In this section, we explore a variety of problems related to managing finances, focusing on methods to handle different types of tasks and calculations. The goal is to provide clear and effective techniques to solve complex scenarios that students often encounter in their studies. By breaking down these exercises step-by-step, we aim to make the process of mastering financial principles both accessible and efficient.

Effective problem-solving is at the core of understanding key financial concepts. With a structured approach, tackling even the most challenging tasks becomes easier. In this guide, we will demonstrate how to navigate through different exercises, offering solutions that highlight the most important aspects of each scenario.

Whether you are preparing for exams or simply refining your knowledge, the insights provided here will help you gain confidence in applying theoretical concepts to practical situations. By focusing on common mistakes and offering useful tips, we aim to guide you toward achieving a stronger grasp of essential principles.

Solutions to Financial Exercises

This section is dedicated to providing clear solutions for complex financial tasks that are commonly encountered in various assessments. By exploring different problem-solving techniques, we focus on enhancing your ability to approach each task with confidence and accuracy. Understanding how to break down these problems into manageable steps is essential for mastering key financial concepts.

We will cover a range of problem types, offering practical examples and clear explanations to guide you through the solutions. Each example highlights specific techniques that will help improve your ability to manage numbers and understand the financial context of the problems.

- Step-by-step breakdowns of common financial scenarios.

- Clear solutions for understanding how to approach calculations and recordkeeping.

- Examples that demonstrate how to correctly interpret data and make informed decisions.

By reviewing these examples, you will be better prepared to tackle similar problems in the future. This section emphasizes the importance of precision and attention to detail, ensuring you can confidently apply learned skills to a wide range of financial situations.

Understanding Key Financial Concepts

Grasping essential principles is the foundation for successfully solving financial problems. These core ideas form the building blocks for more advanced techniques and calculations. By mastering the basics, you gain the ability to analyze and interpret financial data effectively, leading to better decision-making in various scenarios.

Basic Financial Terminology

Before diving into complex exercises, it’s crucial to understand the key terms used in financial analysis. These terms serve as the common language when dealing with financial tasks, and having a solid grasp of them will make the entire process smoother.

- Assets: Resources owned by a business or individual that are expected to bring value in the future.

- Liabilities: Obligations or debts that must be settled in the future.

- Equity: The owner’s stake in the business after subtracting liabilities from assets.

- Revenue: The income generated from normal business operations.

Key Concepts for Financial Success

In addition to terminology, certain concepts are fundamental to understanding financial reports and decision-making. These ideas help establish a clear picture of financial health and guide actions toward achieving specific goals.

- Balance Sheet: A snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and equity.

- Income Statement: A report showing a company’s financial performance over a period, highlighting revenue, expenses, and profit.

- Cash Flow: The movement of money into and out of a business, indicating its liquidity.

By internalizing these core concepts and terms, you build the necessary knowledge to tackle more advanced financial problems with confidence. Understanding these ideas will help you interpret data, make informed decisions, and apply your skills effectively in real-world situations.

Step-by-Step Solution for Problems

Breaking down complex tasks into smaller, manageable steps is crucial for successfully solving financial exercises. This method allows you to tackle each part of the problem individually, ensuring accuracy and clarity at every stage. A systematic approach helps you understand the underlying principles and apply them correctly to different situations.

To guide you through this process, we will demonstrate a clear step-by-step method for solving common financial problems. Each solution will focus on a particular aspect of the task, explaining how to move from one stage to the next with precision.

Step-by-Step Process

The following steps outline the basic approach to solving any financial exercise:

- Read the problem carefully: Ensure that you fully understand what is being asked before proceeding with any calculations.

- Identify the key information: Extract the important data points and variables needed to solve the problem.

- Choose the correct method: Select the appropriate formula or approach that applies to the specific problem.

- Perform the calculations: Execute the necessary mathematical operations carefully to avoid errors.

- Interpret the results: Analyze the outcomes and ensure they align with the question being asked. Double-check for accuracy.

By following these steps, you can approach financial problems with confidence. Whether you’re dealing with simple calculations or more complex scenarios, a structured method helps keep the process organized and efficient.

Common Mistakes in Financial Exercises

When solving financial tasks, even small errors can lead to significant inaccuracies. Understanding the most common mistakes can help you avoid them and improve your problem-solving skills. By identifying where mistakes typically occur, you can develop better strategies for handling complex calculations and scenarios with precision.

