Preparing for a major evaluation in the world of finance requires a clear understanding of key principles, the ability to analyze complex scenarios, and the confidence to apply knowledge under pressure. Whether you’re aiming for a high grade or simply refining your skills, mastering the core concepts is essential to perform well. This section will guide you through the process of navigating through typical questions and maximizing your chances of success.

Effective preparation involves not only memorizing formulas and definitions but also developing the skills needed to think critically and solve problems. From basic calculations to advanced interpretation of data, each question is an opportunity to demonstrate your expertise and ability to handle real-world situations.

Success comes from practice and familiarity with the types of questions you might face. Understanding the structure of the assessment will allow you to approach each task with a strategic mindset. With the right approach, any challenge becomes an achievable goal.

Financial Assessment Preparation Tips

When facing a significant evaluation in the field of finance, understanding the core principles and applying them effectively is essential for success. This section focuses on the strategies and techniques to tackle the most common types of questions encountered during these evaluations. With a structured approach, it’s possible to break down each topic and tackle it confidently.

Preparation is key to achieving high marks. Knowing what to expect and being familiar with the common types of problems that appear on assessments can significantly boost performance. Key topics often include balance sheet analysis, income statements, and cash flow statements, each of which requires a specific set of skills to navigate successfully.

Practice is crucial in mastering the material. The more familiar you become with common question formats, the easier it will be to identify patterns and trends in the problems. Working through practice tests and reviewing solved examples will enhance your problem-solving abilities and allow you to approach complex questions with greater confidence.

Key Concepts for Success

Mastering essential principles and strategies is critical for performing well in any financial assessment. By focusing on the fundamental concepts, you can build a strong foundation and approach questions with clarity and confidence. This section highlights the key topics you should prioritize during your preparation.

Understanding Core Financial Statements

The backbone of any evaluation in this field is the ability to interpret and analyze key documents. Some of the most important statements to focus on include:

