For those pursuing certification in the accounting and financial fields, demonstrating a strong understanding of professional conduct is essential. This knowledge not only ensures compliance with legal standards but also fosters trust and responsibility in practice. As such, mastering the core principles of professionalism and moral judgment is a crucial step in preparing for certification assessments.

Success in this area requires familiarity with key concepts and scenarios that professionals encounter regularly. Whether it’s maintaining objectivity, addressing potential conflicts of interest, or ensuring transparency, the ability to make ethical decisions is foundational to building a successful career in this field. With a thorough understanding of these principles, individuals can approach any related assessments with confidence.

By focusing on the expectations and standards required for this important aspect of certification, candidates can refine their approach, ensuring they meet the high standards set by industry regulators. Building expertise in these areas will not only benefit one’s examination preparation but will also have long-term implications for professional development and ethical responsibility in the workplace.

Overview of Certification Integrity Assessment

Professional integrity is a cornerstone of certification in the accounting and financial fields. Those seeking certification are required to demonstrate a thorough understanding of the standards and practices that govern their professional conduct. This assessment evaluates the candidate’s ability to navigate various scenarios that require sound judgment and adherence to legal and moral guidelines.

The purpose of this evaluation is to ensure that all certified professionals uphold a high standard of conduct, maintaining the trust and confidence of the public, clients, and regulatory bodies. By testing knowledge of fundamental principles, the assessment helps to reinforce the importance of integrity in decision-making processes and everyday professional responsibilities.

For candidates, preparing for this part of the certification process means gaining familiarity with key concepts such as conflict resolution, objectivity, confidentiality, and compliance. The goal is to build a strong foundation that supports ethical decision-making in all aspects of professional practice, ensuring that individuals are not only knowledgeable but also committed to upholding the highest standards throughout their careers.

Understanding the Assessment Requirements

In any certification process, understanding the requirements is crucial for success. The evaluation designed for accounting and financial professionals tests not only theoretical knowledge but also the ability to apply core principles in real-world scenarios. To meet the requirements, candidates must demonstrate their understanding of specific regulations, codes of conduct, and the ethical considerations that govern the profession.

Key Areas of Focus

The assessment covers several fundamental areas that are critical for maintaining professional standards. Candidates are expected to be well-versed in areas such as maintaining objectivity, addressing conflicts of interest, and adhering to confidentiality guidelines. A solid grasp of these core concepts ensures that professionals act responsibly and transparently in their work, promoting public trust.

Preparation Tips

Preparing for this evaluation involves reviewing essential concepts, familiarizing oneself with the latest regulations, and practicing decision-making in hypothetical scenarios. Being able to apply theoretical knowledge to practical situations is key. Candidates should also consider utilizing study materials that offer examples of typical questions or case studies to reinforce their understanding of the standards required for certification.

Key Topics Covered in the Assessment

The certification process for professionals in accounting and finance evaluates several critical areas that ensure candidates uphold high standards of conduct. The topics covered in this assessment are designed to test not only theoretical knowledge but also the application of these principles in practical, real-world situations. Here are some of the key themes that are typically included:

- Professional Integrity: Understanding the importance of maintaining objectivity and fairness in decision-making.

- Confidentiality: Adhering to guidelines for protecting sensitive information and ensuring client privacy.

- Conflicts of Interest: Identifying and managing potential conflicts to ensure impartiality in all professional actions.

- Compliance with Regulations: Familiarity with legal requirements and regulatory frameworks that govern the profession.

- Professional Responsibilities: Emphasizing the duty to serve the public and uphold the reputation of the industry.

- Ethical Decision-Making: Evaluating scenarios that require sound judgment and an understanding of ethical guidelines.

These topics ensure that individuals who successfully complete the assessment are well-equipped to handle the challenges of the profession while adhering to the standards set by regulatory bodies. Mastering these concepts is crucial for long-term success and for building trust with clients and the public.

