Successfully completing a financial certification is a significant milestone for anyone looking to advance their career in the world of finance. Achieving proficiency in key concepts, along with thorough preparation, is essential for ensuring success. Whether you are aiming to enhance your professional knowledge or to obtain a credential that opens up new opportunities, understanding what to expect from the assessment process is crucial.

To achieve a high score, it’s important to grasp not only the basic principles but also the more complex aspects of financial analysis and management. Knowing the structure of the test, along with focusing on core concepts, can provide a clear advantage. Strategic preparation involves practicing under realistic conditions and familiarizing yourself with question formats that will appear during the assessment.

In this guide, we will walk through the most effective ways to approach your study sessions, provide helpful tips on managing time, and highlight common pitfalls to avoid. With the right mindset and preparation, you will be ready to tackle any challenge that comes your way.

CFA Investment Foundations Program Final Exam Answers

When preparing for the final assessment in the financial certification track, understanding the core principles and applying them effectively is key to success. The key to performing well lies not just in memorizing facts but in mastering the critical concepts that will be tested. It’s essential to develop a solid grasp of financial theories, analytical skills, and their real-world applications, as these form the foundation of the entire certification process.

To boost your preparation, it’s helpful to familiarize yourself with the typical structure of the questions. The test is designed to evaluate both your theoretical knowledge and your ability to apply that knowledge in practical scenarios. Many candidates find that practicing with sample questions and reviewing detailed solutions helps them gain insight into how to approach each section effectively.

By focusing on understanding concepts and practicing under timed conditions, you can gain confidence and improve your problem-solving abilities. Ensure that your study plan incorporates a balanced mix of reading, practice tests, and review of key concepts. This holistic approach will provide the clarity needed to succeed and pass with a high score.

Understanding the CFA Investment Foundations Exam

The assessment for this financial certification is designed to test a candidate’s comprehensive understanding of key financial principles and their ability to apply them in practical settings. It evaluates both theoretical knowledge and the practical skills necessary for navigating the complexities of the financial industry. Preparing for this test requires not just a focus on facts, but also an understanding of how various concepts interrelate and how they are used in real-world financial decision-making.

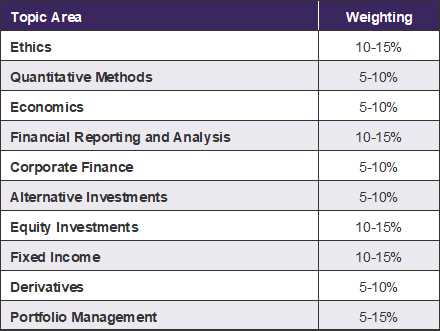

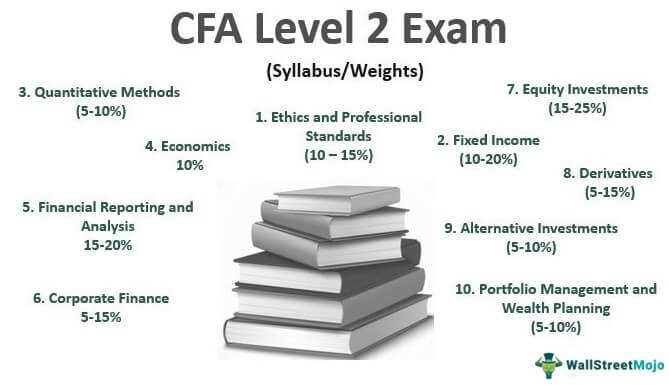

The questions on the test cover a wide range of topics, from economic theory to ethical standards, and from financial markets to asset management. Each section is intended to assess your ability to understand and apply fundamental financial concepts across multiple areas. Familiarity with these core topics, along with the structure of the questions, is essential for performing well in the assessment.

Success in the test is dependent on a deep understanding of both basic and advanced concepts, along with the ability to apply them effectively in different scenarios. Practicing with sample questions, reviewing detailed explanations, and focusing on your weaker areas will help you build the confidence needed to perform at your best.

