Preparing for a challenging assessment in the field of economics requires a strong understanding of various concepts and theories. Grasping the essential ideas behind market dynamics, decision-making, and economic strategies will help in tackling the complex questions you may face. The focus should be on mastering core topics that frequently appear in evaluations and ensuring you’re equipped to apply your knowledge to different scenarios.

Study and practice are critical to success. It’s important to not only familiarize yourself with definitions but also to understand the application of these ideas in real-world settings. Developing problem-solving skills through example questions will aid in reinforcing your understanding and boost your confidence.

By breaking down the material into digestible sections and focusing on key principles, you can enhance your ability to reason through complex problems and effectively approach the assessment. Whether dealing with theoretical constructs or practical examples, being prepared is the best strategy for achieving a top result.

Microeconomics Exam 2 Answers

To perform well on your upcoming assessment, it’s important to review the key concepts and problem-solving strategies that are most commonly tested. By focusing on practical applications of theoretical principles, you can improve your ability to handle different types of questions and scenarios.

The following areas are essential for mastering the material and securing a high score:

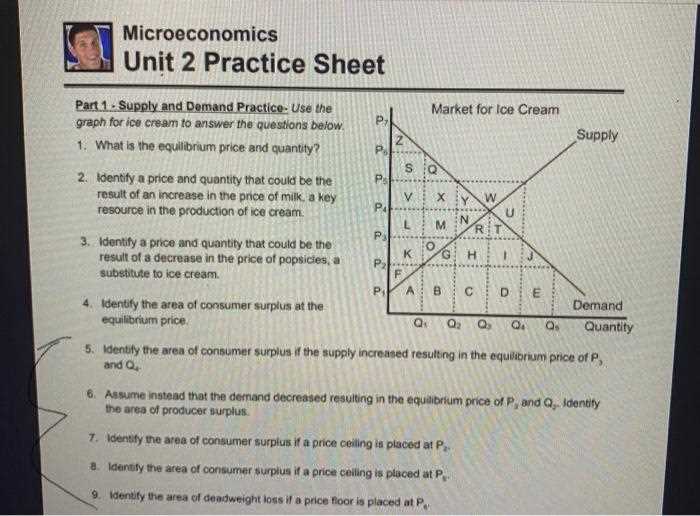

- Understanding the laws of supply and demand and their effects on market prices.

- Grasping the concept of elasticity and how it influences consumer behavior.

- Recognizing the different market structures, from perfect competition to monopoly.

- Analyzing pricing strategies and the role of government intervention.

- Exploring how firms maximize profit and respond to market forces.

By practicing with a variety of questions related to these topics, you will be well-prepared to tackle both theoretical and applied aspects of the test. Additionally, reviewing past examples and sample problems can help familiarize you with the format and structure of the assessment.

Focus on strengthening your analytical skills and understanding the underlying principles, as these will be key to successfully navigating the more complex sections of the test.

Key Concepts for Exam Success

Achieving success in an economic assessment requires a solid grasp of several core principles. Understanding how markets function, how different players interact within the economy, and how to apply theoretical knowledge to practical problems is essential. Below are some of the most crucial concepts that will help you succeed.

Market Fundamentals

- The role of supply and demand in determining prices and quantities.

- How shifts in the demand curve and supply curve affect market equilibrium.

- The impact of price elasticity on consumer choices and business decisions.

Economic Strategies and Market Behavior

- Understanding how firms maximize profits in different market structures.

- The influence of monopolies and oligopolies on pricing and output levels.

- The importance of government policies in regulating market outcomes.

Focusing on these fundamental ideas will provide the foundation needed to approach more complex topics with confidence. Be sure to practice applying these concepts through various problem-solving exercises to sharpen your skills further.

Understanding Supply and Demand

The relationship between supply and demand is a fundamental concept that drives the behavior of markets. It describes how the availability of goods and services interacts with consumer desire to determine the prices and quantities traded in the market. A deep understanding of this dynamic is essential for making informed decisions in both personal and business contexts.

When demand increases for a particular good, the price tends to rise if the supply remains constant. Conversely, when supply increases but demand stays the same, prices generally decrease. These shifts are central to market equilibrium, where the quantity supplied equals the quantity demanded at a specific price level.

Factors such as changes in consumer preferences, income levels, or production costs can significantly influence supply and demand curves. By mastering how these forces work together, you can better analyze and predict market movements and outcomes.

