries | Ensure that every transaction is recorded correctly, with proper debits and credits. Revisit the accounting equation to confirm balance. |

Effective Study Techniques for Accountants

Mastering the core principles of finance requires more than just reading through materials. Successful preparation involves strategic methods that enhance comprehension and retention. By using proven techniques, you can optimize your study sessions and build a strong foundation for tackling complex topics.

One key approach is active learning, which encourages you to engage with the material rather than passively reading. Try solving practice problems, teaching the concepts to others, or summarizing key points in your own words. This helps reinforce understanding and solidifies memory.

Additionally, breaking study sessions into focused intervals can improve concentration and productivity. Using techniques like the Pomodoro method, which involves working for 25 minutes followed by a 5-minute break, helps maintain focus and reduces burnout.

Lastly, consistent review is essential for long-term retention. Regularly revisiting topics ensures that you don’t forget important details and allows you to recognize patterns that can make problem-solving easier during assessments.

Mastering Balance Sheets in Exams

Understanding how to prepare and analyze financial statements is a critical skill that can significantly impact your success in assessments. Mastery of these documents involves knowing the structure, the relationship between components, and how to apply this knowledge under timed conditions. A clear understanding of assets, liabilities, and equity is crucial for solving related problems with precision.

| Component | Description | Example |

|---|---|---|

| Assets | Resources owned by the entity, which have value. | Cash, accounts receivable, inventory |

| Liabilities | Obligations or debts owed to others. | Loans, accounts payable, mortgages |

| Equity | The ownership interest in the entity after liabilities are subtracted from assets. | Common stock, retained earnings |

To efficiently manage time and reduce mistakes during assessments, focus on the structure of these components. Understand how each element interacts and affects the overall financial position. Practicing the preparation of balance sheets with different scenarios helps reinforce your ability to answer questions quickly and accurately.

Key Formulas You Need to Know

To succeed in financial assessments, it’s essential to have a firm grasp of key mathematical formulas that are used to analyze and solve problems. These formulas provide the foundation for determining the health of a business, understanding profitability, and evaluating efficiency. Mastering these equations will allow you to approach questions with confidence and precision.

1. Basic Profitability Formula:

Net Profit = Revenue – Expenses

This formula helps determine the overall profitability of an entity by subtracting total expenses from total revenue.

2. Liquidity Ratio:

Current Ratio = Current Assets / Current Liabilities

This equation measures an entity’s ability to pay short-term obligations and provides insight into liquidity strength.

3. Return on Investment (ROI):

ROI = (Net Profit / Investment) x 100

This formula calculates the return generated on investments, expressed as a percentage, which helps evaluate the profitability of specific investments.

4. Debt to Equity Ratio:

Debt to Equity Ratio = Total Liabilities / Total Equity

This ratio assesses the financial leverage of an entity, showing the proportion of debt used to finance assets.

By understanding these key formulas, you can quickly apply them to solve various problems and enhance your analytical skills, making them an essential part of any financial assessment preparation.

How to Analyze Financial Statements

Analyzing financial records is an essential skill for understanding a company’s economic condition and making informed decisions. By breaking down these documents, you can evaluate profitability, liquidity, and solvency. The key to effective analysis is recognizing the important metrics and how they relate to one another.

Here’s a step-by-step approach to analyzing financial records:

- Examine the Income Statement: This document shows the company’s performance over a specific period. Focus on:

- Revenue trends

- Operating expenses

- Net profit margins

- Review the Balance Sheet: Assess the company’s financial position by looking at:

- Assets: Both current and non-current

- Liabilities: Current and long-term obligations

- Equity: Shareholder’s stake in the company

- Analyze Cash Flow Statements: This statement provides insights into the company’s liquidity. Look for:

- Operating cash flow: Indicates the health of the core business

- Investing cash flow: Reflects on investments made or sold

- Financing cash flow: Shows how the company raises funds

- Evaluate Key Ratios: Financial ratios give insights into the company’s performance and financial health. Important ratios to check include:

- Liquidity ratios (e.g., current ratio)

- Profitability ratios (e.g., return on assets)

- Leverage ratios (e.g., debt-to-equity ratio)

By systematically analyzing these statements and ratios, you gain a clearer understanding of the organization’s financial strength, helping you make data-driven decisions.