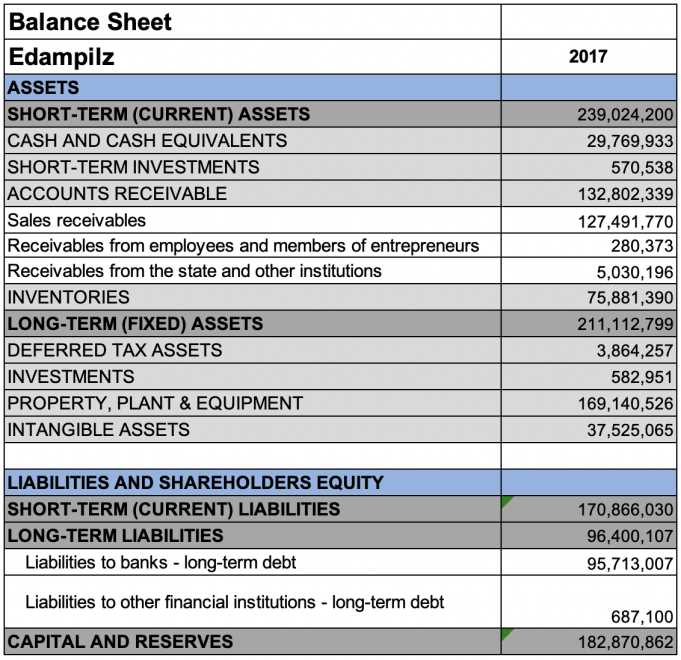

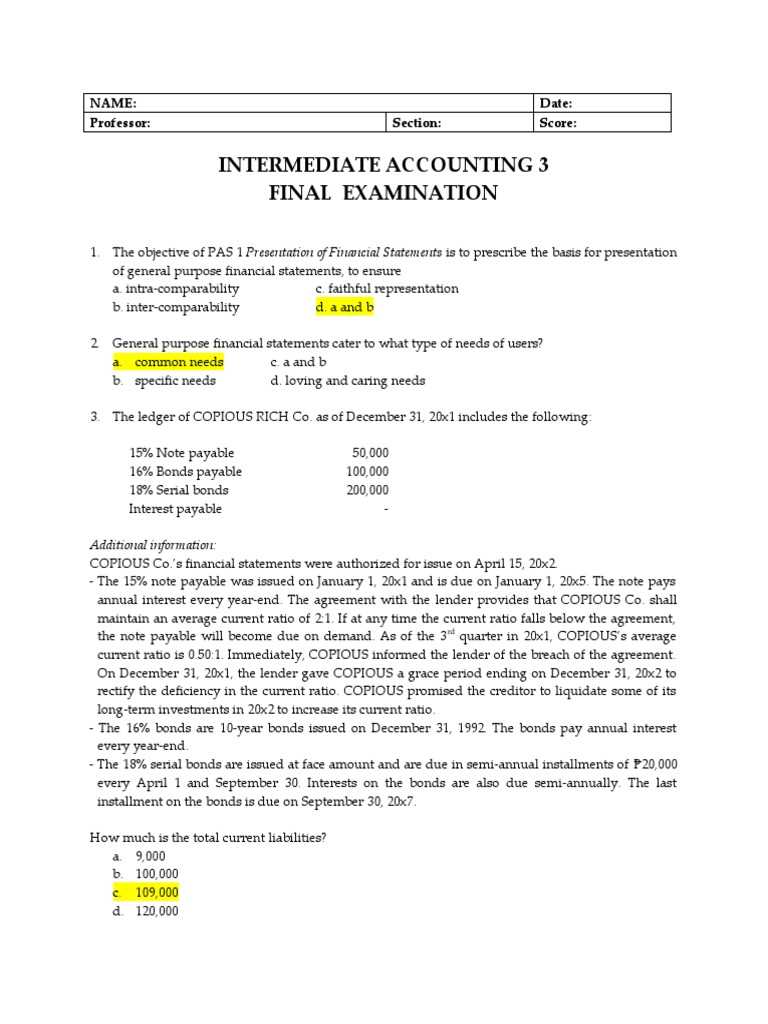

- Balance Sheets: Understanding assets, liabilities, and equity

- Income Statements: Identifying revenue, expenses, and net income

- Cash Flow Statements: Analyzing inflows and outflows of cash

Essential Formulas and Calculations

To excel in problem-solving sections, familiarize yourself with the following essential formulas:

- Return on Assets (ROA): Net Income / Total Assets

- Current Ratio: Current Assets / Current Liabilities

- Debt to Equity Ratio: Total Debt / Total Equity

These formulas are frequently used to assess performance and financial health, so understanding how to apply them will help you navigate related questions with ease.

Understanding Financial Statements Basics

One of the cornerstones of success in any assessment related to finance is a solid understanding of key documents that reflect the financial health of a business. These reports provide vital insights into how resources are managed, how performance is tracked, and how profitability is measured. Mastering the basics of these documents is essential for interpreting data and making informed decisions.

At the core of financial evaluations are three primary documents: the balance sheet, the income statement, and the cash flow statement. Each of these plays a unique role in offering a comprehensive view of a company’s financial position. Understanding the purpose and structure of these reports will not only help you interpret complex scenarios but also equip you with the knowledge needed to address various types of questions effectively.

Common Mistakes in Preparation

Effective preparation is key to performing well, but many candidates fall into common traps that hinder their progress. These mistakes often stem from mismanagement of time, misunderstanding key concepts, or overlooking certain areas of study. Recognizing these pitfalls can help you avoid unnecessary stress and improve your chances of success.

One of the most frequent errors is focusing too much on memorization without truly understanding the underlying principles. Rote learning might help recall facts in the short term, but it doesn’t build the critical thinking skills necessary to apply knowledge in varied contexts. Another common issue is neglecting practice problems and mock tests. Without applying what you’ve learned in a simulated environment, it’s difficult to assess your preparedness accurately. A lack of time management can also lead to cramming at the last minute, which rarely leads to long-term retention of information.

Effective Time Management Tips

Mastering time management is crucial for successful preparation. The ability to organize study sessions, prioritize key topics, and allocate sufficient time for review can significantly impact your performance. By developing a strategic approach, you can ensure that you cover all necessary material without feeling overwhelmed.

Here are some practical tips to help you manage your time more effectively:

- Create a Study Schedule: Break down your preparation into smaller, manageable tasks. Allocate specific time slots for each topic and stick to the plan.

- Set Realistic Goals: Aim for achievable daily or weekly objectives. Focus on mastering one concept at a time rather than cramming large amounts of information.

- Use Timed Practice Tests: Simulate the actual testing environment by setting a timer for practice questions. This will help you get used to time constraints.

- Prioritize Weak Areas: Identify the topics you find most challenging and dedicate more time to those. Make sure to revisit these concepts regularly.

- Take Breaks: Regular breaks are essential for maintaining focus and preventing burnout. Follow the Pomodoro technique or take short breaks after every study block.

By following these tips and staying disciplined with your time, you can make the most of your preparation and approach the evaluation with confidence.

