Mastering the essentials of market investments requires both theoretical understanding and practical skills. For anyone preparing for a financial proficiency test, having a clear grasp of fundamental concepts, tools, and strategies is essential. This guide is designed to help you navigate through the key topics often covered in assessments that evaluate your knowledge of the financial world.

Throughout this article, you will find insights into common topics, terminology, and techniques that are frequently tested in knowledge evaluations. Whether you are just starting or looking to refine your expertise, this resource will equip you with the necessary preparation to succeed. From basic concepts to advanced strategies, the content is structured to provide a comprehensive understanding of the material.

Trading Knowledge Assessment Insights

Understanding the key principles of financial markets is essential for anyone preparing for proficiency tests in the field of investments. In this section, we will explore various aspects of the knowledge required to succeed in these assessments, focusing on essential concepts and techniques that are commonly tested. The ability to comprehend market dynamics, interpret data, and apply strategies is critical for both beginners and experienced individuals.

Preparing for a financial competency evaluation involves a mix of theoretical knowledge and practical skills. Key topics often include understanding how market indicators work, interpreting financial reports, and making informed decisions based on various market factors. The following content will provide you with an overview of common subjects, practical tips for studying, and resources that will enhance your preparation.

Market Fundamentals: Grasping the basic terminology and processes is crucial for any aspiring trader. Topics such as risk management, market orders, and chart analysis form the backbone of the subject matter, enabling you to assess opportunities and make sound decisions in real-world scenarios.

Data Analysis Techniques: A solid understanding of how to interpret market data can significantly improve your chances of success. Learning to analyze trends, financial statements, and key performance indicators (KPIs) will help you understand how markets behave and how to predict potential movements.

By familiarizing yourself with these critical areas, you can approach the test with confidence, knowing that you have a comprehensive understanding of what is required. Preparing effectively is key to passing any proficiency assessment in the financial field.

Overview of Trading Education

To succeed in the financial markets, a strong educational foundation is essential. The world of investments is vast and multifaceted, requiring both theoretical knowledge and practical experience. Whether you are just beginning or aiming to enhance your skills, understanding the core concepts is crucial to navigating complex market dynamics effectively.

Financial education typically covers a variety of topics, each contributing to a well-rounded understanding of market behavior. These areas include fundamental concepts, advanced strategies, and technical tools used for analyzing market trends and making informed decisions. Gaining knowledge in these subjects is essential for anyone looking to build a successful career in trading.

- Market Basics: Understanding how different financial instruments work and how they interact within the broader economy is the first step in any learning process.

- Risk Management: Grasping the importance of managing risk is a key factor in sustainable success, preventing significant losses during volatile periods.

- Technical Analysis: Learning how to read charts, interpret patterns, and use indicators is vital for making informed decisions in fast-moving markets.

- Fundamental Analysis: Evaluating financial health, company performance, and economic conditions provides deeper insights into potential investment opportunities.

- Market Psychology: Understanding investor behavior and market sentiment can greatly enhance decision-making, especially in uncertain or turbulent times.

Each of these areas builds on one another, creating a robust framework for making informed investment choices. As you progress, you will encounter different learning methods, such as simulations, case studies, and real-world examples, which help reinforce these concepts in a practical context.

In conclusion, an effective educational approach not only prepares you for assessments but also equips you with the tools needed for success in the financial markets. A structured, methodical approach to learning these principles will help you gain confidence and mastery in the field of trading.

Key Concepts for Trading Knowledge Assessments

To excel in any financial proficiency test, it’s important to understand the core principles that underpin market activity. These concepts form the foundation of your preparation and are essential for making informed decisions in real-world trading scenarios. A thorough understanding of these topics will not only help you succeed in assessments but also enhance your ability to apply knowledge practically in the financial world.

