Managing personal finances is crucial for individuals in any field, especially for those in service. Having a solid grasp of money management, budgeting, and financial planning helps ensure stability and success both during and after service. The knowledge gained through various educational resources can directly influence one’s ability to make sound financial decisions in everyday life.

For those looking to improve their financial well-being, familiarizing themselves with core principles is essential. This includes understanding how to save, invest, and manage expenses effectively. Mastering these topics can provide the confidence needed to navigate any financial challenge, regardless of future circumstances.

Preparation and practice are key elements when it comes to acquiring financial knowledge. By engaging with relevant content and exploring different strategies, individuals can hone their skills and increase their chances of success in any related assessments.

Army AER Financial Literacy Exam Overview

In any profession, understanding how to manage one’s resources efficiently is vital. For military personnel, mastering this knowledge is not only important for daily living but also for long-term security and stability. The assessment designed to evaluate these skills provides an opportunity to test and enhance one’s capabilities in managing personal funds, making informed choices, and planning for the future.

This evaluation covers a wide range of topics that are essential for developing a robust understanding of money management. The aim is to equip individuals with the necessary skills to navigate both basic and complex financial scenarios, whether it’s budgeting, investing, or preparing for unexpected expenses. The following table outlines the key components typically included in the test:

| Topic | Description |

|---|---|

| Budgeting | Understanding how to allocate income efficiently to cover essential expenses and save for future goals. |

| Saving and Investing | Identifying the best practices for growing wealth and preparing for long-term financial needs. |

| Debt Management | Learning how to handle existing debts and prevent financial strain due to excessive borrowing. |

| Emergency Funds | Building a safety net to manage unexpected financial emergencies and unforeseen circumstances. |

| Insurance | Understanding different types of insurance and how they can protect financial well-being in case of unforeseen events. |

Preparing for this evaluation is crucial, as it not only helps individuals assess their current financial understanding but also strengthens their overall financial planning skills. By familiarizing oneself with the essential concepts and practicing real-world scenarios, anyone can improve their ability to manage money effectively in any situation.

Importance of Financial Literacy in the Army

Mastering personal money management is a critical skill for anyone, but it holds even greater significance for those serving in the military. Understanding how to manage funds effectively can reduce stress, improve overall well-being, and contribute to long-term stability. Whether dealing with immediate financial needs or planning for the future, sound financial knowledge ensures that service members can handle life’s financial challenges with confidence and clarity.

Enhancing Stability and Security

Financial preparedness is essential for avoiding unnecessary difficulties, especially during transitions such as deployments, relocations, or post-service life. A well-prepared individual can handle these changes with less disruption, maintaining a stable financial foundation. This enables better decision-making in the face of unexpected situations, ensuring that essential needs are met without compromising financial goals.

Supporting Personal and Professional Growth

Being equipped with a solid understanding of managing money also contributes to personal and professional development. Service members who manage their resources wisely are less likely to face financial hardship, allowing them to focus on their missions and careers. Furthermore, effective financial management helps cultivate discipline and responsibility, traits that are valuable both in the military and beyond.

Key Topics Covered in the Exam

Effective money management requires a deep understanding of various core concepts that ensure financial stability and success. The assessment designed to evaluate financial competency includes a wide range of subjects aimed at strengthening essential skills for everyday financial decision-making. These topics are fundamental in helping individuals navigate their financial lives, both personally and professionally.

Budgeting and Expense Management

One of the key areas of focus is budgeting. This topic addresses how to allocate income effectively to cover necessary expenses, save for future goals, and avoid unnecessary spending. A solid understanding of budgeting helps individuals stay on track with their financial objectives while maintaining control over their financial situation.

Debt and Credit Management

Another essential topic covered is debt management. It’s important to understand how to manage existing debt, reduce liabilities, and avoid falling into financial traps. The assessment also explores the basics of credit, including how to build and maintain a healthy credit score, which plays a crucial role in achieving long-term financial goals.

