Successfully completing a tax certification assessment requires more than just theoretical knowledge; it demands practical understanding and the ability to navigate real-world scenarios. This test evaluates your grasp of tax laws, filing processes, and the software used in tax preparation. Whether you’re aiming to start a career in tax services or enhance your skills, thorough preparation is key to performing well.

In this guide, we’ll explore essential strategies for tackling this important evaluation. From mastering tax-related concepts to practicing with mock questions, each step will help sharpen your skills and boost your confidence. With the right approach, you can ensure a comprehensive understanding of the material and increase your chances of success.

Stay organized and focus on core principles to build a strong foundation. This will not only aid in passing the test but also in providing high-quality service to clients in the future. Let’s dive into the key areas you need to focus on to excel in this assessment.

Tax Certification Test Solutions

Successfully navigating the tax certification process requires a clear understanding of key concepts and the ability to apply them in a practical setting. This section focuses on providing the necessary tools and resources to help you approach the questions with confidence. Through careful preparation and practice, you can enhance your problem-solving skills and perform well in the assessment.

Key Areas to Focus On

To improve your chances of success, it’s important to focus on the most relevant topics covered in the test. Key areas include tax filing procedures, understanding deductions and credits, and being familiar with the most recent tax laws. A solid grasp of these concepts will help you navigate complex scenarios with ease.

Practicing with Real-Life Scenarios

One of the most effective ways to prepare is by simulating real-world tax situations. This allows you to apply your knowledge and become comfortable with the question formats. Regular practice will not only reinforce your understanding but also help you manage time efficiently during the actual assessment.

Overview of Tax Certification Test Structure

The structure of the certification assessment is designed to test your knowledge and practical skills in the field of tax preparation. The questions are crafted to evaluate both your understanding of theoretical concepts and your ability to apply them in real-life scenarios. Knowing the layout and format of the assessment will help you approach it with more clarity and focus.

Test Format and Sections

The test typically includes multiple-choice questions, scenario-based queries, and practical exercises. Each section is designed to evaluate different aspects of tax preparation, from basic knowledge of tax codes to the application of those codes in specific situations.

| Section | Content | Weight |

|---|---|---|

| Tax Code Knowledge | Understanding key tax rules and regulations | 30% |

| Filing Procedures | Tax return processing, forms, and timelines | 25% |

| Deductions & Credits | Identifying eligible deductions and credits | 20% |

| Scenario-Based Questions | Real-world problem-solving | 25% |

Time Management

Managing time effectively is essential during the test. With a limited amount of time to complete all sections, it’s crucial to focus on high-weighted areas first and ensure that you allocate enough time for scenario-based questions. Practicing under timed conditions can help you develop the necessary pacing for the assessment.

Key Topics Covered in the Assessment

The certification process focuses on several critical areas of tax knowledge and preparation. These topics are designed to test both your theoretical understanding and practical application of tax laws. Mastery of these subjects is essential for successfully navigating the assessment and providing accurate tax services.

Tax Filing Procedures are among the most important topics. Understanding the various forms, timelines, and steps involved in filing a tax return is essential for any tax professional. This includes knowing how to handle different types of returns and the information required for each.

Credits and Deductions play a significant role in reducing a taxpayer’s liability. Being able to identify eligible deductions and credits is crucial in maximizing refunds and minimizing tax obligations. This includes personal deductions, business-related expenses, and specific tax credits available to taxpayers.

Tax Laws and Regulations cover the fundamental rules governing how taxes are calculated, collected, and reported. Familiarity with current tax laws, including any recent updates or changes, is necessary to ensure compliance and accurate filings.