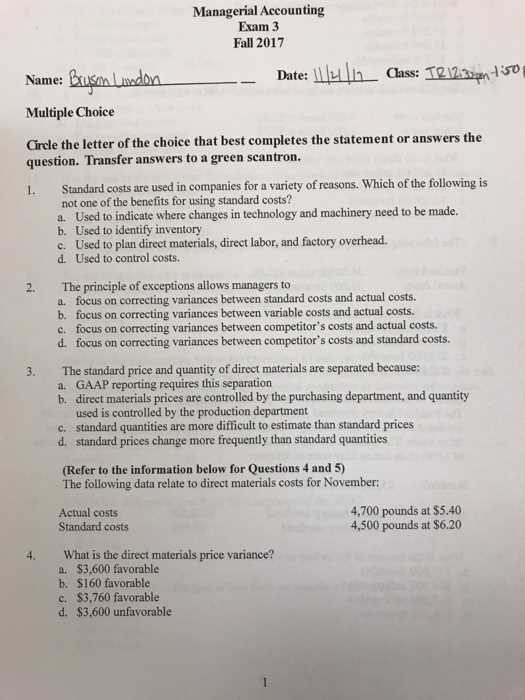

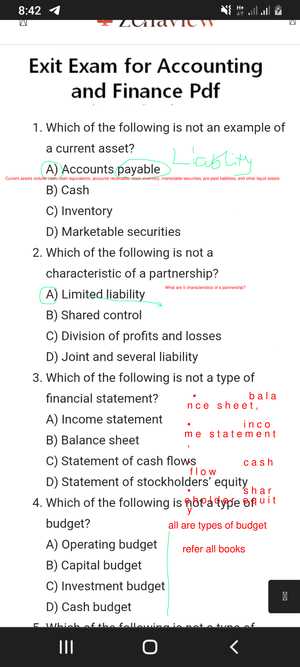

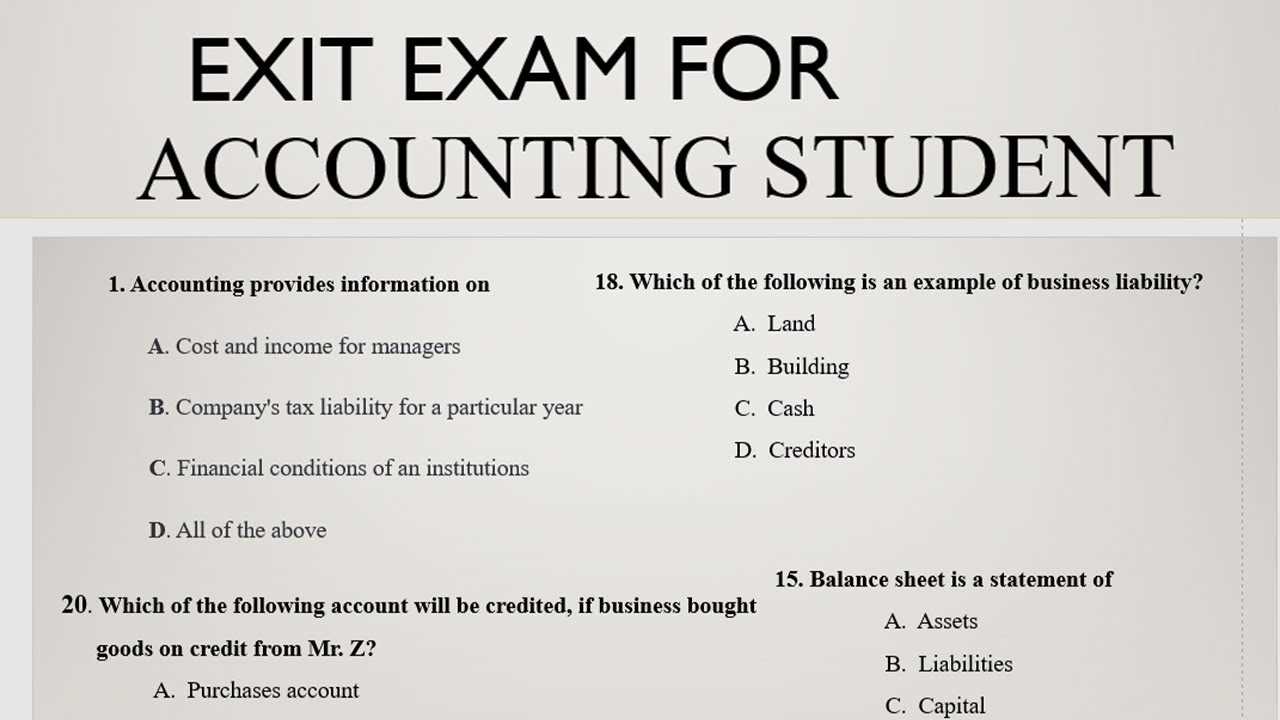

Preparing for Multiple Choice Questions

When faced with multiple-choice questions, the ability to quickly identify the correct option relies on solid preparation and effective strategies. These questions test both your knowledge and your ability to apply concepts accurately in a short amount of time.

Here are some key strategies to improve your performance on multiple-choice assessments:

- Review Core Concepts: Make sure you have a strong understanding of the fundamental principles. Focus on areas that are commonly tested, such as:

- Key formulas and definitions

- Common concepts and their applications

- Identifying patterns in questions

- Practice with Sample Questions: The more you practice, the better you will become at recognizing the structure and types of questions. Try to:

- Use practice tests to familiarize yourself with question formats

- Analyze the reasoning behind correct and incorrect answers

- Eliminate Clearly Wrong Options: When unsure of the answer, start by eliminating the choices that are clearly incorrect. This increases your chances of selecting the right answer from the remaining options.

- Focus on Keywords: Pay attention to specific words in the question and answer choices, such as “always,” “never,” or “most likely.” These can often give clues about the correct response.

- Time Management: Don’t spend too much time on one question. If unsure, move on and come back later if necessary. Managing your time ensures you can answer all questions without rushing at the end.

By employing these strategies, you can approach multiple-choice questions with greater confidence and improve your overall performance.

How to Write Clear Explanations

Providing clear and concise explanations is essential when conveying complex concepts. Whether answering questions or clarifying your thought process, the ability to express your ideas in a structured manner ensures that your message is easily understood by others.

Here are several tips to help you write clear and effective explanations:

