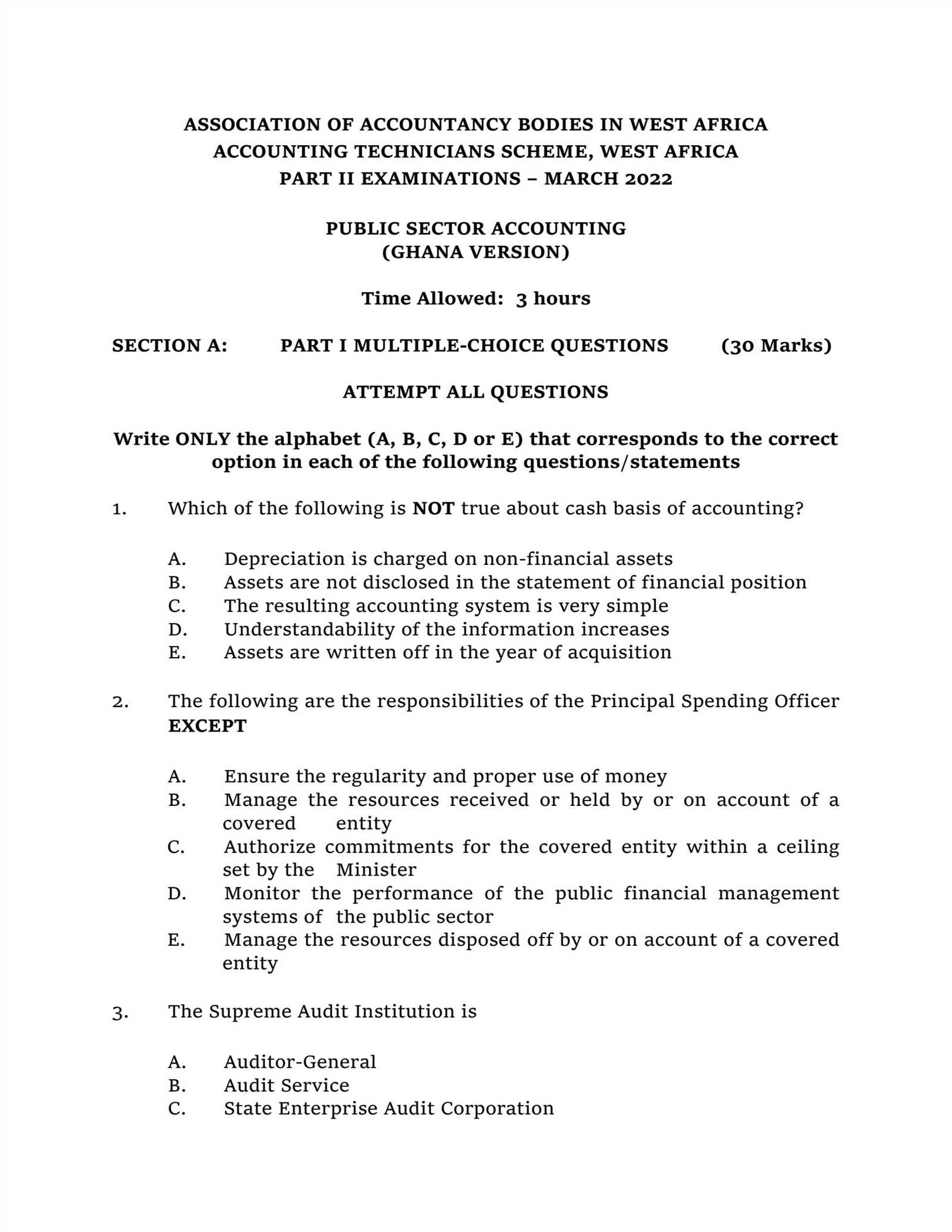

Preparing for written evaluations in the field of finance can be a challenging yet rewarding process. The key to success lies in understanding core principles, practicing problem-solving, and refining the ability to apply knowledge efficiently. Whether you’re facing a test or a practical task, the ability to think critically and analyze various scenarios is crucial.

Effective preparation involves more than just memorizing formulas and concepts. It requires a deep dive into various problem-solving techniques, comprehension of complex topics, and consistent practice to build confidence. By focusing on both theoretical knowledge and practical application, you can enhance your readiness for any assessment in the field.

Through thorough practice, reviewing previous test materials, and developing a strategic approach to tackling different question types, you can ensure a solid foundation for success. This guide offers insights and strategies to help you navigate the process and approach challenges with a structured mindset.

Study Tips for Financial Assessments

To succeed in any written evaluation within the financial field, a structured and methodical approach to preparation is essential. Focusing on key topics, organizing study sessions, and practicing regularly will help sharpen your skills and boost your confidence. Effective preparation is about more than just reviewing materials; it’s about mastering the techniques to handle various challenges efficiently.