Frequent Errors in Financial Tasks

Here are some common pitfalls that people often face when working on financial problems:

- Misinterpreting data: Sometimes, it’s easy to overlook key details in the problem statement, leading to incorrect assumptions and results.

- Incorrect application of formulas: Using the wrong formula or applying it incorrectly can produce inaccurate answers.

- Forgetting to adjust for context: Failing to take into account the specific context of the problem, such as different time periods or units of measurement, can lead to errors.

- Rounding errors: Rounding too early or using incorrect rounding methods can result in minor discrepancies that compound over time.

- Calculation mistakes: Simple arithmetic errors, such as adding or subtracting incorrectly, can derail the entire solution.

Strategies to Avoid Mistakes

To minimize the risk of these errors, consider the following strategies:

- Double-check your work: Always review your calculations before finalizing your solution to catch any obvious mistakes.

- Use a systematic approach: Break the problem into smaller steps and ensure each part is completed correctly before moving on.

- Practice regularly: The more you work on financial problems, the more familiar you will become with common pitfalls and how to avoid them.

By being aware of these common mistakes and adopting strategies to prevent them, you can enhance your accuracy and confidence in solving financial exercises.

How to Approach Financial Exercises

Effectively tackling financial tasks requires a methodical approach. Instead of rushing through the steps, it’s important to break down the problem and approach each part systematically. This will help ensure accuracy and clarity while preventing mistakes from complicating the solution. Below is a practical guide to help you navigate financial exercises with confidence.

| Step | Action | Purpose |

|---|---|---|

| 1 | Read the problem thoroughly | Understand the key details and what is being asked. |

| 2 | Identify the variables | Determine the important figures and terms needed for calculations. |

| 3 | Choose the right formula | Pick the formula or method that fits the problem context. |

| 4 | Perform calculations | Carefully carry out the necessary operations. |

| 5 | Review and verify | Ensure your results are logical and consistent with the problem. |

This structured approach helps you manage each task with a clear plan, ensuring that you address all aspects of the exercise without missing any critical steps. It is important to take your time, double-check your work, and apply the appropriate methods for each unique scenario.

