In the world of market analysis, understanding the factors that influence consumer choices and purchasing behavior is crucial. Various elements shape how products and services are sought after by individuals, ranging from price fluctuations to external influences such as trends and economic shifts. This section delves into the underlying principles that govern these consumer decisions and provides clarity on the processes that drive supply and demand interactions in real-life scenarios.

By examining the intricacies of how preferences, incomes, and other variables affect purchasing patterns, it becomes clear that these interactions are not random. Instead, they follow recognizable patterns that can be analyzed and predicted. Mastering these concepts allows individuals to make informed decisions, whether in business or personal contexts, and to anticipate market movements with greater accuracy.

In the following sections, we will explore essential components such as how external factors alter buying tendencies, the role of consumer psychology, and the ways in which businesses respond to these shifts. By gaining a deeper understanding of these factors, one can better navigate the complexities of the marketplace and make more strategic decisions.

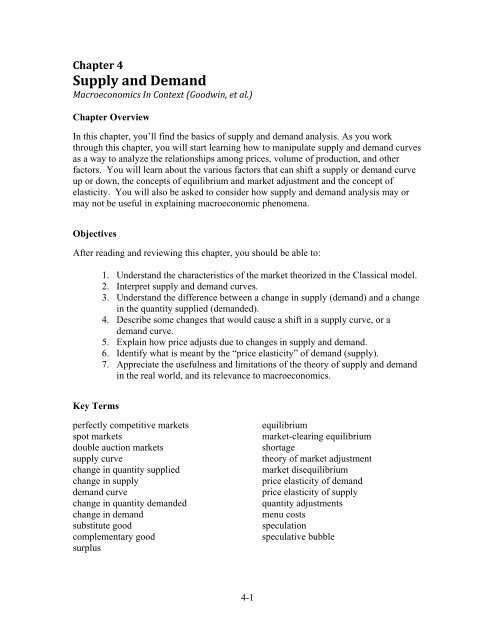

Economics Chapter 4 Demand Assessment Answers

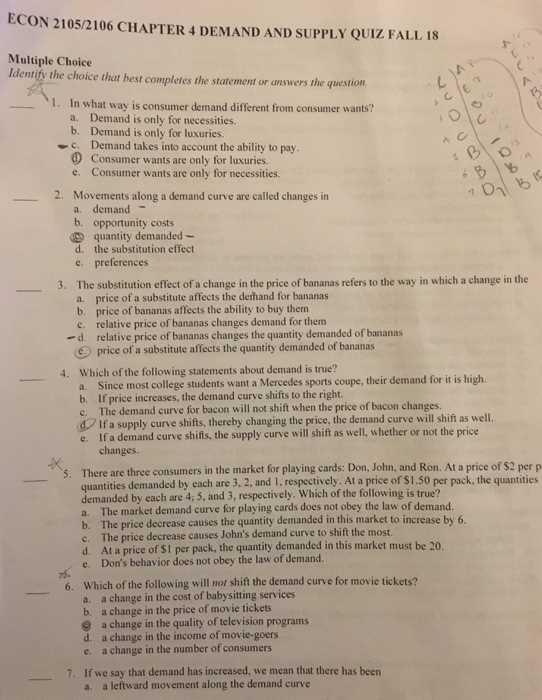

This section explores the key concepts behind consumer behavior and the factors that influence purchasing choices in a marketplace. Understanding how different variables affect people’s decisions allows for a deeper comprehension of how markets function and how supply and demand are balanced. These principles provide a foundation for analyzing various economic situations and predicting future trends in market behavior.

Understanding Consumer Preferences

One of the most crucial aspects of market dynamics is the study of consumer preferences. These preferences are shaped by a variety of factors including income levels, personal tastes, and external influences such as advertising or social trends. By examining how these preferences shift over time, it becomes possible to understand why certain products or services become more popular while others lose their appeal.

Impact of External Influences

External forces, such as government policies, technological advancements, and global events, can significantly alter consumer choices. Government regulations or taxation changes often have a direct impact on how people allocate their spending. Similarly, shifts in technology or the introduction of new products can lead to a rapid change in consumer behavior, pushing markets in new directions. Understanding how these factors come into play is essential for analyzing the bigger picture of economic trends.

Understanding Demand in Economics

At the core of market interactions lies the concept of how people make decisions about what to buy and how much they are willing to pay. These choices are influenced by a range of factors that dictate how products and services are sought after. Understanding these behaviors is essential for grasping the dynamics that shape any economy, whether on a local or global scale.