How to Prepare for the Financial Literacy Test

Preparing for a test that assesses your understanding of managing personal finances requires both study and practical application. Focusing on key concepts such as budgeting, saving, debt management, and investing will provide a strong foundation for success. The goal is to ensure that you not only understand the theory but also know how to apply it in real-life situations.

Start by reviewing all the core topics covered in the assessment. Familiarize yourself with different methods of tracking and allocating resources, as well as strategies for reducing debt and saving for future needs. Practical tools, such as budgeting apps or online calculators, can help you gain a better understanding of the material. Additionally, practice with sample questions or past scenarios to test your knowledge and identify areas for improvement.

Consistency is key when preparing. Set aside time each day to study and reinforce your knowledge, ensuring you’re comfortable with the various topics. As you go through each area, focus on understanding the key principles behind each concept rather than memorizing details. This deeper understanding will make it easier to handle more complex situations and ultimately lead to better results on the test.

Common Questions on the Army AER Exam

When preparing for a test that evaluates your understanding of money management, it’s important to know the types of questions you might encounter. These questions typically assess your knowledge of essential financial principles and your ability to apply them in various scenarios. Having an idea of what to expect can help you feel more confident and ready when it comes time to take the assessment.

What Topics Are Covered?

One of the most common questions is about the specific subjects tested. The assessment usually focuses on areas like budgeting, saving, debt management, and investing. It’s crucial to have a comprehensive understanding of these areas, as they form the foundation of the test. By reviewing the core concepts and practicing with relevant examples, you can improve your grasp of the material and be well-prepared for the questions that cover these topics.

How Should I Study Effectively?

Many individuals ask about the best way to study for the assessment. The most effective approach is a combination of reading, practical application, and reviewing past examples. Focus on understanding the underlying principles and learn how to apply them in different contexts. Utilizing resources like online tools, study guides, and practice scenarios will help you reinforce what you’ve learned and identify any areas that need further attention.

Understanding Financial Management Basics

Effective resource management is essential for achieving long-term stability and reaching personal goals. Having a strong grasp of core principles, such as budgeting, saving, and controlling expenses, helps ensure that individuals make informed decisions about their money. These fundamental skills provide a solid foundation for handling both everyday and unexpected financial situations.

Building a Solid Budget

Creating and maintaining a budget is one of the most important aspects of managing resources. It involves tracking income and expenses, setting aside money for savings, and ensuring that necessary costs are covered. A well-organized budget helps prevent overspending and provides clarity on where adjustments may be needed to meet financial goals.

Saving for the Future

Understanding how to save and invest is crucial for building wealth over time. Setting up savings accounts, contributing to retirement funds, and exploring investment opportunities are all ways to secure financial stability. Consistent saving, even in small amounts, can lead to significant benefits in the long term, ensuring that individuals are prepared for emergencies and future aspirations.

Best Study Resources for the Exam

When preparing for an assessment that tests your understanding of personal money management, utilizing the right study materials can make a significant difference. Having access to reliable resources helps you build a solid foundation, strengthen your skills, and ensure you are well-prepared for the test. These resources can range from online courses to books, practice tests, and financial tools.

Online courses and tutorials are excellent for learning at your own pace. Many websites offer free or paid courses that cover key topics such as budgeting, investing, and debt management. Interactive lessons and quizzes allow you to apply the concepts you learn and track your progress. Additionally, using study guides or textbooks focused on money management can provide a deeper dive into specific areas, helping reinforce the material.

Practice tests are another invaluable resource. They give you a clear idea of the types of questions you will face, allowing you to become familiar with the format and structure of the assessment. Regularly taking practice tests can help you identify areas where you need improvement and boost your confidence as you approach the actual test.

Tips for Passing the Financial Literacy Exam

Success in any assessment that tests your understanding of money management comes down to a combination of preparation, practice, and strategy. By focusing on key concepts and using effective study techniques, you can improve your chances of performing well. These tips can help you navigate the test with confidence and ensure you are fully prepared for the challenges it presents.