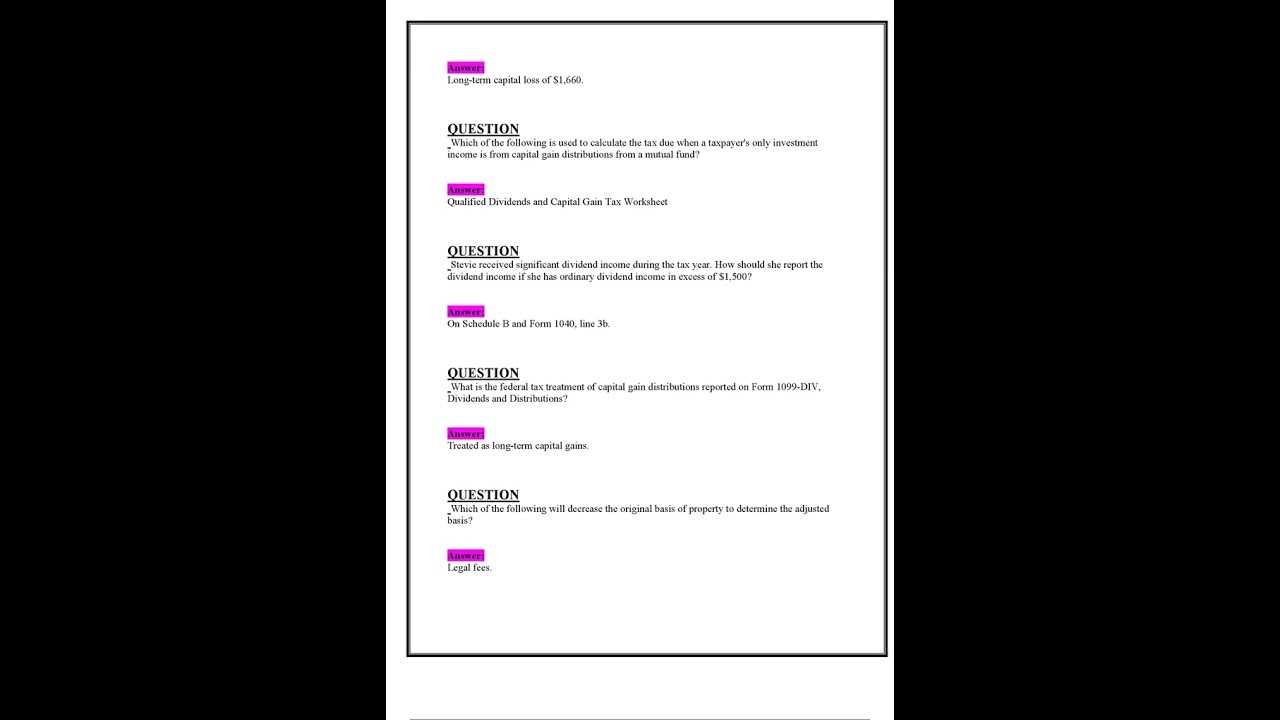

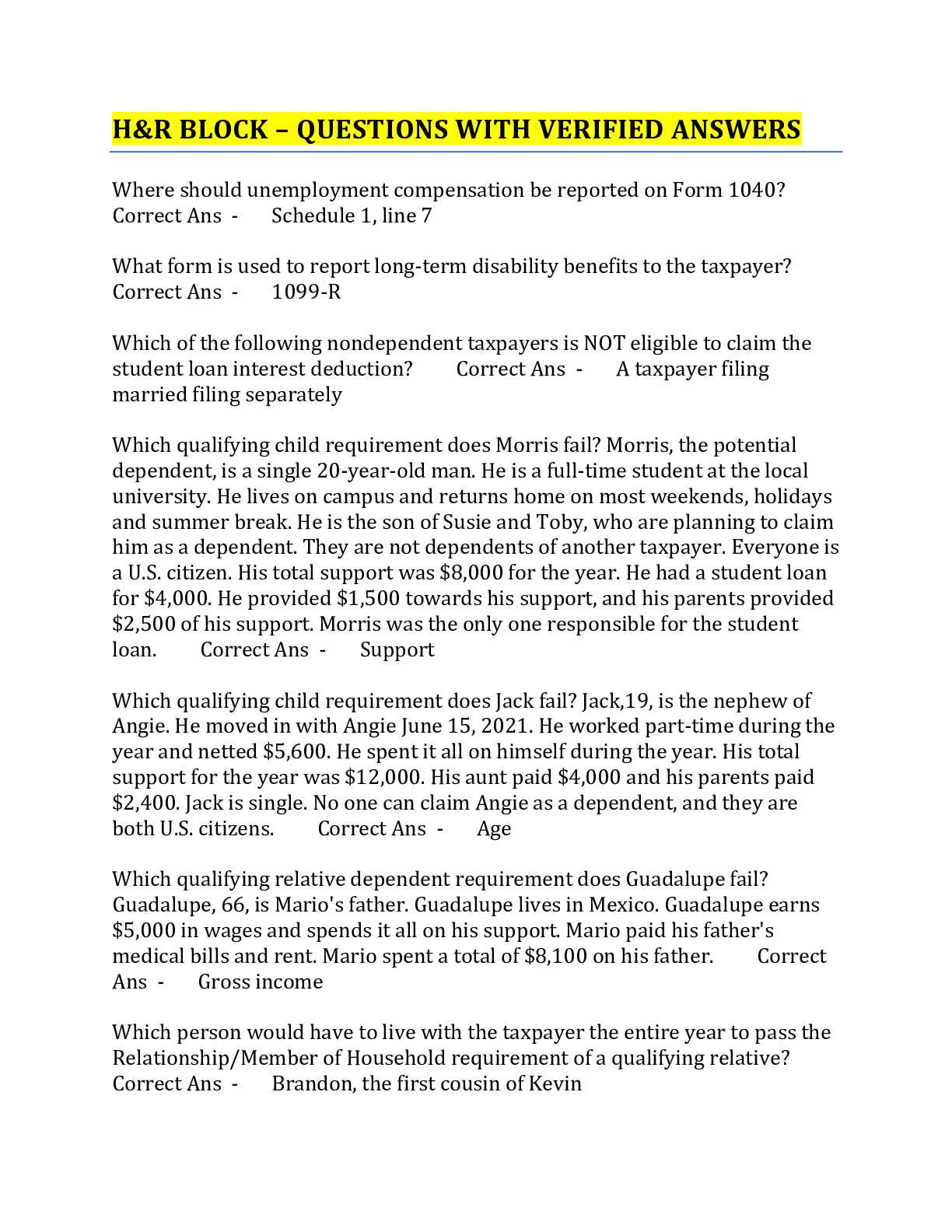

Scenario-Based Problems test your ability to apply tax knowledge to real-world situations. These questions require you to assess different tax scenarios and provide the correct solutions based on the laws and regulations that apply. Practice with such problems can greatly improve your ability to think critically under pressure.

Study Tips for Tax Certification Test

Effective preparation for the certification test involves not only reviewing tax concepts but also developing strong study habits. By focusing on key topics and practicing regularly, you can improve your understanding and ensure success. Implementing a structured approach to your study sessions will help you retain important information and boost your confidence.

Organize Your Study Materials to create a clear roadmap for your preparation. Break down the content into manageable sections, focusing on one topic at a time. This will allow you to focus your efforts and avoid feeling overwhelmed by the volume of information.

Practice with Mock Tests to familiarize yourself with the format and types of questions that will be asked. This will help you identify areas where you need improvement and provide you with the opportunity to practice under timed conditions. The more you practice, the more comfortable you will become with answering questions quickly and accurately.

