Preparing for accounting assessments can often seem challenging, but with the right strategies, it becomes a manageable task. The key to success lies in understanding core principles, practicing regularly, and applying the knowledge efficiently during tests. By adopting the right approach, students can navigate through complex problems with confidence and achieve better results.

Utilizing available resources effectively plays a major role in exam preparation. Whether it’s reviewing study materials, taking practice tests, or focusing on areas of weakness, every step contributes to mastering the subject. Being well-prepared allows for clear thinking and precise calculations when it matters the most.

Time management and staying calm under pressure are also crucial factors. Allocating enough time for each section and ensuring no question is left unanswered ensures a well-rounded performance. A methodical approach to problem-solving will not only boost confidence but also improve the overall efficiency during assessments.

MyAccountingLab Assessment Preparation Guide

Success in accounting evaluations depends largely on how well you understand key concepts and apply them to solve complex problems. With the right approach, students can significantly enhance their performance. This guide provides helpful tips and strategies for mastering the material and tackling various types of problems typically encountered in assessments.

Understanding the Key Concepts

Before attempting any tasks, it’s essential to have a solid understanding of accounting fundamentals. Focus on grasping core topics such as financial statements, journal entries, and the principles of balance sheets. Understanding these concepts allows you to approach problems logically, ensuring that your solutions are both accurate and well-reasoned.

Effective Practice Techniques

Consistent practice is one of the most effective ways to prepare. Work through a variety of problems, ranging from basic calculations to more complex scenarios. This will not only reinforce your knowledge but also increase your speed and confidence when answering questions under time pressure. Use study resources such as quizzes and problem sets to simulate real test conditions.

Time management plays a crucial role during the process. Allocating sufficient time to review each topic and practicing under timed conditions ensures you can complete the evaluation efficiently. The ability to balance speed and accuracy is a key skill in mastering accounting challenges.

Understanding the Assessment Structure

Knowing the layout and format of an accounting assessment is crucial to performing well. Familiarity with how questions are organized and what types of challenges you’ll face helps streamline your preparation. It allows you to focus on the areas that matter most and approach the test with confidence.

Types of Questions

Assessments typically consist of multiple-choice questions, numerical problems, and short-answer sections. Each question type serves a specific purpose, testing different skills and understanding. Multiple-choice questions often check your basic comprehension of accounting principles, while numerical problems test your ability to apply those principles to real-world situations. Short-answer questions challenge your ability to explain concepts and provide reasoning behind your answers.

Time Allocation and Strategy

Time management is a critical factor when tackling accounting evaluations. Knowing how long to spend on each section can greatly impact your overall performance. Start by quickly scanning through the questions to gauge their difficulty level. Allocate more time to challenging sections while ensuring you don’t neglect easier questions. By doing so, you can maximize your score without feeling rushed.

Practice is key to mastering this structure. By taking practice tests and working with sample problems, you will become more comfortable with the format and develop the skills needed to manage time efficiently.

How to Approach Accounting Problems Effectively

Effectively solving accounting problems involves breaking them down into smaller, manageable steps. A clear, structured approach helps ensure that each element of the problem is addressed, minimizing errors and improving your ability to reach accurate solutions. By staying organized and methodical, you can work through complex calculations and concepts with greater efficiency and confidence.

Understand the Problem Before Solving

The first step in tackling any accounting challenge is to fully understand the problem. Carefully read through the instructions and identify the key components–such as the financial data, what is being asked, and any specific methods or calculations required. Taking a moment to plan your approach will prevent rushing and ensure that you don’t overlook important details.

Apply Core Accounting Principles

Once you have a clear understanding of the problem, apply the fundamental accounting principles that govern the task. Whether it’s basic calculations, journal entries, or the application of financial ratios, consistently use the core concepts you’ve learned. These principles form the foundation for your solution and guide you in solving each section logically and systematically.

Practice is crucial to mastering problem-solving skills. The more you work through various accounting challenges, the more comfortable you’ll become in applying the right techniques and reaching correct conclusions under pressure.

Common Mistakes in Accounting Assessments

Even experienced learners can make mistakes when tackling accounting problems. These errors can stem from a variety of factors, such as misinterpreting the question, overlooking important details, or rushing through calculations. Identifying and understanding these common mistakes can help students avoid them, leading to more accurate and effective results.

