Success in any assessment often hinges on understanding the core principles and applying them confidently. When it comes to evaluating knowledge of money management, key areas such as budgeting, investing, and credit play a pivotal role. Grasping these topics will enable you to tackle various questions effectively and make informed financial decisions in real life.

Preparation is the key to performing well. Through focused study and practice, you can improve your grasp of essential topics like debt management, savings strategies, and investment basics. Mastery of these areas ensures you’re not only ready for your assessment but equipped to handle real-world financial challenges.

This guide provides helpful insights and key topics that will support your preparation. From understanding interest rates to evaluating credit scores, each section offers a clear overview of what to expect and how to approach it. By reviewing these essential concepts, you’ll gain confidence and clarity, making your test experience much more manageable.

Essential Tips for Your Test Preparation

Approaching any assessment that covers key personal finance topics requires a well-organized strategy. To ensure you’re fully prepared, it’s important to focus on core concepts and practice applying them to different scenarios. Proper preparation not only helps you recall information but also boosts your confidence during the test.

Here are some essential tips to guide you:

- Understand Key Concepts: Focus on fundamental principles such as budgeting, saving, investing, and managing debt. Make sure you can explain and apply each concept clearly.

- Practice with Sample Problems: Look for practice questions that reflect the types of problems you might encounter. The more you practice, the easier it will be to recognize patterns and solve similar questions quickly.

- Master Important Formulas: There are several key formulas related to interest rates, loan payments, and investment returns. Be sure to memorize and understand how to use these formulas effectively.

- Review Common Mistakes: Identify common pitfalls, such as miscalculating interest or forgetting key steps in calculations. Knowing these mistakes will help you avoid them during the actual test.

- Time Management: During your test, allocate your time wisely. Don’t spend too much time on one question. If you’re stuck, move on and return to it later.

- Stay Calm and Confident: Confidence plays a key role in performing well. Take deep breaths, stay focused, and trust in the preparation you’ve done.

By following these tips, you will not only feel prepared but also have a clear strategy to tackle any questions that come your way. Understanding the basics, practicing regularly, and managing your time effectively will help you excel and achieve your best results.

Understanding Key Concepts in Money Management

To succeed in any assessment related to personal finance, it’s crucial to understand the basic principles that govern how money works. Key topics such as budgeting, saving, debt management, and investment strategies form the foundation of financial knowledge. Mastering these areas not only helps in exams but also in making informed financial decisions in everyday life.

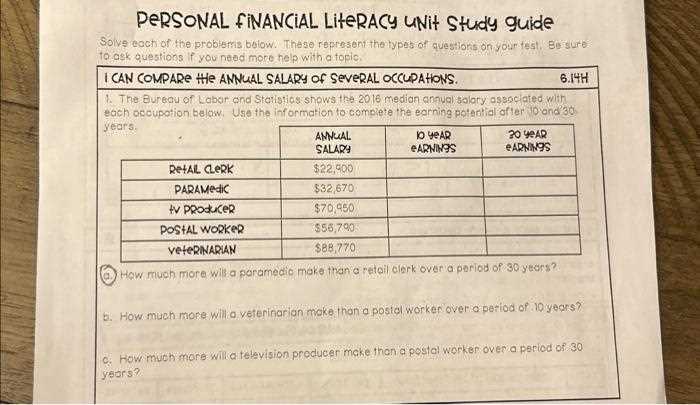

Below is a table outlining some of the most essential topics and their definitions:

| Concept | Description |

|---|---|

| Budgeting | The process of planning and managing income and expenses to achieve financial goals. |

| Saving | Setting aside a portion of income for future needs or emergencies. |

| Debt Management | The strategies for handling existing debt and avoiding excessive borrowing. |

| Investing | Allocating money in assets like stocks, bonds, or real estate to grow wealth over time. |

| Credit | The ability to borrow money with the promise of paying it back later, often with interest. |

| Risk Management | Identifying and minimizing the financial risks associated with investments and other financial decisions. |

By gaining a strong understanding of these concepts, you’ll be able to approach financial decisions with more confidence and accuracy. These core principles will form the basis for success both in assessments and in practical financial situations.

