Success in financial assessments requires not just theoretical knowledge but also practical skills in solving real-world problems. With a clear understanding of core principles and the ability to apply them under pressure, students can confidently tackle any related challenge. Whether focusing on cost analysis, budgeting, or performance evaluation, being well-prepared is the key to achieving top results.

Effective preparation involves mastering key concepts and understanding the underlying mechanics behind each question type. From numerical calculations to detailed explanations, practice is essential. By focusing on essential topics and solving practice problems, students can build the necessary expertise and speed needed to excel in any related test.

Problem-solving techniques are just as crucial as knowledge retention. Familiarity with the structure of typical questions and knowing how to approach them with confidence will make all the difference. With the right strategies, students can improve both accuracy and efficiency, making complex topics more manageable and less daunting during assessments.

Assessments in Financial Management

Preparing for any financial evaluation requires a deep understanding of both theory and application. Success depends on the ability to interpret data, make decisions based on financial metrics, and explain the rationale behind those decisions clearly. Students should focus on grasping the core principles and strategies that are frequently tested in related evaluations.

Common Question Types

Understanding the types of questions commonly encountered in assessments helps in preparing effectively. Here are some typical areas of focus:

- Cost behavior analysis

- Budgeting and forecasting

- Variance and performance analysis

- Break-even calculations

- Financial ratios and performance metrics

Key Strategies for Success

To perform well, students should apply these effective strategies:

- Review core formulas and calculations

- Practice time management to complete tasks efficiently

- Work through sample problems to improve problem-solving skills

- Familiarize yourself with common errors and how to avoid them

- Focus on interpreting data accurately and drawing clear conclusions

By incorporating these strategies into your preparation, you can approach your financial assessments with confidence and clarity, increasing the likelihood of achieving strong results.

Key Concepts for Exam Success

Mastering essential principles is the foundation of performing well in any financial evaluation. A strong grasp of these core concepts enables students to approach questions with confidence and accuracy. Whether dealing with cost management, budgeting, or financial analysis, understanding the underlying theories and calculations is crucial for success.

Core Areas to Focus On

The following topics are frequently tested and should be prioritized in preparation:

| Topic | Description |

|---|---|

| Cost Behavior | Understanding how costs change with variations in production levels |

| Budgeting | Planning and controlling financial resources for specific periods |

| Variance Analysis | Identifying differences between actual and planned performance |

| Break-even Analysis | Determining the sales volume at which total costs equal total revenue |

| Financial Ratios | Evaluating business performance using key financial indicators |

Important Formulas and Calculations

Understanding and memorizing key formulas is essential for quick calculations during an assessment. Below are some important ones to keep in mind:

| Formula | Purpose |

|---|---|

| Contribution Margin = Sales – Variable Costs | Measures profitability after covering variable costs |

| Break-even Point = Fixed Costs / Contribution Margin | Determines the level of sales needed to cover all costs |

| Return on Investment (ROI) = (Net Profit / Investment) x 100 | Measures the efficiency of an investment |

| Current Ratio = Current Assets / Current Liabilities | Assesses liquidity and ability to meet short-term obligations |

By mastering these core topics and formulas, students can confidently tackle the challenges of any financial assessment and improve their chances of success.

Understanding Cost Behavior in Management

Grasping how expenses fluctuate in response to changes in production levels is fundamental to making informed financial decisions. By recognizing patterns in how costs react to various business activities, managers can plan more effectively, allocate resources efficiently, and identify areas for potential savings. This understanding is crucial for long-term financial stability and achieving profitability.

Types of Costs and Their Behavior

Costs can be categorized based on their behavior relative to changes in business activity. The three main types are:

- Fixed Costs: Expenses that remain constant regardless of production levels, such as rent or salaries.

- Variable Costs: Costs that change directly with the volume of goods or services produced, such as raw materials or direct labor.

- Mixed Costs: A combination of fixed and variable costs, like utility bills that have a fixed service charge plus a variable component based on usage.

Analyzing Cost Behavior for Decision Making

Understanding the relationship between costs and production can help managers make key decisions. By analyzing how costs behave, companies can:

- Set appropriate pricing strategies based on production costs

- Optimize production processes to minimize variable costs

- Manage fixed expenses to improve profitability

Incorporating cost behavior analysis into management practices allows businesses to stay agile, adjust to market conditions, and remain competitive.

Effective Time Management for Exam Preparation

Properly organizing study time is crucial for achieving success in any assessment. With limited hours available before the test, a strategic approach to managing your schedule ensures you cover all necessary topics without feeling overwhelmed. The key is to prioritize tasks, allocate enough time for each, and avoid procrastination.

Begin by breaking down the material into manageable sections, focusing on areas of greatest importance or difficulty. Set clear, achievable goals for each study session, and ensure there is enough time for revision and practice. Using a structured timetable can also help you stay on track and reduce last-minute cramming.