In this section, we will highlight some of the most important topics that are often tested. Each of these concepts plays a critical role in developing a well-rounded understanding of the financial markets. Below is a breakdown of key areas that you should focus on during your study.

| Concept | Description |

|---|---|

| Market Mechanics | Understanding how markets operate, including order types, market makers, and liquidity. |

| Risk Management | Techniques to minimize potential losses and ensure long-term profitability, such as stop-loss orders and diversification. |

| Technical Indicators | Key tools used for chart analysis, such as moving averages, RSI, and MACD, to predict price movements. |

| Fundamental Analysis | Evaluating financial health and performance of companies through earnings reports, balance sheets, and economic indicators. |

| Trade Execution | Understanding the process of placing trades, including market orders, limit orders, and order execution strategies. |

| Market Sentiment | Interpreting investor behavior and sentiment to predict future price movements and market trends. |

By mastering these key concepts, you will be well-prepared for any assessment, as they represent the essential building blocks of successful trading. A deep understanding of market dynamics, along with a strategic approach to risk and analysis, is crucial for both passing tests and making informed decisions in actual trading environments.

Understanding Market Basics

To navigate the world of financial investments successfully, it’s essential to grasp the fundamental principles that drive the markets. These basics form the bedrock of more advanced knowledge and play a key role in making informed decisions. Whether you are looking to invest in companies or trade commodities, understanding how markets function is crucial for long-term success.

Market Participants

The financial ecosystem consists of various players, each contributing to market activity. Investors, traders, institutions, and market makers all interact within the system, affecting prices and liquidity. It’s important to understand the roles each participant plays in determining how assets are valued and traded.

Supply and Demand

At its core, the market operates on the principles of supply and demand. The price of any asset, whether it’s a share of a company or a commodity, is determined by how much of it is available and how much demand there is for it. Understanding these dynamics helps in predicting price movements and making well-timed investment decisions.

Common Mistakes to Avoid in Assessments

When preparing for financial assessments, it’s easy to overlook key details or make hasty decisions that can negatively impact your performance. Avoiding common errors is crucial to ensuring that you accurately demonstrate your knowledge and skills. By being aware of these pitfalls, you can approach the evaluation process with more confidence and clarity.

Rushing Through Questions: One of the most common mistakes is rushing through questions without fully understanding them. It’s essential to read each question carefully and ensure that you comprehend what is being asked before selecting an answer. Taking a moment to think critically about each query can prevent costly mistakes.

Ignoring Time Management: Properly managing your time during an assessment is key. Spending too much time on one question may cause you to rush through others. It’s important to allocate your time wisely and ensure that you give every question the attention it deserves. Setting a pace early on will help you stay on track and avoid unnecessary pressure later in the test.

Misinterpreting Key Terms: In any financial assessment, understanding the terminology is fundamental. Misinterpreting important terms or concepts can lead to incorrect answers. Take the time to familiarize yourself with key terms beforehand and review any definitions during the test if needed.

Neglecting to Review Your Work: Many individuals fail to review their responses before submitting them. Mistakes such as overlooked errors, skipped questions, or misread instructions can easily go unnoticed if you don’t take the time to double-check your work. Always leave a few minutes at the end to review your answers carefully.

By staying mindful of these common mistakes, you can improve your chances of performing well and achieve a more accurate reflection of your knowledge. Being prepared, focused, and organized is the key to success in any financial proficiency assessment.

How to Study for Trading Assessments

Preparing for a financial proficiency assessment requires a focused and strategic approach. It’s not enough to simply memorize facts; you need to understand concepts deeply and be able to apply them in various scenarios. Effective studying involves breaking down complex topics into manageable parts, practicing regularly, and testing your knowledge to identify areas for improvement.