Organizing Your Study Routine

One of the most important steps in preparing for assessments is to establish a clear study plan. Without proper structure, it’s easy to become overwhelmed by the amount of material to cover. A well-organized approach can make your study sessions more effective and less stressful.

- Set specific goals: Define clear objectives for each study session, focusing on different topics or types of questions.

- Create a timetable: Allocate time for each subject area and stick to it, ensuring a balanced approach to all key concepts.

- Prioritize weaknesses: Identify areas where you struggle and dedicate extra time to improving those skills.

- Break down complex topics: Divide challenging subjects into smaller, manageable sections for easier understanding.

Practicing with Realistic Scenarios

Real-life applications and problem-solving are crucial for mastering the material. It’s essential to practice as much as possible using past tests, case studies, or simulated scenarios. This hands-on experience will improve your ability to apply theoretical knowledge in practical situations.

- Use past materials: Review previous tests and assignments to familiarize yourself with common question formats and subject matter.

- Simulate the exam environment: Set time limits and recreate test conditions to improve your ability to think under pressure.

- Work in groups: Collaborating with peers can provide new insights and alternative solutions to problems.

- Analyze mistakes: When reviewing practice questions, focus on understanding errors to avoid repeating them.

Effective Ways to Prepare for Financial Tests

Preparation for any type of assessment in the financial field requires a balanced approach, combining theoretical knowledge with practical skills. Successful outcomes are not only a result of hard work but also of strategic planning. Focusing on key concepts, practicing relevant problems, and staying consistent will maximize your chances of performing well.

Building a Strong Foundation

The first step in preparing for any written task is ensuring you have a solid grasp of the core principles. Without this understanding, tackling more advanced topics will be difficult. Dedicate time to reviewing the fundamental theories and practices that underpin the subject.

- Focus on key concepts: Make sure to understand the essential principles and formulas that often appear in tasks.

- Clarify difficult areas: Spend extra time on concepts that seem challenging or unfamiliar to strengthen your foundation.

- Review summaries: Use textbooks or notes that condense the material into easy-to-digest summaries.

Active Practice and Application

Once the basics are covered, it’s time to focus on applying what you’ve learned through practical exercises. Regular practice will not only reinforce your understanding but also help you develop the skills needed to address complex situations efficiently.

- Work through sample problems: Practice as many problems as possible to familiarize yourself with different question types and formats.

- Test yourself under timed conditions: Create a practice environment that simulates the pressure of real tasks to improve your speed and accuracy.

- Review solutions: When going through practice exercises, always check your solutions and understand the reasoning behind correct and incorrect answers.

- Learn from mistakes: Pay close attention to errors and take time to correct them to prevent repeating the same mistakes.

Common Financial Topics in Assessments

In the realm of financial analysis, certain subjects are often tested due to their significant role in evaluating an organization’s fiscal health. These topics focus on the ability to interpret and analyze key data that reflects business performance, resource management, and profitability. Understanding these concepts is essential for measuring a company’s financial stability and its ability to generate returns over time.