Misunderstanding the Problem Requirements

One of the most common mistakes is failing to fully understand the task at hand. This can happen when students rush through the instructions or don’t take the time to identify key figures or requirements. Carefully reading the problem and clarifying any uncertainties before starting to solve the issue is crucial to avoid missteps. Taking a moment to highlight or note key pieces of information can help stay focused on what needs to be accomplished.

Calculation Errors and Oversights

Another frequent issue is making errors during calculations, such as incorrect addition, subtraction, or misapplying formulas. These mistakes often arise from rushing through problems or overlooking small details, like decimal points or units of measurement. To reduce these errors, always double-check calculations and take the time to review your work before moving on to the next section.

Focus and accuracy are essential to mastering accounting challenges. By slowing down and applying consistent attention to detail, learners can significantly improve their performance and minimize common errors.

Time Management Tips for Accounting Assessments

Effective time management is crucial when working through accounting tasks, especially under exam conditions. Allocating enough time for each section, avoiding distractions, and knowing when to move on from difficult questions can make a significant difference in performance. By using a strategic approach to managing time, you can ensure that all aspects of the assessment are completed thoroughly and efficiently.

Prioritize Your Time Wisely

Start by evaluating the difficulty and length of each section. Some tasks may require more time and focus than others, so it’s essential to prioritize based on complexity. Here are a few tips to manage your time effectively:

- Skim through the entire assessment at the beginning to get an overview of the tasks.

- Allocate time for each section based on its difficulty and your familiarity with the material.

- Start with the easier questions to build confidence and secure quick points.

- Leave difficult questions for later if you’re unsure, so you don’t waste valuable time.

Avoid Procrastination and Stay Focused

Distractions can severely affect your ability to manage time properly. Maintain concentration by staying organized and following your plan. Consider these tips to keep on track:

- Set small goals for each section, like completing a set number of problems within a fixed time frame.

- Take short breaks if needed, but limit them to avoid losing focus.

- Stay calm when time runs low, as stress can cloud your judgment and slow you down.

With practice and preparation, you can improve your time management skills and ensure a smoother and more effective experience during assessments.

Strategies for Mastering Accounting Concepts

Mastering accounting concepts requires a deep understanding of core principles, consistent practice, and effective study techniques. Whether you’re learning the basics of financial reporting or more advanced topics like cost analysis and auditing, a strategic approach to your study habits can significantly improve your grasp of the subject. By breaking down complex topics and applying them in real-world scenarios, you can strengthen your understanding and boost your confidence.

Break Down Complex Topics into Manageable Segments

Accounting involves a wide range of concepts that can sometimes feel overwhelming. One effective strategy is to break down these topics into smaller, manageable parts. Instead of trying to learn everything at once, focus on one concept at a time. For example, start with understanding basic principles such as assets, liabilities, and equity, then gradually move on to more complex topics like financial statements and cash flow analysis.

Use Practical Examples to Reinforce Learning

To solidify your understanding, it’s essential to apply accounting concepts to real-world examples. This not only helps you see how these principles work in practice but also makes the material more relatable. Work through case studies, practice problems, or even create your own financial scenarios to apply the knowledge you’ve learned. This hands-on approach will deepen your understanding and allow you to retain key concepts for longer.

Consistent review is also a key to mastery. Set aside time each week to go over previously studied material, reinforcing what you’ve learned and ensuring that foundational concepts stay fresh in your mind. This will help you build a strong base for more advanced topics.

How to Use Accounting Resources Effectively

Maximizing the use of available resources can greatly enhance your understanding of accounting concepts and improve your performance in assignments and tests. Various tools and materials, such as interactive exercises, tutorials, and practice questions, can provide valuable support. By strategically utilizing these resources, you can reinforce your knowledge, address areas of difficulty, and track your progress.