Ethical Standards for California CPAs

For professionals in the accounting field in California, adherence to established standards of conduct is essential. These guidelines are designed to ensure that practitioners maintain a high level of integrity and responsibility in all aspects of their work. By following these principles, certified public accountants (CPAs) contribute to the trust and confidence that clients, businesses, and the public place in the profession.

Core Principles of Professional Conduct

The key principles that guide CPAs in California include maintaining objectivity, acting with due diligence, and ensuring transparency in financial reporting. These standards require professionals to avoid conflicts of interest, to protect confidential information, and to act with fairness and honesty in all dealings. By doing so, they uphold the credibility of the profession and safeguard the interests of clients and the public.

Regulatory Bodies and Guidelines

California CPAs are governed by various regulatory organizations, including the California Board of Accountancy (CBA), which sets forth the codes of conduct for practitioners. These rules not only outline expectations for ethical behavior but also establish consequences for non-compliance. Understanding and adhering to these regulations is crucial for maintaining certification and ensuring the long-term success of an accounting career in the state.

How to Prepare for the Test

Preparing for any professional certification requires a strategic approach to ensure success. The key to performing well in this assessment is to have a clear understanding of the core principles and practical applications that are being tested. A thorough preparation plan will help you build confidence and ensure you’re ready to address any situation presented during the process.

Study Materials and Resources

Start by gathering reliable study materials that cover the essential topics for the assessment. These resources can include textbooks, online courses, practice questions, and case studies that focus on real-world scenarios. Reviewing up-to-date materials will ensure that you are familiar with the latest standards and requirements, which are crucial for success.

Practice and Review

One of the best ways to prepare is by practicing with sample questions or mock tests that mirror the actual format of the assessment. This helps familiarize you with the structure and allows you to manage your time effectively. After each practice session, review your answers carefully, and identify areas where further study is needed. Understanding the reasoning behind correct and incorrect answers will reinforce your knowledge.

Study Materials for Success

Choosing the right study materials is a crucial step in preparing for any professional assessment. High-quality resources provide not only foundational knowledge but also practical examples to help apply concepts in real-world situations. Whether you prefer textbooks, online courses, or interactive materials, selecting comprehensive study tools will make all the difference in achieving success.

Key Study Resources

To ensure a well-rounded preparation, it’s important to use a mix of study resources. Here is a table outlining some of the most effective tools for success:

| Resource Type | Description | Recommended Use |

|---|---|---|

| Textbooks | Books focused on core principles, providing in-depth theory and guidelines. | Use as a primary source to understand foundational concepts. |

| Online Courses | Interactive modules with lessons, videos, and quizzes. | Ideal for a structured learning path and real-time feedback. |

| Practice Tests | Sample questions designed to simulate real assessment conditions. | Excellent for reinforcing knowledge and improving time management. |

| Study Guides | Condensed materials summarizing essential topics. | Great for quick revision and final review before the assessment. |

Maximizing Your Study Time

To get the most out of your preparation, it’s essential to not only study regularly but also actively engage with the material. Take notes, quiz yourself, and practice applying what you’ve learned to hypothetical scenarios. Consistency and active involvement with the study materials will increase your retention and understanding of the key concepts.