Common Topics on Personal Finance Assessments

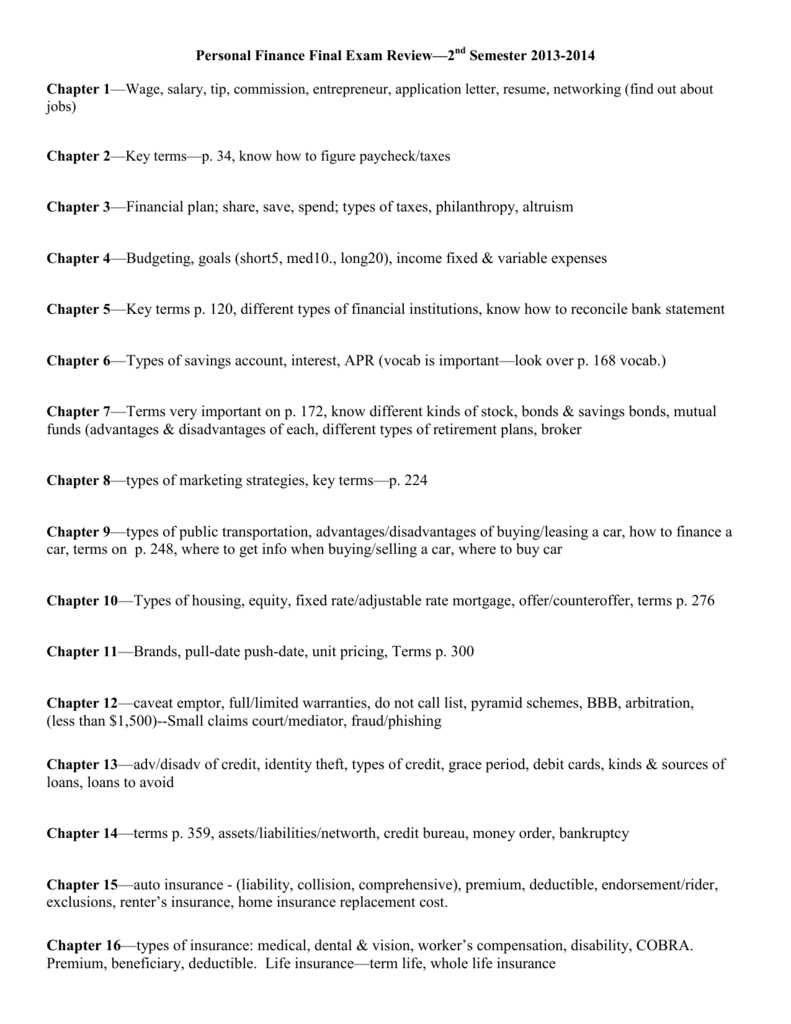

When preparing for an assessment focused on money management and economic decision-making, it’s essential to familiarize yourself with the most commonly tested topics. These areas cover everything from budgeting to investment strategies and can appear in various forms, including multiple-choice questions, problem-solving scenarios, and short-answer prompts.

Here are the most frequently tested topics:

- Budgeting and Expense Management: Understanding how to create and stick to a budget, track income and expenses, and manage day-to-day finances effectively.

- Debt and Loans: Knowing how different types of loans work, the implications of interest rates, and methods for managing or paying off debt.

- Credit Scores and Reports: Understanding the importance of credit, how credit scores are calculated, and how to improve or maintain a good score.

- Investment Basics: Familiarity with different investment options, including stocks, bonds, and real estate, as well as the concept of risk versus reward.