Another effective strategy is the Pomodoro technique, which involves studying for focused intervals followed by short breaks. This method helps maintain concentration while preventing burnout. Be sure to also leave time for relaxation and sleep, as rest is essential for memory retention and overall performance.

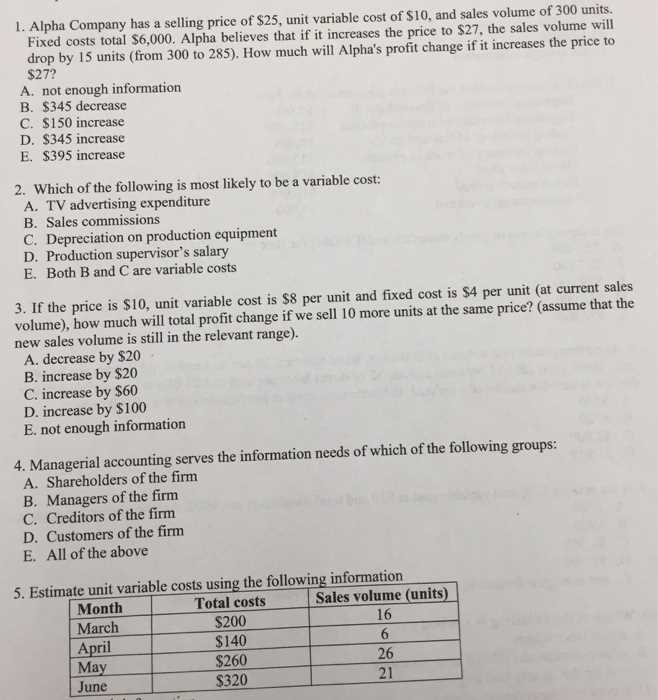

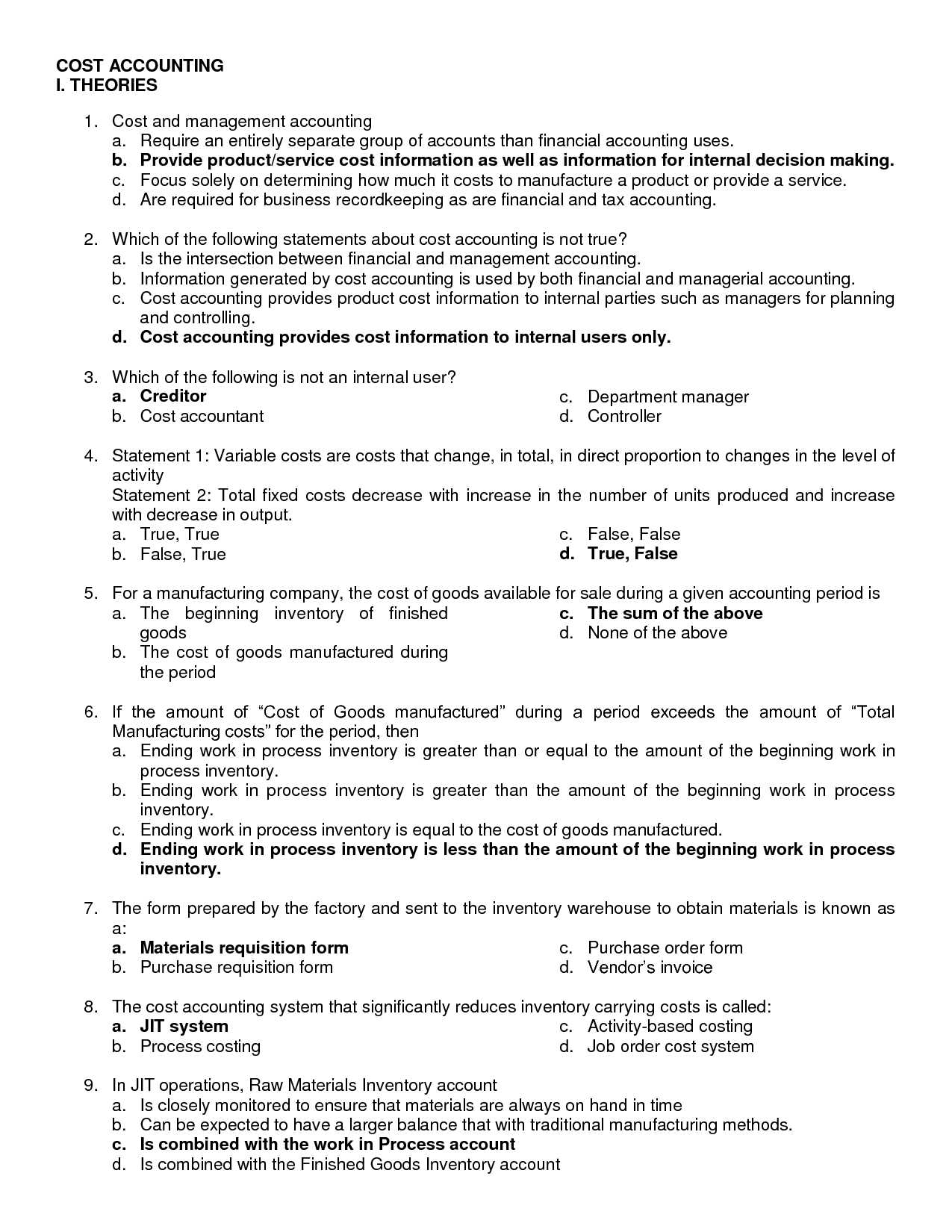

Common Types of Managerial Accounting Questions

Assessments in financial management typically feature a variety of question formats that test both theoretical knowledge and practical application. These questions aim to evaluate the depth of understanding regarding cost structures, financial analysis, and decision-making processes. Being familiar with the different types of inquiries can significantly improve your preparation.

Some of the most common types of questions include:

- Cost Analysis: Questions that require you to calculate or assess the behavior of fixed, variable, and mixed costs in different business scenarios.

- Budgeting: Problems where you are asked to prepare or evaluate budgets, including operating, cash flow, or capital expenditure budgets.

- Variance Analysis: Inquiries that involve analyzing the difference between budgeted and actual performance, helping to identify areas of financial concern.

- Break-even Analysis: Questions focused on calculating the point at which total revenue equals total costs, determining profitability thresholds.

- Financial Ratios: Problems requiring the calculation and interpretation of key financial ratios like liquidity, profitability, and efficiency indicators.