Key Concepts to Focus On

When preparing for the financial certification assessment, it’s crucial to concentrate on the fundamental ideas that form the backbone of the subject matter. These concepts serve as the foundation for understanding how the financial world operates and will be tested thoroughly during the assessment. Mastering these key areas not only helps you perform well but also ensures that you have a well-rounded understanding of the material.

Core Areas of Focus

- Financial Markets and Institutions: Understand the different types of markets and institutions, their roles, and how they operate.

- Ethical Standards and Professional Conduct: Learn the ethical principles that guide financial professionals and their implications in decision-making.

- Economic Principles: Study economic concepts that affect global financial systems, such as supply and demand, inflation, and interest rates.

- Risk Management: Familiarize yourself with strategies to identify, assess, and manage various financial risks.

- Financial Instruments: Understand the different types of financial instruments, their functions, and how they are used in investment and risk management.

Advanced Areas to Review

- Asset Valuation Techniques: Focus on the methods used to value assets, including stocks, bonds, and derivatives.

- Global Financial Systems: Study the structure and function of global markets and the interconnectivity of national economies.

- Investment Strategies: Review various investment approaches, including portfolio diversification and active versus passive management.

Focusing on these areas will not only help you understand the key topics but will also give you the analytical skills needed to excel in applying these concepts in practical situations. Proper preparation in these core and advanced subjects is the best way to ensure success and confidence on assessment day.

How to Prepare Effectively for the Exam

Preparing for a professional financial certification requires a structured approach and a focused study plan. Success doesn’t come from just passively reading materials; it demands active engagement with the content, strategic revision, and effective time management. To be fully prepared, it’s essential to combine various methods of study and ensure that all areas are covered in depth.

Creating a Study Plan

Start by developing a study schedule that allocates sufficient time to each topic based on its complexity and weight in the assessment. Be realistic about how much time you can dedicate each day, and make sure to stick to your plan. Focus on weak areas first and gradually move to more advanced concepts. A structured approach will help prevent last-minute cramming and improve retention.

Utilizing Study Materials and Resources

It’s important to use a variety of resources to ensure a well-rounded understanding. Consider using textbooks, online courses, and practice tests to cover the material from different angles. Active learning techniques, such as summarizing key points, making flashcards, and discussing topics with peers, can help reinforce your knowledge and improve recall. Don’t rely on just one resource; diversify your materials for a more thorough review.

Additionally, practicing with sample questions under timed conditions will help familiarize you with the test format and build confidence. Aim for regular mock tests to track your progress and identify areas that still need improvement.

By staying organized, managing your time well, and using varied study techniques, you can prepare effectively and maximize your chances of success.

Common Mistakes to Avoid During the Test

When taking a high-stakes financial assessment, it’s easy to make errors that can negatively impact your performance. Many candidates make similar mistakes under pressure, which could be avoided with proper preparation and awareness. Understanding common pitfalls and knowing how to navigate them can significantly increase your chances of success.

Typical Mistakes Made by Candidates

| Mistake | How to Avoid It |

|---|---|

| Rushing Through Questions | Take your time to read each question carefully and ensure you understand it before answering. |

| Overthinking Simple Questions | Stick to your first instinct when a question feels straightforward–don’t complicate things unnecessarily. |

| Not Managing Time Properly | Allocate a specific amount of time per section and stick to it, leaving time for review at the end. |

| Skipping Questions You’re Unsure About | Mark difficult questions and return to them after answering the easier ones to avoid losing points. |

| Failing to Review Answers | Always leave time at the end to review your answers, checking for errors or omissions. |

Additional Tips for Success

Another common mistake is not practicing under timed conditions. This can lead to poor time management on test day. Try simulating the test environment as closely as possible in your study sessions to build confidence. Moreover, don’t neglect your physical and mental well-being; adequate rest and staying calm during the test can help you think more clearly and perform better.

By being mindful of these common errors and following a clear strategy, you’ll be better equipped to avoid them and improve your chances of success during the assessment.

Important Topics Covered in the Exam

In any professional certification assessment, the content is carefully structured to cover a range of crucial subjects that evaluate a candidate’s knowledge and ability to apply key financial principles. Understanding the core areas of focus will help guide your study sessions and ensure you’re well-prepared for the challenge ahead. These topics form the foundation of the assessment and are essential for demonstrating competence in the field.

