The world of economics is complex, with numerous factors shaping the way resources are allocated and distributed. Understanding the underlying principles can provide valuable insights into both individual decision-making and broader societal trends. This section delves into key ideas that guide modern economic systems, offering a foundation for analyzing how various forces interact and influence markets globally.

By exploring the connections between theory and practice, this article sheds light on how current economic structures function and evolve. It also provides a glimpse into the challenges and opportunities that lie ahead, helping readers grasp the critical issues impacting future economic development. Whether it is the role of technology, government policy, or global trade, understanding these elements is essential for navigating the complexities of the modern world.

Key Concepts and Future Perspectives in Economic Systems

The study of economic principles provides essential knowledge about how societies organize resources, distribute wealth, and make decisions regarding production and consumption. This section explores the fundamental concepts that shape modern financial systems, from market dynamics to governmental roles, and how these ideas influence real-world applications across various sectors.

As we look forward, the challenges and opportunities of future economic landscapes emerge, driven by technological advancements, global integration, and evolving policies. Understanding how current theories adapt to new conditions is crucial for anticipating shifts in global markets, labor forces, and financial institutions. By examining these interconnected elements, we gain a clearer understanding of the direction in which the global economy is heading.

Key Concepts of Modern Economics

Modern financial systems are built on several fundamental ideas that govern how resources are allocated, how goods and services are distributed, and how decision-making processes unfold within markets. These core principles are vital for understanding how individuals, businesses, and governments interact in the economic sphere. By exploring these concepts, we gain insight into the mechanisms that drive market economies and shape the daily lives of people worldwide.

At the heart of these ideas is the study of supply and demand, the role of competition, and the influence of governmental policies. Understanding how each of these elements interacts helps create a clearer picture of how economies function and evolve over time. The following table outlines some of the key concepts in modern financial thought.

| Concept | Description |

|---|---|

| Supply and Demand | The relationship between the availability of a product and the desire for that product, which influences its price. |

| Market Competition | How different businesses or entities compete for resources, customers, and market share, driving innovation and efficiency. |

| Government Regulation | The rules and policies set by governments to manage markets, ensure fairness, and prevent monopolies. |

| Globalization | The increasing interdependence of economies worldwide, facilitated by trade, technology, and international agreements. |

| Inflation | The general increase in prices and the decline in purchasing power of money over time. |

Understanding Economic Principles in Practice

The practical application of fundamental principles shapes how businesses operate, governments make policy decisions, and individuals interact within markets. These concepts are not just theoretical ideas but tools that influence real-world outcomes. By examining how these principles play out in various settings, we can better understand the forces that drive economic behavior on both a small and large scale.

In practice, these principles affect everything from personal financial decisions to global trade agreements. By observing real-world examples, we see how factors like scarcity, opportunity cost, and incentives influence actions and outcomes. Below are some key examples of how these principles manifest in daily life:

- Resource Allocation: How limited resources are distributed to meet the needs and desires of individuals and businesses.

- Cost-Benefit Analysis: The process of evaluating the advantages and disadvantages of different choices to make informed decisions.

- Market Behavior: The way consumers and producers interact, driven by price signals and market dynamics.

- Government Intervention: How regulations and policies impact economic activities, from taxes to subsidies and trade restrictions.

- Global Trade: The exchange of goods and services across borders, influenced by comparative advantage and international agreements.

These principles are evident not only in major economic structures but also in everyday decisions made by individuals. Understanding their application in real situations is essential for navigating the complexities of the modern economic world.

Market Structures and Their Impacts

The organization of markets plays a crucial role in shaping how goods and services are produced, distributed, and consumed. Different structures create distinct environments where businesses operate, affecting pricing, competition, and consumer choices. Understanding these structures helps to evaluate how markets function and the economic outcomes they produce in various industries.