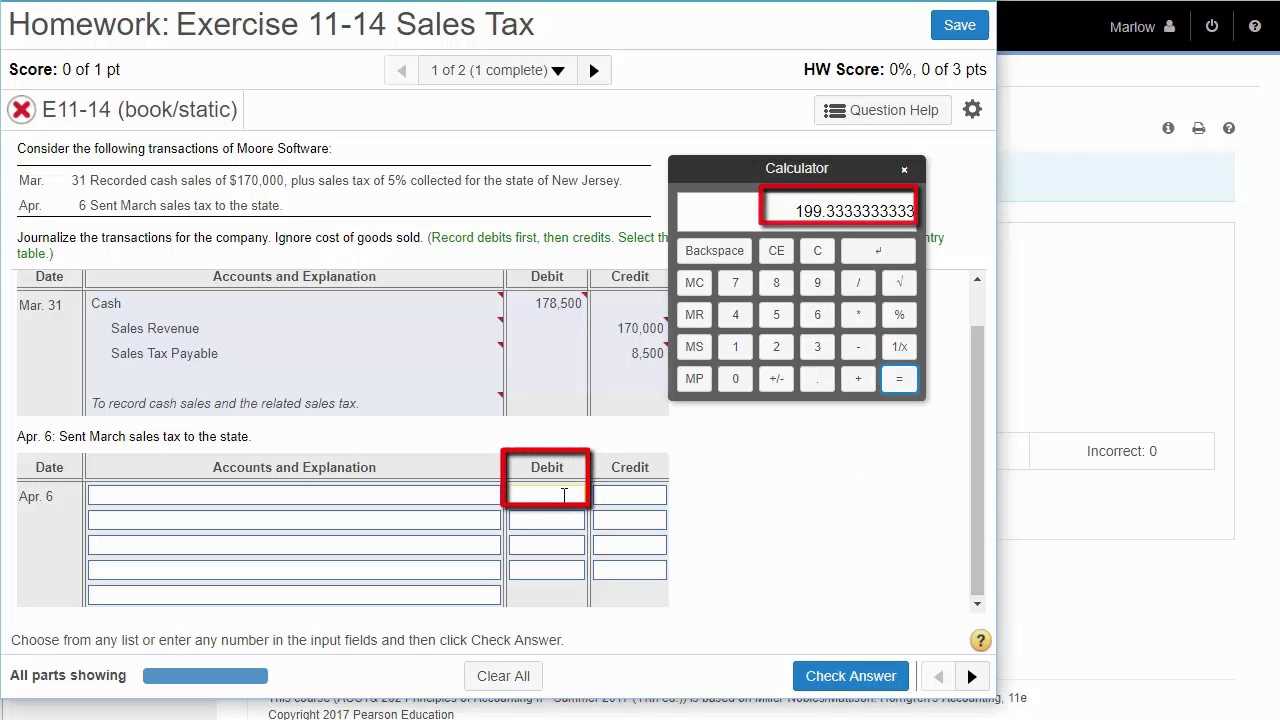

Take Advantage of Interactive Features

Many learning platforms offer interactive exercises that allow you to practice problems in a simulated environment. These exercises provide instant feedback, helping you understand where you might have gone wrong. Here’s how to make the most of these tools:

- Complete practice problems regularly to test your understanding and improve problem-solving skills.

- Review feedback carefully after each exercise to identify errors and correct misunderstandings.

- Track your progress to see areas where you are improving and areas that need more focus.

Utilize Additional Learning Materials

In addition to exercises, other resources like video tutorials, study guides, and reference materials can help deepen your comprehension. Make sure to:

- Watch video lessons to gain a different perspective on challenging topics.

- Use study guides to summarize key points and review important concepts before assessments.

- Access reference materials to clarify doubts or get a more detailed explanation of complex subjects.

By using these resources effectively, you can create a comprehensive learning plan that fits your individual needs and helps you achieve your educational goals.

Tips for Improving Test Scores

Improving your performance on assessments requires a combination of effective study habits, time management, and stress management techniques. By focusing on preparation and employing strategies that help retain key information, you can boost your confidence and achieve better results. Developing a consistent approach to learning and reviewing material will not only help you in tests but also enhance your overall understanding of the subject.

Start Early and Stay Consistent – The earlier you begin studying, the more time you have to absorb the material. Consistent, small study sessions are more effective than cramming the night before. Plan your study schedule in advance and stick to it.

Practice Regularly – Regularly completing practice problems or reviewing past assessments is one of the best ways to familiarize yourself with the types of questions that may appear. It also helps improve your problem-solving speed and accuracy.

Focus on Weak Areas – Identify areas where you are struggling and dedicate extra time to mastering them. Whether it’s understanding certain concepts or refining your calculation methods, addressing weaknesses directly will help improve your overall score.