How to Approach Multiple Choice Questions

Multiple-choice questions can seem intimidating at first, but with the right approach, they can become one of the easiest sections to navigate. Understanding how to efficiently analyze each question, eliminate incorrect options, and make educated choices is essential to maximize your score. Developing a strategic method for tackling these questions can significantly improve your performance under timed conditions.

Read Each Question Carefully

Before rushing into the options, take a moment to fully read and understand the question. Sometimes, the key to selecting the correct answer lies in subtle wording, such as “always” or “never.” Pay attention to these details and make sure you know exactly what is being asked before considering the choices.

Eliminate Clearly Incorrect Options

One of the most effective strategies is to immediately cross out the options that are clearly incorrect. This narrows down your choices, increasing the likelihood of selecting the correct answer. Often, multiple-choice questions contain one or two obvious distractions to mislead you, so be vigilant.

Use Logical Deduction when you’re unsure. If you have narrowed it down to two options but aren’t certain, try to apply what you know from the material to logically reason out which one is more plausible. Eliminate choices that don’t align with what you’ve learned or the context of the question.

Stay Calm and Focused when you encounter difficult questions. If you’re stuck, it’s better to move on and return to the question later rather than wasting time on one item. This ensures that you manage your time efficiently throughout the test.

Mastering Balance Sheets and Ledgers

Understanding balance sheets and ledgers is fundamental for accurately tracking the financial position of a business. These documents offer crucial insights into a company’s assets, liabilities, and equity, providing the foundation for financial analysis. By mastering these concepts, you can interpret complex financial data with ease and precision, a skill that is critical for solving related problems in any evaluation.

Understanding the Structure of a Balance Sheet

A balance sheet presents a snapshot of a company’s financial health at a given moment. It consists of two main sections: assets and liabilities. The balance sheet follows the basic accounting equation: Assets = Liabilities + Equity. Understanding how these components are structured and how they interact allows you to assess the overall financial stability of an organization.

Key Principles of Ledger Management

Ledgers are used to record all financial transactions and categorize them into specific accounts. By organizing transactions this way, it becomes easier to track financial performance over time. When managing ledgers, it’s important to consistently update them, ensuring that all entries are accurate and reflect the true nature of the transactions. This practice is vital for preparing reliable financial statements.