There are several common market types, each with its own set of characteristics and consequences. These structures vary in terms of the number of participants, the level of competition, and the degree of control that firms have over pricing and production. Below are some of the primary market types and their impacts:

- Perfect Competition: Many firms sell identical products, resulting in competitive pricing and consumer choice. This structure tends to lead to efficient resource allocation but is rare in the real world.

- Monopolistic Competition: Numerous businesses offer differentiated products, allowing for some pricing power but still maintaining a relatively competitive environment. This is commonly seen in industries like retail or restaurants.

- Oligopoly: A few large firms dominate the market, often leading to limited competition and the possibility of collusion. Examples include the airline and automobile industries.

- Monopoly: One firm controls the entire market, often leading to higher prices and reduced innovation. Monopolies can occur naturally or be created through government regulations or mergers.

The impact of these market structures extends beyond pricing. They also influence job creation, technological development, and the overall health of the economy. By understanding how each structure operates, businesses, policymakers, and consumers can make informed decisions that shape the future of various industries.

Role of Government in Economic Systems

The involvement of governments in economic systems is essential for maintaining stability, promoting fairness, and ensuring the efficient functioning of markets. While the degree and type of intervention vary across different countries and systems, government actions significantly impact areas such as regulation, taxation, and public services. Understanding these roles helps clarify how government policies influence both individual choices and broader market outcomes.

Key Functions of Government

Governments engage in several crucial activities that shape the structure and performance of economic systems. These actions help balance the interests of different sectors and promote overall social welfare. Below are the primary roles governments play in the economy:

- Regulation and Oversight: Governments establish rules to maintain fairness, prevent market abuses, and protect consumers. This includes regulating industries, setting standards for products, and ensuring fair competition.

- Taxation and Public Spending: By levying taxes, governments generate revenue that is used to fund essential services such as education, healthcare, and infrastructure. Public spending helps stimulate demand and promotes economic growth.

- Monetary and Fiscal Policy: Through policies set by central banks and finance ministries, governments manage inflation, unemployment, and economic growth. These policies include adjusting interest rates and government spending levels.

- Social Welfare Programs: Governments provide financial support to vulnerable populations through programs like unemployment benefits, pensions, and public healthcare. These programs ensure that the basic needs of citizens are met, especially during economic downturns.

Government Influence on Market Dynamics

Government actions can also affect market dynamics by shaping supply, demand, and prices. Through subsidies, tariffs, and trade agreements, governments directly influence the production and consumption of goods and services. For instance, subsidies for renewable energy may encourage the development of green technologies, while tariffs can protect domestic industries from foreign competition.

The balance between government intervention and market freedom is a key factor in determining the success of an economic system. Excessive regulation can stifle innovation and efficiency, while too little oversight may lead to exploitation and inequality. Thus, finding the right equilibrium is critical for ensuring sustainable economic growth and development.

Supply and Demand Explained Simply

Supply and demand are fundamental concepts that explain how prices are determined in a market economy. These forces interact to establish the availability of goods and services and the desire for them. Understanding how changes in supply or demand affect prices helps consumers, businesses, and policymakers make informed decisions about production, consumption, and investment.

The basic idea is simple: when the supply of a good or service increases, but demand remains constant, prices tend to fall. Conversely, if demand increases and supply remains the same, prices generally rise. This relationship helps balance the quantity of products available with the quantity that people want to buy.

In a competitive market, sellers aim to maximize profits by adjusting prices based on changes in supply or demand. Buyers, on the other hand, make decisions based on the prices they are willing to pay and the quantity they desire. Below are some key scenarios that illustrate how supply and demand interact:

- Increase in Supply: When more of a product becomes available, prices tend to decrease if demand stays the same, making the product more affordable for consumers.

- Increase in Demand: When more people want a product and the supply remains unchanged, prices typically rise due to the higher competition among buyers.

- Decrease in Supply: If the availability of a product decreases, and demand remains constant, prices tend to go up as buyers compete for fewer units.

- Decrease in Demand: When fewer people want a product, and supply remains unchanged, prices often drop to encourage more buyers to enter the market.