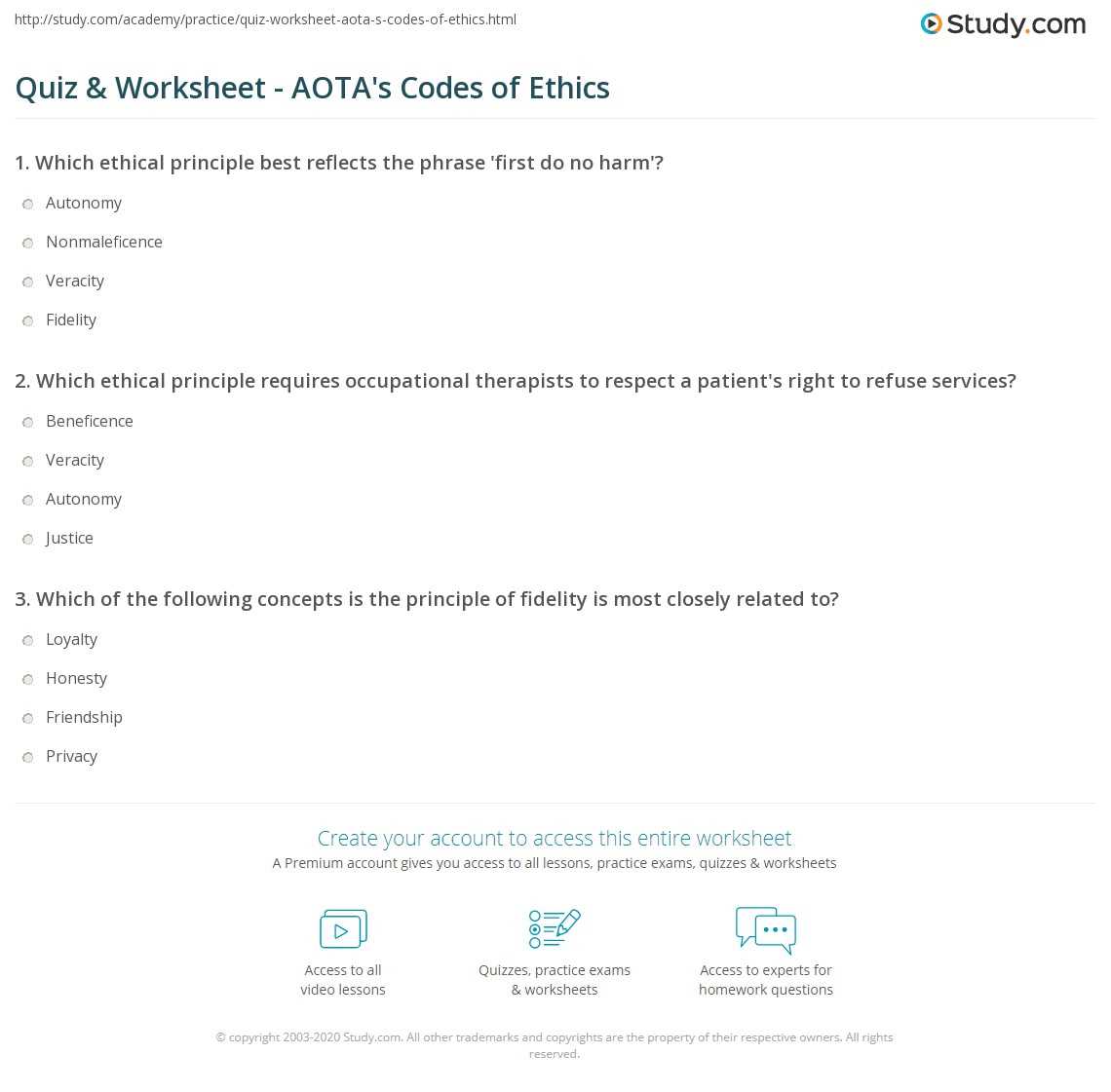

Commonly Asked Questions on the Assessment

When preparing for a professional certification, it’s important to familiarize yourself with the types of questions that may appear. Understanding the common themes and question formats will help you anticipate what to expect and tailor your study efforts accordingly. This section outlines some frequently asked questions to guide your preparation and help you feel more confident going into the test.

| Question Type | Description | Example |

|---|---|---|

| Scenario-Based Questions | These questions present real-world situations where candidates must make decisions based on ethical and legal standards. | “A client asks you to overlook a minor mistake in their financial statement. How would you respond?” |

| Multiple Choice | Multiple-choice questions test knowledge of key concepts, such as regulations and professional conduct. | “Which of the following is considered a conflict of interest?” |

| True/False Statements | These questions assess your ability to distinguish between accurate and inaccurate information related to professional guidelines. | “True or False: CPAs are allowed to disclose client information if it benefits the client.” |

| Short Answer | These questions require concise explanations of key concepts or principles, testing your understanding of critical material. | “Explain the concept of maintaining objectivity in professional practice.” |

By reviewing these common question types, you can focus your study on areas that are most likely to appear in the assessment. Practicing similar questions will help improve your familiarity with the format and increase your readiness for the actual test.

