Preparing for a certification in financial modeling involves more than just learning formulas and techniques. It requires a thorough understanding of the concepts that drive financial analysis and the ability to apply these concepts under pressure. Success in this field hinges on how well one can solve complex problems and interpret data accurately.

To truly excel in your certification journey, focusing on practice and applying your knowledge in realistic scenarios is essential. The path to mastery involves tackling various problem types and refining your approach to maximize efficiency and accuracy. By doing so, you prepare yourself not only for the certification but for real-world financial modeling tasks.

Effective preparation revolves around knowing how to break down each problem, recognizing key elements, and utilizing tools to find the most optimal solutions. It’s not just about memorizing answers but understanding the processes that lead to correct conclusions. With time and dedication, anyone can improve their problem-solving abilities and confidently tackle the toughest challenges in financial modeling.

FMVA Exam Answers and Key Insights

Successfully navigating financial modeling assessments requires a deep understanding of the principles and strategies behind each problem. The key to success lies not just in knowing the correct solutions but in developing a methodical approach to problem-solving. By analyzing sample problems and reviewing solutions, you can gain valuable insights into the reasoning and techniques that lead to optimal results. This approach helps in honing the skills needed for real-world financial tasks.

One of the most important aspects of preparing for such evaluations is understanding the core concepts that form the foundation of financial modeling. Breaking down each scenario, understanding its structure, and identifying the correct variables to focus on are crucial steps. The more you practice with different types of problems, the better you’ll become at recognizing patterns and applying the appropriate solutions quickly and efficiently.

| Topic | Key Insight |

|---|---|

| Problem Breakdown | Focus on understanding the structure of the problem before jumping into the solution process. |

| Time Management | Allocate time wisely, ensuring that more complex problems are given the necessary attention without neglecting easier ones. |

| Model Interpretation | Be clear on the logic behind each model. Understand how data flows through it and how to manipulate inputs for accurate outputs. |

| Data Analysis | Develop an ability to quickly analyze data, identifying trends and anomalies that could affect the final result. |

By focusing on these insights, you can build a solid foundation that will serve you well in both the assessment and your professional career. With consistent practice and an analytical mindset, you will be prepared to handle even the most challenging financial modeling scenarios.

Essential Resources for FMVA Success

Achieving success in a financial modeling certification requires more than just theoretical knowledge. It’s about having access to the right tools and materials that will enhance your understanding and enable you to apply concepts effectively. Whether you are tackling complex models or refining your analysis, the resources you choose play a pivotal role in shaping your preparation and performance.

Books, online platforms, and practice tests are some of the most valuable assets in the preparation process. Structured learning paths and step-by-step guides help break down intricate topics into manageable pieces, making it easier to grasp key concepts. In addition, real-world case studies and examples provide practical insights into how financial models are built and interpreted in professional settings.

Furthermore, being part of study groups or forums can offer support and guidance from others who are also working through the same material. These communities provide an opportunity to exchange ideas, clarify doubts, and gain different perspectives on solving problems. By combining these resources, you can ensure a well-rounded and effective approach to mastering the material and achieving certification success.

How to Approach FMVA Exam Questions

When faced with challenging financial problems, a strategic approach is essential to navigate through each question with precision. The key to success lies in understanding the problem’s structure, identifying the relevant information, and applying the right analytical tools. It’s not just about finding the correct solution but about how you break down and approach each task efficiently and logically.

Breaking Down the Problem

Start by carefully reading the problem to ensure you understand the context and requirements. Identify the main variables involved and how they interact. Focus on what is being asked, whether it’s creating a model, forecasting future trends, or evaluating financial statements. By clearly defining the problem’s scope, you set yourself up for an effective solution process.

Applying Financial Models and Techniques

Once you have a clear understanding of the question, choose the most appropriate method or model to address it. Ensure you are familiar with the various financial models that might be relevant, such as discounted cash flow (DCF), comparable company analysis, or sensitivity analysis. A systematic approach will help you apply the right techniques to derive the most accurate results.

Tips for Effective Financial Modeling Exam

Successfully tackling a financial modeling assessment requires more than just understanding the core concepts. It’s about optimizing your approach, managing time efficiently, and staying organized throughout the process. By applying the right strategies, you can increase your chances of achieving a top score while demonstrating your proficiency in handling complex financial problems.

First, focus on mastering the fundamentals. Build a strong understanding of key financial principles, such as valuation techniques, financial statement analysis, and forecasting methods. Having a solid grasp of these concepts will allow you to approach problems with confidence and accuracy.

Second, practice is crucial. Regularly working through sample problems and past cases will familiarize you with the types of questions you may encounter. This will not only improve your speed but also help you identify common patterns and pitfalls. The more you practice, the more comfortable you will become with applying your knowledge under time constraints.