Market Equilibrium and Efficiency

Market equilibrium occurs when the quantity of goods supplied equals the quantity demanded at a particular price. This balance ensures that there is neither a surplus nor a shortage of products in the market. Efficiency in this context refers to the optimal allocation of resources, where the total welfare of society is maximized by ensuring that goods and services are produced and consumed at the right levels.

When markets operate at equilibrium, resources are used most effectively, and the price reflects the true value of the product based on demand and supply. However, disruptions such as government intervention or external factors can lead to inefficiencies, which may cause imbalances in supply and demand.

| Market Condition | Price | Quantity Supplied | Quantity Demanded |

|---|---|---|---|

| Equilibrium | Market price | Equals demand | Equals supply |

| Excess Supply | Above equilibrium | Exceeds demand | Less than supply |

| Excess Demand | Below equilibrium | Less than supply | Exceeds supply |

Achieving market efficiency is crucial for maximizing consumer and producer welfare. Understanding how equilibrium works helps to identify when and how markets might be pushed away from their ideal state, leading to potential inefficiencies that need to be addressed for optimal performance.

Elasticity and Its Importance

Elasticity measures the responsiveness of one variable to changes in another, particularly how the quantity demanded or supplied reacts to changes in price. This concept plays a vital role in understanding market behavior, as it helps explain how changes in price can significantly influence consumer choices and production decisions.

Price elasticity of demand indicates how sensitive consumers are to price fluctuations. A product is considered elastic if a small change in price leads to a large change in the quantity demanded. On the other hand, inelastic goods show little change in demand despite price alterations.

Price elasticity of supply is equally important, as it reflects how producers adjust the quantity supplied when prices change. A high elasticity means that producers can quickly increase or decrease supply in response to price shifts, while low elasticity suggests a slower response.

Understanding elasticity helps businesses set optimal pricing strategies, forecast market trends, and make informed decisions about production and marketing. It also provides insights into how external factors, like taxes or subsidies, may impact consumer behavior and overall market efficiency.

Cost Structures in Microeconomics

Understanding the different cost structures in production is essential for analyzing how businesses operate and make decisions. These structures define how costs behave as production levels change, which in turn influences pricing strategies and overall profitability. By examining these cost dynamics, businesses can optimize their resources and achieve efficiency in their operations.

Types of Costs

- Fixed Costs: Costs that do not change with the level of production, such as rent or salaries.

- Variable Costs: Costs that vary directly with the level of output, like raw materials and direct labor.

- Total Costs: The sum of fixed and variable costs, representing the overall expenditure in production.

- Marginal Costs: The additional cost of producing one more unit of a good or service.

Cost Behavior and Efficiency

- Economies of Scale: The cost advantages gained when the scale of production increases, leading to a reduction in per-unit costs.

- Diseconomies of Scale: The point at which the cost per unit begins to rise as production expands beyond an optimal level.

By analyzing these cost structures, businesses can make strategic decisions about pricing, production levels, and long-term planning. A clear understanding of cost behavior is crucial for achieving both profitability and operational efficiency.

Perfect Competition and Market Outcomes

In a perfectly competitive market, numerous buyers and sellers interact, each having little to no control over the price. This idealized market structure ensures that resources are allocated efficiently, with firms producing at the lowest possible cost and consumers benefiting from the best possible prices. The outcomes in such markets are driven by competition and the absence of barriers to entry, leading to optimal production levels and price stability.

In the long run, firms in perfect competition earn normal profits as entry and exit from the market adjust to any economic changes. Since no single firm can influence market prices, the price is determined by supply and demand, and firms operate at the most efficient point where marginal cost equals marginal revenue.

Perfect competition leads to the most efficient allocation of resources, with goods produced at the lowest cost and sold at the lowest possible price. This outcome benefits both consumers and producers, ensuring that the total welfare of society is maximized under ideal conditions.

Monopoly and Price Setting

In a market dominated by a single firm, that firm holds the power to influence prices, unlike in competitive markets where prices are determined by supply and demand. This market structure, where one entity controls the entire supply of a good or service, enables the firm to set prices at a level that maximizes its profits. The lack of competition allows for greater flexibility in pricing, but it also has implications for consumer welfare and overall market efficiency.

Price Setting Strategies

- Profit Maximization: The firm sets the price where marginal cost equals marginal revenue, which often leads to higher prices compared to competitive markets.

- Price Discrimination: The firm may charge different prices to different consumers based on their willingness to pay, increasing its total revenue.

- Barriers to Entry: The firm maintains its market dominance by creating obstacles that prevent other companies from entering the market, such as high startup costs or control over essential resources.