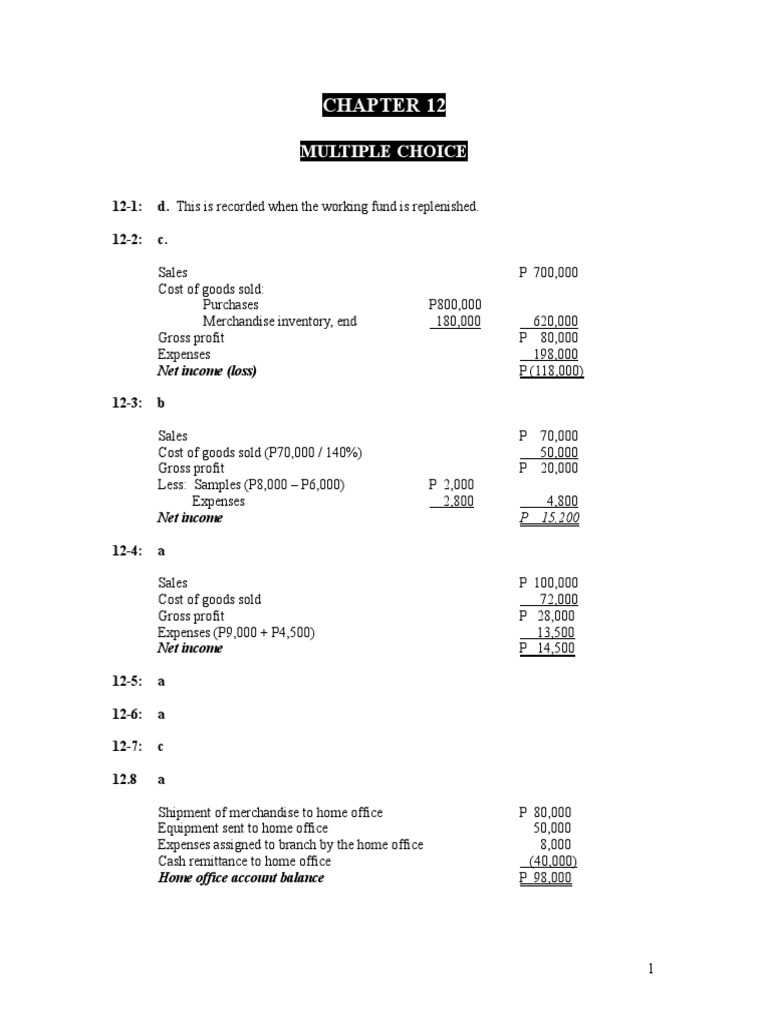

Breaking Down Problem Types

Understanding the different types of financial tasks is essential for efficiently solving problems. Each problem presents unique challenges, but by recognizing the type of task you’re dealing with, you can apply the appropriate techniques and strategies to find the correct solution. Breaking down these problems into categories helps you approach them more effectively, ensuring that you tackle each one with the right mindset and tools.

Financial exercises typically fall into several key categories, each requiring a specific set of skills. By identifying these categories early on, you can save time and avoid confusion when solving problems. Below are the common types of problems and the general approach for each:

- Balance Sheet Calculations: These problems focus on understanding a company’s assets, liabilities, and equity. The goal is to balance the equation and verify that the totals align.

- Income Statement Issues: Tasks in this category involve calculating revenue, expenses, and profit over a set period. The focus is on analyzing financial performance and profitability.

- Cash Flow Analysis: These problems require you to track the flow of cash within a business. You must identify the sources and uses of cash, ensuring that liquidity is properly managed.

- Financial Ratios: These exercises test your ability to calculate and interpret ratios such as profitability, liquidity, and efficiency ratios. Understanding these ratios is crucial for assessing a company’s financial health.

By recognizing the type of problem you’re solving, you can tailor your approach and apply the correct methodology. With practice, you’ll become more proficient at identifying these categories and efficiently solving similar problems in the future.

Tips for Solving Complex Financial Issues

When faced with complicated financial problems, the right approach can make all the difference. Tackling these issues step-by-step allows you to break down the problem into manageable parts, reducing the risk of mistakes and enhancing your overall problem-solving abilities. Developing a methodical approach and staying organized are essential for solving challenging tasks with accuracy.

Strategies for Success

Here are some key strategies to keep in mind when approaching difficult financial problems:

- Break it down: Start by identifying the core elements of the problem. Focus on one part at a time rather than attempting to solve everything all at once.

- Work backward: If the problem seems overwhelming, try working backward from the desired outcome. This can sometimes clarify the necessary steps.

- Stay organized: Keep track of all calculations and relevant information. Use charts or lists to ensure no detail is overlooked.

- Double-check your work: Always verify your calculations and assumptions before finalizing your solution. Small errors can lead to larger inaccuracies.

Additional Tips for Handling Complexity

In addition to the basic strategies, there are a few more advanced techniques that can help you manage complex tasks:

- Use examples: Work through similar examples before tackling the main problem to familiarize yourself with the process and methods.

- Seek clarification: If certain details or terms are unclear, don’t hesitate to revisit the problem or consult additional resources for a deeper understanding.

- Stay patient: Complex problems require time and careful thought. Take breaks if needed, and approach the task with patience to avoid errors caused by rushing.

By following these strategies and maintaining a disciplined approach, you will improve your ability to solve even the most difficult financial problems with confidence and precision.

Practice Problems to Test Your Skills

One of the best ways to improve your problem-solving abilities is through regular practice. Working on exercises designed to challenge your understanding helps reinforce concepts and allows you to identify areas that need further attention. Practice problems simulate real-life scenarios, enabling you to apply what you’ve learned and sharpen your skills for more complex tasks.

Test Your Knowledge

Here are some practice exercises that will help you assess and strengthen your skills:

- Exercise 1: Calculate the net income given a set of revenues and expenses.

- Exercise 2: Create a balance sheet using a set of financial data.

- Exercise 3: Prepare a cash flow statement by identifying sources and uses of cash.

- Exercise 4: Compute various financial ratios, such as the current ratio and return on equity.

Challenges for Advanced Learners

If you’re looking for more difficult problems to test your advanced understanding, consider these tasks:

- Advanced Exercise 1: Analyze a set of financial statements to identify trends in profitability and solvency.