Core Financial Concepts

The test will assess your knowledge of fundamental financial concepts, including:

- Financial Markets: Learn the structure, types, and functions of financial markets and their role in the global economy.

- Economic Principles: Understand the basic principles of supply and demand, inflation, monetary policy, and their impact on markets.

- Risk Management: Be familiar with the methods used to identify, measure, and manage different types of financial risks.

- Ethics and Professional Standards: Know the ethical frameworks that govern financial decision-making and professional conduct.

Investment and Asset Management

Another key area focuses on understanding different investment strategies and asset management practices:

- Portfolio Theory: Grasp the principles of portfolio diversification, risk-return trade-offs, and asset allocation.

- Valuation of Securities: Learn how to assess the value of stocks, bonds, and other financial instruments.

- Global Financial Systems: Understand the interconnectedness of international markets and the effects of global economic events on local economies.

Mastering these topics will give you a solid foundation for tackling the assessment, helping you approach each section with confidence and understanding.

Recommended Study Materials for Success

To achieve success in any financial certification assessment, having the right study materials is crucial. The best resources not only cover the necessary concepts but also provide practice opportunities to reinforce learning. A mix of textbooks, online resources, and interactive tools will help ensure a well-rounded understanding of the content and improve retention.

Essential Textbooks and Guides

Start with comprehensive textbooks that cover the core topics in depth. These books should explain key concepts clearly, and often include examples and exercises for practical application. Recommended books may include:

- Principles of Finance: A solid foundational text that covers the basics of financial theory and its real-world applications.

- Ethical and Professional Standards: Materials that focus on the ethical frameworks and professional standards governing financial practices.

- Investment Strategies and Analysis: Books that delve into asset management, portfolio theory, and risk management techniques.

Online Courses and Practice Resources

Alongside textbooks, online courses can provide more interactive learning experiences. Platforms that offer video lectures, quizzes, and mock tests can help solidify your understanding and allow for active learning. Some helpful resources include:

- Interactive Learning Platforms: Websites offering structured study plans, videos, and quizzes to guide your learning.

- Practice Question Banks: Use question banks to test your knowledge and simulate test conditions, helping you become familiar with question formats.

- Study Groups and Forums: Engaging with online communities can provide additional insights and allow you to discuss challenging topics with peers.

By using a combination of these resources, you’ll be able to reinforce your learning and ensure that you’re fully prepared for the assessment.

Time Management Tips for Exam Day

Effective time management is a critical skill when taking a professional financial certification assessment. Without a clear strategy for allocating time, candidates may rush through sections, miss important details, or fail to complete the test on time. By planning ahead and managing your time carefully during the test, you can maximize your performance and reduce stress.

Pre-Test Time Management

- Get a Good Night’s Sleep: Rest is essential for sharp focus and clear thinking. Ensure you are well-rested before the test to perform at your best.

- Eat a Nutritious Meal: A balanced meal before the test will give you the energy needed to stay alert and focused throughout the day.

- Arrive Early: Aim to arrive at the test center with plenty of time to spare. This reduces anxiety and gives you time to settle in before you begin.

During the Test: Managing Time Effectively

- Allocate Time for Each Section: Before you begin, glance through the entire test to understand the number of questions and the time available. Divide your time wisely between each section based on its length and complexity.

- Stick to Your Time Limits: Avoid spending too much time on any one question. If you’re stuck, move on and come back to it later if time permits.

- Prioritize Easy Questions: Start with questions that you are confident about. This will boost your confidence and help you accumulate easy points early on.

- Use the Process of Elimination: For multiple-choice questions, eliminate obviously incorrect answers to increase your chances of selecting the right one even if you’re unsure.

- Leave Time to Review: Always aim to finish at least 10-15 minutes before the end of the allotted time. Use this extra time to review your answers and check for errors or overlooked questions.

By staying organized, keeping an eye on the clock, and practicing effective time allocation, you will be in a much stronger position to complete the test successfully. Time management is as much about preparation as it is about execution, so make sure to plan ahead and stay focused throughout the test.