Assessment Structure and Question Types

Understanding the layout of the certification process is key to successful preparation. Knowing the structure and types of questions that will appear allows candidates to strategize their study efforts more effectively. This section provides an overview of the typical framework and question formats you can expect when taking the test.

The structure of this assessment is designed to evaluate both theoretical knowledge and practical decision-making skills. The questions are varied to test different aspects of professional conduct, including knowledge of regulations, ethical standards, and the application of core principles in realistic scenarios. Understanding the different question types will help you approach each section with confidence.

Common question formats in the assessment include multiple-choice questions, true/false statements, scenario-based questions, and short-answer inquiries. Each question type requires a different approach, whether it’s choosing the correct answer from a set of options, analyzing a situation and making a judgment, or providing a concise explanation of a concept.

Tips for Answering Ethical Questions

When faced with questions that assess your understanding of professional conduct, it’s important to approach them with a clear and methodical mindset. These types of questions often require not only knowledge of regulations but also the ability to apply ethical principles in real-world situations. Here are some tips to help you effectively tackle these questions.

- Read the question carefully – Ensure that you fully understand the situation or issue being presented before selecting your answer. Look for key phrases that highlight the ethical dilemma or conflict.

- Identify the core issue – Many questions are designed to test your ability to recognize and address the heart of the problem. Pinpoint the ethical concern or legal aspect that must be dealt with.

- Consider all options – Don’t rush to choose the first answer that seems right. Evaluate all possible choices and eliminate those that are clearly incorrect or fail to address the issue properly.

- Apply relevant principles – Use your knowledge of professional guidelines, codes of conduct, and best practices to guide your decision-making process. Base your answer on widely accepted standards and the context provided in the question.

- Stay neutral and objective – Always approach ethical questions from an impartial perspective, focusing on fairness and integrity, rather than personal opinion or biases.

- Think about long-term consequences – Consider how each possible action might affect stakeholders in the long run. Ethical decisions often involve balancing immediate needs with lasting impact.

By following these strategies, you can approach ethical questions with a more structured mindset, ensuring that you make informed and well-reasoned decisions during your assessment.

How to Manage Time During the Test

Time management is crucial when preparing for and taking a professional assessment. The ability to allocate your time wisely can significantly impact your performance. Without a clear strategy, it’s easy to spend too much time on one question or section, leaving insufficient time for others. Here are some key strategies to ensure that you stay on track throughout the entire assessment process.

Start with a Plan – Before diving into the questions, take a moment to review the entire test. Gauge how much time you have and set a rough time limit for each section. This will help prevent you from getting bogged down by any one part of the test and ensure that you can pace yourself effectively.

Prioritize Easy Questions – Begin by tackling the questions that you find easiest or most straightforward. This allows you to quickly gain confidence and accumulate points. If you encounter a challenging question, move on and come back to it later, when you have more time to think through your response.

Monitor Your Time – Keep track of the time as you progress through the test. Set intervals to check the clock, ensuring you’re on schedule. A simple trick is to divide the total time by the number of sections or questions to understand how much time you should ideally spend on each one.

Avoid Overthinking – It’s natural to second-guess yourself, but spending excessive time pondering over one question can lead to rushing through others. Trust your instincts, and if you’re unsure, make your best educated guess and move on. You can always revisit difficult questions if time permits.

Leave Time for Review – As you near the end of the assessment, leave at least 10–15 minutes to review your answers. This allows you to catch any mistakes or missed details, improving your overall score.

By employing these time-management strategies, you’ll be able to approach the test with a calm and focused mindset, giving yourself the best chance to succeed.

Importance of Ethical Standards in the CPA Field

Professional conduct is a cornerstone of the accounting industry, ensuring that practitioners operate with integrity, transparency, and accountability. In a field where clients’ financial stability and trust are at stake, adhering to high standards of behavior is essential. Upholding these principles helps maintain the credibility and reliability of the profession.