Key Drivers of Consumer Choices

Several factors drive the purchasing decisions of consumers. These include:

- Price: The cost of a product directly affects its appeal to potential buyers. As prices rise, demand tends to fall, and vice versa.

- Income: A consumer’s financial situation determines what goods and services they can afford, influencing their purchasing patterns.

- Substitute Products: The availability of similar alternatives can impact the appeal of a particular item, affecting consumer choices.

- Consumer Preferences: Shifts in tastes, often influenced by trends or cultural changes, play a significant role in demand levels.

- External Factors: Events like government policies, economic conditions, and technological advancements can dramatically change consumer behavior.

Analyzing the Behavior of Consumers

To fully grasp how purchasing patterns evolve, it is important to examine the factors that influence them in more detail. Behavioral analysis often includes:

- Market Research: Gathering data about consumer preferences and behaviors helps to predict future trends and understand shifts in demand.

- Price Sensitivity: Understanding how price changes affect consumer choices can help businesses adjust their strategies to meet demand effectively.

- Consumer Sentiment: Emotional and psychological factors also play a role in purchasing decisions, particularly when products are perceived as status symbols or necessities.

Key Factors Affecting Demand

The purchasing behavior of consumers is shaped by a variety of factors that influence their willingness and ability to buy goods and services. These elements work together to create patterns of consumption that reflect both individual choices and broader market trends. Understanding the primary drivers behind these shifts is essential for businesses and policymakers to respond effectively to changes in the market.

Several key factors determine how much of a product or service is purchased at any given time. These factors include:

- Price Levels: The cost of a product is one of the most influential factors in determining its attractiveness to consumers. As prices rise, the quantity of products demanded typically decreases, and vice versa.

- Income of Consumers: A person’s income level affects their purchasing power. As incomes increase, people are more likely to buy higher quantities or more expensive products.

- Availability of Substitutes: The presence of alternative products or services can reduce the demand for a specific item. When substitutes are available at a lower price or offer better quality, consumers may shift their preferences.

- Consumer Preferences: Shifts in tastes, cultural trends, or seasonal needs play a critical role in determining which products become popular over time.

- External Economic Factors: Economic conditions such as inflation, unemployment, or changes in interest rates can influence how much people are willing to spend and what they are able to afford.

- Government Policies: Regulations, taxes, subsidies, or tariffs can impact the cost of goods and services, directly influencing consumer behavior and demand.

Law of Demand Explained

The relationship between the price of a product and the quantity people are willing to buy follows a predictable pattern. In general, when prices decrease, the amount of goods that consumers are ready to purchase tends to increase. This principle forms the foundation for understanding market behavior and plays a crucial role in how businesses set prices and predict consumer reactions.

Understanding the Price-Quantity Relationship

At the heart of this concept is the inverse relationship between price and quantity purchased. As prices rise, fewer consumers are likely to buy the product, leading to a decrease in quantity demanded. Conversely, lower prices usually lead to increased purchasing activity. This fundamental idea can be illustrated through the following table:

| Price | Quantity Demanded |

|---|---|

| $10 | 100 units |

| $8 | 150 units |

| $6 | 200 units |

| $4 | 250 units |

Factors Affecting the Law of Demand

While the basic principle holds true in most cases, there are exceptions. External factors, such as consumer preferences or the availability of substitutes, can alter how the law applies in certain situations. However, the fundamental relationship remains a key element in understanding purchasing behavior and predicting market trends.

Price and Quantity Relationship

The connection between the cost of a product and the amount that people are willing to purchase is a fundamental concept in market analysis. Typically, as prices fluctuate, the quantity of a product bought by consumers responds accordingly. Understanding this relationship is essential for businesses and policymakers to make informed decisions about pricing strategies and economic forecasting.

How Price Affects Consumer Choices

In general, when the price of an item increases, the number of units consumers are willing to purchase decreases. This inverse relationship is influenced by several factors, including consumer preferences, income levels, and availability of alternatives. As prices rise, people tend to search for substitutes or simply buy less, reflecting the natural reaction to higher costs.

Illustrating the Price-Quantity Trend

This connection can be visualized through basic market principles. For example, if a store raises the price of a product, it might see a decline in sales, while a price reduction could lead to an increase in the quantity sold. Businesses use this knowledge to adjust pricing strategies in ways that maximize their revenue while meeting consumer demand.