Lastly, ensure that your solutions are clear and well-organized. Structure your models logically and present your findings in a concise, easy-to-follow manner. Use appropriate formatting, and always double-check your work for errors. A clean, well-organized approach demonstrates professionalism and attention to detail.

Best Practices for Studying FMVA

Effective preparation for financial modeling certifications requires a disciplined approach, a focus on key concepts, and consistent practice. By incorporating the right strategies, you can optimize your study sessions, enhance your understanding, and build the skills necessary to succeed. The most successful candidates develop a structured study plan and stay committed to improving their analytical and problem-solving abilities.

Creating a Study Plan

A well-organized study plan is the foundation of any successful preparation process. Here are some steps to help you create an effective plan:

- Set clear goals for each study session, such as mastering a specific model or financial concept.

- Break down large topics into smaller, manageable sections, allowing for focused learning.

- Allocate time for reviewing and practicing key concepts regularly to reinforce learning.

- Set aside time for mock problems to test your understanding under timed conditions.

Key Study Resources

To maximize your preparation, it’s important to utilize the right resources. Below are some essential materials to incorporate into your study routine:

- Textbooks and Guides: Comprehensive resources that cover core financial concepts and modeling techniques.

- Online Courses and Tutorials: Interactive platforms that offer in-depth explanations and video lessons.

- Practice Problems: Regularly work through past cases and model-building exercises to test your skills.

- Discussion Groups: Engage with others in study forums to exchange ideas and clarify doubts.

By following these best practices and staying consistent, you will build the necessary foundation and skills to excel in your certification journey.

Common Mistakes to Avoid in FMVA

While preparing for financial modeling certifications, many candidates make avoidable errors that can significantly impact their performance. Understanding these common mistakes and learning how to avoid them can make a big difference in your results. From neglecting key concepts to rushing through problems without proper analysis, these pitfalls can hinder progress. It’s essential to approach each task with care, attention to detail, and a clear strategy to ensure success.

| Common Mistake | How to Avoid It |

|---|---|

| Rushing Through Problems | Take the time to carefully read each question and ensure you understand the requirements before starting. Avoid jumping straight into calculations without planning. |

| Neglecting Conceptual Understanding | Don’t just memorize formulas–focus on understanding the underlying concepts and the logic behind financial models. This will help you solve problems more effectively. |

| Overlooking Small Details | Double-check your calculations, assumptions, and inputs. Small errors can lead to inaccurate results, so pay attention to every detail. |

| Inadequate Time Management | Manage your time wisely by allocating sufficient time for each question and leaving a few minutes at the end to review your work. |

| Skipping Practice Problems | Regularly solve practice problems to familiarize yourself with the types of questions you’ll encounter and to refine your approach. |

By being aware of these common mistakes and taking steps to avoid them, you can improve your preparation and enhance your ability to tackle financial modeling challenges with confidence and accuracy.

How to Pass the FMVA Certification

Successfully obtaining a financial modeling certification requires more than just knowledge of theory; it demands practical application, problem-solving skills, and a strategic approach to preparation. With the right mindset, effective study techniques, and continuous practice, you can significantly increase your chances of passing the certification with flying colors. The key is to combine deep understanding of the subject matter with efficient test-taking strategies.

The first step in preparation is to thoroughly understand the foundational concepts, such as financial statement analysis, valuation methods, and forecasting. Build a strong base by mastering these core topics, as they are essential for tackling any problem you encounter during the process. Don’t just memorize formulas–understand the reasoning behind them to apply them accurately in different scenarios.

Next, create a study plan that balances theory with practical exercises. Regularly work through practice problems and case studies to test your knowledge and enhance your problem-solving abilities. This will not only help you get comfortable with the material but also improve your ability to manage time effectively during the assessment.

Finally, review and refine your skills by consistently revisiting complex topics and solving new problems. Keep track of areas where you might be struggling and focus additional time on improving those weaknesses. By staying disciplined and focused, you will be well-prepared to tackle the challenges of the certification and achieve success.