By analyzing these patterns, one can predict how market forces will drive price fluctuations and how changes in the economy might affect everyday purchasing decisions.

Globalization and Its Economic Effects

The growing interconnectedness of the world’s markets has led to both positive and negative consequences across various industries. As countries become increasingly linked through trade, investment, and technology, they experience shifts in their economic landscapes. While this global integration fosters growth and innovation, it also presents challenges related to labor markets, inequality, and environmental sustainability.

Benefits of Global Integration

Globalization brings several advantages that drive economic development and improve living standards. By opening up new markets and fostering competition, countries can increase their production capacity and access a wider range of goods and services. The following are key benefits:

- Access to Larger Markets: Businesses can expand their reach internationally, boosting sales and creating job opportunities in local economies.

- Cost Efficiency: With the ability to source raw materials and labor from lower-cost regions, companies can reduce production costs, leading to lower prices for consumers.

- Innovation and Technology Sharing: Nations and companies benefit from the exchange of ideas, technologies, and practices, accelerating innovation and improving efficiency across industries.

Challenges of Global Integration

Despite its advantages, globalization also introduces a number of challenges. Some sectors may experience negative consequences as industries adjust to the increased competition and shifting labor dynamics. The following are some of the key issues:

- Job Displacement: As companies outsource production to countries with cheaper labor, workers in higher-wage economies may lose jobs or face wage stagnation.

- Income Inequality: The wealth generated by global markets is often unevenly distributed, leading to widening gaps between the rich and poor, both within and between countries.

- Environmental Impact: Increased production, transportation, and consumption can lead to greater resource depletion, pollution, and climate change.

In summary, while global integration has the potential to drive economic growth and improve standards of living, it also requires careful consideration of its broader social and environmental impacts. Finding a balance that fosters sustainable growth and equitable development is crucial as the world becomes more interconnected.

Economic Decision Making and Risk

In any financial environment, decision-making is a crucial process that requires evaluating options and understanding the associated risks. Individuals, organizations, and governments constantly face choices where the outcomes are uncertain, and the future is hard to predict. These decisions often have significant impacts on resources, growth, and stability, making it essential to assess potential risks carefully before acting.

Types of Risk in Financial Decisions

Risk is an unavoidable element in every decision, whether it’s investing in stocks, launching a new business, or adjusting public policy. The potential for loss or failure exists in every choice, but it can be mitigated with informed strategies. Below are some common types of risks involved in decision-making processes:

- Market Risk: This risk arises from fluctuations in prices, demand, and market conditions, affecting the profitability of investments and business operations.

- Credit Risk: The likelihood that a borrower will default on a loan or fail to meet financial obligations, leading to financial losses for lenders or investors.

- Operational Risk: Risks related to the internal functioning of a business, such as errors in processes, system failures, or human mistakes.

- Liquidity Risk: The potential for an asset to be difficult to sell quickly without incurring a significant loss, often caused by an absence of buyers or market inefficiencies.

Strategies for Managing Risk

Although risk is inevitable, various strategies can be employed to minimize its negative impacts. Understanding these strategies allows individuals and organizations to protect their interests and maximize their chances of success. Some of the most effective methods for managing risk include:

- Diversification: Spreading investments across different assets or sectors reduces exposure to the risk of any one asset or market.

- Hedging: Using financial instruments, such as futures contracts or options, to offset the potential loss from price fluctuations.

- Insurance: Purchasing insurance policies to safeguard against specific risks, such as property damage, health costs, or business interruptions.

- Scenario Planning: Evaluating different possible outcomes by considering various scenarios helps in preparing for unexpected events or changes in market conditions.

In conclusion, making well-informed decisions in an uncertain environment requires an understanding of the risks involved and employing strategies to manage them effectively. Whether for individual financial decisions or large-scale corporate strategies, the ability to assess and mitigate risk plays a key role in achieving desired outcomes and maintaining long-term success.