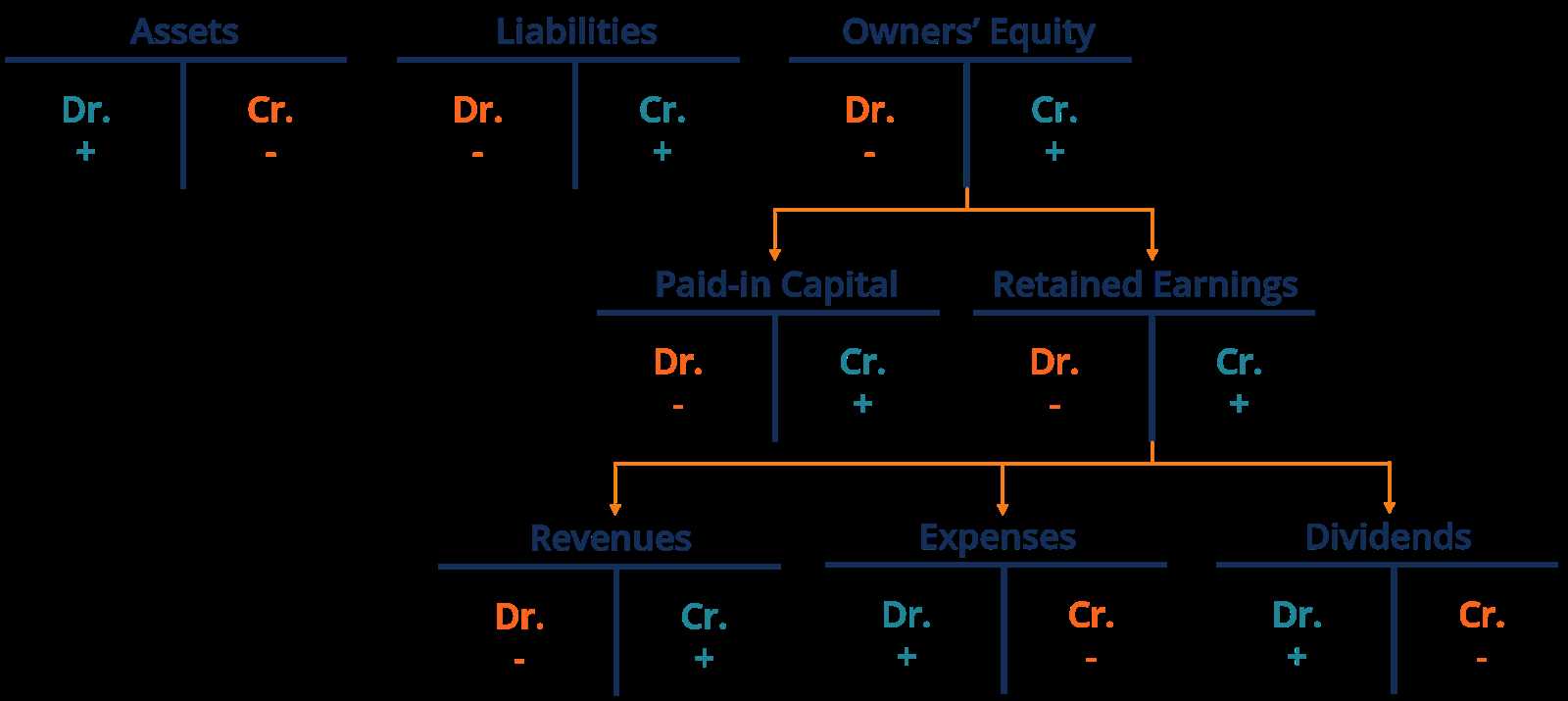

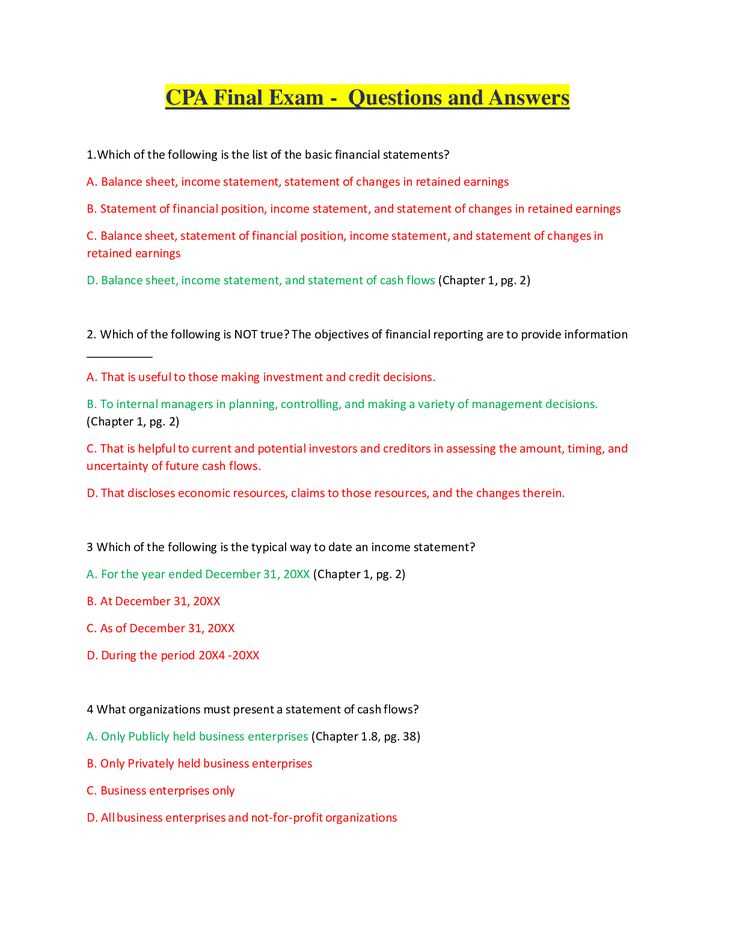

Key Financial Statements

These essential documents provide a snapshot of a company’s financial condition and performance over a specified period. They are fundamental for assessing how well an organization is managing its assets, liabilities, and equity, as well as its capacity to generate revenue and manage expenses.

| Document | Description |

|---|---|

| Balance Sheet | Summarizes an entity’s assets, liabilities, and shareholders’ equity, offering insights into financial position and stability. |

| Income Statement | Shows the company’s profitability by summarizing revenues, expenses, and net income over a given period. |

| Cash Flow Statement | Tracks cash inflows and outflows, illustrating liquidity and a company’s ability to meet short-term obligations. |

| Equity Statement | Details changes in ownership equity, reflecting retained earnings, investments, and dividends. |