Review Real-World Scenarios to better understand how tax laws apply in different situations. Simulating practical tax scenarios will not only reinforce your theoretical knowledge but also help you build problem-solving skills. This practice is essential for answering scenario-based questions that test your ability to apply what you’ve learned in a practical context.

Stay Consistent with your study schedule. Set aside dedicated time each day to study, and make sure to cover all areas of the test. Regular review sessions will help keep the material fresh in your mind and allow you to identify any gaps in your knowledge.

How to Prepare for Tax Scenarios

Preparing for tax-related scenarios is an essential part of excelling in a certification assessment. These types of questions require not only theoretical knowledge but also the ability to think critically and apply tax laws to real-life situations. By practicing and understanding the underlying principles, you can improve your ability to navigate complex scenarios with confidence.

Study Tax Laws Thoroughly to ensure a solid foundation in the rules that govern tax filing and compliance. Understanding how different deductions, credits, and income types are treated will enable you to address various scenarios with accuracy. The more familiar you are with the tax code, the easier it will be to recognize how it applies in different situations.

Analyze Case Studies to simulate real-world situations that might appear on the test. These case studies often involve detailed tax problems where multiple rules must be applied. Practice by breaking down the facts and applying relevant tax laws step by step. This method will help you build a logical approach to answering questions, ensuring you don’t miss key details.