Simulate Test Conditions – Practicing under timed conditions will help you manage your time during the actual test. It also allows you to become accustomed to the pressure, making it easier to stay calm and focused when you encounter difficult questions.

Review Your Mistakes – After completing practice problems, take the time to review mistakes carefully. Understanding why you made an error is key to avoiding it in the future. Learn from your mistakes to avoid repeating them in the test.

Utilizing Practice Tests for Better Results

One of the most effective ways to improve your performance on assessments is by incorporating practice tests into your study routine. These mock assessments simulate the real test environment, helping you familiarize yourself with the format and types of questions you may encounter. By regularly practicing, you can identify areas that need more attention and build the confidence needed to excel on test day.

Why Practice Tests Work – Practice tests allow you to assess your current knowledge while also helping you refine your problem-solving techniques. They provide an opportunity to review material in a controlled setting, where you can practice managing time and stress, both of which are critical during actual assessments. Below are some of the key benefits:

| Benefit | Explanation |

|---|---|

| Time Management | Simulating the test environment helps you learn how to allocate your time effectively, ensuring that you can complete all questions within the given time frame. |

| Identifying Weak Areas | Practice tests highlight topics or question types that you struggle with, allowing you to focus your study efforts on those specific areas. |

| Stress Reduction | Regular practice helps desensitize you to test anxiety, allowing you to stay calm and composed during the real assessment. |

| Confidence Boost | Repeated practice builds familiarity, which increases your confidence and readiness to tackle the test. |

How to Maximize the Benefits – To make the most of practice tests, consider the following strategies:

- Set time limits to simulate real testing conditions and improve your time management skills.

- Review your performance after each practice test, paying close attention to mistakes and areas where you can improve.

- Use different resources to ensure you’re exposed to a wide variety of questions and test formats.

- Practice regularly to maintain consistency and reinforce your understanding of the material.

By incorporating practice tests into your study routine, you can significantly enhance your preparedness and increase your chances of achieving better results.

Understanding Key Accounting Principles

Accounting is governed by a set of fundamental principles that guide the recording, reporting, and analysis of financial transactions. These core concepts provide a foundation for making accurate and consistent financial decisions. Understanding these principles is essential for anyone studying or working in the field, as they ensure clarity, transparency, and reliability in financial reporting.

The Basic Principles of Accounting

There are several key principles that serve as the foundation of accounting practices. These principles help professionals maintain consistency and fairness when managing financial data. The following are some of the most important ones:

- Consistency – Financial statements must be prepared using consistent methods, allowing for comparisons across periods and businesses.

- Relevance – The information provided should be useful for decision-making, offering a true and fair view of the financial status.

- Reliability – Financial data must be accurate and verifiable, ensuring that the information presented is trustworthy.

- Comparability – Financial information should be presented in a way that allows for comparison between different companies or periods.

Applying These Principles in Practice

To effectively apply accounting principles in real-world scenarios, it’s important to grasp both the theory and the practical techniques behind these rules. This allows accountants to prepare financial statements that reflect the true financial health of a business. Whether it’s preparing balance sheets, income statements, or cash flow reports, these principles help maintain integrity and accountability in the financial world.

By mastering the core principles of accounting, you can build a strong foundation for analyzing financial data, making informed business decisions, and communicating effectively with stakeholders.

How to Stay Focused During Exams

Maintaining concentration during high-pressure assessments is crucial for achieving optimal results. Distractions can be a major obstacle, but with the right strategies, you can enhance your ability to stay focused and manage your time effectively. By adopting specific techniques, you can keep your mind sharp and perform at your best, even in challenging situations.

Here are some tips that can help you stay focused and perform better during assessments:

| Tip | Description |

|---|---|

| Prepare in Advance | Organize your study materials and review key concepts ahead of time. The more prepared you are, the more confident and focused you will feel. |

| Manage Stress | Stress can impair your ability to focus. Practice relaxation techniques such as deep breathing or mindfulness to keep calm during the assessment. |

| Avoid Distractions | Minimize external distractions by creating a quiet, organized environment. Put away your phone and other potential distractions to maintain focus on the task at hand. |

| Take Short Breaks | If the assessment allows, take short breaks to clear your mind. This can help prevent fatigue and improve your overall focus. |

| Stay Positive | Keeping a positive mindset can help you stay engaged and perform at your best. Believe in your preparation and stay confident throughout the process. |

By following these strategies, you can reduce distractions, stay calm under pressure, and maintain the focus needed to succeed. Remember, preparation and a positive mindset are key to staying focused during any assessment.

