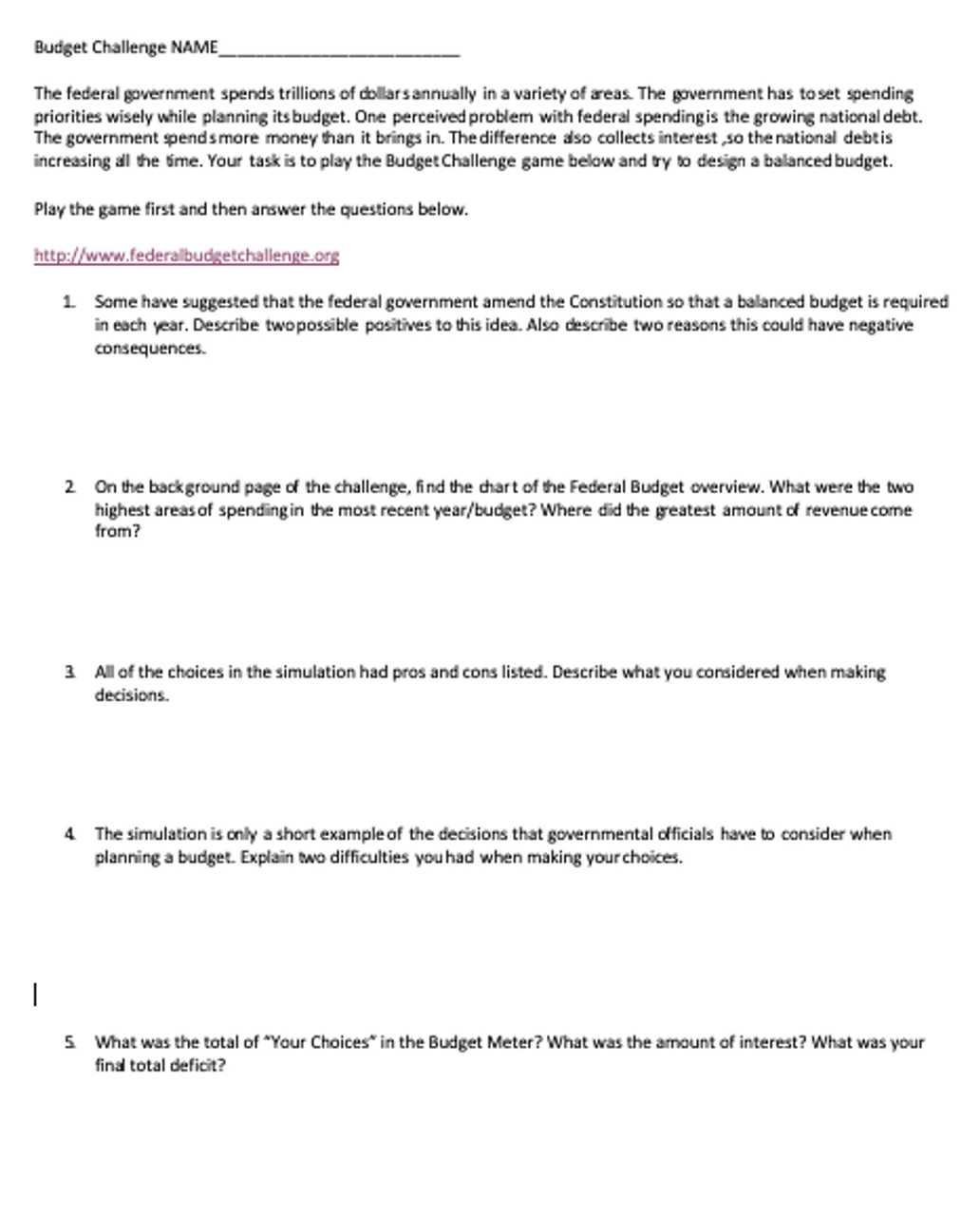

Managing the financial resources of a nation involves addressing complex decisions regarding income, spending, and saving. This process plays a crucial role in shaping the overall economic health and ensuring that the government can fulfill its obligations to citizens and various sectors. Balancing these aspects requires careful planning and a thorough understanding of various economic factors.