Money, Banking, and Financial Systems

The role of financial institutions and currency in the economy is fundamental to facilitating trade, investment, and economic stability. At the heart of a functioning economic system lies the efficient flow of money, the security provided by banks, and the interconnected network of financial institutions that help manage risk, distribute capital, and ensure liquidity. Understanding these components is essential for grasping how economies grow and adapt to changes over time.

Money serves as a medium of exchange, a store of value, and a unit of account. Its role in facilitating transactions is key to maintaining economic activity across regions and industries. Without a stable and efficient financial system, both individuals and businesses would face significant difficulties in conducting everyday operations, saving, or investing for the future.

The Role of Banks in the Economy

Banks act as intermediaries between savers and borrowers, providing the essential service of channeling funds from those with surplus capital to those who require capital for investments or expenditures. They also play a crucial role in managing risk, offering loans, providing credit, and supporting economic growth. The banking system is vital for fostering financial stability and promoting investment opportunities.

- Deposits: People and businesses store their money in banks, where it earns interest and is safe from theft or loss.

- Loans: Banks lend money to individuals and businesses, enabling them to invest, expand, or make purchases that fuel economic activity.

- Credit Creation: Through the process of fractional reserve banking, banks can create new credit by lending out a portion of deposited funds, which stimulates economic growth.

Understanding Financial Systems

Financial systems consist of various institutions and markets that facilitate the exchange of funds. These systems help allocate resources efficiently by matching savers with borrowers and enabling businesses to secure the capital they need. The most common financial markets include stock exchanges, bond markets, and foreign exchange markets. These markets help determine interest rates, price assets, and manage liquidity.

- Stock Markets: Platforms where individuals and institutions buy and sell shares of publicly traded companies, which allow businesses to raise capital.

- Bond Markets: Markets where governments and corporations issue debt securities to borrow money from investors.

- Foreign Exchange Markets: Platforms where currencies are traded, influencing exchange rates and the global flow of capital.

In conclusion, the interdependent relationship between money, banking, and financial systems is critical to the proper functioning of modern economies. These components allow for the efficient movement of capital, the creation of wealth, and the management of financial risks, ensuring a stable environment for both individuals and businesses.

Comparing Economic Theories and Models

Different frameworks and models seek to explain how resources are allocated, how individuals and organizations interact, and how various factors influence the functioning of a society. By comparing these models, we can better understand the diverse approaches to managing economic activity and the challenges faced by decision-makers. Each theory presents a unique lens through which to view the processes of production, consumption, and distribution, offering different insights into the mechanisms at play within markets and economies.

These models are often built on distinct assumptions about human behavior, market dynamics, and the role of government intervention. Some emphasize the self-regulating nature of markets, while others advocate for proactive involvement to correct imbalances. A deeper understanding of the contrasting viewpoints can help policymakers, businesses, and individuals navigate the complexities of a rapidly changing economic environment.

Classical vs. Keynesian Models

The classical model, originating from economists like Adam Smith, assumes that markets are inherently efficient and that any intervention by the government would distort the natural balance of supply and demand. According to this theory, economies tend toward full employment in the long run, and any fluctuations are temporary corrections. Classical thinkers argue that the best approach is to allow market forces to operate freely without interference.

In contrast, the Keynesian model, developed by John Maynard Keynes, asserts that markets do not always correct themselves quickly, and government intervention is necessary to smooth out economic cycles. Keynesians believe that in times of recession or economic stagnation, increased government spending or tax cuts can stimulate demand, create jobs, and restore economic activity. This model emphasizes the need for active fiscal policies to address unemployment and economic instability.

Monetarism vs. Supply-Side Economics

Monetarism, as popularized by Milton Friedman, focuses on the control of the money supply as the primary tool for regulating inflation and stabilizing the economy. Monetarists argue that an excessive growth of the money supply leads to inflation, and central banks should manage this growth carefully to maintain price stability. They believe that long-term economic growth depends on controlling inflation, not government spending or taxation policies.