By practicing these common question types, you can improve your problem-solving skills and be better prepared for any test, ensuring you can tackle a wide range of scenarios with confidence.

How to Interpret Financial Statements

Understanding how to read and analyze financial reports is a vital skill for anyone involved in business decision-making. These documents provide insight into a company’s financial health, allowing stakeholders to assess performance, profitability, and stability. By interpreting the numbers accurately, you can make informed judgments that drive strategy and improve outcomes.

There are several key components to focus on when reviewing these reports:

- Income Statement: This statement outlines the company’s revenues, expenses, and profits over a specific period. By comparing different periods, you can assess the company’s ability to generate profit and manage costs.

- Balance Sheet: The balance sheet provides a snapshot of the company’s assets, liabilities, and equity at a given point in time. Analyzing the balance sheet helps to evaluate the company’s liquidity, financial leverage, and overall stability.

- Cash Flow Statement: This report tracks the flow of cash in and out of the business. It’s crucial for assessing how well the company manages its cash resources to meet obligations and support growth.

To effectively interpret these statements, focus on key metrics such as profitability, debt levels, liquidity, and cash generation. Ratios like return on equity, current ratio, and gross margin can provide a clearer picture of financial health. By learning to read these reports with an analytical mindset, you can identify trends, opportunities, and potential risks, which are essential for making sound financial decisions.