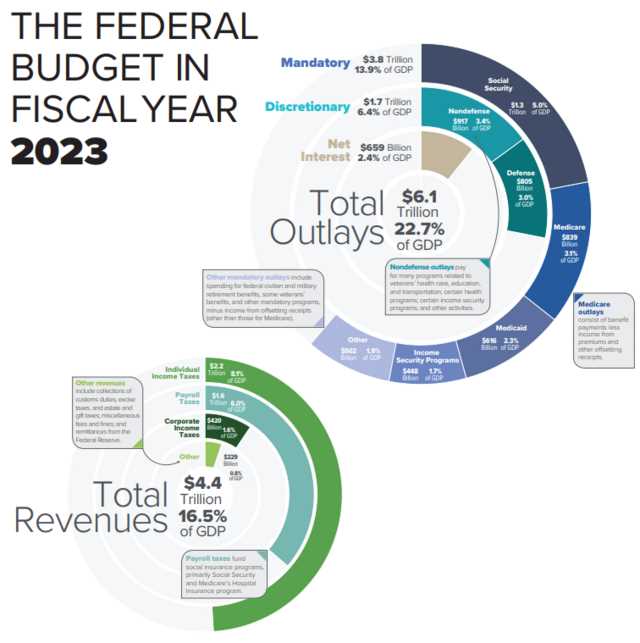

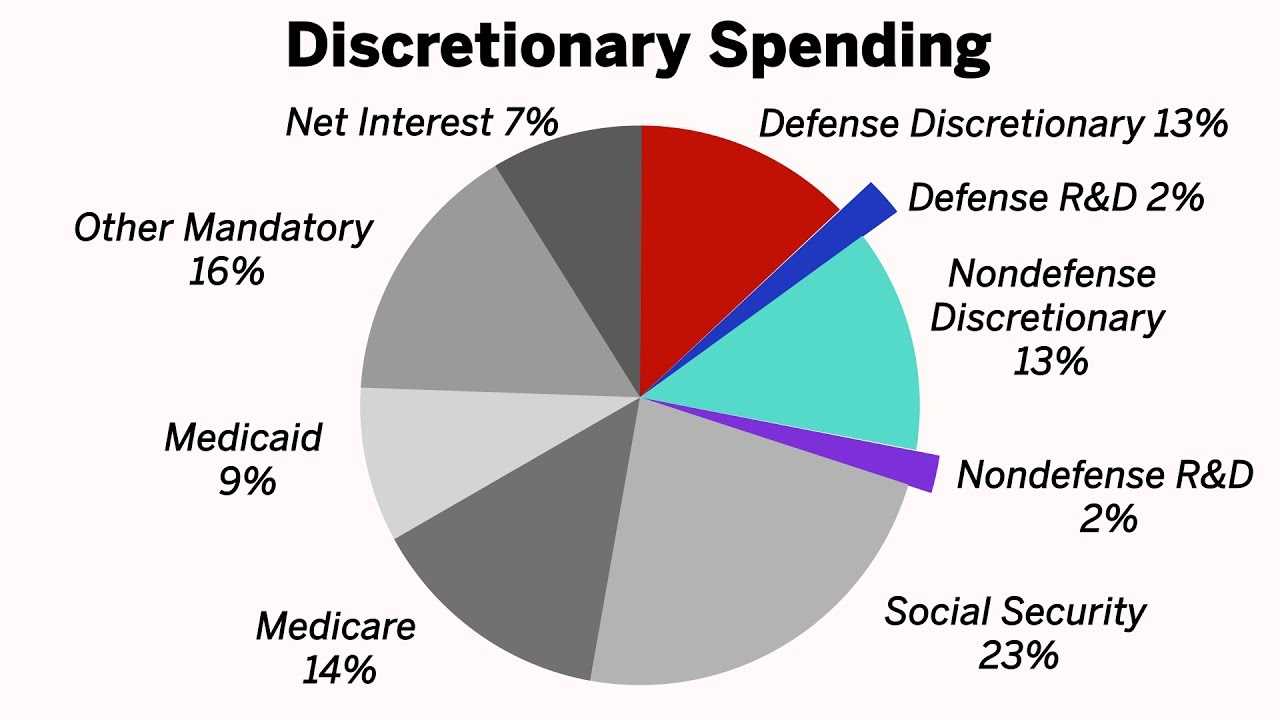

One of the most significant aspects of this task is how the government handles its revenues and expenditures. With limited resources, determining the right allocation to key areas such as defense, healthcare, and social services can often be contentious. Additionally, managing national debt and ensuring long-term fiscal sustainability presents ongoing challenges for policymakers.

Throughout this article, we explore various solutions and strategies to address these pressing issues, providing insights into how governments can better navigate their financial complexities while aiming for a prosperous future. Financial planning is key to achieving long-term success, and understanding the key components of this system is essential for anyone interested in economic policy and governance.

Solutions to Government Financial Issues

Effectively managing national finances requires addressing a range of economic concerns that often intersect and create significant challenges. Governments are tasked with ensuring the efficient use of resources, tackling debt, and meeting the demands of citizens through various public services. The strategies employed to navigate these complexities play a crucial role in determining the long-term economic stability of a nation.

Key Strategies for Fiscal Sustainability

One essential aspect of resolving financial difficulties is creating a sustainable path forward. This involves finding ways to increase revenue while controlling spending. Strategies like tax reforms, reducing unnecessary expenditures, and prioritizing investments in areas that yield long-term benefits are commonly considered. Governments must also strike a balance between stimulating economic growth and maintaining fiscal discipline.

Addressing National Debt and Deficit

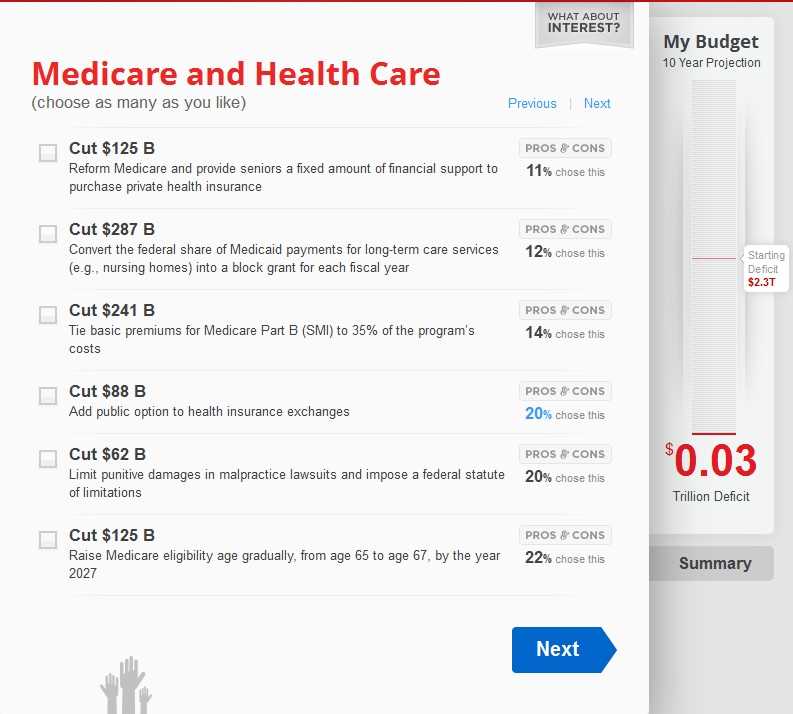

National debt remains one of the most pressing concerns in managing a country’s finances. Over time, an increasing debt burden can limit the government’s ability to fund essential services or invest in critical areas such as infrastructure or healthcare. Implementing effective debt reduction plans, restructuring existing obligations, and ensuring future borrowing is sustainable are vital components of any financial recovery strategy.