How to Approach Multiple-Choice Questions

Multiple-choice questions are a common feature in many professional assessments and require a specific strategy for success. Unlike essay-style questions, multiple-choice tests often assess your ability to quickly identify the correct answer from a set of options. The key is not just knowing the material but also developing the right approach to efficiently and accurately navigate through the questions.

Strategies for Answering Multiple-Choice Questions

- Read Each Question Carefully: Before looking at the answer choices, read the question thoroughly to ensure you understand what is being asked. Pay attention to keywords and phrases that define the scope of the question.

- Eliminate Clearly Incorrect Options: Narrow down your choices by eliminating answers that are obviously wrong. This increases the likelihood of selecting the correct answer even if you’re unsure initially.

- Look for Clues in the Question: Sometimes, the question itself may contain hints that guide you toward the correct answer. Pay attention to words like “always,” “never,” or “most likely,” which can help differentiate between options.

- Consider All Options: Don’t settle for the first answer that seems correct. Always evaluate all the choices before making a final decision. Sometimes the best answer isn’t the most obvious one.

- Don’t Overthink: Trust your initial instinct. Often, your first choice is the correct one. If you feel unsure, go with your gut unless you can clearly justify a different answer.

Managing Time and Avoiding Common Pitfalls

- Don’t Spend Too Much Time on One Question: If you’re stuck on a question, move on and come back to it later. Spending too much time on a difficult question can waste valuable minutes.

- Use the Process of Elimination: If you’re unsure of the correct answer, eliminate the least likely choices first. This increases your odds of selecting the right one from the remaining options.

- Answer Every Question: Don’t leave questions unanswered. Even if you’re unsure, make an educated guess. Leaving a question blank guarantees no points.

By following these strategies, you can maximize your chances of success in multiple-choice sections. A well-thought-out approach will help you answer questions more efficiently and with greater confidence.

Analyzing the CFA Investment Foundations Curriculum

The curriculum for this financial certification is designed to provide a thorough understanding of essential concepts and practices that are fundamental to the finance industry. It covers a broad range of topics, from the principles of financial markets to risk management strategies, offering a comprehensive framework for both beginners and those looking to deepen their knowledge. Analyzing the curriculum helps identify the key areas to focus on and ensures a well-rounded understanding of the material.

The structure of the curriculum is organized into several core modules that build upon each other. Each module is carefully crafted to offer both theoretical knowledge and practical application, ensuring that candidates not only understand key concepts but can also apply them in real-world scenarios. Below is a breakdown of the major topics typically covered in the curriculum.

| Module | Key Topics Covered |

|---|---|

| Financial Markets | Overview of financial markets, types of markets, market participants, and the role of markets in the economy. |

| Risk Management | Types of financial risks, methods of measuring risk, risk management strategies, and the importance of diversification. |

| Ethics and Professional Standards | Ethical frameworks, professional conduct guidelines, and the importance of ethical decision-making in finance. |

| Financial Instruments | Types of financial instruments (stocks, bonds, derivatives), their functions, and how they are traded and valued. |

| Global Financial Systems | The structure of global financial systems, the role of central banks, and the interconnection of international markets. |

Each of these modules plays a crucial role in building a well-rounded understanding of the financial industry. By focusing on these areas, candidates can gain the knowledge and practical skills needed to navigate complex financial environments. This curriculum serves as a solid foundation for those aiming to pursue further professional certifications or build careers in finance.

Exam Format and What to Expect

Understanding the structure and format of the assessment is essential for proper preparation. Knowing what to expect can help reduce anxiety and allow you to focus on answering the questions effectively. The format is designed to assess your ability to apply financial concepts in a variety of scenarios, with a mix of question types to test both your knowledge and decision-making skills.