Market Impact and Efficiency

- Reduced Consumer Surplus: Due to higher prices, consumers may not be able to purchase as much of the good or service as they would in a competitive market.

- Deadweight Loss: Monopoly pricing can lead to inefficiency in the market, where potential gains from trade are not realized, creating a loss in overall welfare.

While monopolies may lead to higher profits for the firm, the lack of competition typically results in negative consequences for consumers and the overall economy. Understanding the dynamics of price setting in monopolistic markets is crucial for assessing both the advantages and disadvantages of such market structures.

Oligopoly and Market Strategies

In markets where a few large firms dominate, companies must carefully consider the actions of their competitors when making decisions about pricing, production, and other strategic moves. Unlike in perfectly competitive markets, firms in an oligopoly are interdependent, meaning that the behavior of one firm can significantly affect the others. This leads to the use of various market strategies to gain a competitive edge and secure greater market share.

Firms operating in an oligopoly often engage in strategic planning that involves anticipating competitors’ actions, reacting to market trends, and sometimes even collaborating to maintain stability. The market power held by these firms can influence prices, production levels, and innovation, leading to a complex and competitive environment.

Key Strategies in Oligopolistic Markets

- Collusion: Firms may attempt to coordinate their pricing and output decisions to reduce competition and increase profits. This can lead to price fixing and market manipulation.

- Price Leadership: One firm often takes the lead in setting prices, with other firms following suit to avoid price wars or losing market share.

- Non-Price Competition: Firms focus on differentiating their products through marketing, innovation, and customer service rather than competing solely on price.

- Product Differentiation: Firms may try to distinguish their products through features, branding, and quality to reduce direct competition and increase consumer loyalty.

The strategic decisions made by firms in an oligopoly can have significant implications for the overall market, affecting prices, innovation, and consumer choice. While competition may still exist, the limited number of players in the market means that each firm’s actions carry substantial weight in shaping the competitive landscape.

Game Theory and Decision Making

In scenarios where multiple decision-makers interact, understanding how individuals or firms choose their strategies is crucial. Each player’s choice can depend on the choices of others, making the decision process highly interdependent. This leads to a strategic environment where the outcome depends not only on one’s own decisions but also on the anticipated actions of others. Game theory provides a framework to analyze such situations and predict the most likely outcomes based on rational decision-making.

At the core of game theory lies the concept of strategic interaction. By modeling decision-making as a game, participants can assess the best course of action by considering possible strategies, payoffs, and potential outcomes. Whether in business, politics, or everyday life, game theory helps explain how individuals or companies navigate competitive environments and make optimal choices.

Key Elements of Game Theory

| Concept | Description |

|---|---|

| Players | The decision-makers involved in the game, whether individuals, firms, or governments. |

| Strategies | The possible actions each player can take in response to others’ actions. |

| Payoffs | The rewards or penalties each player receives based on their chosen strategies and the strategies of others. |

| Equilibrium | A situation where no player can improve their payoff by unilaterally changing their strategy, often represented by Nash equilibrium. |

Applications of Game Theory

- Pricing Strategies: Firms may use game theory to determine pricing strategies that take into account competitor reactions, such as in oligopolistic markets.

- Negotiations: Game theory is often applied to negotiations to anticipate how opposing parties will act and to determine the best strategy for reaching an agreement.

- Auctions: Understanding how bidding strategies work in different types of auctions can be analyzed using game theory principles.

- Public Goods: Game theory is used to study how individuals contribute to public goods and how cooperation can be achieved despite individual incentives to free-ride.

By incorporating game theory into decision-making processes, individuals and organizations can navigate complex strategic environments, enhance their chances of success, and better understand the dynamics of competition and cooperation.

Consumer Choice Theory Explained

Understanding how individuals make decisions regarding their consumption is essential to analyzing economic behavior. People are constantly faced with choices about how to allocate their limited resources to maximize their satisfaction or utility. The theory behind these decisions explores the factors influencing consumer preferences, the trade-offs they face, and how they prioritize different goods and services within their budget constraints.

Consumers aim to achieve the highest possible satisfaction by carefully selecting combinations of products that offer the best value for their money. These decisions are influenced by various elements, such as income, prices, and personal preferences, all of which play a critical role in determining the most preferred consumption bundle. The theory suggests that consumers will always make rational choices based on their preferences and available resources.

In simple terms, consumer choice theory helps explain how individuals decide what to buy and how they allocate their spending across different goods and services, given the constraints they face, like limited income and varying prices in the market.