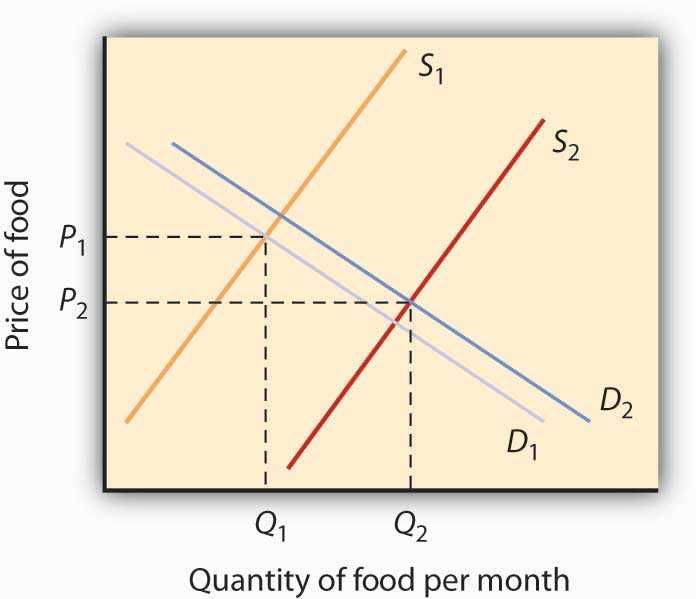

Shifts vs Movements Along Demand Curve

Understanding the differences between changes in the quantity of a product demanded and changes in the overall market conditions is crucial for analyzing market behavior. These two phenomena, while related, have distinct causes and implications. Recognizing when a change is due to a movement along a curve versus when it signals a shift in the entire curve helps clarify how external factors influence consumer purchasing patterns.

A movement along the curve occurs when the quantity of a product purchased changes in response to a change in its price. This type of movement does not alter the underlying market conditions but reflects a direct price-related adjustment. For example, a price reduction typically results in an increase in the quantity purchased, while a price hike leads to a decrease.

On the other hand, a shift in the curve happens when factors other than price cause a change in the quantity consumers are willing to buy at any given price. These shifts can be caused by changes in consumer preferences, income levels, the availability of substitutes, or external factors like government regulations. A shift can either move the curve to the right, indicating an increase in demand, or to the left, signifying a decrease in demand, even if prices remain the same.

Market Demand vs Individual Demand

The concepts of overall market behavior and individual consumer choices are closely related but distinct. While individual decisions are influenced by personal preferences and resources, market behavior reflects the collective choices of all consumers within an economy. Understanding the difference between these two perspectives helps clarify how products and services are valued across various segments of society.

Individual purchasing behavior focuses on the choices of a single consumer, taking into account their income, preferences, and personal circumstances. This behavior can vary widely from person to person, as each consumer has unique tastes and financial constraints. For example, an individual’s decision to buy a specific product depends on how it fits their budget and needs.

Market behavior, in contrast, aggregates the choices of all consumers in a given area, often resulting in a broader view of how a product is valued by society as a whole. The overall quantity of a product demanded in the market is determined by the combined decisions of many individuals. Market demand reflects the total quantity of a product that all consumers are willing to purchase at various price levels, accounting for a wide range of economic and social factors.

Determinants of Demand Changes

Several factors play a role in influencing how much of a product or service is sought after in the market. These factors can lead to shifts in consumer behavior, causing an increase or decrease in the overall desire to purchase goods, even when prices remain constant. Understanding these determinants is key to predicting and responding to changes in market trends.

Key Influences on Consumer Preferences

Some of the most important elements that drive changes in the quantity people are willing to buy include:

- Income Levels: As individuals’ earnings rise or fall, so does their capacity to purchase goods. Higher income usually increases demand, while lower income has the opposite effect.

- Substitute Goods: The availability of alternative products can impact demand. If a better or cheaper substitute becomes available, people may shift their preferences, decreasing the need for the original product.

- Consumer Expectations: If consumers expect future prices to rise, they may purchase more now, anticipating higher costs later. Conversely, expectations of price reductions may lead to reduced demand in the short term.

- Tastes and Preferences: Changes in lifestyle, culture, or trends can make certain products more or less desirable, shifting demand patterns accordingly.