Understanding the Financial Deficit

At the heart of many financial struggles faced by governments is the issue of imbalance between income and expenditure. When the outflows exceed the inflows, it creates a gap that needs to be addressed. This situation can have wide-ranging effects on a nation’s economy, influencing everything from public services to national debt. Understanding the causes and consequences of such imbalances is essential to developing effective solutions.

Causes of the Financial Deficit

The primary reasons behind this imbalance often stem from factors like increased government spending, reduced tax revenue, or unexpected economic downturns. When expenditures outpace the resources available, borrowing becomes necessary to cover the difference. Over time, if this trend continues, it can lead to an unsustainable level of debt.

Consequences and Long-Term Impact

If the gap between spending and income persists, it can lead to inflation, reduced investments in key areas like infrastructure or healthcare, and even a loss of investor confidence. The longer a country operates under such conditions, the more difficult it becomes to rectify the situation without implementing drastic financial reforms.

| Year | Expenditure ($ Trillions) | Revenue ($ Trillions) | Deficit ($ Trillions) |

|---|---|---|---|

| 2018 | 4.1 | 3.5 | 0.6 |

| 2019 | 4.5 | 3.6 | 0.9 |

| 2020 | 5.0 | 3.4 | 1.6 |

| 2021 | 6.0 | 3.8 | 2.2 |

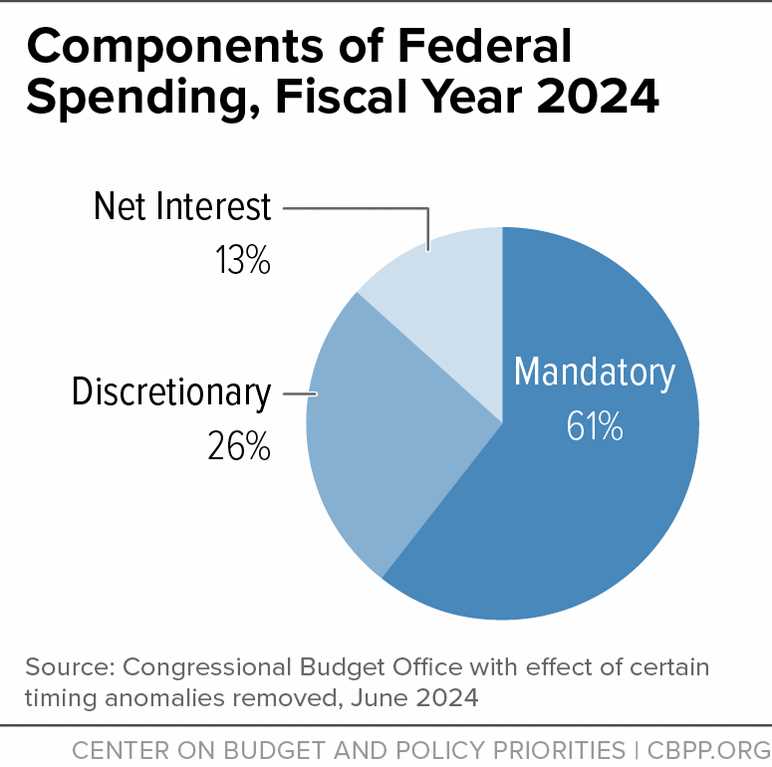

Key Factors Influencing Government Spending

Various elements contribute to how a government allocates its financial resources. These factors range from immediate economic conditions to long-term policy goals. Understanding these influences is crucial for comprehending the priorities that shape national financial planning and the overall economic landscape.

Economic Conditions and Fiscal Policies

The state of the economy is one of the most significant drivers of government expenditures. In times of economic downturn, governments may increase spending to stimulate growth, often through stimulus programs or public investments. Conversely, during periods of economic prosperity, spending may be more focused on debt reduction or investments in infrastructure and social services.

- Recessions lead to increased government spending to boost economic activity.

- Periods of growth often result in more investments in long-term infrastructure projects.

- Government responses to inflation and deflation can heavily influence spending priorities.

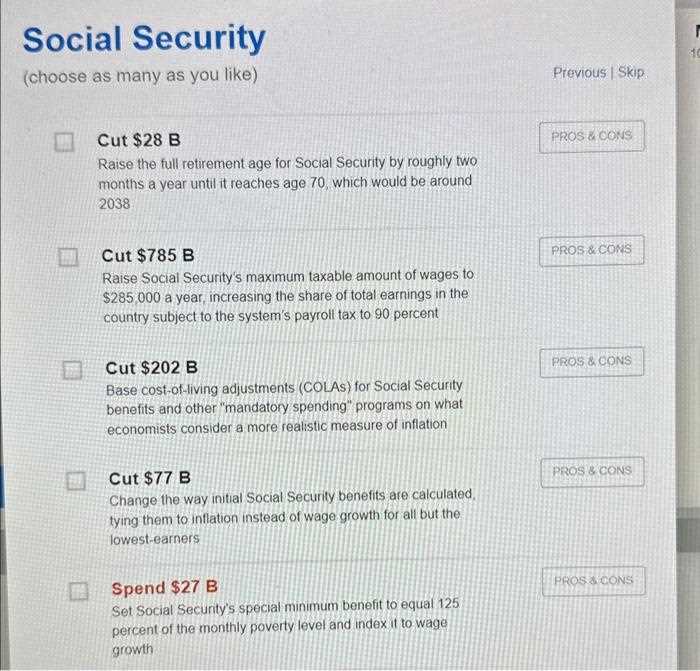

Public Demands and Social Programs

As societal needs evolve, so does the demand for government-funded services. Expanding healthcare, education, and social security programs are common responses to the needs of an aging population or growing social challenges. The government often adjusts spending to meet these needs, which may result in significant changes to how resources are distributed across different sectors.