Here are some practical steps to help you study effectively and increase your chances of success in any trading-related evaluation:

| Study Technique | Description |

|---|---|

| Create a Study Plan | Outline a clear study schedule that allocates time for each major topic. Consistency is key to mastering complex material. |

| Focus on Key Concepts | Prioritize the most frequently tested and fundamental topics. Understanding the basics will help you solve more advanced problems. |

| Use Practice Tests | Take mock assessments to simulate real test conditions. This helps improve time management and identifies areas needing further review. |

| Review Mistakes | After completing practice questions, review incorrect answers to understand why they were wrong. Learning from mistakes helps reinforce correct knowledge. |

| Study with Peers | Collaborating with others allows for different perspectives and can expose you to topics you may have missed in solo study. |

By incorporating these strategies into your study routine, you’ll be better prepared to tackle the assessment with confidence. Remember, the goal is to understand the material in-depth, not just memorize answers. Focused, consistent preparation will ensure that you’re ready for any challenge that comes your way.

Important Terms for Trading Assessments

To succeed in any trading proficiency evaluation, it’s essential to have a strong grasp of key terminology. These terms form the foundation of the concepts you’ll encounter and help you navigate both the theoretical and practical aspects of financial markets. Understanding these terms will not only aid you during the assessment but also enhance your ability to make informed decisions in real-world trading situations.

Below are some of the most important terms you should be familiar with when preparing for any trading-related evaluation:

| Term | Definition |

|---|

| Term | Definition |

|---|---|

| Liquidity | The ease with which an asset can be bought or sold without affecting its price. |

| Volatility | The degree of variation in the price of an asset over time, often used as a measure of risk. |

| Market Order | An order to buy or sell a security immediately at the current market price. |

| Limit Order | An order to buy or sell a security at a specified price or better, with the trade only executing at the desired price or better. |

| Spread | The difference between the buying price (ask) and the selling price (bid) of an asset. |

| Margin | Using borrowed funds from a financial institution to trade an asset, typically for larger positions. |

| Short Selling | The practice of selling a security that is not currently owned, typically with the intention of repurchasing it at a lower price. |

| Blue Chip | Stocks from large, well-established, and financially stable companies that are expected to perform consistently over time. |

| Dividend | A payment made by a company to its shareholders from its profits, usually on a quarterly basis. |

| Portfolio | A collection of investments held by an individual or institution, designed to meet specific financial objectives. |

These terms are fundamental to understanding how the markets work and will be essential as you navigate your way through any assessments. Being familiar with these definitions will help you understand the material in greater depth and apply the concepts effectively in practice.

Best Resources for Financial Proficiency Assessments

Preparing for any financial proficiency assessment can feel overwhelming, but having access to the right resources makes the process much more manageable. With the vast amount of learning materials available, selecting the most effective tools is crucial to mastering the necessary concepts. From books and online courses to community forums and practice tests, there are numerous resources to help you achieve your goals.

Here are some of the best resources to aid your preparation:

- Online Courses – Many websites offer structured courses that cover key concepts in financial markets and trading. These often include video lectures, quizzes, and assignments to test your understanding. Websites such as Udemy, Coursera, and Khan Academy are great starting points.

- Books and Guides – Comprehensive books that explain trading strategies, financial terminology, and market fundamentals can be an invaluable resource. Some recommended titles include “The Intelligent Investor” by Benjamin Graham and “Market Wizards” by Jack Schwager.

- Practice Tests – Simulating the real test environment with practice tests helps improve both your knowledge and time management skills. Many online platforms, such as Investopedia and financial exam prep sites, offer mock tests designed to mimic actual assessments.

- Financial Forums and Communities – Engaging with online communities can provide valuable insights and practical advice from individuals who have already taken similar tests. Websites like Reddit, Trade2Win, and The Trader’s Podcast forum offer helpful discussions on market strategies and exam tips.

- Webinars and Workshops – Participating in live webinars and workshops hosted by industry experts can enhance your learning experience. Many institutions offer free or paid webinars that focus on specific topics related to financial assessments.

- Official Resource Pages – Don’t overlook the official websites of financial institutions or exam providers. They often provide sample questions, study guides, and tips that are directly aligned with the content of the assessment.