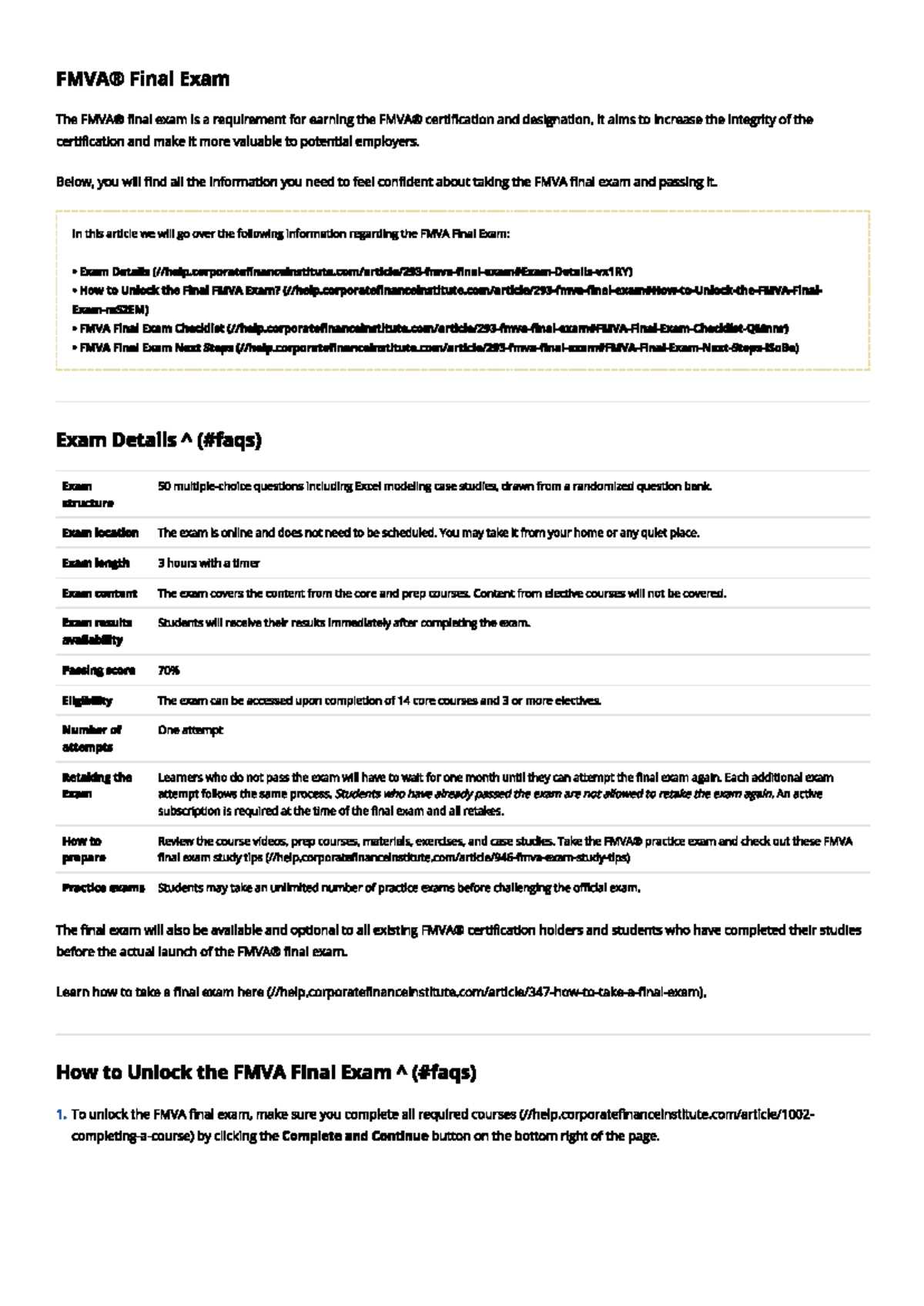

FMVA Exam Structure Explained

Understanding the structure of a financial certification assessment is crucial for effective preparation. The format, types of questions, and time constraints are all elements that contribute to how the evaluation is designed. Being familiar with these components will allow you to approach the assessment with confidence and focus on the most important areas. Knowing what to expect can help you allocate your time wisely and tackle each section strategically.

Typically, the assessment is divided into multiple sections, each testing different aspects of financial modeling and analysis. The questions may range from theoretical concepts, where you demonstrate your understanding of key financial principles, to practical exercises, where you are asked to apply these principles to real-world scenarios. You may encounter various formats, including multiple-choice questions, case studies, and spreadsheet-based tasks.

One of the key elements of the structure is time management. Each section has a specific time limit, and it is essential to pace yourself accordingly. Prioritize questions based on their difficulty and the time required to complete them. If you find a particular question challenging, it’s better to move on and come back to it later rather than getting stuck.

Another important aspect is the weight of each section. Some areas may be more heavily tested, so it’s vital to focus on mastering the most important topics. By breaking down the structure and familiarizing yourself with each part, you can approach the assessment in a more organized and efficient manner.

Understanding FMVA Answer Key Techniques

In any financial assessment, understanding how to approach and interpret solutions is crucial for improving performance and ensuring accuracy. The key to mastering these solutions lies in recognizing the underlying techniques that guide the correct answers. Developing an understanding of these techniques not only helps you navigate complex questions but also enables you to apply the right strategies to similar problems in the future.