- Advanced Exercise 2: Prepare a detailed budget forecast based on historical financial data and market conditions.

- Advanced Exercise 3: Solve complex multi-step problems involving adjustments to financial statements.

Regularly tackling these practice problems will help you build confidence and mastery in financial tasks. The more you practice, the easier it becomes to solve even the most challenging problems efficiently and accurately.

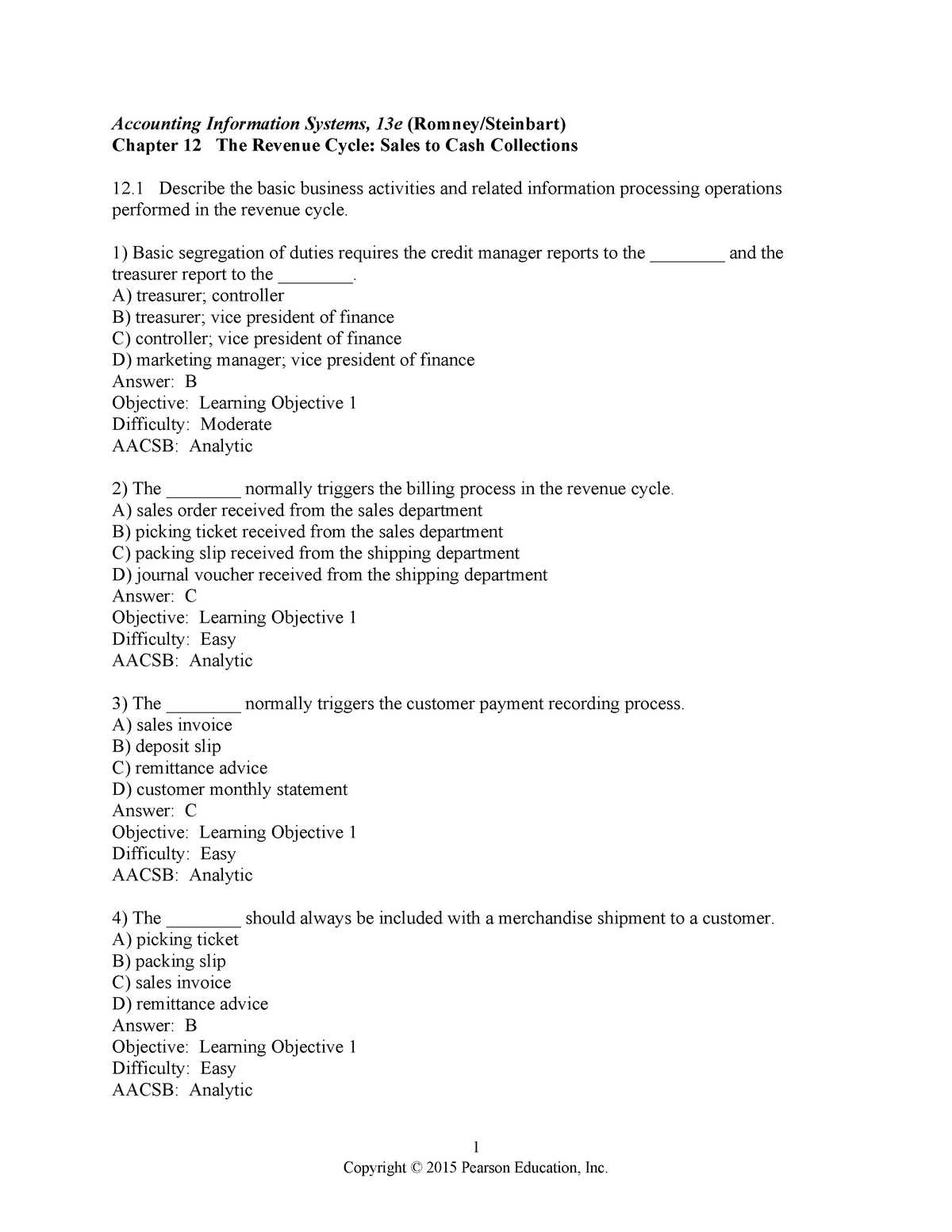

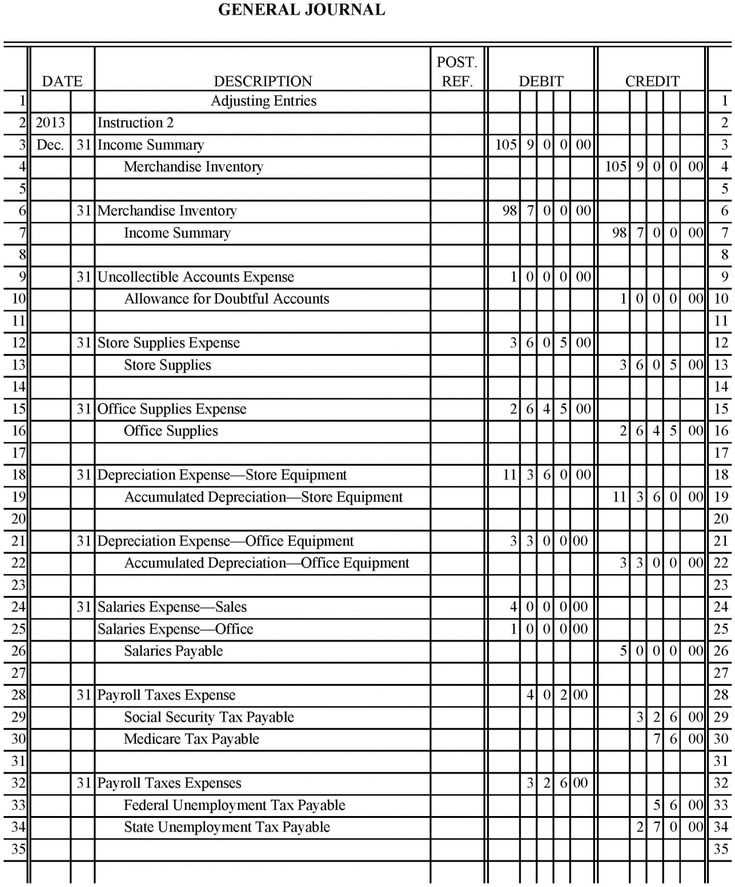

Analyzing Financial Transactions in Chapter 12

Understanding how to analyze financial transactions is crucial for developing a comprehensive view of an organization’s economic activities. Each transaction provides valuable information that helps track the flow of resources and obligations. By carefully examining these transactions, you can determine their impact on financial statements, ensuring that everything is recorded accurately and in accordance with the necessary guidelines.

The process involves identifying the key elements of each transaction, including what is being exchanged and the corresponding accounts that will be affected. This enables you to maintain clarity in financial reporting and ensures that no important details are overlooked. Below is a basic approach to analyzing transactions:

- Step 1: Identify the parties involved and the nature of the exchange.

- Step 2: Determine which accounts are affected (e.g., assets, liabilities, equity, revenues, expenses).

- Step 3: Understand how the transaction affects each account–whether it increases or decreases.

- Step 4: Record the transaction using the appropriate debit and credit entries.

- Step 5: Review and ensure that the accounting equation remains balanced (Assets = Liabilities + Equity).