Key Financial Ratios

In addition to financial statements, several ratios are commonly used to assess various aspects of a company’s operations. These ratios provide deeper insights into areas like profitability, risk, efficiency, and overall financial performance.

| Ratio | Purpose | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Profitability Ratios | Measure the company’s ability to generate profit relative to its revenue or assets, such as gross profit margin. | |||||||||||||||||||||||||||||||||||||||||

| Liquidity Ratios | Indicate the ability of an entity to cover its short-term liabilities, such as the current ratio and quick ratio. |

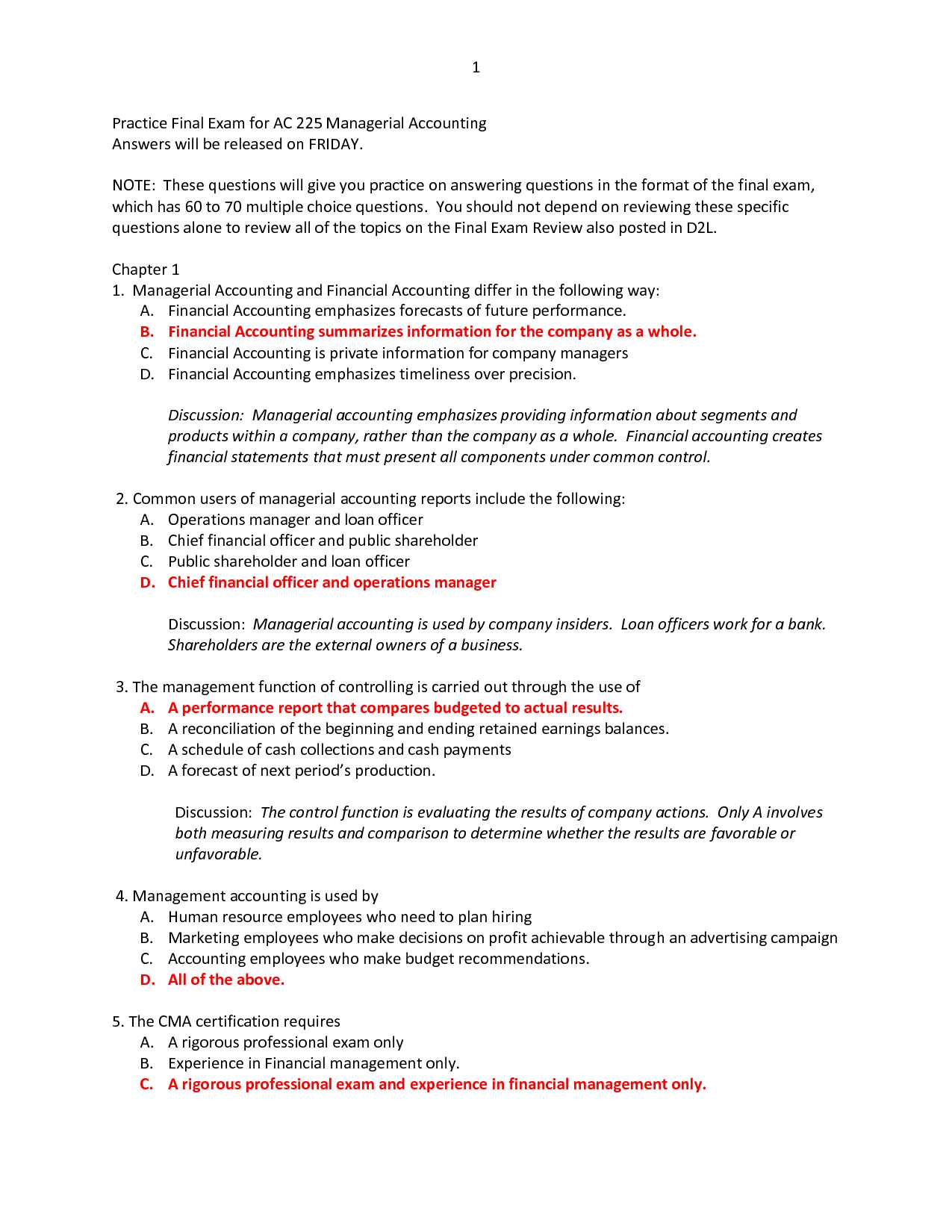

| Strategy | Description |

|---|---|

| Read the Question Carefully | Ensure you fully understand what is being asked before you begin considering the options. |

| Review All Choices | Don’t rush into selecting the first option that seems correct. Consider all possible answers before making a decision. |

| Eliminate Incorrect Options | By crossing out obviously wrong answers, you can narrow your focus and increase the odds of selecting the correct one. |

| Focus on Keywords | Look for key terms in both the question and options that could give clues to the correct response, such as “always” or “never.” |

| Use Logical Reasoning | If uncertain, apply logic or your understanding of related topics to eliminate unlikely options. |