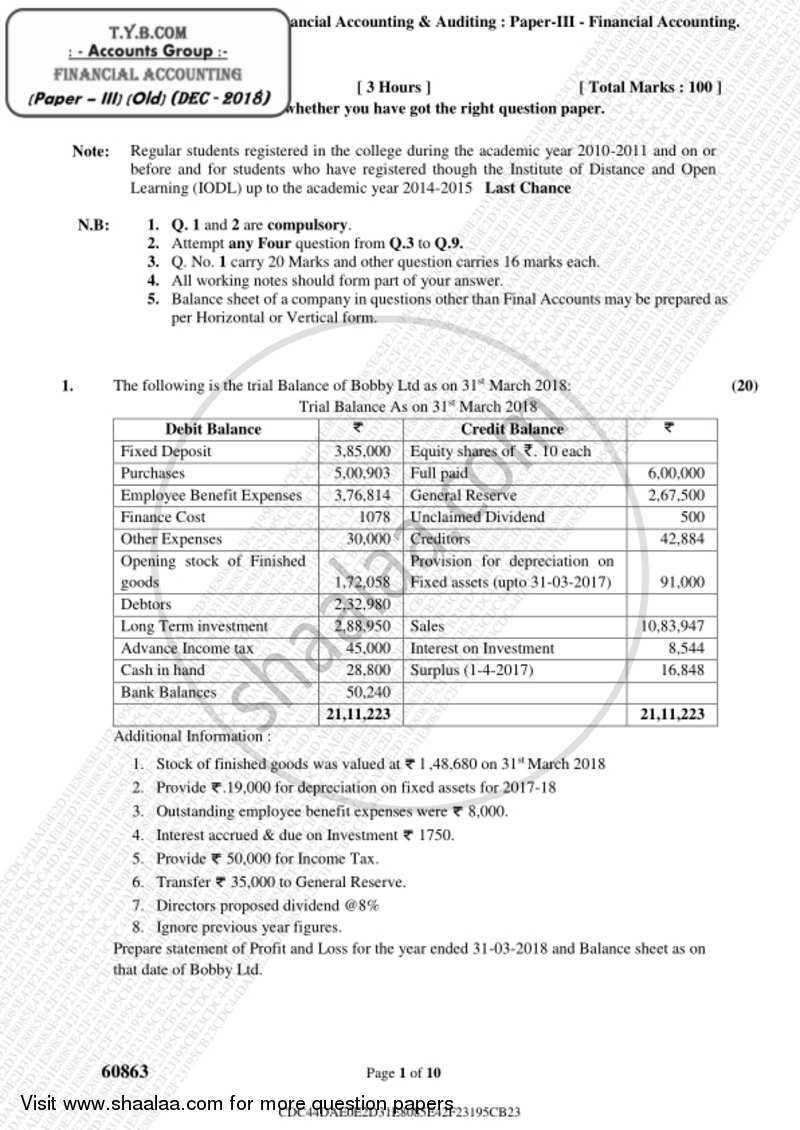

Preparing for Income Statement Questions

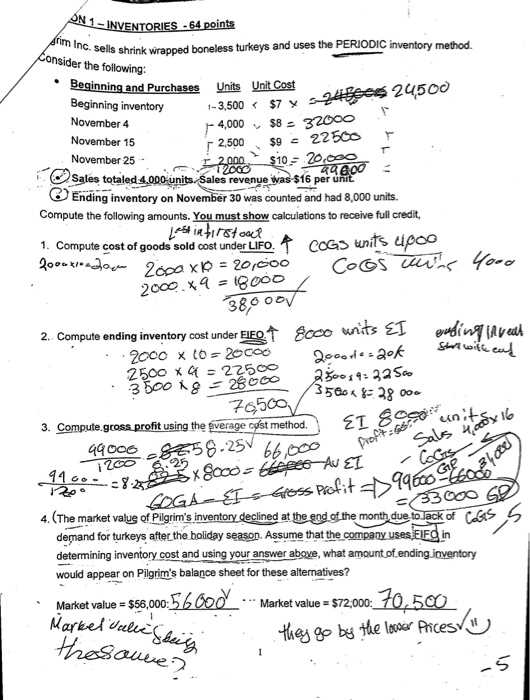

Income statement questions assess your ability to analyze and interpret the profitability of a company over a specific period. These questions typically focus on the revenues, expenses, and profits that are reported in the statement. A solid understanding of the structure and components of an income statement is essential for navigating these types of questions effectively.

Key Components to Focus On

Before tackling any questions related to income statements, ensure you are familiar with the following essential components:

- Revenue: The total amount of income generated from normal business operations.

- Cost of Goods Sold (COGS): The direct costs attributable to the production of goods sold during a period.

- Operating Expenses: The costs associated with running the business, including rent, utilities, and salaries.

- Net Profit: The final profit figure after all expenses, taxes, and interest have been deducted from total revenue.

Effective Strategies for Answering Questions

When faced with income statement questions, use the following strategies to improve your accuracy:

- Understand the Format: Familiarize yourself with the standard layout of an income statement so you can quickly identify where specific information is located.

- Calculate Profitability Ratios: If asked to assess profitability, know how to calculate ratios like the gross profit margin and net profit margin to support your analysis.

- Pay Attention to Adjustments: Be alert to adjustments for depreciation, amortization, and other non-cash expenses that may impact net income.

Cash Flow Analysis Simplified

Understanding cash flow is essential for evaluating a company’s ability to generate and manage cash during a specific period. It reflects how well a company can meet its financial obligations, reinvest in its operations, and return value to its shareholders. Cash flow analysis can be simplified by focusing on the main categories: operating, investing, and financing activities.

By breaking down cash flows into these three primary categories, you can easily identify the sources and uses of cash within a company. This analysis helps to assess whether a company is operating efficiently, managing its investments wisely, and maintaining a sustainable financial structure.

| Category | Cash Inflow | Cash Outflow |

|---|---|---|

| Operating Activities | Revenue from sales, interest, dividends | Cost of goods sold, operating expenses |

| Investing Activities | Sale of assets, investments | Purchase of assets, investments |

| Financing Activities | Issuance of stock, loans | Repayment of loans, dividends |

By examining the flows in each category, you can gauge the company’s liquidity and overall financial health, giving you a comprehensive understanding of its cash position.