One of the most effective methods for interpreting solutions is breaking down the process step by step. This allows you to understand the logic behind each answer and learn how to approach problems in a systematic manner. Below are some essential techniques to keep in mind:

- Identifying Core Principles: Focus on understanding the fundamental financial concepts and how they apply to various scenarios. Knowing the underlying principles allows you to solve a range of problems with similar logic.

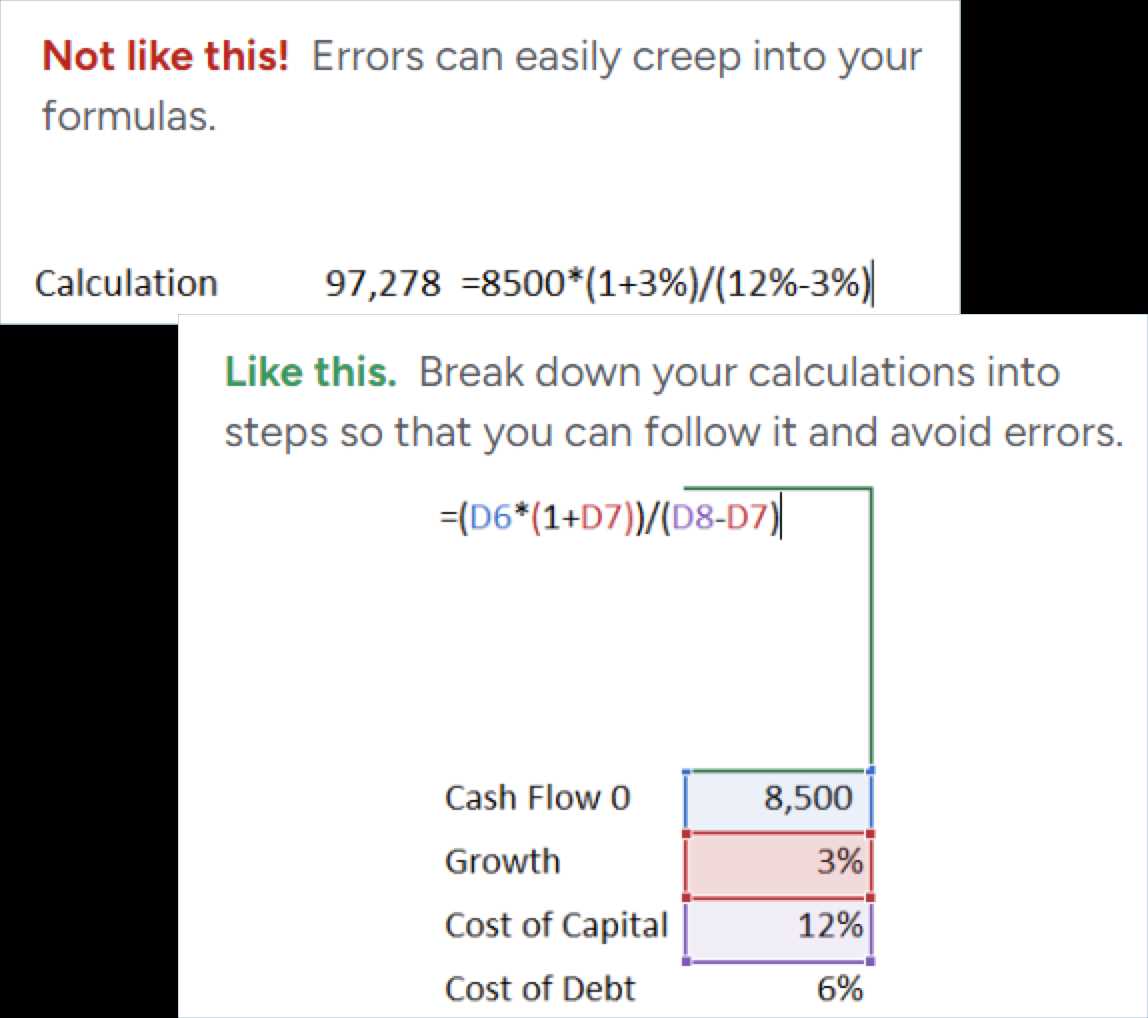

- Breaking Down Complex Problems: If faced with a difficult question, divide it into smaller, manageable parts. Address each part one at a time to avoid feeling overwhelmed and to ensure accuracy in your calculations.

- Using Real-World Applications: Always relate your solutions to real-world financial models. Understanding how theoretical concepts work in practical settings helps make your approach more relevant and practical.

- Testing Assumptions: Regularly review your assumptions to ensure that they align with the problem requirements. Incorrect assumptions can lead to misleading answers, so it’s essential to stay vigilant.

- Efficiency in Problem Solving: Learn to balance speed and accuracy. Practicing time management during problem-solving will help you avoid rushing through questions and reduce errors.