Master the Basics

Before diving into complex topics, ensure you have a solid grasp of the fundamental principles. Understanding the basics of budgeting, saving, managing debt, and planning for future needs is essential. Start with simple exercises and work your way up to more advanced scenarios. Building a strong foundation will make it easier to tackle more difficult questions and scenarios during the assessment.

Practice with Sample Questions

Familiarizing yourself with the format of the test and practicing with sample questions is one of the most effective ways to prepare. Many study resources offer practice tests or question banks that mimic the real exam. By taking these practice tests, you’ll get a feel for the types of questions that might be asked and improve your time management skills. Use these tests to identify any gaps in your knowledge and focus on areas where you may need additional study.

What to Expect on Exam Day

When it comes time to take the assessment that tests your understanding of personal money management, being prepared for the day of the test is just as important as your study efforts. Knowing what to expect can help reduce anxiety and ensure that you are ready to perform at your best. On test day, it’s essential to approach the situation with a clear mind and a well-prepared strategy.

Arrival and Setup

On the day of the test, make sure you arrive early to allow enough time to check in and get settled. Typically, you will need to present identification and perhaps sign in before entering the testing area. Once you’re seated, take a few deep breaths and review any instructions provided. Being mentally prepared before you begin can set the tone for a more successful experience.

During the Test

Expect a timed session where you will need to apply your knowledge to answer a series of questions. These questions may be multiple choice or require you to choose the best solution for a given scenario. Stay calm and focus on the questions without rushing. If you encounter a difficult question, don’t panic. Move on to the next and return to the challenging ones after you have answered the easier ones. This strategy will help manage your time more effectively.

Strategies for Effective Time Management

Effective time management is crucial when preparing for any assessment or tackling complex tasks that require thoughtful analysis. The ability to allocate your time wisely ensures that you can cover all necessary material, avoid feeling rushed, and perform at your best. By adopting certain strategies, you can maximize your study sessions and stay organized throughout the process.

Prioritize Tasks

One of the most important aspects of time management is knowing which tasks to focus on first. Prioritizing ensures that you dedicate time to the most critical areas of study. Here’s how to do it:

- Identify key topics: Focus on areas that are most frequently tested or where you feel less confident.

- Set achievable goals: Break down larger topics into smaller, manageable sections.

- Use a schedule: Allocate specific time blocks for each topic to ensure balanced study coverage.

Maximize Focus and Minimize Distractions

When it comes to studying, maintaining concentration is key. Here are some tips to enhance focus:

- Create a dedicated study space: Choose a quiet, distraction-free environment to work in.

- Limit interruptions: Turn off your phone, social media notifications, and other potential distractions while studying.

- Use time blocks: Study for 25-30 minute intervals, followed by a 5-minute break to stay fresh and maintain focus.

By using these time management strategies, you’ll be able to approach your study sessions in a more organized and efficient manner, helping you perform better when it’s time for the assessment.

How to Improve Your Budgeting Skills

Mastering the art of managing your finances is a crucial skill that can greatly enhance your financial well-being. Being able to plan your income, track your expenses, and save effectively lays the foundation for long-term financial security. Improving your budgeting skills can help you make smarter decisions and avoid unnecessary debt. By focusing on key strategies and adopting helpful tools, you can become more proficient in managing your money.

Track Your Spending

The first step to improving your budgeting skills is understanding where your money is going. Keeping track of your daily, weekly, and monthly expenses allows you to identify patterns and areas where you can cut back. Use a simple method, such as keeping a journal or using budgeting apps, to record all your expenditures. This gives you a clear picture of your financial situation and helps you make informed decisions.

Create a Realistic Budget

Once you know where your money is going, the next step is to create a budget that fits your lifestyle. A good budget should account for all necessary expenses, savings goals, and discretionary spending. Here’s how you can create a practical budget:

- List your sources of income: Make sure to include all forms of earnings, including salary and side income.

- Prioritize essential expenses: These may include rent, utilities, groceries, and transportation.