On the other hand, supply-side economics focuses on stimulating production by reducing barriers for businesses, such as taxes and regulations. Proponents of this model argue that lowering tax rates and allowing businesses more freedom to operate will lead to job creation, increased investment, and overall economic growth. Supply-side economists believe that a thriving private sector is the key to long-term prosperity and that government intervention should be minimal.

Each of these models has its strengths and weaknesses, and their effectiveness depends on the specific context in which they are applied. Whether advocating for minimal government involvement, active fiscal policies, or monetary control, understanding the core principles behind these economic frameworks can provide valuable insights for addressing contemporary economic challenges.

The Influence of Technology on Economics

Technological advancements have transformed the way industries operate, reshaping global markets and influencing the distribution of resources. The introduction of new technologies has led to more efficient production processes, expanded access to information, and created entirely new sectors of the economy. Understanding the impact of technology is crucial for grasping the shifts in supply chains, labor markets, and consumer behavior that occur in response to innovation.

One of the most significant ways technology influences economic activity is through increased productivity. Automation, artificial intelligence, and data analytics allow businesses to operate more efficiently, reducing costs while improving output. This technological efficiency can lead to higher profits, lower prices for consumers, and the creation of new goods and services that were previously unfeasible.

Impact on Labor Markets

The rise of automation and artificial intelligence has also affected the labor market. While some jobs have been displaced by machines, technology has created new opportunities in areas such as software development, data analysis, and digital marketing. However, the rapid pace of change also requires workers to adapt, learning new skills to stay competitive in a tech-driven world.

Technology’s Role in Globalization

Technology has also played a pivotal role in accelerating globalization. The internet, mobile technology, and advances in transportation have made it easier for businesses to reach international markets, collaborate across borders, and access global supply chains. This interconnectedness has increased competition, expanded trade, and allowed economies to specialize in particular goods or services, thereby improving overall global efficiency.

| Technology | Impact on Economy | Example |

|---|---|---|

| Automation | Increased productivity, reduced costs | Manufacturing robots in car production |

| Artificial Intelligence | Improved decision-making, enhanced services | AI in healthcare diagnostics |

| Blockchain | Decentralized finance, increased transparency | Cryptocurrency transactions |

As technology continues to evolve, its influence on economic systems will only grow stronger. Businesses and governments must adapt to these changes by fostering innovation, ensuring equitable access to new technologies, and addressing the challenges that arise from rapid technological shifts. Ultimately, technology will continue to shape the future of markets, industries, and the global economy in ways that are both predictable and surprising.

Environmental Issues in Economic Development

As economies grow and develop, environmental concerns become increasingly important. The expansion of industries, urbanization, and resource extraction can often lead to negative consequences for the natural world, such as pollution, deforestation, and climate change. Balancing economic growth with environmental sustainability is a critical challenge that requires innovative solutions and global cooperation.

One of the primary issues is the depletion of natural resources. As demand for goods and services increases, so does the consumption of raw materials like fossil fuels, metals, and water. This overconsumption can lead to resource scarcity, making it more difficult for future generations to meet their needs. The extraction and use of these resources often have significant environmental impacts, including habitat destruction, soil degradation, and air and water pollution.

Sustainable Development and Green Growth

To address these challenges, many nations and organizations are focusing on sustainable development. This concept emphasizes the need to meet present economic needs without compromising the ability of future generations to fulfill their own needs. It advocates for a balanced approach that includes the use of renewable resources, energy efficiency, and sustainable agricultural practices. Green growth, which encourages innovation in clean technologies, is an essential part of this movement, promoting environmentally friendly industries that can still contribute to economic growth.