- Healthcare and social services require substantial funding to meet the needs of a growing population.

- Education funding is adjusted to accommodate demographic changes and rising enrollment rates.

- Changes in public opinion and political pressure can lead to shifts in how funds are allocated.

Strategies to Reduce National Debt

Addressing the growing debt of a country requires a mix of short-term actions and long-term structural changes. Reducing the national debt is essential for improving economic stability and ensuring sustainable growth. Various strategies can be employed to slow the accumulation of debt and begin to reduce existing obligations. These approaches generally focus on increasing revenue, cutting unnecessary spending, and fostering economic growth.

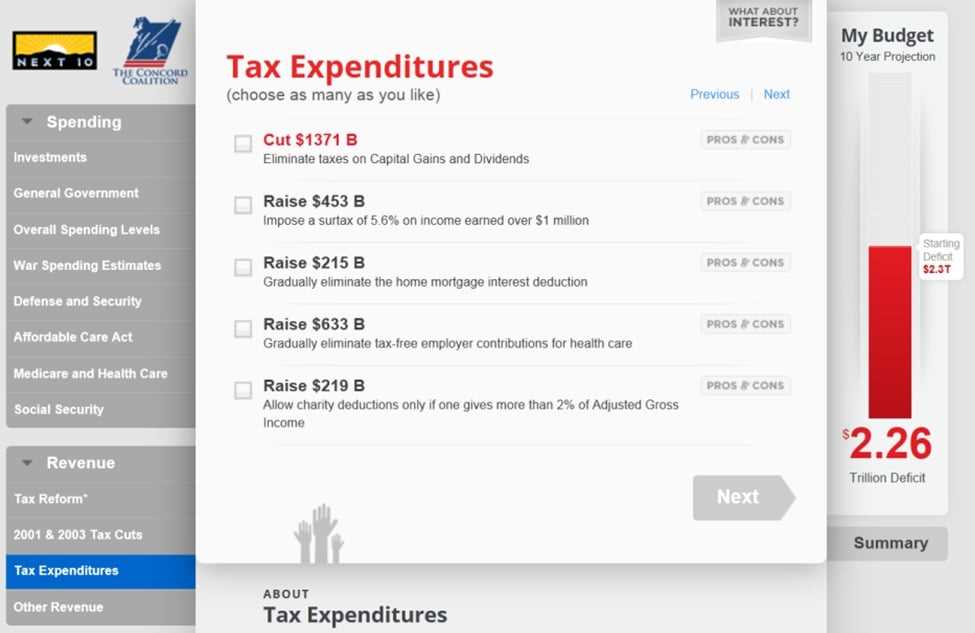

Increasing Revenue Through Tax Reforms

One of the most effective ways to reduce debt is by increasing government revenue. This can be achieved through reforms in the tax system, aimed at making it more efficient and equitable. Raising taxes on higher incomes, closing loopholes, and improving compliance can help generate additional revenue without stifling economic growth.

- Progressive tax systems can ensure that those with greater financial resources contribute more.

- Closing loopholes and cracking down on tax evasion increases the effectiveness of the tax code.

- Corporate tax reforms can ensure that businesses pay their fair share of taxes.

Cutting Unnecessary Expenditures

Reducing wasteful spending is another critical step in addressing national debt. Governments can identify areas where funds are being allocated inefficiently or where certain expenditures no longer serve the public interest. Cutting or reforming outdated programs and focusing on cost-effective solutions can help free up resources for more pressing needs.

- Streamlining government operations to eliminate inefficiencies can lead to significant savings.

- Reevaluating and prioritizing public spending ensures that funds are directed toward the most necessary areas.

- Subsidies and unnecessary grants can be reassessed to reduce long-term financial burdens.

How Taxation Affects Government Finances

Tax policies play a pivotal role in shaping the financial landscape of a country. The way taxes are structured directly influences the government’s ability to fund public services, invest in infrastructure, and manage its overall financial health. A balanced approach to taxation can help generate the necessary revenue while supporting economic growth and ensuring fairness within society.

The Role of Tax Revenue in Financing Services

Taxes are the primary source of income for governments, providing the funds required to support a wide range of public services, from healthcare and education to defense and social welfare. The amount of revenue generated through taxes affects the scale and quality of these services. When tax income is insufficient, governments may have to borrow or cut spending, which can have negative consequences for public programs.

- Higher tax revenues enable more robust funding for critical services and infrastructure projects.

- Insufficient tax income may lead to budget deficits, increasing reliance on debt financing.

- Progressive tax systems help distribute the financial burden more equitably among citizens.

Impact of Taxation on Economic Growth

While taxes are necessary for government functioning, they also have implications for the broader economy. Excessive taxation can discourage investment and reduce consumer spending, which may slow down economic growth. Conversely, tax cuts can stimulate economic activity, but without careful planning, they may lead to a shortfall in public funds. Striking the right balance between fostering growth and generating sufficient revenue is essential for long-term financial stability.

