Managing personal finances requires a solid understanding of various systems designed to protect and secure your future. Whether it’s safeguarding assets or planning for unexpected events, it’s important to know the options available to help you make informed choices.

Financial protection tools offer a way to manage risks while ensuring stability. By grasping the basics of how these mechanisms work, you can better navigate decisions that affect your overall financial health.

In addition, the obligations related to annual filings play a crucial role in determining your financial standing. Understanding the fundamentals behind these processes ensures you are compliant while optimizing your returns.

Understanding the Basics of Insurance

Protecting yourself and your assets from unforeseen events is a fundamental aspect of financial planning. A system designed to mitigate potential risks ensures that you’re covered in case of emergencies, accidents, or losses. It acts as a safety net, offering peace of mind by providing financial support when needed most.

At its core, this system involves paying regular amounts to secure protection in exchange for future coverage. The concept revolves around pooling resources to help individuals and businesses recover from unexpected events without suffering significant financial hardship.

There are various types of coverage, each tailored to address specific needs, such as safeguarding property, health, or income. Understanding these options can help you select the right plan based on your personal circumstances and goals.

How Taxes Affect Your Financial Planning

Effective financial planning requires considering all aspects that influence your overall financial health, including mandatory contributions that reduce your disposable income. These obligations play a critical role in shaping both short-term spending habits and long-term saving strategies.

Understanding how different contributions impact your income is essential for building a balanced financial strategy. The amount you pay annually can affect your ability to invest, save for retirement, or allocate funds toward other financial goals.

Strategically managing these obligations can lead to significant advantages, such as tax credits or deductions that reduce your liabilities. By optimizing your approach, you can ensure that you retain more resources for future growth and stability.

Key Principles of Health Insurance

When planning for medical care, it’s crucial to understand how protective services can reduce the financial burden of health-related expenses. These mechanisms offer a way to share the costs of medical treatment by pooling funds among a large group of participants.

Understanding Premiums and Coverage

One of the central aspects is the payment made periodically to maintain access to these services. In return, individuals receive coverage for various health-related issues, such as doctor visits, surgeries, or prescriptions. The level of protection often depends on the type of plan selected and the amount paid over time.

Managing Out-of-Pocket Expenses

Even with a comprehensive plan, some costs may still require out-of-pocket payments. These can include co-pays or deductibles, which vary based on the agreement made between the participant and the provider. Understanding these terms is crucial for effective budgeting and avoiding unexpected costs.

Types of Tax Deductions Explained

Reducing your overall liabilities is a key part of optimizing your financial situation. Certain expenses can be subtracted from your total earnings, lowering the amount subject to mandatory contributions. This can help improve your financial standing and provide savings for future goals.

Common Deduction Categories

There are various ways to lower your taxable income, including costs related to medical care, home ownership, or educational expenses. Each type of deduction serves to reduce the overall amount on which you need to pay. Understanding the categories available is essential for maximizing these benefits.

| Deduction Type | Eligible Expenses |

|---|---|

| Medical Costs | Doctor visits, hospital stays, prescribed medications |

| Mortgage Interest | Interest on home loans, property taxes |

| Educational Expenses | Tuition, books, student loan interest |

| Charitable Contributions | Donations to qualified charities |

Maximizing Your Savings

Understanding which expenses qualify for deductions can help you lower your total contribution obligations. By keeping track of all eligible costs throughout the year, you can ensure you take full advantage of available reductions, leading to a more favorable financial outcome.

What is Auto Insurance Coverage?

Protecting your vehicle and yourself on the road involves having a system in place that helps manage the financial consequences of accidents or damage. This system ensures that in the event of an unexpected incident, you are not left with overwhelming costs, whether for repairs, medical bills, or legal fees.

At its core, this type of coverage helps to safeguard against the financial risks associated with driving. Depending on the plan, it can cover damage to your own vehicle, injuries sustained in an accident, or damage caused to other parties. The extent of protection typically depends on the level of coverage you select and the associated cost.