The role of accountants goes beyond number-crunching; they are entrusted with sensitive financial information and must make decisions that impact their clients, stakeholders, and the public. Adherence to moral guidelines ensures that professionals act responsibly, making choices that prioritize fairness and transparency.

- Building Trust with Clients – Ethical behavior strengthens the relationship between accountants and their clients, fostering trust and long-term partnerships.

- Protecting Public Interests – Accountants hold a position of responsibility that affects both private and public sectors. Maintaining high standards protects not only clients but also the wider community.

- Avoiding Legal Issues – Missteps in professional conduct can lead to legal ramifications, including lawsuits or regulatory penalties. Ethical standards help prevent such risks.

- Enhancing Professional Reputation – Practitioners who consistently demonstrate strong ethical practices earn the respect of peers, clients, and regulatory bodies, contributing to a stronger, more respected profession.

- Guiding Decision Making – Ethical principles provide a framework for accountants when facing difficult decisions, ensuring their actions align with the best interests of all parties involved.

In the accounting field, ethical behavior is not just a guideline–it is an essential part of sustaining the integrity of the profession and ensuring that public confidence remains high. Those who follow these principles set the standard for others to follow and contribute to a culture of professionalism and accountability.

Why Knowledge of Professional Standards is Crucial

In any profession that involves handling sensitive information or making decisions that impact others, understanding and adhering to the established standards of conduct is essential. Professionals are often faced with situations where their actions have a direct impact on the public, clients, and colleagues, making the need for a strong ethical foundation even more important. Knowledge of these standards helps ensure that decisions are made with integrity and accountability.

Protecting Client Interests – When professionals are well-versed in the rules that govern their behavior, they are better equipped to act in the best interests of their clients. Understanding how to navigate conflicts of interest, maintain confidentiality, and provide transparent advice helps build trust and foster long-term relationships.

Upholding Industry Reputation – A profession’s reputation is built on the actions of its members. Professionals who are knowledgeable about conduct guidelines contribute to maintaining the credibility of the field. This knowledge helps individuals avoid behaviors that could undermine public trust and damage the profession’s standing.

Guiding Complex Decision-Making – Many situations in professional practice involve complex moral or ethical dilemmas. A strong grasp of industry standards provides a clear framework for making difficult decisions, helping individuals choose actions that align with the greater good while staying within legal and professional boundaries.

Mitigating Risks – Inadequate understanding of professional standards can lead to unintended consequences, including legal penalties, reputational harm, and financial loss. By ensuring a solid knowledge of ethical practices, professionals can minimize these risks and make informed decisions that safeguard their career and the interests of their clients.

Enhancing Professional Development – Continuous learning about the evolving standards of conduct allows professionals to stay relevant in a changing landscape. By regularly updating their knowledge, they not only protect themselves from potential pitfalls but also position themselves as experts within their field.

In summary, understanding and adhering to professional standards is not just a matter of compliance but a key factor in building a successful, sustainable career. It ensures that professionals maintain trust, make informed decisions, and contribute positively to the reputation of their industry.

How to Succeed in the Professional Standards Test

Successfully completing a test that evaluates your understanding of professional conduct requires preparation, focus, and a clear strategy. Mastering the material ensures you are well-prepared to handle the challenges and questions that assess your knowledge in key areas such as integrity, responsibility, and transparency. With the right approach, you can confidently tackle the test and achieve a strong result.

Understand the Test Structure – Familiarize yourself with the format and types of questions that are likely to appear. This can include multiple-choice questions, case studies, and scenario-based questions that assess your ability to apply knowledge in real-world situations. Knowing the structure will help you manage your time effectively during the test.

Study Core Concepts – Review the essential principles that govern professional conduct in your field. Focus on key topics such as conflict resolution, confidentiality, and the responsibilities you have toward clients and the public. Understanding these core areas will give you the foundation needed to answer questions with confidence.

Utilize Practice Materials – Make use of practice tests and study guides that simulate the real test environment. This allows you to identify areas where you may need additional focus and provides an opportunity to become comfortable with the format of the questions.