The test consists primarily of multiple-choice questions that cover a wide range of topics. These questions are designed to evaluate not only your factual knowledge but also your ability to analyze and apply concepts in realistic contexts. In addition, the time limit is carefully structured to ensure that you can demonstrate your proficiency under pressure. Below is a breakdown of the typical format and what you can expect during the assessment.

| Section | Content Covered | Question Type | Duration |

|---|---|---|---|

| Section 1 | Financial Markets, Risk Management | Multiple-choice | 30 minutes |

| Section 2 | Ethics, Professional Standards | Multiple-choice | 30 minutes |

| Section 3 | Financial Instruments, Global Financial Systems | Multiple-choice | 30 minutes |

| Section 4 | Portfolio Management, Analysis Techniques | Multiple-choice | 30 minutes |

Each section is timed separately, with a focus on specific areas of financial knowledge. The total duration of the assessment is generally about two hours, providing ample time to complete each section while maintaining a steady pace. The questions will range in difficulty, so it’s important to stay focused and manage your time efficiently throughout the test. Familiarizing yourself with the test format ahead of time will allow you to approach each section with confidence and improve your overall performance.

Strategies for Reviewing CFA Materials

Effective review strategies are key to mastering the content and performing well on any professional certification. Simply reading through the materials may not be enough; an active and structured approach is necessary to reinforce key concepts and ensure retention. In this section, we will explore strategies that will help you review efficiently and effectively, ensuring that you are fully prepared for the assessment.

Active Review Methods

- Summarize Key Concepts: After studying a chapter, write a brief summary of the main points. This helps reinforce your understanding and allows you to quickly recall important details during the review.

- Teach What You’ve Learned: Teaching someone else what you’ve just studied is one of the best ways to solidify your knowledge. Explaining complex ideas in simple terms forces you to fully understand the material.

- Create Flashcards: Flashcards are an excellent tool for memorizing definitions, formulas, and key concepts. Review them regularly to keep the material fresh in your mind.

- Practice with Real-Life Scenarios: Apply the theoretical knowledge to real-world situations. Try to think through how the concepts relate to current events or practical financial problems.

Timed Practice and Mock Tests

- Take Practice Tests: Regularly test yourself under timed conditions to simulate the pressure of the actual assessment. This helps you get comfortable with the format and improves your ability to recall information quickly.

- Focus on Weak Areas: After each practice test, review your mistakes carefully. Focus your study on the areas where you made errors, and continue practicing until you improve.

- Review Incorrect Answers: Make sure you understand why certain answers were wrong. This allows you to learn from your mistakes and strengthens your ability to apply the concepts correctly in the future.

Revision Techniques

- Spaced Repetition: Use a spaced repetition technique, reviewing topics at increasing intervals to improve long-term retention of information.

- Group Study Sessions: Consider studying with peers to exchange ideas and clarify doubts. Group discussions can offer different perspectives and enhance your understanding.

- Focus on Core Material: While reviewing, prioritize the most important and frequently tested concepts. Don’t get bogged down in less critical details unless you have time to spare.

By incorporating these strategies into your study plan, you will be better prepared to recall key information, improve your performance, and approach the assessment with confidence. Consistency and active engagement with the material are crucial for success.

How to Stay Motivated During Study

Staying motivated throughout a long and rigorous study process can be challenging. It’s easy to lose focus, especially when the material seems overwhelming or when distractions arise. However, maintaining a steady sense of motivation is key to making consistent progress. By incorporating effective strategies and setting achievable goals, you can keep yourself on track and energized as you work toward your goal.

Set Clear Goals

Establishing clear, specific goals is one of the most powerful ways to stay motivated. Break down your larger objectives into smaller, more manageable tasks. By focusing on completing one small goal at a time, you create a sense of accomplishment that fuels your drive to move forward. For instance, instead of thinking “I need to study all of Chapter 3,” set a goal like “I will finish reading the first section and take notes.” This approach helps reduce the feeling of being overwhelmed and keeps your momentum going.

Track Your Progress

Monitoring your progress helps you stay focused on your journey. Whether it’s marking off completed study sessions on a calendar or using a checklist, visual progress tracking can remind you how far you’ve come and provide a sense of achievement. This also helps you identify areas where you might need to adjust your focus or study plan. Seeing the progress you make, even in small increments, can provide a significant motivational boost.

Reward Yourself

Incorporating rewards for reaching milestones can help you stay motivated over time. After completing a certain number of study hours or finishing a challenging chapter, treat yourself to something you enjoy–a break, a favorite snack, or an episode of your favorite show. These small rewards create positive reinforcement and provide an incentive to stay on task.