The Importance of Regular Review Sessions

Consistent revision is one of the most effective ways to reinforce your understanding of complex subjects and ensure long-term retention of key concepts. Regular review sessions help to solidify your knowledge, identify areas of weakness, and improve overall performance. This practice not only boosts your confidence but also ensures that you are well-prepared for any assessment.

Here’s why scheduling regular review sessions is essential for success:

| Benefit | Description |

|---|---|

| Improved Retention | Repetition and revisiting the material periodically strengthens your memory, making it easier to recall information when needed. |

| Increased Understanding | Reviewing content regularly helps you to better grasp complex topics and make connections between different concepts. |

| Identifying Gaps in Knowledge | Frequent reviews allow you to spot areas where your understanding is weak, giving you time to focus on and address these gaps before they become major issues. |

| Reduced Stress | By spreading out your study sessions and consistently reviewing material, you avoid last-minute cramming, which can lead to stress and burnout. |

| Enhanced Time Management | Regular sessions make it easier to plan your study schedule effectively, ensuring that all topics are covered without feeling rushed. |

Incorporating regular review sessions into your study routine is a proven strategy to improve both your comprehension and retention. By staying consistent with your revision, you’ll feel more confident and prepared when facing any challenge or assessment.

How to Tackle Difficult Accounting Questions

When faced with complex and challenging problems, it’s easy to feel overwhelmed. However, approaching tough accounting questions with a structured and systematic strategy can help break them down and make them more manageable. By staying calm and following a logical process, you can approach even the most difficult tasks with confidence.

Here are some strategies to effectively tackle challenging questions in accounting:

1. Break Down the Problem

Start by carefully reading the question and identifying the key pieces of information. Break the problem into smaller, more manageable parts. This will help you understand the core issues and simplify the process of solving them.

2. Identify Relevant Concepts

Once you’ve broken down the problem, focus on identifying the accounting principles or formulas that apply. Recall any relevant concepts that you’ve learned and consider how they might fit into the solution. Drawing connections between theory and practice will help you find the right approach.

By following these steps and maintaining a clear, methodical mindset, you can work through difficult questions with ease. Remember, persistence and practice are key to mastering challenging topics in accounting.

Why Accuracy Matters in Accounting Exams

In accounting, precision is not just important–it’s essential. Even the smallest error in calculations or data entry can lead to incorrect results, which can significantly affect your overall performance. In assessments, where every point counts, accuracy plays a critical role in ensuring that the information you provide is both reliable and valid.

Accounting is a field where precision is the foundation of sound financial decision-making. Whether it’s balancing ledgers or preparing financial reports, accuracy directly impacts the outcomes. A minor miscalculation can result in a cascading effect, leading to errors in other areas.

1. The Impact of Small Mistakes

Small mistakes, such as misplacing a decimal point or adding the wrong figure, can have a significant impact on your final result. In financial analysis, these seemingly minor discrepancies can alter the entire financial picture, leading to faulty conclusions.

2. Building Credibility and Trust

In the professional world, accuracy in accounting directly influences the trust placed in your work. Employers and clients rely on precise reports to make critical decisions, and a mistake can undermine your credibility. During assessments, the same principle applies: accurate work is a reflection of your knowledge and attention to detail.

Therefore, taking the time to double-check your calculations, review your work, and ensure that every figure is correct is essential. Accuracy not only helps you perform well but also reinforces your understanding of the material, contributing to better outcomes in the long run.

Benefits of Collaborative Studying for Exams

Collaborative studying can significantly enhance your preparation process by combining different perspectives and learning strategies. Working with peers allows you to engage in discussions, share resources, and solve problems together, fostering a deeper understanding of complex material. This approach has proven to be highly effective in improving both comprehension and retention.