Manage Your Time Wisely – Time management is crucial when taking any test. Allocate a specific amount of time to each section of the test, and avoid spending too long on any one question. If you’re unsure of an answer, move on and return to it later if time permits.

Stay Calm and Focused – During the test, maintain a calm and focused mindset. Read each question carefully, and make sure you understand what is being asked before selecting your answer. Stress and rushing through questions can lead to mistakes, so it’s important to stay level-headed.

Review Your Answers – If time allows, review your responses before submitting the test. Ensure you didn’t overlook any important details and that your answers align with the key concepts of professional conduct.

By following these strategies and dedicating time to thorough preparation, you’ll be well-equipped to succeed in the test. The knowledge and skills gained will not only help you pass but also enhance your ability to make ethical decisions in your professional career.

Common Mistakes to Avoid

When preparing for and taking a test that assesses your understanding of professional standards, it’s easy to make mistakes that could impact your performance. Being aware of these common errors can help you avoid them and improve your chances of success. Below are some key pitfalls to be mindful of as you approach the test.

Not Reviewing Key Concepts

Failing to focus on essential principles can lead to confusion during the test. Make sure you thoroughly understand core topics such as client relationships, confidentiality, and the responsibilities that come with the profession. Without a solid grasp of these subjects, you may struggle to accurately answer scenario-based questions.

Overlooking Instructions

Skipping or misinterpreting instructions is another common mistake. Each question or section of the test may have specific guidelines on how to answer. It’s crucial to read and understand the instructions before jumping into the answers. Misreading can lead to answers that are technically correct but do not fully address the question asked.

Spending Too Much Time on One Question

Time management is critical during any assessment. Spending too much time on a difficult question can leave you with less time for other, possibly easier questions. If you find yourself stuck, move on and return to it later. Prioritize completing all questions within the allotted time.

Not Practicing with Sample Tests

Neglecting practice materials can leave you unprepared for the actual test format. Sample tests and mock exams are a great way to get familiar with question types and the time constraints. Without this practice, you may struggle with test anxiety or miss important nuances in the questions.

Underestimating the Importance of Review

Failing to review your responses before submitting the test is a mistake that many candidates make. If time permits, always go over your answers to ensure they align with the key concepts and guidelines. This is especially important for questions that may involve complex reasoning or multi-step processes.

Avoiding these mistakes will significantly improve your chances of performing well on the test. By preparing thoroughly, managing your time effectively, and staying calm, you can navigate the assessment with confidence and achieve a strong result.