By using a combination of these resources, you can build a well-rounded understanding of the topics and feel more prepared for the evaluation. Consistency and strategic use of these materials will ensure that you’re ready to tackle any challenges that arise.

How to Interpret Market Data

Understanding market data is essential for anyone looking to make informed decisions in the financial world. This data provides insights into the performance of various assets and enables traders and investors to gauge trends, volatility, and potential opportunities. By analyzing key metrics and figures, you can form strategies that align with your financial goals.

Here are some key aspects to consider when interpreting market data:

- Price Movements – The price of an asset fluctuates based on supply and demand. Understanding how prices move can help you predict market trends. Pay attention to opening, closing, high, and low prices within specific time frames.

- Volume – Trading volume indicates the number of shares or contracts traded within a given period. A higher volume suggests increased interest and activity in the market, while lower volume may indicate less investor confidence or market stagnation.

- Trends – Identifying trends is crucial for making informed decisions. Trends can be upward, downward, or sideways. Analyzing historical data helps you understand whether a market is in a bullish or bearish phase and how long such trends may last.

- Volatility – Volatility measures the rate at which an asset’s price changes. Assets with high volatility are riskier but offer the potential for greater returns. Understanding volatility allows you to assess risk and adjust your strategies accordingly.

- Indicators and Ratios – Various financial indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, help you assess market conditions. Ratios like the price-to-earnings (P/E) ratio can also provide insights into an asset’s value relative to its earnings.

- News and Events – Economic reports, company earnings, and global events can all significantly influence market behavior. Stay updated on news that may impact the markets, as it often plays a role in price fluctuations and investor sentiment.

By analyzing these elements, you can gain a clearer picture of the market’s movements and make decisions based on data rather than speculation. Understanding how to read and interpret market data is a vital skill that will help you navigate the complexities of the financial world with confidence.