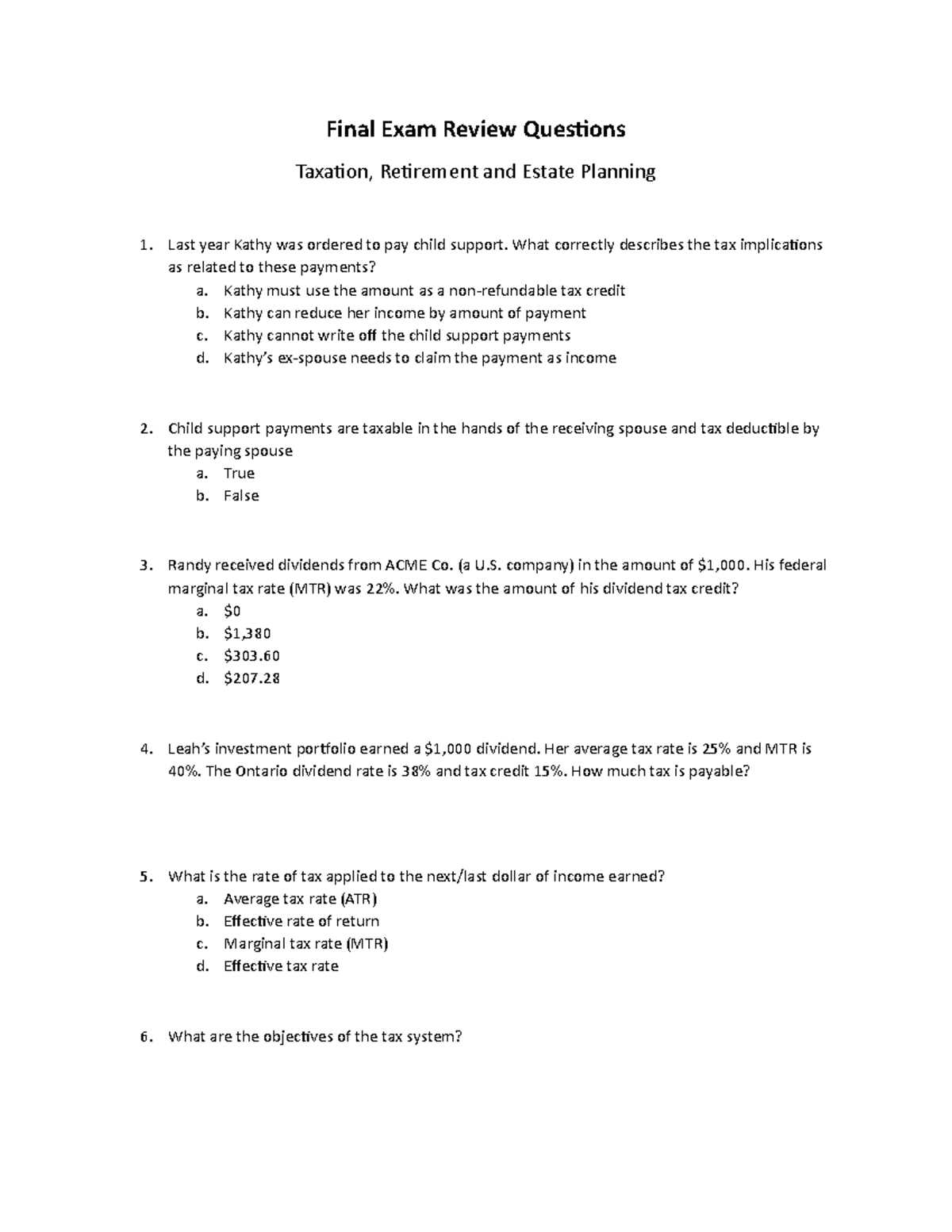

- Taxation: The basics of income tax, deductions, and how taxes affect both personal earnings and business profits.

- Insurance and Risk Management: Understanding various insurance products (health, auto, life) and how to assess risks to minimize financial losses.

- Retirement Planning: Strategies for saving and investing for long-term goals, particularly retirement, and understanding different retirement accounts.

Being familiar with these topics not only helps with the structure of the assessment but also provides practical knowledge to make informed decisions in everyday financial situations. Mastering these areas will ensure that you can approach any related questions with confidence and clarity.

How to Prepare for the Assessment

Preparation is the key to success in any assessment, especially when it comes to topics involving money management and economic decision-making. Effective studying involves reviewing key principles, practicing problem-solving techniques, and organizing your study time efficiently. By focusing on the most relevant material and honing your skills, you can approach the assessment with confidence.

Develop a Study Plan

Creating a structured plan is one of the best ways to prepare. Break down the topics you need to study into smaller, manageable sections, and allocate specific times for each. Focus on areas that are more challenging and require more attention. Make sure to include time for both theoretical concepts and practical applications to ensure a balanced understanding.

Practice and Test Yourself

To reinforce your understanding, practice with sample questions and exercises. Simulate test conditions by setting a timer and working through problems without interruptions. This will help you manage time effectively during the real assessment. Additionally, reviewing mistakes from practice tests can highlight areas for further improvement.

By organizing your study sessions and regularly practicing, you’ll not only retain key concepts but also gain the confidence to tackle the assessment with ease.

Practice Questions for Money Management Assessments

One of the most effective ways to prepare for an assessment on personal finances is by practicing with sample questions. These questions help reinforce key concepts, identify areas where further study is needed, and build the confidence to apply knowledge under test conditions. By regularly testing yourself, you can improve both your speed and accuracy when tackling problems related to budgeting, saving, investing, and other essential topics.