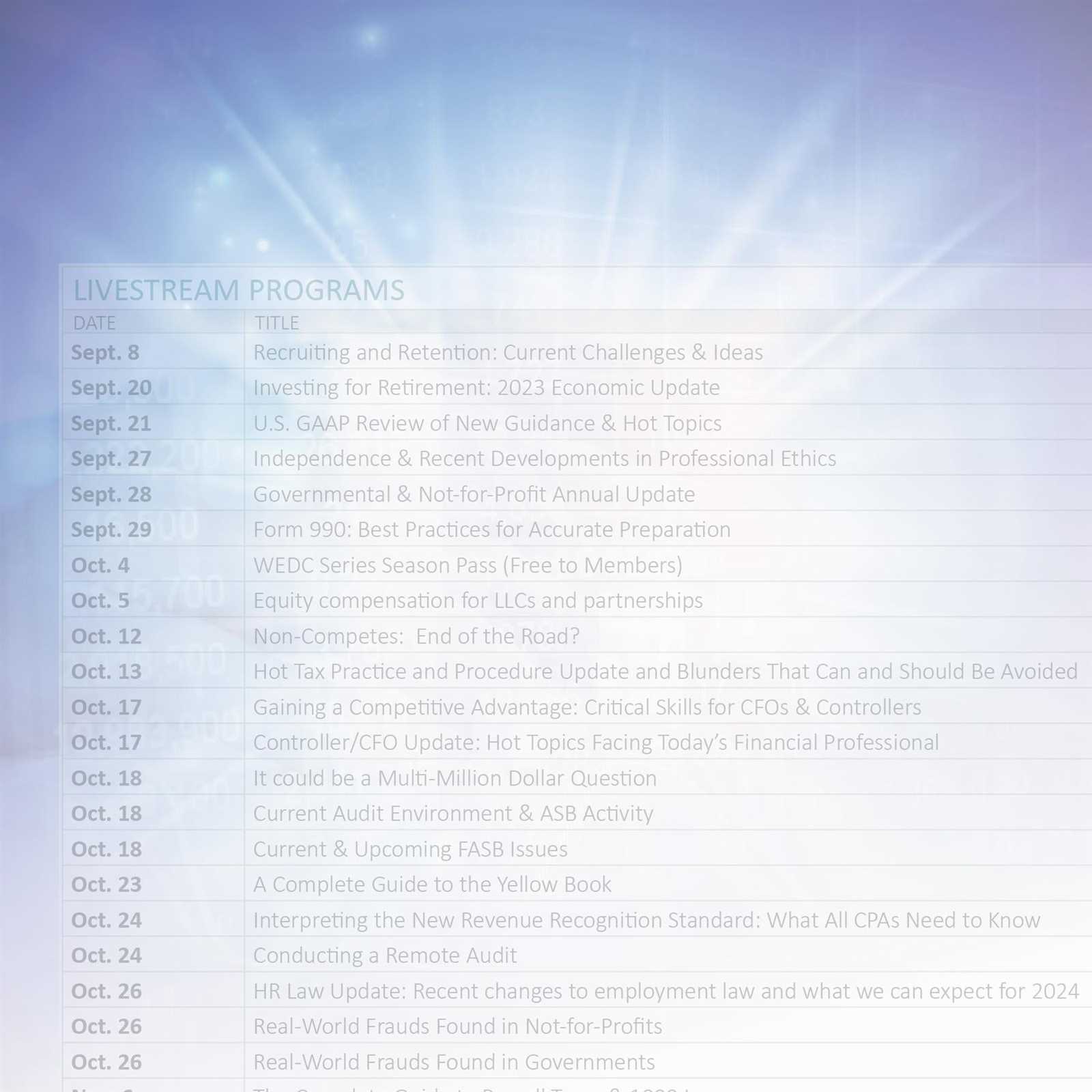

Where to Find Practice Questions

Practicing with sample questions is an essential part of preparing for any professional assessment. Familiarizing yourself with the types of questions you may encounter helps to improve both your confidence and performance. Below are several reliable sources where you can find practice materials to effectively prepare for the assessment.

Official Study Guides and Resources

The first place to look for practice questions is through official resources provided by professional organizations. Many regulatory bodies or associations offer comprehensive study guides and sample tests tailored to their specific requirements. These materials are often updated to reflect the most recent standards and question formats, ensuring that you’re practicing with the most relevant content.

Online Question Banks

Numerous online platforms provide question banks specifically designed for those preparing for professional assessments. These sites often offer a range of difficulty levels, detailed explanations for correct answers, and the opportunity to track your progress. Many websites also allow you to take timed practice tests, helping you simulate the actual testing environment.

Books and Printed Materials

Books dedicated to preparing for assessments often include hundreds of practice questions. These resources can be found in bookstores, libraries, or through online retailers. While digital options offer convenience, printed study guides allow for focused review without distractions, and can be a helpful tool for those who prefer offline study methods.

Study Groups and Forums

Another valuable source for practice materials is peer-reviewed study groups and forums. Many professionals who have already taken the test share their experiences, questions, and insights in online communities. These platforms can offer a mix of informal practice questions and personal advice, creating a supportive environment for test preparation.

By utilizing these various resources, you can build a solid foundation of practice questions and better understand what to expect during your assessment. The more familiar you become with the format and types of questions, the more confident you’ll be when it’s time to take the test.

Resources for Practicing Ethical Scenarios

When preparing for assessments that involve decision-making and problem-solving in professional settings, practicing with real-life scenarios is essential. These practice scenarios help individuals hone their judgment and reasoning skills, providing a realistic representation of challenges they may face in their careers. Below are various resources designed to help you practice navigating such situations.

