In this section, we will explore an engaging way to test and enhance your skills in financial planning through a dynamic and interactive simulation. The activity allows participants to make key decisions and manage a set of resources, learning valuable lessons in decision-making, resource allocation, and strategy development along the way.

The goal is to equip players with the tools they need to navigate the complexities of real-world financial choices. Whether you are aiming to achieve a specific outcome or simply trying to improve your overall money management, this hands-on experience offers practical insights that can be applied beyond the game.

Effective management is at the heart of this experience, and the strategies you employ will shape your success. Through trial and error, you’ll gain a deeper understanding of how various financial principles come into play, and how to adapt your approach to meet ever-changing circumstances.

Success in this simulation is not just about winning but about learning the nuances of managing finances in a controlled yet challenging environment.

Understanding the Financial Planning Simulation

This interactive experience provides a platform to sharpen your financial management skills through a series of simulated scenarios. Participants are tasked with making critical decisions about money management, balancing competing priorities, and adapting to changing circumstances. By engaging with the simulation, players gain a deeper understanding of personal finance, resource allocation, and long-term planning.

The goal is to simulate real-life financial decision-making processes in a way that is both educational and engaging. The activity helps individuals practice managing resources effectively and learn to anticipate challenges while sticking to a strategy.

| Key Concepts | How They Apply |

|---|---|

| Resource Management | Deciding how to allocate funds effectively for different needs and priorities. |

| Long-Term Planning | Setting and achieving financial goals over extended periods. |

| Risk Management | Handling unexpected financial obstacles and making adjustments to your strategy. |

| Decision Making | Evaluating different options and understanding their impact on overall goals. |

Through participation, players gain a practical sense of how to approach and manage finances in both simple and complex situations. The insights gained from each decision-making moment can be applied in real-world scenarios to improve financial literacy and decision-making skills.

How to Approach Budgeting in the Game

Successfully managing your resources in this activity requires a clear and structured approach. Developing a strategy for how to allocate funds and prioritize spending can make a significant difference in achieving your objectives. By understanding the game’s structure and applying effective financial principles, players can optimize their decisions and enhance their performance.

To begin, it’s essential to identify key areas where funds need to be allocated. Focus on the following strategies to manage your resources effectively:

- Prioritize Necessities: Make sure to cover the essential expenses first before considering discretionary spending.

- Set Realistic Goals: Define clear financial objectives and work towards achieving them without overextending yourself.

- Track Spending: Regularly monitor your spending to ensure that you’re staying on track and adjusting when necessary.

- Plan for Unexpected Costs: Build flexibility into your plan to accommodate unforeseen expenses.

Additionally, it’s important to regularly reassess your strategy. Throughout the simulation, you may need to adapt based on new challenges or changing circumstances. By staying flexible and ready to adjust your tactics, you can better handle the unpredictability of the activity.

- Review your financial goals at each stage of the game.

- Consider how each decision impacts your long-term success.

- Be prepared to make adjustments as you encounter unexpected obstacles.

By combining solid planning with the ability to adapt, you will be well-equipped to succeed in the game and master the art of resource management.

Step-by-Step Guide to Winning the Game

Achieving success in this interactive simulation requires a well-thought-out plan, careful decision-making, and the ability to adapt to new challenges. By following a step-by-step approach, players can maximize their chances of reaching their financial goals and mastering the game’s requirements. The key is to stay organized, make informed choices, and continuously assess progress.

Here’s a clear path to help you navigate the experience:

- Understand the Rules: Familiarize yourself with the game’s structure and the goals you need to achieve. Knowing what’s expected will help you make strategic decisions.

- Set Clear Objectives: Determine what success looks like for you in the game. Whether it’s managing resources efficiently or meeting specific financial targets, having defined goals is essential.

- Plan Your Resources: Start by allocating your funds wisely. Prioritize essentials, and make sure you have enough for unexpected costs that may arise later.

- Track Progress Regularly: Monitor how well you’re sticking to your plan. Check if you’re on target to meet your goals and make adjustments if necessary.

- Adapt to Changes: Be prepared for any unexpected obstacles. Flexibility is crucial in adapting your strategy as circumstances shift throughout the game.