- Set savings goals: Determine a realistic amount to save each month for emergencies or long-term objectives.

- Allow flexibility for discretionary spending: Allocate money for non-essential but enjoyable activities, like dining out or entertainment.

With practice, these strategies will help you build a stronger budgeting habit, allowing you to better manage your finances and work toward your financial goals.

Understanding Credit and Debt Management

Managing credit and debt effectively is a key component of maintaining a healthy financial situation. It’s important to understand how credit works, how to use it responsibly, and how to manage debt in a way that avoids unnecessary financial stress. By adopting good practices and strategies, you can improve your creditworthiness and ensure that your debt doesn’t overwhelm you.

How Credit Works

Credit allows individuals to borrow money or access goods and services with the promise to pay later. Understanding the different types of credit, such as credit cards, loans, and lines of credit, is essential for responsible use. Here’s what you need to know:

- Credit Limit: This is the maximum amount you can borrow. It’s important to stay below your credit limit to avoid penalties and maintain a good credit score.

- Interest Rates: When borrowing money, you’ll likely incur interest charges. These rates can vary depending on the type of credit and your credit score.

- Credit Score: Your credit score is a reflection of your borrowing behavior. A good score means you are seen as a low-risk borrower, which can lead to better loan terms.

Managing Debt Responsibly

Debt management is crucial for avoiding financial strain. Being in debt isn’t inherently bad, but how you manage it can make a significant difference. Here are some tips for managing debt:

- Create a debt repayment plan: Organize your debts by interest rate or balance and prioritize paying off high-interest debts first.

- Pay more than the minimum: Whenever possible, pay more than the minimum payment on your credit cards or loans to reduce interest charges over time.

- Consolidate your debt: If you have multiple loans or credit card balances, consider consolidating them into a single loan with a lower interest rate.

- Avoid taking on new debt: Focus on paying down existing debt before taking on additional borrowing, especially for non-essential purchases.

By following these steps, you can ensure that you’re using credit wisely and managing debt in a way that supports your long-term financial well-being.

Saving and Investing: Key Concepts

Building wealth is not only about earning more but also about making your money work for you. Saving and investing are two essential pillars of personal finance that allow individuals to build a secure future. While saving focuses on putting money aside for future use, investing involves putting that money into assets that can grow in value over time. Understanding the difference between these two concepts is vital for anyone looking to take control of their financial journey.

Understanding Saving

Saving is the practice of setting aside money for future needs or emergencies. The goal is to preserve capital and keep it accessible when needed. Here are some key elements of saving:

- Liquidity: Savings are typically kept in easily accessible accounts like savings accounts or money market accounts.

- Safety: The primary focus of saving is to keep the principal amount safe, with minimal risk.

- Low Returns: Savings accounts generally offer lower returns compared to investments, but they provide security and quick access to funds.

Understanding Investing

Investing, on the other hand, involves committing money to assets with the expectation that they will generate returns over time. This is a strategy for building wealth, but it comes with a higher level of risk. Here are some basic concepts related to investing:

- Risk vs. Return: The potential for higher returns often comes with increased risk. Understanding this trade-off is key when considering investments.

- Diversification: This involves spreading investments across different asset classes (stocks, bonds, real estate) to reduce risk.

- Time Horizon: The longer you invest, the more time your money has to grow, making long-term investments often more profitable.

Saving vs. Investing

It’s important to know when to save and when to invest. Generally, short-term goals, like buying a car or going on vacation, may require saving, while long-term goals, like retirement, may benefit from investing. Below is a comparison of saving and investing to help you decide which strategy fits your financial goals:

| Aspect | Saving | Investing |

|---|---|---|

| Purpose | Preserve capital and provide liquidity | Grow wealth over time |

| Risk | Low risk | Higher risk |

| Return | Low return | Potential for higher return |

| Time Horizon | Short-term | Long-term |

By understanding the basic concepts of saving and investing, you can make more informed decisions that align with your financial goals. Whether you’re looking to build an emergency fund or plan for retirement, both saving and investing have important roles to play in your financial strategy.