There are various options available, ranging from basic coverage that covers minimal expenses to more comprehensive plans that provide broader protection. Understanding the different levels and what each one covers is essential in choosing the right policy for your needs.

How to File Taxes Efficiently

Filing your yearly obligations can be a complex task, but with proper organization, the process can be streamlined and straightforward. Being well-prepared helps avoid last-minute stress and ensures that all necessary documents are submitted correctly and on time.

Here are some steps to help ensure an efficient filing process:

- Gather all relevant documents, including income statements, receipts, and previous records.

- Choose the right filing method: online services, paper submission, or professional assistance.

- Double-check that all information is accurate, such as personal details, income, and deductions.

- Consider itemizing your expenses if it leads to greater deductions.

- File early to avoid unnecessary delays or penalties.

By following these steps, you can ensure that the process is as efficient as possible, allowing you to focus on other financial goals while staying compliant with regulations.

Understanding Life Insurance Policies

When planning for the future, securing financial support for loved ones in the event of an unexpected loss is crucial. These financial tools are designed to provide peace of mind by offering a payout to beneficiaries after the policyholder passes away. The coverage ensures that your family or dependents are not left with a financial burden during difficult times.

There are several types of policies available, each offering different levels of coverage, premiums, and terms. The key to choosing the right option is understanding your specific needs and the benefits each plan provides.

| Policy Type | Description | Best For |

|---|---|---|

| Term Coverage | Covers for a specific period, offering a payout if the policyholder passes within the term. | Those seeking affordable short-term protection. |

| Whole Life | Provides lifetime coverage with an investment component that grows over time. | Individuals looking for long-term coverage and a savings element. |

| Universal Life | Offers flexible premiums and coverage, allowing policyholders to adjust the terms as needed. | Those seeking flexibility in their coverage with potential investment growth. |

By understanding these options, you can select a policy that aligns with your long-term financial goals and the needs of those who depend on you.

Tax Brackets and Their Impact

The amount you are required to contribute each year is influenced by how much you earn. The system divides income into segments, each taxed at different rates. Understanding how these segments work can help you make informed decisions about your finances and possibly reduce your liabilities.

How Brackets Work

Each income range is subject to a specific rate, with higher earnings often taxed at a higher percentage. The system ensures that individuals pay proportionally based on their ability to contribute. However, only the portion of income within each range is taxed at the respective rate, meaning not all your earnings are taxed equally.

Maximizing Financial Strategies

Being aware of the different levels can help you plan your income or deductions more effectively. By strategically managing your finances, such as utilizing deductions or credits, you may be able to lower your overall rate, resulting in significant savings in the long run.

Importance of Homeowners Insurance

Protecting your home from unexpected events is a vital aspect of long-term financial security. Whether it’s damage from natural disasters, theft, or accidents, having a safeguard in place can help you recover quickly without facing overwhelming financial strain.

Why Protection Matters

Owning a home comes with significant responsibilities, and unexpected events can cause extensive damage. Without proper protection, the costs of repairs or rebuilding could be financially devastating. This coverage helps to mitigate those risks and provides peace of mind in the event of a mishap.

What It Covers

- Damage to the structure of your home due to accidents or disasters

- Loss of personal property caused by theft, fire, or vandalism

- Liability for injuries that occur on your property

- Temporary living expenses if your home becomes uninhabitable

By ensuring that your property and belongings are protected, you can focus on other aspects of homeownership without the constant worry of financial instability following an unfortunate event.

Common Tax Filing Mistakes to Avoid

When completing your annual financial reporting, small errors can lead to big complications, including delayed refunds or even penalties. Recognizing and avoiding common missteps can ensure a smoother process and help you avoid unnecessary stress.

Common Errors to Watch Out For

One of the most frequent mistakes is incorrect personal details, such as misspelled names or wrong Social Security numbers. Even a small typo can cause issues with processing your submission.

- Incorrect filing status: Choose the wrong status (single, married, etc.) and it could impact deductions.

- Missing or incorrect deductions: Failing to claim eligible deductions or inaccurately reporting them can lead to overpayment.