- Evaluate Outcomes: After each decision, review the consequences and determine whether you need to adjust your approach for the next round. Constantly refining your

Common Mistakes in Financial Simulations

While participating in financial planning simulations, many players make avoidable mistakes that hinder their ability to succeed. These errors often arise from a lack of preparation, poor decision-making, or failing to adapt to changing circumstances. Recognizing these common pitfalls and learning how to avoid them can significantly improve your chances of achieving your financial goals.

Below are some of the most frequent mistakes made during the simulation:

- Ignoring Long-Term Goals: Focusing solely on short-term needs can lead to poor decision-making that affects long-term success. It’s important to keep your bigger objectives in mind.

- Overlooking Unexpected Costs: Failing to plan for unforeseen expenses can quickly derail your strategy. Always set aside a portion of your resources for emergencies.

- Underestimating Resource Allocation: Misjudging how much to allocate to each area can lead to shortages or wasted resources. Be strategic and ensure each decision aligns with your overall plan.

- Being Too Conservative: Playing it too safe can limit your potential growth. It’s important to take calculated risks when appropriate, especially when opportunities arise.

- Neglecting to Track Progress: Without monitoring your progress, it’s difficult to know whether you’re on the right path. Regularly reassess your financial situation and adjust your plan accordingly.

- Failing to Adapt to Changes: Sticking rigidly to an initial plan can prevent you from seizing new opportunities or addressing unexpected challenges. Flexibility is key to navigating dynamic situations.

By being aware of these common mistakes and actively avoiding them, you can improve your strategy and enhance your ability to succeed in any financial scenario.

Common Mistakes in Financial Simulations

While participating in financial planning simulations, many players make avoidable mistakes that hinder their ability to succeed. These errors often arise from a lack of preparation, poor decision-making, or failing to adapt to changing circumstances. Recognizing these common pitfalls and learning how to avoid them can significantly improve your chances of achieving your financial goals.

Below are some of the most frequent mistakes made during the simulation:

- Ignoring Long-Term Goals: Focusing solely on short-term needs can lead to poor decision-making that affects long-term success. It’s important to keep your bigger objectives in mind.

- Overlooking Unexpected Costs: Failing to plan for unforeseen expenses can quickly derail your strategy. Always set aside a portion of your resources for emergencies.

- Underestimating Resource Allocation: Misjudging how much to allocate to each area can lead to shortages or wasted resources. Be strategic and ensure each decision aligns with your overall plan.

- Being Too Conservative: Playing it too safe can limit your potential growth. It’s important to take calculated risks when appropriate, especially when opportunities arise.

- Neglecting to Track Progress: Without monitoring your progress, it’s difficult to know whether you’re on the right path. Regularly reassess your financial situation and adjust your plan accordingly.

- Failing to Adapt to Changes: Sticking rigidly to an initial plan can prevent you from seizing new opportunities or addressing unexpected challenges. Flexibility is key to navigating dynamic situations.

By being aware of these common mistakes and actively avoiding them, you can improve your strategy and enhance your ability to succeed in any financial scenario.

How to Track Your Progress Effectively

To succeed in any financial simulation, it’s essential to monitor your progress regularly. Tracking your performance allows you to identify whether you’re meeting your goals, staying within your limits, and adjusting your strategy when necessary. Without consistent tracking, it’s difficult to make informed decisions or respond to unexpected challenges.

Here are some methods to help you keep a close eye on your progress:

- Set Clear Milestones: Break down your overall goals into smaller, measurable targets. This way, you can track your success step by step and make adjustments as needed.

- Use a Progress Tracker: Utilize spreadsheets or financial apps to log your decisions, resources, and outcomes. Visual representations such as graphs can make it easier to see how well you’re doing over time.

- Review Regularly: Schedule regular check-ins to review your progress. Compare your current position to your planned milestones to identify any discrepancies and correct them early.

- Analyze Key Metrics: Focus on important indicators like resource usage, spending patterns, and goal achievement rates. These metrics will give you a clearer picture of your overall performance.

- Adjust Strategy Based on Results: If you’re falling short of your goals, it’s important to reassess your approach. Look at where things went wrong and adapt your strategy to improve future outcomes.

By keeping track of your progress, you can make more informed decisions, stay on course, and ultimately increase your chances of success in any financial scenario.