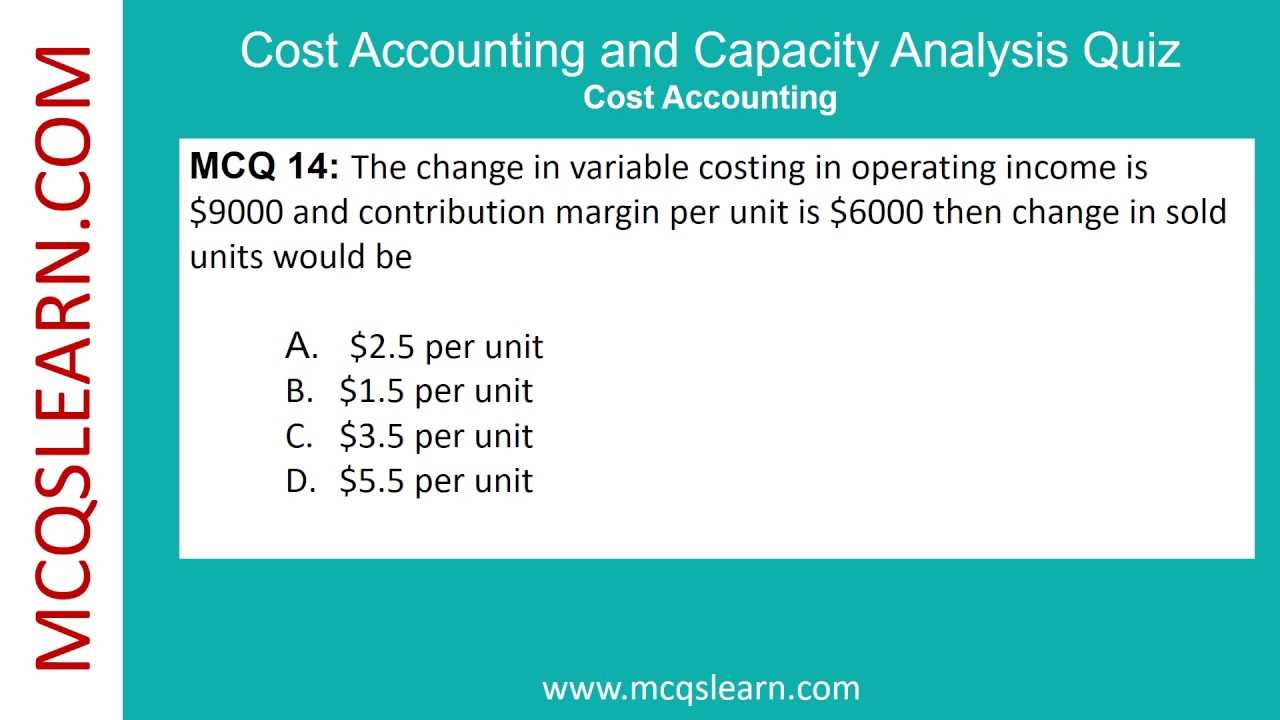

Top Strategies for Answering Multiple Choice Questions

When faced with multiple-choice inquiries, a strategic approach can make a significant difference in your performance. Rather than simply guessing, it’s important to analyze each option carefully and apply logical reasoning. By following certain techniques, you can improve your chances of selecting the correct response, even when uncertain about the answer.

Understanding the Question

Before jumping into the options, take time to fully comprehend the question. Identify key terms or phrases that indicate what is being asked. This will help you focus on relevant information and avoid being misled by distractors. In some cases, rephrasing the question in your own words can clarify your understanding.

Eliminating Incorrect Options

Start by eliminating obviously incorrect choices. Often, multiple-choice tests include one or two options that are clearly wrong, allowing you to narrow down your choices. This increases your chances of selecting the correct answer if you need to guess. Even if you’re unsure, this process helps improve the odds by focusing on more reasonable options.

Look for Clues: Pay attention to words like “always,” “never,” or “most likely,” as they can indicate extremes that are often incorrect. Additionally, check for answers that are factually incorrect or inconsistent with the information provided in the material.

Guess Wisely: If you must guess, make an educated guess based on the information you have. If you’ve narrowed down the choices, select the option that seems most consistent with the concepts you know.

By applying these strategies, you can navigate multiple-choice questions more effectively, boosting your chances of success. Practice these techniques in your preparation to become more adept at managing different types of queries during your assessment.

Solving Budgeting and Forecasting Problems

When faced with budgeting and forecasting challenges, it’s essential to approach the task methodically. These types of problems require you to use historical data, market trends, and financial assumptions to predict future performance. Solving such problems involves understanding the key components and utilizing the right tools to make accurate projections and effective financial plans.

Steps to Solve Budgeting Problems

Creating an accurate budget is the foundation of any successful financial planning process. The following steps can help ensure a thorough approach:

- Identify Key Expenses: Begin by identifying all significant costs, both fixed and variable. This includes direct costs, overheads, and any anticipated changes in spending.

- Set Clear Financial Goals: Determine what the organization aims to achieve financially. Whether it’s reducing costs, increasing revenue, or improving profitability, setting specific goals is crucial.

- Estimate Revenues: Use historical sales data and industry trends to predict future revenue streams. This will provide a benchmark for how much the business expects to earn.

- Review and Adjust: Continually assess the budget against actual performance and make adjustments as necessary. Flexibility is key to maintaining a realistic and functional budget.

Approaches to Forecasting

Forecasting involves predicting future outcomes based on past performance and current trends. The process can be broken down into the following stages:

- Collect Relevant Data: Start with a thorough analysis of past financial reports and industry data. The more data you have, the more reliable your forecast will be.

- Select the Right Forecasting Method: There are different methods to use, including quantitative models like time series analysis and qualitative methods such as expert judgment.

- Make Projections: Based on the selected method, create detailed projections for sales, expenses, profits, and other key metrics over the forecasting period.

- Monitor and Revise: After making the initial forecast, monitor actual performance against your projections. Revise forecasts as necessary based on new information and changing market conditions.

By following these steps, you can effectively solve budgeting and forecasting problems, providing your organization with a solid financial roadmap for the future.

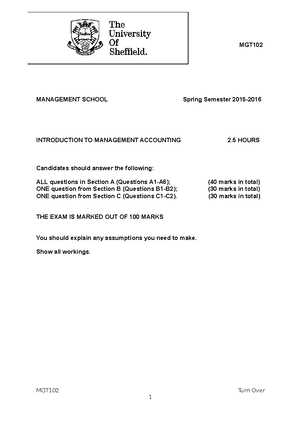

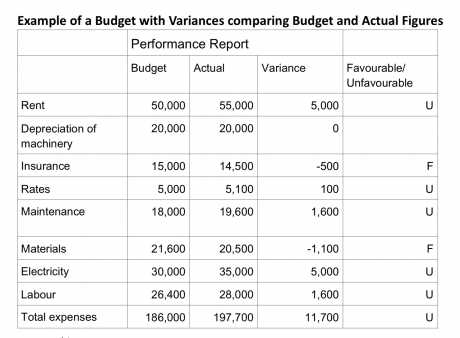

Understanding Variance Analysis for Exams

Variance analysis is a powerful tool used to compare actual performance against budgeted or expected results. It helps to identify discrepancies and understand why these differences occurred. By mastering this concept, you can better analyze financial performance, assess efficiency, and improve decision-making. In the context of assessments, knowing how to conduct variance analysis can lead to accurate conclusions and demonstrate a deep understanding of financial principles.