Financial Planning for Military Personnel

For those serving in uniform, managing money and preparing for the future can present unique challenges and opportunities. Whether navigating frequent relocations, managing deployments, or planning for life after service, effective planning is essential. Understanding the importance of budgeting, saving, and investing will help service members achieve financial security, both during and after their military careers.

Key Elements of Financial Planning

Creating a strong financial plan requires addressing several critical components. Each of these elements plays a crucial role in building a stable financial future:

- Budgeting: Establishing a clear budget allows individuals to track income and expenses. Knowing where your money goes helps make better spending decisions and avoid unnecessary debt.

- Emergency Savings: Having an emergency fund provides a safety net in case of unexpected expenses, such as medical bills or urgent travel needs. Aim to save at least three to six months’ worth of living expenses.

- Debt Management: Military service members may be entitled to specific debt relief programs. It’s important to manage high-interest debt like credit card balances while utilizing any available resources to reduce loans or other liabilities.

- Retirement Planning: Starting early on retirement contributions, such as through government-sponsored programs or private accounts, ensures financial security in the future.

Resources Available for Service Members

Military personnel have access to a variety of financial resources designed to make the planning process easier. These resources can help build a strong financial foundation:

- Military Pay and Benefits: Service members are eligible for specialized pay benefits, allowances, and insurance options, which should be factored into any financial plan.

- Financial Counseling: Many installations offer free financial counseling services to assist in budgeting, debt management, and investment planning.

- Thrift Savings Plan (TSP): The TSP is a government-sponsored retirement savings plan that offers tax benefits and low administrative fees, allowing military personnel to save for retirement with ease.

- Veteran Assistance Programs: When transitioning out of service, veterans can access additional financial programs and support services to guide their financial journey post-service.

Through effective financial planning, service members can ensure they’re prepared for any challenges that arise, both during their time in service and after transitioning to civilian life. With the right tools, resources, and knowledge, military personnel can build a secure financial future.

Reviewing Previous Exam Questions

One of the most effective ways to prepare for any assessment is to review questions from past evaluations. By doing so, you can familiarize yourself with the format and types of topics that are commonly covered. This practice not only reinforces your understanding but also helps identify areas that may require further study.

Looking back at previous questions offers valuable insights into the kinds of concepts that are tested, how questions are structured, and what key information is often emphasized. It provides an opportunity to gauge the level of difficulty and the types of scenarios you might encounter. Additionally, by working through these questions, you can enhance your problem-solving skills and gain confidence in your ability to tackle similar challenges on the actual assessment.

Reviewing past materials can also highlight patterns and trends that may not be immediately obvious from just reading through study guides or textbooks. It’s a strategy that helps solidify knowledge, making it easier to recall during the actual test.