Production and Profit Maximization

In any market, businesses strive to optimize their output while keeping costs under control. The main goal is to produce goods or services efficiently to maximize the difference between total revenue and total costs, thereby achieving the highest possible profit. The process of determining the optimal production level, where the business generates the greatest return relative to its investment, is at the core of profit maximization.

To achieve this, companies need to understand the relationship between input factors, such as labor and capital, and the output produced. By adjusting these inputs, businesses can find the point where the cost of production is minimized, and profit is maximized. This requires careful analysis of production costs, including fixed and variable costs, and how they influence decision-making at different levels of output.

Optimal Production and Cost Efficiency

Firms must consider how to utilize their resources effectively. By analyzing marginal costs and marginal revenue, they can determine the ideal production level. Producing beyond this point leads to diminishing returns, where the additional cost of producing one more unit exceeds the revenue generated, reducing overall profit.

Revenue and Profit Considerations

Maximizing profit isn’t just about lowering costs. It also involves strategies to increase revenue, whether through expanding market reach, enhancing product value, or adjusting pricing strategies. A balance between cost efficiency and revenue growth is essential for long-term business success.

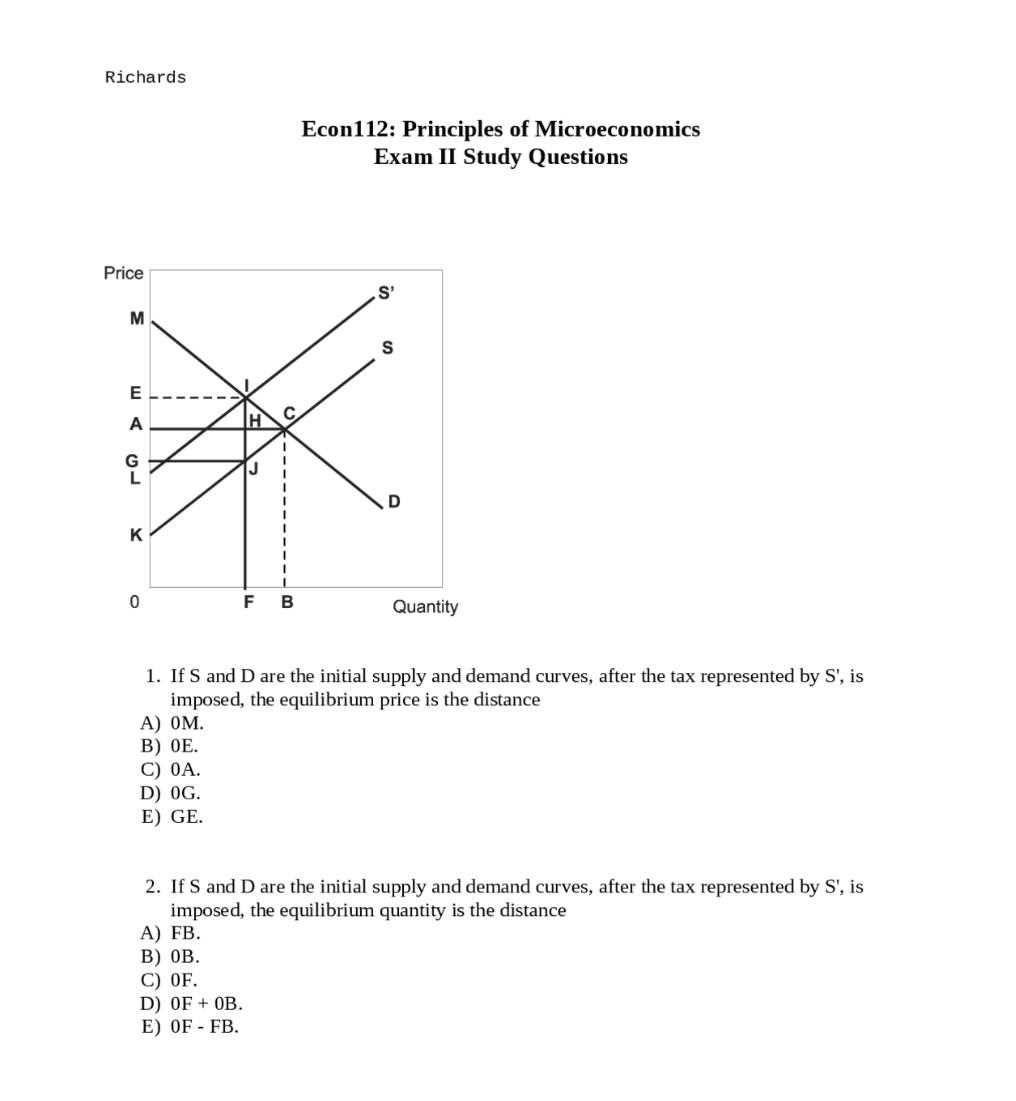

Government Intervention in Markets

In a free-market system, supply and demand typically dictate the allocation of resources. However, there are times when market outcomes may not be optimal for society as a whole. Governments may step in to correct these market failures by implementing various policies aimed at influencing or regulating the behavior of producers and consumers. These interventions are designed to ensure fair competition, protect consumers, and address social welfare concerns.

Government involvement in markets can take various forms, including price controls, taxes, subsidies, and regulation. Each of these measures aims to either encourage or discourage certain economic activities, ensuring that market dynamics align more closely with societal goals such as equity, sustainability, and overall economic stability.

Price Controls: Minimum and Maximum Limits

One of the most common forms of government intervention is setting price controls. These can be in the form of price floors (minimum prices) or price ceilings (maximum prices). Price floors prevent prices from falling below a certain level, ensuring that producers receive adequate compensation for their goods or services. Price ceilings, on the other hand, prevent prices from rising beyond a certain point, protecting consumers from excessive prices.

Taxes and Subsidies: Shaping Market Behavior

Governments also use taxes and subsidies to influence market behavior. Taxes can be used to reduce demand for harmful goods, such as tobacco or alcohol, by increasing their cost to consumers. Conversely, subsidies are often provided to encourage the production and consumption of goods that provide positive externalities, such as clean energy or education. Both taxes and subsidies can have a significant impact on consumer and producer decisions, thereby guiding the economy in a desired direction.

Externalities and Market Failures