Common Mistakes to Avoid

Even with a strong approach, it’s easy to make errors when answering these questions. Be aware of the following pitfalls to ensure you don’t lose valuable points.

| Mistake | How to Avoid | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rushing Through | Take your time to read and consider each option thoroughly. Hasty decisions can lead to mistakes. | |||||||||||||||||||

| Overthinking | Trust your initial instincts unless you are confident in another choice. Overthinking can cause confusion. | |||||||||||||||||||

| Skipping Options | Don’t skip over any options. Always review all the choices before making your selection. | |||||||||||||||||||

| Changing Answers Too Often |

| Resource | Key Features |

|---|---|

| Study Guides | Comprehensive coverage of topics, example problems, and solutions |

| Practice Tests | Timed mock exams to simulate real test conditions |

| Online Platforms | Interactive quizzes, flashcards, and video tutorials |

Best Strategies for Answering Essay Questions

Effectively tackling essay questions requires both a clear understanding of the topic and the ability to organize thoughts in a coherent manner. To provide a well-rounded response, it’s essential to develop a strategy that includes planning, structuring your argument, and ensuring clarity in your writing. Below are key strategies that can help you craft strong, focused essays under timed conditions.

1. Read and Understand the Prompt

Before you begin writing, carefully read the question and make sure you understand exactly what is being asked. Identify the main focus of the prompt and determine whether it requires a descriptive, analytical, or evaluative response. Highlight key terms and phrases to ensure you address all parts of the question.

2. Plan Your Response

Once you have a clear understanding of the prompt, spend a few minutes organizing your thoughts. Create a quick outline to structure your answer. This will help you ensure that you cover all the necessary points and maintain a logical flow in your response. Start with an introduction, followed by your main argument or explanation, and finish with a concise conclusion.

3. Stay Focused and Clear

Throughout your response, remain focused on the central topic and avoid deviating from the main points. Support your arguments with relevant examples, evidence, or reasoning to strengthen your position. Be clear and concise in your writing, ensuring that each paragraph contributes to your overall argument.

How to Analyze Financial Statements

Interpreting financial data is crucial for understanding the financial health of an organization. Analyzing key reports, such as income statements, balance sheets, and cash flow statements, helps to assess profitability, liquidity, and overall performance. By evaluating these reports effectively, you can make informed decisions or identify potential areas for improvement.

1. Understand the Key Components

Each financial report contains specific data points that reflect different aspects of a company’s financial status. The income statement shows revenue and expenses, the balance sheet outlines assets, liabilities, and equity, and the cash flow statement tracks cash inflows and outflows. Familiarizing yourself with these elements is the first step in any analysis.

2. Perform Ratio Analysis

One effective way to analyze financial statements is by using ratios that provide insights into profitability, efficiency, and solvency. Key ratios include the current ratio, return on equity, and net profit margin. These ratios help compare performance over time or against industry benchmarks.

| Ratio | Formula | Purpose |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures liquidity, ability to meet short-term obligations |

| Return on Equity | Net Income / Shareholders’ Equity | Indicates profitability relative to equity invested |

| Net Profit Margin | Net Income / Revenue | Shows how much profit is made for each dollar of sales |

3. Compare Trends Over Time

Tracking changes in financial data over several periods helps identify trends in a company’s performance. A decline in profitability or an increase in debt levels could signal potential risks, while improvements in cash flow or revenue growth may indicate a solid financial position.

Examining Common Accounting Mistakes

Identifying and correcting frequent errors in financial processes is crucial for maintaining accuracy and reliability. These mistakes can lead to misrepresentation of an organization’s financial position, affecting decision-making and compliance. Below are some of the most common errors and ways to avoid them.

1. Misclassifying Transactions

One of the most frequent mistakes is misclassifying transactions, which can result in inaccurate financial reports. It’s important to assign each transaction to the correct category, such as revenue, expenses, assets, or liabilities. Misclassification can distort key figures and affect the overall financial analysis.

- Ensure proper categorization of income and expenditure items.

- Review general ledger entries regularly to avoid misclassification.

2. Failing to Reconcile Accounts

Reconciliation is a critical process to ensure that records in the financial statements match external documents such as bank statements. Failing to perform reconciliations can lead to errors in cash balances and other key figures. It is essential to cross-check records to maintain accuracy.

- Reconcile accounts on a regular basis to identify discrepancies.

- Investigate any differences between internal and external records.