By following these steps, you ensure that each financial transaction is recorded correctly and that the financial statements accurately reflect the company’s performance and financial position. This process is essential for making informed decisions and maintaining transparency in financial reporting.

Practical Examples and Real-World Applications

Applying theoretical knowledge to real-world situations is key to truly mastering financial concepts. By exploring practical examples, you can see how abstract ideas are translated into everyday business decisions. These examples not only help solidify your understanding but also demonstrate the importance of these principles in the real world.

For instance, understanding how to manage cash flow is crucial for any business. A company that effectively tracks its cash inflows and outflows can make informed decisions about expansion, investment, and risk management. Below are some examples of how financial concepts are applied in practice:

- Example 1: A small business owner uses a simple income statement to track monthly sales and expenses, ensuring profitability remains consistent.

- Example 2: A large corporation conducts a financial ratio analysis to assess its liquidity, solvency, and profitability, helping it secure financing for future growth.

- Example 3: A manager in a manufacturing firm prepares a budget forecast by analyzing past financial data, predicting future costs, and planning for potential market fluctuations.

- Example 4: An investor uses financial statements to evaluate potential investment opportunities, determining the risk and return on various stocks.

By incorporating these types of real-world examples into your study routine, you can better grasp how financial principles apply to various industries and business environments. This practical experience is invaluable in preparing for complex financial tasks in professional settings.