- Omitting income: Be sure to include all income sources to avoid discrepancies with the tax authorities.

- Not keeping proper records: Failing to keep accurate records or receipts may make it difficult to back up claims or deductions later.

How to Prevent Mistakes

To reduce the risk of errors, double-check all forms, ensure that all required documents are submitted, and, if needed, seek help from a tax professional. Keeping organized records throughout the year can save you time and avoid costly mistakes during the filing process.

Exploring Disability Insurance Benefits

When faced with an unexpected illness or injury that prevents you from working, having a safety net can provide crucial financial support. These protection plans offer a vital source of income during times when you are unable to earn a living due to a medical condition.

Why It’s Essential

Many individuals rely on their ability to work for their livelihood, and without the means to earn, life expenses can quickly become overwhelming. These plans are designed to replace a portion of your income, ensuring that you can maintain financial stability while you focus on recovery.

Key Benefits

- Income Replacement: A percentage of your earnings is paid to you regularly, helping you meet essential expenses.

- Peace of Mind: Knowing that you have support in place can reduce stress during a challenging period of your life.

- Long-Term Security: Some plans offer extended coverage, ensuring that you’re protected for months or even years, depending on the severity of your condition.

By securing this type of coverage, you can safeguard yourself from the financial impacts of an unforeseen health crisis, allowing you to focus on recovery rather than financial concerns.

How to Calculate Your Tax Refund

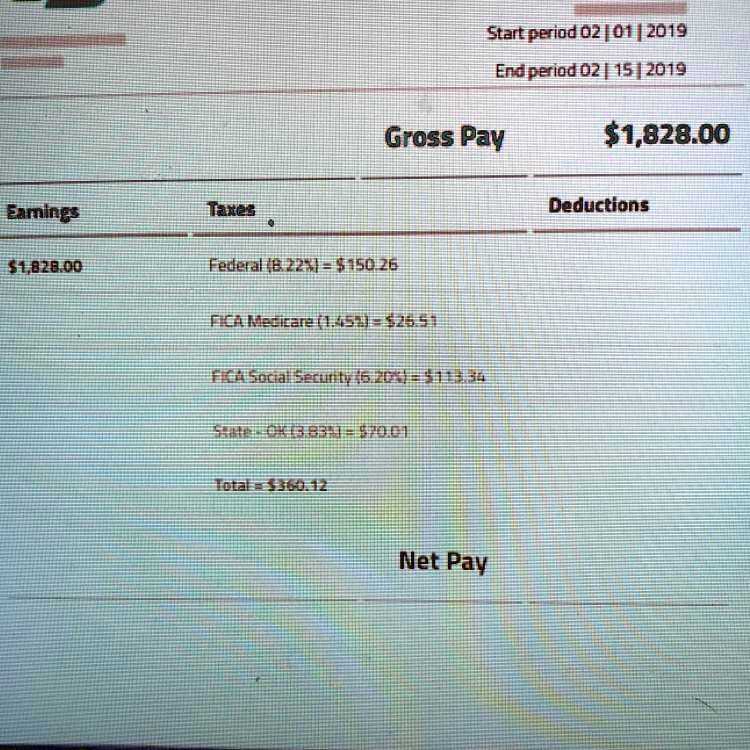

Determining the amount you may receive back from the government after filing your yearly financial report involves understanding several key factors. By comparing your total payments throughout the year with the amount you actually owe, you can figure out whether you’ll get money back or need to pay additional funds.

Key Elements to Consider

The first step in calculating your refund is to review your total earnings and any taxes you’ve already paid. This includes amounts withheld from your paycheck, any quarterly payments, or credits you may have qualified for. After that, compare the total of these payments with the amount you owe based on your filing status, deductions, and exemptions.

Steps to Calculate Your Refund

- Step 1: Add up all the taxes you’ve already paid throughout the year.

- Step 2: Calculate the total amount due based on your taxable income and deductions.

- Step 3: Subtract the amount due from what you’ve paid to determine if you’ll receive a refund or owe more.