Use Problem-Solving Techniques to approach each scenario systematically. Identify the tax issues at hand, research the applicable laws, and carefully calculate the necessary amounts. Practicing these steps will not only increase your accuracy but also improve your speed when answering time-sensitive questions.

Stay Updated on Tax Changes since tax laws and regulations can change frequently. Make sure you’re aware of the latest updates, as they may impact your answers in specific scenarios. Reviewing recent changes to tax codes will give you a competitive edge in accurately solving problems that reflect the current tax environment.

Common Mistakes to Avoid on the Test

When preparing for a certification assessment, it’s crucial to be aware of common errors that can significantly impact your performance. Many candidates make avoidable mistakes that can lead to unnecessary penalties or missed opportunities to score higher. Recognizing these pitfalls beforehand will help you stay focused and improve your chances of success.

Rushing Through Questions is one of the most common mistakes. Time management is essential, but hurrying through questions without fully reading them can lead to careless errors. Make sure to carefully review each question and all the answer choices before selecting your response. Take your time to ensure you’re not overlooking important details.

Neglecting the Instructions often leads to errors, especially when there are specific directions for certain sections. Pay attention to any instructions regarding formatting, calculations, or steps that must be followed. Ignoring these can result in losing points for not adhering to the given guidelines.

Failing to Double-Check Calculations can also cost you valuable points. Even simple math errors can have significant consequences, especially in complex tax-related problems. Always take the time to double-check your calculations before finalizing your answers, especially when dealing with deductions, credits, or income adjustments.

Overlooking the Small Details in scenario-based questions is another common mistake. These types of questions often contain subtle information that can change the outcome of the answer. Look for clues in the scenario that might indicate an exception or special consideration. Missing these details could lead to incorrect conclusions.

Understanding the Question Format

One of the key elements to succeeding in a certification assessment is understanding how the questions are structured. The format is designed to test both your knowledge of tax principles and your ability to apply them in practical scenarios. Familiarizing yourself with the types of questions you may encounter will help you respond more effectively and avoid unnecessary confusion during the test.

Multiple-Choice Questions

Multiple-choice questions are commonly used to assess your knowledge of key concepts. These questions typically present a statement or problem, followed by a set of possible answers. It’s important to carefully read each option and eliminate incorrect answers to increase your chances of selecting the right one. In some cases, multiple answers may seem correct, but one will be the best fit based on the context provided.

Scenario-Based Questions

Scenario-based questions are designed to evaluate your ability to apply tax laws to real-life situations. These questions often provide a detailed situation involving a taxpayer’s financial circumstances. You will need to analyze the information provided, identify the relevant tax rules, and apply them to determine the correct course of action. These types of questions test your critical thinking and problem-solving skills, so it’s essential to practice working through such scenarios before the assessment.

Essential Concepts for Tax Filings

Understanding the fundamental principles of tax filings is crucial for anyone preparing for a certification assessment. Whether you are assisting clients or handling your own finances, knowing the key concepts will help ensure compliance and maximize the benefits of available deductions and credits. This section highlights the core topics you need to grasp when preparing for tax-related responsibilities.

Types of Income

One of the most important aspects of tax preparation is identifying different types of income that may be subject to taxation. These include:

- Earned Income: Wages, salaries, tips, and self-employment income.

- Unearned Income: Interest, dividends, rental income, and capital gains.

- Other Sources: Alimony, pensions, unemployment benefits, and government assistance.

Each type of income has its own tax treatment and requirements, which is why it is essential to correctly categorize all income sources during tax filing.

Common Deductions and Credits

Deductions and credits can significantly reduce the amount of tax owed. It is essential to understand the most commonly used deductions and credits available:

- Standard Deduction: A set amount that reduces taxable income for individuals who do not itemize.

- Itemized Deductions: Specific expenses, such as mortgage interest or medical expenses, that can reduce taxable income.

- Tax Credits: Direct reductions in tax liability, such as for education expenses or child care.

Knowing when to apply each deduction or credit can help optimize a tax return and reduce a taxpayer’s overall liability.

Reviewing the IRS Tax Codes

A solid understanding of the IRS tax codes is essential for anyone involved in preparing tax returns. These codes provide the legal framework for tax laws in the United States and contain the rules and regulations necessary to ensure accurate filings. This section will help you familiarize yourself with key tax codes that directly impact the filing process and the determination of tax liability.