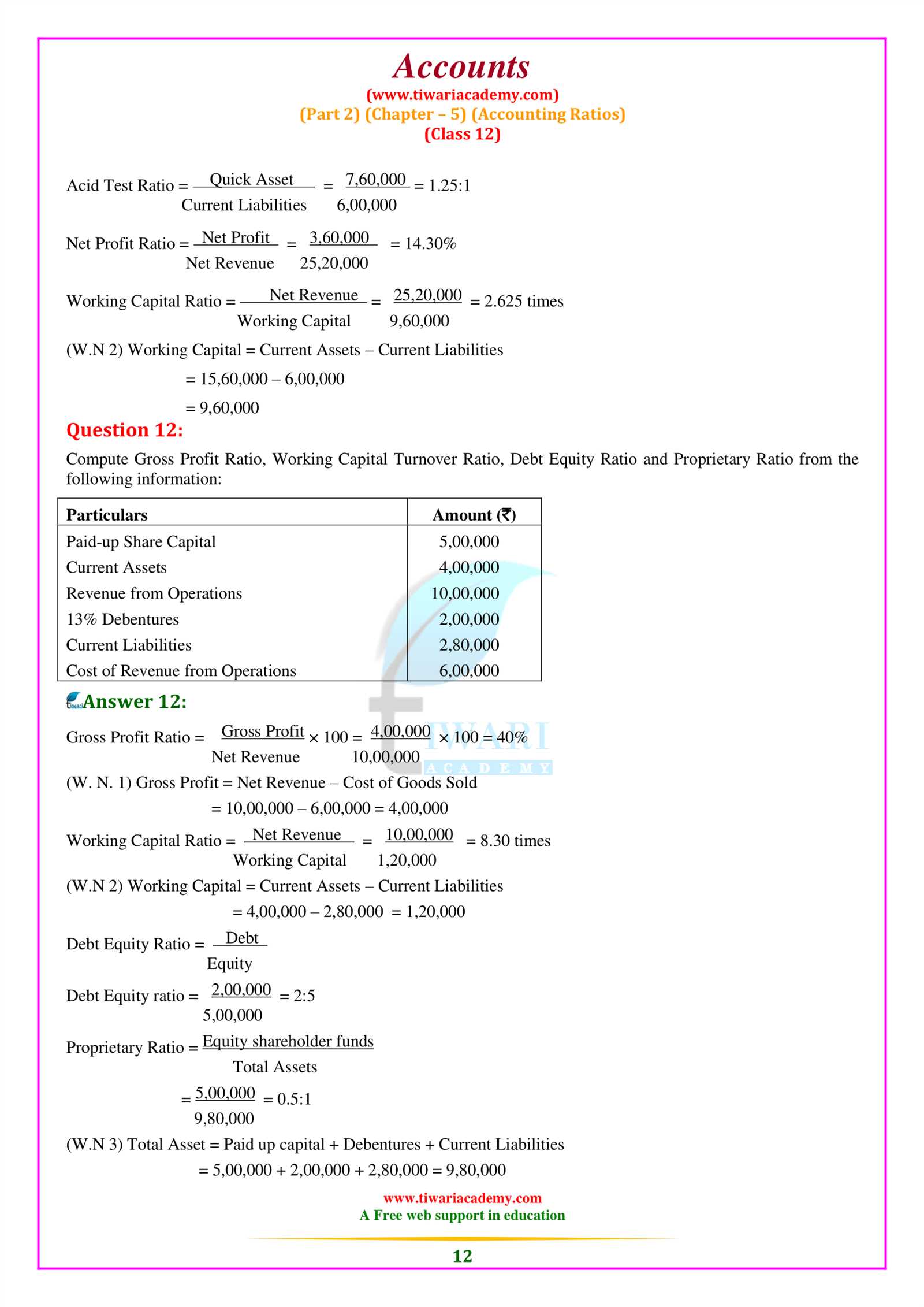

Key Formulas and Equations for Financial Analysis

Understanding the essential formulas and equations is crucial for interpreting financial data accurately. These mathematical tools serve as the foundation for calculating key financial metrics, such as profitability, liquidity, and solvency. Mastery of these formulas not only helps in analyzing past performance but also aids in making projections and informed decisions for future operations.