External Factors Driving Demand Fluctuations

Beyond individual choices, broader economic or social factors can influence demand. These include:

- Government Regulations: Policies such as taxes, subsidies, or trade restrictions can alter the cost of goods, leading to changes in the quantity demanded.

- Population Changes: An increase in population can raise the total market size, driving higher demand for various products and services.

- Technological Advances: Innovations that improve the functionality, efficiency, or availability of products can stimulate demand for new or improved goods.

Elasticity of Demand Overview

The concept of elasticity explains how sensitive consumer purchasing behavior is to changes in the price of goods and services. Understanding this sensitivity helps businesses and policymakers make informed decisions about pricing and revenue. Essentially, elasticity measures the responsiveness of the quantity of a product demanded when there is a price change.

When a product is highly elastic, even a small price change can lead to a significant change in the quantity purchased. On the other hand, inelastic products experience little to no change in demand despite fluctuations in price. Several factors determine whether a product is elastic or inelastic, which include the availability of substitutes, the necessity of the product, and the proportion of income spent on the item.

Types of Elasticity

There are different types of elasticity that help to better understand market behavior:

- Price Elasticity of Demand (PED): This refers to the percentage change in quantity demanded resulting from a price change. If the demand for a product is highly responsive to price changes, it is considered elastic.

- Income Elasticity of Demand (YED): This measures how demand changes with changes in consumer income. Luxury goods tend to have a higher income elasticity, meaning demand increases as income rises.

- Cross-Price Elasticity of Demand (XED): This type measures the responsiveness of demand for one product when the price of another product changes. Substitutes tend to have positive cross-price elasticity, while complementary goods have negative elasticity.

Factors Influencing Elasticity

Various factors influence the degree of elasticity for a given product:

- Availability of Substitutes: If alternatives are readily available, consumers can easily switch, making the product more elastic.

- Necessity vs. Luxury: Essential items, like basic food or healthcare, are typically inelastic, as consumers will continue purchasing even if prices rise. Conversely, luxury goods are more elastic.

- Time Horizon: Over a longer period, consumers may find more substitutes or adjust their consumption habits, making demand more elastic in the long run.

- Proportion of Income: Products that take up a significant portion of a consumer’s budget tend to have more elastic demand, as price changes are more noticeable to the buyer.

Calculating Price Elasticity of Demand

Price elasticity is a key concept for understanding how price changes affect the quantity of a product that consumers are willing to buy. The calculation of price responsiveness helps businesses and policymakers predict the potential impact of price adjustments. By measuring how sensitive demand is to price fluctuations, it becomes possible to make more informed decisions about pricing strategies and market behavior.

To calculate price elasticity, a simple formula is often used. It compares the percentage change in quantity demanded to the percentage change in price. This provides a numerical value that indicates the degree of responsiveness. If the result is greater than one, the product is considered elastic, meaning consumers are highly responsive to price changes. If it is less than one, the product is inelastic, indicating that price changes have little effect on demand.

The formula to calculate price elasticity is as follows:

Price Elasticity of Demand (PED) = (% Change in Quantity Demanded) / (% Change in Price)For example, if the price of a product increases by 10% and the quantity demanded decreases by 20%, the price elasticity would be calculated as:

PED = (-20%) / (10%) = -2A value of -2 suggests that the product is elastic, as the percentage change in quantity is greater than the percentage change in price. It’s important to note that the negative sign is typically ignored in the calculation, as it simply reflects the inverse relationship between price and quantity demanded.

Understanding how to calculate elasticity is crucial for setting optimal prices. It allows businesses to evaluate how much they can increase or decrease prices without significantly affecting the number of units sold. Similarly, policymakers can use elasticity to predict how taxes or subsidies will impact consumption.

Income Effect and Substitution Effect

When the price of a good or service changes, it can influence consumer behavior in two primary ways. These two effects, which are closely related, explain why and how people adjust their purchasing decisions when faced with price variations. Understanding these effects is key to recognizing how price shifts can alter consumption patterns in different markets.

The income effect occurs when a change in the price of a product affects the consumer’s overall purchasing power. When prices rise, the consumer feels poorer because their income can no longer purchase the same amount of goods as before. On the other hand, a decrease in price increases purchasing power, making it easier for consumers to buy more of the product or other goods.