3. Ignoring Depreciation and Amortization

Depreciation and amortization are often overlooked or improperly calculated. These non-cash expenses play a vital role in accurately representing the value of assets over time. Failure to account for these can overstate asset values and profitability.

- Ensure all fixed assets are appropriately depreciated over their useful life.

- Amortize intangible assets consistently based on their expected duration.

4. Overlooking Tax Implications

Not considering tax impacts when recording transactions is a common mistake. Tax errors can result in financial penalties or missed opportunities for deductions. It’s essential to consider tax effects on revenues, expenses, and assets from the outset.

- Ensure taxes are accurately calculated and recorded for each transaction.

- Consult tax professionals to remain compliant with current regulations.

5. Inconsistent Application of Principles

Inconsistencies in applying financial principles, such as revenue recognition or expense matching, can create discrepancies in financial statements. It’s essential to apply standards uniformly to ensure accurate financial reporting.

- Follow standardized principles consistently across all periods.

- Ensure that all changes in accounting methods are documented and justified.

Study Techniques for Complex Accounting Problems

Tackling intricate financial challenges requires strategic preparation and a clear understanding of key principles. The complexity of certain topics often demands a deep focus, practical application, and systematic approaches to ensure mastery. Below are effective methods to help simplify and resolve complicated financial issues.

1. Break Down the Problem

Complex problems can seem overwhelming at first, but breaking them down into smaller, manageable components makes them more approachable. Start by identifying the key elements and focus on one step at a time. This method allows you to better understand the structure of the problem and reduces the likelihood of overlooking important details.

- Identify each part of the problem and categorize it.

- Work through the components individually before attempting to solve the entire issue.

2. Practice Regularly with Real-World Examples

Practical experience is essential in mastering complicated subjects. By working on real-world scenarios, you can better understand the application of theory and enhance your problem-solving skills. Regular practice helps reinforce learning and builds confidence in tackling complex financial tasks.

- Use case studies and examples from reputable sources to apply concepts in a practical setting.

- Review a variety of problems to become familiar with different scenarios and solutions.

Creating a Study Plan for Assessments

Having a structured study plan is crucial for effectively preparing for challenging evaluations. A well-organized approach ensures that all key topics are covered and helps manage time efficiently, reducing stress. Crafting a comprehensive schedule with clear goals allows for targeted revision and enhances focus during preparation.

1. Set Clear Goals

The first step in creating an effective study plan is defining what you aim to achieve. Break down your objectives into smaller, specific targets. These goals will guide your preparation, making it easier to track progress and stay motivated.

- Determine the topics you need to master based on the scope of the subject.

- Set measurable goals for each session, such as understanding a concept or solving a specific number of problems.

- Ensure goals are realistic and aligned with the time available.

2. Organize Study Sessions

Divide your available study time into focused sessions. Prioritize areas that require more attention while allowing enough time for revision. A balanced approach ensures thorough coverage and avoids last-minute cramming.

- Allocate specific time slots for each topic based on its complexity.

- Take regular breaks to maintain focus and avoid burnout.

- Review previous material regularly to reinforce learning.

3. Track Progress and Adjust

It is important to monitor your progress throughout the preparation process. This helps identify any weak areas that may require additional focus. Make adjustments to your plan as needed to ensure a more balanced and efficient study approach.

- Evaluate your understanding after each study session to identify gaps.

- Modify the plan if certain topics need more time or a different approach.