Below are some of the most important formulas commonly used in financial analysis:

- Basic Accounting Equation: Assets = Liabilities + Equity

- Net Income Formula: Net Income = Revenues – Expenses

- Gross Profit Margin: Gross Profit Margin = (Revenue – Cost of Goods Sold) / Revenue

- Current Ratio: Current Ratio = Current Assets / Current Liabilities

- Quick Ratio (Acid Test): Quick Ratio = (Current Assets – Inventory) / Current Liabilities

- Return on Assets (ROA): ROA = Net Income / Average Total Assets

- Return on Equity (ROE): ROE = Net Income / Average Shareholders’ Equity

- Debt-to-Equity Ratio: Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

- Cash Flow from Operations: Cash Flow = Operating Income + Depreciation – Changes in Working Capital

These formulas are essential tools for any financial analyst or business professional. By applying them correctly, you can evaluate a company’s financial health, measure its performance over time, and make more informed decisions regarding investments and operations.

Clarifying Common Financial Terms

In the world of finance, certain terms can often be misunderstood or used interchangeably, leading to confusion. It is essential to have a clear understanding of these terms to navigate financial discussions, reports, and analyses effectively. Below is a breakdown of some of the most commonly used terms, helping you to distinguish between them and understand their specific meanings in different contexts.

| Term | Definition |

|---|---|

| Asset | A resource owned by a company that is expected to provide future economic benefits. |

| Liability | An obligation of the company arising from past transactions or events, which will require future settlement, typically in the form of money or services. |

| Equity | The value of the owner’s interest in the business, calculated as assets minus liabilities. |

| Revenue | Income generated from the sale of goods or services before any expenses are deducted. |

| Expense | The cost of operations that a company incurs to generate revenue, such as rent, wages, and utilities. |

| Net Income | The profit of a company after all expenses, taxes, and costs have been deducted from total revenue. |

| Depreciation | The allocation of the cost of a tangible asset over its useful life to account for wear and tear. |

| Cash Flow | The net amount of cash being transferred into and out of a business, indicating its liquidity. |

Having a firm grasp of these terms enables you to better understand financial statements, communicate effectively with financial professionals, and analyze the financial health of a business. These terms form the building blocks of financial literacy, which is essential for anyone involved in business operations or investment decisions.

Improving Accuracy in Financial Calculations

Accurate calculations are vital in financial analysis and decision-making. Even small errors can lead to significant misinterpretations, affecting overall financial health and strategies. To enhance precision in calculations, it’s essential to adopt systematic approaches and utilize proper tools. Below are several strategies to ensure greater accuracy when performing financial assessments.

- Double-checking Calculations: Always review your figures before finalizing reports. Simple mistakes, such as misplacing decimal points or adding incorrect amounts, can be easily avoided through a second verification.

- Using Financial Software: Leverage software tools designed specifically for financial calculations. These tools reduce human error and streamline complex computations, especially when handling large data sets.

- Establishing Clear Formulas: Ensure that the formulas you use are well-established and appropriate for the task. Using consistent, recognized formulas will help maintain uniformity and prevent misapplication of methods.

- Setting Up a Review Process: In addition to double-checking, implementing a peer review system can catch mistakes early. Having another set of eyes on your calculations often reveals errors that may be overlooked.

- Maintaining Consistent Units: Ensure that all financial data is in the correct unit of measurement, such as thousands, millions, or percentages. Mixing different units can lead to miscalculations and confusion in the final analysis.

By incorporating these practices into your financial routines, you can minimize the risk of errors and improve the reliability of your calculations. With a more accurate financial analysis, businesses and individuals can make better-informed decisions and avoid costly mistakes.

Time-Saving Strategies for Accounting Students

For students in the field of financial studies, time management can often be a challenge due to the complexity and volume of material to be learned. Mastering time-saving strategies can help students balance coursework, assignments, and exam preparation more effectively. Below are some proven methods to optimize time usage and improve productivity without compromising the quality of work.