- Tax cuts can boost consumer spending and business investment, stimulating the economy.

- Overburdening taxes may lead to reduced disposable income, affecting consumption patterns.

- Well-structured tax policies can encourage sustainable economic development while maintaining fiscal health.

The Role of Social Programs in Budgeting

Social programs play a significant part in a nation’s financial planning, as they are designed to support the welfare and well-being of the population. These programs address critical needs such as healthcare, housing, unemployment benefits, and education. The allocation of funds to social services impacts overall fiscal decisions and can be a major factor in determining how resources are distributed across different sectors.

Investing in social services ensures that citizens have access to essential services, promoting social stability and economic mobility. However, such programs can also place considerable pressure on government finances, especially when demand for services increases due to demographic changes or economic challenges. Managing this balance between social needs and fiscal responsibility is crucial for maintaining long-term sustainability.

Funding Social Programs for Public Welfare

Governments allocate a portion of their financial resources to ensure that citizens receive adequate support in times of need. These services often serve as a safety net for the most vulnerable members of society. The success of these programs depends on careful planning and consistent funding, with a focus on equity and efficiency in service delivery.

- Healthcare and education are key components of social programs that require substantial funding.

- Support for vulnerable populations, such as the elderly and unemployed, also requires significant resources.

- Investing in social services can reduce inequality and enhance overall societal well-being.

Challenges in Allocating Resources to Social Services

While social programs are essential, they can create challenges in terms of funding and sustainability. In times of economic downturn or when government revenue decreases, the ability to adequately fund these services may be threatened. Policymakers must consider how to prioritize social programs without compromising other critical investments such as infrastructure or national security.

- Balancing the cost of social services with other essential public investments is a key challenge.

- Reforming social programs to increase efficiency and reduce waste can help manage financial pressure.

- Long-term solutions require thoughtful planning to ensure that services remain accessible and effective without overstretching public resources.

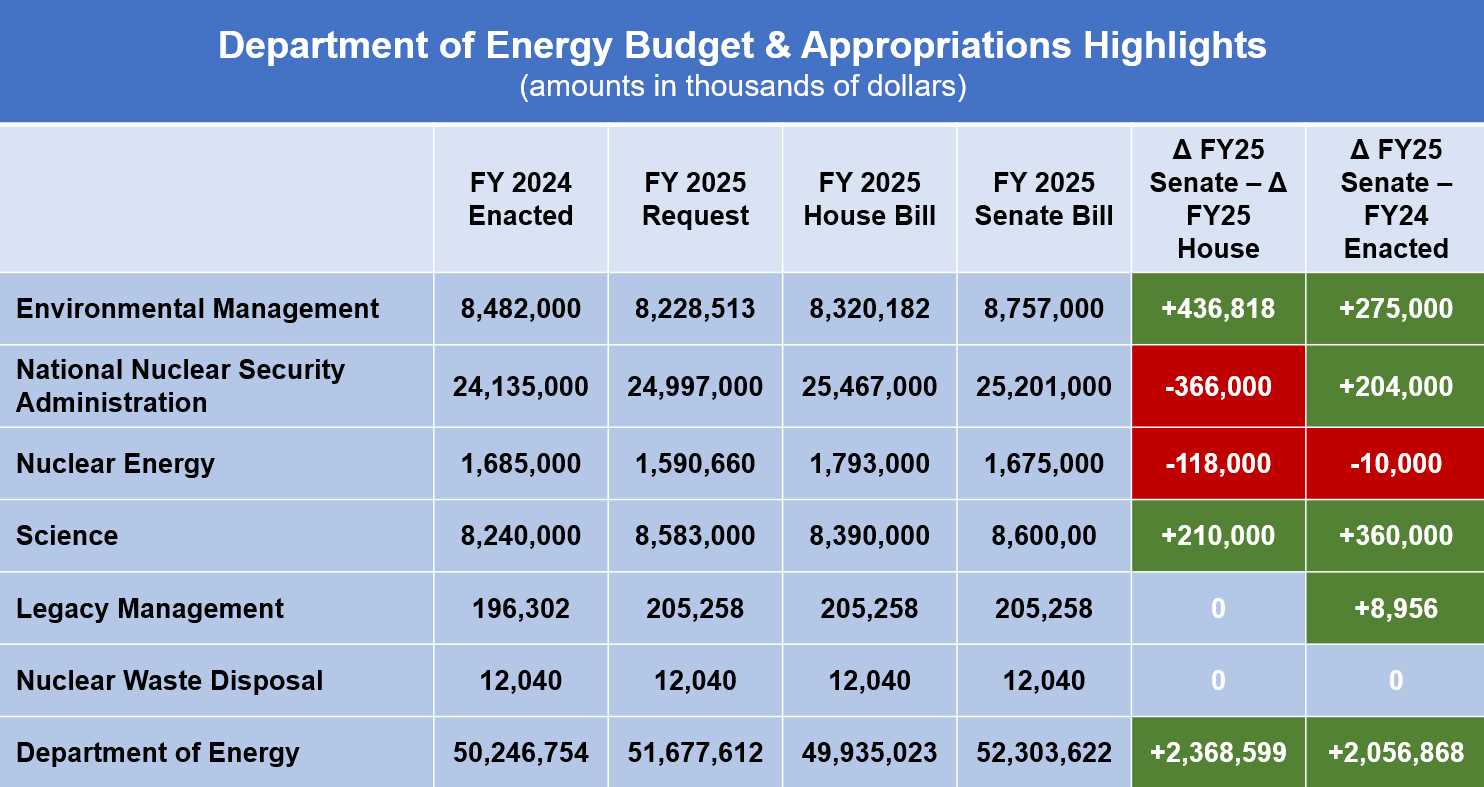

Impact of Military Expenditures on the Financial Plan

Military spending is a significant component of a nation’s financial strategy, affecting the allocation of resources across various sectors. The costs associated with defense, including personnel, equipment, research, and operations, can consume a substantial portion of public funds. While maintaining national security is crucial, the allocation of these resources can influence other areas of public spending and shape overall financial stability.