In a perfect market, resources are allocated efficiently, and all parties involved benefit. However, there are instances when markets fail to achieve optimal outcomes. One of the primary causes of such failures is the presence of externalities. Externalities occur when the actions of individuals or firms impact others in ways that are not reflected in market prices. These effects can be either positive or negative, and they often lead to inefficiency in the allocation of resources.

Market failures due to externalities occur when the true cost or benefit of an economic activity is not fully captured by the market. This results in either overproduction or underproduction of certain goods or services, which can have detrimental effects on social welfare. Governments and regulators often intervene in these situations to correct the imbalance and restore efficiency.

Types of Externalities

Externalities can be classified into two main categories: positive and negative.

| Type of Externality | Explanation | Examples |

|---|---|---|

| Negative Externalities | These occur when the actions of individuals or firms impose costs on others that are not reflected in the market price. | Pollution, noise from factories, traffic congestion |

| Positive Externalities | These arise when the actions of individuals or firms generate benefits for others that are not reflected in the market price. | Education, public health, vaccinations |

Correcting Market Failures

To address externalities and correct market failures, governments can implement various policies. These may include imposing taxes on activities that generate negative externalities (such as carbon taxes for pollution) or providing subsidies for activities that create positive externalities (such as subsidies for education or renewable energy projects). By adjusting market incentives, these interventions aim to align private costs and benefits with social costs and benefits, leading to more efficient outcomes.

Price Discrimination in Real Markets

In many markets, businesses do not charge a single price for their products or services. Instead, they engage in pricing strategies that involve varying the price depending on certain factors such as the customer’s willingness to pay, location, or purchase behavior. This practice, known as price discrimination, allows firms to maximize their profits by capturing more consumer surplus and converting it into producer surplus. Though often seen in specific industries, such strategies are common in the real world, where different groups of consumers are charged differently for essentially the same good or service.

Types of Price Discrimination

Price discrimination can take different forms, each with distinct characteristics. Below are the main types:

- First-degree price discrimination: Also known as personalized pricing, it involves charging each consumer the highest price they are willing to pay for a product or service. This type of pricing is often seen in negotiations or auctions.

- Second-degree price discrimination: Prices vary based on the quantity consumed or the product features. For example, bulk purchases or premium product features might result in lower or higher prices.

- Third-degree price discrimination: Involves charging different prices to different consumer groups based on observable characteristics such as age, income, or location. For example, student or senior discounts are common examples of this pricing strategy.

Benefits and Drawbacks

While price discrimination can increase a company’s overall profits, it also has advantages and disadvantages for both consumers and producers. For businesses, it allows them to cater to various consumer segments, ensuring that they are able to sell to both high and low willingness-to-pay customers. However, consumers may feel unfairly treated if they discover they are being charged more than others for the same product. Moreover, excessive price discrimination can lead to reduced competition and lower market efficiency.