Maintain a Study Routine

Consistency is crucial when preparing for any professional assessment. By creating a study routine and sticking to it, you build positive habits that require less effort to maintain over time. Having a set study schedule reduces procrastination and ensures that you’re consistently making progress. Plus, it eliminates the need to constantly decide when to study, making the process more automatic.

Stay Connected with Your Support System

Having a support system can provide the encouragement and accountability you need to stay motivated. Whether it’s friends, family, or fellow candidates, having someone to share progress with and talk about challenges can help maintain a positive mindset. Consider joining a study group or finding a study buddy to keep each other motivated and focused.

By applying these strategies, you can make the study process more manageable and stay motivated throughout. The key is to stay consistent, celebrate your successes along the way, and keep your end goal in mind.

What to Do After Completing the Exam

Once you’ve finished the assessment, it’s important to take the right steps to ensure you stay on track with your career goals. While it’s natural to feel a sense of relief or even anxiety after completing a challenging test, how you manage the period following your test can have a significant impact on your future plans. Whether you’re awaiting results or planning your next steps, this time offers opportunities to reflect, relax, and prepare for what comes next.

Relax and Recharge

After the intensity of studying and sitting for the test, giving yourself time to relax is essential. Stress can build up during preparation, so taking a break and engaging in activities that help you unwind is important for your well-being. Whether it’s a weekend getaway, indulging in a hobby, or simply spending time with family, allowing yourself to recharge will help you refocus for any future professional goals.

Review and Reflect

While it’s tempting to move forward quickly, taking some time to review your experience can be beneficial. Reflect on the areas where you felt confident and the topics that posed challenges. This analysis can guide your future studies and help you identify areas for improvement in your approach to professional development. Consider reviewing practice questions or mock tests you used during your preparation to further solidify your understanding of the material.

If you haven’t already, this might also be the right time to explore additional resources or certifications that align with your career path. Building on your recent experience and knowledge will help you stay engaged in your professional growth.

Finally, remember that regardless of the outcome, completing such a comprehensive assessment is a significant achievement. Take the time to celebrate your hard work before you move on to the next chapter in your professional journey.

How to Interpret CFA Exam Results

Once you receive your results, it’s essential to understand what they mean and how to interpret them in the context of your overall professional development. The results not only indicate whether you passed but also provide valuable insights into your strengths and areas that may require additional focus. Understanding how to read and analyze these results can help you plan your next steps effectively, whether it’s moving forward with further certifications or revisiting certain concepts to strengthen your foundation.

Understanding the Score Report

Your score report will typically include an overall result, as well as a breakdown of performance across different sections or topics. Focus on the overall performance first, as it will confirm whether you passed or not. If you passed, congratulations! If you didn’t, don’t be discouraged–use the feedback provided to guide your future preparation. Review the individual section scores to see which areas you excelled in and which ones need improvement.

Key Areas to Focus On

- Pass/Fail Status: This is the most important part of the report. If you passed, it confirms that you’ve met the required standards. If you didn’t, it indicates that you need to revisit your approach and possibly retake the assessment.

- Topic Breakdown: Many assessments include a detailed breakdown of your performance across different topics. Pay attention to the areas where you scored lower to identify knowledge gaps that need to be addressed before retaking the test or moving forward in your career.

- Competency Levels: Some reports also include ratings of your competency in specific areas, such as “basic,” “proficient,” or “advanced.” These can help you gauge how well you understood the material and which areas require more focus.

After reviewing your score report, take time to reflect on your performance. If you passed, use the results to confidently move ahead in your career or pursue further qualifications. If you didn’t pass, take the time to analyze your mistakes, reassess your study strategy, and seek additional resources or support before reattempting. Remember, each attempt provides an opportunity for growth and improvement.

Success Stories and Exam Tips from Graduates

Hearing from those who have successfully completed the certification process can provide both inspiration and practical advice. Many graduates have navigated the challenges of the assessment and emerged with valuable insights that can help guide future candidates. In this section, we share success stories and exam tips that will help you stay motivated and effectively prepare for your own journey toward professional certification.