Maximizing Your Budget in the Game

To succeed in this interactive simulation, you must make the most of the resources available to you. Managing your funds efficiently is key to overcoming obstacles and achieving your goals. By strategically allocating your resources, you can optimize your performance and maximize your potential for success.

Prioritize Essential Expenses

Start by identifying your most critical needs. Allocate funds first to cover the essentials, such as immediate expenses or areas that directly impact your ability to progress. This ensures that you have a solid foundation to build upon and can weather any unexpected challenges that arise.

Balance Flexibility and Control

While it’s important to maintain control over your spending, allow some flexibility in your strategy. Unexpected events will occur, and being too rigid in your approach can hinder your ability to respond effectively. Keep a portion of your resources reserved for adjustments when new opportunities or challenges arise.

Smart allocation is key to maximizing your resources, ensuring you meet your goals while preparing for unforeseen circumstances. Adapting to the flow of the simulation and being mindful of how you distribute your assets will significantly improve your chances of success.

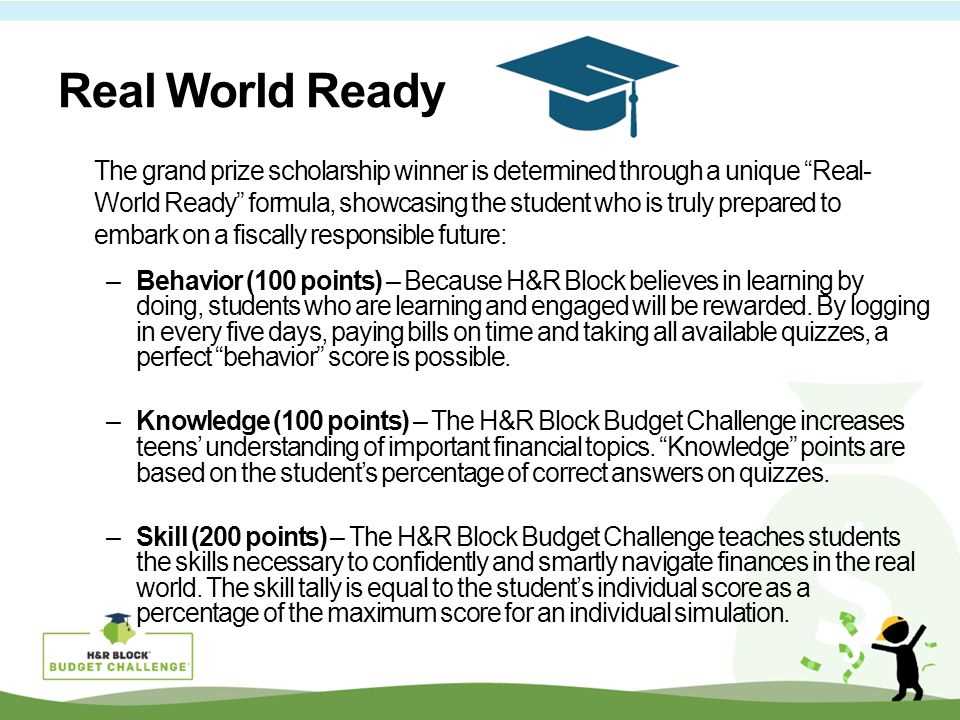

Understanding the Scoring System

In any financial simulation, knowing how your actions are scored is crucial for strategizing and improving your performance. The scoring system is designed to evaluate how well you manage your resources, meet your goals, and make decisions under pressure. By understanding the factors that contribute to your score, you can make more informed choices and increase your chances of success.

Key Factors that Affect Your Score

Several key components are taken into consideration when calculating your score. These include:

- Resource Allocation: How efficiently you distribute your funds across various needs and objectives.

- Goal Achievement: Whether you meet specific financial milestones within the given time frame.

- Adaptability: Your ability to adjust your strategy based on changing circumstances or unexpected challenges.

- Decision Quality: The effectiveness of your financial choices in achieving long-term success.

Maximizing Your Score

To maximize your score, it’s important to balance short-term needs with long-term objectives. Keeping track of progress, adapting your approach as the simulation evolves, and prioritizing key actions will ensure that you’re making the best use of available resources. The goal is to consistently make well-informed decisions that align with both your immediate goals and future success.