Costs and Consequences of High Military Spending

Excessive spending on defense can strain a country’s finances, especially when it leads to large deficits or reduces the funds available for essential services like education and healthcare. Military expenditures, though vital for national security, must be balanced against the need to invest in other public sectors. Excessive or poorly managed defense budgets can lead to long-term financial challenges.

- High military costs can divert funds from other critical public services.

- Increased defense spending can lead to higher public debt, especially in times of conflict.

- Large defense budgets may reduce the government’s ability to invest in domestic infrastructure or social programs.

Balancing Defense and Public Investment

Governments must carefully evaluate military needs in relation to other spending priorities. While national defense is undeniably important, excessive financial commitment to the military may undermine other essential investments. Effective financial planning involves striking a balance, ensuring that defense spending does not overly restrict opportunities for growth and social development.

- Reassessing defense contracts and prioritizing spending on modern, cost-effective technologies can reduce waste.

- Collaborating with international allies on defense initiatives can help share costs and reduce the burden on public funds.

- Strategic investment in defense infrastructure can improve efficiency and long-term financial sustainability.

Debt Ceiling and Its Financial Impact

The debt ceiling is a critical financial mechanism that places a limit on the amount of money a government can borrow to meet its existing financial obligations. When this limit is reached, the government must either raise the ceiling or face potential default, which could have significant repercussions for both the economy and government operations. This limitation on borrowing can severely impact a nation’s ability to fund various programs and projects, leading to complex financial decisions.

Effects on Government Operations

When the debt ceiling is reached and not raised, the government may be forced to halt certain spending activities, delay payments, or prioritize some programs over others. This can create uncertainty in financial markets and hinder the government’s ability to maintain smooth operations. Such disruptions can also undermine public trust and confidence in government financial management.

- Government operations may be interrupted due to a lack of available funds.

- Failure to raise the debt ceiling can lead to delayed payments to contractors, employees, and retirees.

- Uncertainty surrounding the debt ceiling can reduce investor confidence and raise borrowing costs.

Long-term Economic Consequences

While raising the debt ceiling may provide temporary relief, it does not address the underlying issues of national debt or fiscal sustainability. Continuously increasing the borrowing limit without corresponding efforts to manage debt can lead to long-term economic instability. Over time, the cost of servicing debt may crowd out spending on critical public services and infrastructure, which can harm economic growth.

- Long-term reliance on borrowing can lead to higher interest payments, reducing the funds available for other needs.

- Failing to address fiscal imbalances can result in higher national debt levels, burdening future generations.

- Raising the debt ceiling without fiscal reforms can contribute to increased uncertainty and volatility in the financial markets.

Challenges in Achieving Fiscal Balance

Achieving a balanced financial plan is a complex task that requires careful management of revenues and expenditures. Governments face numerous obstacles in striving to balance the books, as they must navigate fluctuating income from taxes, economic instability, and the growing demand for public services. The challenge lies in ensuring that spending does not exceed available funds while maintaining essential services and fostering economic growth.

Economic Factors and Revenue Fluctuations

The income available for government spending is largely dependent on the health of the economy. Tax revenues can fluctuate based on economic conditions, and during periods of recession or slow growth, revenues may fall significantly. This creates a challenge in maintaining a balanced financial plan, as governments may need to increase borrowing or reduce spending to compensate for lower revenues.

- Recessions or economic downturns can lead to reduced tax collections.

- Volatile markets and global economic factors can affect government income.

- Unexpected economic shifts can complicate long-term fiscal planning.

Increased Public Demands and Spending Pressures

Another significant challenge in balancing finances is the growing demand for public services. As populations age and social needs increase, spending on healthcare, pensions, and social services tends to rise. At the same time, governments must also invest in infrastructure and other long-term projects. This can create a situation where spending continuously outpaces revenue, forcing governments to take on more debt or cut essential programs.

- The aging population increases demand for healthcare and retirement benefits.

- Rising social needs often result in higher public expenditures.

- Maintaining infrastructure while controlling costs requires strategic investment planning.

Political and Policy Constraints

Political challenges also play a critical role in achieving fiscal balance. Public opinion and the interests of various groups can make it difficult to make necessary cuts or implement tax increases. Political leaders may face opposition when trying to introduce measures that affect key constituencies, making it harder to make tough decisions that are essential for fiscal health.

- Resistance to tax increases or spending cuts can stall necessary reforms.

- Political divisions often lead to budgetary gridlock and delayed decisions.

- Balancing political priorities with fiscal responsibility requires compromise and negotiation.

The Importance of Financial Transparency

Transparency in financial planning is a cornerstone of effective governance. When citizens, policymakers, and other stakeholders can clearly understand how public funds are allocated and spent, it fosters trust and accountability. Open access to financial data enables informed decision-making, helps identify inefficiencies, and encourages responsible fiscal management. Ensuring that financial strategies are transparent is essential for maintaining public confidence and promoting long-term economic stability.

Building Public Trust

When governments are transparent about how they handle public resources, it enhances trust among citizens. People are more likely to support policies and decisions if they believe that funds are being used efficiently and responsibly. Without transparency, there is a risk of corruption, mismanagement, and a loss of faith in public institutions.