By mastering these techniques and applying them consistently, you can significantly improve your problem-solving skills and perform better in assessments. This approach not only helps you arrive at the correct answers but also enhances your ability to think critically and apply knowledge in diverse situations.

Top Strategies for FMVA Exam Preparation

Effective preparation is the cornerstone of success in any financial certification. By utilizing the right strategies, you can ensure that you not only cover all the necessary material but also reinforce your understanding through practical application. The key to excelling in such assessments lies in a structured approach that balances studying, practicing, and reviewing key concepts. Below are some of the most successful strategies to help you prepare efficiently.

- Create a Study Schedule: Plan your study sessions in advance and allocate enough time to each topic. This will ensure that you don’t miss any critical areas and stay on track as you progress toward the assessment.

- Focus on Core Topics: Prioritize the essential topics that are most likely to appear in the assessment. Concentrate on mastering core concepts such as financial statements, valuation techniques, and forecasting methods.

- Practice with Real-World Case Studies: Use case studies and practical exercises to apply the knowledge you’ve gained. This will not only test your understanding but also prepare you for the practical aspects of the assessment.

- Use Multiple Learning Resources: Don’t rely on just one source of study material. Combine textbooks, online courses, and interactive tools to enhance your learning and gain different perspectives on key topics.

- Simulate Real Testing Conditions: Take practice tests under timed conditions to simulate the real assessment environment. This will help you develop your time management skills and reduce test anxiety.

- Review and Analyze Mistakes: After completing practice tests, carefully review your mistakes. Understand where you went wrong and use that information to correct your approach before the actual assessment.

- Stay Consistent and Motivated: Maintain a consistent study routine and stay motivated throughout the preparation process. Small, regular study sessions are often more effective than cramming large amounts of information all at once.

By following these strategies and staying disciplined throughout your preparation, you’ll be well-equipped to succeed in any financial certification. Focus on understanding the material, practicing regularly, and refining your approach to ensure that you’re ready for the challenges ahead.

Breaking Down FMVA Case Study Questions

Case study questions often require a deeper level of analysis and practical application. These questions are designed to assess your ability to integrate various financial concepts and apply them to real-world scenarios. Breaking down a case study into manageable steps can help you understand the problem better and develop a structured solution. The key to success lies in recognizing the most relevant information and applying your knowledge in a logical and methodical way.

When tackling case study questions, it’s important to follow a systematic approach to ensure that you address all aspects of the problem. Here are some steps to help you break down and solve case study questions effectively:

- Read the Question Carefully: Start by thoroughly reading the case study question to understand what is being asked. Pay attention to key details such as financial data, constraints, and objectives.

- Identify Key Issues: Break the case into smaller components and identify the main financial issues or challenges. Focus on areas that require immediate attention, such as cash flow problems, profitability, or valuation concerns.

- Gather Relevant Data: Extract the key data points provided in the case. Organize this information in a way that helps you easily refer to it when needed, ensuring that no crucial details are overlooked.

- Apply Financial Models: Use the appropriate financial models and techniques to analyze the data. Whether it’s building financial projections, conducting valuations, or assessing risk, ensure you apply the right tools to reach a solution.

- Develop a Structured Solution: Once the analysis is complete, organize your findings into a clear, logical response. Structure your answer with an introduction, analysis, and conclusion. Ensure that your solution is comprehensive and well-supported by the data.

- Review Your Work: Finally, review your solution to ensure it addresses the question fully and accurately. Double-check your calculations and ensure that all aspects of the case have been considered.

By following these steps, you can approach case study questions with greater confidence and improve your ability to solve complex financial problems. A structured, methodical approach will not only help you find the right answers but also demonstrate your understanding and analytical abilities effectively.

Time Management Tips for FMVA Exam

Effective time management is essential for success in any challenging financial assessment. The key is to balance speed with accuracy, ensuring that you are able to complete all tasks within the given timeframe without sacrificing the quality of your work. Developing a strategy for managing your time during the test is critical, as it helps reduce stress and maximizes your chances of success. Below are some practical time management tips that can help you navigate the assessment more efficiently.

Plan Your Time in Advance

Before you start the assessment, take a few moments to review the entire set of questions and plan how you will allocate your time. By determining which sections are the most time-consuming or challenging, you can prioritize your approach. Consider using the following techniques:

- Estimate Time per Section: Divide the total time into blocks based on the difficulty and length of each section. Allocate more time to complex calculations or case studies, while reserving quicker tasks for sections with simpler questions.

- Start with Easier Questions: Tackle the questions you feel most confident about first. This builds momentum and allows you to answer some questions quickly, which frees up time for the harder sections.