Climate Change and Its Economic Impacts

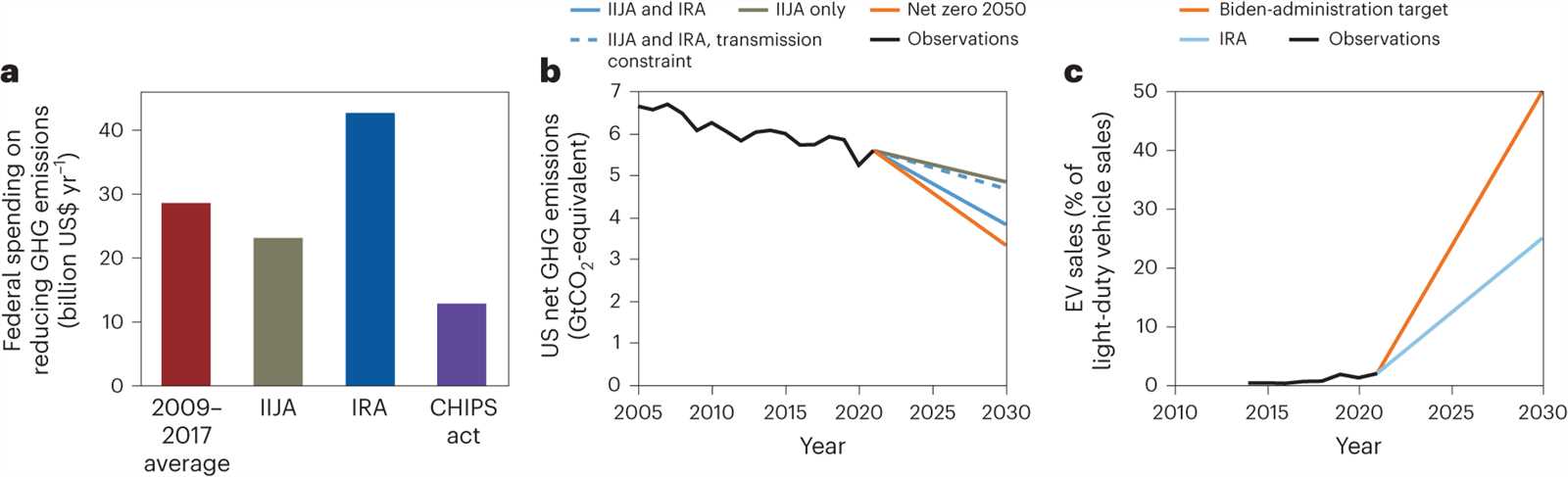

Climate change is one of the most pressing environmental challenges facing economies worldwide. Rising global temperatures, shifting weather patterns, and more frequent natural disasters pose risks to agricultural productivity, infrastructure, and public health. Additionally, the economic costs of mitigating climate change, such as transitioning to renewable energy sources and investing in climate resilience, can be substantial. However, addressing climate change also presents opportunities for growth in clean energy sectors, green jobs, and sustainable technologies.

Governments, businesses, and individuals must work together to integrate environmental considerations into economic planning. Policymakers are increasingly recognizing the need for green policies, such as carbon pricing, pollution regulations, and incentives for renewable energy. At the same time, businesses are adopting more sustainable practices in production, transportation, and consumption to minimize their environmental footprint. By fostering innovation and cooperation, it is possible to build a future where economic development and environmental stewardship go hand in hand.

Economic Growth and Sustainable Practices

As nations strive to enhance their prosperity, there is a growing emphasis on aligning development with environmental preservation. The pursuit of long-term growth must account for the careful use of resources, the minimization of waste, and the reduction of harmful environmental impacts. Achieving this balance requires adopting strategies that foster both economic success and environmental protection.

Sustainable practices are essential for ensuring that growth does not deplete the resources future generations will need. This approach involves utilizing renewable energy, improving energy efficiency, and promoting responsible consumption. In doing so, it is possible to stimulate economic activity without overburdening ecosystems or contributing to irreversible environmental damage.

Green Technologies and Innovation

One of the key factors in sustainable growth is the widespread adoption of green technologies. These innovations reduce the carbon footprint of industries and facilitate the shift toward renewable energy sources such as solar, wind, and hydroelectric power. From electric vehicles to energy-efficient buildings, these technological advancements are not only environmentally beneficial but also create new economic opportunities by generating jobs and reducing long-term costs.