Inspiring Success Stories

Many candidates begin the journey with doubts, but hearing success stories can offer motivation and perspective. Take, for example, Sarah, a recent graduate who balanced her full-time job with study sessions. Despite her busy schedule, she passed on her first attempt. Her success was built on disciplined time management, consistent study habits, and finding small ways to integrate learning into her daily routine. Sarah’s advice to others is simple: “Consistency is key–study a little every day, and it will pay off.”

Another success story comes from Mark, who struggled with understanding complex concepts initially. However, after attending review sessions and participating in study groups, Mark was able to master the material. His key takeaway was the power of collaboration: “Don’t study in isolation. Engaging with others can help clarify difficult topics and provide new perspectives that you may not have considered on your own.”

Top Exam Tips from Graduates

- Create a Study Schedule: Many successful candidates emphasize the importance of a structured study plan. Set clear goals for each week and allocate time to review each topic thoroughly. A detailed schedule keeps you organized and ensures you’re covering all necessary areas without feeling overwhelmed.

- Focus on Weak Areas: While it’s tempting to revisit what you already know well, several graduates suggest spending more time on your weak points. By strengthening your understanding of these areas, you increase your overall performance.

- Practice Under Test Conditions: Simulating test day conditions is crucial. Take full-length practice tests to get accustomed to the format and timing. This will not only help you build confidence but also improve your ability to manage time effectively during the actual assessment.

- Stay Positive and Manage Stress: Stress management is essential for success. Many graduates recommend relaxation techniques such as deep breathing or mindfulness exercises to stay calm and focused during the preparation process and on the day of the assessment.

- Review Mistakes and Learn from Them: After each practice session, take time to review your errors. Understanding why you made certain mistakes allows you to correct them and avoid similar pitfalls in the future.

Learning from the experiences of graduates who have successfully completed the assessment can be a powerful tool in your preparation. Their strategies and advice provide a roadmap for success and help you avoid common pitfalls. With dedication, the right resources, and the right mindset, you too can achieve your goal of certification.

Why the CFA Investment Foundations Matters

Achieving proficiency in the core principles of finance and investment is essential for anyone looking to build a successful career in the financial industry. This certification provides a solid understanding of the essential concepts, helping individuals to grasp the key concepts that form the foundation of the financial world. While it might not be as advanced as other professional qualifications, it plays a crucial role in setting the stage for more specialized knowledge and career advancement.

Enhances Career Opportunities

One of the key reasons this qualification is so valuable is its ability to expand career prospects. The knowledge gained from completing the certification can open doors to various roles within the finance sector. Whether you are looking to start a career or transition into finance, having a recognized qualification provides credibility and demonstrates a solid understanding of basic principles.

Builds a Strong Knowledge Base

- Understanding of Key Concepts: The certification provides a deep dive into financial instruments, risk management, and ethics in finance, helping professionals gain a well-rounded grasp of the industry.

- Improved Decision-Making: With a solid understanding of core financial principles, candidates are better equipped to make informed decisions, which is essential in day-to-day operations in any financial role.

- Foundation for Advanced Studies: This certification acts as a stepping stone to more specialized and advanced qualifications in the finance sector, such as investment analysis or portfolio management.

Strengthens Ethical Understanding

Another significant benefit of this qualification is its emphasis on ethics and professional standards. A strong ethical foundation is essential in finance, where trust and integrity are crucial. By understanding the ethical standards expected in the industry, professionals can ensure that they act in a responsible and transparent manner, helping to build stronger relationships with clients and colleagues.

Provides a Competitive Advantage

- Distinguishing Yourself from Others: Many professionals in finance have similar backgrounds and qualifications. This certification allows you to stand out by demonstrating that you have a deeper understanding of the industry’s fundamental concepts.

- Global Recognition: The certification is recognized worldwide, meaning that the skills and knowledge you gain can be applied in various global markets, offering flexibility in your career path.

Ultimately, this qualification matters because it provides a strong foundation for those entering the financial world. It helps professionals navigate complex concepts with ease, opens up new career opportunities, and sets the stage for continued learning and growth within the industry.