By mastering the scoring system, you can improve your overall performance and move closer to achieving the best possible outcome in the simulation.

Key Strategies for Success in Budgeting

Achieving success in financial planning requires a combination of careful strategy, resource management, and consistent decision-making. With the right approach, you can effectively manage your resources, minimize waste, and reach your financial goals. Here are some essential strategies that can help you excel in any financial simulation or real-world planning scenario.

Strategy Description Prioritize Needs Over Wants Focus on meeting essential expenses first, ensuring that basic needs are always covered before considering optional expenditures. Set Clear, Achievable Goals Establish specific, measurable objectives to guide your decisions and track your progress over time. Track Spending Regularly Monitor your expenses frequently to ensure you’re staying within limits and not overspending in any area. Be Adaptable Respond to changing conditions by adjusting your strategy when necessary, allowing for flexibility in the face of unexpected events. Build an Emergency Fund Set aside a portion of your resources for emergencies, ensuring that you have a buffer in case of unforeseen circumstances. By implementing these strategies, you can ensure that your financial decisions are thoughtful and well-organized, setting yourself up for long-term success. These practices can be applied both in simulations and in real-life financial planning, helping you achieve your objectives while maintaining control over your resources.

Essential Tools for Completing the Challenge

To succeed in any financial planning or simulation task, having the right set of tools is critical. These tools allow you to track your progress, make informed decisions, and stay organized throughout the process. Whether it’s software for calculating expenses or templates for planning, the right resources can streamline your efforts and enhance your overall strategy.

Financial Tracking Software: A robust tracking tool is essential for monitoring your income, expenses, and remaining resources. These programs allow you to input data and visualize your spending patterns, helping you make quick adjustments when necessary. Tools like spreadsheets or specialized apps offer a user-friendly way to keep everything organized.

Spending Templates: Having a well-structured template for outlining your income and expenditures can help you stay on top of your goals. These templates allow you to categorize expenses and set limits, making it easier to manage your finances and identify areas where you can cut back or allocate more funds.

Financial Calculators: Calculators that estimate loan payments, tax deductions, and savings goals can be invaluable when making complex decisions. These tools help ensure that your decisions are financially sound and based on accurate predictions, allowing for better long-term planning.

Budgeting Apps: For on-the-go management, budgeting apps allow you to keep track of spending in real-time. Many apps are designed to sync with your bank accounts, making it easy to categorize and update transactions automatically. These apps can also send alerts when you’re nearing your limits, helping you maintain discipline.

Utilizing these tools effectively will not only simplify your financial planning but also help you stay focused on your goals. Each of these resources plays a role in ensuring that you make the right choices and maintain control over your resources throughout the entire process.

How to Deal with Financial Setbacks

Unexpected financial obstacles can throw off even the best-laid plans. Whether it’s due to unforeseen expenses, a temporary loss of income, or poor financial decisions, these setbacks can be overwhelming. However, with the right strategies, you can recover and move forward. The key is to remain proactive, reevaluate your situation, and make the necessary adjustments to stay on track.

Steps to Overcome Financial Hurdles

When dealing with financial setbacks, it’s important to stay calm and take the following steps to regain control:

- Evaluate the Impact: Understand the extent of the setback. Is it a temporary issue or a longer-term problem?

Budget Challenge Solutions for Beginners

For those just starting to manage their finances, it’s crucial to take small but deliberate steps towards achieving financial stability. Developing a practical and sustainable plan can seem overwhelming at first, but with the right approach, it becomes easier. In this section, we’ll explore effective strategies and solutions that can help beginners stay on track and reach their financial goals without feeling lost in the process.

Steps to Get Started

When beginning the journey towards financial stability, having a clear plan in place can make all the difference. Start by focusing on the following actions to lay a solid foundation:

- Track Your Income and Expenses: Knowing exactly how much you earn and spend each month is the first step towards controlling your finances.

- Set Achievable Goals: Break down large goals into smaller, manageable steps to prevent feeling overwhelmed.

- Prioritize Essential Costs: Ensure that essential expenses, such as housing, food, and transportation, are covered first.

- Build a Safety Net: Establish a savings account for emergencies or unexpected expenses to avoid financial strain.

- Review and Adjust Regularly: Regularly check your progress to ensure you’re staying on track and making necessary adjustments as needed.