To approach variance analysis effectively, focus on understanding the key components involved:

- Price Variance: This measures the difference between the actual price paid for materials or services and the budgeted price. It helps identify whether the company is paying more or less than expected for resources.

- Quantity Variance: This focuses on the difference between the actual quantity of resources used and the budgeted quantity. It shows how efficiently resources are utilized in production.

- Cost Variance: This examines the overall cost differences, combining both price and quantity variances to provide a complete view of how actual costs compare to expectations.

To apply variance analysis in assessments, follow these steps:

- Identify the Variance: Determine the difference between actual and expected results for each component, such as price, quantity, or overall cost.

- Classify the Variance: Categorize the variance as favorable or unfavorable. A favorable variance means actual results are better than expected, while an unfavorable variance indicates the opposite.

- Analyze the Cause: Investigate the reasons behind the variance. This could include changes in market conditions, efficiency issues, or inaccuracies in planning.

- Adjust Future Projections: Use the insights gained from the variance analysis to refine future budgeting or forecasting methods, improving accuracy and performance.

By mastering variance analysis, you can more confidently approach problems and provide well-reasoned, data-driven answers in assessments, showcasing your understanding of key financial concepts.

Mastering Break-Even Analysis Techniques

Break-even analysis is a crucial technique used to determine the point at which total revenues equal total costs, resulting in neither profit nor loss. This concept is fundamental for evaluating financial health, setting pricing strategies, and making informed business decisions. Understanding how to conduct a break-even analysis allows you to assess the feasibility of projects and products, ultimately helping in financial planning and risk management.

Key Components of Break-Even Analysis

To master this technique, it’s essential to understand the three primary components involved in break-even analysis:

- Fixed Costs: These are costs that remain constant, regardless of the level of production or sales. Examples include rent, salaries, and insurance premiums.

- Variable Costs: These costs fluctuate depending on the production volume or sales activity. Raw materials, labor, and shipping expenses are common examples of variable costs.

- Sales Price per Unit: This is the amount at which each unit of a product or service is sold. It plays a crucial role in calculating how many units need to be sold to cover both fixed and variable costs.

Calculating the Break-Even Point

The break-even point is calculated using the formula:

Break-even point (units) = Fixed Costs ÷ (Sales Price per Unit – Variable Cost per Unit)

This formula tells you how many units of a product must be sold in order to cover both fixed and variable costs. Once you reach this point, any additional units sold contribute directly to profit.

In addition to calculating the break-even point in units, you can also calculate the break-even point in revenue:

Break-even point (revenue) = Break-even point (units) × Sales Price per Unit

By mastering break-even analysis, you gain the ability to assess the profitability of different business scenarios and make more informed decisions regarding pricing, production levels, and cost management.

Handling Calculations with Ratios

Ratios are vital tools for analyzing a company’s financial health and performance. They provide insights into various aspects of a business, such as liquidity, profitability, efficiency, and solvency. By mastering the calculation and interpretation of these ratios, individuals can make more informed decisions and identify areas that require improvement. Understanding how to use financial ratios in different scenarios is crucial for both academic assessments and practical applications in the business world.

Some common ratios and their applications include:

- Liquidity Ratios: These ratios assess the ability of a company to meet its short-term obligations. The current ratio, calculated by dividing current assets by current liabilities, is a widely used measure of liquidity.

- Profitability Ratios: These ratios evaluate a company’s ability to generate profits relative to its revenue, assets, or equity. The return on assets (ROA) and return on equity (ROE) are examples of profitability ratios.

- Efficiency Ratios: Efficiency ratios measure how well a company utilizes its resources to generate sales. The asset turnover ratio, which compares sales to total assets, is an example of an efficiency ratio.

- Leverage Ratios: These ratios help assess the extent to which a company relies on borrowed funds. The debt-to-equity ratio, which compares total debt to shareholders’ equity, is a common leverage ratio.

To handle ratio calculations effectively, it is essential to know how to gather the necessary data from financial statements and apply the formulas correctly. By doing so, you can accurately assess the financial position of a business and provide useful insights for strategic decision-making.

Key Formulas for Your Financial Assessment

Formulas are essential tools when preparing for any financial assessment. They simplify complex concepts and allow for the efficient calculation of critical values needed for problem-solving. Understanding the key formulas for financial analysis can help you tackle a wide variety of questions confidently and accurately. Below are some of the most important formulas to focus on when preparing for your assessment.