- Leave Time for Review: Always set aside a portion of your time at the end to review your answers. Even a brief review can help you spot errors or areas that need clarification.

Maintain a Steady Pace

Once you begin the assessment, it’s important to maintain a consistent pace throughout. Avoid spending too much time on any one question, even if it’s difficult. Here’s how to manage your pace effectively:

- Use a Timer: Keep an eye on the clock as you work through each section. Set mini-deadlines to help stay on track, ensuring that you complete each section within the designated time.

- Skip and Return: If you encounter a particularly challenging question, don’t get stuck. Move on to the next question and return to the difficult one once you’ve completed the easier ones.

- Don’t Rush: Speed is important, but rushing through questions can lead to careless mistakes. Aim for a steady pace that allows you to think through each question carefully without being overly rushed.

By planning your time in advance and maintaining a steady pace throughout the assessment, you can significantly improve your performance and ensure that you complete the test on time. Time management is a critical skill that will not only help you during the assessment but also in your future financial career.

FMVA Exam Practice Questions and Solutions

Practice questions are an essential part of preparation for any financial certification. They allow you to familiarize yourself with the types of problems you may encounter and help reinforce your understanding of key concepts. Working through these questions, coupled with detailed solutions, will not only improve your problem-solving skills but also boost your confidence in tackling complex financial scenarios. Below are some practice questions along with their solutions to help guide your preparation.

Practice Question 1: Financial Statement Analysis

Question: You are given the following financial data for a company:

- Revenue: $500,000

- Cost of Goods Sold: $300,000

- Operating Expenses: $100,000

- Interest Expense: $10,000

- Tax Rate: 25%

Calculate the company’s net income.

Solution: To calculate net income, follow these steps:

- Gross Profit = Revenue – Cost of Goods Sold = $500,000 – $300,000 = $200,000

- Operating Income = Gross Profit – Operating Expenses = $200,000 – $100,000 = $100,000

- Interest Expense: $10,000

- Taxable Income = Operating Income – Interest Expense = $100,000 – $10,000 = $90,000

- Taxes = Taxable Income * Tax Rate = $90,000 * 25% = $22,500

- Net Income = Taxable Income – Taxes = $90,000 – $22,500 = $67,500

The company’s net income is $67,500.

Practice Question 2: Discounted Cash Flow Valuation

Question: A company is projected to generate free cash flow of $50,000 for the next year, with a growth rate of 5% per year. If the discount rate is 10%, calculate the present value of the company’s free cash flow for the next 5 years.

Solution: To calculate the present value of the free cash flow, we use the following formula for each year:

- Year 1: PV = $50,000 / (1 + 10%)^1 = $45,454.55

- Year 2: PV = $50,000 * (1 + 5%) / (1 + 10%)^2 = $45,351.47

- Year 3: PV = $50,000 * (1 + 5%)^2 / (1 + 10%)^3 = $45,249.47

- Year 4: PV = $50,000 * (1 + 5%)^3 / (1 + 10%)^4 = $45,148.52

- Year 5: PV = $50,000 * (1 + 5%)^4 / (1 + 10%)^5 = $45,048.61

The present value of the company’s free cash flow for the next 5 years is the sum of these amounts:

Total PV = $45,454.55 + $45,351.47 + $45,249.47 + $45,148.52 + $45,048.61 = $225,252.62

The present value of the free cash flow over the next 5 years is $225,252.62.

By working through these practice questions, you gain a deeper understanding of core financial concepts and improve your ability to solve similar problems under exam conditions. Continue practicing with additional questions and refine your skills for optimal performance.