Here are some example questions to guide your practice:

- Budgeting: If your monthly income is $3,500 and your monthly expenses total $2,800, how much can you save each month?

- Interest Rates: If you invest $1,000 at an annual interest rate of 5%, how much interest will you earn in one year?

- Debt Management: You have a loan of $5,000 with an interest rate of 6%. How much will you pay in interest over the course of a year if the loan is paid off in equal monthly installments?

- Credit Scores: What are some common factors that can affect your credit score, and how can you improve it?

- Investing: What is the difference between stocks and bonds, and how does each type of investment carry different levels of risk?

Practicing with questions like these will not only familiarize you with the material but also help you approach your test with a clear understanding of how to apply financial concepts to real-world situations.

Understanding Budgeting and Saving

Effective management of income and expenses is essential to achieving long-term financial stability. By learning how to allocate funds appropriately and set aside savings, individuals can better prepare for both planned and unexpected costs. This understanding is critical in ensuring that financial goals are met while maintaining the ability to cover day-to-day needs.

Budgeting involves creating a plan for how money will be spent over a given period. It helps track where your money is going and ensures that you live within your means. A well-structured budget allows you to make informed decisions about where to allocate your income, such as paying bills, investing, or saving for future goals.

Saving is just as crucial. Setting aside money regularly for emergencies, large purchases, or retirement can significantly reduce financial stress in the future. By prioritizing savings, you can build an emergency fund to handle unexpected expenses without going into debt, as well as invest in opportunities that can help grow wealth over time.

Both budgeting and saving are foundational practices that contribute to financial independence and security. With a clear understanding of how to manage income and save effectively, individuals can make smarter financial choices and feel confident in their ability to meet their goals.

Investment Basics to Master

Investing is a powerful tool for growing wealth, but understanding the fundamental principles behind it is essential for making informed decisions. Whether you’re interested in stocks, bonds, or real estate, mastering the basics will help you navigate the complex world of investments and mitigate risks effectively. A solid foundation in investment knowledge ensures that you make decisions that align with your financial goals and risk tolerance.

Here are some of the key concepts to understand:

- Risk and Return: Investments come with varying levels of risk, and understanding the relationship between risk and potential return is crucial. Higher risk often leads to higher potential rewards, but it can also result in significant losses.

- Diversification: Spreading investments across different assets helps reduce risk. By diversifying, you avoid putting all your resources into a single investment, which can help protect against market fluctuations.

- Asset Classes: There are several types of assets you can invest in, including stocks, bonds, real estate, and commodities. Each class has its own characteristics, risk levels, and expected returns.

- Compound Interest: This concept refers to the process where the interest earned on an investment itself earns interest over time. The longer you leave your money invested, the greater the growth potential.

- Investment Goals: Clearly defining your investment goals–whether it’s saving for retirement, buying a house, or building wealth–is critical in choosing the right investment strategy.

Mastering these basic concepts will equip you with the knowledge to make better decisions, minimize risks, and work toward achieving your financial objectives. Investing doesn’t have to be complicated, but having a clear understanding of the fundamentals is key to long-term success.

Loan Terms and Interest Rates Explained

When borrowing money, understanding the key components of a loan agreement is essential for making informed decisions. The terms of a loan, along with the interest rate, determine how much you will ultimately pay and how long it will take to repay the loan. By understanding these elements, you can avoid costly mistakes and manage your finances more effectively.

Key Loan Terms

There are several important terms to be aware of when considering a loan. Here are the most common:

- Principal: The original amount of money borrowed, not including interest or fees. This is the base amount that will accrue interest over the life of the loan.

- Term: The length of time over which the loan will be repaid. Loan terms can vary from a few months to several years, and longer terms often result in lower monthly payments but higher total interest.

- Repayment Schedule: This refers to the frequency and amount of payments. Common schedules include monthly or quarterly payments, depending on the loan type.

- Collateral: Some loans require collateral–assets like property or vehicles–that the lender can claim if the borrower fails to repay the loan.

Understanding Interest Rates

The interest rate is the cost of borrowing money, expressed as a percentage of the principal. It is essential to understand how the interest rate will affect the total cost of the loan over time.

- Fixed Interest Rate: The interest rate remains the same throughout the loan term, making it easier to budget and plan your payments.

- Variable Interest Rate: The rate can change over time based on market conditions, which means your monthly payments could fluctuate.