Online Simulators and Scenario Tools

Many websites and platforms offer interactive scenario simulators that allow you to walk through various ethical dilemmas. These tools often present a situation followed by multiple response options, each with a consequence. By engaging in these exercises, you can test your ability to identify the most ethical course of action and learn from detailed feedback. This interactive format provides valuable hands-on experience in a controlled environment.

Case Study Books and Guides

Books that include case studies and scenario-based questions are another excellent resource for practicing ethical decision-making. These resources often outline real-world situations faced by professionals and ask you to determine the most appropriate response based on ethical guidelines and principles. By reviewing these case studies, you gain insight into how others have approached complex ethical issues and learn how to apply the same strategies in your own practice.

Professional Training Courses

Many professional organizations offer training courses that incorporate ethical scenario exercises. These courses are often led by experienced instructors who present hypothetical situations that are reflective of common challenges in the industry. They also include discussions that help reinforce ethical standards and provide clarification on best practices when handling difficult situations.

By regularly practicing with these resources, you can enhance your ability to make sound, ethical decisions under pressure, an essential skill for any professional. Engaging with diverse materials will improve your overall judgment and help you better navigate complex issues in your field.

Understanding the Scoring System

Grasping how assessments are scored is an essential part of preparing for any evaluation that tests professional judgment and knowledge. A clear understanding of the scoring system allows you to focus on the areas that matter most, improving your chances of success. The way scores are assigned can vary, but typically, it reflects how well an individual adheres to the standards and principles in practical situations. Below, we’ll break down the key components that determine how your performance is evaluated.

Scoring Criteria

When it comes to assessments designed to evaluate professional competency, scoring is often based on several key factors, including accuracy, consistency, and the ability to demonstrate sound reasoning. These criteria assess how well you are able to apply knowledge in real-life scenarios, ensuring that your responses are not just theoretical but practical and aligned with industry standards.

Point Allocation System

In most evaluations, different types of questions carry varying weight depending on their complexity. For example, multiple-choice questions may carry fewer points compared to scenario-based questions, which require deeper analysis and judgment. Below is a simplified table outlining a typical point allocation system:

| Question Type | Points |

|---|---|

| Multiple Choice | 1-2 points |

| Short Answer | 2-4 points |

| Case Study/Scenario | 5-10 points |

This table shows how each type of question may be weighted. The more complex questions typically require a more thorough explanation, and thus, they carry more points. It’s important to spend extra time on these higher-weighted questions to maximize your score.

By understanding the scoring structure, you can prioritize your preparation, ensuring that you give ample time to the most challenging parts of the assessment while managing your time effectively across all sections.

What a Passing Score Means

A passing score represents the threshold required to demonstrate adequate proficiency in the key areas being assessed. It is not just about correctly answering a specific number of questions; rather, it signifies that an individual has the necessary knowledge, skills, and understanding to perform competently in professional situations. Achieving a passing score ensures that you meet the minimum standards expected by regulatory bodies and employers within your field.

While the precise score needed to pass may vary depending on the assessment’s structure and purpose, it usually reflects a comprehensive understanding of the material and the ability to apply it appropriately. In most cases, achieving a passing score means that you have met all the necessary criteria to proceed to the next stage in your career or certification process.

Key Factors in Determining a Passing Score

The following factors contribute to what constitutes a passing score:

- Minimum Percentage: Most assessments require you to achieve a certain percentage of correct answers. This percentage is usually set by the governing body or the assessment organization.

- Correct Application of Knowledge: It’s not just about answering questions correctly but also demonstrating the ability to apply your knowledge in practical situations.

- Consistency: A passing score reflects consistent performance across various topics and scenarios. This ensures you are well-rounded and capable of handling different challenges.

In essence, passing the assessment confirms that you have the competence to meet the ethical and professional standards expected within your field. It is a crucial milestone in ensuring that professionals are equipped to make responsible decisions in their practice, protecting the public interest and maintaining trust in the profession.