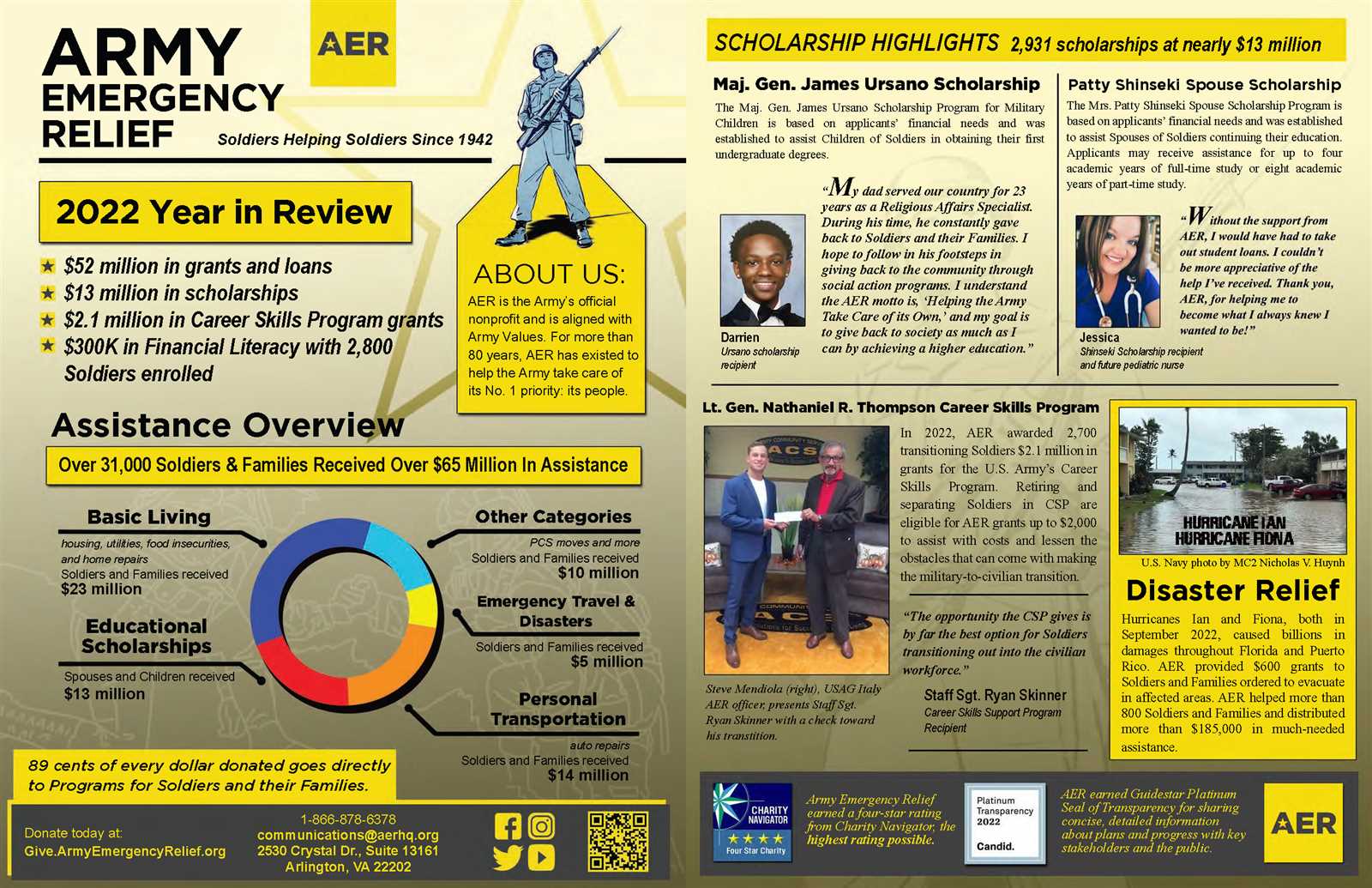

Additional Support and Resources for Soldiers

Military personnel have access to a wide range of support services and resources designed to assist them in both their personal and professional development. These resources are crucial for managing various challenges, whether they pertain to financial matters, career planning, or overall well-being. Utilizing these services can help ensure that soldiers are fully equipped to succeed in their duties and personal lives.

Several organizations and programs provide valuable tools for learning and growth. These services can assist in areas such as budget management, retirement planning, education, and mental health support. Below are some key resources that soldiers can turn to for additional help:

- Financial Counseling Services: Many installations offer free financial planning and counseling services to help personnel manage their income, savings, and debts.

- Education Assistance Programs: These programs provide funding for soldiers to pursue further education or certifications, supporting their career advancement.

- Mental Health and Wellness Resources: Access to confidential counseling and stress management programs is available to ensure mental well-being.

- Veteran Support Networks: Organizations like the Veterans Affairs (VA) offer numerous services to veterans, including healthcare, housing assistance, and career transition support.

By taking advantage of these available resources, soldiers can better manage their personal and professional challenges, which can significantly improve both their performance and quality of life.