- APR (Annual Percentage Rate): This is the total cost of the loan expressed as an annual interest rate, including fees and other costs. It provides a more complete picture of how much the loan will cost you.

- Simple vs. Compound Interest: Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal and any accumulated interest, leading to a higher overall cost over time.

By understanding these loan terms and interest rate structures, you can make more informed decisions and choose the loan option that best suits your needs and financial situation.

Insurance and Risk Management Essentials

Managing risk is an important aspect of protecting both personal and financial well-being. Insurance is a key tool used to transfer the financial burden of unexpected events, while a strategic approach to risk management helps individuals and businesses minimize exposure to loss. Understanding these concepts is crucial for making informed decisions about safeguarding assets and planning for the future.

Insurance helps mitigate the financial impact of various risks, such as accidents, illnesses, or property damage. By paying regular premiums, policyholders can receive compensation in the event of a covered loss, reducing the financial strain of such incidents. Different types of insurance cover different risks, including life, health, auto, and home insurance, each serving a specific purpose in managing potential expenses.

Risk management, on the other hand, involves identifying potential risks and taking steps to reduce or control their impact. This process can involve a variety of strategies, such as avoiding certain risks altogether, reducing their likelihood, or transferring the risk to another party through insurance. A proactive approach to risk management ensures that individuals are better prepared to handle unexpected challenges without jeopardizing their financial stability.

Understanding the relationship between insurance and risk management allows individuals to make choices that protect their financial future and help them recover from unforeseen events with minimal disruption.

Understanding Credit and Debt Management

Effectively managing borrowing and repayments is essential for maintaining financial health. Credit allows individuals to access funds for various needs, but it comes with the responsibility of managing repayments. When handled properly, credit can be a useful tool, but mismanagement can lead to significant financial challenges. Understanding how to use credit wisely and how to control and reduce debt is key to ensuring long-term stability.

Managing Credit Wisely

Credit is a valuable resource, but it must be used responsibly. It allows you to make purchases or borrow money with the understanding that repayment will be made over time. It’s important to be mindful of the terms and conditions, including interest rates and repayment schedules, to avoid accumulating excessive debt. Building a good credit history is crucial for accessing better borrowing options in the future, such as lower interest rates or higher credit limits.

- Know Your Credit Limit: Always be aware of your credit limit and avoid maxing out your available credit. Doing so can negatively impact your credit score and make it more difficult to manage payments.

- Pay on Time: Timely payments are critical for maintaining a good credit score. Missing payments or paying late can result in penalties, higher interest rates, and a lower credit rating.

- Monitor Your Credit Score: Regularly check your credit report to ensure there are no errors and to track your progress. A good credit score opens up more favorable lending opportunities.

Effective Debt Management

Debt management involves strategies to reduce and eventually eliminate outstanding obligations. The goal is to balance the need to borrow with the ability to repay in a manageable way. Whether through paying off high-interest debts first or consolidating loans, effective debt management can ease the burden and help avoid the negative consequences of unmanageable debt.

- Prioritize High-Interest Debts: Focus on paying off debts with the highest interest rates first to minimize the amount of interest paid over time.

- Consolidate Loans: If you have multiple debts, consolidating them into one loan can simplify repayment and potentially lower your overall interest rate.

- Set a Repayment Plan: Establish a clear repayment schedule and stick to it. Consistent payments will help reduce the principal and minimize the risk of falling deeper into debt.

By managing both credit and debt carefully, individuals can maintain financial security and improve their overall financial situation. It’s all about making smart borrowing choices and staying disciplined in repayment practices.

Reading Financial Statements Efficiently

Being able to interpret key financial documents is crucial for making informed decisions about personal or business finances. These reports provide a snapshot of an organization’s financial health, revealing important data such as profits, expenses, and overall stability. Understanding how to read these documents efficiently can help you identify trends, assess risks, and make smarter financial choices.

To gain the most insight from financial reports, it’s important to focus on the most relevant information. Common financial statements include the balance sheet, income statement, and cash flow statement. Each document serves a unique purpose, but together they provide a comprehensive view of the financial situation.

The balance sheet outlines what the company owns (assets) and owes (liabilities) at a specific point in time, helping to gauge its overall financial position. The income statement shows the company’s profitability over a period, including revenue, costs, and expenses. Lastly, the cash flow statement tracks the movement of cash, indicating the liquidity available to the business.