If the amount paid exceeds what is owed, you will receive a refund. The more accurately you track your payments and deductions throughout the year, the easier it will be to calculate your potential refund.

The Role of Insurance in Risk Management

Managing potential threats to personal or business financial security requires a structured approach to handling uncertainties. One key strategy to reduce the impact of unforeseen events involves shifting some of the financial risk to external parties, ensuring that the burden of large losses does not fall solely on the individual or organization.

How Risk Management Works

Effective risk management is about identifying, assessing, and minimizing the impact of unexpected events. A key component of this strategy is transferring financial risk through various protection plans, allowing individuals and businesses to focus on growth and stability without worrying about major financial setbacks.

Strategies for Risk Mitigation

- Risk Transfer: By securing appropriate coverage, you can shift the financial consequences of certain risks to another party.

- Cost Control: Risk management tools help keep premiums affordable while still providing essential coverage.

- Minimizing Financial Impact: In the event of a loss, having a safety net in place can minimize the long-term financial strain on your assets.

- Legal Protection: Risk management can help protect you from lawsuits or claims that could arise from accidents or damages.

By integrating effective protection strategies into risk management, you can safeguard against potentially devastating financial situations, ensuring greater stability and peace of mind.

Filing Taxes as a Self-Employed Person

When you work for yourself, your financial responsibilities go beyond just earning an income. In addition to managing business expenses, you must ensure that you report your earnings and pay the correct amount to the government. The process involves understanding both your income and allowable deductions, as well as the special forms that apply to self-employed individuals.

Unlike traditional employees, self-employed individuals are responsible for calculating their own contributions, including both personal and business-related obligations. This often means filling out additional paperwork and keeping detailed records of all income sources, as well as any deductions or credits available to reduce your liability.

Key Steps in Filing

- Track All Income: Maintain accurate records of every payment or revenue source, whether it comes from clients, customers, or other business-related activities.

- Deduct Business Expenses: Keep track of eligible expenses, such as equipment, travel costs, office supplies, and even a portion of your home expenses if you work from home.

- Estimate Quarterly Payments: As a self-employed individual, you’re typically required to make estimated payments four times a year to avoid underpayment penalties.

- Complete the Correct Forms: File using the necessary forms, such as Schedule C for business income and expenses, and Schedule SE for self-employment taxes.

Filing properly ensures you avoid costly penalties and make the most of available deductions. While it can seem daunting, with careful planning and organization, the process becomes much more manageable, providing clarity and helping you stay compliant.