The substitution effect happens when a price change makes a good more or less attractive relative to other similar products. If the price of a product increases, consumers may shift to buying a cheaper substitute, thereby reducing their consumption of the more expensive option. Conversely, if the price of a product falls, it may become more attractive than substitutes, leading to increased consumption.

Understanding the Impact of Price Changes

These effects interact in complex ways. Here are the key outcomes:

- Price Increase:

- The income effect typically causes consumers to buy less of the product, as their real income decreases.

- The substitution effect encourages consumers to seek alternative, less expensive options, reducing demand for the original product.

- Price Decrease:

- The income effect makes consumers feel wealthier, which may lead to buying more of the product or other items.

- The substitution effect makes the product more attractive compared to alternatives, potentially increasing its consumption.

Both effects play a significant role in shaping market behavior and determining how responsive consumers are to price changes. For businesses, understanding these dynamics helps in setting pricing strategies that take into account both the direct and indirect consequences of price alterations.

Consumer Preferences and Demand

Consumers make purchasing decisions based on a variety of factors, and one of the most important drivers of these decisions is personal preference. The choices individuals make are influenced by their tastes, values, and desires, all of which shape how much of a product they are willing to buy at a given price. Understanding how consumer preferences affect purchasing behavior is crucial for businesses and policymakers alike.

When consumers prefer a particular product or service, the likelihood of increased demand rises, even if the price remains stable. As preferences shift, the demand for certain goods may rise or fall, independent of changes in income or prices. This highlights the importance of understanding psychological and social factors in market trends.

Several factors contribute to these preferences, including:

- Cultural Influences: Different cultures have varying tastes and customs that influence consumption choices, leading to differences in demand across regions.

- Advertising and Marketing: Effective marketing can shift consumer preferences, making a product seem more desirable, even if it is similar to alternatives.

- Social Trends: Changes in social attitudes, such as increased environmental awareness, can lead consumers to favor sustainable or eco-friendly products.

- Personal Experiences: Previous interactions with a product or brand can influence whether a consumer continues to buy it in the future.

As consumer preferences change, they can have a significant impact on the quantity of goods or services that are purchased. Businesses must be agile in responding to these shifts, adjusting their offerings to match the evolving tastes and needs of their target audience. Similarly, understanding these preferences helps businesses predict future trends and prepare accordingly, ensuring they meet the changing demands of the market.

Impact of Government Policies on Demand

Government regulations and policies play a significant role in shaping the behavior of consumers and, consequently, the purchasing patterns in a market. By introducing measures such as taxes, subsidies, price controls, or regulations, governments can directly or indirectly affect the quantity of goods and services demanded by individuals. These actions can lead to shifts in consumer preferences and influence market dynamics in a variety of ways.

For instance, when governments impose taxes on certain products, such as tobacco or sugary drinks, the higher prices may reduce consumer demand. Conversely, subsidies or incentives aimed at making products more affordable can encourage consumers to purchase more of those goods. Regulatory policies can also alter demand by either limiting the availability of certain products or making them more accessible to the public.

Price Controls: Price Ceilings and Price Floors

Price controls are one of the most common tools governments use to affect demand. There are two main types:

- Price Ceiling: A maximum price set by the government, typically lower than the market equilibrium price. This is often used for essential goods, such as food and fuel, to make them more affordable. However, price ceilings can lead to shortages, as producers may be unwilling to supply goods at the lower price.

- Price Floor: A minimum price set by the government, often used to protect producers, such as in the case of agricultural products. This can result in surpluses, as consumers may not be willing to purchase the goods at the higher price.

Subsidies and Taxes

Government subsidies or taxes can also have a profound effect on market demand. When the government provides financial assistance to producers or consumers, the price of the subsidized goods or services is reduced, making them more attractive to consumers. This can increase demand for those products. On the other hand, taxes imposed on goods or services typically lead to higher prices, which can reduce consumer demand, especially for non-essential items.

In summary, government policies directly influence the purchasing behavior of individuals by altering the prices of goods and services or making certain products more or less available. These policies can lead to shifts in demand, depending on how they impact consumer affordability and preferences. Understanding these dynamics is essential for businesses and policymakers to anticipate market changes and make informed decisions.

Demand and Consumer Behavior

Consumer choices are influenced by a variety of factors that determine how much of a particular product or service they are willing and able to purchase at different price levels. These factors include individual preferences, income levels, cultural influences, and the availability of substitutes. Understanding consumer behavior is crucial for businesses and policymakers as it helps predict market trends and make informed decisions about pricing, production, and marketing strategies.