Essential Formulas for Financial Analysis

The following formulas are fundamental for understanding key concepts and performing calculations effectively:

- Break-Even Point (Units): This formula helps you determine the number of units needed to cover both fixed and variable costs.

- Break-even point (units) = Fixed Costs ÷ (Sales Price per Unit – Variable Cost per Unit)

- Contribution Margin: This ratio is used to evaluate the profitability of individual items by comparing the selling price with variable costs.

- Contribution Margin = Sales Price per Unit – Variable Cost per Unit

- Operating Profit Margin: This formula calculates the percentage of revenue remaining after paying for variable costs.

- Operating Profit Margin = Operating Income ÷ Revenue

- Return on Investment (ROI): This formula measures the profitability relative to the investment made.

- ROI = (Net Profit ÷ Cost of Investment) × 100

- Current Ratio: This ratio measures a company’s ability to cover its short-term liabilities with its short-term assets.

- Current Ratio = Current Assets ÷ Current Liabilities

lessCopy code

How to Apply These Formulas

Once you have memorized the formulas, it’s important to practice applying them in different scenarios. Working through problems that require these calculations will improve your problem-solving skills and help you become more comfortable with the concepts. Remember to break down complex problems into manageable parts and apply each formula step by step.

By mastering these core formulas, you will be well-equipped to solve a variety of questions and gain a deeper understanding of financial principles.

Best Study Resources for Financial Assessments

Finding the right resources for preparing for financial assessments can greatly enhance your understanding and performance. With the right materials, you can gain a deeper insight into key concepts, practice applying formulas, and test your knowledge in various scenarios. Below are some of the best study resources that can help you succeed in your preparation.

| Resource Type | Description | Best For |

|---|---|---|

| Textbooks | Comprehensive guides offering in-depth explanations of core concepts, formulas, and examples. | Fundamental understanding of topics |

| Online Courses | Interactive lessons and video tutorials that break down complex material into digestible segments. | Visual learners and structured learning |

| Practice Problems | Sets of exercises and questions designed to help you apply concepts and test your knowledge. | Hands-on practice and reinforcement |

| Study Guides | Condensed versions of textbooks with key concepts, formulas, and practice problems for quick review. | Reviewing before assessments |

| Online Forums | Communities where students and professionals discuss concepts, share resources, and provide insights into difficult topics. | Clarifying doubts and learning from peers |

By utilizing a combination of these resources, you can ensure a well-rounded preparation approach. It is important to not only study theory but also practice applying the concepts through exercises. This will allow you to gain confidence and enhance your problem-solving abilities, making you more prepared for any challenge during your assessment.

How to Approach Written Problem Solving

When tackling written problems, a methodical approach is crucial for clarity and accuracy. The goal is to break down complex issues into manageable steps while ensuring that each part of the question is addressed thoroughly. A structured process not only aids in reaching the correct solution but also helps in organizing your thoughts clearly on paper.

Step 1: Read the Problem Carefully

The first step is always to understand what is being asked. Take your time to read the question thoroughly. Identify key information, such as numbers, dates, and specific requirements. Pay attention to any instructions on the format or presentation of the answer.

Step 2: Break Down the Problem

Once you have understood the core question, break the problem into smaller, simpler components. This could mean dividing a financial scenario into its key elements or organizing data into categories. Doing this will allow you to address each part in a logical sequence.

Step 3: Organize Your Work

Use bullet points, tables, or diagrams to organize your calculations and explanations. Clear organization helps prevent errors and allows you to easily track your work. Additionally, having a clear structure makes your solution easier to follow for anyone reviewing your answer.

Step 4: Solve Step-by-Step

Work through each part of the problem methodically, showing all necessary calculations, formulas, or reasoning behind each decision. This will not only demonstrate your understanding but will also allow you to spot any potential mistakes before finalizing your answer.

Step 5: Double-Check Your Solution

Before finalizing your answer, always take a moment to review your work. Check for any calculation errors or missed steps. Ensuring that all aspects of the problem have been addressed and that your solution is coherent will significantly increase the likelihood of success.

By following these steps, you can approach written problem-solving with confidence, improving both the efficiency and accuracy of your responses.

Dealing with Time Pressure in Exams

Time constraints during assessments can be overwhelming, but mastering the art of managing time effectively can significantly reduce stress and enhance performance. The key to handling time pressure is strategic planning, prioritization, and staying focused throughout the test. When you know how to allocate your time efficiently, you can tackle difficult sections without losing confidence.

Effective Time Management Techniques

Here are some useful techniques to help you manage your time more efficiently:

- Preview the Entire Assessment: Before diving into the questions, take a few moments to glance through the entire paper. This helps you get a sense of the difficulty level of each section and allows you to plan your approach.

- Prioritize Simple Questions: Start with the easiest questions that require less time, ensuring you build momentum and secure quick points before tackling more complex items.