By mastering the basics of these key reports, you can quickly spot any red flags, assess performance, and gain a deeper understanding of financial operations.

Understanding Taxes and Filing Systems

Grasping the basics of taxes and how to navigate the filing process is an essential skill for managing personal finances. Taxes impact nearly every aspect of life, from income to property ownership, and understanding how they work can help individuals make informed decisions. Knowing the different types of taxes and how to file them correctly ensures compliance with regulations and can help optimize your financial situation.

Types of Taxes

Taxes come in various forms, each serving a specific purpose in the economy. Common types include income tax, property tax, sales tax, and capital gains tax. Each type is applied differently depending on the circumstances, such as earnings, purchases, or investment profits. Understanding these taxes can help individuals plan for their obligations and avoid surprises when it’s time to file.

- Income Tax: The most common tax, applied to earnings from employment, investments, and other sources of income.

- Property Tax: Charged on real estate or other properties, usually paid annually based on the value of the property.

- Sales Tax: Applied to purchases made, usually as a percentage of the price of goods or services.

- Capital Gains Tax: Tax on profits made from the sale of assets like stocks, real estate, or other investments.

Filing Systems and Methods

The process of filing taxes involves submitting documentation to the appropriate authorities, such as the government or tax agencies, to report earnings, deductions, and other relevant information. The filing system can be done through various methods, including online submission, mail, or in-person with a tax professional. The choice of filing method often depends on the complexity of your financial situation and personal preference.

- Online Filing: The most efficient and popular method, offering a quick way to submit forms electronically and often with added tools to assist in the process.

- Paper Filing: An older method where forms are completed manually and mailed to the tax authority. This method may take longer but is still an option for some individuals.

- Professional Help: For those with complicated financial situations, working with a tax advisor or accountant can ensure proper filing and maximize potential returns.

Being proactive about taxes and understanding the filing systems can help reduce stress during tax season and ensure that you meet all necessary requirements. Taking the time to familiarize yourself with the process and seeking assistance when needed can ultimately save time and money.

Saving for Retirement Explained

Planning for the future and ensuring financial security in later years is a vital aspect of personal finance. Saving for retirement allows individuals to maintain their quality of life after they stop working. Understanding the various saving options and strategies can help you build a robust plan to ensure that you have sufficient resources when the time comes to retire.

Types of Retirement Accounts

There are several types of accounts designed specifically for retirement savings. These accounts offer various benefits, including tax advantages and flexibility in investment choices. It’s important to understand the differences between them to choose the best fit for your needs and goals.

- Employer-Sponsored Plans: These plans, such as 401(k) accounts, allow you to contribute a portion of your salary, often with employer matching contributions. They are typically tax-deferred, meaning you won’t pay taxes until you withdraw the funds.

- Individual Retirement Accounts (IRAs): IRAs are personal accounts that offer tax advantages. There are two main types: Traditional IRAs, where contributions may be tax-deductible, and Roth IRAs, where withdrawals are tax-free in retirement.

- Self-Employed Options: For those who are self-employed, there are specific retirement savings accounts like SEP IRAs and Solo 401(k) plans, which allow higher contribution limits and tax benefits.

Strategies for Effective Saving

In addition to selecting the right retirement accounts, implementing effective strategies can significantly improve your retirement savings over time. Consistency and smart planning are key to building a secure financial future.

- Start Early: The earlier you begin saving, the more time your investments have to grow. Compound interest plays a significant role in building wealth over the long term.

- Set Realistic Goals: Establish a savings target based on your desired lifestyle and estimated expenses during retirement. Regularly reassess and adjust your goals to stay on track.

- Maximize Contributions: Contribute as much as you can to your retirement accounts, especially if your employer offers a matching contribution. Take full advantage of any tax benefits available to you.

Saving for retirement is a long-term commitment that requires careful planning and discipline. By selecting the right accounts and following proven saving strategies, you can ensure that you will have the financial resources to enjoy a comfortable retirement when the time arrives.

Key Formulas for Financial Calculations

Mastering certain mathematical formulas is essential for making informed decisions in money management. Whether you are analyzing investment returns, determining loan payments, or calculating savings growth, understanding these calculations enables you to make more accurate financial choices. Below are some fundamental formulas that everyone should know to navigate through various financial scenarios.

Simple Interest Calculation

Simple interest is used when calculating the interest earned or paid on a principal amount without compounding. It is often used in short-term loans or investments. The formula for calculating simple interest is:

Simple Interest = Principal × Rate × Time

- Principal: The initial amount of money invested or loaned.