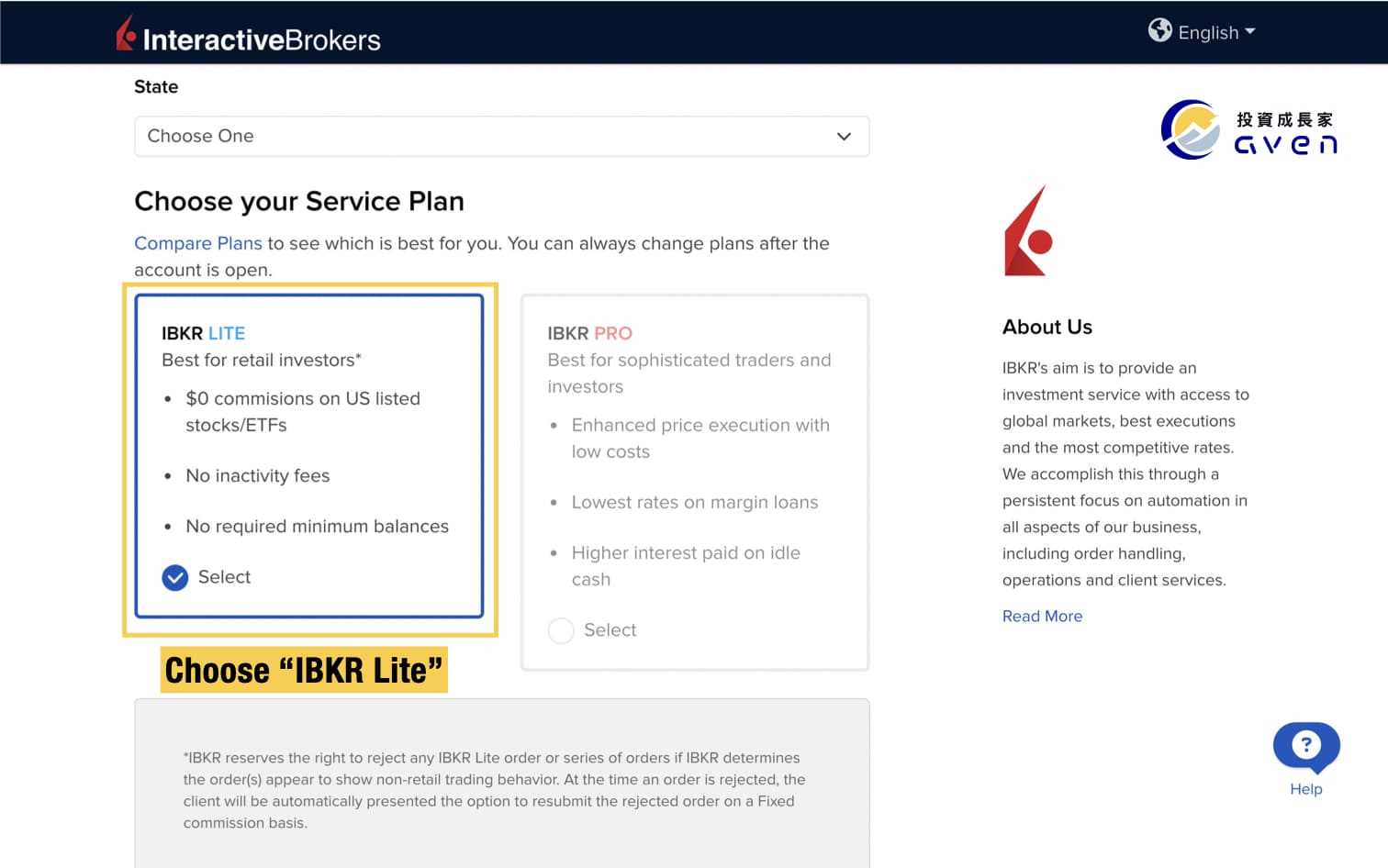

Account Setup Process

Setting up an account for financial transactions is a critical step toward engaging in the world of investments. This process involves several stages, from registration to verification, that ensure the account meets regulatory standards and is ready for use. By following the required steps carefully, you can ensure a smooth experience when beginning to trade or invest in various financial markets.

Registration and Initial Information

The first step in the process is to register your account. This typically involves providing basic personal information such as your name, address, date of birth, and contact details. During this phase, you will also be asked to create a secure password and choose your account type, whether it’s for individual or joint use.

Identity Verification

To comply with legal and regulatory requirements, verifying your identity is necessary. This may include submitting documents such as a government-issued ID, proof of address, and financial statements. The verification process helps prevent fraud and ensures that the account holder is legitimate and meets all eligibility criteria for participating in financial markets.

Once your identity is verified, you can fund your account and set up additional preferences such as trading limits, risk tolerance, and preferred communication methods. It’s important to carefully review all the terms and conditions provided before proceeding with any deposits or trades.

By completing this setup process, you will have full access to your account and be ready to engage in various financial activities, including buying and selling assets, managing investments, and tracking your performance over time.

Tips for Effective Preparation

Preparing for any assessment requires focus, organization, and the right strategies. Whether you’re studying for a financial qualification or any other professional certification, having a clear plan can significantly improve your chances of success. It’s essential to create a study routine, utilize various resources, and stay disciplined throughout your preparation.

Here are some helpful tips to enhance your study process:

- Set Clear Goals – Break down your study sessions into manageable tasks. Set specific, measurable objectives for each study session to keep track of your progress.

- Create a Study Schedule – Plan your study time well in advance. Allocate time for each topic based on its difficulty and importance. Consistency is key, so aim to study a little each day.

- Use Multiple Resources – Don’t rely on just one source of information. Combine textbooks, online courses, videos, and practice tests to get a well-rounded understanding of the material.

- Practice with Mock Tests – Taking practice tests simulates the actual assessment environment. It helps you become familiar with the format and manage your time effectively during the real test.