- Stay Flexible: Be ready to adjust your approach if you find certain sections taking longer than expected. Don’t get stuck on one question; move on and return to it later if time permits.

Time Allocation Example

The following table illustrates an example of time allocation for a 60-minute assessment with varying levels of difficulty:

| Section | Questions | Time per Question | Total Time |

|---|---|---|---|

| Easy | 10 | 2 minutes | 20 minutes |

| Medium | 5 | 5 minutes | 25 minutes |

| Hard | 5 | 5 minutes | 25 minutes |

| Total | 20 | 60 minutes |

Stay Calm and Keep Focused

It’s essential to stay calm, even when the clock is ticking down. If you find yourself feeling stressed, take a deep breath and refocus. Anxiety can cloud your judgment and slow you down, so maintaining a calm demeanor will help you think more clearly and make better decisions during the test.

By practicing these time-management techniques, you’ll be able to handle the pressure and maximize your performance, completing the assessment with confidence and efficiency.

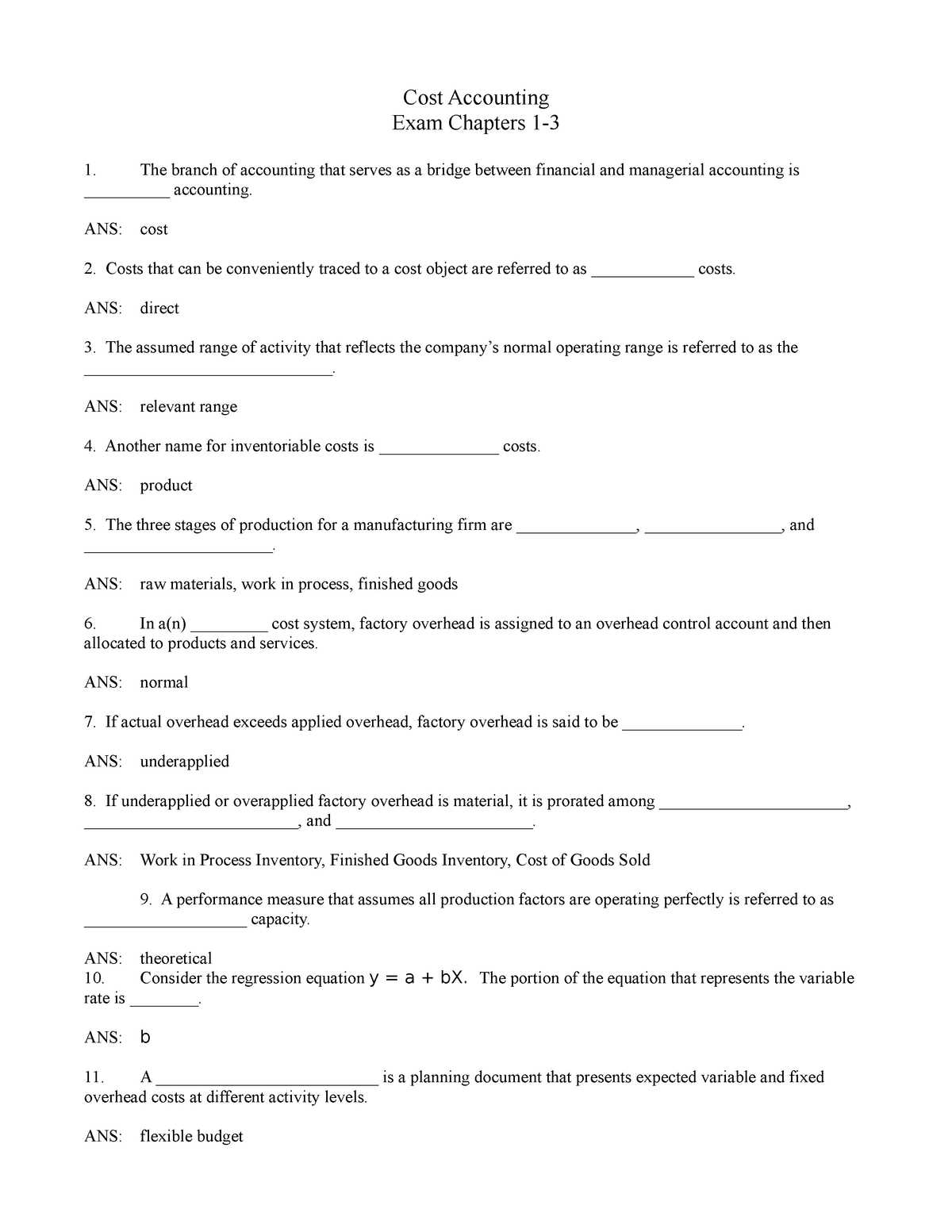

Reviewing Past Exams for Practice

One of the most effective ways to prepare for an upcoming assessment is by revisiting previous tests. Practicing with old materials allows you to familiarize yourself with the format, types of questions, and areas commonly tested. This approach also helps in identifying patterns in question styles and improving time management during the actual test.