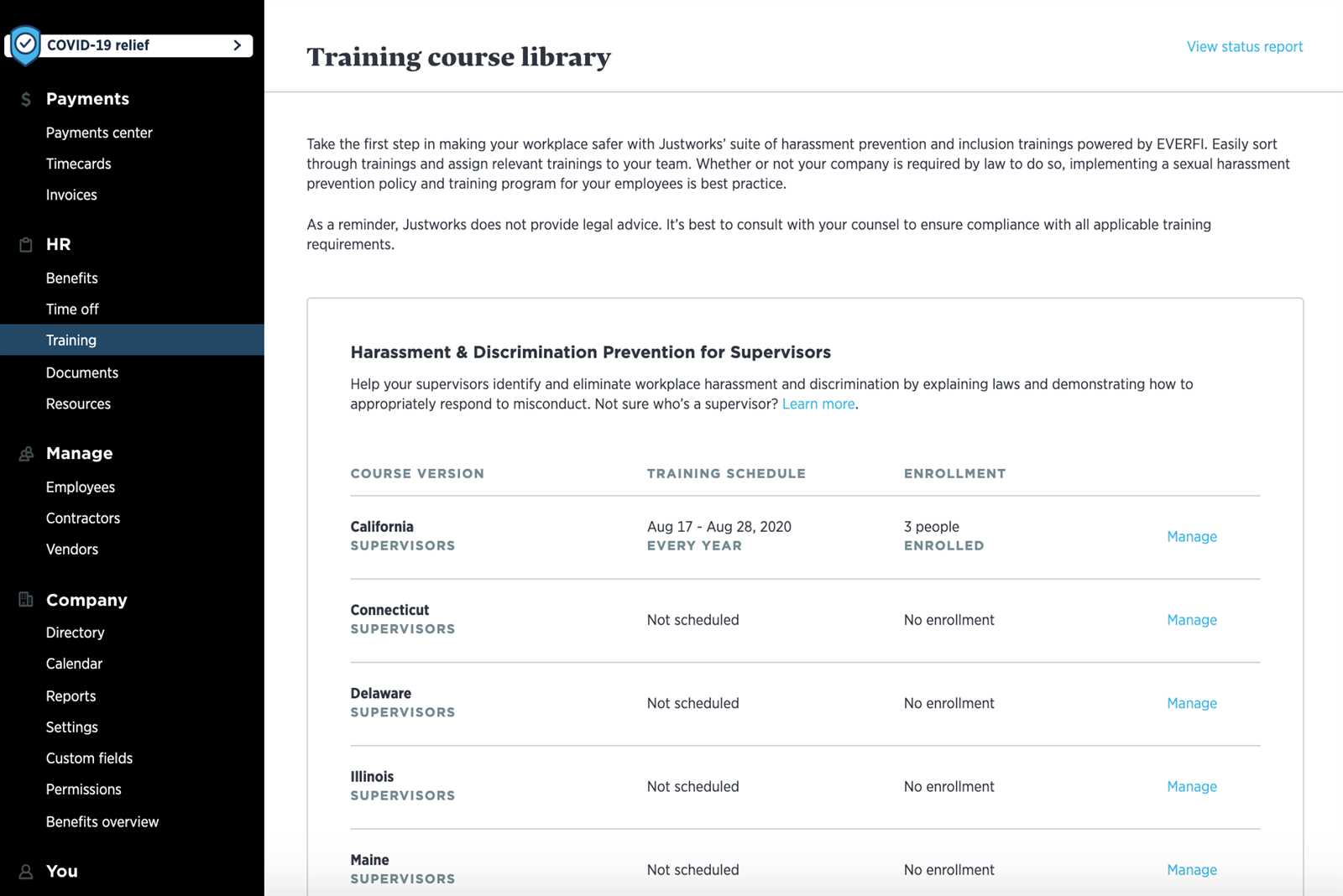

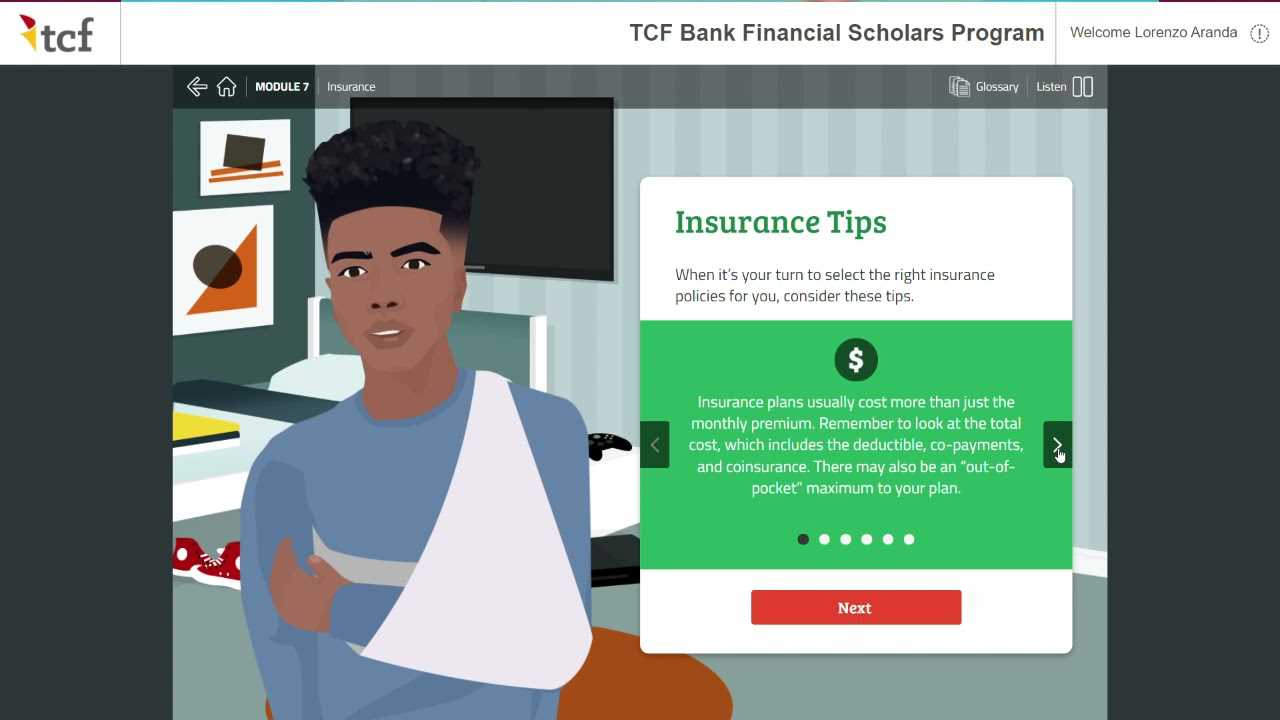

Choosing the Right Insurance Plan

When selecting a coverage plan, it’s essential to understand the variety of options available and how each one fits with your needs. The right plan depends on multiple factors, including your lifestyle, health, financial situation, and future goals. Making an informed decision requires evaluating the level of protection offered, as well as the costs and potential benefits.

In choosing a plan, it’s not only about the premium you’ll pay each month. You also need to consider factors such as deductibles, co-pays, coverage limits, and the network of providers included. Having a clear understanding of these elements will help you select a plan that provides peace of mind without overburdening your finances.

Factors to Consider

- Coverage Needs: Consider what you need covered based on your health, family, and financial situation. Different plans cater to specific needs such as hospital care, medications, or routine doctor visits.

- Premiums vs. Deductibles: A lower monthly premium might seem appealing, but it could come with higher out-of-pocket costs when you need care. Make sure the balance suits your budget.

- Provider Network: Ensure that your preferred doctors and hospitals are included in the plan’s network, especially if you require ongoing treatment or specialist care.

- Plan Flexibility: Some plans offer flexibility in terms of switching coverage or making adjustments as your needs change over time.

By carefully considering these factors, you can choose a plan that provides both the protection you need and the financial stability you desire. Take the time to compare different options and tailor your selection to your unique requirements.