- Start with the Basics: Begin with a brief overview of the topic. Ensure the reader grasps the foundational idea before diving into more complex details.

- Be Logical and Structured: Organize your explanation in a logical flow. Break down the steps or points in a way that the reader can easily follow. You can use:

- Clear introductions and conclusions

- Bullet points or numbered lists for clarity

- Avoid Jargon: Use simple and precise language. While technical terms may be necessary in some cases, always define them and avoid overcomplicating your explanation.

- Use Examples: Concrete examples can help make abstract concepts more tangible. Providing real-life scenarios or hypothetical cases allows the reader to see the practical application of your explanation.

- Stay Focused: Stick to the main topic and avoid unnecessary tangents. Each sentence should contribute to the overall explanation without diverting attention from the key points.

- Summarize Key Points: After elaborating on your explanation, provide a brief summary of the main ideas to reinforce understanding.

By following these tips, you can ensure that your explanations are clear, concise, and easy to follow, leading to better comprehension and communication of your ideas.

Top Mistakes to Avoid in Accounting Exams

When tackling assessments that require technical knowledge and problem-solving, it’s essential to stay vigilant. Even small errors can lead to significant losses in marks or misunderstanding of key concepts. Knowing what to avoid during these assessments can greatly enhance your performance and improve your understanding of the subject matter.

Here are some common pitfalls to watch out for:

- Rushing Through Questions: It’s tempting to hurry through questions to finish faster, but this often leads to careless mistakes. Always read the instructions and questions carefully before answering.

- Skipping Steps: Many problems require a series of logical steps. Skipping steps may cause confusion or lead to incomplete answers. Always follow a structured approach to ensure clarity and accuracy in your responses.