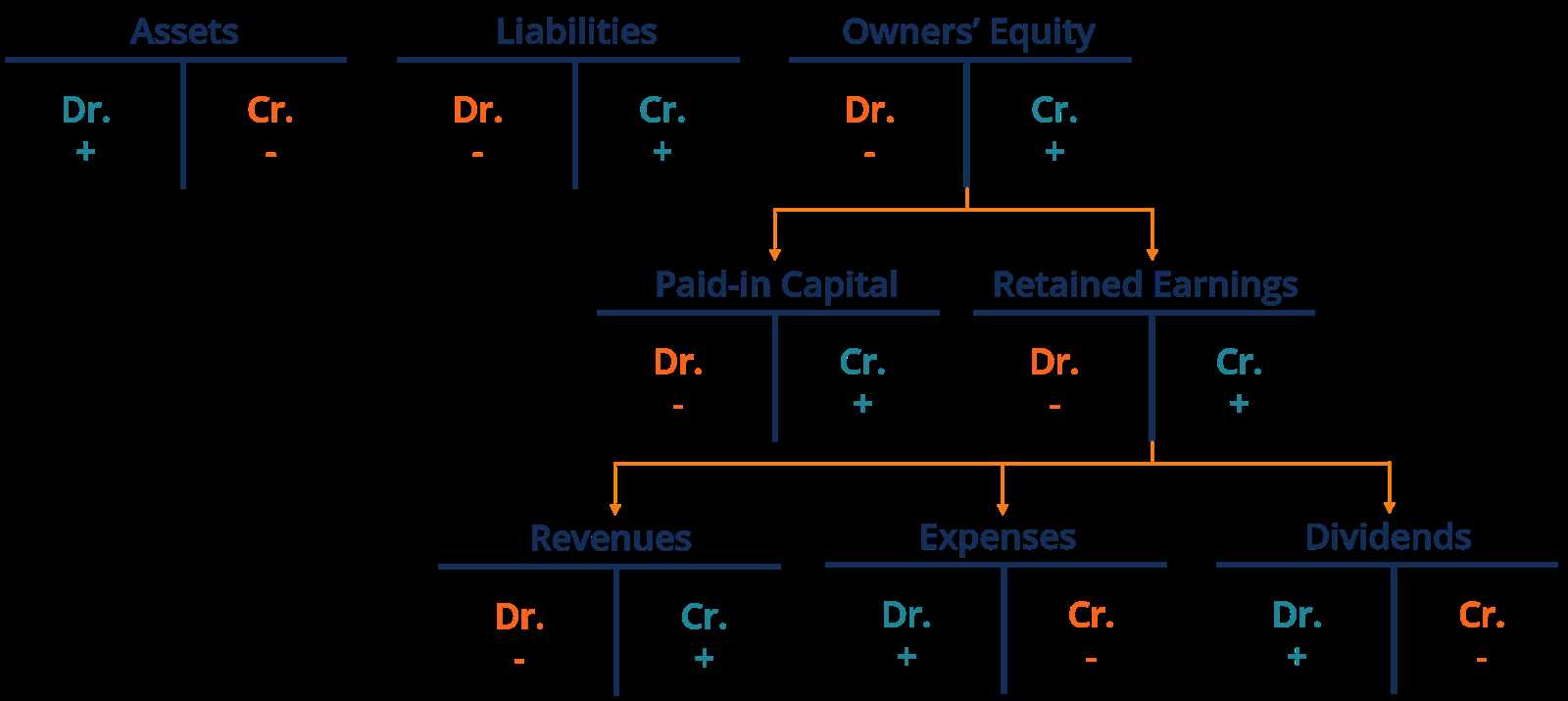

Understanding Debits and Credits

Debits and credits are fundamental concepts in financial records, representing the two sides of every transaction. By understanding how these elements work together, you can accurately record business activities, ensuring the integrity of the financial data. Each transaction involves a debit to one account and a credit to another, maintaining the balance in the books.

The Role of Debits and Credits

In double-entry systems, every financial transaction affects at least two accounts. Debits and credits are used to ensure that the accounting equation remains balanced. Understanding the effects of each on different types of accounts is essential for proper recordkeeping.

| Account Type | Debit | Credit |

|---|---|---|

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Equity | Decrease | Increase |

| Revenue | Decrease | Increase |

| Expenses | Increase | Decrease |

Practical Example of Debits and Credits

When a company purchases inventory with cash, the transaction involves debiting the inventory account (an asset) and crediting the cash account (another asset). This ensures that both accounts reflect the change, with the overall balance maintained.

Important Accounting Formulas to Know

Mastering essential mathematical formulas is crucial for analyzing and interpreting financial data effectively. These formulas help in understanding the financial health of a company, enabling accurate assessments of profitability, liquidity, and overall performance. Knowing the right formulas ensures that you can solve problems accurately and efficiently during any assessment or real-world application.