Understanding FMVA Financial Models

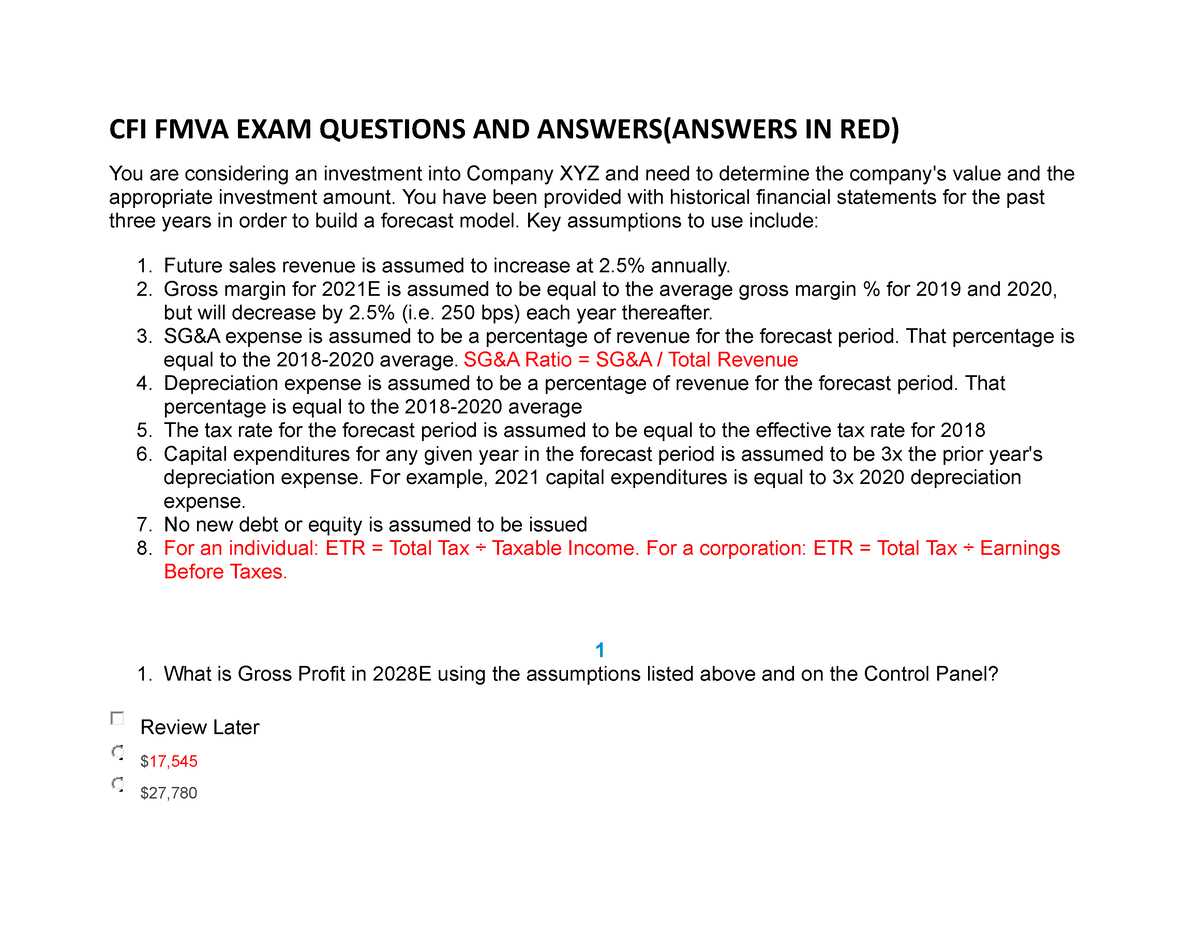

Financial models are essential tools used to represent a company’s financial performance and forecast future outcomes based on certain assumptions. These models help professionals make data-driven decisions by analyzing historical data, projecting future performance, and evaluating the financial impact of various scenarios. A strong grasp of financial modeling techniques is key to constructing reliable models and interpreting their results accurately. In this section, we will explore the core concepts of financial modeling and how to apply them effectively in real-world situations.

Types of Financial Models

There are several types of financial models, each designed to serve a specific purpose depending on the needs of the user. Some of the most commonly used models include:

- Discounted Cash Flow (DCF) Model: This model values a business based on its projected cash flows and discounts them to present value using a required rate of return.

- Comparable Company Analysis: This approach involves evaluating a company by comparing its financial metrics to those of similar companies in the same industry.

- Precedent Transactions Model: This model looks at past transactions of similar companies to assess the value of a company based on historical transaction multiples.

- Budgeting and Forecasting Models: These models help businesses plan their operations and predict future financial results based on historical performance and market conditions.

Key Steps in Building a Financial Model

Building a reliable financial model involves several key steps. Each step requires attention to detail and a thorough understanding of both the business and the modeling techniques. The general steps include:

- Data Collection: Gather relevant financial data, such as income statements, balance sheets, and cash flow statements, to form the foundation of the model.

- Assumption Development: Identify key assumptions, such as growth rates, margins, and discount rates, which will drive the financial forecasts.

- Building the Model: Using spreadsheet software, input the historical data and assumptions to create the core structure of the model, ensuring it reflects accurate financial relationships.

- Sensitivity Analysis: Test the model’s robustness by adjusting key assumptions and evaluating the impact on results.

- Scenario Analysis: Simulate different business scenarios (e.g., best case, worst case) to evaluate how the company might perform under various conditions.

Understanding the intricacies of financial models allows professionals to assess a company’s financial health, make strategic decisions, and predict future trends with greater confidence. Mastering these modeling techniques is crucial for anyone looking to succeed in finance and related fields.

Real-World Application of FMVA Knowledge

The principles and techniques learned in financial modeling training have a broad range of practical applications in the business world. Professionals use these skills to analyze financial statements, develop forecasts, and evaluate potential investment opportunities. By leveraging these tools, individuals can create actionable insights that drive strategic decision-making, optimize resource allocation, and enhance overall business performance. In this section, we explore how financial modeling knowledge is applied across various industries and business functions.