When studying alone, it’s easy to overlook gaps in knowledge or struggle with difficult concepts. However, group studying offers several advantages that can lead to more efficient and comprehensive learning:

- Improved Understanding: Explaining concepts to others and hearing their interpretations can clarify your own understanding. Collaborative study sessions help identify areas where your knowledge may be lacking.

- Diverse Learning Strategies: Different study techniques can be applied within a group setting, from flashcards to mind maps, helping to solidify understanding through various methods.

- Increased Motivation: Working with others can help maintain focus and motivation, especially when tackling challenging subjects. Peer support provides encouragement and accountability.

- Faster Problem Solving: Collaborating on problem sets enables quick identification of solutions. Working as a team allows for faster analysis of different approaches and the application of best practices.

Overall, the collaborative approach is a powerful tool for enhancing exam preparation. It brings together the strengths of multiple individuals, accelerating learning and increasing the chances of success. Whether it’s through group study sessions or peer discussions, the benefits of working together cannot be underestimated.

How to Avoid Plagiarism in Accounting Assignments

Maintaining academic integrity is crucial when working on assignments, especially in a field like accounting. Plagiarism, the act of using someone else’s work or ideas without proper acknowledgment, can have serious consequences. Avoiding plagiarism not only ensures that you are adhering to ethical standards but also helps you learn and understand the material better. There are several strategies you can employ to ensure that your work is original and properly referenced.

Here are a few tips to help you avoid plagiarism in accounting-related tasks:

- Understand the Material: Ensure that you fully grasp the concepts before completing any task. This will help you express ideas in your own words, making your work more authentic and reflective of your understanding.

- Properly Cite Sources: Whenever you use external resources, such as textbooks, websites, or articles, make sure to properly cite them according to the required citation style. This gives credit to the original authors and avoids any accusation of plagiarism.

- Paraphrase Effectively: Paraphrasing involves rephrasing someone else’s ideas in your own words. It’s essential to do this properly. Simply changing a few words is not enough; ensure that you transform the sentence structure and wording while retaining the original meaning.

- Use Quotation Marks: When using an exact quote from a source, place it in quotation marks and cite it appropriately. This indicates to your reader that the words are not your own.

- Check Your Work: Before submitting any work, make use of plagiarism detection tools to ensure that your content is free from unintentional plagiarism. These tools can help identify if any part of your assignment is too similar to an existing source.

By following these simple guidelines, you can avoid plagiarism and submit original, ethical work that reflects your own efforts and understanding. Remember that maintaining academic integrity is a vital part of the learning process, and taking the necessary steps to avoid plagiarism is essential to your success.

Maximizing Your Accounting Learning Experience

To get the most out of your accounting studies, it is essential to make full use of the available resources and tools. Whether you’re working through assignments, exploring practice problems, or engaging with interactive lessons, there are several strategies you can employ to enhance your understanding and performance. By leveraging the platform effectively, you can build a solid foundation in accounting principles and boost your confidence.

Here are some tips to help you maximize your learning experience:

- Stay Organized: Keep track of deadlines, assignments, and progress. Use digital planners or calendars to ensure you stay on top of your tasks. Organization helps prevent last-minute stress and allows you to allocate enough time for each topic.

- Engage with Interactive Features: Many platforms offer interactive exercises that allow you to apply concepts in real-time. Take advantage of these features to reinforce your learning. These activities provide hands-on experience, helping you grasp accounting concepts more effectively.

- Review Feedback Thoroughly: After completing an assignment, always review the feedback provided. Understanding why a particular answer is correct or incorrect helps you identify areas where you need improvement. This ongoing feedback loop ensures you’re constantly learning and refining your skills.

- Utilize Supplemental Resources: Beyond the core lessons, most platforms offer additional materials such as practice tests, study guides, and tutorial videos. Make use of these resources to deepen your understanding and get a clearer picture of the subject matter.

- Collaborate with Peers: Studying with classmates or peers can provide fresh perspectives and insights. Consider joining discussion forums or study groups where you can ask questions, share knowledge, and tackle challenging concepts together.

- Set Realistic Goals: Break your study sessions into manageable chunks. Focus on mastering one topic at a time before moving on to the next. Setting small, achievable goals keeps you motivated and makes your overall learning process more manageable.

By following these strategies, you can make the most of your accounting resources and gain a deeper understanding of the material. The key to success lies in staying consistent, staying organized, and actively engaging with all the available tools.