Policy and Corporate Responsibility

Governments play a crucial role in fostering sustainable practices through the implementation of regulations, incentives, and subsidies that encourage green technologies and sustainable business models. Policies such as carbon taxes, renewable energy subsidies, and waste reduction programs incentivize companies to adopt more responsible approaches. Similarly, businesses are increasingly recognizing the importance of sustainability as a key component of their corporate strategy. By focusing on sustainable supply chains, eco-friendly product development, and reducing waste, companies can contribute to both economic growth and environmental conservation.

Incorporating sustainable practices into growth strategies is not only beneficial for the environment but also supports long-term economic stability. By investing in green technologies, efficient resource management, and environmentally-conscious policies, societies can build a foundation for prosperous, sustainable futures.

The Labor Market and Employment Trends

The labor market constantly adapts to shifts in technology, global demands, and societal changes. This dynamic environment influences job availability, wages, and workforce participation. Understanding these trends helps individuals make informed career choices and allows businesses to align their hiring strategies with emerging needs. Employment trends provide valuable insights into the health of various industries and the skills that will be in demand in the future.

Key Factors Driving Employment Trends

Several key factors play a significant role in shaping current employment patterns:

- Technological Advancements: The rise of automation, artificial intelligence, and digital platforms continues to reshape the workforce, affecting the types of jobs available and how work is performed.

- Globalization: As businesses expand globally, they seek workers with specialized skills and knowledge, influencing demand for certain job sectors in different regions.

- Demographic Shifts: An aging population, increasing diversity, and changes in workforce participation patterns all contribute to evolving employment trends.

Emerging Employment Opportunities

In response to these driving forces, specific sectors have seen significant growth. These include:

- Technology and IT: As reliance on digital tools and platforms grows, there is increasing demand for roles in software development, cybersecurity, and data analysis.

- Healthcare: With an aging population and advances in medical technology, healthcare jobs continue to expand, from medical practitioners to researchers and administrators.

- Green Energy: Environmental sustainability initiatives have led to growth in renewable energy jobs, energy efficiency services, and environmental conservation roles.

As the labor market evolves, individuals must remain agile, acquiring new skills and staying informed about shifts in demand. Businesses, too, must adjust their strategies to recruit and retain talent that aligns with current trends. Understanding these changes is key to navigating the future of work.

Understanding Inflation and Deflation

Price levels in an economy can fluctuate over time, influencing the purchasing power of money. These changes often occur as a result of shifts in supply and demand, government policies, or external factors. Two of the most significant economic phenomena that affect consumers, businesses, and governments are inflation and deflation. Both represent opposing trends in the value of money, with inflation causing prices to rise, while deflation leads to a decline in prices.

What Causes Inflation?

Inflation occurs when there is a general increase in the prices of goods and services over time. Several factors can contribute to inflation:

- Demand-Pull Inflation: When demand for goods and services outpaces supply, prices tend to rise as businesses struggle to meet consumer needs.

- Cost-Push Inflation: Rising production costs, such as wages or raw materials, can lead companies to raise prices to maintain profit margins.

- Monetary Expansion: An increase in the money supply, often through central bank policies, can devalue currency, resulting in higher prices.

The Impact of Deflation

Deflation, on the other hand, occurs when prices generally fall over time, which can have both positive and negative effects on the economy:

- Increased Purchasing Power: As prices drop, consumers can buy more with the same amount of money, potentially increasing consumption in the short term.

- Delayed Spending: Consumers may anticipate even lower prices in the future and delay purchases, which can lead to reduced demand and further economic stagnation.

- Debt Burden: Deflation increases the real value of debt, making it more expensive for borrowers to repay loans, which can lead to defaults and financial instability.

Understanding the effects of inflation and deflation is essential for managing personal finances, business strategies, and government policies. While inflation can erode purchasing power, deflation can lead to economic stagnation. Balancing these forces is key to maintaining economic stability and fostering long-term growth.