- Ignoring Details: Pay attention to every detail in the question. Missing out on important information or overlooking crucial instructions can affect the quality of your solution.

- Not Double-Checking Your Work: Always leave some time at the end to review your responses. This helps identify potential errors and ensures you’ve addressed all parts of the question.

- Mismanaging Time: Poor time management can cause panic and incomplete answers. Plan your time effectively so that you can give each question the attention it deserves.

- Overcomplicating Simple Problems: Sometimes, the simplest problems are made unnecessarily complex. Stay focused on the basics and apply the right techniques to reach an efficient solution.

- Forgetting to Show Work: It’s important to show the steps you took to arrive at your final answer. Without this, even a correct result may not be awarded full credit.

By avoiding these common mistakes, you can ensure that you approach your tasks with greater confidence and accuracy, ultimately leading to better results.

How to Use Practice Papers Effectively

Practice papers are an essential tool for reinforcing knowledge and preparing for assessments that test your technical and analytical skills. By simulating real-world problems and providing an opportunity to apply what you’ve learned, they help you get comfortable with the structure and pacing of tasks. However, simply completing them isn’t enough. It’s important to use these materials strategically to maximize their effectiveness.

Understanding the Purpose of Practice Papers

The main goal of using practice papers is to familiarize yourself with the types of problems you will encounter. Approach these exercises as if they were actual tasks, adhering to the time constraints and focusing on accuracy. This practice builds your confidence, improves your time management, and ensures you’re comfortable with the range of questions you might face.

Review and Analyze Your Performance

Once you complete a practice paper, it’s crucial to thoroughly review your work. Don’t just look at the answers, but go through the steps and reasoning behind each solution. Identifying any mistakes and understanding why they occurred is key to improving. This reflective process helps you pinpoint areas where you might need further study or clarification.