One of the most common uses of financial modeling is in investment banking, where professionals assess the value of companies, model potential acquisitions, or structure mergers. By utilizing discounted cash flow (DCF) analysis and comparable company analysis, financial analysts can provide accurate valuations that guide investment decisions.

In corporate finance, financial models are used for budgeting, forecasting, and capital allocation decisions. Companies rely on detailed financial projections to determine the feasibility of new projects, analyze cost structures, and optimize cash flow management. These models allow businesses to understand the impact of different financial strategies, such as debt financing or equity issuance, on their long-term goals.

For private equity firms and venture capitalists, financial models help in evaluating startup companies and mature businesses alike. These professionals use sophisticated modeling techniques to assess the risk and return profiles of potential investments, ensuring that they are making well-informed decisions. These models often include scenario analysis to evaluate how changes in market conditions or operational performance affect the value of an investment.

Similarly, in the real estate industry, financial models are crucial for evaluating property investments, projecting rental income, and assessing the profitability of development projects. Real estate analysts use these models to determine the optimal pricing strategies, financing structures, and expected returns on investment.

By mastering financial modeling techniques, professionals can add significant value to their organizations, contributing to smarter financial strategies, improved operational efficiency, and better-informed business decisions across various sectors.

FMVA Exam Resources and Study Guides

Preparing for financial modeling certification requires access to high-quality resources and structured study materials that guide candidates through key concepts and practical applications. Whether you are a beginner or an experienced professional, using the right tools and guides can significantly improve your understanding and retention of critical financial modeling techniques. This section highlights some of the best resources to help you succeed in your financial modeling journey.

One of the most comprehensive resources available are official study guides, which outline the topics covered in the certification process. These guides typically include detailed explanations, examples, and practice questions that test your understanding of important financial principles and modeling techniques. By following a structured approach and using these materials, you can ensure that you are covering all necessary concepts and adequately preparing for the challenges ahead.

Online learning platforms also offer a wide variety of study tools, including video tutorials, interactive quizzes, and webinars. These platforms often provide self-paced courses designed by industry experts, making it easier to learn complex concepts at your own speed. Some of these platforms also offer access to forums where you can engage with fellow learners, share tips, and ask questions, fostering a collaborative learning environment.

In addition to formal study materials, practice tests and mock exams are invaluable tools for assessing your readiness. Taking these mock exams under timed conditions can help you get familiar with the format and pacing of the assessments, ensuring that you are well-prepared for the actual certification process. Many study guides and online resources also offer answer keys and detailed solutions, allowing you to review your mistakes and understand how to approach similar questions in the future.

Finally, supplementing your learning with books by financial modeling experts is another great way to deepen your knowledge. Books often provide in-depth discussions on topics like valuation models, risk analysis, and financial statement forecasting. These resources are ideal for those who want to explore the subject matter in greater detail and build a stronger foundation in financial modeling.

By utilizing a combination of study guides, online courses, practice exams, and reference books, you can develop a comprehensive understanding of financial modeling and ensure that you are well-prepared for certification success.

FMVA Exam Scoring and Evaluation Process

The assessment process for financial modeling certification is designed to measure both your theoretical knowledge and practical application of key concepts. Understanding how your performance is evaluated can help you approach the assessment with greater confidence and improve your chances of success. This section will explain the scoring system, the criteria used to evaluate your performance, and how to interpret the results.

Scoring System

The scoring system is typically based on a combination of multiple-choice questions, case studies, and practical modeling exercises. Each section is assigned a specific weight, and your total score is calculated by summing your performance across all components. Here’s a breakdown of how the scoring is usually structured:

| Component | Weight |

|---|---|

| Multiple-choice Questions | 30% |

| Case Studies | 40% |

| Practical Modeling Exercises | 30% |

Evaluation Criteria

Each component of the assessment is evaluated based on a set of specific criteria. For multiple-choice questions, your ability to recall and apply financial concepts is assessed. Case studies evaluate your problem-solving skills and your capacity to interpret real-world financial situations. Practical exercises test your ability to build accurate and reliable financial models, demonstrating your understanding of complex financial concepts.

The grading is typically done on a pass/fail basis, and some certifications may provide additional feedback regarding areas where you performed well or could improve. Passing the assessment usually requires achieving a minimum score across all components, ensuring that candidates have a well-rounded understanding of the subject matter.

Understanding how your performance is evaluated can help you focus your study efforts and practice key areas that are weighted more heavily in the assessment. By being familiar with the scoring process, you can enter the certification process with a clear strategy and increase your likelihood of achieving a successful outcome.