Efficient Study Techniques

Efficient study techniques are essential for mastering complex topics in a shorter amount of time. Implementing these strategies can make your study sessions more productive.

| Strategy | Benefit |

|---|---|

| Use of Study Guides | Study guides provide a structured overview of key concepts and reduce the time spent searching for important information. |

| Active Recall | This technique focuses on testing your memory regularly, which helps reinforce retention and understanding of key concepts faster. |

| Pomodoro Technique | By studying in short, focused intervals with breaks in between, the Pomodoro method helps improve concentration and productivity. |

| Group Study Sessions | Collaborating with peers can help clarify difficult topics and allow for quicker problem-solving through shared knowledge. |

Leveraging Technology

Modern technology offers numerous tools that can help streamline learning and increase efficiency. Here are some useful digital tools for accounting students:

- Spreadsheet Software: Mastering software like Excel can save a lot of time when working on complex calculations and financial models.

- Financial Calculators: Online or app-based financial calculators can simplify common calculations, reducing time spent on manual work.

- Online Forums and Communities: Engaging with online forums allows students to quickly find answers to difficult questions and learn from others’ experiences.

- Time Management Apps: Apps designed to track study time, set goals, and remind you of deadlines can significantly improve time management skills.

By incorporating these time-saving strategies into your routine, you can enhance your learning efficiency and better manage the demands of financial studies, all while reducing stress and increasing performance.

Reviewing Key Learning Points from Chapter 12

To reinforce your understanding of the material, it’s essential to revisit the core concepts and skills presented in this section. By breaking down the main topics, you can better identify key takeaways and ensure a solid grasp of the subject matter. Below are some critical points that will help you focus on the most important aspects of this unit.

Core Concepts and Definitions

Understanding the foundational concepts is crucial for applying them in real-world situations. Below are some key terms and ideas that should be mastered:

- Financial Statements: These documents summarize the financial activities of a business, including income statements, balance sheets, and cash flow reports.

- Double-Entry System: This accounting principle ensures that each financial transaction affects at least two accounts, maintaining the balance between debits and credits.

- Accrual vs. Cash Basis: The difference between recognizing income when earned and expenses when incurred (accrual) versus recognizing transactions when cash changes hands (cash basis).

- Revenue Recognition: The process of recognizing revenue when it is earned, not necessarily when the payment is received.

Practical Application of Concepts

Beyond understanding definitions, it’s important to apply these concepts to solve practical problems. Here are some key techniques and methods that will help you work through challenges effectively:

- Financial Ratios: Learn how to calculate and interpret key financial ratios like the current ratio, quick ratio, and debt-to-equity ratio to assess a company’s financial health.

- Adjusting Entries: Make sure to master adjusting entries to ensure that financial statements reflect the true financial position of a company.

- Bank Reconciliation: Practice reconciling bank statements with business records to identify discrepancies and ensure accuracy in financial reporting.

- Depreciation Methods: Understand how different depreciation methods, such as straight-line and declining balance, affect financial statements over time.

By reviewing these key concepts and methods, you can ensure a thorough understanding of the material and improve your ability to apply it in practical scenarios.

Preparing for Exams with Chapter 12

Effective exam preparation requires a thorough understanding of the topics covered in the unit. By focusing on the core principles, practicing key problems, and reinforcing your knowledge with review exercises, you can approach the exam with confidence. Below are some strategies to help you prepare for the upcoming test.

Master Core Concepts

Before diving into practice problems, ensure that you have a clear grasp of the fundamental concepts. These are the building blocks for solving more complex problems:

- Understanding Basic Terminology: Make sure you know the essential terms and their definitions, as these will appear frequently in exam questions.

- Reviewing Important Formulas: Familiarize yourself with key formulas used in the exercises, such as those for calculating financial ratios, depreciation, and net income.

- Clarifying Key Methods: Whether it’s journal entries, reconciliation processes, or adjusting transactions, be sure you can apply these methods in various scenarios.

Practice Problems and Solutions

One of the best ways to prepare is through hands-on practice. Start with simpler problems and gradually increase the difficulty level. This will help you gain familiarity with the exam format and improve problem-solving speed:

- Work through Examples: Practice the sample problems provided in the unit. These are designed to mirror the type of questions you may encounter in the exam.

- Simulate Test Conditions: Time yourself while completing practice problems to simulate the actual exam environment. This will help you manage time effectively during the test.

- Understand Mistakes: When you make an error, take time to understand why it happened and how to avoid it in the future.

By focusing on core concepts and practicing consistently, you can build the confidence and skills needed to excel in your exam.