Key Formulas to Remember

Here are some of the most important formulas that every student or professional in the field should be familiar with:

- Net Income = Revenue – Expenses

- Gross Profit = Revenue – Cost of Goods Sold (COGS)

- Operating Income = Gross Profit – Operating Expenses

- Return on Assets (ROA) = Net Income / Total Assets

- Return on Equity (ROE) = Net Income / Shareholders’ Equity

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Why These Formulas Matter

Each of these formulas is a tool that offers insights into different areas of a business’s operations. For example, the Net Income formula reveals how well a company manages its revenue and expenses, while the Return on Assets ratio evaluates how effectively it uses its assets to generate profit. Knowing how and when to apply these formulas is key to analyzing financial statements accurately.

Exam Strategies for Challenging Sections

When facing difficult sections in an assessment, it’s important to stay calm and approach each problem strategically. By breaking down complex questions and using effective techniques, you can improve your chances of success. Developing a clear strategy for tackling tough sections can help you manage time efficiently and enhance your problem-solving abilities.

Here are some effective strategies for approaching challenging areas:

- Understand the Key Concepts: Before attempting a question, make sure you understand the underlying principles. This will help you identify the best approach to solving the problem.

- Break Down Complex Problems: If a question seems overwhelming, break it down into smaller, manageable parts. Focus on solving each part one step at a time.

- Eliminate Obvious Wrong Answers: For multiple-choice questions, narrow down the options by eliminating answers that are clearly incorrect. This increases your chances of selecting the right one.

- Manage Your Time: Allocate a specific amount of time to each section, ensuring you don’t spend too long on one particular problem. This way, you’ll have enough time for other questions.

- Practice Problem Solving: Regular practice with various types of questions can help you become familiar with different scenarios, making it easier to solve problems during the assessment.

By applying these strategies, you can better manage challenging sections and increase your chances of performing well on the assessment.