When consumers decide whether to buy a product, they evaluate its perceived value relative to its price. As prices change, the quantity of goods that individuals are willing to purchase also shifts. This relationship between price and purchasing behavior is central to understanding the factors that drive market dynamics. Additionally, external influences such as changes in income or the introduction of competing products can further modify consumer decisions.

Factors Influencing Consumer Decisions

There are several key elements that shape how consumers respond to price changes and the overall availability of goods and services:

- Income Levels: As income increases, consumers tend to purchase more goods and services. Conversely, when income decreases, people may reduce their spending or switch to lower-priced alternatives.

- Substitute Goods: The availability of substitutes can affect consumer behavior significantly. If the price of a product rises, consumers may switch to a similar, more affordable option, reducing the demand for the original item.

- Tastes and Preferences: Changes in personal preferences, often driven by trends, advertising, or social influences, can also cause shifts in purchasing behavior. For example, increased awareness of health benefits can lead to higher demand for organic products.

Price Sensitivity and Consumer Choices

Another key aspect of consumer behavior is price sensitivity. Different consumers react differently to price changes. Some products may see little change in demand despite price fluctuations, while others may experience significant shifts in consumption. Products that are seen as essential or have fewer substitutes often experience inelastic demand, meaning that price changes have little effect on the quantity demanded. On the other hand, non-essential items with many alternatives tend to have more elastic demand, where a small price change can lead to a noticeable change in purchasing behavior.

In conclusion, consumer behavior is a complex interaction of personal preferences, external influences, and economic factors. Understanding these elements allows businesses to better cater to their customers’ needs and predict how price and market conditions will affect sales. By analyzing consumer behavior, companies can make more informed decisions about pricing, product offerings, and marketing strategies.

Factors Influencing Market Demand

The overall quantity of a product or service that consumers are willing to purchase in a market is influenced by several key factors. These elements shape the collective preferences and purchasing decisions of consumers across various segments. Market conditions, shifts in consumer behavior, and external forces play an essential role in determining the purchasing power and preferences of individuals within a given market. Understanding these factors helps businesses forecast demand and adjust their strategies accordingly.

Some of the most significant drivers of market behavior include changes in income levels, the availability of substitute products, consumer preferences, and broader economic conditions. External events, such as government policies, technological advancements, or social trends, can also impact the market’s response to pricing and product availability.

Key Drivers of Market Demand

- Income Levels: As the financial resources of individuals grow, they are more likely to purchase a greater variety of goods and services. A rise in disposable income generally leads to an increase in market activity, while a decline may have the opposite effect.

- Price of Related Goods: The prices of complementary or substitute products can directly affect the demand for a given item. If the price of a substitute good drops, consumers may shift their preferences, reducing the demand for the original product.

- Consumer Preferences and Tastes: Changes in consumer preferences, influenced by factors such as trends, advertising, or social influences, can significantly alter demand patterns. Products that align with current consumer interests or lifestyles tend to see increased sales.

- Expectations about Future Prices: When consumers anticipate that prices will rise in the future, they may choose to purchase more of a product in the present, increasing demand. Similarly, expectations of lower prices may decrease current demand as consumers hold off on purchases.

External Influences on Market Behavior

In addition to individual and collective consumer choices, external factors also play a vital role in shaping market conditions. Government regulations, changes in the economic environment, or even global events can lead to sudden shifts in market demand.

- Government Policies: Regulatory measures such as taxes, subsidies, or import restrictions can significantly influence market conditions by either encouraging or discouraging the purchase of specific goods.

- Technological Innovations: Advancements in technology often create new opportunities for consumers to access products more easily, potentially expanding market demand for new goods and services.

By analyzing these factors and their potential impact on consumer behavior, businesses can make better predictions about market trends, adjust their pricing strategies, and ensure that their offerings align with current consumer needs and expectations.

Understanding Demand Forecasting

Accurately predicting future consumer behavior is crucial for businesses seeking to optimize their operations. Forecasting involves using historical data and various analytical methods to estimate the future need for goods or services in a market. The ability to make these predictions helps companies adjust production schedules, manage inventory, and develop pricing strategies, ensuring they meet market needs effectively and efficiently.

Effective forecasting relies on several factors, including historical trends, consumer behavior patterns, and external influences. These elements provide valuable insights that guide businesses in making informed decisions and minimizing risks associated with unexpected shifts in consumer preferences or market conditions.