- Review and Revise Regularly – Regular revision of what you’ve learned helps reinforce the material and improves long-term retention. Set aside time each week to go over previous topics.

- Stay Positive and Manage Stress – Stress is a common barrier to effective learning. Try relaxation techniques such as deep breathing or meditation to stay calm and focused.

By following these strategies and staying committed to your study plan, you can feel more confident as you approach your assessment. Consistent effort, proper planning, and utilizing the right resources are all key factors in achieving success.

Mastering Technical Analysis for Tests

Understanding the fundamentals of market movements and price charts is essential for anyone preparing for an assessment related to financial markets. Technical analysis involves evaluating past price data, volume trends, and chart patterns to make informed predictions about future price movements. Mastering these skills will help you not only excel in tests but also gain valuable insights into market dynamics.

Here are several tips to help you master technical analysis for your studies:

- Learn the Basic Chart Patterns – Study common patterns such as head and shoulders, double tops, and triangles. These formations often provide clues about potential price changes and trend reversals.

- Understand Key Indicators – Familiarize yourself with essential technical indicators like moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. These tools help identify overbought or oversold conditions and market trends.

- Practice Analyzing Historical Data – Analyzing historical price movements will help you understand how markets react under different conditions. It’s crucial to interpret charts in the context of real-time events and adjust predictions accordingly.

- Master Trend Analysis – Recognizing the direction of the market is key. Learn how to identify bull and bear markets, trends, and trend reversals. This will guide your decision-making in any given market environment.

- Develop a Risk Management Strategy – In addition to understanding chart patterns, you need to develop skills in managing risks. This includes knowing when to exit a trade and how to limit potential losses through stop-loss orders or position sizing.

- Use Paper Trading to Practice – Before applying technical analysis in real-world scenarios, use simulated trading platforms to practice your skills. This helps you develop a sense of market movement without the risk of real financial loss.

By focusing on these fundamental areas and applying them regularly, you’ll enhance your ability to analyze market data and perform well in any related assessments. Mastering technical analysis requires patience and continuous practice, but it will provide the tools needed to make confident, informed decisions in financial markets.

Understanding Financial Statements in Trading

Financial statements are essential tools for evaluating the performance of companies and understanding their financial health. For anyone involved in market activities, interpreting these reports accurately can offer invaluable insights into a company’s profitability, stability, and growth potential. Whether you’re assessing an individual asset or analyzing a broader market trend, understanding these documents is key to making informed decisions.

There are three primary types of financial statements that traders should focus on:

- Income Statement – This statement shows a company’s profitability over a specific period, detailing revenues, expenses, and net income. By analyzing it, you can determine whether the company is generating enough revenue to cover its expenses and create profit.

- Balance Sheet – The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a particular point in time. It helps assess the financial stability of a company and provides insights into how its assets are financed, whether through debt or equity.

- Cash Flow Statement – This document tracks the flow of cash in and out of a company. It is particularly useful in assessing a company’s liquidity and its ability to meet short-term obligations without relying on external funding.

By regularly reviewing and understanding these financial reports, traders can gain a deeper understanding of a company’s financial position, which can significantly impact investment strategies. Proper analysis of these statements allows for more informed, strategic decision-making and can help in identifying high-potential opportunities or risks within the market.

Evaluating Stock Performance Metrics

Assessing the performance of an asset or market position involves examining key financial indicators that provide insight into its value, growth potential, and overall stability. These metrics offer traders and investors a way to gauge how well an investment is performing and whether it aligns with their financial goals. Understanding and analyzing these figures is crucial for making informed decisions in a competitive market environment.

Key Metrics for Performance Evaluation

Several important metrics are commonly used to evaluate the performance of assets in the market. These indicators help assess profitability, risk, and growth potential. Here are some of the most important metrics to consider:

- Price-to-Earnings (P/E) Ratio – This ratio compares a company’s share price to its earnings per share (EPS). A high P/E ratio may indicate that the asset is overvalued, while a low P/E ratio could suggest it is undervalued.