Common Pitfalls to Avoid

While taking the first steps toward managing your finances, beginners often make several common mistakes. Avoiding these errors can make the process much smoother:

- Ignoring Small Purchases: Small, seemingly insignificant expenses can add up quickly. Keep track of all spending to prevent overspending.

- Overcomplicating Your Plan: Keep things simple and focus on the basics to avoid feeling overwhelmed or losing motivation.

- Skipping Budget Reviews: Your financial situation may change over time. Regularly reviewing your plan ensures you’re always on the right path.

- Living Beyond Your Means: Always make sure to live within your income to avoid accumulating unnecessary debt.

Helpful Tools for Success

In the modern digital age, there are plenty of tools available that can simplify financial tracking and management. Below are some tools that beginners can use to make the process easier:

Tool Function Expense Tracking Apps Helps monitor daily spending and categorize expenses for easier analysis. Budget Spreadsheets Provides a clear overview of income, expenses, and savings goals to track progress. Automatic Saving Systems Automatically transfers a set amount to savings accounts to build financial security. With the right mindset and tools in place, anyone can begin managing their finances more effectively. Start small, stay consistent, and adjust as necessary to ensure long-term financial success.

Advanced Tips for Experienced Players

For those who are already familiar with financial management and have some experience under their belt, advancing to the next level requires refining strategies and incorporating more sophisticated tactics. By using advanced approaches, you can maximize your efficiency, stay ahead of unexpected challenges, and achieve long-term success. In this section, we’ll discuss expert tips that can help experienced players further sharpen their financial skills and take control of their financial future.

Refining Your Strategy

Once you’ve gained some experience, it’s time to move beyond basic budgeting and explore more advanced methods that will help you optimize your financial decisions. These techniques can provide greater flexibility and help you reach your goals more efficiently:

- Diversify Income Streams: Relying on a single source of income can be limiting. Explore side gigs, investments, or passive income opportunities to broaden your financial base.

- Optimize Cash Flow Management: Pay close attention to your cash flow, ensuring that you have enough liquidity to cover expenses without compromising savings or investments.

- Utilize Financial Forecasting: Regularly forecast your finances to predict future trends and prepare for any potential financial shifts.

- Refine Debt Management: Beyond paying off existing debts, focus on minimizing interest costs by managing payment schedules and consolidating high-interest loans.

Leveraging Technology for Efficiency

In today’s digital age, technology can significantly enhance your financial management process. Experienced players can take advantage of more advanced tools to automate and streamline their financial practices:

- Financial Automation Tools: Set up automatic transfers for savings, bills, and investments to ensure consistency and avoid missed payments.

- Advanced Expense Tracking Software: Use tools that offer more detailed analysis and customization, helping you monitor spending in real-time and adjust quickly.

- Investment Portfolio Trackers: Monitor and optimize your investments with tools that give insights into asset performance and risk management.

Planning for the Future

Long-term planning becomes essential as you progress in managing your finances. By focusing on future goals, you can ensure stability and avoid unexpected setbacks. Here are some strategies for preparing for the future:

- Set Long-Term Financial Goals: Look beyond short-term milestones and set ambitious long-term goals, such as retirement savings, property acquisition, or financial independence.

- Engage in Tax Optimization: Develop strategies that minimize your tax liabilities, such as utilizing tax-deferred accounts and exploring deductions.

- Review Estate Planning: Consider creating a will or setting up a trust to secure your assets and ensure a smooth transition for your loved ones.

By implementing these advanced tips, you can take your financial management skills to the next level, improving both short-term stability and long-term growth. As an experienced player, it’s essential to stay proactive and adaptable to navigate the complexities of modern finance.

How to Adjust Your Strategy Mid-Game

In any game that involves financial planning or resource management, it’s important to recognize when things aren’t going as planned and make necessary adjustments. Adapting your approach mid-way through can be the difference between failure and success. Whether it’s due to unexpected challenges, shifts in your goals, or new opportunities, knowing how to pivot and recalibrate your strategy will ensure that you stay on track and continue progressing toward your objectives.

Here are several key strategies for making effective adjustments when the need arises:

- Evaluate Your Progress Regularly: Check in with your current situation often. Analyze whether you are meeting your initial expectations or if certain goals need to be altered to reflect the current circumstances.