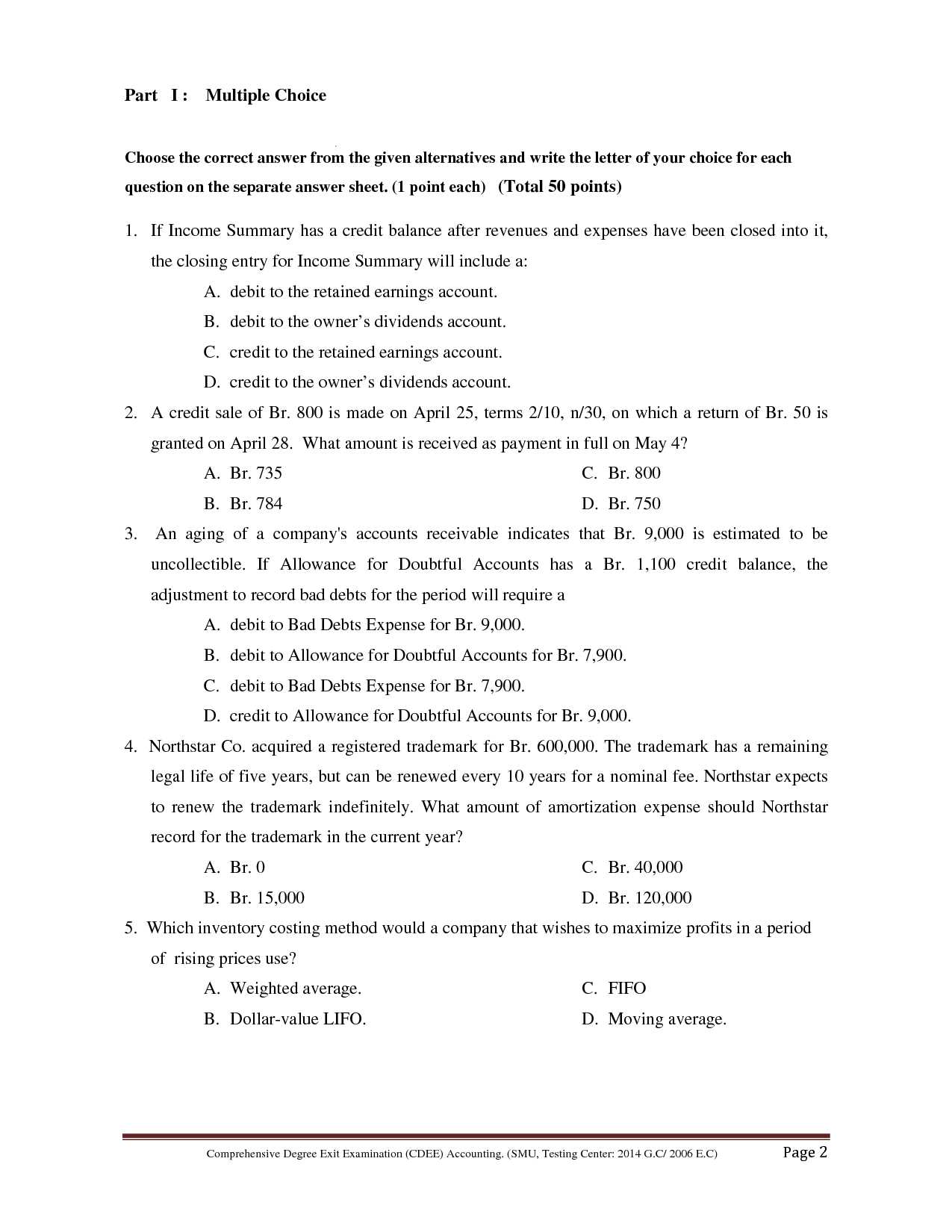

Importance of Past Assessment Papers

Reviewing previous test papers is an essential strategy for anyone preparing for an upcoming evaluation. These materials offer valuable insights into the structure and types of questions typically asked, providing a clear indication of what to expect. Studying past papers allows candidates to familiarize themselves with the format and style of questions, improving both confidence and efficiency during the actual assessment.

1. Understand the Question Pattern

Past papers reveal the most common question formats and trends, helping learners predict which topics are likely to appear. By analyzing these questions, it is possible to identify key themes and areas that require more focused attention.

- Recognize recurring themes and topics that are consistently tested.

- Understand how questions are framed, making it easier to respond quickly and accurately.

- Prepare for both short-answer and complex questions by practicing on past examples.

2. Improve Time Management

One of the biggest challenges during any test is managing time effectively. Practicing with past papers helps improve time allocation for each section, ensuring that candidates can answer all questions within the given timeframe.

- Simulate test conditions to get used to the time constraints.

- Identify which sections take longer and plan strategies to answer them more efficiently.

- Build stamina and reduce anxiety by practicing under real-time pressure.

3. Evaluate Your Knowledge

Working through past papers provides an opportunity to assess your current level of understanding. By attempting these questions, you can identify any gaps in knowledge and determine which areas need further revision.

- Track your progress by comparing your responses with model answers or guides.

- Pinpoint weaker areas that need more focused study sessions.

- Gain confidence in your ability to tackle challenging questions.

Mastering Formulas and Equations

In many fields, a strong grasp of essential formulas and equations is vital for problem-solving and analysis. Understanding these mathematical tools enables individuals to tackle complex scenarios efficiently. Familiarity with key formulas not only saves time but also ensures accuracy when calculating values or analyzing data.

1. Key Formulas for Quick Recall

Familiarizing yourself with the most commonly used formulas is the first step in mastering their application. These foundational equations are often involved in multiple calculations, and recognizing them quickly can enhance your performance.

- Revenue = Price x Quantity

- Net Profit = Total Revenue – Total Expenses

- Asset Turnover = Net Sales / Average Total Assets

2. Practice and Application

Merely memorizing formulas is not enough–practicing them in various scenarios helps solidify understanding. Regular application of these equations in real-world problems allows individuals to gain confidence and accuracy, ultimately leading to quicker problem resolution.

- Use past examples to apply formulas in different contexts.

- Break down complex problems into smaller, manageable steps using the relevant formulas.