- Return on Equity (ROE) – ROE measures a company’s profitability in relation to shareholder equity. A high ROE indicates efficient use of equity capital in generating profits.

- Dividend Yield – This metric represents the annual dividend income as a percentage of the asset’s price. It’s particularly useful for evaluating income-generating investments.

Understanding Volatility and Risk

In addition to profitability metrics, it’s essential to evaluate the risks involved with an asset. Volatility, for example, measures the degree of price fluctuation over time, helping traders understand how much an asset’s price can vary within a short period. Higher volatility typically indicates greater risk but also potential for higher returns.

- Beta – A beta value indicates how much an asset’s price moves in relation to the overall market. A beta greater than 1 suggests the asset is more volatile than the market, while a beta below 1 indicates less risk.

- Standard Deviation – This statistic measures the variation in an asset’s returns. A higher standard deviation indicates more unpredictable price changes, which is useful for assessing potential risk.

By analyzing these performance metrics, investors can develop a clearer picture of an asset’s current position in the market, helping to identify potential opportunities or risks. Understanding the balance between risk and reward is key to creating a successful investment strategy.

Types of Stock Orders You Should Know

When placing trades in the market, it’s essential to understand the different order types available. Each order serves a specific purpose and offers varying levels of control over the trade execution. Knowing which order to use based on market conditions and investment goals can help you achieve more favorable outcomes, whether you’re aiming for a quick buy or sell or seeking to limit your risk exposure.

Common Order Types

Below are some of the most frequently used order types in the financial markets. Each one has unique characteristics that determine how and when trades are executed.

| Order Type | Description |

|---|---|

| Market Order | This order type is executed immediately at the best available price in the market. It’s ideal for traders who want to make a quick trade without worrying about the price movement. |

| Limit Order | A limit order allows traders to specify the maximum price they’re willing to pay for a purchase or the minimum price for a sale. The order is only filled if the market reaches that price or better. |

| Stop Order | A stop order becomes a market order once the asset’s price hits a specified level. It is often used to limit potential losses or protect gains by automatically triggering a trade when the price moves unfavorably. |

| Stop-Limit Order | Similar to a stop order, but once the price reaches the stop level, a limit order is placed instead of a market order, offering more control over the price at which the trade is executed. |

| Trailing Stop Order | A trailing stop allows traders to set a stop order that moves with the market price. This is useful for locking in profits as the asset moves in a favorable direction, but protecting against reversals. |

Choosing the Right Order

The key to successful trading is selecting the order type that best matches your strategy and market conditions. For instance, if you’re willing to accept any price and prioritize speed, a market order may be the right choice. However, if you want more control over the price at which your trade executes, a limit order may be better suited to your needs.

Understanding the difference between stop orders and stop-limit orders is also crucial for managing risk. Stop orders can help you minimize losses in volatile markets, while stop-limit orders allow you to control the price at which the order is filled, though there’s a risk the order may not execute at all if the price doesn’t reach your limit.

By familiarizing yourself with these various order types, you can enhance your trading strategy and make more informed decisions that align with your risk tolerance and investment goals.

How to Use Trading Platform

Understanding how to navigate a trading platform is essential for efficiently executing trades and managing your investments. Whether you are a beginner or an experienced trader, mastering the tools and features available on the platform can significantly improve your trading experience. This section will guide you through the process of using a comprehensive trading interface to place orders, track market movements, and analyze your portfolio.

To begin, you first need to set up an account and configure the platform to your preferences. Once logged in, you’ll be able to access various sections such as the dashboard, trading interface, market data, and account settings. The dashboard provides a quick overview of your positions, balance, and recent market activity, while the trading interface is where you can enter new orders or modify existing ones.

Key Features of the Trading Platform

- Order Entry: This is where you can place different types of trades, including market, limit, and stop orders. Make sure to familiarize yourself with the order types available to choose the one that best fits your strategy.