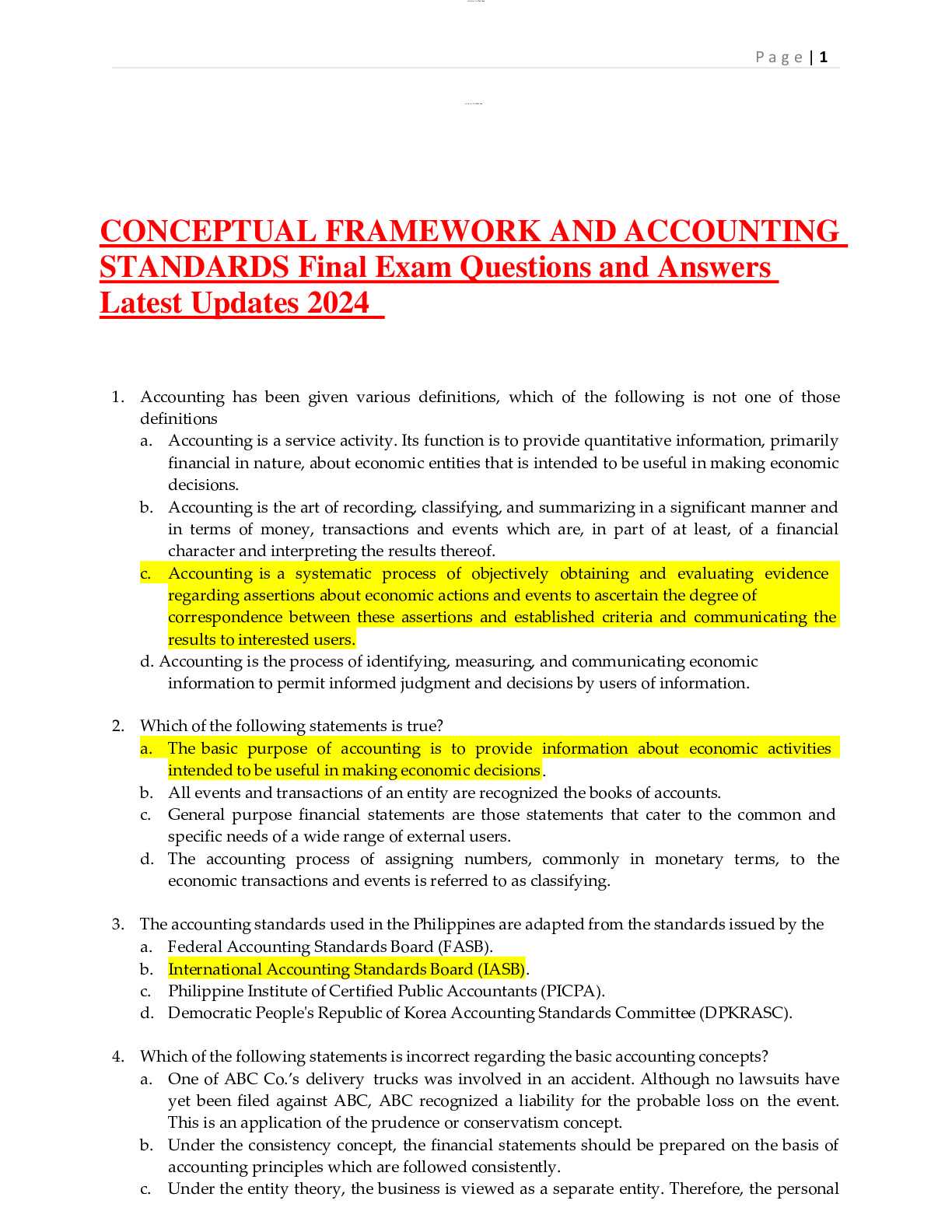

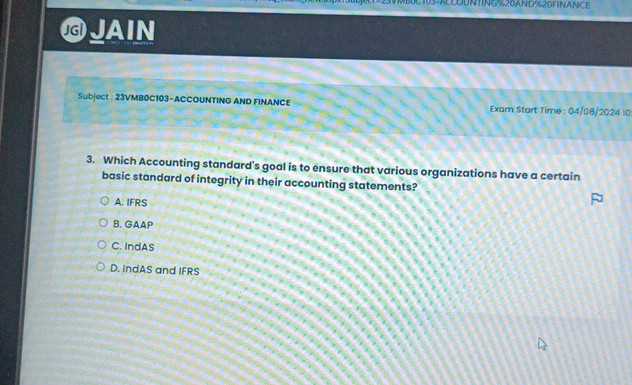

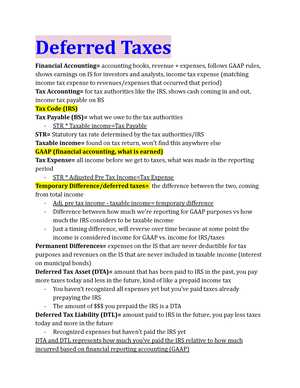

Commonly Tested Accounting Standards

Understanding the core principles that govern business reporting is essential for both practical and theoretical knowledge. These guidelines shape how financial data is recorded, reported, and interpreted, ensuring consistency and transparency across different organizations. A solid grasp of the most frequently tested standards will help you navigate various scenarios and improve your performance in assessments.

Here are some key standards that are often emphasized:

- Revenue Recognition Principle: This standard dictates when and how revenue should be recognized in financial reports, ensuring it reflects the actual earning process.

- Matching Principle: This principle requires that expenses be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement.

- Cost Principle: It mandates that assets be recorded at their original cost, providing a clear, verifiable starting point for financial records.

- Full Disclosure Principle: This standard ensures that all relevant financial information is disclosed in reports, enabling stakeholders to make informed decisions.

- Conservatism Principle: This principle advises recognizing potential losses early, but delaying the recognition of gains until they are certain, promoting cautious and responsible reporting.

By familiarizing yourself with these standards, you can more effectively understand the structure and requirements of financial statements, making it easier to analyze and apply them in various situations.

Reviewing Practice Questions for Success

Practicing with sample questions is one of the most effective ways to prepare for any assessment. By reviewing and solving these questions, you reinforce key concepts, develop problem-solving strategies, and build confidence. Consistent practice not only helps you become familiar with the format and structure of questions but also allows you to identify common patterns and areas where you might need additional focus.

Benefits of Practicing with Sample Questions

- Familiarizes You with Question Types: Regularly working through practice questions helps you understand the various formats and scenarios that might appear, allowing for quicker and more accurate responses.

- Strengthens Your Understanding: By applying your knowledge to practice problems, you reinforce important concepts and clarify any misunderstandings.

- Boosts Time Management Skills: Simulating the test environment with timed practice questions helps you manage your time more effectively during the actual assessment.

- Enhances Confidence: As you become more comfortable with different types of questions, your confidence grows, reducing anxiety on the test day.

Tips for Effective Practice Sessions

- Focus on Weak Areas: Identify which types of questions you find most challenging and devote extra time to mastering them.

- Simulate Real Test Conditions: Try to replicate the conditions of the actual test by timing yourself and working without distractions.

- Review Mistakes: After completing practice questions, thoroughly review your mistakes and understand why your answer was incorrect. This will help you avoid similar errors in the future.

- Vary the Difficulty: Start with easier questions and gradually increase the difficulty to challenge yourself and build your problem-solving skills.

By incorporating regular practice into your study routine, you can approach your assessments with greater readiness and ensure you’re well-prepared for any challenges that arise.