Benefits of Using Past Papers

Working through past questions offers several advantages:

- Improved Familiarity: By solving previous assessments, you become more comfortable with the structure and types of problems you may encounter.

- Time Efficiency: Regular practice helps you develop a sense of how long to spend on each question, ensuring that you don’t run out of time during the actual test.

- Identifying Weak Areas: Reviewing your answers to past tests helps you pinpoint areas that need more focus and revision.

- Enhanced Problem-Solving Skills: Repetition strengthens your ability to quickly analyze and solve questions, improving both speed and accuracy.

How to Make the Most of Past Papers

To maximize the benefits of this practice method, consider the following strategies:

- Simulate Test Conditions: Time yourself and complete the past test under the same conditions as the real assessment. This helps build discipline and prepares you mentally.

- Review Your Mistakes: After completing a practice test, carefully review all the questions you got wrong. Understanding why you made errors is crucial for improving.

- Focus on Key Topics: Identify patterns in the topics covered in past assessments and prioritize studying those areas where you struggled the most.

Regularly reviewing past assessments is a powerful tool in boosting your performance and confidence. It helps you understand the test’s format, improve problem-solving speed, and identify areas for improvement, making it an essential part of any preparation strategy.

Common Mistakes to Avoid During Exams

During high-pressure assessments, it’s easy to fall into certain traps that can hinder performance. Recognizing these potential pitfalls ahead of time can help reduce errors and boost confidence. Avoiding these common mistakes will allow you to approach each task methodically and improve your chances of success.

1. Mismanaging Time

One of the most frequent issues faced during assessments is poor time management. It’s important to allocate time wisely across all tasks, ensuring that no section is left incomplete. Many people waste too much time on a difficult question, leaving insufficient time for the remaining items.

- Solution: Prioritize questions based on difficulty, and aim to finish the easier ones first. This ensures a better distribution of time across the entire test.

2. Skipping Instructions

It is easy to overlook instructions, especially when under pressure, but this can lead to unnecessary mistakes. Whether it’s a specific format for an answer or a limitation on word count, missing these details can negatively impact your results.

- Solution: Read the instructions carefully before beginning any question. Taking a moment to understand what’s required can save valuable time later.

3. Overthinking Questions

Overcomplicating simple problems is another common error. Stress or anxiety can make straightforward tasks appear more complex than they really are. This can lead to unnecessary second-guessing or applying the wrong approach.

- Solution: Stick to the basics. If the question seems simple, trust your initial understanding and apply the most direct solution.

4. Not Reviewing Your Work

Many students fail to review their responses before submitting the test, assuming they’ve answered everything correctly. This oversight can result in easily fixable mistakes such as simple calculation errors or skipped questions.

- Solution: Always leave time at the end for a quick review. Check your calculations, ensure all questions are answered, and look for any careless mistakes.

5. Ignoring the Question’s Focus

Sometimes, it’s easy to focus on the wrong aspect of a question. For instance, spending too much time on an irrelevant part of the prompt, or failing to address the key elements the question is asking for.

- Solution: Identify the main focus of the question first, and ensure your answer is aligned with that focus. Stay on topic and avoid going off on tangents.

By being mindful of these common errors, you can approach your tasks with greater clarity and efficiency. A little preparation and awareness can go a long way in improving your performance and reducing unnecessary stress.

Building Confidence for Your Final Exam

Confidence plays a crucial role in performing well under pressure. When preparing for a major assessment, how you approach the days leading up to the test can greatly influence your mindset on the day of the actual task. By using a combination of strategies to reinforce your knowledge and calm your nerves, you can walk into the final stage with assurance and readiness.

1. Preparation and Consistent Practice

Confidence starts with preparation. The more familiar you are with the material, the more at ease you will feel. Break your study sessions into manageable chunks and tackle topics one by one. Consistent practice, whether through reviewing past material, taking mock tests, or doing sample questions, will solidify your understanding and boost your confidence.

- Tip: Create a study schedule that covers all key areas. Gradually increase the difficulty level as you progress.

- Tip: Regularly test your knowledge with practice questions to identify weak spots and address them early.

2. Mental Preparation and Stress Management

Exam anxiety is a common challenge, but it’s possible to manage it. Taking time to relax and clear your mind is essential. Incorporate mindfulness exercises such as deep breathing or meditation into your daily routine to calm nerves. Additionally, focusing on the effort you’ve put into preparing, rather than worrying about the outcome, will help shift your mindset to a more positive one.

- Tip: Practice stress-reduction techniques to stay calm and composed. Visualize yourself succeeding.

- Tip: Get plenty of rest in the days leading up to the assessment to ensure you’re mentally sharp.

By preparing systematically and managing your emotions effectively, you will find yourself walking into the final assessment with increased self-assurance, ready to tackle the challenges ahead.