- Market Data: Real-time data feeds on asset prices, including charts and technical indicators. Having up-to-date information is essential for making informed decisions about when to enter or exit trades.

- Portfolio Management: Track your open positions, monitor performance, and view detailed reports of profits and losses. This section helps you stay on top of your investments.

- Research Tools: Use various analytical tools like charting software, historical data, and news feeds to gather insights and forecast market trends. These tools are invaluable when performing in-depth technical or fundamental analysis.

- Account Settings: Adjust your personal information, set risk parameters, and configure notifications to ensure you stay informed about important events or trade executions.

Executing Trades

When it comes to placing trades, understanding the process is crucial. You will typically need to select the asset you want to trade, specify the quantity, and choose the type of order you want to place. Once the trade is placed, you can monitor its execution in real time. If necessary, you can adjust the order, cancel it, or modify it based on the changing market conditions.

Practice and Familiarization

Most platforms offer a demo or paper trading feature, which allows you to practice executing trades without real money. This is an excellent way to familiarize yourself with the platform and its various tools before committing to live trades. Taking advantage of this feature can help reduce errors and increase your confidence when using the platform for real trading.

By understanding these basic features and tools, you can navigate the trading platform with ease, making informed decisions and executing trades effectively. The key is to take the time to practice and explore all the functionalities the platform offers, ensuring that you are well-prepared for real-world trading scenarios.

Strategies for Passing the Test Successfully

Successfully completing any type of evaluation requires strategic planning, preparation, and the ability to stay calm under pressure. By understanding key concepts, practicing regularly, and adopting effective study techniques, you can maximize your chances of performing well. This section outlines proven strategies to help you succeed in your upcoming evaluation.

1. Master the Fundamentals

Before diving into advanced topics, it’s important to build a solid foundation. Familiarize yourself with essential concepts and definitions, as they will serve as the building blocks for understanding more complex material. Focusing on core principles ensures you won’t miss key details during the test.

- Identify key topics: Know which concepts are most likely to appear and prioritize them in your study sessions.

- Understand definitions: Be clear about important terms and their applications.

- Clarify difficult topics: If something is unclear, seek further explanation through additional resources or ask for help.

2. Practice Consistently

One of the most effective ways to prepare is through regular practice. Completing sample questions and reviewing previous tests not only helps solidify your knowledge but also improves your ability to recall information quickly during the real assessment.

- Take timed quizzes: Practice under timed conditions to improve your speed and ensure you can manage your time effectively during the test.

- Track progress: Keep track of your results to identify strengths and weaknesses.

- Review mistakes: Learn from any errors you make to avoid repeating them in the future.

3. Create a Structured Study Plan

Planning ahead is essential for covering all the material in an organized way. Break down your study time into manageable blocks and stick to a schedule to stay on track. A structured approach will help prevent last-minute cramming and allow for better retention of information.

- Set achievable goals: Define clear, specific goals for each study session, such as mastering a particular topic or completing a set number of practice questions.

- Distribute study time: Balance your time across various subjects, and make sure to allocate extra time to areas that are more challenging.

- Review periodically: Revisit previously studied material regularly to reinforce your knowledge and maintain long-term retention.

4. Stay Calm and Focused During the Test

On the day of the assessment, it’s essential to remain calm and composed. Anxiety can hinder your ability to think clearly, so practicing relaxation techniques beforehand can help manage nerves. Approach each question methodically, and don’t rush your answers.

- Take deep breaths: Use breathing exercises to stay calm and maintain focus.

- Read each question carefully: Make sure you understand what’s being asked before answering. Look for keywords and clues that can guide you.

- Manage your time: Keep an eye on the clock, but don’t rush. Allocate enough time for each section and review your answers if possible.

By following these strategies and maintaining a disciplined approach to studying, you can boost your chances of passing the test and achieving the results you want. Consistency, preparation, and a clear mindset are the keys to success.