- Clear communication of spending helps prevent misunderstandings and misinterpretations.

- Transparency encourages citizen participation and feedback on fiscal policies.

- Open financial data discourages corruption and the misuse of resources.

Encouraging Efficient Resource Allocation

When financial plans are open and accessible, it becomes easier to spot areas where funds are being underutilized or wasted. This allows for better resource allocation, ensuring that public money is spent where it can have the greatest impact. Transparency helps identify opportunities for cost savings, program improvements, and more effective use of taxpayer dollars.

- Efficient management of resources is possible through constant review and oversight.

- Transparent processes encourage competition and innovation in public sector services.

- Accountability leads to more accurate forecasting and budget adjustments when necessary.

Economic Growth and Financial Forecasting

Accurate financial planning requires a deep understanding of economic trends and growth projections. Forecasting future financial conditions is essential for creating sustainable strategies, as it helps governments anticipate revenue streams, plan expenditures, and adjust to changing economic landscapes. The relationship between economic growth and forecasting is vital because an expanding economy can lead to increased revenues, while a contracting economy can result in shortfalls and the need for adjustments in fiscal policy.

Impact of Economic Growth on Revenue Projections

Economic growth directly influences the amount of tax revenue a government can expect. As businesses thrive, employment increases, and consumer spending rises, so does the overall tax base. Understanding these dynamics allows policymakers to estimate future revenue more accurately and plan for public spending accordingly. However, external factors such as global economic shifts or domestic recessions can complicate these projections, requiring constant monitoring and adjustment.

- Growing economies typically see an increase in tax revenue from higher wages and corporate profits.

- Accurate growth projections help avoid large deficits or unexpected surpluses.

- Rapid changes in the economy may necessitate quick adjustments to fiscal policies.

Challenges in Forecasting Amid Economic Uncertainty

While forecasting is essential, predicting future economic performance is inherently uncertain. Global events, technological disruptions, and shifts in consumer behavior can all have unforeseen impacts on economic stability. As a result, financial plans must be flexible, allowing governments to respond to unexpected challenges without derailing long-term objectives.

- Economic forecasts are subject to unpredictable global and local factors.

- Flexibility in financial planning is crucial to adapt to unforeseen market shifts.

- Accurate forecasting requires data from diverse sources and constant reevaluation.

Public Opinion on Financial Policies

The way a government allocates resources and manages financial strategies often sparks significant public debate. Citizens’ views on fiscal policies are shaped by their personal experiences, economic conditions, and understanding of how public funds are distributed. Public opinion plays a crucial role in influencing the decisions of policymakers, as it reflects the level of support or opposition to various economic initiatives. When people feel that their needs and concerns are addressed, they are more likely to support these policies, but when they perceive financial decisions as harmful or unfair, discontent may grow.

Factors Influencing Public Opinion

Several factors contribute to shaping public opinion about economic policies. These include the effectiveness of government communication, the impact of policies on different socioeconomic groups, and the overall economic environment. When economic growth is strong, citizens may view financial strategies more favorably. However, during times of recession or financial instability, criticism and dissatisfaction tend to rise.

- The success or failure of specific policies can shape public sentiment significantly.

- Transparency and accessibility of information help people understand the reasoning behind financial decisions.

- The personal impact of policies on citizens’ lives often dictates their support or opposition.

Public Influence on Policy Development

Public opinion can influence the direction of fiscal policies through voting, protests, or direct communication with elected officials. In democratic systems, governments are more likely to adjust policies when they face significant opposition or when there is a strong public demand for change. However, balancing public opinion with long-term economic needs is often challenging, as the immediate preferences of the populace may not always align with sustainable financial strategies.

- Public input can drive changes in spending priorities and tax policies.

- Strong public support can lead to the implementation of new initiatives or reforms.

- Governments must often weigh short-term political pressure against long-term economic goals.

International Comparisons of Financial Planning

Different nations adopt various approaches to managing public finances, influenced by their unique economic structures, political climates, and societal needs. The way countries plan their financial strategies can significantly affect their economic stability and growth. By examining global practices, it becomes possible to understand the diverse methods used to balance revenue, expenditures, and debt. These comparisons help to identify best practices and areas where improvements can be made, offering valuable insights for countries looking to refine their financial management processes.

Variations in Fiscal Approaches

While some nations prioritize balanced financial plans, others may focus on stimulating economic growth through increased public spending. These approaches are often shaped by historical, cultural, and political factors that dictate how governments allocate funds. For instance, certain countries with large welfare programs might allocate more resources to social services, while others with strong military or infrastructure needs may direct their funds accordingly.

- Some countries adopt stringent fiscal discipline, emphasizing low deficits and debt levels.

- Others prioritize economic stimulus through higher public spending during economic downturns.

- Countries with strong welfare states often allocate significant funds to healthcare, education, and social security.

Lessons from Global Fiscal Practices

By studying financial strategies from different parts of the world, governments can identify successful approaches that could be adapted to their own needs. For example, nations that have successfully reduced public debt may have useful strategies for controlling spending without stifling growth. Conversely, countries that have struggled with deficits can offer lessons on the challenges of managing high levels of public debt and how to adjust policies to regain financial stability.

- Global comparisons help identify successful strategies for managing public finances.

- Adapting policies from other countries requires consideration of local economic and political contexts.

- International cooperation can also provide frameworks for managing global economic challenges.

Evaluating Financial Efficiency and Effectiveness

Assessing the efficiency and effectiveness of financial plans is a critical process for ensuring that public funds are utilized in the most impactful way. It involves examining how well resources are allocated to meet specific goals while minimizing waste. Efficient financial management ensures that every dollar spent contributes to the desired outcomes, while effectiveness focuses on the actual achievement of those objectives. Evaluating both efficiency and effectiveness helps governments make informed decisions on where to cut costs or increase investments, ultimately driving better financial performance.