What to Know About Estate Taxes

When it comes to transferring wealth after death, understanding the financial obligations that may arise is essential. These obligations, which are applied to the value of an individual’s assets, can significantly affect the inheritance passed on to beneficiaries. Being well-informed about these laws and requirements can help individuals plan effectively for the future and minimize potential financial burdens.

Estate obligations are typically determined based on the total value of the assets left behind, including real estate, investments, and personal property. While some individuals may not face these charges due to exemptions or deductions, others may need to take proactive steps to manage this aspect of wealth transfer.

Key Aspects to Understand

- Exemption Limits: There is often a threshold below which estates are not subject to charges. Understanding these limits can help individuals plan to keep their estate below taxable thresholds.

- Valuation of Assets: Properly assessing the value of assets such as property or investments is critical. Misvaluation can lead to unexpected obligations or challenges in transferring assets.

- State vs. Federal Obligations: While federal laws govern the taxation of estates, individual states may impose their own regulations and taxes, which can vary greatly.

- Exemptions and Deductions: There are various exemptions available, such as for charitable donations, spousal transfers, or specific types of property, which can reduce the overall liability.

Planning ahead by understanding the nuances of these rules can greatly reduce the financial burden on your heirs. Consulting with financial professionals or estate planners is often advisable to navigate the complexities of these laws effectively.