Key Tax Codes to Focus On

The IRS tax code covers a wide range of topics, but focusing on the following areas will give you a solid foundation:

- Section 61 – Gross Income: This section defines what constitutes taxable income, including wages, interest, dividends, and other types of income.

- Section 162 – Business Expenses: This code provides the rules for deducting ordinary and necessary expenses related to running a business.

- Section 401 – Retirement Plans: The IRS guidelines on the tax advantages and rules for contributing to and withdrawing from retirement accounts.

- Section 164 – Deductions for State and Local Taxes: Covers allowable deductions for state and local taxes paid, including property and income taxes.

How to Navigate the Tax Code Effectively

While the IRS tax code can be complex, there are several strategies to make it more manageable:

- Use IRS Publications: IRS publications provide simplified explanations and examples to help you understand the intricacies of the tax code.

- Stay Updated on Tax Law Changes: The tax code is subject to frequent changes, so it’s important to stay informed about new laws and amendments.

- Focus on Commonly Used Sections: Concentrate on the most frequently applied sections, such as those related to deductions, credits, and income reporting.

By regularly reviewing and understanding the relevant tax codes, you can ensure that you are prepared to address any tax-related scenario with accuracy and confidence.

How to Manage Time During the Exam

Effective time management is a key factor in performing well during any assessment. Being able to allocate time appropriately across all sections and questions can prevent stress and help ensure that you complete the test with confidence. This section will guide you through strategies to optimize your time during the test and avoid common pitfalls that can lead to rushing or incomplete responses.

Plan Your Time in Advance

Before you begin answering questions, it’s important to have a clear time management plan. The following tips can help you allocate time wisely:

- Set Time Limits: Allocate a specific amount of time to each section or question. For example, spend no more than 5 minutes on each multiple-choice question.

- Prioritize Difficult Questions: If you encounter a challenging question, mark it and move on to easier ones. Return to the difficult questions later with a clearer mindset.

- Leave Time for Review: Ensure that you leave a few minutes at the end of the test to review your answers, particularly those you were unsure about.

How to Avoid Time Traps

While managing your time is essential, there are certain pitfalls that can waste time and reduce your efficiency. Here’s how to avoid them:

- Avoid Overthinking: If you’re stuck on a question for too long, it can waste valuable time. Trust your instincts and move forward when needed.

- Don’t Skip Instructions: Skipping over or rushing through the instructions can lead to misunderstandings. Read them carefully to avoid mistakes.

- Stay Calm: Stress can disrupt your focus and slow you down. Keep calm and pace yourself throughout the test.

By following these strategies, you can effectively manage your time and increase your chances of completing the test with optimal performance.

Important Resources for Exam Preparation

Preparation for any certification or assessment requires a combination of materials and tools to help you succeed. Utilizing the right resources will provide the foundational knowledge needed to excel. In this section, we will highlight key resources that can aid in your preparation process, from official guides to practice tests and online forums.

Essential Study Materials

Several key materials can significantly enhance your study efforts. Here is a breakdown of the most useful resources:

| Resource | Description | Purpose |

|---|---|---|

| Official IRS Publications | Comprehensive guides that cover tax laws and regulations. | Provide in-depth explanations and examples of tax-related concepts. |

| Online Practice Tests | Practice questions that simulate the actual test format. | Help familiarize you with the question types and time constraints. |

| Tax Preparation Software | Software used by professionals to prepare tax returns. | Offer hands-on experience and tools that can simplify complex tax calculations. |

| Study Guides | Books or online materials designed to review key concepts. | Summarize important topics and provide structured lessons. |

Additional Helpful Tools

In addition to study guides and practice tests, there are several other tools that can support your exam preparation:

- Online Forums: Participating in discussion groups allows you to connect with others and gain insights into the exam process.

- Video Tutorials: Visual guides can provide step-by-step instructions on complex tax topics, helping to clarify difficult concepts.

- Flashcards: Useful for memorizing key terms, definitions, and tax codes.

By combining these resources, you can enhance your understanding, sharpen your skills, and increase your confidence when approaching the assessment.