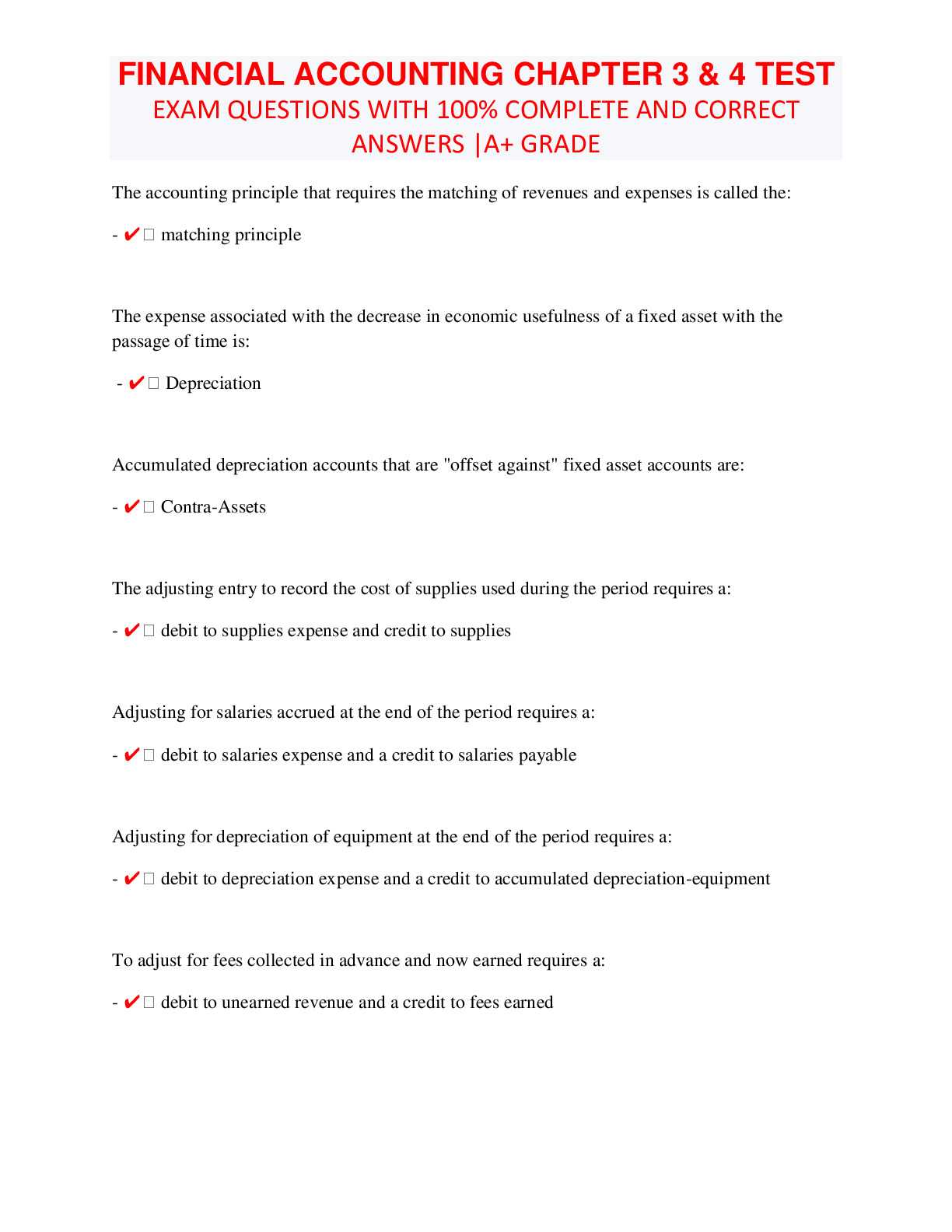

Understanding Depreciation for Exams

Depreciation is a key concept that often appears in assessments, particularly in relation to how assets lose value over time. It’s important to not only grasp the calculations but also understand the rationale behind these processes. By comprehending the reasons for depreciation, you can confidently approach questions and provide accurate answers, even when faced with complex scenarios.

Different Methods of Depreciation

There are various methods for calculating depreciation, each with its own approach and impact on financial statements. The most common methods include straight-line depreciation, reducing balance, and units of production. Understanding when and why to apply each method is critical for solving related problems. Practice working with each method to become familiar with their differences and use cases.

Impact of Depreciation on Financial Statements

Depreciation not only affects the value of an asset but also influences the overall financial picture. It reduces the asset’s book value over time and, in turn, impacts profits by spreading the expense across the asset’s useful life. Knowing how depreciation is reflected in balance sheets and income statements will help you interpret financial data more effectively during assessments.

Tips for Solving Complex Accounting Problems

When facing intricate problems that require detailed solutions, it’s essential to approach them step by step. These challenges often involve multiple components, so breaking them down into smaller, manageable parts can significantly improve clarity and accuracy. The key is to methodically analyze the given information and apply appropriate techniques to arrive at the correct answer.

Start by thoroughly reading through the problem to understand its context and objectives. Identifying key figures and understanding how they relate to each other is crucial. Once you have a clear grasp of the problem, organize your work logically. Use formulas and methods you’re familiar with to solve individual sections, ensuring no detail is overlooked. It’s also helpful to double-check calculations to avoid errors, as small mistakes can lead to incorrect results in complex scenarios.

How to Stay Calm During the Exam

Maintaining composure during a high-pressure situation is essential for performing at your best. The key to staying calm is to manage your anxiety effectively and approach the task with confidence. There are several strategies you can use to keep your mind focused and reduce nervousness as you work through your tasks.

Preparation is Key

Being well-prepared is one of the most effective ways to stay relaxed. When you know you’ve put in the time to understand the material, it builds confidence that you can handle any challenge that comes your way. Here are a few steps to ensure you’re ready:

- Review key concepts and practice regularly.

- Simulate real conditions by timing yourself during practice sessions.

- Organize your notes and materials for easy reference.

Relaxation Techniques

Using relaxation techniques can help you manage stress when you feel overwhelmed. Some useful methods include:

- Deep breathing: Inhale deeply for four counts, hold for four counts, and exhale for four counts.

- Positive self-talk: Remind yourself that you are capable and have prepared well.

- Taking short breaks: When allowed, step back for a few moments to refresh your mind.

By practicing these strategies, you can stay calm and focused, allowing you to perform with clarity and confidence.