- Rate: The annual interest rate, expressed as a decimal.

- Time: The time period the money is invested or borrowed for, typically in years.

Compound Interest Formula

Compound interest takes into account not only the interest on the initial amount (the principal) but also on the interest that accumulates over time. This is commonly used for long-term investments and savings accounts. The formula is:

Compound Interest = Principal × (1 + Rate/n)^(n × Time) – Principal

- n: The number of times the interest is compounded per year.

- Time: The number of years the money is invested or borrowed for.

Loan Payment Formula (Amortization)

When you borrow money, such as for a mortgage or car loan, the loan payment formula helps you calculate the monthly payments needed to pay off the loan. The formula is as follows:

Monthly Payment = P × [r(1 + r)^n] / [(1 + r)^n – 1]

- P: The principal loan amount.

- r: The monthly interest rate (annual rate divided by 12).

- n: The number of payments (loan term in months).

These formulas provide a foundation for evaluating and managing different financial scenarios. By understanding how to use them correctly, you can make more confident decisions regarding loans, investments, and savings strategies.

Top Mistakes to Avoid During the Exam

When preparing for any type of assessment, there are several common pitfalls that can hinder your performance. Avoiding these mistakes will help you manage your time efficiently, reduce unnecessary stress, and improve your chances of success. Below are the most frequent errors people make and how to steer clear of them during your test.

1. Failing to Manage Time Effectively

One of the biggest mistakes during any assessment is not allocating enough time for each section or question. Make sure to read through the entire test at the start, estimate how much time each part will take, and pace yourself accordingly. This way, you’ll avoid spending too much time on difficult questions while neglecting easier ones.

2. Overthinking or Second-Guessing Your Answers

While it’s important to think critically, overanalyzing can lead to confusion and incorrect answers. Often, the first answer you come up with is the right one. Trust your instincts, and don’t waste too much time rethinking your responses unless you’re certain you made a mistake.

3. Ignoring Instructions

Always read the instructions carefully before jumping into the questions. It might seem obvious, but failing to follow directions can result in losing valuable points. For instance, if a question asks for specific details or requires a particular format, ignoring these requirements can lead to incorrect answers, even if the content is correct.

4. Skipping Questions or Sections

Don’t leave any question unanswered, even if you’re unsure about the answer. An unanswered question is an automatic zero, while a guess might earn partial credit. If you’re unsure about a question, mark it and return to it later, once you’ve completed the rest of the test.

5. Not Reviewing Your Work

If time permits, always review your answers before submitting your test. You might catch small errors, miscalculations, or missed details that could improve your score. A quick final check can make a significant difference.

Avoiding these common mistakes will not only help you perform better but will also give you a more organized and less stressful experience. Preparation and focus are key to maximizing your performance on any assessment.

Effective Time Management for Studying

Maximizing productivity during your study sessions relies heavily on how well you manage your time. Effective time management allows you to allocate sufficient time for each subject, prioritize tasks, and maintain focus. By developing a solid plan, you can make the most of your study hours without feeling overwhelmed.

Creating a Study Schedule

A well-structured study plan is essential for success. It helps you break down the material into manageable chunks and ensures you cover all necessary topics before the test. Below is a simple strategy to create a study schedule:

| Step | Action | Time Allocation |

|---|---|---|

| 1. Assess the material | Review all the topics you need to study and identify the areas that require more focus. | 1 hour |

| 2. Set specific goals | Break down the material into daily goals. Set achievable targets for each study session. | 15 minutes |

| 3. Prioritize tasks | Focus on the most important and challenging topics first, leaving easier ones for later. | 30 minutes |

| 4. Take regular breaks | Incorporate short breaks every 45-60 minutes to maintain concentration. | 10-15 minutes |

| 5. Review and adjust | At the end of each week, assess your progress and make adjustments to your schedule. | 30 minutes |

Minimizing Distractions

During study sessions, distractions are one of the biggest time-wasters. Creating a distraction-free environment is key to staying focused. Here are some tips to minimize interruptions:

- Turn off notifications on your phone and computer.

- Choose a quiet place to study, away from distractions like TV or social media.

- Set specific times for breaks to avoid losing focus.

By implementing a clear study schedule and eliminating distractions, you can enhance your learning efficiency and reduce stress during preparation. Time management is the key to mastering any subject in a timely and organized manner.