Methods of Forecasting

- Qualitative Methods: These methods are often used when there is limited historical data available. Expert opinions, focus groups, and market research surveys help generate insights into consumer preferences and potential future trends.

- Quantitative Methods: These methods rely on numerical data, such as sales figures and market trends, to make predictions. Time-series analysis and regression models are commonly used to analyze patterns and forecast future behavior based on historical data.

- Causal Models: These models consider external factors, such as economic indicators or social trends, to predict future demand. By understanding the cause-and-effect relationships, businesses can anticipate shifts in the market and plan accordingly.

Factors Affecting Forecasting Accuracy

While forecasting can provide valuable insights, its accuracy depends on various factors. A successful forecast is built upon the quality and relevance of the data used, as well as the ability to account for unpredictable events or changes in the market.

- Data Quality: Reliable, up-to-date data is essential for making accurate predictions. Inaccurate or outdated data can lead to faulty forecasts that misrepresent future market conditions.

- Market Conditions: Fluctuations in economic conditions, such as recessions or booms, can dramatically influence future demand. Forecasting models must consider these shifts to remain relevant.

- Consumer Sentiment: The emotional and psychological factors influencing consumer behavior are often difficult to quantify but can significantly impact demand. Changes in consumer confidence or preferences may affect purchasing decisions in ways that are hard to predict using historical data alone.

By understanding the methods and factors involved in demand forecasting, businesses can make more informed decisions and reduce the likelihood of overproduction or stockouts. A well-executed forecast enables companies to align their offerings with market needs, improving customer satisfaction and overall business performance.

Real-World Examples of Demand Assessment

Understanding how consumer preferences evolve and how external factors influence purchasing decisions is critical for businesses aiming to stay competitive. By carefully observing shifts in the marketplace and consumer behavior, companies can predict future trends, adjust their strategies, and better meet customer needs. In this section, we explore real-world cases from various industries, illustrating how organizations assess the factors that impact their sales and operations.

Example 1: Technology Sector – Smartphone Brands

In the technology sector, particularly with smartphone manufacturers, understanding shifts in consumer preferences is key to staying ahead. Brands like Apple and Samsung use market analysis to predict when customers are likely to upgrade their devices or demand new features. By tracking purchasing habits and identifying emerging trends, such as the demand for foldable screens or 5G technology, these companies adjust their product development and marketing strategies accordingly.

Example 2: Fashion Industry – Fast Fashion Retailers

The fashion industry, with its rapidly changing trends, provides another example of how consumer behavior shapes business decisions. Retailers like Zara and H&M continuously monitor social media trends, celebrity influences, and seasonal preferences. By assessing what styles, colors, and fabrics are gaining popularity, these companies can quickly adjust their inventory to match shifting consumer tastes, ensuring they remain relevant and profitable.

Example 3: Airline Industry – Ticket Pricing Strategies

In the airline industry, understanding when consumers are most likely to travel, and how much they are willing to spend, plays a vital role in pricing strategies. Airlines like Delta and Southwest use historical data, economic forecasts, and special events to determine peak travel times. By assessing the factors that influence ticket sales–such as school holidays, long weekends, and major events–they can adjust their pricing to maximize revenue while meeting consumer demand.

Example 4: Food & Beverage – Health-Conscious Products

The food and beverage sector has seen significant changes in consumer preferences over recent years. Companies like Coca-Cola and Nestlé have had to adapt to growing concerns about health and wellness. The rising demand for low-sugar, plant-based, and organic options has prompted many brands to diversify their product lines. Through careful observation of consumer choices and market trends, these companies have introduced healthier alternatives to cater to the increasing number of health-conscious buyers.

Key Insights from These Examples

| Industry | Key Factor | Impact on Business |

|---|---|---|

| Technology | Consumer preference for new features | Product innovation and feature updates |

| Fashion | Trends, social media influence | Rapid inventory adjustments, trend forecasting |

| Airline | Seasonality, events, economic factors | Dynamic pricing and schedule optimization |

| Food & Beverage | Health trends, dietary preferences | Product diversification and health-focused options |

These examples demonstrate that successful companies constantly assess market forces, analyze consumer behavior, and adapt their operations to meet evolving needs. By making data-driven decisions, businesses can not only satisfy their current customers but also anticipate future demand shifts and stay ahead of the competition.