Key Metrics for Evaluation

To effectively evaluate financial efficiency and outcomes, specific metrics must be considered. These metrics help identify whether the resources are being used optimally and whether the goals set forth are being achieved. These measurements can vary depending on the type of expenditure, but common metrics include cost-benefit analysis, return on investment (ROI), and performance indicators related to specific programs.

| Metric | Description | Example |

|---|---|---|

| Cost-Benefit Analysis | Compares the total costs of a project or initiative to its expected benefits. | Assessing the impact of infrastructure projects versus their total cost. |

| Return on Investment (ROI) | Measures the gain or loss generated by an investment relative to its cost. | Evaluating the economic returns from public health initiatives. |

| Performance Indicators | Tracks specific objectives and benchmarks to measure progress. | Monitoring student performance in education programs. |

Challenges in Evaluation

Evaluating financial efficiency and effectiveness is not without its challenges. External factors, such as economic downturns or unforeseen events, can affect both the cost and outcomes of public projects. Additionally, data collection and measurement often involve subjective judgment, making it difficult to establish clear-cut results. Despite these challenges, continuous monitoring and adapting strategies based on results remain key to improving public financial management.

- External factors can distort the actual performance of initiatives.

- Subjective judgments in data interpretation may lead to biases in assessment.

- Regular reviews and adjustments help refine financial strategies for better results.

Future Financial Reforms and Proposals

The future of public finance is likely to involve significant reforms aimed at enhancing efficiency, sustainability, and equity. These reforms may focus on revising existing financial policies, implementing new strategies for resource allocation, and addressing long-term fiscal challenges. As economies evolve and face new pressures, it is crucial to explore innovative approaches that can adapt to changing circumstances while maintaining fiscal responsibility. This section will explore some of the proposed reforms that could shape the future of financial governance.

Proposed Reforms for Financial Sustainability

To address the growing demands on public resources, many proposals focus on enhancing sustainability by adjusting expenditure priorities, reforming tax systems, and improving financial transparency. The goal is to create a more resilient financial structure that can withstand economic fluctuations and deliver lasting benefits to citizens.

| Reform | Description | Expected Benefit |

|---|---|---|

| Progressive Taxation Systems | Adjusting tax rates based on income or wealth to ensure fairness and increase revenue. | More equitable distribution of the tax burden and increased revenue for essential services. |

| Spending Caps | Implementing limits on discretionary spending to prioritize critical areas like healthcare and education. | Reducing unnecessary expenditures while focusing on long-term priorities. |

| Automatic Stabilizers | Introducing measures that automatically adjust spending based on economic performance (e.g., unemployment benefits during recessions). | Mitigating the impact of economic downturns and stabilizing the economy. |

Innovative Strategies for Resource Allocation

Future financial planning will require more targeted and strategic approaches to allocating resources. Proposals are emerging to use data-driven methods to prioritize funding in a way that maximizes impact and efficiency. For example, performance-based budgeting systems could be adopted to ensure that public funds are directed toward the most effective programs.

- Data analytics to optimize resource distribution and evaluate program effectiveness.

- Performance-based models that link funding to measurable outcomes.

- Decentralization of financial decision-making to local governments for more responsive spending.

By incorporating these reforms, governments can better align their financial practices with future needs, ensuring sustainable growth and improved public welfare. However, these reforms will require careful consideration, planning, and collaboration across various sectors to ensure their successful implementation.

Impact of National Financial Plans on States

The distribution of national resources plays a crucial role in shaping the financial landscape of individual states. Decisions made at the national level regarding spending, taxation, and funding allocations directly affect how state governments can plan and execute their own financial strategies. These financial frameworks influence state budgets, public services, and infrastructure projects. Understanding how national policies impact state-level financial decisions is vital for assessing the broader economic landscape and ensuring the equitable distribution of resources across regions.

States often rely on national allocations for funding key services, including healthcare, education, and transportation. Changes in national priorities or shifts in financial strategy can result in increased or decreased funding for these essential sectors. As a result, state governments must adjust their budgets accordingly, balancing the demands of local needs with available resources.

Additionally, national economic decisions can influence tax policies and revenue streams for states. For instance, modifications to national tax rates or the implementation of new policies may affect state tax revenues, which could require states to either raise taxes or cut services to compensate for financial shortfalls.

The Role of Government Accountability Office

The Government Accountability Office (GAO) plays a critical role in ensuring transparency and efficiency in the management of public funds. Its primary responsibility is to provide oversight of government spending and programs to ensure that resources are used effectively and in alignment with legal and ethical standards. Through audits, investigations, and evaluations, the GAO serves as a check on the executive branch, offering insights and recommendations to improve operations, reduce waste, and enhance accountability.

Key Responsibilities

- Conducting audits and evaluations: The GAO examines the financial statements and performance of government agencies to ensure that funds are spent appropriately.

- Providing recommendations: After assessments, the GAO suggests improvements to programs and practices that could lead to better results and savings.

- Supporting Congress: The office provides objective, nonpartisan information to help lawmakers make informed decisions on policy matters and resource allocations.

- Ensuring compliance: The GAO monitors adherence to laws, regulations, and standards governing government programs and activities.

Impact on Government Transparency

The work of the GAO is essential for maintaining public trust in the efficiency and integrity of government operations. By independently assessing how public resources are allocated and spent, the GAO holds the government accountable to taxpayers, ensuring that public funds are used in the best interests of the population. Its findings often lead to policy reforms and procedural changes that improve governmental functions and reduce inefficiencies.