Market Structure and Efficiency

The way markets are organized plays a crucial role in determining how resources are allocated and how efficiently goods and services are produced and distributed. Different types of market structures, ranging from highly competitive to monopolistic, influence the behavior of firms and consumers. Each structure has distinct characteristics that affect pricing, production decisions, and overall economic welfare. Understanding these structures is essential for analyzing how market forces impact efficiency and consumer well-being.

Types of Market Structures

Market structures can be broadly classified into four main types, each with its own level of competition and impact on market efficiency:

| Market Structure | Characteristics | Efficiency |

|---|---|---|

| Perfect Competition | Many firms, homogeneous products, free entry and exit | Allocative and productive efficiency achieved |

| Monopolistic Competition | Many firms, differentiated products, some barriers to entry | Less efficient than perfect competition, some deadweight loss |

| Oligopoly | Few firms, interdependent pricing, barriers to entry | Potential for inefficiency, but depends on competition level |

| Monopoly | One firm, unique product, high barriers to entry | Significant inefficiency, potential for higher prices and lower output |

Impact of Market Structure on Efficiency

Each market structure has distinct impacts on efficiency. In perfect competition, firms operate at maximum efficiency, producing the quantity of goods where price equals marginal cost, ensuring that resources are allocated optimally. However, in monopolistic competition and oligopolies, firms have some control over prices, leading to less than optimal resource distribution. Monopolies, with their lack of competition, tend to reduce efficiency, as they may set higher prices and produce less than what would be socially optimal. As a result, consumer welfare may be reduced, and there may be deadweight loss in the economy.

Exam Strategies for Microeconomics

Approaching a test in this field requires a structured plan to ensure a thorough understanding of the key concepts and efficient time management. Success depends not only on knowing the material but also on applying the right strategies during preparation and the test itself. By focusing on the most important topics, practicing problem-solving techniques, and honing your ability to analyze and apply theory, you can improve your performance significantly.

Preparation Tips

- Review Key Concepts: Focus on understanding the foundational principles and their real-world applications. Familiarize yourself with supply and demand curves, cost structures, market outcomes, and economic models.

- Practice Problem-Solving: Work through sample problems to improve your ability to quickly solve questions. This helps in enhancing your speed and accuracy during the actual assessment.

- Utilize Study Materials: Use textbooks, notes, and online resources to reinforce your understanding. Group study sessions can also be effective for discussing complex topics with peers.

Test-Taking Strategies

- Time Management: Allocate enough time to each section, ensuring that you don’t spend too long on any one question. It’s important to leave time for review at the end.

- Read Carefully: Understand each question fully before attempting to answer. Pay attention to details like keywords that indicate whether you should analyze, define, or calculate.

- Answer What You Know First: Begin with the questions that you feel most confident about. This approach boosts your morale and ensures you gain easy points early on.

Practice Questions and Solutions

One of the most effective ways to prepare for a test is to practice with a variety of questions that reflect the types of challenges you may face. Working through these questions helps reinforce key concepts and enhances your problem-solving skills. Below are some practice questions along with detailed solutions to help you better understand the material.

Sample Questions

- Question 1: What happens to the equilibrium price and quantity when demand increases while supply remains constant?

- Question 2: How do monopolists determine the price and output level that maximizes their profit?

- Question 3: Explain the concept of price elasticity of demand and how it affects a firm’s pricing strategy.

- Question 4: What is the effect of government intervention in a competitive market, such as through price controls or subsidies?

Solutions

- Solution to Question 1: When demand increases while supply remains constant, the equilibrium price will rise, and the equilibrium quantity will also increase. This happens because higher demand leads to a shortage at the original price, prompting producers to increase both price and output.

- Solution to Question 2: A monopolist maximizes profit by producing where marginal cost (MC) equals marginal revenue (MR). This point determines the optimal output, and the monopolist sets the price based on the demand curve at that quantity.

- Solution to Question 3: Price elasticity of demand measures the responsiveness of quantity demanded to changes in price. If demand is elastic, a small price decrease will result in a significant increase in quantity demanded, making lower prices potentially more profitable for firms. Conversely, inelastic demand means that price changes have little impact on demand.

- Solution to Question 4: Government intervention, such as price floors or ceilings, can distort market outcomes. Price controls can lead to shortages (in the case of price ceilings) or surpluses (in the case of price floors), as they prevent the market from reaching equilibrium.