- Repetition is key–frequent practice improves speed and understanding.

How to Improve Speed and Accuracy

Increasing both speed and precision is crucial when handling complex tasks. Achieving this balance requires focused practice, understanding the underlying concepts, and refining techniques over time. By developing habits that promote efficiency and reduce errors, individuals can significantly enhance their performance.

1. Master the Basics

Before attempting to solve intricate problems quickly, it’s essential to have a solid understanding of the fundamental concepts. Mastering the core principles ensures that you can approach any challenge with confidence, making it easier to apply more advanced techniques without hesitation.

- Understand key formulas and their applications.

- Practice simple calculations regularly to increase familiarity and speed.

- Review fundamental concepts frequently to keep them fresh in your mind.

2. Develop Time Management Strategies

Effective time management is integral to improving both speed and accuracy. By setting time limits for each task and allocating time appropriately, you ensure that you don’t rush through important steps. Prioritizing the most complex questions while managing the easier ones can also help optimize performance.

- Set time constraints for each task during practice to simulate real conditions.

- Start with problems that you find easier to build confidence and gain momentum.

- Take regular breaks to avoid fatigue, which can lead to mistakes.

3. Minimize Distractions and Focus

Distractions can significantly reduce both speed and precision. Creating a distraction-free environment and focusing solely on the task at hand can lead to better concentration, allowing for faster problem-solving with fewer errors.

- Find a quiet place to work where you can concentrate fully.

- Use tools that help you stay focused, such as timers or apps that block distractions.

- Avoid multitasking to ensure your full attention is on the current task.

Managing Stress During Evaluation Periods

Stress can significantly impact performance, especially when facing challenging assessments. It is essential to implement effective strategies to manage pressure, ensuring clarity of thought and maintaining composure. Managing stress not only improves focus but also enhances overall productivity, leading to better results under pressure.

1. Prepare with a Structured Plan

One of the most effective ways to manage stress is through careful preparation. Creating a clear study schedule helps reduce uncertainty and allows for manageable chunks of material to be covered. Knowing exactly what needs to be studied each day can bring peace of mind and make the workload feel less overwhelming.

- Break down the syllabus into smaller sections and set daily goals.

- Prioritize areas of difficulty or topics that need extra attention.

- Allocate time for regular breaks to avoid burnout.

2. Practice Mindfulness and Relaxation Techniques

When stress begins to build, taking a moment to pause and focus on breathing can make a huge difference. Mindfulness exercises such as deep breathing or meditation help center your thoughts and calm your mind. Regular practice of these techniques can help you stay focused and reduce feelings of anxiety.

- Take deep breaths to calm your nervous system before starting any task.

- Incorporate short meditation sessions into your routine to increase mental clarity.

- Stretch or engage in light physical activity to release tension in your body.

3. Get Sufficient Rest

Proper rest is vital to managing stress effectively. Lack of sleep can impair concentration and make it more difficult to retain information. A good night’s sleep ensures that you are mentally and physically prepared for any challenges ahead.

- Avoid late-night studying to prevent exhaustion and cognitive fatigue.

- Maintain a consistent sleep schedule, ensuring you get at least 7–8 hours of rest.

- Take short naps if needed to recharge your energy during long study sessions.

Post-Assessment Review for Continuous Improvement

After completing any assessment, it is crucial to take the time to reflect on your performance. This reflection helps identify strengths and areas for growth, guiding your future preparation. Reviewing your results is an essential step towards improvement, as it provides insights into what strategies worked and what could be enhanced.

1. Analyze Mistakes and Understand Missteps

It is easy to focus on the questions you got right, but to truly improve, it is essential to examine where you went wrong. Identify the types of questions or concepts that caused confusion. Understanding why you made specific mistakes can provide clarity and prevent similar errors in the future.

- Review incorrect answers and understand the underlying concepts.

- Identify patterns in mistakes, such as misinterpretation or skipped steps.

- Ask for feedback if you’re unsure about a specific question or approach.

2. Strengthen Weak Areas with Targeted Practice

Once you have identified areas that need improvement, it’s time to take focused action. Create targeted practice sessions to address these weaknesses. Continuous improvement comes from dedicated effort and consistent practice in areas that challenge you the most.

- Focus on the topics where you had the most difficulty.

- Seek additional resources, such as guides, exercises, or tutorials, to deepen your understanding.

- Regularly test yourself on these topics to build confidence and mastery.

3. Reflect on Effective Strategies

Not all areas require improvement–some strategies and methods worked well during the assessment. Recognizing and reinforcing these effective techniques ensures that you continue using them in the future. Build on your successes to keep enhancing your approach to preparation.

- Recognize which study methods helped you perform well.

- Incorporate these successful strategies into your ongoing study routine.

- Maintain consistency in your approach to ensure continued success.