- Reassess Your Resources: If something isn’t working as planned, take a moment to re-evaluate the resources at your disposal. Are there areas where you can reallocate funds or efforts to better suit your new direction?

- Adjust Risk Levels: Sometimes, the strategy needs to become more conservative or aggressive based on the current financial environment. Weigh the risks associated with any changes and make decisions that balance risk and reward appropriately.

- Modify Your Goals: Don’t be afraid to adjust your goals as you move forward. It may be necessary to redefine short-term objectives to fit your updated path or to realign long-term plans according to new realities.

By recognizing when it’s time to adapt, and by implementing a clear, methodical process for adjusting your plan, you can overcome setbacks and continue making progress toward your desired outcome. Flexibility is a key trait of successful players who know how to thrive in changing conditions.

Overcoming Common Budgeting Obstacles

When managing finances, players often encounter several barriers that can make it difficult to stay on track and reach their goals. Whether it’s unexpected expenses, poor planning, or lack of motivation, overcoming these obstacles is essential for maintaining progress. Identifying the most common challenges and knowing how to tackle them can help you stay in control of your financial strategy, even when faced with setbacks.

Here are some common issues that players face and strategies to overcome them:

- Unforeseen Expenses: Unexpected costs can throw off any plan. It’s important to have a contingency fund or a flexible approach that allows for adjustments without derailing your overall strategy. Prioritize essential expenses and find ways to cut back on non-essentials.

- Overestimating Resources: Many players start with overly ambitious expectations of their available resources. It’s crucial to remain realistic about what you have at your disposal and adjust your expectations accordingly. Focus on achievable goals and reallocate resources as needed.

- Lack of Consistency: Staying consistent with your plan can be difficult, especially if there are distractions or temptations. Break your strategy into smaller, manageable tasks and set regular checkpoints to assess your progress. Consistency is key to long-term success.

- Unrealistic Goals: Setting goals that are too ambitious or not aligned with current capabilities can lead to frustration and a sense of failure. Regularly review your objectives and modify them to ensure they remain attainable and relevant to your circumstances.

- Emotional Spending: Many players struggle with impulse spending when emotions come into play. Recognize emotional triggers and create strategies to avoid making hasty financial decisions. Planning and self-control are essential for overcoming this challenge.

By identifying these obstacles early and employing strategies to overcome them, you can maintain better control of your financial journey and stay focused on your objectives. Persistence, flexibility, and smart decision-making are key to overcoming the common challenges that arise in financial planning games.

Overcoming Common Budgeting Obstacles

When managing finances, players often encounter several barriers that can make it difficult to stay on track and reach their goals. Whether it’s unexpected expenses, poor planning, or lack of motivation, overcoming these obstacles is essential for maintaining progress. Identifying the most common challenges and knowing how to tackle them can help you stay in control of your financial strategy, even when faced with setbacks.

Here are some common issues that players face and strategies to overcome them:

- Unforeseen Expenses: Unexpected costs can throw off any plan. It’s important to have a contingency fund or a flexible approach that allows for adjustments without derailing your overall strategy. Prioritize essential expenses and find ways to cut back on non-essentials.

- Overestimating Resources: Many players start with overly ambitious expectations of their available resources. It’s crucial to remain realistic about what you have at your disposal and adjust your expectations accordingly. Focus on achievable goals and reallocate resources as needed.

- Lack of Consistency: Staying consistent with your plan can be difficult, especially if there are distractions or temptations. Break your strategy into smaller, manageable tasks and set regular checkpoints to assess your progress. Consistency is key to long-term success.

- Unrealistic Goals: Setting goals that are too ambitious or not aligned with current capabilities can lead to frustration and a sense of failure. Regularly review your objectives and modify them to ensure they remain attainable and relevant to your circumstances.

- Emotional Spending: Many players struggle with impulse spending when emotions come into play. Recognize emotional triggers and create strategies to avoid making hasty financial decisions. Planning and self-control are essential for overcoming this challenge.

By identifying these obstacles early and employing strategies to overcome them, you can maintain better control of your financial journey and stay focused on your objectives. Persistence, flexibility, and smart decision-making are key to overcoming the common challenges that arise in financial planning games.