Studying with Accounting Textbooks

Textbooks are a valuable resource when preparing for any test, offering in-depth explanations, examples, and exercises that reinforce your understanding. These materials provide a structured approach to mastering core concepts, and with careful study, they help you build a solid foundation of knowledge. Using textbooks effectively requires not just reading but engaging with the content, practicing exercises, and revisiting challenging sections for clarity.

How to Maximize Your Use of Textbooks

- Read with Purpose: Focus on the key chapters or sections that are most relevant to your goals. Skim through introductory content and dive deep into the more complex areas.

- Practice the Examples: Many textbooks provide worked-out examples. Try to solve similar problems on your own to ensure you understand the process, not just the final solution.

- Use Review Questions: Most textbooks contain review questions at the end of each chapter. These questions are designed to reinforce your understanding and test your comprehension of key topics.

- Cross-reference with Other Resources: If a concept isn’t clear in the textbook, refer to online tutorials or videos for additional explanations. Sometimes a different perspective can make all the difference.

Additional Strategies for Efficient Textbook Study

- Highlight Key Information: Mark important definitions, formulas, and examples as you read. This will help you locate critical points when you need to review quickly.

- Take Notes: Write summaries of key ideas in your own words. This will help reinforce the material and provide you with a quick reference for revision.

- Review Regularly: Don’t wait until the last minute to go over your textbook. Regular review helps you retain information over a longer period and minimizes cramming.

By actively engaging with your textbooks and applying these strategies, you can improve your understanding and boost your performance in any academic challenge.

Top Resources for Exam Preparation

Effective study relies on utilizing a variety of resources to reinforce learning and ensure thorough preparation. While textbooks provide the fundamental content, other materials and tools can help you better understand complex topics and practice essential skills. By integrating multiple resources, you can enhance your overall grasp of the subject and improve your chances of success.

Key Resources to Consider

| Resource | Purpose | Benefits |

|---|---|---|

| Online Practice Tests | Simulate real-world assessments | Improves test-taking skills and identifies weak areas |

| Study Guides | Simplify complex topics | Summarizes key concepts for efficient revision |

| Video Tutorials | Provide visual and step-by-step explanations | Great for understanding complex processes or concepts |

| Discussion Forums | Allow peer interaction and problem-solving | Clarifies doubts and provides diverse perspectives |

| Flashcards | Help with memorization of key terms and concepts | Convenient and portable for quick review |

Choosing the Right Resources

When selecting resources, it’s important to focus on quality over quantity. Not all materials are equally effective, so prioritize resources that align with your learning style. Some students may find interactive practice tests helpful, while others may benefit more from visual learning through video tutorials. Combining different methods will allow you to approach the material from multiple angles and reinforce your understanding.

Incorporating these resources into your study plan, while remaining consistent and disciplined, will significantly improve your preparation and help you feel confident heading into your assessments.

Final Tips for Passing Financial Accounting

To succeed in any assessment, it’s essential to approach your preparation with a strategic mindset. Mastering the key principles, familiarizing yourself with the format, and practicing consistently are all crucial steps in ensuring that you perform at your best. By following the tips below, you can maximize your chances of success and feel confident during your assessments.

1. Focus on Core Concepts

Understanding the fundamental concepts is crucial. These principles will be the foundation for answering most questions, whether they involve problem-solving or theoretical knowledge. By mastering the basics, you can apply them effectively in various scenarios, improving your ability to solve complex problems with ease.

2. Consistent Practice

One of the most effective ways to prepare is through consistent practice. Regularly working through sample problems helps reinforce your knowledge and improve your problem-solving skills. It also familiarizes you with common question formats, allowing you to respond quickly and accurately during the actual assessment.

3. Review Mistakes Thoroughly

It’s important to carefully review any errors you make during your practice sessions. Understanding why a particular approach or answer was incorrect will help you avoid similar mistakes in the future. Focus on refining your techniques and clarifying any areas of confusion to improve your performance in the long run.

4. Time Management

During the assessment, managing your time effectively is key. Allocate sufficient time to each question and ensure that you’re able to move on if you get stuck. By practicing under timed conditions, you’ll become better at pacing yourself, which will reduce stress and improve your efficiency.

5. Stay Calm and Confident

Stress can be a major hindrance to performance. Stay calm, focus on the task at hand, and trust in the preparation you’ve done. Confidence plays a significant role in answering questions correctly, so maintaining a positive mindset is crucial to success.

By implementing these strategies and staying disciplined throughout your preparation, you’ll greatly increase your chances of success. Consistent effort, combined with the right approach, will allow you to tackle any challenges that come your way and pass with confidence.