International Trade and Economic Relations

The exchange of goods, services, and capital between countries is a vital component of the global economy. International trade allows nations to access resources and products that may not be available domestically, fostering economic growth and innovation. The nature of these interactions, however, is shaped by a wide range of policies, agreements, and geopolitical factors. Understanding the dynamics of global trade is essential for recognizing how economic relations impact both local and international markets.

Key Drivers of International Trade

Several factors contribute to the flow of goods and services between nations:

- Comparative Advantage: Countries specialize in producing certain goods or services more efficiently than others, allowing them to trade these items for those they cannot produce as effectively.

- Trade Agreements: Bilateral and multilateral agreements, such as free trade pacts, lower barriers to trade and encourage economic cooperation between countries.

- Global Supply Chains: Technological advancements and improved logistics enable the movement of raw materials and finished products across borders, making international trade more efficient.

Impact of Trade Relations on Economies

International trade has both positive and negative effects on national economies. On the one hand, trade can stimulate economic growth by providing access to a larger market and offering consumers more variety. On the other hand, it can lead to challenges such as:

- Job Displacement: Industries that cannot compete with cheaper foreign goods may suffer, leading to layoffs or a decline in certain sectors.

- Trade Imbalances: When a country imports more than it exports, it may face a trade deficit, which could affect the overall economic stability.

- Cultural and Environmental Concerns: Global trade can contribute to cultural homogenization and environmental degradation, as industries seek to maximize production efficiency.

Ultimately, international trade plays a crucial role in shaping the global economy, with nations navigating complex relationships to maximize benefits while addressing potential drawbacks. The ongoing evolution of trade practices and policies continues to define how countries interact and develop in the modern world.

Future Trends in Economic Thought

The way we approach the study of financial systems, societal progress, and human behavior is constantly evolving. As the world faces new challenges and opportunities, it is expected that the future of economic thought will adapt by integrating more diverse perspectives. This shift will likely reflect advances in technology, changes in the global political landscape, and increased awareness of social and environmental concerns. The future will require rethinking traditional models while embracing innovation and inclusivity in analyzing economic processes.

Key Emerging Areas

Several areas are expected to gain more focus in the coming years:

- Sustainable Development: Growing concerns over environmental degradation will drive the emphasis on models that incorporate ecological considerations alongside growth goals.

- Technological Advancements: The role of digital transformation and innovations like AI, automation, and blockchain are anticipated to reshape traditional economic frameworks.

- Inclusive Growth: Future theories will likely focus on reducing disparities in wealth and providing more equitable opportunities across different societal groups.

Possible Shifts in Theoretical Perspectives

As economic thought evolves, there will likely be a greater emphasis on the following concepts:

- Behavioral Insights: Incorporating psychological principles into economic theory will provide a more accurate understanding of decision-making and market behavior.

- Global Cooperation: Given the interconnectedness of modern economies, collaborative international frameworks may become central in addressing global challenges.

- Digital Economies: The rise of digital goods, services, and cryptocurrencies will lead to new economic models that prioritize virtual spaces and online markets.

Policy Implications of Future Trends

As new trends shape the future, economic policies will need to adapt. Policymakers will likely focus on addressing both traditional concerns, such as inflation and unemployment, as well as newer issues arising from technological progress and environmental responsibility. The following table outlines some areas where policy changes may be needed:

| Focus Area | Policy Implication |

|---|---|

| Sustainability | Regulations promoting green technologies, reducing carbon footprints, and encouraging sustainable consumption. |

| Technology | Developing policies to govern AI, digital currencies, and the impact of automation on labor markets. |

| Inclusive Growth | Policies aimed at reducing inequality, improving education, and increasing access to healthcare and social services. |

The future of economic thought promises a shift toward more comprehensive models that consider a wider range of factors. Policymakers, business leaders, and academics alike will need to collaborate to address the complexities of global progress in a balanced and sustainable way.